TIDMSRB

For immediate release

14 August 2020

Serabi Gold plc

("Serabi" or the "Company")

Unaudited Results for the three and six month periods ended 30 June 2020

Serabi (AIM:SRB, TSX:SBI), the Brazilian focused gold mining and

development company, today releases its unaudited results for the three

and six month periods ended 30 June 2020.

Financial Highlights

-- Cash Cost for the year to date of US$961 per ounce.

-- All-In Sustaining Cost for the year to date of US$1,265 per ounce.

-- EBITDA for the second quarter of 2020 of US$6.2 million (Q2 2019: US$3.3

million) an improvement of 89 per cent.

-- EBITDA for the year to date ("ytd") of US$9.4 million (2019 ytd US$7.6

million) an improvement of 24 per cent.

-- Post tax profit for the year to date of US$4.2 million (2019 ytd: US$1.7

million) an improvement of 142 per cent.

-- Earnings per share for the year to date of 7.05 cents.

-- Average gold price of US$1,647 received on gold sales in 2020.

-- Outstanding loan from Sprott (US$6.9 million at start of year) repaid in

full at 30 June 2020.

-- Agreement, concluded in April 2020, with Greenstone Resources II LP

("Greenstone") to subscribe for US$12 million Convertible Loan Notes --

US$2.0 million drawn down to date with balance available to be drawn

until 30 June 2021.

-- Agreement reached with Equinox Gold Corp. ("Equinox") allowing the

Company to pay, in monthly instalments, the remaining US$12 million

consideration for purchase of Coringa, until travel restrictions caused

by Coronavirus are lifted -- US$2.5 million settled to date.

Key Financial Information

6 months to 3 months to 6 months to 3 months to

30 June 2020 30 June 2020 30 June 2019 30 June 2019

US$ US$ US$ US$

--------------- ------------- ------------- ----------------- -----------------

Revenue 29,461,830 16,364,143 29,585,739 12,459,699

Cost of sales (16,421,213) (8,188,157) (19,164,989) (7,803,002)

------------- ------------- ----------------- -----------------

Gross operating

profit 13,040,617 8,175,986 10,420,750 4,656,697

Administration

and share

based

payments (3,670,066) (2,005,436) (2,803,500) (1,378,996)

------------- ------------- ----------------- -----------------

EBITDA 9,370,551 6,170,550 7,617,250 3,277,701

Depreciation

and

amortisation

charges (3,232,094) (1,527,733) (4,250,501) (1,960,956)

------------- ------------- ----------------- -----------------

Operating

profit /

(loss) before

finance and

tax 6,138,457 4,642,817 3,366,749 1,316,745

------------- ------------- ----------------- -----------------

Profit / (loss)

after tax 4,156,467 3,383,835 1,719,640 169,678

------------- ------------- ----------------- -----------------

Earnings per

ordinary share

(basic) 7.05c 5.74c 2.92c 0.29c

------------- ------------- ----------------- -----------------

Average gold

price received

(US$/oz) US$1,647 US$1,710 US$1,287 US$1,292

As at

30 June As at As at

2020 31 December 2019 31 December 2018

US$ US$ US$

--------------- ------------- ------------- ----------------- -----------------

Cash and cash

equivalents 9,627,412 14,234,612 9,216,048

Net assets 56,492,450 69,733,388 69,110,287

Cash Cost and

All-In

Sustaining

Cost ("AISC")

---------------

6 months to 6 months to 12 months to 12 months to

30 June 2020 30 June 2019 31 Dec 2019 31 Dec 2018

--------------- ------------- ------------- ----------------- -----------------

Gold production 17,524 ozs 19,691 ozs 40,101 ozs 37,108 ozs

for cash cost

and AISC

purposes

------------- ------------- ----------------- -----------------

Total Cash Cost US$961 US$860 US$832 US$821

of production

(per ounce)

------------- ------------- ----------------- -----------------

Total AISC of US$1,265 US$1,085 US$1,081 US$1,093

production

(per ounce)

------------- ------------- ----------------- -----------------

Operational Highlights

-- Second quarter gold production of 8,504 ounces, resulting in 17,524

ounces for the year to date.

-- 43,519 tonnes of ore mined during the quarter at 5.85 grams per tonne

("g/t") of gold.

-- 44,235 tonnes of run of mine ("ROM") ore were processed through the plant

from the combined Palito and Sao Chico orebodies, with an average grade

of 5.91 g/t of gold.

-- 3,004 metres of horizontal development completed during the quarter, the

highest level of development metres to date.

SUMMARY PRODUCTION STATISTICS FOR 2020 AND FOR 2019

Qtr 1 Qtr 2 YTD Qtr 1 Qtr 2 Qtr 3 Qtr 4 Total

------------ -------

2020 2020 2020 2019 2019 2019 2019 2019

------------ ------- ------ ------ ------ ------ ------ ------ ------ -------

Gold

production

(1) (2) Ounces 9,020 8,504 17,524 10,164 9,527 10,187 10,233 40,101

Mined ore --

Total Tonnes 42,036 43,519 85,555 42,609 44,784 44,757 44,092 176,243

Gold grade (g/t) 6.54 5.85 6.19 7.47 6.72 7.14 6.69 7.00

Milled ore Tonnes 40,465 44,235 84,700 43,451 43,711 45,378 44,794 177,335

Gold grade (g/t) 6.66 5.91 6.27 7.69 6.72 6.84 6.81 7.02

Horizontal

development

-- Total Metres 2,878 3,004 5,882 1,868 2,419 2,433 2,908 9,628

------------ ------- ------ ------ ------ ------ ------ ------ ------ -------

1. Gold production figures are subject to amendment pending final agreed

assays of the gold content of the copper/gold concentrate and gold

doré that is delivered to the refineries.

2. Gold production totals for 2020 include treatment of 18,939 tonnes of

flotation tails at a grade of 3.80 g/t (H1 2019: 10,892 tonnes at a

grade of 4.38 g)

3. The table may not sum due to rounding.

Exploration and Development Highlights

--Results reported in the second quarter for a further eight surface

holes and ten underground holes at Sao Chico. These results demonstrate

the Main Vein structure now continues to host gold bearing

mineralisation for approximately 375 metres to the west of the current

mine limits, an extension of a further 75 metres.

Results included:

-- 5.30m @ 12.10g/t Au (Hole: 20-SC-166)

-- 3.40m @ 3.94g/t Au (Hole: 20-SC-164)

-- 1.37m @ 28.77g/t Au (Hole: 20-SCUD-341)

-- 2.72m @ 5.06g/t Au (Hole: 20-SCUD-343)

-- Reverse circulation percussion drilling on the Cicada terrestrial

geophysics anomaly indicates the strong likelihood that the anomaly is a

western extension of the Sao Chico vein structure, approximately 1,000

metres to the west of the current mine limits. Results include:

-- 3m @ 2.09g/t Au (Hole: SCRC-004)

-- 1m @ 1.17g/t Au (Hole: SCRC-007)

-- Regional geochemical sampling has highlighted an area, referred to as

Mata Cobra, which represents an eight kilometre by two kilometre soil

copper anomaly exceeding 100ppm. This anomaly is coincidental with

multiple molybdenum, bismuth, tellurium and arsenic multi-element

anomalies as well as the original airborne electromagnetic ("AEM")

anomalies

Key Objectives for 2020

-- Continue to implement measures to minimise short term impacts of

Coronavirus ("CV-19") on current operations and provide a safe and

responsible work environment for staff during the crisis.

-- Continue advancing the licensing process for Coringa along with ongoing

engineering studies.

-- Secure financing package for the Coringa project to fund plant assembly

and other site developments.

-- Complete, as soon as practically possible, exploration drilling at Sao

Chico with a view to producing a new resource estimation.

-- Complete exploration discovery drilling programme over the geophysical

anomalies to the west and south of Sao Chico.

-- Maintain payment programme required to complete acquisition of Coringa

gold project.

2020 Production Guidance

The impact of CV-19 pandemic has resulted in production of 17,524 ounces

of gold for the first six months of the year. The company is working

hard to expand the camp allowing for a return to full staffing levels

before the end of the third quarter. With this in mind third quarter

performance is anticipated to be similar to that of the second quarter,

with a return to full levels of production in the early part of the

fourth quarter. Should this be achieved, full year production would be

expected to be between 34,000 and 37,000 ounces.

Clive Line, CFO of Serabi has been interviewed by Crux Investors and BRR

Media. These interviews can be accessed using the following links

Crux Investors -

https://www.globenewswire.com/Tracker?data=JGi7Nyo_iisn0wijZgQKVxtmCQMv4eDEwsBryjQP--Yn5gL518kN1DKk1_HSXVHhhbbR9UKVhhfmt5oC4VGnDpL7QO2zB8OUvMwDWADdh_MZCjEYYWQPxTvOP1UEb2a1

https://youtu.be/jHyjme-IeJo

BRR Media -

https://www.globenewswire.com/Tracker?data=JGi7Nyo_iisn0wijZgQKV3fojJW_0mXWcQP3KfIeSPwxIB7mF53B8pzHOadkLP3N2YF3vN3r3nMXqf9VBWN0A_J-Tu99fSYJOfjdEh3SD-gCP6E-SZbKNDbkXS74E2wHBA9Xrt8t7tnEZGJ4onFMJ6t7NCTK-irRZNBMgBot8xH3Swb0pV2LdtOhPuu247uZaIq-P7Y8I9wF8jBvVL73AtRXJcClfXj__5iFCD-jo-6ttPGy9PVd0HjZ3NNG71ScFGPwgVYWhEdM_uHqNkXjZxMV4VNA9PJ_XRMb2mNJT8ROS-a-VHYwCn9s2q4cJL_GA6lUrVbReMnSL5wqAZ8vJEWL2di3zr1k0Ry4ovLmSM8=

https://www.brrmedia.co.uk/broadcasts-embed/5f33db75b14d872626436cbb/copied-from-5f292eef65023062edd7e282?popup=true

Clive Line, CFO of Serabi commented,

"The second quarter of the year has proved, financially, to be one of

our most successful ever and viewed in the context of the uncertainties

that we were facing at the end of March, both from a financial and

operational perspective, the workforce have produced an exceptional

result in extremely challenging circumstances.

"Cashflow generated from operations was US$5.85 million and after

accounting for capital expenditures the net operational cash flow of

US$4.2 million represents the best level of quarterly cash flow

generated by the Company to date.

"Operating profit (before finance costs) of US$4.64 million, is up by

253% compared to the same quarter in 2019 and for the year to date there

has been an 82% improvement year on year. The financial performance has

been assisted by the strong gold price and the continued weakness of the

Brazilian Real. Since the end of the quarter we have seen continued

improvement in the gold price, with record highs being reached in early

August, and an average gold price for this current third quarter of

approximately US$1,880 to date, compared with the average price achieved

for the year to date of US$1,647 per ounce. With the expectation of

gold production for the third quarter being at similar levels to that of

the second quarter levels, this bodes well for the Company's cash

generation going forward.

"The Company was able to repay the US$3.5 million outstanding secured

loan liability to Sprott Resource Lending during the quarter without any

impact on our cash position. In light of the operational uncertainties

created by the COVID-19 pandemic we were able to renegotiate the terms

for the settlement of the final payment for the Coringa gold project and

this is now being paid down, whilst there are travel restrictions in

place both internationally and within Brazil, in monthly instalments.

We also put in place a US$12 million Convertible Loan Note facility (the

"Loan Note Facility") arrangement with Greenstone Resources II LP

("Greenstone"), one of our major shareholders, which provided certainty

that the Company had funding available to it to meet this acquisition

obligation. At the end of the second quarter Serabi had drawn down

US$1.5 million against the Loan Note Facility and settled US$1.0 million

of the acquisition obligation. Subsequent to the end of the quarter, a

further US$1.5 million of the acquisition obligation has been paid, with

only US$0.5 million of additional funding being drawn down against the

Loan Note Facility. With the Sprott debt now repaid and given the

levels of cash currently expected to be generated, management will

continue to try to pay the on-going instalment payments for Coringa from

cash flow generated from operations, and minimise the requirement to

make further draw-downs against the Loan Note Facility.

"The cash cost per ounce and the AISC per ounce for the year to date

need to be viewed in context. Gold production for the year to date has

been lower than was originally forecast. In the first quarter this was

the result of a breakdown of the largest of the three ball mils during

February, and although we quickly bounced back and were able to report

our highest ever monthly level of production for March 2020, we could

not fully recover the earlier shortfall. The second quarter production

has been affected by the need to reduce the workforce on site to allow

socially distanced working conditions. By the end of the quarter, the

Company recorded over 85 per cent of its original production estimate

with just 65 per cent of the normal level of workforce at site. Those

staff that were at site, voluntarily extended their work rosters. Many

spent up to three months at site to maintain the mining operations as

restrictions on travel and a lack of testing capacity at the time

rendered team changes very difficult. However, taking this action kept

the camp safe. Nevertheless, additional costs have been incurred as a

result of the pandemic, including hardship payments to staff that

remained at site, salary payments whilst staff were quarantining in

advance of starting their work rosters and additional medical and other

costs as the Company adapted the conditions in the live-in camp to the

changing requirements imposed by the pandemic, ensuring that it provides,

as much as possible, a safe and secure work and living environment. Had

production been at the original levels expected, this would have

potentially translated into a 12.5 per cent improvement in the AISC and

Cash Costs.

"Looking at the operational statistics during the first six months of

the 2020, mined tonnage and plant throughput have been at similar levels

to the same period in 2019 with lower mine grades being the major

contributor to the reduction in gold production. The original plan for

2020 was to increase mining rates compared with 2019, and to use the ore

sorter to beneficiate the lower grade material and deliver a sorted

higher grade product to the process plant. The mine plan was therefore

deliberately designed to undertake more development (more diluted ore

given the mining method) as well as more lower grade stopes. The

intention was to beneficiate this lower grade material through the ore

sorter, screen out the majority of the waste and send the resultant

lower volume of higher grade product to the plant. However, despite the

Company continuing to follow the original mine plan, the reduced

workforce meant the mining rates could not attain budgeted levels. As

we begin to return to normal mining rates during the second part of this

year mine output is expected to exceed the current plant capacity and

with that, the effects of the ore sorter will really come into their

own. With this, I would fully expect to see unit costs coming down as

we spread the costs of the operation, many of which are relatively fixed

in the short term, over a growing production base.

"We have re-started some of the investment programmes that were put on

hold at the end of March 2020 in particular underground drilling at Sao

Chico which is required for longer term mine planning purposes and

orders for capital equipment to replace some of the mining fleet.

Exploration programmes are expected to re-start in the fourth quarter

once additional accommodation units and other infrastructure changes are

installed to house and support Serabi's own full workforce complement.

"It has been said before, but I would like to take this opportunity to

personally thank all of our Brazilian staff and management for the

efforts they have made over the recent months. They have shown a

commitment, flexibility, patience and loyalty that has allowed the

Company to weather this storm and emerge in a strong position and the

Board of Serabi is extremely grateful for their dedication."

This announcement is inside information for the purposes of Article 7 of

Regulation 596/2014. The person who arranged the release of this

statement on behalf of the Company was Clive Line, Director.

Enquiries:

Serabi Gold plc

Michael Hodgson Tel: +44 (0)20 7246 6830

Chief Executive Mobile: +44 (0)7799 473621

Clive Line Tel: +44 (0)20 7246 6830

Finance Director Mobile: +44 (0)7710 151692

Email: contact@serabigold.com

-----------------------------

Website: www.serabigold.com

-----------------------------

Beaumont Cornish Limited

Nominated Adviser

Roland Cornish Tel: +44 (0)20 7628 3396

Michael Cornish Tel: +44 (0)20 7628 3396

Peel Hunt LLP

UK Broker

Ross Allister Tel: +44 (0)20 7418 8900

Copies of this announcement are available from the Company's website at

www.serabigold.com.

Neither the Toronto Stock Exchange, nor any other securities regulatory

authority, has approved or disapproved of the contents of this

announcement.

The following information, comprising, the Income Statement, the Group

Balance Sheet, Group Statement of Changes in Shareholders' Equity, and

Group Cash Flow, is extracted from these financial statements.

Statement of Comprehensive Income

For the three and six month periods ended 30 June 2020

For the three months ended For the six months ended

30 June 30 June

2020 2019 2020 2019

(expressed in US$) Notes (unaudited) (unaudited) (unaudited) (unaudited)

-------------------------- --------- ------------------- ------------- ------------ ------------

CONTINUING OPERATIONS

Revenue 16,364,143 12,459,699 29,461,830 29,585,739

Cost of sales (8,188,157) (7,803,002) (16,421,213) (19,664,989)

Release of inventory

impairment provision -- -- -- 500,000

Depreciation and

amortisation charges (1,527,733) (1,960,956) (3,232,094) (4,250,501)

-------------------------- --------- ------------------- ------------- ------------ ------------

Total cost of sales (9,715,890) (9,763,958) (19,653,307) (23,415,490)

Gross profit 6,648,253 2,695,741 9,808,523 6,170,249

Administration expenses (1,922,181) (1,415,133) (3,663,145) (2,798,964)

Share-based payments (136,600) (65,486) (161,838) (130,971)

Gain on sales of assets

disposal 53,345 101,623 154,917 126,435

-------------------------- --------- ------------------- ------------- ------------ ------------

Operating profit 4,642,817 1,316,745 6,138,457 3,366,749

Foreign exchange loss (141,816) (51,486) (150,674) (66,103)

Finance expense 2 (918,061) (849,336) (1,103,052) (1,123,599)

Finance income 2 725,349 159,600 725,349 161,817

-------------------------- --------- ------------------- ------------- ------------ ------------

Profit before taxation 4,308,289 575,523 5,610,080 2,338,864

Income tax expense 3 (924,454) (405,845) (1,453,613) (619,224)

-------------------------- --------- ------------------- ------------- ------------ ------------

Profit after taxation 3,383,835 169,678 4,156,467 1,719,640

-------------------------- --------- ------------------- ------------- ------------ ------------

Other comprehensive income

(net of tax)

Items that may be reclassified subsequently to profit

or loss

Exchange differences on

translating foreign

operations (2,637,441) 1,053,943 (17,613,949) 491,850

-------------------------- --------- ------------------- ------------- ------------ ------------

Total comprehensive profit

/(loss) for the

period(1) 746,394 1,223,621 (13,457,482) 2,211,490

-------------------------- --------- ------------------- ------------- ------------ ------------

Profit per ordinary share 4 5.74c 0.29c 7.05c 2.92c

(basic)()

-------------------------- --------- ------------------- ------------- ------------ ------------

Profit per ordinary share 4 5.56c 0.28c 6.83c 2.85c

(diluted)

-------------------------- --------- ------------------- ------------- ------------ ------------

(1) The Group has no non-controlling interests and all losses

are attributable to the equity holders of the parent company.

Balance Sheet as at 30 June 2020

As at As at As at

30 June 30 June 31 December

2020 2019 2019

(expressed in US$) (unaudited) (unaudited) (audited)

------------------------------ ------------ ------------ ------------

Non-current assets

Deferred exploration costs 25,724,189 29,591,753 30,686,652

Property, plant and equipment 28,413,097 39,055,069 37,597,100

Right of use assets 1,863,595 2,173,269 1,997,176

Taxes receivable 829,555 1,556,125 848,845

Deferred taxation 490,890 2,008,732 1,321,782

-------------------------------- ------------ ------------ ------------

Total non-current assets 57,321,326 74,384,948 72,451,555

-------------------------------- ------------ ------------ ------------

Current assets

Inventories 5,587,300 6,898,033 6,577,968

Trade and other receivables 1,344,595 1,291,505 802,275

Prepayments and accrued income 2,078,415 4,706,018 3,473,288

Cash and cash equivalents 9,627,412 12,366,683 14,234,612

-------------------------------- ------------ ------------ ------------

Total current assets 18,637,722 25,262,239 25,088,143

-------------------------------- ------------ ------------ ------------

Current liabilities

Trade and other payables 5,514,477 7,389,818 6,113,789

Acquisition payment outstanding 10,430,799 11,530,027 12,000,000

Other interest bearing

liabilities -- 6,122,584 6,952,542

Derivative financial

liabilities -- 681,765 --

Accruals 281,712 335,142 319,670

------------ ------------ ------------

Total current liabilities 16,226,988 26,059,336 25,386,001

-------------------------------- ------------ ------------ ------------

Net current assets 2,410,734 (797,097) (297,858)

-------------------------------- ------------ ------------ ------------

Total assets less current

liabilities 59,732,060 73,587,851 72,153,697

-------------------------------- ------------ ------------ ------------

Non-current liabilities

Trade and other payables 88,707 562,627 183,043

Other interest bearing

liabilities 1,163,683 -- --

Derivative financial

liabilities 340,508 -- --

Provisions 1,646,712 1,572,476 2,237,266

Total non-current liabilities 3,239,610 2,135,103 2,420,309

-------------------------------- ------------ ------------ ------------

Net assets 56,492,450 71,452,748 69,733,388

-------------------------------- ------------ ------------ ------------

Equity

Share capital 8,888,963 8,882,803 8,882,803

Share premium reserve 21,800,976 21,752,430 21,752,430

Option reserve 833,370 1,106,017 1,019,589

Other reserves 9,017,420 5,590,190 7,149,274

Translation reserve (61,892,895) (40,315,273) (44,278,946)

Retained surplus 77,844,616 74,436,581 75,208,238

-------------------------------- ------------ ------------ ------------

Equity shareholders' funds 56,492,450 71,452,748 69,733,388

-------------------------------- ------------ ------------ ------------

The interim financial information has not been audited and does not

constitute statutory accounts as defined in Section 434 of the Companies

Act 2006. Whilst the financial information included in this announcement

has been compiled in accordance with International Financial Reporting

Standards ("IFRS") this announcement itself does not contain sufficient

financial information to comply with IFRS. The Group statutory accounts

for the year ended 31 December 2019 prepared under IFRS as adopted in

the EU and with IFRS and their interpretations adopted by the

International Accounting Standards Board have been filed with the

Registrar of Companies following their adoption by shareholders at the

2020 Annual General Meeting. The auditor's report on these accounts was

unqualified. The auditor's report did not contain a statement under

Section 498 (2) or 498 (3) of the Companies Act 2006.

Statements of Changes in Shareholders' Equity

For the three and six month periods ended 30 June 2020

(expressed in

US$)

Share Other

Share Share option reserves Translation Retained

(unaudited) capital premium reserve (1) reserve Earnings Total equity

-------------- --------- ---------- --------- --------- ------------ ----------- ------------

Equity

shareholders'

funds at 31

December

2018 8,882,803 21,752,430 1,363,367 4,763,819 (40,807,123) 73,154,991 69,110,287

-------------- --------- ---------- --------- --------- ------------ ----------- ------------

Foreign

currency

adjustments -- -- -- -- 491,850 -- 491,850

Profit for the

period -- -- -- -- -- 1,719,640 1,719,640

-------------- --------- ---------- --------- --------- ------------ ----------- ------------

Total

comprehensive

income for

the period -- -- -- -- 491,850 1,719,640 2,211,490

Transfer to

taxation

reserve -- -- -- 826,371 -- (826,371) --

Share options

lapsed in

period -- -- (388,321) -- -- 388,321 --

Share option

expense -- -- 130,971 -- -- -- 130,971

-------------- --------- ---------- --------- --------- ------------ ----------- ------------

Equity

shareholders'

funds at 30

June 2019 8,882,803 21,752,430 1,106,017 5,590,190 (40,315,273) 74,436,581 71,452,748

-------------- --------- ---------- --------- --------- ------------ ----------- ------------

Foreign

currency

adjustments -- -- -- -- (3,963,673) -- (3,963,673)

Profit for the

period -- -- -- -- -- 2,113,344 2,113,344

-------------- --------- ---------- --------- --------- ------------ ----------- ------------

Total

comprehensive

income for

the period -- -- -- -- (3,963,673) 2,113,344 (1,850,329)

Transfer to

taxation

reserve -- -- -- 1,559,084 -- (1,559,084) --

Share options

lapsed in

period -- -- (217,397) -- -- 217,397 --

Share option

expense -- -- 130,969 -- -- -- 130,969

-------------- --------- ---------- --------- --------- ------------ ----------- ------------

Equity

shareholders'

funds at 31

December

2019 8,882,803 21,752,430 1,019,589 7,149,274 (44,278,946) 75,208,238 69,733,388

-------------- --------- ---------- --------- --------- ------------ ----------- ------------

Foreign

currency

adjustments -- -- -- -- (17,613,949) -- (17,613,949)

Profit for the

period -- -- -- -- -- 4,156,467 4,156,467

-------------- --------- ---------- --------- --------- ------------ ----------- ------------

Total

comprehensive

income for

the period -- -- -- -- (17,613,949) 4,156,467 (13,457,482)

Shares issued

in the

period 6,160 48,546 -- -- -- -- 54,706

Transfer to

taxation

reserve -- -- -- 1,868,146 -- (1,868,146) --

Share options

lapsed in

period -- -- (348,057) -- -- 348,057 --

Share option

expense -- -- 161,838 -- -- -- 161,838

-------------- --------- ---------- --------- --------- ------------ ----------- ------------

Equity

shareholders'

funds at 30

June 2020 8,888,963 21,800,976 833,370 9,017,420 (61,892,895) 77,844,616 56,492,450

-------------- --------- ---------- --------- --------- ------------ ----------- ------------

(1) Other reserves comprise a merger reserve of US$361,461 and a

taxation reserve of US$8,655,959 (31 December 2019: merger reserve of

US$361,461 and a taxation reserve of US$6,787,813).

Cash Flow Statement

For the three and six month periods ended 30 June 2020

For the three months For the six months

ended ended

30 June 30 June

2020 2019 2020 2019

(expressed in US$) (unaudited) (unaudited) (unaudited) (unaudited)

------------------------------------------------------ ----------- ----------- ----------- -----------

Operating activities

Post tax (loss) / profit for period 3,383,835 169,678 4,156,467 1,719,640

Depreciation -- plant, equipment and mining properties 1,527,733 1,960,956 3,232,094 4,250,501

Net financial expense 334,528 741,222 528,377 1,027,885

Provision for impairment of inventory -- -- -- (500,000)

Provision for taxation 924,454 405,845 1,453,613 619,224

Share-based payments 191,306 65,486 216,544 130,971

Foreign exchange (loss) / gain (123,744) (404,652) (45,805) (382,801)

Changes in working capital

(Increase)/decrease in inventories 568,519 (572,470) (789,533) 2,165,340

(Increase) in receivables, prepayments and accrued

income (521,624) (376,417) (1,000,176) (1,113,022)

Increase/(decrease) in payables, accruals and

provisions (800,544) 979,894 (57,232) 1,518,388

----------------------------------------------------- ----------- ----------- ----------- -----------

Net cash inflow from operations 5,484,463 2,969,542 7,694,349 9,436,126

------------------------------------------------------ ----------- ----------- ----------- -----------

Investing activities

Purchase of property, plant and equipment and assets

in construction (181,643) (1,071,564) (1,189,953) (1,461,292)

Mine development expenditure (634,068) (654,253) (1,221,677) (1,492,563)

Geological exploration expenditure (248,911) (208,062) (1,085,272) (796,524)

Pre-operational project costs (262,344) (403,580) (477,640) (843,522)

Acquisition of mining project (1,000,000) -- (1,000,000) --

Acquisition of other property rights (149,274) (120,988) (332,513) (1,156,075)

Proceeds from sale of assets 88,856 118,039 327,859 153,081

Interest received 911 -- 911 2,217

------------------------------------------------------ ----------- ----------- ----------- -----------

Net cash outflow on investing activities (2,386,473) (2,340,408) (4,978,285) (5,594,678)

------------------------------------------------------ ----------- ----------- ----------- -----------

Financing activities

Drawdown of convertible loan 1,500,000 -- 1,500,000 --

Repayment of secured loan (3,491,746) (195,043) (6,983,492) (195,043)

Payment of finance lease liabilities (9,966) (81,573) (46,274) (267,178)

Interest paid and other finance costs (58,330) (151,137) (262,999) (303,933)

----------- ----------- ----------- -----------

Net cash (outflow) / inflow from financing activities (2,060,042) (427,753) (5,792,765) (766,154)

------------------------------------------------------ ----------- ----------- ----------- -----------

Net increase / (decrease) in cash and cash equivalents 1,037,948 201,381 (3,076,701) 3,075,294

Cash and cash equivalents at beginning of period 9,149,274 12,133,712 14,234,612 9,216,048

Exchange difference on cash (559,810) 31,590 (1,530,499) 75,341

------------------------------------------------------ ----------- ----------- ----------- -----------

Cash and cash equivalents at end of period 9,627,412 12,366,683 9,627,412 12,366,683

------------------------------------------------------ ----------- ----------- ----------- -----------

Notes

1. Basis of Preparation

These interim condensed consolidated financial statements are for the

three and six month periods ended 30 June 2020. Comparative information

has been provided for the unaudited three and six month periods ended 30

June 2019 and, where applicable, the audited twelve month period from 1

January 2019 to 31 December 2019. These condensed consolidated financial

statements do not include all the disclosures that would otherwise be

required in a complete set of financial statements and should be read in

conjunction with the 2019 annual report.

The condensed consolidated financial statements for the periods have

been prepared in accordance with International Accounting Standard 34

"Interim Financial Reporting" and the accounting policies are consistent

with those of the annual financial statements for the year ended 31

December 2019 and those envisaged for the financial statements for the

year ending 31 December 2020.

.

Accounting standards, amendments and interpretations effective in 2020

The Group has not adopted any standards or interpretations in advance of

the required implementation dates.

The following Accounting standard has come into effect as of 1 January

2020 have been

IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors

(Amendment -- Definition of Material)

The adoption of this standard has had no effect on the financial results

of the Group.

There are a number of standards, amendments to standards, and

interpretations which have been issued that are effective in future

periods and which the Group has chosen not to adopt early. None of

these are expected to have a significant effect on the Group, in

particular

IAS 1 Presentation of Financial Statements

IFRS 3 Business Combinations (Amendment -- Definition of a Business)

These financial statements do not constitute statutory accounts as

defined in Section 434 of the Companies Act 2006

Going concern and availability of finance

As at 30 June 2020 the Group had cash in hand of US$9.63 million and net

assets of US$56.49 million.

The occurrence of the Coronavirus (COVID-19) pandemic has created

significant uncertainty for all business sectors including Serabi.

However during the second quarter of 2020, the Group has maintained its

gold mining operations without interruption, albeit that the Group took

the decision to reduce the levels of workforce at site as a

pre-cautionary measure to improve social distancing whilst additional

accommodation and other facilities could be put in place prior to a

return to full workforce numbers. Whilst production levels during the

second quarter of 2002 were approximately 85 per cent of the levels that

the Group had originally forecast, the weakness of the Brazilian Real

and the increased gold price that prevailed during the second quarter,

resulted in strong cash flow being generated by the Group. This has

permitted the Group to repay in full US$3.5 million of secured loan that

was outstanding at 31 March 2020.

At the current time the Directors have assumed that mining operations

and gold production will continue at the Palito Complex at similar

levels of production for the third quarter and expect that, with a

return to a full workforce during the fourth quarter, production in the

fourth quarter will increase. There is no evidence, at this time, to

suggest that the authorities in Brazil have any intention to try and

close down or suspend mining activities as a result of the current

Coronavirus pandemic. On 20 March 2020, it was stipulated in Decree

10,282/20 that mineral activity was considered an essential business

sector and further actions have subsequently been invoked to prevent any

restrictive measures being applied to the supplies required by the

mining industry including transportation of supplies, availability of

materials required for processing, and the sale and transportation of

the mineral products.

The Group has renegotiated the terms relating to the settlement of a

final acquisition payment of US$12 million due to Equinox Gold Inc

("Equinox") in respect of the purchase of Chapleau Resources Limited and

its Coringa gold project (the "Coringa Deferred Consideration"). Under

the revised arrangement the Group will pay monthly instalments

commencing 1 May 2020 of US$500,000 per month, increasing to US$1

million per month from 1 August 2020 and payable thereafter ("the

"Deferral Period") until such time as certain conditions relating to

travel into and within Brazil are lifted (the "Travel Restriction

Conditions"). Within 6 weeks of the satisfaction of the Travel

Restriction Conditions the remaining portion of the Coringa Deferred

Consideration will become payable.

The Company announced on 22 January 2020 that it had entered into an

agreement with Greenstone Resources II LP ("Greenstone") for the issue

of and subscription by Greenstone of US$12 million of Convertible Loan

Notes the proceeds of which would be used to satisfy the Coringa

Deferred Consideration. However, due to the uncertainties created by

the impact of the Coronavirus, the Company and Greenstone agreed to

extend the period for the satisfaction of the conditions required for

completion of the subscription by Greenstone. On 24 April 2020 the

Company announced that it had agreed certain amendments to the original

agreement with Greenstone (the "Amended Subscription Deed").

Under the Amended Subscription Deed and a further subsequent amendment

agreed with Greenstone

(a) the Company may, prior to the satisfaction of the Travel

Restriction Condition only submit a subscription request in respect of

Convertible Loan Notes in the amount of US$500,000 each month. Following

the satisfaction of the Travel Restriction Condition, the Company may

then issue further subscription request for amounts of not less than

US$100,000 and not exceeding an amount equal to US$12,000,000 less the

sum of the aggregate principal amount of all Notes outstanding at that

time.

(b) the Convertible Loan Notes were initially unsecured and

subordinated to the Sprott Loan. Following the completion of the

repayment of the Sprott Loan on 30 June 2020, the security interests of

Sprott have been discharged and the Company has granted to Greenstone

the security package as originally envisaged save that a pledge of the

shares of Chapleau Resources Limited ("CRL") will continue to be held by

Equinox until such time as the Coringa Deferred Consideration is settled

in full. CRL holds 100% of the shares of Chapleau Exploração

Mineral Ltda which in turn holds the exploration licences for the

Coringa gold project

(d) The period during which the Company may issue an Issue

Notice to Greenstone expires on 30 June 2021

(e) Subject to Greenstone not having exercised its option to

convert the amount outstanding into Conversion Shares, the Convertible

Loan Notes are due to be repaid 16 months after the first Issue Date

which was 30 April 2020.

Based on the performance of the Group during the second quarter, and

having discharged the Sprott Loan, the Board considers, if current

production levels can be maintained and gold prices remain at current

levels, that the Group can generate adequate cash flow, at least in the

short term, to satisfy the on-going commitment in respect of the Coringa

Deferred Consideration without needing to make further drawdowns against

the Convertible Loan Notes. As at the current date, US$2.0 million has

been drawn down against the Convertible Loan Notes and US$9.5 million

remains outstanding in respect of the Coringa Deferred Consideration.

The Balance Sheet of the Group shows a net liability position of US$0.83

million at 30 June 2020 including the fair value of a cash liability of

US$11 million in respect of Coringa Deferred Consideration (reduced to

US$9.5 million subsequent to the period end. The Group plans to try and

finance this liability as much as possible from its operational cash

flow but can also obtain additional working capital through the issue of

the balance of US$12 million of Convertible Loan Notes to Greenstone

which will not be repayable until 31 August 2021.

Whilst the Directors consider that the assumptions they have used are

reasonable and based on the information currently available to them,

there remains significant uncertainty regarding further actions that

have not been anticipated but which may be required or imposed and may

impact on the ability of the Group to meet the operational plan and cash

flow forecast.

Whilst recognising all the above uncertainties, the Directors have

prepared the financial statements on a going concern basis. In the

event that additional short term funding is required, the Directors

believe there is a reasonable prospect of the Group securing further

funds as and when required in order that the Group can meet all

liabilities including the Coringa Deferred Consideration as and when

they fall due in the next 12 months. The Directors have been successful

in raising funding as and when required in the past and consider that

the Group continues to have strong support from its major shareholders

who been supportive of and provided additional funding when required on

previous occasions.

As at the date of this report both the medium and long term impact of

COVID-19 on the underlying operations, and the outcome of raising any

further funds that may be required, remains uncertain and this

represents a material uncertainty surrounding going concern. If the

Group fails to achieve the operational plan or to raise any additional

necessary funds, the Group may be unable to realise its assets and

discharge its liabilities in the normal course of business. The matters

explained indicate that a material uncertainty exists that may cast

significant doubt on the Group and Company's ability to continue as a

going concern. These financial statements do not show the adjustments to

the assets and liabilities of the Group or the Company if this was to

occur.

2. Finance expense and income

3 months ended 3 months ended 6 months ended

30 June 2020 30 June 2019 30 June 2020 6 months ended

(unaudited) (unaudited) (unaudited) 30 June 2019 (unaudited)

US$ US$ US$ US$

Interest expense on secured loan (58,036) (150,956) (203,127) (300,540)

Interest expense on convertible loan (38,907) -- (38,907) --

Interest expense on mineral property acquisition

liability (584,290) -- (584,290) --

Unwinding of discount on mineral property acquisition

liability -- (270,750) -- (532,271)

Expense in respect of non-substantial modification (195,137) (13,300) (235,037) (13,300)

Amortisation of arrangement fee for convertible loan (37,500) -- (37,500) --

Loss on revaluation of derivatives (4,191) (427,630) (4,191) (290,788)

(918,061) (862,636) (1,103,052) (1,136,899)

Gain in respect of non-substantial modification 724,438 172,900 724,438 172,900

Interest income 911 -- 911 2,217

-------------- -------------- -------------- -------------------------

Net finance expense (192,712) (689,736) (377,703) (961,782)

-------------- -------------- -------------- -------------------------

3. Taxation

The Group has recognised a deferred tax asset to the extent that the

Group has reasonable certainty as to the level and timing of future

profits that might be generated and against which the asset may be

recovered. The Group has released the amount of US$536,270 as a

deferred tax charge during the six month period to 30 June 2020.

The Group has also incurred a tax charge in Brazil for the six month

period of US$917,343.

4. Earnings per Share

3 months ended 30 June 2020 3 months ended 30 June 2019 6 months ended 30 June 2020 6 months ended 30 June 2019

(unaudited) (unaudited) (unaudited) (unaudited)

------------- --------------------------- --------------------------- --------------------------- ---------------------------

Profit

attributable

to ordinary

shareholders

(US$) 3,383,835 169,678 4,156,467 1,719,640

------------- --------------------------- --------------------------- --------------------------- ---------------------------

Weighted

average

ordinary

shares in

issue 58,947,463 58,909,551 58,928,611 58,909,551

Basic profit

per share (US

cents) 5.74c 0.29c 7.05c 2.92c

------------- --------------------------- --------------------------- --------------------------- ---------------------------

Diluted

ordinary

shares in

issue (1) 62,459,640 60,430,473 62,440,788 60,430,473

Diluted 5.42c 0.28c 6.66c 2.85c

profit per

share (US

cents)

------------- --------------------------- --------------------------- --------------------------- ---------------------------

(1) Based on 1,903,425 options vested and exercisable as at 30 June 2020

and 1,608,750 shares that could be issued pursuant to any exercise of

conversion rights attaching to the Convertible Loan Notes as at 30 June

2020 (30 June 2019: 1,520,922 options)

4. Post balance sheet events

On 4 August 2020, the Company announced that the period during which the

Company may issue an Issue Notice in respect of the US$12 million

Convertible Loan Note facility with Greenstone was extended from 31

December 2020 to 30 June 2021.

Save for the above and subsequent to the end of the quarter, there has

been no item, transaction or event of a material or unusual nature

likely, in the opinion of the Directors of the Company to affect

significantly the continuing operation of the entity, the results of

these operations, or the state of affairs of the entity in future

financial periods.

Qualified Persons Statement

The scientific and technical information contained within this

announcement has been reviewed and approved by Michael Hodgson, a

Director of the Company. Mr Hodgson is an Economic Geologist by training

with over 26 years' experience in the mining industry. He holds a BSc

(Hons) Geology, University of London, a MSc Mining Geology, University

of Leicester and is a Fellow of the Institute of Materials, Minerals and

Mining and a Chartered Engineer of the Engineering Council of UK,

recognising him as both a Qualified Person for the purposes of Canadian

National Instrument 43-101 and by the AIM Guidance Note on Mining and

Oil & Gas Companies dated June 2009.

Assay Results

The assay results reported within this release include those provided by

the Company's own on-site laboratory facilities at Palito which may not

have been independently verified. Serabi closely monitors the

performance of its own facility against results from independent

laboratory analysis for quality control purpose. As a matter of normal

practice the Company sends duplicate samples derived from a variety of

the Company's activities to accredited laboratory facilities for

independent verification. Based on the results of this work, the

Company's management are satisfied that the Company's own facility shows

good correlation with independent laboratory facilities. The Company

would expect that in the preparation of any future independent

Reserve/Resource statement undertaken in compliance with a recognised

standard, the independent authors of such a statement would not use

Palito assay results but only use assay results reported by an

appropriately certificated laboratory.

Forward Looking Statements

Certain statements in this announcement are, or may be deemed to be,

forward looking statements. Forward looking statements are identi ed by

their use of terms and phrases such as "believe", "could", "should"

"envisage", "estimate", "intend", "may", "plan", "will" or

the negative of those, variations or comparable expressions, including

references to assumptions. These forward looking statements are not

based on historical facts but rather on the Directors' current

expectations and assumptions regarding the Company's future growth,

results of operations, performance, future capital and other

expenditures (including the amount, nature and sources of funding

thereof), competitive advantages, business prospects and opportunities.

Such forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to the

Directors. A number of factors could cause actual results to differ

materially from the results discussed in the forward looking statements

including risks associated with vulnerability to general economic and

business conditions, competition, environmental and other regulatory

changes, actions by governmental authorities, the availability of

capital markets, reliance on key personnel, uninsured and underinsured

losses and other factors, many of which are beyond the control of the

Company. Although any forward looking statements contained in this

announcement are based upon what the Directors believe to be reasonable

assumptions, the Company cannot assure investors that actual results

will be consistent with such forward looking statements.

ENDS

Attachment

-- Serabi - Q2 Results News Release

https://ml-eu.globenewswire.com/Resource/Download/c8fdc635-485b-4709-a6e2-bb833ecd9177

(END) Dow Jones Newswires

August 14, 2020 02:00 ET (06:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

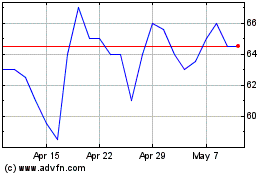

Serabi Gold (LSE:SRB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Serabi Gold (LSE:SRB)

Historical Stock Chart

From Apr 2023 to Apr 2024