TIDMSST

RNS Number : 2054V

Scottish Oriental Smlr Co Tst PLC

13 April 2021

THE SCOTTISH ORIENTAL SMALLER COMPANIES TRUST PLC

Interim results for the six months to 28 February 2021

(Extracted from the Interim Report)

The Board of The Scottish Oriental Smaller Companies Trust plc

is pleased to announce the results for the six months to 28

February 2021.

Financial Highlights

Total Return Performance for the six months to 28 February 2021

(Unaudited)

MSCI AC Asia ex Japan

Net Asset Value 14.1% Index (GBP) 18.0%

MSCI AC Asia ex Japan

Share Price 15.4% Small Cap Index (GBP) 22.5%

FTSE All-Share Index

(GBP) 12.0%

Summary Data at 28 February 2021 (Unaudited)

Shares in issue 28,156,097 Shareholders' Funds GBP318.79m

Net Asset Value per 1,132.23p Market Capitalisation GBP274.80m

share

Share Price Discount

Share Price 976.00p to Net Asset Value 13.8%

--------------------- ----------- ----------------------- -----------

Corporate Objective

The investment objective of The Scottish Oriental Smaller

Companies Trust plc ("Scottish Oriental", "the Company" or "the

Trust") is to achieve long-term capital growth by investing in

mainly smaller Asian quoted companies with market capitalisations

of below US$5,000m, or the equivalent thereof, at the time of

investment. For investment purposes, this includes Australasia, the

Indian sub-continent and Japan.

This is an abridged version of Scottish Oriental's investment

policy and objective. A full statement of Scottish Oriental's

investment policy can be found on page 80 of the Annual Report and

Accounts* for the year ending 31 August 2020 ("the Annual Report

and Accounts").

*The Company's Annual Report and Accounts for the year ending 31

August 2020 can be found on the Company's website at:

www.scottishoriental.com.

Interim Management Report

Investment Performance

Over the six months ending 28 February 2021, Scottish Oriental's

net asset value ("NAV") per share increased by 14.1 per cent in

total return terms, while the MSCI AC Asia ex Japan Index recorded

a sterling adjusted increase of 18.0 per cent and the MSCI AC Asia

ex Japan Small Cap Index an increase of 22.5 per cent on the same

basis. The Company's share price rose by 15.4 per cent in total

return terms over the period. The Company's NAV outperformed the

FTSE All-Share Index, which rose by 12.0 per cent in total return

terms over the six month period.

The biggest contributor to performance was Scottish Oriental's

large exposure to Indian companies.

The Company also benefited from strong share price performance

from its investments in China, Malaysia and Vietnam. The Company

was negatively impacted by poor performance from its investments in

South Korea, Hong Kong, Pakistan and the Philippines.

The Company's shares traded at a discount ranging from 11.4 per

cent to 18.2 per cent, reflecting the volatility in Asian markets

and continued investor caution, and stood at a discount to NAV of

13.8 per cent on 28 February 2021.

The Company's cash level was GBP9.8 million at the end of the

period, representing 3.1 per cent of net assets. The impact of

Covid-19 on some stocks has offered the opportunity to acquire a

number of companies at reasonable valuations resulting in a notably

reduced cash balance.

Subsequent to the period end, the Company raised GBP30m of debt

at an interest rate of 2.75% fixed for 20 years. We will seek to

invest this money steadily, as we believe the outlook for Asian

equities over a 20 year time frame to be very strong.

Dividend

A dividend of 11.5p per share was paid on 15 January 2021 for

the year ending 31 August 2020 (31 August 2019: 11.5p per share).

It is too early to make a forecast of the distribution for the

current financial year. The Company has never sought to pay high

dividends instead focusing on finding growing companies, which tend

to have lower yields. We expect that any reduced dividend should be

compensated for by higher capital growth from the Company's

investments.

Review

Asian stock markets were strong over the six months ending 28

February 2021. Investor sentiment was positive for most of the

period on expectations of a strong recovery from the impact

Covid-19 has had on the global economy. Stock markets further

benefitted from significant fiscal support from policymakers.

South Korea and Taiwan were the best performing major markets

over the period, driven by strong performance by their large

technology companies which have benefited from increased demand for

semiconductor chips over the past year. The Indian market also

produced strong returns on evidence of an improving economy. Most

other markets rose with only Malaysia and Pakistan producing

sterling losses.

Asian smaller companies outperformed their larger

counterparts.

13 new positions were initiated. Beijing Capital International

Airport and property developer China Overseas Grand Ocean were

purchased on attractive valuations. In India we bought IIFL Wealth

Management for its leading position in the country's growing wealth

management industry; cable manufacturer Kei Industries which has

many growth opportunities; city gas distributor Mahanagar Gas which

has seen its franchise solidified by a recent regulatory review;

temporary staffing provider Quess Corp where a new chief executive

has made many positive changes; and engineering company Thermax

which is seeing demand return after a long fallow period and strong

interest from customers in its clean energy business. In South East

Asia we purchased leading nappy and feminine hygiene brand owner

Uni-Charm Indonesia; Mr DIY, Malaysia's leading home improvement

store; Singapore's Credit Bureau Asia which has a near monopoly on

credit reference services in its home market and further growth

opportunities in Cambodia and Myanmar; and TISCO Financial, a

leading auto finance company in Thailand. We also purchased South

Korea's Zinus an innovator in mattress and furniture retailing and

Taiwan's Parade Technologies which is benefiting from rising demand

for its integrated circuits which facilitate high speed data

transmission.

13 positions were sold. Several Indian holdings were sold

following strong share price performance being cement companies ACC

Limited and Ambuja Cements; chemicals company BASF India; Great

Eastern Shipping; IT outsourcer Zensar Technologies; and Tata

Global Beverages. Hong Kong's Nexteer Automotive Group; Korean

technology firm Leeno Industrial; and Vietnamese conglomerate REE

Corp were also sold following strong share price appreciation. We

sold city gas distributor Towngas China; Chinese online recruitment

platform 51jobs; and Malaysian auto components manufacturer APM

Automotive on disappointing capital allocation. Hatton National

Bank was sold as the Sri Lankan economy looks likely to remain

depressed.

As a result of this, Scottish Oriental's exposure to China,

Indonesia, Taiwan and Singapore rose, whereas exposure to Hong

Kong, India and the Philippines fell. At a sector level, exposure

to Consumer Discretionary and Financials rose, with Materials

falling. Although the number of transactions was high this period,

the bulk of this activity was as a result of profit taking with

proceeds reinvested in companies which we believe have similar

growth potential to those sold but at more reasonable

valuations.

Outlook

The impact that Covid-19 has had on Asia's economies, companies

and people has been significant. This impact has been less severe

in North Asia where governments have performed better at containing

the virus than in South and South East Asia. North Asia's economies

are also more export focused with exports proving more resilient

than domestic consumption. As Asia's economies open up again we

expect consumption to return to normal gradually. One of the key

drivers of exports has been fiscal and monetary stimulus in the

West. This stimulus should not be sustainable but recent activity

by policymakers shows an intent to support economic activity and

markets in the short term at almost any cost.

Expectations are for strong growth in corporate earnings in

2021. Looking at Scottish Oriental's portfolio, many of its

investments are attractively valued, particularly when based upon

measures such as market capitalisation per capita. This is most

obvious in Indonesia and the Philippines where sentiment is

currently poor and smaller companies have lagged over the last few

years. As these economies normalise we expect to see the dominant

franchises the Company owns benefit from significantly improved

levels of profitability which will in turn be reflected in their

share prices. The last year has been tough for many of Scottish

Oriental's holdings but we have been impressed at the actions taken

by their management teams to rein in costs and adapt business

models. As a result we have every confidence in their future

prospects, particularly as the crisis has not been as kind to

weaker competitors.

In the past year there has been much interest by market

participants in the technology and healthcare sectors where growth

potential is believed to be the highest, and excess liquidity has

led to large sums of money bidding up valuations. Many companies in

more traditional sectors with proven business models and high

returns on capital have been left behind despite having strong

competitive positions and there still being much growth to come.

Recently we have seen indications of a broadening in the market

rebound to include such proven but less fashionable companies. We

have not chased valuations in companies that have rallied the

hardest and continue to focus on increasing the quality of the

portfolio by identifying companies that are growing, have strong

competitive positions, and are already highly profitable. We

believe the growth and high returns on capital enjoyed by the

companies in Scottish Oriental's portfolio offers a compelling

proposition.

Income Statement for the six months to 28 February 2021

Six months to Six months to

28 February 2021 29 February 2020

(unaudited) (unaudited)

Revenue Capital Total* Revenue Capital Total*

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------- --------- --------- ------------- ----------- -----------

Gains/(losses) on investments - 46,158 46,158 - (24,954) (24,954)

Income from investments 1,820 - 1,820 1,448 - 1,448

Other income - - - 33 - 33

Investment management

fee (1,158) - (1,158) (1,232) - (1,232)

Currency losses - (98) (98) - (1,888) (1,888)

Other administrative

expenses (426) - (426) (416) - (416)

-------------- --------- --------- ------------- ----------- -----------

Net return on ordinary

activities before taxation 236 46,060 46,296 (167) (26,842) (27,009)

Tax on ordinary activities

(note 3) (273) (3,770) (4,043) (77) (256) (333)

-------------- --------- --------- ------------- ----------- -----------

Net return attributable

to equity

shareholders (37) 42,290 42,253 (244) (27,098) (27,342)

-------------- --------- --------- ------------- ----------- -----------

Net return per ordinary

share (0.13p) 147.56p 147.43p (0.82p) (90.71p) (91.53p)

* The total column of this statement is the Profit & Loss

Account of the Company. The revenue and capital columns are

supplementary to this and are prepared under guidance published by

the Association of Investment Companies.

There are no items of other comprehensive income. This statement

is, therefore, the single statement of comprehensive income of the

Company.

All revenue and capital items derive from continuing

operations.

Statement of Financial Position as at 28 February 2021

At 28 At 31

February August 2020

2021

GBP'000 GBP'000

(unaudited) (audited)

FIXED ASSETS - EQUITY INVESTMENTS

Bangladesh 4,732 4,952

China 34,744 21,950

Hong Kong 17,002 22,349

India 117,410 113,874

Indonesia 52,910 36,558

Malaysia 3,209 127

Pakistan 3,821 3,317

Philippines 32,460 36,190

Singapore 9,128 3,369

South Korea 7,579 4,422

Sri Lanka - 1,615

Taiwan 19,337 11,367

Thailand 3,841 -

Vietnam 5,368 7,236

Total Equities 311,541 267,326

Net Current Assets 9,572 22,122

Non-current Liabilities (note 3) (2,320) -

------------- -------------

Total Assets less Liabilities 318,793 289,448

CAPITAL AND RESERVES

Ordinary share capital 7,853 7,853

Share premium account 34,259 34,259

Capital redemption reserve 58 58

Capital reserve 272,800 240,134

Revenue reserve 3,823 7,114

------------- -------------

Equity Shareholders' Funds 318,793 289,448

============= =============

Net asset value per share 1,132.23p 992.14p

Cash Flow Statement for the six months to 28 February 2021

Six months Six months

to to

28 February 29 February

2021 2020

GBP'000 GBP'000

(unaudited) (unaudited)

Note

Net cash outflow from operations

before dividends, interest, purchases

and sales of investments 9 (1,589) (1,691)

Dividends received from investments 1,900 1,777

Interest received from deposits - 33

Purchases of investments (83,169) (72,415)

Sales of investments 85,028 58,408

------------ ------------

Cash inflow/(outflow) from operations 2,170 (13,888)

Taxation (1,733) (345)

------------ ------------

Net cash inflow/(outflow) from operating

activities 437 (14,233)

Financing activities

Equity dividend paid (3,284) (3,435)

Buyback of ordinary shares (9,720) -

Net cash outflow from financing activities (13,004) (3,435)

Decrease in cash and cash equivalents (12,567) (17,668)

Cash and cash equivalents at the

start of the period 22,459 40,949

Effect of currency losses (98) (1,888)

------------ ------------

Cash and cash equivalents at the

end of the period* 9,794 21,393

------------ ------------

*Cash and cash equivalents represents cash at bank

Statement of Changes in Equity

For the six months ended 28 February

2021

Share Capital

Share Premium Redemption Capital Revenue

Capital Account Reserve Reserves Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ---------- --------- ------------ ----------- ---------- ----------

Balance at 31

August 2020 7,853 34,259 58 240,134 7,144 289,448

-------------------------- ---------- --------- ------------ ----------- ---------- ----------

Total comprehensive

income:

Return for the

period - - - 42,290 (37) 42,253

Transactions

with owners recognised

directly in equity:

Dividend paid

in the period - - - - (3,284) (3,284)

Buyback of Ordinary

shares - - - (9,624) - (9,624)

Balance at 28

February 2021 7,853 34,259 58 272,800 3,823 318,793

-------------------------- ---------- --------- ------------ ----------- ---------- ----------

For the six months ended 29 February

2020

Share Capital

Share Premium Redemption Capital Revenue

Capital Account Reserve Reserves Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ---------- --------- ------------ ----------- ---------- -----------

Balance at 31

August 2019 7,853 34,259 58 295,754 8,140 346,064

-------------------------- ---------- --------- ------------ ----------- ---------- -----------

Total comprehensive

income:

Return for the

period - - - (27,098) (244) (27,342)

Transactions

with owners recognised

directly in equity:

Dividend paid

in the period - - - - (3,435) (3,435)

Balance at 29

February 2020 7,853 34,259 58 268,656 4,461 315,287

-------------------------- ---------- --------- ------------ ----------- ---------- -----------

Notes to Accounts

(1) The condensed Financial Statements for the six months to 28

February 2021 comprise the Income Statement, Statement of Financial

Position, Cash Flow Statement and Statement of Changes in Equity,

together with the notes set out below. They have been prepared in

accordance with FRS 104 'Interim Financial Reporting', UK Generally

Accepted Accounting Principles ("UK GAAP") and the AIC's Statement

of Recommended Practice issued in October 2019.

(2) The position as at 31 August 2020 is an abridged version of

that contained in the Annual Report and Accounts, which received an

unqualified audit report and which have been filed with the

Registrar of Companies. This Interim Report has been prepared under

the same accounting policies adopted for the year to 31 August

2020.

(3) On 1 April 2018, the Indian Government withdrew an exemption

from capital gains tax on investments held for 12 months or longer.

Indian capital gains tax is now charged on sales of investments at

15% where the investment has been held for less than 12 months,

this is reduced to 10% if the investment has been held for longer

than 12 months.

The Company has incurred GBP1,450,000 of capital gains tax on

the sale of investments in the six months to 28 February 2021 (six

months to 29 February 2020: GBP256,000).

The Company has recognised a deferred tax liability of

GBP2,320,000 (31 August 2020: GBPnil) on capital gains which may

arise if Indian investments are sold.

(4) The return per ordinary share figure is based on the net

return for the six months ended

28 February 2021 of GBP42,253,000 (six months ended 29 February

2020: net loss of GBP27,342,000) and on 28,659,615 (six months

ended 29 February 2020: 29,873,784) ordinary shares, being the

weighted average number of ordinary shares in issue during the

respective periods.

(5) At 28 February 2021 there were 28,156,097 ordinary shares in

issue and 3,257,566 ordinary shares held in Treasury (31 August

2020: 29,174,030 in issue and 2,239,633 held in Treasury). During

the six months ended 28 February 2021, the Company bought back

1,017,933 ordinary shares (year to 31 August 2020; the Company

bought back 699,754 ordinary shares).

(6) Dividends

At At

28 February 29 February

2021 2020

GBP'000 GBP'000

Amounts recognised as distributions

in the period:

Dividend for the year ending 31 August

2020 of 11.5p (2019 - 11.5p), paid 15

January 2021 3,284 3,435

------------- -------------

(7) Under the terms of the Investment Management Agreement, an

annual performance fee may be payable to the Investment Manager at

the end of the year. A detailed explanation of the performance fee

computation is set out on page 63 of the Annual Report and

Accounts. The total fee payable to the Investment Manager is capped

at 1.5% per annum of the Company's net assets.

Assuming no change in share price, MSCI AC Asia ex Japan Index

Total Return and shares in issue between 28 February 2021 and 31

August 2021, the estimated performance fee for the year ending 31

August 2021 would amount to GBPnil. No performance fee has been

accrued in the six months to 28 February 2021.

(8) Investments in securities are financial assets designated at

fair value through profit or loss on initial recognition. In

accordance with FRS 102 and FRS 104, these investments are analysed

using the far value hierarchy described below. Short-term balances

are excluded as their carrying value at the reporting date

approximates to their fair value.

The levels are determined by the lowest (that is, the least

reliable or least independently observable) level of input that is

significant to the fair value measurement for the individual

investment in its entirety as follows:

Level 1 - Investments with prices quoted in an active

market;

Level 2 - Investments whose fair value is based directly on

observable current market prices or is indirectly being derived

from market prices; and

Level 3 - Investments whose fair value is determined using a

valuation technique based on assumptions that are not supported by

observable current market prices or are not based on observable

market data.

All of the Company's investments were categorised as Level 1 for

the six month period to 28 February 2021.

(9) Reconciliation of total return on ordinary activities before

taxation to net cash outflow before dividends, interest, purchases

and sales

Six months Six months

to to

28 February 29 February

2021 2020

GBP'000 GBP'000

Net return on activities before taxation 46,296 (27,009)

Net (gains)/losses on investments (46,158) 24,954

Currency losses 98 1,888

Dividend income (1,820) (1,448)

Interest income - (33)

Decrease in creditors (1) (31)

Increase in debtors (4) (12)

------------ ------------

Net cash outflow from operations before

dividends,

interest, purchases and sales of investments (1,589) (1,691)

(10) On 23 March 2021 the Company agreed to issue GBP30 million

of long-term, fixed rate, senior, unsecured privately placed notes

providing the Company with long-term financing.

The new privately placed notes are being issued in one tranche:

GBP30 million with a fixed coupon of 2.75% to be repaid 24 March

2041. The coupon will be payable semi-annually. The funding date

was 24 March 2021.

Principal Risks and Uncertainties

The principal and emerging risks faced by the Company are;

investment objective and strategy, investment performance,

financial and economic, operational and regulatory. These risks

have not changed since the publication of the Annual Report and

Accounts. The principal and emerging risks and uncertainties facing

the Company, together with a summary of the mitigating action the

Board takes to manage these risks, are set on pages 28 and 29 of

the Annual Report and Accounts. Scottish Oriental's assets mainly

comprise listed equities though the significant market volatility

resulting from the outbreak of Covid-19 may impact liquidity in the

underlying portfolio. The Investment Manager monitors portfolio

liquidity and manages this to ensure the Company maintains

sufficient levels of liquidity to operate effectively. Scottish

Oriental's investment portfolio is exposed to market price

fluctuations and currency fluctuations which are monitored by the

Investment Manager. The Company is also exposed to minimal interest

rate risk on interest receivable from bank deposits and interest

payable on bank overdraft positions.

Going Concern

After making inquiries and bearing in mind the nature of the

Company's business and assets, the Directors believe that the

Company has adequate resources to continue operating for at least

twelve months from the date of approval of the condensed financial

statements. For this reason, they continue to adopt the going

concern basis in preparing the financial statements.

Directors' Responsibility Statement

The Directors are responsible for preparing the half-yearly

financial report in accordance with applicable law and regulations.

The Directors confirm that, to the best of their knowledge:

(a) the condensed set of financial statements within the

half-yearly financial report, prepared in accordance with the

Financial Reporting Standard 104 (Interim Financial Reporting),

gives a true and fair view of the assets, liabilities, financial

position and profit or loss of the Company; and

(b) the Interim Management Report includes a fair review of the

information required by 4.2.7R of the Financial Conduct Authority's

Disclosure Guidance and Transparency Rules (important events that

have occurred in the first six months of the Company's financial

year, together with their effect on the half-yearly financial

statements to 28 February 2021 and a description of the principal

risks and uncertainties for the remaining six months of the

financial year). Rule 4.2.8R requires information on related party

transactions. No related party transactions have taken place during

the first six months of the financial year that have materially

affected the financial position of the Company during that period

and there have been no changes in the related party transactions

described in the last Annual Report and Accounts that could do

so.

The half-yearly report for the six months to 28 February 2021

comprises the Interim Management Report, the Directors'

Responsibility Statement and a condensed set of financial

statements and has not been audited or reviewed by auditors

pursuant to the Auditing Practices Board guidance on Review of

Interim Financial Information.

By order of the Board

James Ferguson

Chairman

12 April 2021

-- The terms of the half-yearly financial report and this

announcement were approved by the Board on 12 April 2021.

-- Copies of the half-yearly financial report will be posted to

shareholders shortly and will be available thereafter on the

Company's website: www.scottishoriental.com and from the Company

Secretary's office at 28 Walker Street, Edinburgh EH3 7HR.

Enquiries:

PATAC Limited, Edinburgh, +44 (0)131 378 0500

12 April 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFDFMEEFSEFL

(END) Dow Jones Newswires

April 13, 2021 02:00 ET (06:00 GMT)

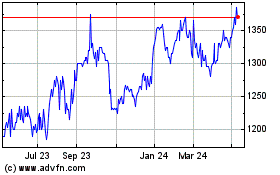

Scottish Oriental Smalle... (LSE:SST)

Historical Stock Chart

From Mar 2024 to Apr 2024

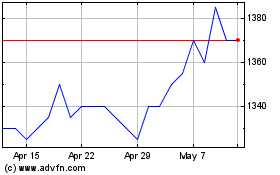

Scottish Oriental Smalle... (LSE:SST)

Historical Stock Chart

From Apr 2023 to Apr 2024