TIDMSRB

For immediate release

23 July 2020

Serabi Gold plc

("Serabi" or the "Company")

Serabi reports encouraging level of gold production for the second

quarter of 2020.

Serabi Gold plc (AIM: SRB, TSX: SBI), the Brazilian focused gold mining

and development company, is pleased to provide the results and a review

of its second quarter operational and development activities in the

Tapajos region of Para State, Northern Brazil.

A PDF copy of this news release can be accessed using he following link

- https://bit.ly/2ZR7pYM

OPERATIONAL and DEVELOPMENT HIGHLIGHTS

-- Second quarter gold production of 8,504 ounces, resulting in 17,525

ounces for the year to date.

-- 43,519 tonnes of ore mined during the quarter at 5.85 grams per tonne

("g/t") of gold.

-- 44,235 tonnes of run of mine ("ROM") ore were processed through the plant

from the combined Palito and Sao Chico orebodies, with an average grade

of 5.91 g/t of gold.

-- 3,004 metres of horizontal development completed during the quarter, the

highest level of development metres to date.

-- Results reported in the second quarter for a further eight surface holes

and ten underground holes at Sao Chico demonstrate the Main Vein

structure now continues to host gold bearing mineralisation for

approximately 375 metres to the west of the current mine limits, an

extension of a further 75 metres.

Results included:

-- 5.30m @ 12.10g/t Au (Hole: 20-SC-166)

-- 3.40m @ 3.94g/t Au (Hole: 20-SC-164)

-- 1.37m @ 28.77g/t Au (Hole: 20-SCUD-341)

-- 2.72m @ 5.06g/t Au (Hole: 20-SCUD-343)

-- Reverse circulation percussion drilling on the Cicada terrestrial

geophysics anomaly indicates the strong likelihood that the anomaly is a

western extension of the Sao Chico vein structure, approximately 1,000

metres to the west of the current mine limits. Results include:

-- 3m @ 2.09g/t Au (Hole: SCRC-004)

-- 1m @ 1.17g/t Au (Hole: SCRC-007)

-- Regional geochemical sampling has highlighted an area, referred to as

Mata Cobra, which represents an eight kilometre by two kilometre soil

copper anomaly exceeding 100ppm. This anomaly is coincidental with

multiple molybdenum, bismuth, tellurium and arsenic multi-element

anomalies as well as the original airborne electromagnetic ("AEM")

anomalies.

FINANCIAL AND CORPORATE HIGHLIGHTS

-- Cash balance at end of June 2020 of US$9.6 million.

-- Loan from Sprott Resource Lending Partnership ("Sprott"), of which US$7.0

million was outstanding at the start of 2020, fully repaid at end of June

2020.

-- Revised terms for drawdown of convertible loan with Greenstone Resources

II LP ("Greenstone") agreed. US$1.5 million drawn down at end of June

2020.

Mike Hodgson has provided interviews to BRR Media and Crux Investors

where he answers questions on the Company's second quarter results and

activities. These interviews can be accessed using the following links.

BRR Media -

https://www.brrmedia.co.uk/broadcasts-embed/5f171a294c167c121579821e/?popup=true

Crux Investors - https://youtu.be/zidepQVcrwg

Key Operational Information

SUMMARY PRODUCTION STATISTICS FOR 2020 AND FOR 2019

Qtr 1 Qtr 2 YTD Qtr 1 Qtr 2 Qtr 3 Qtr 4 Total

------------ -------

2020 2020 2020 2019 2019 2019 2019 2019

------------ ------- ------ ------ ------ ------ ------ ------ ------ -------

Gold

production

(1) (2) Ounces 9,020 8,504 17,524 10,164 9,527 10,187 10,233 40,101

Mined ore --

Total Tonnes 42,036 43,519 85,555 42,609 44,784 44,757 44,092 176,243

Gold grade (g/t) 6.54 5.85 6.19 7.47 6.72 7.14 6.69 7.00

Milled ore Tonnes 40,465 44,235 84,700 43,451 43,711 45,378 44,794 177,335

Gold grade (g/t) 6.66 5.91 6.27 7.69 6.72 6.84 6.81 7.02

Horizontal

development

-- Total Metres 2,878 3,004 5,882 1,868 2,419 2,433 2,908 9,628

------------ ------- ------ ------ ------ ------ ------ ------ ------ -------

1. Gold production figures are subject to amendment pending final agreed

assays of the gold content of the copper/gold concentrate and gold

doré that is delivered to the refineries.

2. Gold production totals for 2020 include treatment of 18,939 tonnes of

flotation tails at a grade of 3.80 g/t (H1 2019: 10,892 tonnes at a

grade of 4.38 g)

3. The table may not sum due to rounding.

Mike Hodgson, CEO, commented:

"In light of the unique challenges with the pandemic that we have faced

over the past months, I am delighted with the gold production level for

the second quarter of 8,504 ounces, which is beyond my expectation at

the start of the quarter.

"Early in the quarter we took the decision to implement numerous changes

to maintain gold production. Normally the operation, accommodates

approximately 360 people within the mine camp. As a precaution we sent

home personnel not directly involved in gold production, and also older

employees and any individuals with the potential to have underlying

health issues. Any personnel arriving at site for their work rotation

were subject to health screening and CV19 testing before being securely

transported to site. These measures have necessitated a reduction in

the workforce at site to 240 people, liberating space and allowing

accommodation of these remaining employees under improved social

distancing conditions. Achieving the original second quarter production

plan of approximately 10,000 ounces, with only 65% of the workforce

available at site would have been challenging, so to achieve over 8,500

ounces and therefore over 85% of the original plan has been an excellent

achievement.

"The mining operation is not just about achieving daily gold production

targets, so it is equally pleasing to see us achieve over 3,000 metres

of mine development in the quarter being the highest quarterly level of

development to date. In the Palito orebody, production for the quarter

continued to focus on the Mogno and Ipe veins. These are being

developed on several levels and we have been mining some zones of

exceptionally high grade copper and gold, with gold grades of up to

20g/t. At the Sao Chico orebody, the ramp is being extended to -76mRL,

whilst development continues to the west on the upper levels of 186mRL

and 156mRL along the Main Vein.

"During the first quarter of 2020 we reported, on 3 March 2020, some

very exciting exploration results especially for the work being

undertaken around the Sao Chico area. However, to minimise personnel at

site, and especially as exploration is reliant on third-party contactors,

exploration activities were suspended during April. Therefore,

follow-up work has been limited and further results reported in the

second quarter were limited to the remaining drilling that was completed

prior to the suspension but which was nonetheless very successful. The

underground drilling at Sao Chico focused on the shallow portion of the

Main Vein immediately beyond the mine's western limit and returned 1.37m

@ 28.77g/t Au (20-SCUD-341) and 2.72m @ 5.06g/t (20-SCUD-343), both

very encouraging. Surface drilling targeted the deeper portion of the

main vein and its westerly extension, and results again demonstrate good

depth and grade continuity, with intercepts of 5.30m @ 12.10g/t Au

(20-SC-166) and 3.40m @ 3.94g/t Au (20-SC-164). The intercept in drill

hole 20-SC-166 is 300 metres below surface, and immediately down dip of

holes 20-SC-164, 20-SCUD-341 & 20-SCUD-343, with all holes demonstrating

mineable widths and grades. On a long section, an interesting

high-grade zone is clearly evolving.

[Please click on the link below to access Figure 1]

Figure 1 -- Long section of Sao Chico underground development and step

out drilling to the Cicada anomaly -

https://www.globenewswire.com/Tracker?data=aaLMOPps2cuhYK-D9fmfBNpoTSuQGaW2iIziFXouzHTMr-m9uvxwVlEEcrOK-Sts7zCrTDPk0pkMFFj27WNVUSXGL0_X0E_J-aEJSQSiykc=

https://bit.ly/2CtnF9x

"Further west we have new holes 20-SC-167, 169 and 170. These are the

three most westerly holes and all three intersected the Main Vein with

the clearly defined vein/alteration being visible. Whilst the grades

returned from the intersections (hole 20-SC-170 graded 1.00m @ 1.09g/t

Au) are quite low, this is not unusual and most importantly the

intersections demonstrate continuity of a gold bearing structure that is

still going strong in our most western hole, now located 375 metres west

of the current mine workings.

"The full results of this remaining drilling were set out in a news

release issued by Serabi on 11 May 2020.

[Please click on the link below to access Figure 2]

Figure 2 - Plan view of Sao Chico and geophysical anomalies to the west

showing drilling locations -

https://www.globenewswire.com/Tracker?data=aaLMOPps2cuhYK-D9fmfBPc29tM3T1Y9_G5P7GpkaQvjU5cZpi3le7A-hgYiNxuKmt7OR-0EHY_G8KhhsYo-tQwdI2OvzmAlf4tRoJL6Vb0=

https://bit.ly/2E0tmvN

"The Cicada terrestrial geophysics anomaly is located approximately 700

metres further to the west of hole 20-SC-170. We undertook reverse

circulation (RC) drilling over this area targeting the series of high

chargeability anomalies defined in 2018 (news release dated 28 November

2018). We are delighted to report numerous very positive results with a

number of intersections grading gold and the geology indicating strong

zones of alteration and associated sulphides. The best intercept

returned to date has been from drill hole SCRC004, where 3.00m @ 2.09g/t

Au was recovered from a depth of 169 metres including a zone of 1m @

5.42g/t Au. Again, a long section, which shows the location of the RC

programme over Cicada and the step out drilling going west from Sao

Chico, clearly suggests that as we continue to drill in the gap, the two

areas of mineralisation could ultimately connect.

"During the quarter we also saw the results from the geochemistry

programme conducted to the south of Palito, following up on some of the

findings from our 2018 airborne geophysics survey, focussing in

particular, on the very prominent 14 kilometre long, east-west trending,

magnetic anomaly known as the Mata Cobra lineament and the adjacent

NE-SW trending Cinderella shear. Since mid-2019, we have been busy with

a regional geochemical sampling campaign in and around the Mata Cobra

belt, and can now report that the prospectivity of the Mata Cobra

geophysical magnetic anomaly has been strengthened by the identification

of an eight kilometre by two kilometre copper anomaly with analytical

results over 100ppm, coincidental with the geophysical anomaly

identified by the AEM.

[Please click on the link below to access Figure 3]

Figure 3 -- Regional plan showing tenement and contours of soil

anomalies identified by geochemical sampling -

https://www.globenewswire.com/Tracker?data=aaLMOPps2cuhYK-D9fmfBKkCXNTpgiSGe6tHgC-ABSQRi38r-oL4sSNRhvoGf-_3Xfi7Wlm6gYX1qmY8qpijIlsRqjaU4M3bErgXVz9V4UM=

https://bit.ly/3hqnNoP

"Within the contours of this 100ppm copper anomaly, we have identified

some very exciting prospects, these include Calico and Juca, at the west

end of the corridor and approximately five kilometres south of Palito.

Both of these prospects exhibit a very similar geological setting to

Palito and anomalous gold grades in addition to the copper.

"With respect to Coringa, there has been modest progress with the

permitting. The state environmental agency ("SEMAS") have approved all

final amendments to our Licencia Previa (the Preliminary License)

application, and we now await the final stage, the meeting of the State

Environmental Council ("COEMA") to agree and hopefully the award of the

Licencia Previa.

"Having been able to achieve a base level of production and with some

limited improvement in local travel logistics we are now looking at the

measures we need to both continue to control the CV-19 pandemic at site

whilst also being able to resume full mine-site operations in the coming

months. To begin with, we are working hard to significantly expand the

camp to accommodate the full 360 on site workforce under improved social

distancing conditions. Once this is in place, we can bring all

employees currently on vacation or under the Brazilian Government

suspension scheme back to work. Health screening and testing of all

employees will be routine for all returning employees. We will also

extend the work rosters, so that employees will spend more time at site

and with longer breaks at home, reducing the number of journeys and

therefore assisting virus control. With this in mind, we expect that

production levels for the third quarter can be similar to those for the

second quarter with the hope that we can see a return to full production

levels in the fourth quarter.

"During the initial period of the pandemic, we built up stockpiles of

many critical mining and processing consumables and supplies to minimise

short term supply issues that might otherwise have impacted production

"Whilst we have not reached been able to achieve our initial production

forecasts for the first six months of a little in excess of 20,000

ounces, we have benefitted from improved gold prices and a favourable

exchange rate. Strong cash flow during the quarter has allowed us to

repay the remaining balance of the loan from Sprott of approximately

US$3.5 million. We started the quarter with a cash balance of US$9.1

million and notwithstanding this US$3.5 million outflow, finished the

period with cash holdings of US$9.6 million.

"During the quarter we also finalised the arrangements with Greenstone

for their subscription for up to US$12 million of convertible loan

notes. This investment to help finance the outstanding liability of

US$12 million due to Equinox Gold Corp. for the Coringa gold project,

had been placed on hold in mid-March 2020 in light of the uncertainty

caused by the CV-19 pandemic. Revised drawdown terms were agreed in

April 2020 and as at the end of June we have drawn down US$1.5 million

of convertible loan notes to help finance the revised payment schedule

for the completion of the acquisition of Coringa.

"I would like to end by taking the opportunity to thank the flexibility

and professionalism of our Serabi workforce, I said the same at the end

of the first quarter, but I think their efforts during the second

quarter and the superb results achieved, in the circumstances, deserve

to be properly acknowledged."

Production Results

Total production for the second quarter of 2020 was 8,504 ounces of gold,

generated from the processing of 44,235 tonnes of ore at overall average

grades of 5.91 g/t of gold. This processed ore was sourced from hard

rock mined ore from the Palito and Sao Chico orebodies, supplemented by

the processing of 9,763 tonnes of surface stockpiled flotation tailings

grading approximately 3.30 g/t gold. Mined tonnage for the quarter

totalled 43,519 tonnes with a grade of 5.85 g/t of gold. The lower

grades are a result of maintaining development rates but with the

consequence of a reduction in mill feed grade through increased

dilution. For the year to date, 17,525 ounces of gold have been

produced.

On 30 June 2020, there were coarse ore stocks of approximately 5,156

tonnes of ore with an average grade of 3.23 g/t of gold, and a

significant stockpile of flotation tails with an estimated average grade

of 3.00 g/t of gold. These stockpiles continue to be consumed slowly and

used as a 'top-up' to mined ROM to keep the plant full. The stockpile

of flotation tailings is sufficient to continue to process this material

at current rates for the rest of the year.

A total of 3,004 metres of horizontal development has been completed

during the quarter, of which 1,769 metres was ore development. The

balance is the ramp, cross cuts and stope preparation development.

2020 Production Guidance

As discussed above, the impact of CV-19 pandemic has resulted in

production of 17,525 ounces of gold for the first six months of the

year. The company is working hard to expand the camp allowing for a

return to full staffing levels before the end of the third quarter.

With this in mind, we anticipate, third quarter performance being

similar to that of the second quarter, and a return to full levels of

production in the early part of the fourth quarter. Should this be

achieved full year production would be expected to be between 34,000 and

37,000 ounces.

This announcement is inside information for the purposes of Article 7 of

Regulation 596/2014.

The person who arranged for the release of this announcement on behalf

of the Company was Clive Line, Director.

Enquiries:

Serabi Gold plc

Michael Hodgson Tel: +44 (0)20 7246 6830

Chief Executive Mobile: +44 (0)7799 473621

Clive Line Tel: +44 (0)20 7246 6830

Finance Director Mobile: +44 (0)7710 151692

Email: mailto:contact@serabigold.com

contact@serabigold.com

--------------------------------------------------

Website: http://www.serabigold.com

www.serabigold.com

--------------------------------------------------

Beaumont Cornish Limited

Nominated Adviser and Financial Adviser

Roland Cornish Tel: +44 (0)20 7628 3396

Michael Cornish Tel: +44 (0)20 7628 3396

Peel Hunt LLP

UK Broker

Ross Allister Tel: +44 (0)20 7418 8900

Copies of this announcement are available from the Company's website at

www.serabigold.com.

Neither the Toronto Stock Exchange, nor any other securities regulatory

authority, has approved or disapproved of the contents of this

announcement.

GLOSSARY OF TERMS

The following is a glossary of technical terms:

"Ag" means silver.

------------------ ------------------------------------------------------------

"Au" means gold.

------------------ ------------------------------------------------------------

"assay" in economic geology, means to analyse the proportions

of metal in a rock or overburden sample; to test an

ore or mineral for composition, purity, weight or

other properties of commercial interest.

------------------ ------------------------------------------------------------

"CIM" means the Canadian Institute of Mining, Metallurgy

and Petroleum.

------------------ ------------------------------------------------------------

"chalcopyrite" is a sulphide of copper and iron.

------------------ ------------------------------------------------------------

"Cu" means copper.

------------------ ------------------------------------------------------------

"cut-off grade" the lowest grade of mineralised material that qualifies

as ore in a given deposit; rock of the lowest assay

included in an ore estimate.

------------------ ------------------------------------------------------------

"deposit" is a mineralised body which has been physically delineated

by sufficient drilling, trenching, and/or underground

work, and found to contain a sufficient average grade

of metal or metals to warrant further exploration

and/or development expenditures; such a deposit does

not qualify as a commercially mineable ore body or

as containing ore reserves, until final legal, technical,

and economic factors have been resolved.

------------------ ------------------------------------------------------------

"electromagnetics" is a geophysical technique tool measuring the magnetic

field generated by subjecting the sub-surface to electrical

currents.

------------------ ------------------------------------------------------------

"garimpo" is a local artisanal mining operation

------------------ ------------------------------------------------------------

"garimpeiro" is a local artisanal miner.

------------------ ------------------------------------------------------------

"geochemical" refers to geological information using measurements

derived from chemical analysis.

------------------ ------------------------------------------------------------

"geophysical" refers to geological information using measurements

derived from the use of magnetic and electrical readings.

------------------ ------------------------------------------------------------

"geophysical include the exploration of an area by exploiting differences

techniques" in physical properties of different rock types. Geophysical

methods include seismic, magnetic, gravity, induced

polarisation and other techniques; geophysical surveys

can be undertaken from the ground or from the air.

------------------ ------------------------------------------------------------

"gossan" is an iron-bearing weathered product that overlies

a sulphide deposit.

------------------ ------------------------------------------------------------

"grade" is the concentration of mineral within the host rock

typically quoted as grams per tonne (g/t), parts per

million (ppm) or parts per billion (ppb).

------------------ ------------------------------------------------------------

"g/t" means grams per tonne.

------------------ ------------------------------------------------------------

"granodiorite" is an igneous intrusive rock similar to granite.

------------------ ------------------------------------------------------------

"hectare" or a is a unit of measurement equal to 10,000 square metres.

"ha"

------------------ ------------------------------------------------------------

"igneous" is a rock that has solidified from molten material

or magma.

------------------ ------------------------------------------------------------

"IP" refers to induced polarisation, a geophysical technique

whereby an electric current is induced into the sub-surface

and the conductivity of the sub-surface is recorded.

------------------ ------------------------------------------------------------

"intrusive" is a body of rock that invades older rocks.

------------------ ------------------------------------------------------------

"mineralisation" the concentration of metals and their chemical compounds

within a body of rock.

------------------ ------------------------------------------------------------

"mineralised" refers to rock which contains minerals e.g. iron,

copper, gold.

------------------ ------------------------------------------------------------

"mt" means million tonnes.

------------------ ------------------------------------------------------------

"ore" means a metal or mineral or a combination of these

of sufficient value as to quality and quantity to

enable it to be mined at a profit.

------------------ ------------------------------------------------------------

"oxides" are near surface bed-rock which has been weathered

and oxidised by long term exposure to the effects

of water and air.

------------------ ------------------------------------------------------------

"ppm" means parts per million.

------------------ ------------------------------------------------------------

"saprolite" is a weathered or decomposed clay-rich rock.

------------------ ------------------------------------------------------------

"sulphide" refers to minerals consisting of a chemical combination

of sulphur with a metal.

------------------ ------------------------------------------------------------

"vein" is a generic term to describe an occurrence of mineralised

rock within an area of non-mineralised rock.

------------------ ------------------------------------------------------------

"VTEM" refers to versa time domain electromagnetic, a particular

variant of time-domain electromagnetic geophysical

survey to prospect for conductive bodies below surface.

------------------ ------------------------------------------------------------

Assay Results

The assay results reported in the table within this release are those

provided by the Company's own on-site laboratory facilities at Palito

and have not been independently verified. Serabi closely monitors the

performance of its own facility against results from independent

laboratory analysis for quality control purpose. As a matter of normal

practice the Company sends duplicate samples derived from a variety of

the Company's activities to accredited laboratory facilities for

independent verification. Based on the results of this work, the

Company's management are satisfied that the Company's own facility shows

good correlation with independent laboratory facilities. The Company

would expect that in the preparation of any future independent

Reserve/Resource statement undertaken in compliance with a recognised

standard, the independent authors of such a statement would not use

Palito assay results but only use assay results reported by an

appropriately certificated laboratory.

Qualified Persons Statement

The scientific and technical information contained within this

announcement has been reviewed and approved by Michael Hodgson, a

Director of the Company. Mr Hodgson is an Economic Geologist by training

with over 26 years' experience in the mining industry. He holds a BSc

(Hons) Geology, University of London, a MSc Mining Geology, University

of Leicester and is a Fellow of the Institute of Materials, Minerals and

Mining and a Chartered Engineer of the Engineering Council of UK,

recognising him as both a Qualified Person for the purposes of Canadian

National Instrument 43-101 and by the AIM Guidance Note on Mining and

Oil & Gas Companies dated June 2009.

Forward Looking Statements

Certain statements in this announcement are, or may be deemed to be,

forward looking statements. Forward looking statements are identi ed by

their use of terms and phrases such as "believe", "could", "should"

"envisage", "estimate", "intend", "may", "plan", "will" or

the negative of those, variations or comparable expressions, including

references to assumptions. These forward looking statements are not

based on historical facts but rather on the Directors' current

expectations and assumptions regarding the Company's future growth,

results of operations, performance, future capital and other

expenditures (including the amount, nature and sources of funding

thereof), competitive advantages, business prospects and opportunities.

Such forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to the

Directors. A number of factors could cause actual results to differ

materially from the results discussed in the forward looking statements

including risks associated with vulnerability to general economic and

business conditions, competition, environmental and other regulatory

changes, actions by governmental authorities, the availability of

capital markets, reliance on key personnel, uninsured and underinsured

losses and other factors, many of which are beyond the control of the

Company. Although any forward-looking statements contained in this

announcement are based upon what the Directors believe to be reasonable

assumptions, the Company cannot assure investors that actual results

will be consistent with such forward looking statements.

ENDS

Attachment

-- Q2 2020 Operational Update

https://ml-eu.globenewswire.com/Resource/Download/7fb94fda-3d68-4341-a59c-e6fe37c3db61

(END) Dow Jones Newswires

July 23, 2020 02:00 ET (06:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

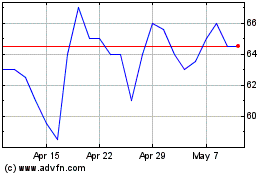

Serabi Gold (LSE:SRB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Serabi Gold (LSE:SRB)

Historical Stock Chart

From Apr 2023 to Apr 2024