TIDMSSPG

RNS Number : 9541P

SSP Group PLC

22 February 2021

22 February 2021

LEI: 213800QGNIWTXFMENJ24

SSP Group plc

(the "Company")

Posting of 2020 Annual Report and Accounts and Notice of Annual

General Meeting

On 17 December 2020, the Company published its preliminary

results for the year ended 30 September 2020. The Company announces

that it has today posted to shareholders copies of its Annual

Report and Accounts for the period ending 30 September 2020, the

Notice of Annual General Meeting (the "Notice of AGM") and Form of

Proxy.

Copies of the 2020 Annual Report and Accounts, the Notice of AGM

and Form of Proxy have been submitted to the National Storage

Mechanism and will shortly be available for inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism . Copies of

the 2020 Annual Report and Accounts and the Notice of AGM are also

available on the Company's website at www.foodtravelexperts.com

.

Annual General Meeting

The Annual General Meeting ("AGM") of the Company will be held

on 25 March 2021 at 1.30 p.m. In light of the Covid-19 pandemic and

the UK Government's Stay at Home Guidance, to ensure we protect the

health and safety of our shareholders, our people and Directors,

the AGM will be a closed meeting, held at the Company's registered

office.

Neither shareholders nor their proxies (other than the Chairman

of the Meeting) will be able to attend in person and anyone

attempting to do so will unfortunately have to be refused entry.

The Company will arrange for the requisite quorum to be in

attendance at the Company's registered offices to ensure that

formalities are complied with.

As shareholders cannot attend the AGM, we strongly encourage

Shareholders to appoint the Chair of the meeting as their proxy to

ensure their vote is counted. Proxy appointments must be received

by Computershare by no later than 1.30 p.m. (GMT) on 23 March

2021.

Despite this year's AGM format, the Company is committed to

ensuring our Shareholders are able to raise questions with the

Board. The Notice of AGM sets out details of how Shareholders can

submit questions ahead of the AGM. Responses to questions received

by 1.00 p.m. (GMT) on 22 March 2021 will be published on the

Company's website as soon as practicable after that date.

Regulated Information

The information set out in the Appendix, which is extracted from

the 2020 Annual Report and Accounts, is included for the purposes

of complying with DTR 6.3.5 and its requirements on how to make

public annual financial reports. The information in the Appendix

should be read in conjunction with the Company's preliminary

results for the year ended 30 September 2020 released on 17

December 2020 which can be viewed at www.foodtravelexperts.com .

Together, these constitute the material required by DTR 6.3.5 to be

communicated in unedited full text through a Regulatory Information

Service.

For further information contact:

SSP Group plc

Helen Byrne

Company Secretary & General Counsel

0207 543 3300

Investor and analyst enquiries

Sarah John

Director of Investor Relations

+44 (0) 203 714 5251

E-mail: sarah.john@ssp-intl.com

Notes to Editor

About SSP

SSP is a leading operator of food and beverage concessions in

travel locations, operating restaurants, bars, cafés, food courts,

lounges and convenience stores in airports, train stations,

motorway service stations and other leisure locations. Prior to the

onset of Covid-19, we served around one and a half million

customers every day at approximately 180 airports and 300 rail

stations in 35 countries around the world and operated more than

550 international, national and local brands across our c. 2,700

units.

www.foodtravelexperts.com

Appendix

This material should also be read in conjunction with, and is

not a substitute for reading, the full 2020 Annual Report and

Accounts.

Note and page references in the text of this Appendix refer to

note numbers and page numbers in the 2020 Annual Report and

Accounts that can be viewed on the Company's website.

1. Directors' Responsibility statement

The following responsibility statement is repeated here to

comply with DTR 6.3.5. This statement relates to, and is extracted

from, page 92 of the 2020 Annual Report and Accounts.

Responsibility is for the full 2020 Annual Report and Accounts, not

the extracted information presented in this announcement and the

full year results announcement.

The Directors are responsible for preparing the Annual Report

and the Group and parent company financial statements in accordance

with applicable law and regulations.

Company law requires the Directors to prepare Group and parent

company financial statements for each financial year. Under that

law they are required to prepare the Group financial statements in

accordance with International Financial Reporting Standards as

adopted by the European Union (IFRSs as adopted by the EU) and

applicable law. The Directors have elected to prepare the parent

company financial statements in accordance with UK accounting

standards and applicable law (UK Generally Accepted Accounting

Practice), including FRS 101 Reduced Disclosure Framework.

Under company law, the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and parent company, and

of their profit or loss for that period. In preparing each of the

Group and parent company financial statements, the Directors are

required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and estimates that are reasonable, relevant and reliable;

-- state whether they have been prepared in accordance with

IFRSs as adopted by the EU or applicable UK accounting standards in

the case of the parent company;

-- assess the Group and parent company's ability to continue as

a going concern, disclosing, as applicable, matters related to

going concern; and

-- use the going concern basis of accounting unless they either

intend to liquidate the Group or the parent company, or to cease

operations, or have no realistic alternative but to do so.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the parent

company's transactions and disclose with reasonable accuracy at any

time the financial position of the parent company, and enable them

to ensure that its financial statements comply with the Companies

Act 2006. They are responsible for such internal control as they

determine is necessary to enable the preparation of financial

statements that are free from material misstatement, whether due to

fraud or error, and have general responsibility for taking such

steps as are reasonably open to them to safeguard the assets of the

Group, and to prevent and detect fraud and other

irregularities.

Under applicable law and regulations, the Directors are also

responsible for preparing a Strategic Report, Directors' Report,

Directors' Remuneration Report and Corporate Governance Statement

that complies with that law and those regulations.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the UK governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

Responsibility statement of the Directors in respect of the

Annual Financial Report

We confirm that to the best of our knowledge:

-- the financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

taken as a whole; and

-- the Strategic Report and the Directors' Report includes a

fair review of the development and performance of the business and

the position of the Company and the undertakings included in the

consolidation taken as a whole, together with a description of the

principal risks and uncertainties that they face.

We consider the Annual Report and Accounts, taken as a whole, to

be fair, balanced and understandable, and provides the information

necessary for shareholders to assess the Company's and the Group's

position and performance, business model and strategy.

Simon Smith

Chief Executive Officer

16 December 2020

Jonathan Davies

Chief Financial Officer

16 December 2020

2. Principal Risks

The description below of the principal risks and uncertainties

that the Company faces is extracted from pages 36 to 41 of the 2020

Annual Report and Accounts.

Risks are identified as 'principal' on the basis of their

likelihood of occurrence and their potential impact on the Group.

Furthermore, our strategic priorities based on our five lever

framework laid out below form the basis of Group-wide risk

identification, assessment and discussions:

1 Optimising our offer to benefit from the positive trends in

our markets and driving profitable LFL sales;

2 Growing profitable new space;

3 Optimising gross margins and leveraging scale benefits;

4 Running an efficient and effective business; and

5 Optimising investment using best practice and shared resource.

The principal risks discussed in the table below are listed in

order of priority. New risks have been added to the principal risks

since last year regarding liquidity and funding and the impact of

Covid-19.

Risk increasing Risk decreasing No risk movement

Risk/Risk Risk Description Mitigating factors

Priority

1. Liquidity Covid-19 has significantly reduced SSP has implemented effective

and funding trading over an extended and processes to minimise liquidity

uncertain timeframe. An inability pressures; for example, a significant

New Risk to effectively respond and manage reduction in capital spend and

expenditure accordingly would the furlough of colleagues,

impact the Group's ability to as well as salary reductions

operate within committed credit have been implemented across

facilities. senior management.

The Group is reliant on the Further, the Group did not declare

Covid Corporate Financing Facility an interim dividend, postponed

(CCFF), and an inability to its share buyback programme

refinance the facility or draw and completed a new equity placing

down further funding tranches in March 2020 (as well as a

would further impact the Group's small placing in June 2020 to

ability to operate within committed retain some of the final 2019

credit facilities. The Group's dividend as cash in the business).

senior debt facilities, which

mature in July 2022, will also Covenant amendments have been

need refinancing or extending secured as further detailed

in due course. There is also in the viability statement on

a risk of breaching covenants pages 42-43, and in the going

on existing financing facilities concern note on pages 106-107.

unless covenant waivers are Management will remain in close

secured from lenders. If the dialogue with both lenders and

Group is unable to agree covenant USPP note holders and will seek

waivers there is a risk that further covenant amendments

Strategic the lenders could require repayment should the need arise. Liquidity

Priorities of their financing commitments. and covenants headroom is closely

4 monitored and stress tested.

SSP has also engaged in ongoing

discussions with key advisors

and lenders about access to

alternative sources of finance

in the future should this be

needed in the medium to longer

term.

------------------- ----------------------------------------- --------------------------------------------

2. Impact of The pandemic has had a severe The Group has implemented short-term

Covid-19 effect on the travel sector, cost reductions and a significant

which has been effectively closed restructuring programme to reduce

in many of SSP's markets, and the cost base, while also improving

there is a risk that the recovery short-term liquidity by the

in the travel markets may be use of government support schemes,

prolonged due to ongoing restrictions such as the UK's Coronavirus

for health and safety reasons Job Retention Scheme, reduction

and behavioral changes which in capex spend and negotiating

might impact passenger numbers. rent reliefs with its clients.

In the Air sector most industry There has also been a reduction

analysts expect that there will in product range to further

not be a recovery to pre-Covid reduce supply chain complexity

levels of activity until 2023 and costs.

or 2024. The principal reasons

for this will be a potential

loss of business travel, as

companies look to restrict travelling

and promote video-conferencing,

which has proven effective during

the pandemic, and a reduction

in long haul travel, as a consequence

of airline capacity reductions

and safety concerns. In the

Rail sector, there may also

be some longer term impacts

on passenger numbers as a consequence

the accelerated trend towards

working from home, which has

proven effective for many firms

and their employees, and will

affect commuter travel which

is important for SSP's rail

operations.

2.

New Risk The risks to SSP are that passenger The Group CEO and CFO continue

volumes may not return to pre-Covid to carry out focused weekly

levels, and therefore impact trading reviews with country

sales potential, leaving some management teams. Management

outlets and contracts operating have also put in place rolling

at uneconomic levels of sales, forecasts in place of quarterly

given the fixed operational forecasts to enable the Group

cost base. There is also a risk to react to changes as they

that there is greater pressure occur.

from clients to pay fixed minimum

guaranteed rents, even at lower

passenger volumes, or open more

outlets at individual sites

than is commercially optimal

for SSP.

Furthermore there is a risk At the outset of the Covid-19

that some of the actions taken pandemic, the

by SSP to trade through the

pandemic, notably the organisational

restructuring undertaken in

many countries, may leave the

business under-resourced for

a recovery in demand and remove

key management capabilities.

Group established a Business

Continuity Committee to ensure

that the Group had all the proper

processes in place to mitigate

the risks of a variety of Covid-19

scenarios. This was led by the

Group HR Director with input

from our internal auditor's

risk/crisis team.

As a consequence of Covid-19

the Group has been required

to adopt new health and safety

protocols and operational standards

(e.g. to meet social distancing

regulations)

in order to protect its staff Group HR has led a comprehensive

and customers. All of these review of government guidelines

potentially lead to higher operational on health and safety and social

costs and carry compliance risks. distancing procedures to ensure

customer and employee safety

can be ensured as offices and

units start to reopen

Strategic

Priorities

4

------------------- ----------------------------------------- --------------------------------------------

3. Business The Group operates in the travel The Group monitors the performance

environment environment where external factors of individual business units

and geopolitical such as the general economic and markets regularly. The Executive

uncertainty and geopolitical climate, levels Directors review detailed weekly

of disposable income, weather, and monthly information covering

changing demographics and travel a range of KPIs, and monitor

patterns could all impact both progress on key strategic projects

passenger numbers and consumer with local senior management.

spending. There is a risk that Specific short- and medium-term

the Group is unable, or poorly actions are taken to address

placed, to respond to these any trading performance issues

external events. which are monitored on an ongoing

basis.

The travel environment is vulnerable

to acts of terrorism or war, There has been greater focus

an outbreak of pandemic disease, on business continuity planning

or a major and extreme weather and recovery. The Business Continuity

event or natural disaster which plan has been tested during

could reduce the number of passengers this current crisis with staff

in travel locations. Tourism working from home and has proved

and business travel have been to be effective.

materially impacted by Covid-19 The Group has been conducting

resulting in a direct business research to understand changing

impact due to the downturn in requirements of customers in

the global economy while also light of the pandemic to better

increasing the risk of economic tailor our offer to their needs.

downturn in the global economy.

The crisis will be more acute

in countries with a high level

of debt and dependency on tourism,

e.g. Greece and Spain, and the

timeline to recovery in the

travel sector is uncertain.

Strategic

Priorities Further, Covid-19 has exacerbated

1, 2 risk to airline stability, which

had previously been increasing,

e.g. the failure of Jet Airways

and impact of Boeing Max 737

grounding.

Increased protectionist trade

policy and tariffs could result

in cost inflation, particularly

in the US. Public concern over

climate change may impact air

travel, either directly or through

government policies.

------------------- ----------------------------------------- --------------------------------------------

4. Retention The Group's operations are dependent The Group's local management

of existing on the terms of airport and structures in all its major

contracts railway station concession agreements. geographies allow it to maintain

Growth (and maintenance of market strong relationships with its

share) is dependent on the Group's clients and to monitor performance

ability to retain existing concession in close partnership with its

contracts and win new contracts clients' management teams.

from either new or existing

clients. Further, the Group has an established

contact strategy with key clients

Covid-19 has resulted in a reduction to establish and/or maintain

in tenders, thus reducing this ongoing relationships. These

risk in the short term. However, are discussed between Group

rent relief negotiations may and local management on a regular

result in friction, especially basis.

for reliefs sought beyond the

near term. Unsuccessful rent Management has actively engaged

relief negotiations may force with clients on a reopening

the Group to exit units that programme to ensure that units

are no longer viable. can be reopened profitably.

The Group conducts regular online

Moreover, as trading recovers and interview-based client surveys

from Covid-19 impact, there to ensure any concerns are being

may be tensions over the timing addressed.

Strategic of reinstatement of suspended

Priorities capital expenditure programmes

1, 2 given the ongoing pandemic and

unit closures.

Resource reductions made in

response to Covid-19 may result

in reduced operational standards,

impacting relationships with

clients and franchise partners

in the medium term.

------------------- ----------------------------------------- --------------------------------------------

5. Impact of Brexit may have an adverse impact The Group carefully monitors

Brexit on the wider economic environment the ongoing negotiations of

in the UK and across the EU, the UK's exit from the EU through

resulting in weaker consumer its Brexit risk mitigation committee.

spending in the travel food

and beverage markets. It would The Group maintains a global

also impact the travel sector portfolio and regularly monitors

directly if any restrictions the impact of foreign exchange

in the freedom of industrial fluctuations on its cash flows,

air travel between the UK and mitigating the impact from foreign

EU countries come into force. exchange risk.

The potential depreciation of The Group's pricing and range

the pound could lead to cost initiatives are driven by continuous

inflation pressures, particularly monitoring of consumer spending

in the food commodity markets. benchmarks.

Potential restrictions on mobility Various gross margin initiatives,

of EU nationals post-Brexit including recipe re-engineering

may limit the availability of and procurement rationalisation

labour resource in the UK in continue to be pursued, to mitigate

the long term. the impact of cost inflation.

These risks may be compounded The Group continues to develop

in the case of its UK recruitment strategy

a 'no deal' Brexit which could to ensure SSP is positioned

Strategic further reduce the attractiveness as an attractive employer in

Priorities of the UK for investment. the UK during the store reopening

1, 3 programme. There is also an

ongoing focus on labour flexibility

and productivity to improve

retention rates post Brexit.

An increased focus on technology

initiatives during the Covid-19

recovery stage will help reduce

demand for labour as units open.

------------------- ----------------------------------------- --------------------------------------------

6. Senior Management The performance of the Group The Remuneration Committee reviewed

capability depends on its ability to attract, the remuneration for senior

and retention motivate and retain key employees. management in light of Covid-19

The skills developed in our with the aim of ensuring that

business are highly attractive the reward offer is designed

to other companies, which regularly to attract, retain and motivate

target our staff for recruitment. the key personnel required to

run the Group effectively. In

Given the impact of Covid-19 light of Covid-19 and the resulting

and the increasing risk over increased recruitment and retention

staff retention, particularly risk, the Group has developed

for senior employees with transferable revised incentive schemes for

skills, insufficient senior senior management, e.g. a revised

capability risk has increased LTIP structure.

over the prior year. Additionally,

there continues to be a risk The Group also continues to

that the Group may not have review key roles and succession

sufficient resources in various plans at a country and at a

functions including in legal, Group level. The Group carries

Strategic finance and IT, to meet the out an annual talent mapping

priorities changing and complex needs of exercise to identify candidates

4 an international business as for future roles and continues

it adapts and recovers from to invest in additional resources

the impact of Covid-19. to support change initiatives

and career development programmes.

It may also be difficult to

attract senior employees as

the travel food sector will

be considered riskier in the

short to medium term.

------------------- ----------------------------------------- --------------------------------------------

7. Regulatory The laws and regulations governing The Group has procedures and

Compliance the Group's industry have become processes in place to ensure

increasingly complex across compliance with local laws and

a number of jurisdictions and regulations. The Group may obtain

a wide variety of areas, including, external advice to supplement

among others, labour, employment, the in-house legal and compliance

immigration, security and safety, team.

bribery and corruption, tax

evasion, modern slavery, competition The Group has a number of key

and antitrust, consumer protection, compliance policies (e.g. Anti-Bribery

data protection, licensing requirements and Anti-Corruption) for which

and related compliance. There training has been rolled out

is a risk that the Group fails internationally. This is continually

to comply with such laws and being reviewed and updated to

regulations. improve controls and monitoring.

The Group's procedures under

The UK Corporate Governance its compliance policies include

Code 2018, certain amendments regular reporting by the businesses

to the Companies Act and IFRS to the Risk Committee and regular

16 are applicable to SSP's current monitoring by internal audit.

financial year. These new requirements All alleged breaches of the

create a disclosure and reporting Group's policies are investigated.

risk in the financial statements

as well as reputational risk GDPR compliance is determined

if the new rules are not properly and managed locally but is overseen

implemented. by a steering committee, comprising

leadership from Group HR, Group

Covid-19 has resulted in an IT, Commercial and Legal. The

additional compliance burden Group's Global Privacy development

due to the increased health programme is temporarily on

and safety protocols to be observed hold in light of Covid-19, however,

for colleagues and customers, with advice from its external

use of government support programmes advisors, the Group has adopted

(e.g. furlough schemes) and a short-term simplified controls

an increased focus on good governance. programme for FY 2021.

Reduced staffing and employees Related to IFRS 16, a new software

being placed on furlough, and solution has been implemented

an increase in reliance on external to ensure correct computation

advisors, has also led to an of the impact on the financial

increased compliance risk, slightly statements. Increased frequency

offset by the extension of compliance of reviews from country CFOs

deadlines have ensured that risks related

to completeness and accuracy

Strategic of the numbers is mitigated.

Priorities

1, 2 Following the onset of the Covid-19

pandemic, the Group's internal,

legal and finance teams (supported

by the Business Continuity Committee)

have worked closely with the

local business teams to assess

the risk of non-compliance with

laws and contracts arising from

the crisis and to advise on

mitigating actions (including

operational protocols to safeguard

our various stakeholders).

------------------- ----------------------------------------- --------------------------------------------

8. Food safety Food safety and integrity are The Group has implemented a

and product vital for our business. The global safety management programme,

compliance preparation of food and maintenance setting minimum standards of

of the Group's supply chain health and safety, fire safety

require a base level of hygiene, and food safety across all its

temperature maintenance and operations and requiring periodic

traceability. Non-compliance reporting

with food safety laws or failure of performance and incident

to effectively respond to a statistics. Within this management

food safety incident, can expose programme are food safety standards

the Group to significant reputational which include processes to monitor

damage as well as possible food the supply chain and to manage

safety liability claims, financial allergens. All SSP country operations

penalties and other issues. are required to report on all

food safety incidents (including

Proper management of allergens allergens) on a periodic basis

remain in the industry spotlight. to the Risk Committee, which

From October 2021, foods that reports on global safety performance

are pre-packaged for direct to the Audit Committee every

sale in the United Kingdom will six months.

need to have a label with a

full ingredients list with allergenic SSP UK & Ireland currently controls

ingredients emphasised within allergen management within the

it (commonly referred to as supply chain, supported by staff

'Natasha's Law'). training and unit audits. All

operational staff undertake

An increase in NGO activism allergen training as part of

and UK public awareness has mandatory training upon commencement

seen increased pressure to reduce of employment in unit. All units

the use of plastics in the food are subject to an unannounced

and beverage (F&B) industry. 'Safe and Legal' audit by the

Network Rail has stated that Health and Safety team on a

F&B units must be plastic-free 12-monthly cycle. Full technical

Strategic at their sites by 2020. Switching guidance and clarity of scope

Priorities to non-plastic alternative materials of Natasha's Law is expected

1, 2 could have significant cost to be provided by the Food Standards

impact on the business. There Agency. The UK allergens working

is also the risk of additional group set up last year is currently

levies being imposed by the checking which products are

government on the use of plastic. in scope, and sourcing an IT

platform to support allergen

data and labelling.

Ongoing reviews of operations

are being carried out in the

UK to determine plastic-free

feasibility and opportunities.

------------------- ----------------------------------------- --------------------------------------------

9. Labour laws Approximately half of the Group's The Group works proactively

and unionisation employees are subject to collective with all of its unions to ensure

bargaining agreements. These that the various collective

are principally in France, Germany, bargaining agreements are appropriate

Spain, Denmark, Finland, Norway, for the Group and therefore

Sweden and the United States. minimise commercial risks.

The Group is also subject to The Group is continually reviewing

minimum wage requirements and the impact of changes in remuneration

mandatory healthcare subsidisation structures in developing mitigating

in some of the jurisdictions strategies across the Group.

in which it operates, notably The reviews include the ongoing

North America, the United Kingdom impact of the National Living

and China. Furthermore, in the Wage and the Apprenticeship

US, costs have continued to Levy in the United Kingdom,

increase due to the Fair Labor and the impact of healthcare

Standards Act ('FLSA') as well legislation and FLSA in the

as the immigration policy which United States.

has had an adverse impact on

the supply of labour. There The Group's strategic plan in

is a risk that the Group is response to Covid-19 includes

unable to offset the cost impact initiatives to improve labour

of the above on its overall efficiency and profitable reopening

labour costs. of units with continued focus

Strategic on roll-out of technology solutions

priorities There is also a risk that governments to such as self order Kiosks

4 will seek further employee protections and order at table to reduce

as a result of Covid-19, which costs.

could negatively impact the

Group's base costs. Owing to the job losses due

to Covid-19, there might be

increased labour supply in the

short to medium term which may

mitigate some of the risk of

the ongoing labour inflation.

------------------- ----------------------------------------- --------------------------------------------

10. Information There is a risk that the Group The Group has developed extensive

security becomes exposed to information IT disaster recovery and information

and stability security, cyber threats, e.g. security policies and practices,

threats detailed in the Payment to ensure that these meet the

Card Industry Data Security changing landscape. These are

Standards (PCIDSS) as well as regularly discussed and reviewed

ransomware attacks, particularly by the Risk and Audit Committees

in light of increased homeworking as well as the Board.

of its head office staff.

The Group's new Security operation

The Group has commenced a major centre became operational in

programme to implement SAP Inventory September 2020 (as part of the

and Finance systems which can Company's Cyber Security Programme).

risk significant operational This will help to reduce time

disruption. There is a risk to detect and respond to incidents

that the speed of implementation (spam, malware attacks, phishing

is negatively impacted by the emails, etc.). Additional layers

Covid-19 recovery process. of protection to prevent ransomware

impacting critical files on

As the Group adapts to the post servers have been added. The

Covid-19 way of doing business, Group has also rolled out cyber

there is likely to be an increased security training across the

focus on technology solutions business to reinforce data protection

and there is a risk that the responsibilities and cyber risks.

Group is unable to make the

right investment of time, capital The Group's segmental business

and resource into such programmes. model and IT systems structure

help to ensure that potential

Reduction in resource as part cyber attacks are likely to

of Covid-19 response may generally remain isolated locally rather

increase pressure on IT teams. than impact the entire Group.

A clear governance and management

structure has been set up for

the SAP project implementation

including the engagement of

a SAP preferred partner for

the roll-out which has significant

Strategic experience of implementing SAP

Priorities at large companies.

4, 5

In light of the increased working

from home by head office colleagues,

the Group has increased the

roll-out of the new modern workplace

technology to improve security

of our laptops across the business

(e.g. multi-factor authentication,

encryption of all data on hard

disks, etc.).

------------------- ----------------------------------------- --------------------------------------------

11. Benefits The Group is continuously seeking The Group's strategic plan in

realisation new programmes to improve efficiency. response to Covid-19 is being

from efficiency There is a risk that these programmes implemented with focus on guiding

programmes may be difficult to implement the business strategy through

due to complexity, and furthermore the Covid-19 period to ensure

that they could fail to deliver evaluation of the overall cost

the desired benefits, e.g. labour structure. This includes various

efficiency and minimising waste initiatives such as simplification

and loss. of product offering and profitable

reopening of units.

The impact of Covid-19 restructuring

has been significant and may The Group has completed a detailed

lead to loss of momentum on evaluation, planning and partial

technology enhancements and implementation of its major

capital investment that are change programmes, and adapts

required for sustainable growth. and responds to feedback on

This may be compounded by the an ongoing basis.

loss of resource in areas such

as commercial, waste and loss, To aid these programmes, the

procurement and labour management. Group continues to utilise specialist

Strategic expertise in the business where

Priorities required, both at a Group and

3, 4, 5 at a country level.

Group IT also provides support

for project management and implementation,

using agreed standard business

processes and controls.

------------------- ----------------------------------------- --------------------------------------------

12. Changing Changing client requirements, The Group has in place a clear

client behaviours such as splitting tenders across 'SSP Value Proposition' that

two or more providers, seeking it presents to the client to

new income streams through pouring address this risk.

rights agreements, partnering

with operators in joint ventures, Senior Group commercial management

developing third party purchasing works closely with country management

models and favouring franchise teams to enhance and clarify

and local brand operators or the Group's proposition to its

partnering directly with brand clients. There is greater focus

owners or increased health and on developing internal concepts

safety monitoring requirements, to reduce complexity and costs.

may adversely affect the Group's

business and /or profit margins. The Group's contact strategy

with key stakeholders and clients

Furthermore, new tender processes helps to mitigate this risk.

Strategic can be more complex and demand This is informed by its annual

Priorities increased rents. However, Covid-19 client survey, which is carried

1, 2 is expected to result in a reduction out by an independent party.

in new tenders and increased

flexibility as clients aim to

get through the downturn.

------------------- ----------------------------------------- --------------------------------------------

13. Outsourcing The Group may fail to execute The Group continues to utilise

programmes outsourcing projects effectively, specialist resources in the

resulting in business as usual business to manage implementation

being disrupted and the introduction and transition projects, and

of new third party risks. it continues to use external

advisors to provide input into

Furthermore, any benefits expected the management of risks in such

from the outsourcing programme projects.

may not be realised.

The Group has temporarily scaled

Staff turnover at outsourcing down some outsourced resources

partners may be impacted by to match reduction in business

Covid-19. operations in light of Covid-19.

This process has been well managed.

There are also monthly and quarterly

reviews with outsourcing partners

Strategic focusing on efficiency and costs

Priorities to ensure shared services are

5 being appropriately managed.

Performance feedback is reported

to the Executive Committee and

the Risk Committee on a regular

basis.

------------------- ----------------------------------------- --------------------------------------------

14. Tax strategy The Group may suffer reputational The Group has a tax management

damage if customers, clients policy which is based on the

and/or suppliers believe that Board's guidance to adopt a

the Group is engaged in aggressive low-risk tax strategy.

or abusive

tax avoidance. The Group also regularly reviews

its tax priorities and has done

There is a risk that the Group so in light of the Covid-19

may not be tax compliant due pandemic (for example, the Eat

to complicated local tax laws Out to Help Out scheme was successfully

across different geographical rolled out at short notice).

territories. Covid-19 support There is also increased oversight

schemes (e.g. furlough) have and monitoring of key tax issues

further increased the tax compliance within divisions by the Group

burden. tax team.

There is an increased focus Increased disclosure of tax

on tax governance from the tax policy and tax payments in Group

authorities, including the integration financial documents.

of systems with tax authorities.

There continues to be more investment

Strategic from OECD into Base Erosion

Priorities and Profit Shifting (BEPS) related

1, 2 initiatives. There is a risk

that there could be wholesale

changes to how taxation systems

work based on the data gathered

in the future. This is also

driving digitisation resulting

in a cost and complexity impact.

------------------- ----------------------------------------- --------------------------------------------

15. Maintenance/ The Group's success is largely In light of Covid-19, to provide

Development dependent upon its ability to greater support to the regions,

of brand maintain its portfolio of proprietary the top 10 franchise brand negotiations

portfolio brands and the brands of its are being handled by the Group

franchisors, as well as the centrally. There are also ongoing

appeal of those brands to clients negotiations with franchise

and customers. brand partners to obtain better

terms, which have been accelerated

The loss of any significant due to the need to respond to

partner brands, the inability Covid-19.

to obtain rights to new brands

over time or the diminution The Group continues to work

in appeal of partner brands closely with its partner brands,

or the Group's proprietary brands, particularly in light of Covid-19,

could impair the Group's ability to maximise the roll-out of

to compete effectively in tender operational efficiencies to

processes and ultimately have ensure units are opening profitably

a material adverse effect on despite lower passenger numbers.

the Group's business.

The Group will continue to carry

The risk has reduced over the out customer research into passengers'

prior year as, in light of Covid-19, needs as necessary to ensure

there have been no significant its brands and concepts have

new brand openings during the the right offer in the post-Covid-19

year. In the short term the world.

Strategic need for new brands has reduced

Priorities due to the economic disruption Finally, the Group continuously

1, 2 caused by Covid-19. There is looks to strengthen the depth

however, a risk that some of and breadth of its brand partners

our brand partners may fail as well as to reform and strengthen

during the ongoing pandemic its own proprietary brands.

resulting in adverse financial

and reputational consequences

for the Group.

------------------- ----------------------------------------- --------------------------------------------

16. Expansion Historically, the Group's strategy The Group has strong management

into new has involved expanding its business teams in developing markets

markets in developing markets. The political, where this risk exists. In addition,

economic and legal systems and the Group adopts a joint venture

conditions in these markets model in certain new territories

are less predictable than in to provide access to existing

countries with more developed local infrastructure and expertise,

institutional structures, subjecting as well as to help mitigate

the Group to additional commercial, the risk inherent on entering

reputational, legal and compliance new territories.

risks.

The Group has clearly defined

However, this risk has reduced authorisation procedures for

due to the ongoing impact of all contract investments, to

Covid-19 as entering new markets ensure that they are consistent

in the short to medium term with the objectives set by the

is unlikely. However, Covid-19 Board and that they fully consider

may extend the time period over and evaluate the risks inherent

which new businesses can reach in expansion into new locations

profitability after the initial and territories. The Group works

set-up. with in-house and external advisors

to ensure the risks of doing

business in developing markets

are identified and where possible,

mitigated before entering those

markets. This includes appropriate

due diligence of potential joint

venture and other local partners.

Strategic The Group legal team works closely

Priorities with country legal and operational

1, 2 teams to support business development

activities and to ensure compliance

with local requirements.

The risk of working in developing

markets is also monitored by

the Risk Committee, Group Investment

Committee and the Audit Committee.

------------------- ----------------------------------------- --------------------------------------------

3. Related Parties

The following is extracted from note 31 to the Group's

consolidated financial statements (on page 147).

Related party relationships exist with the Group's subsidiaries,

associates (note 15), key management personnel, pension schemes

(note 23) and employee benefit trust (note 25).

Subsidiaries

Transactions between the Company and its subsidiaries, and

transactions between subsidiaries, have been eliminated on

consolidation and are not disclosed in this note. Where the Group

does not own 100% of its subsidiary, significant transactions with

the other investors in the non-wholly owned subsidiary

('investor'), other than those listed in note 25, are disclosed

within this note (in the table below). Sales and purchases with

related parties are made at normal market prices.

Associates

Significant transactions with associated undertakings during the

year, other than those included in note 15, are included in the

table below.

Related party transactions

2020 2019

GBPm GBPm

------------------------------------------------------- ------ ------

Purchases from related parties(1) (1.7) (3.0)

------------------------------------------------------- ------ ------

Management fee income 2.2 2.6

------------------------------------------------------- ------ ------

Other income 1.1 1.6

------------------------------------------------------- ------ ------

Other expenses(2) (11.2) (14.2)

------------------------------------------------------- ------ ------

Amounts owed by related parties at the end of the year 3.6 10.1

------------------------------------------------------- ------ ------

Amounts owed to related parties at the end of the year (6.1) -

------------------------------------------------------- ------ ------

Operating lease commitments - (18.5)

------------------------------------------------------- ------ ------

1 The majority of purchases from related parties relates to

purchases from The Minor Food Group PCL (GBP0.9m; 2019: GBP0.9m)

which owns 51% of Select Service Partner Co. Limited.

2 The majority of other expenses relate to GBP11.2m rent from

Midway Partnership LLC (2019: GBP8.9m concession fees with various

parties).

Bank guarantees

The Group has provided a number of guarantees to third parties

and has given guarantees to partners of consolidated non-wholly

owned subsidiaries in respect of obligations of its non-wholly

owned subsidiaries, relating to, for example, concession

agreements, franchise agreements and financing facilities. In

addition, certain subsidiaries benefit from guarantees provided by

the Group's non-controlling interest partners to similar third

parties (in respect of obligations of the subsidiaries). These

guarantees are consistent with those provided in the normal course

of business in respect of the Group's wholly owned subsidiaries. At

30 September 2020 the value of these guarantees was GBP119.0m. The

Group does not expect these guarantees to be called on and as such

no liability has been recognised in the financial statements.

Remuneration of key management personnel

The remuneration of key management personnel of the Group is set

out below in aggregate for each of the categories specified in IAS

24 'Related Party Disclosures'. The Group considers key management

personnel to be the Chief Executive Officer, Chief Financial

Officer, Non- Executive Directors and the Group Executive

Committee.

2020 2019 GBPm

GBPm

----------------------------- ----- --------------

Short-term employee benefits (5.0) (6.5)

Post-employment benefits (0.6) (0.4)

Share-based payments (0.8) (1.5)

----------------------------- ----- --------------

(6.4) (8.4)

----------------------------- ----- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOAZZGZZNZRGMZM

(END) Dow Jones Newswires

February 22, 2021 12:30 ET (17:30 GMT)

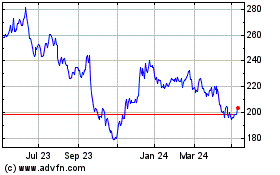

Ssp (LSE:SSPG)

Historical Stock Chart

From Mar 2024 to Apr 2024

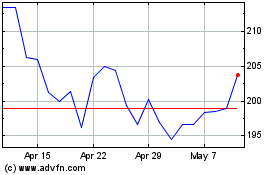

Ssp (LSE:SSPG)

Historical Stock Chart

From Apr 2023 to Apr 2024