TIDMSRB

THIS ANNOUNCEMENT, IS NOT FOR RELEASE, PUBLICATION,DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED

STATES, AUSTRALIA, NEW ZEALAND JAPAN, SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH IT WOULD BE UNLAWFUL TO DO SO.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE AN OFFER OF SECURITIES IN ANY JURISDICTION. PLEASE SEE THE

IMPORTANT NOTICES AT THE OF THIS ANNOUNCEMENT.

This announcement contains inside information for the purposes of

Article 7 of Regulation (EU) No 596/2014 which is part of UK law by

virtue of the European Union (Withdrawal) Act 2018.

Terms used in this announcement have the same meaning given to them as

defined in the Placing Announcement.

For immediate release

2 March 2021

Serabi Gold plc

("Serabi", the "Company" or the "Group")

Results of Placings

Serabi Gold Plc (AIM:SRB, TSX:SBI), the Brazil focussed gold producer

and developer, is pleased to announce the successful completion of the

Placings and PrimaryBid Offer announced yesterday (the "Placing

Announcement").

A total of 16,650,000 new Ordinary Shares in the capital of the Company

have been placed with new and existing investors at a Placing Price of

GBP0.75 (C$1.32) per new Ordinary Share. The Placing and PrimaryBid

Offer have raised gross proceeds of approximately US$17.5 million for

the Company (approximately GBP12.5 million / C$22.0 million) (before

expenses).

Pursuant to the Placing, a total of 15,684,257 Placing Shares have been

placed with new and existing investors at the Placing Price, raising

gross proceeds of approximately US$16.4 million (GBP11.8 million /

C$20.7 million). In addition, retail investors have subscribed in the

PrimaryBid Offer for 965,743 PrimaryBid Offer Shares at the Placing

Price raising gross proceeds of approximately US$1.0 million (GBP0.7

million / C$1.3 million).

The Placing Price of GBP0.75 pence represents a discount of

approximately 5.1 per cent. to the closing price on 26 February 2021,

the last trading day prior to the announcement of the Fundraising and a

discount of approximately 2.6 per cent. to the closing price on the day

of the launch of the Fundraising.

Pursuant to the Warrant Placing, investors have also subscribed for

4,003,527 Warrants at a price of GBP0.06 (C$0.11) per Warrant (the

"Warrant Price") to raise gross proceeds of US$0.3 million (GBP0.2

million / C$0.4 million), subject amongst other things to shareholder

approval at a general meeting to be held on or before the end of May

2021. The Warrants will have an Exercise Price of GBP0.9375 (C$1.65) per

new Ordinary Share and will be exercisable for two years from their date

of issue.

Peel Hunt and Tamesis acted as Joint Bookrunners and Beacon acted as

Manager in respect of the Placings.

The 16,650,000 new Ordinary Shares to be issued in aggregate pursuant to

the Placing and the PrimaryBid Offer (the "New Ordinary Shares")

represent 28.2 per cent. of the issued ordinary share capital of the

Company prior to the Placing.

The New Ordinary Shares will, when issued, be credited as fully paid and

will rank pari passu in all respects with the existing Ordinary Shares

at that time. The Warrants, when issued, will not be transferable and

will not be listed on AIM, the Toronto Stock Exchange (the "TSX") or any

other exchange or market.

The Company has applied to the London Stock Exchange plc for Admission,

and to the TSX to list, 16,650,000 New Ordinary Shares. Subject to,

inter alia, the Placing Agreement not having been terminated in

accordance with its terms as well as admission to AIM, it is expected

that admission to AIM of the 16,650,000 New Ordinary Shares will occur

at 8:00 am on or around 9 March 2021 and admission to the TSX on or

around 9 March 2021.

In accordance with the provision of the Disclosure Guidance and

Transparency Rules of the FCA ("DTRs"), the Company confirms that,

following Admission, its issued share capital will comprise 75,734,551

Ordinary Shares, each of which carries the right to vote, with no

Ordinary Shares held in treasury. This figure may be used by

Shareholders as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a change

to their interest in, the Company under the DTRs.

Greenstone

As announced in the Placing Announcement, the Company and Greenstone

have entered into an agreement (the "Redemption Agreement") pursuant to

which they have agreed, conditional on Admission, to redeem the

outstanding Convertible Loan Notes held by Greenstone being US$2 million

together with accrued interest of approximately US$200,000 and the

arrangement fee and other expenses of approximately US$333,000, to

terminate the Subscription Deed and to release the security granted by

the Company in favour of Greenstone.

Greenstone (which holds shares representing approximately 25.2% of the

Company's share capital as at the date hereof) is a related party of the

Company for the purposes of Rule 13 of the AIM Rules, and has

participated in the Placing by subscribing for 4,195,424 Placing Shares

and 2,097,711 Warrants. This constitutes a related party transaction

under Rule 13 of the AIM Rules for Companies. As such, the Independent

Directors of the Company (being the Board other than Mark Sawyer)

consider, having consulted with the Company's nominated adviser,

Beaumont Cornish, that the terms of the participation in the Placings by

Greenstone are fair and reasonable insofar as the Company's shareholders

are concerned.

Greenstone's participation in the Placing also constitutes a related

party transaction for the Company under Canadian securities laws

pursuant to Multilateral Instrument 61-101 -- Protection of Minority

Security Holders in Special Transactions ("MI 61-101"). In accordance

with MI 61-101, the Company is relying on the exemptions from the

requirement to obtain a formal valuation and minority shareholder

approval on the basis that the board of directors of the Company

determined that the fair market value of the transaction with Greenstone

is less than 25% of the market capitalisation of the Company. For the

purposes of MI 61-101, the independent directors of the Company (which

excludes appointees of Greenstone) consider that the participation of

Greenstone in the placing is fair and reasonable and in the best

interests of the independent shareholders and the Company as a whole.

For the purposes of MI 61-101 there has not been in the 24 months

preceding the date of the Placing any valuation in respect of the

Company that relates to the subject matter of or is otherwise relevant

to the transaction.

FX rate used is the Bloomberg daily spot rate on 26 February 2021 for

pounds sterling of GBP1.00 = US$1.3976, GBP1.00 = C$1.7580

Mike Hodgson, CEO of Serabi Gold plc commented:

"The financing completed today creates a strong financial position for

Serabi from which we will be able to advance our significant growth

opportunities.

Following this fundraising, Serabi will become debt free and, together

with cash being generated from the current operations, the Company will

be in a strong position to move forward with the development of Coringa

and at the same time accelerate an aggressive exploration programme over

the Palito Complex tenements.

With the all-important Preliminary Licence for Coringa awarded in

October 2020, good progress is being made on the submissions required

for the Installation Licence and with a trial mining licence in place to

allow mine development, we will commence development of the underground

mine this year. This will improve the project, hopefully allow better

optimisation of mine planning, and put us in a good position to seek

attractive debt financing terms to continue the development and

construction of the project.

It is also very pleasing that the Company now has the financing to

advance some of the best of numerous exploration opportunities that

exist in close proximity to both Palito and Sao Chico orebodies and I

feel confident that over the next couple of years these exploration

prospects will generate some significant resource growth for the

Company.

We have added some very strong names to our shareholder register, who

have been attracted by the growth that Coringa presents and the

potential that exists for future resource and ultimately production

growth in our tenements. I thank them and our existing shareholders for

their support and look forward to updating them on continued progress as

we drive forward on the next stage of the Company's growth.

Enquiries:

Serabi Gold plc

Michael Hodgson (Chief Executive) Tel: +44 (0)20 7246 6830

Clive Line (Finance Director) Tel: +44 (0)20 7246 6830

Peel Hunt LLP

Joint Bookrunner & Corporate Broker

Investment Banking

Ross Allister / Alexander Allen Tel: +44 (0)20 7418 8900

ECM / Syndicate

Al Rae / Max Irwin

Tamesis Partners LLP

Joint Bookrunner

Richard Greenfield / Charlie Bendon Tel: +44 (0)203 882 0712

Beacon Securities Limited

Manager

Investment Banking

Daniel Belchers Tel: +1 416 507 3954

ECM / Syndicate

Kim MacIntyre

Beaumont Cornish Limited

Nominated Advisor

Roland Cornish / Michael Cornish Tel: +44 (0)20 7628 3396

For the purposes of MAR, the person responsible for arranging for the

release of this Announcement on behalf of the Company is Clive Line,

Director.

IMPORTANT NOTICES

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR FORM ANY PART OF AN OFFER TO SELL OR ISSUE, OR A

SOLICITATION OF AN OFFER TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE ANY

SECURITIES IN THE UNITED STATES (INCLUDING ITS TERRITORIES AND

POSSESSIONS, ANY STATE OF THE UNITED STATES AND THE DISTRICT OF COLUMBIA

(COLLECTIVELY, THE "UNITED STATES")), AUSTRALIA, THE REPUBLIC OF SOUTH

AFRICA, JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH OFFER OR

SOLICITATION WOULD BE UNLAWFUL OR TO ANY PERSON TO WHOM IT IS UNLAWFUL

TO MAKE SUCH OFFER OR SOLICITATION. NO PUBLIC OFFERING OF THE PLACING

SHARES IS BEING MADE IN ANY SUCH JURISDICTION. ANY FAILURE TO COMPLY

WITH THESE RESTRICTIONS MAY CONSTITUTE A VIOLATION OF THE SECURITIES

LAWS OF SUCH JURISDICTIONS.

Neither this Announcement, nor any copy of it, nor the information

contained in it, is for publication, release, transmission distribution

or forwarding, in whole or in part, directly or indirectly, in or into

the United States, Australia, Japan or the Republic of South Africa or

any other jurisdiction in which publication, release or distribution

would be unlawful (or to any persons in any of those jurisdictions).

Neither the Placing Shares nor the Warrants have been, and they will not

be registered under the US Securities Act of 1933, as amended (the "US

Securities Act") or with any securities regulatory authority or under

any securities laws of any state or other jurisdiction of the United

States and may not be offered, sold, resold, pledged, taken up,

exercised, transferred or delivered, directly or indirectly, in or into

the United States except pursuant to an applicable exemption from, or in

a transaction not subject to, the registration requirements of the US

Securities Act and in compliance with the securities laws of any state

or other jurisdiction of the United States. No public offering of

securities is being made in the United States.

Neither the Placing Shares nor the Warrants have been approved,

disapproved or recommended by the U.S. Securities and Exchange

Commission, any state securities commission in the United States or any

other U.S. regulatory authority, nor have any of the foregoing

authorities passed upon or endorsed the merits of the offering of the

Placing Shares or the Warrants.

Subject to certain exceptions, the securities referred to herein may not

be offered or sold in the United States, Australia, Canada, Japan or the

Republic of South Africa or to, or for the account or benefit of, any

national, resident or citizen of the United States, Australia, Canada,

Japan or the Republic of South Africa.

This Announcement is directed at and is only being distributed to: (a)

persons in member states of the European Economic Area who are

"qualified investors", as defined in Article 2(e) of the Prospectus

Regulation (Regulation (EU) 2017/1129) (the "Prospectus Regulation")

("Qualified Investors"), (b) persons in the United Kingdom, who are

qualified investors, being persons falling within the meaning of Article

2(e) of Prospectus Regulation (EU) 2017/1129 as it forms part of

domestic law by virtue of the European Union (Withdrawal) Act 2018 (the

" UK Prospectus Regulation"), and who (i) have professional experience

in matters relating to investments who fall within the definition of

"investment professionals" in Article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the

"Order") or are high net worth companies, unincorporated associations or

partnerships or trustees of high value trusts as described in Article

49(2)(a) to (d) of the Order and (ii) are Qualified Investors, or (c)

otherwise, persons to whom it may otherwise lawfully be communicated

(each such person in (a), (b) and (c), a "Relevant Person"). No other

person should act on or rely on this Announcement and persons

distributing this Announcement must satisfy themselves that it is lawful

to do so. By accepting the terms of this Announcement, you represent and

agree that you are a Relevant Person. This Announcement must not be

acted on or relied on by persons who are not Relevant Persons. Any

investment or investment activity to which this Announcement or the

Placing relates is available only to Relevant Persons and will be

engaged in only with Relevant Persons.

This Announcement is not being distributed by, nor has it been approved

for the purposes of section 21 of the Financial Services and Markets Act

2000, as amended ("FSMA") by, a person authorised under FSMA. This

Announcement is being distributed and communicated to persons in the

United Kingdom only in circumstances in which section 21(1) of FSMA does

not apply.

No offering document or prospectus will be made available in any

jurisdiction in connection with the matters contained or referred to in

this Announcement or the Placing or the Warrant Placing and no such

prospectus is required (in accordance with the Prospectus Regulation or

the UK Prospectus Regulation) to be published. Members of the public are

not eligible to take part in the Placing or the Warrant Placing and no

public offering of Placing Shares or Warrants is being or will be made

in the United States, United Kingdom or elsewhere.

All offers of the Placing Shares and Warrants will be made pursuant to

an exemption under the Prospectus Regulation and the UK Prospectus

Regulation from the requirement to produce a prospectus.

This Announcement has been issued by, and is the sole responsibility of,

the Company. No responsibility or liability is or will be accepted by,

and no undertaking, representation or warranty or other assurance,

express or implied, is or will be made or given by the Joint Bookrunners

or Manager or by any of its partners, directors, officers, employees,

advisers, consultants or affiliates as to, or in relation to, the

accuracy, fairness or completeness of the information or opinions

contained in this Announcement or any other written or oral information

made available to or publicly available to any interested person or its

advisers, and any liability therefore is expressly disclaimed. The

information in this Announcement is subject to change.

Peel Hunt and Tamesis, who are authorised and regulated in the United

Kingdom by the FCA, and Beacon, who are regulated in Canada by the

Investment Industry Regulatory Organisation of Canada, are acting

exclusively for the Company and no-one else in connection with the

Placing and the Warrant Placing and the transactions and arrangements

described in this Announcement and will not regard any other person

(whether or not a recipient of this Announcement) as a client in

relation to the Placing, the Warrant Placing or any other matter

referred to in this Announcement.

Neither Peel Hunt, Tamesis or Beacon are responsible to anyone other

than the Company for providing the protections afforded to clients of

Peel Hunt, Tamesis or Beacon or for providing advice in connection with

the contents of this Announcement, the Placing, the Warrant Placing or

the transactions, arrangements and matters referred to herein.

None of the information in this Announcement has been independently

verified or approved by the Joint Bookrunners or the Manager or any of

their partners, directors, officers, employees, advisers, consultants or

affiliates. Save for any responsibilities or liabilities, if any,

imposed on the Joint Bookrunners or the Manager by FSMA or by the

regulatory regime established under it, no responsibility or liability

whatsoever whether arising in tort, contract or otherwise, is accepted

by the Joint Bookrunners or the Manager or any of their respective

partners, directors, officers, employees, advisers, consultants or

affiliates whatsoever for the contents of the information contained in

this Announcement (including, but not limited to, any errors, omissions

or inaccuracies in the information or any opinions) or for any other

statement made or purported to be made by or on behalf of the Joint

Bookrunners or the Manager or any of their respective partners,

directors, officers, employees, advisers, consultants or affiliates in

connection with the Company, the Placing Shares, the Warrants or the

Placing or the Warrant Placing or for any loss, cost or damage suffered

or incurred howsoever arising, directly or indirectly, from any use of

this Announcement or its contents or otherwise in connection with this

Announcement or from any acts or omissions of the Company in relation to

the Placing and/or the Warrant Placing. The Joint Bookrunners, the

Manager and their partners, directors, officers, employees, advisers,

consultants and affiliates accordingly disclaim all and any

responsibility and liability whatsoever, whether arising in tort,

contract or otherwise (save as referred to above) in respect of any

statements or other information contained in this Announcement and no

representation or warranty, express or implied, is made by the Joint

Bookrunner or the Manager or any of its partners, directors, officers,

employees, advisers, consultants or affiliates as to the accuracy,

completeness or sufficiency of the information contained in this

Announcement.

Beaumont Cornish is authorised and regulated in the United Kingdom by

the FCA. Beaumont Cornish's responsibilities as the Company's nominated

adviser under the AIM Rules for Nominated Advisers are owed solely to

the London Stock Exchange and are not owed to the Company or to any

Director or to any other person.

The distribution of this Announcement and the offering of the Placing

Shares and/or the Warrants in certain jurisdictions may be restricted by

law. No action has been taken by the Company, the Joint Bookrunners or

the Manager or any of its affiliates that would permit an offering of

the Placing Shares or the Warrants or possession or distribution of this

Announcement or any other offering or publicity material relating to the

Placing Shares and/or the Warrants in any jurisdiction where action for

that purpose is required. Persons into whose possession this

Announcement comes are required by the Company and the Joint Bookrunners

and the Manager to inform themselves about, and to observe, such

restrictions.

Persons distributing this Announcement must satisfy themselves that it

is lawful to do so. Persons (including without limitation, nominees and

trustees) who have a contractual right or other legal obligations to

forward a copy of this Announcement (or any part thereof) should seek

appropriate advice before taking any action.

In connection with the Placing, the Joint Bookrunners and the Manager

and any of their affiliates, acting as investors for their own account,

may take up a portion of the shares in the Placing and/or the Warrant

Placing as a principal position and in that capacity may retain,

purchase, sell, offer to sell for the own accounts or otherwise deal for

their own account in such shares and other securities of the Company or

related investments in connection with the Placing or otherwise.

Accordingly, references to Placing Shares or Warrants being offered,

acquired, placed or otherwise dealt in should be read as including any

issue or offer to, or acquisition, placing or dealing by, the Joint

Bookrunners, the Manager and their affiliates acting in such capacity.

In addition, the Joint Bookrunners and the Manager and any of their

affiliates may enter into financing arrangements (including swaps) with

investors in connection with which the Joint Bookrunners and the Manager

and any of their affiliates may from time to time acquire, hold or

dispose of shares or other securities. The Joint Bookrunners and the

Manager do not intend to disclose the extent of any such investment or

transactions otherwise than in accordance with any legal or regulatory

obligations to do so.

This Announcement may contain and the Company may make verbal statements

containing "forward-looking statements" with respect to certain of the

Company's plans and its current goals and expectations relating to its

future financial condition, performance, strategic initiatives,

objectives and results. Forward-looking statements sometimes use words

such as "aim", "anticipate", "target", "expect", "estimate", "intend",

"plan", "goal", "believe", "seek", "may", "could", "outlook" or other

words of similar meaning. By their nature, all forward-looking

statements involve risk and uncertainty because they relate to future

events and circumstances which are beyond the control of the Company. As

a result, the actual future financial condition, performance and results

of the Company may differ materially from the plans, goals and

expectations set forth in any forward-looking statements. Any

forward-looking statements made in this Announcement by or on behalf of

the Company speak only as of the date they are made. These

forward-looking statements reflect the Company's judgment at the date of

this Announcement and are not intended to give any assurance as to

future results and cautions that its actual results of operations and

financial condition, and the development of the industry in which it

operates, may differ materially from those made in or suggested by the

forward-looking statements contained in this Announcement and/or

information incorporated by reference into this Announcement. The

information contained in this Announcement is subject to change without

notice and except as required by applicable law or regulation, each of

the Company, the Joint Bookrunners and the Manager expressly disclaim

any obligation or undertaking to publish any updates, supplements or

revisions to any forward-looking statements contained in this

Announcement to reflect any changes in the Company's expectations with

regard thereto or any changes in events, conditions or circumstances on

which any such statements are based, except where required to do so

under applicable law or regulation.

This Announcement does not identify or suggest, or purport to identify

or suggest, the risks (direct or indirect) that may be associated with

an investment in the Placing Shares or the Warrants. Any investment

decision to buy Placing Shares in the Placing or Warrants in the Warrant

Placing must be made solely on the basis of publicly available

information, which has not been independently verified by the Joint

Bookrunners or the Manager.

This Announcement does not constitute a prospectus or offering

memorandum or an offer in respect of any securities and is not intended

to provide the basis for any decision in respect of the Company or other

evaluation of any securities of the Company or any other entity and

should not be considered as a recommendation that any investor should

subscribe for, purchase, otherwise acquire, sell or otherwise dispose of

any such securities. Recipients of this Announcement who are considering

acquiring Placing Shares pursuant to the Placing and/or Warrants

pursuant to the Warrant Placing are reminded that they should conduct

their own investigation, evaluation and analysis of the business, data

and property described in this Announcement. The price and value of

securities can go down as well as up and investors may not get back the

full amount invested upon the disposal of the shares. Past performance

is not a guide to future performance. The contents of this Announcement

are not to be construed as legal, business, financial or tax advice.

Each investor should consult with his or her or its own legal adviser,

business adviser, financial adviser or tax adviser for legal, financial,

business or tax advice.

Any indication in this Announcement of the price at which the Company's

shares have been bought or sold in the past cannot be relied upon as a

guide to future performance. Persons needing advice should consult an

independent financial adviser. No statement in this Announcement is

intended to be a profit forecast or profit estimate for any period and

no statement in this Announcement should be interpreted to mean that

earnings, earnings per share or income, cash flow from operations or

free cash flow for the Company for the current or future financial

periods would necessarily match or exceed the historical published

earnings, earnings per share or income, cash flow from operations or

free cash flow for the Company.

References in this Announcement to other reports or materials, such as a

website address, have been provided to direct the reader to other

sources of information on the Company which may be of interest.

Neither the content of the Company's website (or any other website) nor

the content of any website accessible from hyperlinks on the Company's

website (or any other website) is incorporated into or forms part of

this Announcement.

The Placing Shares to be issued or sold pursuant to the Placing will not

be admitted to trading on any stock exchange other than AIM and the

Toronto Stock Exchange ("TSX"). The Warrants will not be transferable

and will not be admitted to trading on any stock exchange.

Copies of this announcement are available from the Company's website at

https://www.globenewswire.com/Tracker?data=mgfYUXwjrF_D0aTjfdJkCjwPoRoF2CX8fs3bbTcBEgi87dpv-IaBVIeltCK9nBoTqKY4enX4fS424R7zrLIf99MQnxwyGDW52qRlZqg-L1A=

www.serabigold.com.

Neither the London Stock Exchange, the Toronto Stock Exchange, nor any

other securities regulatory authority, has approved or disapproved of

the contents of this announcement.

(END) Dow Jones Newswires

March 02, 2021 02:00 ET (07:00 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

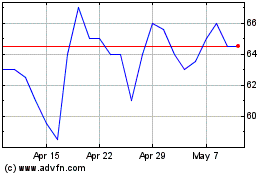

Serabi Gold (LSE:SRB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Serabi Gold (LSE:SRB)

Historical Stock Chart

From Apr 2023 to Apr 2024