Serabi Gold plc Notice Of General Meeting

April 28 2021 - 6:30AM

UK Regulatory

TIDMSRB

For immediate release

28 April 2021

Serabi Gold plc

("Serabi" or the "Company")

Notice of General Meeting

The Company announces that a General Meeting will be held on Tuesday 25

May 2021, at The Long Barn, Cobham Park Road, Downside, Surrey KT11 3NE

England at 10.00 am (BST). The Company has published the formal notice

of the meeting (the "Notice") on its website which can be accessed using

the following link

https://www.globenewswire.com/Tracker?data=PN2GN3ugmDjOQDaCqdAt6VB3-cqwR7_3EyVvQCUBmYJ4qy3hlu4_c5Y9g-A18CRE1GM2LBHnLDUG6NrnGGw8jA7RnhEzk64rH-r0wnyaEcE=

https://bit.ly/3dMm7at. Proxy voting forms are being posted to all

shareholders providing details of how to access the Notice and

instructions for voting. A copy of the Notice together with proxy voting

forms is being posted to all shareholders who are required to receive or

have formally requested to receive these documents.

The Notice contains a letter from the Chairman of the Company, Mr

Nicolas Bañados, which is set out below in the Appendix.

Changes to the format of the General Meeting

The Board continues to closely monitor developments in relation to the

Covid-19 pandemic and the health and wellbeing of the Company's

shareholders and employees continue to remain of paramount importance.

As a result of the UK Government's current guidance on social distancing

and the prohibition on public gatherings due to the Covid-19 pandemic,

it is expected that shareholders will not be permitted to attend the

General Meeting.

The General Meeting will be convened in accordance with the Company's

Articles of Association and in line with the UK Government guidance. The

Company will make arrangements such that the legal requirements to hold

the General Meeting can be satisfied through the attendance of a minimum

number of people who are essential for the business of the General

Meeting, and the format of the General Meeting will be purely

functional. Having regard to their own safety and that of others, the

Board respectfully requests that, if these restrictions remain in place

at the time of the General Meeting (as they are expected to),

shareholders comply with the UK Government's current guidance and do not

make plans to attend the General Meeting.

To ensure the safety of the limited number of people whose attendance at

the General Meeting is essential, we will not be able to allow any other

Shareholders to gain access to the General Meeting on the day. If it

becomes possible to admit Shareholders to the General Meeting, we will

make an announcement on our website (www.serabigold.com) and via a

Regulatory Information Service. To ensure that Shareholders' votes are

counted, the Board strongly encourages all Shareholders to exercise

their right to vote by appointing the Chairman of the General Meeting as

their proxy to vote at the General Meeting on their behalf, in

accordance with their instructions. Shareholders should not appoint any

person other than the Chairman of the General Meeting to act as their

proxy, as that person will likely not be granted access to the General

Meeting on the day and their appointing shareholder's votes will not be

able to be counted.

(1) Certain resolutions to be proposed at the meeting will be

special resolutions requiring approval of more than 75% of the votes

cast. Under Canadian National Instrument 54-101, the meeting therefore

also constitutes a Special Meeting.

Enquiries:

Serabi Gold plc

Michael Hodgson Tel: +44 (0)20 7246 6830

Chief Executive Mobile: +44 (0)7799 473621

Clive Line Tel: +44 (0)20 7246 6830

Finance Director Mobile: +44 (0)7710 151692

Email: contact@serabigold.com

------------------------------

Website: www.serabigold.com

------------------------------

Beaumont Cornish Limited

Nominated Adviser

Roland Cornish Tel: +44 (0)20 7628 3396

Michael Cornish Tel: +44 (0)20 7628 3396

Peel Hunt LLP

UK Broker

Ross Allister Tel: +44 (0)20 7418 9000

CAMARCO

Investor and Public Relations

Gordon Poole Tel:+ 44 (0)20 3757 4997

Nick Hennis

Emily Hall

Copies of this announcement are available from the Company's website at

https://www.globenewswire.com/Tracker?data=bHkFewH0uu_zofouY3Y14NiiQUtWm40--_AwZDanJRWsFBg_4DYtfLAuIqg7_O9BlOETfUBld4GF2Z0XRP9dWX-c61d_DiGuv6dsBg1B-dY=

www.serabigold.com.

Neither the Toronto Stock Exchange, nor any other securities regulatory

authority, has approved or disapproved of the contents of this

announcement.

Appendix 1

The letter from the Chairman of the Company included in the Notice is

reproduced below (without material adjustment):

Dear Shareholder

Introduction

On 2 March 2021, the Company announced it had raised GBP12.5 million

(approximately US$17.5 million) (before expenses) by way of the Share

Placing and PrimaryBid Offer to institutional and other investors at a

price of 75 pence per Ordinary Share. The Company also announced that it

had secured conditional subscriptions for 4,003,527 Warrants at an issue

price of GBP0.06 (C$0.11) per Warrant to raise gross proceeds of

approximately US$0.3 million (GBP0.2 million / C$0.4 million), subject

amongst other things to shareholder approval at the General Meeting. The

Warrants will have an Exercise Price of GBP0.9375 (C$1.65) per new

Ordinary Share and will be exercisable for two years from their date of

issue.

The purpose of this document is to provide the formal notice (the

"Notice") of the General Meeting to be held at The Long Barn, Cobham

Park Road, Downside, Cobham, Surrey, KT11 3NE, England on 25 May 2021 at

10 a.m. (London time) at which the Resolutions to approve the issue of

the Warrants will be proposed. .

Canadian Designated Foreign Issuer Status

The Company is a "designated foreign issuer" for the purposes of

Canadian Securities Administrators' National Instrument 71-102 --

Continuous Disclosure and Other Exemptions Relating to Foreign Issuer

("NI 71-102"), and, as such, the Company is not subject to the same

ongoing reporting requirements as most other reporting issuers in

Canada. Generally, the Company complies with Canadian ongoing reporting

requirements by complying with the regulatory requirements of AIM, which

is a "foreign regulatory authority" (as defined in NI 71-102), and

filing any documents required to be filed with or furnished to AIM with

the securities regulatory authorities in Canada.

Background to and reasons for the issue of the Warrants

On 2 March 2021, the Company announced that it had placed with new and

existing investors a total of 16,650,000 new Ordinary Shares in the

capital of the Company at a Placing Price of GBP0.75 (C$1.32) per new

Ordinary Share. At the same time and pursuant to the Warrant Placing,

the Company also secured commitments from investors to subscribe for

4,003,527 Warrants at an issue price of GBP0.06 (C$0.11) per Warrant

raising gross proceeds of US$0.3 million (GBP0.2 million / C$0.4

million), subject amongst other things to shareholder approval at the

General Meeting.

The Warrants will have an Exercise Price of GBP0.9375 (C$1.65) per new

Ordinary Share and will be exercisable for two years from their date of

issue. Accordingly, if all the Warrants are exercised, the aggregate

exercise price receivable by the Company in respect of the 4,003,527 new

Ordinary Shares would be an additional amount of approximately GBP3.75

million.

During the course of planning for the Share Placing, the Company, after

consultation with the Joint Bookrunners and the Manager, had decided

that in order to secure the best terms for the Share Placing and to

widen the appeal of the Share Placing for investors, it was appropriate

that investors should be given the opportunity to subscribe for

Warrants. Recognising that some investors may have restrictions on their

ability to hold securities which provide future rights to subscribe for

Ordinary Shares, such as the Warrants, it was decided that the Warrants

would be offered by way of a separate subscription.

The Directors believe that the amount that would be paid to the Company

in respect of the Warrants is justified on the basis that: (i) the

Warrant Placing assisted in obtaining the best terms for the Share

Placing, and (ii) the Exercise Price in respect of the Warrants

represented a 25% premium to the Placing Price.

The Warrant Placing

The Warrant Placing is conditional upon, among other things, the

approval of the Resolutions at the General Meeting, and such aspects of

the Placing Agreement as relate specifically to the Warrants becoming

unconditional and the Placing Agreement not being terminated in

accordance with its terms prior to the date of issue of the Warrants.

The Ordinary Shares to be issued pursuant to the exercise of the

Warrants will rank pari passu with the Existing Ordinary Shares.

At the General Meeting, the Company will be seeking to pass both an

ordinary and special resolution (which will require votes in favour from

at least 75% of the Ordinary Shares present and voting at the General

Meeting) in order to give the Directors authority to allot the Warrants

to the Warrant Placees on a non-pre-emptive basis.

Use of proceeds

The Directors intend to use the proceeds from the Warrant Placing which

in total will be GBP0.24 million (before expenses) for the Company's

working capital purposes.

The General Meeting

The Warrant Placing is conditional upon the approval of the Resolutions

by Shareholders at the General Meeting to be held at The Long Barn,

Cobham Park Road, Downside, Cobham, Surrey, KT11 3NE, England on 25 May

2021 at 10 a.m. The notice convening the General Meeting is incorporated

in this document.

At the 2020 Annual General Meeting, the Directors were authorised to

allot 20 million Ordinary Shares on a non-pre-emptive basis. Since the

2020 Annual General Meeting, the Company has allotted 16,650,000

Ordinary Shares and, as a consequence, the Directors do not have

sufficient authority to grant the Warrants. The Company is therefore

proposing to seek specific authorities to grant the Warrants at the

General Meeting. The Directors intend to propose resolutions to renew

the general authorities at the 2021 Annual General Meeting.

Resolution 1 provides the Company with authority to grant the Warrants

and Resolution 2 disapplies the statutory pre-emption rights applicable

to those Warrants.

Resolution 1 will be proposed as an ordinary resolution requiring a

majority of votes cast at the General Meeting to be in favour of it in

order for it to be passed. Resolution 2 will be proposed as a special

resolution requiring 75% of the votes cast at the General Meeting to be

in favour of it for it to be passed.

Shareholders should note that the Resolutions in relation to the

Warrants to be proposed at the General Meeting are inter-conditional and

if any one of them is not passed the Warrant Placing will not be

completed.

Fratelli Investments Limited, which holds shares representing

approximately 25.5% of the Existing Ordinary Shares has irrevocably

undertaken to vote in favour of the Resolutions.

Greenstone Resources II LP, which holds shares representing

approximately 25.2% of the Existing Ordinary Shares has irrevocably

undertaken to vote in favour of the Resolutions.

Coronavirus (Covid-19)

The Board continues to closely monitor developments in relation to the

Covid-19 pandemic and the health and wellbeing of the Company's

shareholders and employees continue to remain of paramount importance.

As a result of the UK Government's current guidance on social distancing

and the prohibition on public gatherings due to the Covid-19 pandemic,

it is expected that shareholders will not be permitted to attend the

General Meeting.

The General Meeting will be convened in accordance with the Company's

Articles of Association and in line with the UK Government guidance. The

Company will make arrangements such that the legal requirements to hold

the General Meeting can be satisfied through the attendance of a minimum

number of people who are essential for the business of the General

Meeting, and the format of the General Meeting will be purely

functional. Having regard to their own safety and that of others, the

Board respectfully requests that, if these restrictions remain in place

at the time of the General Meeting (as they are expected to),

shareholders comply with the UK Government's current guidance and do not

make plans to attend the General Meeting.

To ensure the safety of the limited number of people whose attendance at

the General Meeting is essential, we will not be able to allow any other

Shareholders to gain access to the General Meeting on the day. If it

becomes possible to admit Shareholders to the General Meeting, we will

make an announcement on our website (www.serabigold.com) and via a

Regulatory Information Service. To ensure that Shareholders' votes are

counted, the Board strongly encourages all Shareholders to exercise

their right to vote by appointing the Chairman of the General Meeting as

their proxy to vote at the General Meeting on their behalf, in

accordance with their instructions. Shareholders should not appoint any

person other than the Chairman of the General Meeting to act as their

proxy, as that person will likely not be granted access to the General

Meeting on the day and their appointing shareholder's votes will not be

able to be counted.

Shareholders are encouraged to submit their proxy forms or voting

instructions online following the details set out in the Proxy

Instructions that accompanies this Circular. Alternatively, Shareholders

can return their proxy forms or voting instructions by post following

the instructions provided in this Circular. Proxy appointments or voting

instructions should be received as soon as possible and must be received

by no later than 10:00 am (London time) on 20 May 2021 in order to be

valid.

Despite these necessary changes to the format of the General Meeting,

the Board wants to ensure that shareholders have an opportunity to

engage with the Company and the Board. Shareholders are encouraged to

submit questions in advance of the General Meeting, by emailing

EGM2021@serabigold.com and including "EGM 2021" in the subject line. We

will endeavour to answer these questions on the Company's website prior

to the General Meeting. It is not the intention at this time to arrange

a formal Q&A webinar to coincide with the General Meeting.

The health of our shareholders and colleagues remains our priority and

the steps set out above are necessary to ensure their well-being during

the Covid-19 pandemic.

Action to be taken by Shareholders

A Form of Proxy for use by Shareholders at the General Meeting

accompanies this document. To be valid, Forms of Proxy must be completed

and returned so as to be received at either the offices of the Company's

UK Registrar, Computershare Investor Services Plc, The Pavilions,

Bridgwater Road, Bristol, BS99 6ZZ or the offices of the Company's

Canadian Registrar, Computershare Investor Services Inc., 100 University

Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 by not later than 10 a.m.

(London time) (5 am Eastern time) on 20 May 2021. Alternatively,

Shareholders can submit their Proxy to Computershare UK through CREST by

not later than not later than 10 a.m. (London time) on 20 May 2021 in

accordance with the procedures set out in the Form of Proxy. The Board

strongly encourages all Shareholders to exercise their right to vote by

appointing the Chairman of the General Meeting as their proxy to vote at

the General Meeting on their behalf, in accordance with their

instructions. Shareholders should not appoint any person other than the

Chairman of the General Meeting to act as their proxy, as that person

will likely not be granted access to the General Meeting on the day and

their appointing Shareholder's votes will not be able to be counted.

Completion and return of a Form of Proxy will not ordinarily prevent

Shareholders from attending and voting in person at the General Meeting

should they so wish. However, as set out above, the General Meeting will

likely be held as a closed meeting and Shareholders will not be

permitted to attend due to the Covid-19 restrictions.

Beneficial Shareholders should note that only registered Shareholders or

their duly authorised proxy holders are entitled to vote at the General

Meeting. Each Beneficial Shareholder should ensure that their voting

instructions are communicated to the appropriate person well in advance

of the General Meeting.

Further details of the restrictions and steps to be taken with respect

to voting are set out in the Notice and Management Information Circular

contained in this document.

Recommendation and importance of vote

Shareholders should be aware that, if the Resolutions are not approved

at the General Meeting, the net proceeds of the Warrant Placing will not

be received by the Company.

The Directors consider that the Resolutions set out in the Notice and

being put to the General Meeting are in the best interests of the

Company and its Shareholders and are most likely to promote the success

of the Company for the benefit of the Shareholders as a whole.

Accordingly, the Directors unanimously recommend that Shareholders vote

in favour of the proposed Resolutions as they intend to do in respect of

their own holdings, where relevant, amounting to an aggregate of

1,262,345 Ordinary Shares, representing approximately 1.67% of the

Company's Existing Ordinary Shares.

Yours faithfully

(Signed) "Nicolas Bañados"

Nicolas Bañados

Non-executive Chairman

ENDS

(END) Dow Jones Newswires

April 28, 2021 07:30 ET (11:30 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

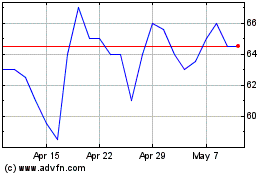

Serabi Gold (LSE:SRB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Serabi Gold (LSE:SRB)

Historical Stock Chart

From Apr 2023 to Apr 2024