TIDMSTM

RNS Number : 2711Y

STM Group PLC

08 September 2020

STM Group Plc

("STM", "the Company" or "the Group")

Unaudited Interim Results for the six months ended 30 June

2020

& Investor Presentation

STM Group Plc (AIM: STM), the multi-jurisdictional financial

services group, is pleased to announce its unaudited interim

results for the six months ended 30 June 2020.

Financial Highlights:

2020 2020 2019 2019 (underlying)**

(reported) (underlying)** (reported)

Revenue GBP11.8m GBP11.8m GBP11.9m GBP11.6m

------------- ----------------- ------------- --------------------

Profit before other items* GBP1.8m GBP1.9m GBP2.1m GBP2.3m

------------- ----------------- ------------- --------------------

Profit before taxation GBP1.0m GBP1.1m GBP3.4m GBP1.6m

("PBT")

------------- ----------------- ------------- --------------------

Profit before other items

margin 15% 16% 18% 20%

------------- ----------------- ------------- --------------------

Earnings per share 1.33p 1.45p 5.30p 2.30p

------------- ----------------- ------------- --------------------

Cash at bank (net of borrowings) GBP17.6m N/A GBP17.3m N/A

------------- ----------------- ------------- --------------------

Interim dividend 0.55p N/A 0.75p N/A

------------- ----------------- ------------- --------------------

* Profit before other items is defined as revenue less operating

expenses i.e. profit before taxation, finance income and costs,

depreciation, amortisation, bargain purchase gain and gain on the

call options

** Underlying statistics are net of certain transactions which

do not form part of the regular operations of the business as

further detailed in the table below

Highlights:

-- Pensions administration business underpinning increase in recurring revenues

-- Stability of Group revenue demonstrated through the Covid-19 virus

-- Successful transition to remote working arrangements

-- Key IT projects for improved profitability remain on track

with full benefits expected in 2021

-- Carey acquisition now fully integrated, and UK rebranding of

"Options, for your tomorrow" successfully launched

-- Acquisition opportunities continue to be presented

-- UK orientated products - Shariah SIPP and Workplace Pensions

solution now launched, opportunity for international solution as

well

-- Workplace Pensions corporate business moving towards break-even

-- Flexible annuity pipeline building, but frustration in slower

than anticipated conversion

Post period end:

-- Acquisition of the Berkeley Burke Small Self Administered

Schemes ("SSAS") and Group Personal Pension ("GPP") companies,

driving UK centric business growth on scalable operating

platform

Commenting on the results and prospects for STM, Alan Kentish,

Chief Executive Officer, said:

" Covid-19 has presented challenges however the business has

responded admirably and, as anticipated, the quality of our

recurring revenue stream has under-pinned our half year results.

The challenge and opportunity for us over the next 12 months is to

accelerate the conversion to revenue of our healthy new business

pipeline, particularly in relation to our flexible annuity

product.

"Within the business, as part of our new operating model and

drive for improved margins, I am pleased to confirm that our key IT

projects remain on track with regards to scheduled completion,

which we expect to lead to a step change in profitability in

2021.

"The recent acquisition of the Berkeley Burke SSAS and GPP

companies are a welcome addition to the UK business portfolio, and

demonstrates our commitment to further building our UK operations

and delivering on our growth potential. In addition, we continue to

pursue acquisition opportunities where we are in active

discussions. "

Investor Presentation: 4pm on Thursday 10 September 2020

The Directors will hold a presentation to introduce STM Group

Plc to investors and cover the Interim Results and prospects at

4.00 p.m. on Thursday 10 September 2020.

The presentation will be hosted through the digital platform

Investor Meet Company. Investors can sign up to Investor Meet

Company and add to meet STM Group Plc via the following link

https://www.investormeetcompany.com/stm-group-plc/register-investor

.

For those investors who have already registered and added to

meet the Company, they will automatically be invited.

Questions can be submitted pre-event to STM@walbrookpr.com or in

real time during the presentation via the "Ask a Question"

function.

The information communicated in this announcement is inside

information for the purposes of Article 7 of Regulation

596/2014.

For further information, please contact:

STM Group Plc

Alan Kentish, Chief Executive Officer Via Walbrook PR

Therese Neish, Chief Financial Officer www.stmgroupplc.com

finnCap Tel: +44 (0)20 7600 1658

Matt Goode / Emily Watts - Corporate Finance www.finncap.com

Tim Redfern / Richard Chambers - ECM

Media enquiries:

Walbrook PR Tel: +44 (0) 20 7933 8780

Tom Cooper / Paul Vann Mob: +44 (0) 797 122 1972

tom.cooper@walbrookpr.com

Notes to editors:

STM is a multi-jurisdictional financial services group which is

listed on AIM, a market operated by the London Stock Exchange. The

Group specialises in the delivery of a wide range of financial

service products to professional intermediaries and the

administration of assets for international clients in relation to

retirement, estate and succession planning and wealth

structuring.

Today, STM has operations in the UK, Gibraltar, Malta, Jersey

and Spain. The Group is looking to expand through the development

of additional products and services that its ever more

sophisticated clients demand. STM has developed a specialist

international pensions division which specialises in Self-Invested

Personal Pensions (SIPPs) for expatriates, Qualifying Recognised

Overseas Pension Schemes (QROPS), Qualifying Non UK Pension Schemes

(QNUPS). STM has two Gibraltar Life Assurance Companies which

provide life insurance bonds - wrappers in which a variety of

investments, including investment funds, can be held.

Further information on STM Group Plc can be found at

www.stmgroupplc.com .

Chairman's Statement

I am pleased to present the results for the first six months of

2020 where the Covid-19 virus has brought with it many challenges,

not only for STM and our stakeholders but to the worldwide

financial sector in general.

We are proud that the nature of our business has meant that both

our revenue base and cost base have remained relatively stable,

with only a small loss to our existing revenue stream whilst

reporting high levels of recurring revenues. Also, as part of our

business continuity strategy we have continued to put the safety of

our staff at the heart of our plans and I am pleased and proud of

how it has gone so far.

However, and frustratingly, our new business flows from various

areas of the Group are materialising slower than we would have

liked, especially in the flexible annuities and workplace pension

areas. Whilst we believe this is a timing issue that would appear

to be primarily driven by Covid-19, it does put pressure on our

likely performance in the second half of 2020 with some

consequential impact on our 2021 financial year.

I have now been in tenure as Chairman for two years, and am

pleased to say that we are continuing to make progress in many key

areas, including building both a stronger leadership structure and

business support infrastructure in addition to our critical

investment in IT that will soon improve both our operating margins

and customers' experience. This, coupled with a step change in our

focus on bringing in new business and further resources for new

product development, will bring a strong performance in 2021.

As a board, we continue to look for acquisition opportunities

that will support and complement our organic growth plans. The

recent Berkeley Burke acquisition completed in August fits such a

criteria adding both a Small Self Administered Scheme (" SSAS") and

Group Personal Pension ("GPP") portfolio.

In summary, it has been a challenging 2020 so far, largely due

to Covid-19 impacts but we are looking forward with improved

strategic clarity, strong priority focus and disciplined execution.

I look forward to updating the market with our future developments

and achievements at the appropriate time.

Duncan Crocker

Chairman

Chief Executive's Review

Overview

Along with all businesses, STM Group has had to navigate through

unprecedented times as a result of the Covid-19 pandemic. These

challenges encompass changes to how we do business, how we

communicate with our customers and intermediaries, as well as our

own colleagues. However, we have demonstrated that our business

model is robust, and the implementation of our business continuity

plans has meant that we continue to meet expected service standards

for our customers.

As anticipated, the quality of our recurring revenue stream has

under-pinned our half year results, with only a very small element

of our fees being dependent on assets under management or driven by

interest rates.

Covid-19 has however had an impact on our new business

expectations in that we have seen delays in the take-up of certain

product offerings. This is particularly apparent in our recently

launched flexible annuity product and bulk transfers to our

workplace pension master trust, albeit in both cases we see this as

a matter of timing rather than lost business.

As part of our new operating model, and drive for improved

margins, I am pleased to confirm that our key IT projects remain on

track with regards to scheduled completion.

I am also pleased to note that during the period an agreement

was reached between the STM Group Gibraltar regulated companies

that formed part of the Skilled Persons Review in 2018 and the

Gibraltar Financial Services Commission. This concluded that all

remediation and action points identified during the Skilled Persons

Review have now been implemented and no further action is

contemplated.

The recent acquisition of the Berkeley Burke SSAS and GPP

companies are a welcome addition to the UK business portfolio, and

demonstrates our commitment to further building our UK

operations.

Financial review

Financial performance in the period

The Group has reported revenues for the first half of the year

of GBP11.8 million (2019: GBP11.9 million), with underlying revenue

being GBP0.2m up on 2019 figure of GBP11.6m after stripping out the

2019 adjustments of the technical reserve release from the life

assurance company and the accounting policy adjustment on the Carey

acquisition.

Recurring revenues for the period have increased by 15% to

GBP10.0 million (2019: GBP8.7 million), now representing 85% of

total revenues (2019: 73%). These high levels of recurring revenues

remain a key performance measure for the business and demonstrate

the quality of the Group's revenues.

Profit before other items for the period is GBP1.8 million

(2019: GBP2.1 million) with reported profit before tax of GBP1.0

million (2019: GBP3.4 million). However, as was the case with

revenue there were a number of adjustments included in last year's

figures, largely due to the Carey acquisition. Thus the underlying

profit before other items is GBP1.9 million (2019: GBP2.3 million)

and underlying profit before tax of GBP1.1 million (2019: GBP1.6

million).

The decrease in underlying profitability is largely as a result

of the higher professional indemnity insurance premiums which were

introduced in September 2019 thus were not included in the first 6

months of 2019; and with some additional personnel costs also

commencing in July 2019 to finalise the key recruits under the new

operating model. This increase in costs has resulted in a decrease

in underlying profit margins to 16% for profit before other items

as compared to 20% for the first half of 2019. The investment in

the Group's systems and IT infrastructure together with continued

increase in business revenues is expected to result in improved

margins for 2021 and beyond.

The reconciliation of reported measures to underlying measures

is made up of items which are either non-recurring or exceptional

and thus do not form part of the normal course of business. This

reconciliation for all three key financial measures is shown in the

table below:

RECONCILIATION OF REPORTED TO UNDERLYING MEASURES

REVENUE PROFIT BEFORE PROFIT BEFORE

OTHER ITEMS TAX

------------- ---------------- ----------------

2020 2019 2020 2019 2020 2019

----- ------ ------- ------- ------- -------

GBPm GBPm GBPm GBPm GBPm GBPm

----- ------ ------- ------- ------- -------

Reported measure 11.8 11.9 1.8 2.1 1.0 3.4

----- ------ ------- ------- ------- -------

Less: release on technical

reserve - (0.9) - (0.9) - (0.9)

----- ------ ------- ------- ------- -------

Less: adjustment on Carey

revenue recognition - 0.6 - 0.6 - 0.6

----- ------ ------- ------- ------- -------

Add: integration and acquisition

costs for H1 - - 0.1 0.3 0.1 0.3

----- ------ ------- ------- ------- -------

Add: other non-recurring costs - - - 0.3 - 0.3

----- ------ ------- ------- ------- -------

Less: bargain purchase gain

and derivative asset - - - - - (2.0)

----- ------ ------- ------- ------- -------

Underlying measure 11.8 11.6 1.9 2.3 1.1 1.6

----- ------ ------- ------- ------- -------

Cashflows

Cash and cash equivalents at 30 June 2020 were GBP18.3 million

(2019: GBP18.1 million) with cash generated from operating

activities being GBP1.7 million (2019: GBP2.2 million) thus

exceeding our reported profit before tax.

During the period we repaid GBP0.5 million of our bank loan

leaving a balance of GBP0.7 million outstanding and due to be fully

repaid by October (2019: GBP0.8 million). Net cash and cash

equivalents as at 30 June 2020 were therefore GBP17.6 million

(2019: GBP17.3 million).

As would be expected for a Group regulated in a number of

jurisdictions, a significant proportion of this balance forms part

of the regulatory and solvency requirements. It is not possible to

determine exactly how much of the cash and cash equivalents are

required for solvency purposes as other assets can be used to

support the regulatory solvency requirement. The total regulatory

capital requirement across the Group as at 30 June 2020 is GBP18.6

million.

The balance sheet also gives visibility of future revenue and

cash generation and, in line with all administration services

businesses, the Group had accrued income in the form of work

performed for clients but not yet billed of GBP1.7 million as at

the period end (2019: GBP1.1 million). This gives some visibility

of revenue still to be billed and collected as cash at bank.

Additionally, deferred income relating to annual fees invoiced

but not yet earned stood at GBP4.4 million (2019: GBP4.7 million).

This figure gives good visibility of revenue that is still to be

earned through the Income Statement in the coming months.

Trade receivables as at 30 June 2020 were GBP3.2 million showing

an increase from the position as at 30 June 2019 of GBP2.5

million.

Dividend

In line with the more prudent approach adopted by the Board with

regards to the 2019 final dividend, the Board has considered the

unprecedented times in conjunction with the robustness of the

Group's business model. As such I am pleased to announce that the

Board has declared an interim dividend of 0.55 pence per share

(2019: 0.75 pence). The interim dividend is expected to be paid on

19 November 2020 to those shareholders on the register on 23

October 2020. The ordinary shares will become ex-dividend on 22

October 2020.

Subject to trading continuing to perform in line with our

revised expectations, the Board expects to propose a final dividend

for the full year.

Review of operations

Pensions

The pensions administration businesses continue to be the

cornerstone of our operations, with the 2019 acquisition of the

Carey pension business giving us a stronger platform for growth in

the UK market.

Overall the pensions revenue for the period was GBP7.9 million

(2019: GBP6.8 million) representing 67% (2019: 57%) of total Group

revenues. Total revenue is split between GBP5.1 million for QROPS

(2019: GBP5.0 million), GBP1.9 million (2019: GBP1.3 million) for

the SIPP business and a further GBP1.0 million (2019: GBP0.5

million) for the workplace pensions business.

The recurring revenue percentage for this operating segment

continues to increase at 93% (2019: 90%) for the period. This

combined with low attrition rates means that it remains a solid

predictor of future divisional profitability.

New business applications for QROPS and SIPPs have seen an

increase from the same period last year at 473 (2019: 349). This

increase is largely within our UK SIPP business which is now being

marketed under our new UK brand "Options, for your tomorrow".

The final pensions revenue stream within the Group is the

auto-enrolment business acquired as part of the Carey acquisition,

now branded Options Corporate. Whilst this business has seen circa

30,000 new members in the first six months; the levels of new

business are not as high as management were originally expecting.

This is very much a direct impact of the global pandemic causing

employers to delay the transfer of schemes during lockdown. We

remain confident that this is purely a delay rather than potential

new business being diverted elsewhere.

The UK businesses have seen significant change operationally

during the first six months of the year, with all administration

now being carried out from our Milton Keynes office. In addition,

both the SIPP and auto-enrolment businesses are in the process of

migrating onto new administration software.

In relation to the UK pension sector, there was welcome clarity

from the judgment handed down on the Adams vs Carey case, with all

points found in favour of Carey. It remains to be seen whether

leave to Appeal will be granted, and to what extent the Financial

Ombudsman and Regulator will consider this new legal precedent when

reviewing complaints against SIPP providers.

Life assurance

Revenue for the combined life assurance businesses amounted to

GBP2.0 million as compared to GBP2.8 million in 2019. This decrease

is largely due to the 2019 figures including the final release of

the technical reserve of GBP0.9 million. Net of this adjustment

revenue in 2019 was GBP1.9 million.

In a similar manner to the pensions operating segment, our life

assurance business also has high recurring fees. Whilst in absolute

numbers this is only slightly higher than last year at GBP1.9

million (2019: GBP1.7 million) the percentage value (as compared to

total divisional revenues) is significantly higher at 95% (2019:

62%) given that there are no further technical reserve

releases.

Ongoing work continues in relation to the project to merge the

two life companies . T his is made more complicated due to STM Life

having written a number of life assurance policies for EU resident

individuals.

The launch of our flexible annuity products aimed at the UK

market remain the key focus for organic growth within our life

businesses. Our pipeline of potential new business continues to

grow, albeit, as mentioned above there remains frustration at the

length of time for that to convert into new business. In addition,

we continue to look to build our UK intermediary base to promote

our flexible annuity product.

Corporate and Trust Services ("CTS")

Revenue from the Corporate and Trustee Services division for the

period was GBP1.6 million (2019: GBP1.9 million) , thus accounting

for 14% of the Group's total revenues (2019: 16%).

Our Gibraltar business contributed 52% (2019: 46%) of this

revenue, with Jersey contributing the other 48% (2019: 54%).

Recurring revenue for the CTS operating segment was consistent

with the prior year's figure at GBP0.6 million and thus 38% of the

total CTS revenues (2019: 33%).

As noted in previous year's reports, the CTS environment and

sector remains challenging, and it is fully recognised by the Group

that this will be a difficult division to grow organically.

Other divisions

Having closed down the insurance management division in March

2019, this revenue now relates solely to the Spanish office which

has performed in line with management expectations. Revenue for

this operating segment for the period amounted to GBP0.3 million

and thus a slight decrease compared to last year (2019: GBP0.5

million).

Covid-19

There is no doubt that Covid-19 has changed the face of how many

businesses operate. During these unprecedented times, our key

criteria has been to ensure the welfare of our colleagues, whilst

maintain service levels to all our stakeholders, not just our

customers and intermediaries. As a result, our working practices

have evolved and we will ensure that, where appropriate, we learn

from these different ways of working.

We are continuing to follow the various governmental guidelines

in each of the jurisdictions that we operate from, and have adopted

a phased return to workplace policy.

Whilst there have been disruptions to our colleagues working

conditions as they quickly adapted to remote working almost without

warning, the transition was done with professionalism and

commitment. My heartfelt thanks goes to each and every one of them

for their resilience and positivity throughout this year.

Post period end events

Since the period end and as per our announcement of 13 August

2020 we have acquired 100% of the share capital of Berkeley Burke

(Financial Services) Limited and Berkeley Burke Employee Benefits

Consultants Limited. These companies provide administration and

consultancy services to Small Self-administered Pension Schemes in

the UK and to large and medium sized UK and International

businesses. The acquisition comes with good quality portfolio of

clients as well as competent and qualified staff, which will

complement STM's existing business.

In addition, we continue to pursue acquisition

opportunities.

Outlook

A key focus for the second half of the year, and into 2021, is

accelerating our new business activity for new products, which for

the reasons given above, is behind management's expectations.

Understandably, some of this timing delay is down to the disruption

caused by Covid-19. With our recent launch of additional new

pension product offerings for both SIPPs and the workplace pension

aimed at the Shariah market, we are confident that these will start

to fill some of the shortfall. We continue to look at ways to

enhance and market our products to proactively serve our target

market and deliver future growth.

We expect that 2021 will see a step-change in profitability due

to improved operating margins as our investment in IT initiatives

start to bear fruit, and our Options workplace pension business

moves from a loss making position into profitability.

We look forward to updating the market as and when we deliver on

these opportunities.

Alan Kentish

Chief Executive Officer

CONSOLIDATED INCOME STATEMENT

For the period from 1 January 2020 to 30 June 2020

Unaudited Unaudited

6 months 6 months Audited

to to Year to

30 June 30 June 31 December

2020 2019 2019

Notes GBP'000 GBP'000 GBP'000

Revenue 4 11,810 11,945 23,251

Administrative expenses (10,002) (9,883) (19,776)

---------------------------------- ------ ---------- ---------- -------------

Profit before other items 1,808 2,062 3,475

---------------------------------- ------ ---------- ---------- -------------

OTHER ITEMS

Bargain purchase gain - 1,630 1,702

Gains from financial instruments

at FVTPL - 416 416

Finance costs (126) (153) (325)

Depreciation and amortisation (669) (593) (1,345)

---------------------------------- ------ ---------- ---------- -------------

Profit before taxation 1,013 3,362 3,923

---------------------------------- ------ ---------- ---------- -------------

Taxation (224) (214) (520)

---------------------------------- ------ ---------- ---------- -------------

Profit after taxation 789 3,148 3,403

OTHER COMPREHENSIVE INCOME

Items that are or may

be reclassified to profit

and loss

Foreign currency translation

differences for foreign

operations 16 (51) (97)

----------------------------------- ------ ---------- ---------- -------------

Total other comprehensive

income/(loss) 16 (51) (97)

----------------------------------- ------ ---------- ---------- -------------

Total comprehensive income

for the period/year 805 3,097 3,306

---------------------------------- ------ ---------- ---------- -------------

Profit attributable to:

Owners of the Company 861 3,301 3,756

Non-Controlling interests (72) (153) (353)

---------------------------------- ------ ---------- ---------- -------------

789 3,148 3,403

---------------------------------- ------ ---------- ---------- -------------

Total comprehensive income

attributable to:

Owners of the Company 877 3,250 3,659

Non-Controlling interests (72) (153) (353)

---------------------------------- ------ ---------- ---------- -------------

805 3,097 3,306

---------------------------------- ------ ---------- ---------- -------------

Earnings per share basic

(pence) 5 1.33 5.30 5.73

Earnings per share diluted

(pence) 5 1.33 5.13 5.64

---------------------------------- ------ ---------- ---------- -------------

The results for the period from 1 January 2020 to 30 June 2020

relate to continuing activities. The results for the period from 1

January 2019 to 30 June 2019 include both continuing activities and

discontinued operation (see Note 6).

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2020

Unaudited Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

Notes GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment 2,596 2,783 2,953

Intangible assets 20,634 20,733 20,488

Financial assets at FVTPL 416 416 416

Deferred tax asset 84 98 92

Total non-current assets 23,730 24,030 23,949

------------------------------- ------ ---------- ---------- -------------

Current assets

Accrued income 1,692 1,138 1,186

Trade and other receivables 9 5,062 4,976 5,765

Cash and cash equivalents 8 18,279 18,137 18,406

------------------------------- ------ ---------- ---------- -------------

Total current assets 25,033 24,251 25,357

------------------------------- ------ ---------- ---------- -------------

Total assets 48,763 48,281 49,306

------------------------------- ------ ---------- ---------- -------------

EQUITY

Called up share capital 12 59 59 59

Share premium account 22,372 22,372 22,372

Retained earnings 12,951 12,526 12,536

Other Reserves (430) (399) (446)

------------------------------- ------ ---------- ---------- -------------

Equity attributable to

owners of the Company 34,952 34,558 34,521

Non-controlling interests (347) (78) (275)

------------------------------- ------ ---------- ---------- -------------

Total equity 34,605 34,480 34,246

------------------------------- ------ ---------- ---------- -------------

LIABILITIES

Current liabilities

Liabilities for current

tax 1,216 888 1,083

Trade and other payables 10 10,944 10,646 11,634

------------------------------- ------ ---------- ---------- -------------

Total current liabilities 12,160 11,534 12,717

------------------------------- ------ ---------- ---------- -------------

Non-current liabilities

Other payables 11 1,998 2,267 2,343

------------------------------- ------ ---------- ---------- -------------

Total non-current liabilities 1,998 2,267 2,343

------------------------------- ------ ---------- ---------- -------------

Total liabilities and equity 48,763 48,281 49,306

------------------------------- ------ ---------- ---------- -------------

CONSOLIDATED CASH FLOW STATEMENT

For the period from 1 January 2020 to 30 June 2020

Unaudited Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

Notes GBP'000 GBP'000 GBP'000

Operating Activities

Profit for the period/year before

tax 1,013 3,362 3,923

Adjustments for:

Depreciation of property, plant

and equipment 398 347 773

Amortisation of intangible assets 271 246 572

Write-off of intangible assets - - 71

Loss on sale of fixed asset - 2 5

Taxation paid (100) (234) (345)

Bargain purchase gain - (1,630) (1,702)

Unrealised gains on financial

instruments at FVTPL - (416) (416)

Share based payments - 18 18

Decrease in trade and other receivables 703 1,592 827

Increase in accrued income (506) (254) (301)

Decrease in trade and other payables (96) (808) (326)

Net cash from operating activities 1,683 2,225 3,099

----------------------------------------- ------ ---------- ---------- -------------

Investing activities

Disposal of investments - 74 74

Purchase of property, plant and

equipment (40) (88) (117)

Increase in intangible assets (417) (46) (160)

Consideration paid on acquisition

of subsidiary - (350) (350)

Cash acquired on acquisition of

Subsidiary - 1,116 1,116

Net cash used in investing activities (457) 706 563

----------------------------------------- ------ ---------- ---------- -------------

Cash flows from financing activities

----------------------------------------- ------ ---------- ---------- -------------

Proceeds from Bank loans - - 1,200

Bank loan repayment (500) (825) (1,650)

Lease liabilities paid (444) (358) (745)

Treasury shares purchased - (117) (117)

Dividends paid 7 (446) (772) (1,218)

Net cash from financing activities (1,390) (2,072) (2,530)

----------------------------------------- ------ ---------- ---------- -------------

(Decrease)/increase in cash and

cash

equivalents (164) 859 1,132

----------------------------------------- ------ ---------- ---------- -------------

Reconciliation of net cash flow

to movement in net funds

Analysis of cash and cash equivalents

during the period/year

(Decrease)/increase in cash and

cash equivalents (164) 859 1,132

Effect of movements in exchange

rates on cash and cash equivalents 38 11 7

Balance at start of period/year 18,406 17,267 17,267

Balance at end of period/year 18,279 18,137 18,406

----------------------------------------- ------ ---------- ---------- -------------

STATEMENT OF CONSOLIDATED CHANGES IN EQUITY

For the period from 1 January 2019 to 30 June 2019

Shares

Based Non-Controlling

Share Share Retained Treasury Translation Payments Interests Total

Capital Premium Earnings Shares Reserve Reserve Total GBP'000 Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance

at

1 January

2019 59 22,372 9,998 (432) 38 144 32,179 - 32,179

TOTAL COMPREHENSIVE INCOME FOR THE PERIOD

Profit for

the period - - 3,756 - - - 3,756 (353) 3,403

Other comprehensive income

Foreign

currency

translation

differences - - - - (97) - (97) - (97)

Transactions with owners, recorded directly in equity

Dividend

paid - - (1,218) - - - (1,218) - (1,218)

Treasury

shares

purchased - - - (117) - - (117) - (117)

Share based

payments - - - - - 18 18 - 18

Changes in ownership interest

- - - - - - - 78 78

-------------- --------- --------- ---------- ---------- ------------- --------- ----------------------- ----------------- ---------

At 31

December

2019 and

1 January

2020 59 22,372 12,536 (549) (59) 162 34,521 (275) 34,246

-------------- --------- --------- ---------- ---------- ------------- --------- ----------------------- ----------------- ---------

TOTAL COMPREHENSIVE INCOME FOR THE PERIOD

Profit for

the period - - 861 - - - 861 (72) 789

Other comprehensive income

Foreign

currency

translation

differences - - - - 16 - 16 - 16

Transactions with owners, recorded directly in equity

Dividend

paid - - (446) - - - (446) - (446)

Treasury

shares

purchased - - - - - - - - -

Share based

payments - - - - - - - - -

At 30 June

2020 59 22,372 12,951 (549) (43) 162 34,952 (347) 34,605

-------------- --------- --------- ---------- ---------- ------------- --------- ----------------------- ----------------- ---------

NOTES TO THE CONSOLIDATED RESULTS

For the period from 1 January 2020 to 30 June 2020

1. Reporting entity

STM Group Plc (the "Company") is a company incorporated and

domiciled in the Isle of Man and was admitted to trading on the

London Stock Exchange AIM Market on 28 March 2007. The address of

the Company's registered office is 18 Athol Street, Douglas, Isle

of Man, IM1 1JA. The Group is primarily involved in financial

services.

2. Basis of preparation

Results for the period from 1 January 2020 to 30 June 2020 have

not been audited.

The consolidated results have been prepared in accordance with

International Financial Reporting Standards ("IFRS"),

interpretations adopted by the International Accounting Standards

Board ("IASB") and in accordance with Isle of Man law and IAS 34,

Interim Financial Reporting.

3. Significant accounting policies

The accounting policies in these consolidated results are the

same as those applied in the Group's consolidated financial

statements for the year ended 31 December 2019. No changes in

accounting policies are expected to be reflected in the Group's

consolidated financial statements for the year ended 31 December

2020.

4. Segmental Information

STM Group has four reportable segments: Pensions, Life

Assurance, Corporate Trustee Services and Other Services. Each

segment is defined as a set of business activities generating a

revenue stream and offering different services to other operating

segments. The Group's operating segments have been determined based

on the management information reviewed by the CEO and Board of

Directors.

The Board assesses the performance of the operating segments

based on turnover generated. The performance of the operating

segments is not measured using costs incurred as the costs of

certain segments within the Group are predominantly centrally

controlled and therefore the allocation of these is based on

utilisation of arbitrary proportions. Management believe that this

information and consequently profitability could potentially be

misleading and would not enhance the disclosure above.

The following table presents the turnover information regarding

the Group's operating segments:

Operating Segment Unaudited Unaudited Audited

6m 2020 6m 2019 2019

GBP'000 GBP'000 GBP'000

Pensions 7,930 6,760 14,074

Life Assurance 1,945 2,798 4,768

Corporate Trustee Services 1,613 1,881 3,662

Other Services 322 506 747

---------------------------- ---------- ---------- ---------

11,810 11,945 23,251

---------------------------- ---------- ---------- ---------

Analysis of the Group's turnover information by geographical

location is detailed below:

Geographical Segment Unaudited Unaudited Audited

6m 2020 6m 2019 2019

GBP'000 GBP'000 GBP'000

Gibraltar 4,080 5,144 9,329

Malta 3,855 3,750 7,542

United Kingdom 2,828 1,739 3,964

Jersey 773 1,011 1,901

Other 274 301 515

---------------------- ---------- ---------- ---------

11,810 11,945 23,251

---------------------- ---------- ---------- ---------

5. Earnings per Share

Earnings per share for the period from 1 January 2020 to 30 June

2020 is based on the profit after taxation of GBP789,000 divided by

the weighted average number of GBP0.001 ordinary shares during the

period of 59,408,088 basic. Dilutive share options expired one

month after the Company announced its 2018 results, no options were

exercised.

A reconciliation of the basic and diluted number of shares used

in the period ended 30 June 2020 and 30 June 2019 is as

follows:

2020 2019

Weighted average number of shares 59,408,088 59,408,088

Share incentive plan - 1,915,343

Diluted 59,408,088 60,365,759

=================================== =========== ===========

6. Discontinued operation

In March 2019, the Group closed down its Insurance management

business. Management committed to a plan to cease trading for this

part of the segment following an assessment of the viability of the

insurance management business and its alignment with the Group's

long term strategy to focus on its core activities.

This other services segment, of which the insurance management

business was a part of, was not previously classified as

held-for-sale or as a discontinued operation.

There are no results for the discontinued operation included in

the six month period ended 30 June 2020. Results of the

discontinued operation are as follows for both the six month ended

30 June 2019 and the year ended 31 December 2019:

GBP'000

Revenue 179

Expenditure (140)

Results from operating activities 39

Income tax (3)

Results from operating activities,

net of tax 36

Gain on sale of discontinued operation -

Profit from discontinued operation 36

---------------------------------------- --------

The profit from the discontinued operation is attributable

entirely to the owners of the Company.

7. Dividends

The following dividends were declared and paid by the Group

during the period:

Unaudited Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

0.75 pence (2019: 1.3 pence) per qualifying

ordinary share 446 772 446

---------- ---------- -------------

8. Cash and cash equivalents

Cash at bank earns interest at floating rates based on

prevailing rates. The fair value of cash and cash equivalents in

the Group is GBP18,279,000.

9. Trade and other receivables

Unaudited Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

Trade receivables 3,236 2,524 3,908

Prepayments 879 956 621

Other receivables 947 1,496 1,236

-------------------

Total 5,062 4,976 5,765

------------------- ---------- ---------- -------------

10. Trade and other payables

Unaudited Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

Deferred income 4,369 4,662 4,193

Trade payables 659 445 466

Bank loan 700 825 1,200

Lease liabilities 788 652 795

Contingent consideration - 100 39

Other creditors and accruals 4,428 3,962 4,941

---------- ----------

10,944 10,646 11,634

---------- ---------- -------------

In October 2019 the Company took out a one year loan for GBP1.20

million with quarterly instalments which pays interest of 4% above

LIBOR. This loan is secured by a capital guarantee provided by STM

Fidecs Limited.

In October 2016 the Company took out a 3 year bank loan for

GBP3.30 million which pays interest of 4% above LIBOR. The bank

loan was interest only for the first year with quarterly repayments

thereafter commencing in January 2018 and this was fully repaid

during 2019.

11. Other payables - amounts falling due in more than a year

Unaudited Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

Lease liabilities 1,508 1,835 1,889

Deferred tax liabilities 279 329 295

Provisions for dilapidation costs 211 103 159

1,998 2,267 2,343

---------- ---------- -------------

12. Called up share capital

Unaudited Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

Authorised

100,000,000 ordinary shares of GBP0.001

each 100 100 100

Called up, issued and fully paid

59,408,088 ordinary shares of GBP0.001

each 59 59 59

---------- ---------- -------------

13. Post balance sheet event

Subsequent to the period end, on 13 August 2020 the Company

acquired 100% of the share capital of Berkeley Burke (Financial

Services) Limited and Berkeley Burke Employee Benefits Consultants

Limited. These companies provide administration and consultancy

services to Small Self-administered Pension Schemes in the UK and

to large and medium sized UK and International businesses. The

acquisition comes with good quality portfolio of clients as well as

competent and qualified staff, which will complement STM's existing

business.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SSDFMWESSESU

(END) Dow Jones Newswires

September 08, 2020 02:00 ET (06:00 GMT)

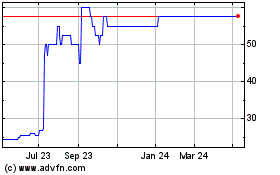

Stm (LSE:STM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stm (LSE:STM)

Historical Stock Chart

From Apr 2023 to Apr 2024