Seneca Growth Capital VCT plc Investment Realisations And Nav

September 16 2020 - 1:00AM

UK Regulatory

TIDMHYG TIDMSVCT

Seneca Growth Capital VCT Plc (the "Company")

16 September 2020

Realisations of Ordinary Share Investments and New Ordinary Share Net

Asset Value ("NAV").

Full Realisation of Ordinary Share Investment in Omega Diagnostics Group

plc ("Omega")

Following the recent rise in Omega's share price on AIM, the Company has

sold the remaining 400,000 Omega shares it retained, realising

GBP296,166, an increase of GBP132,166 (unaudited) on their carrying

value as at 30 June 2020, being the date of the most recently announced

NAV per Ordinary Share. The Company has now sold a total of 2,293,868

Omega shares from the Ordinary Share pool since 31 December 2019 fully

realising the investment for a total of GBP987,318 and generating a

profit versus original cost of GBP659,318 (a 3x return on the original

investment).

Partial Realisation of Ordinary Share Investment in Scancell Holdings

Plc ("Scancell")

The Directors are also pleased to report that the Company has sold

1,049,730 Scancell shares from the Ordinary Share pool, realising

GBP126,619 and generating a profit versus original cost of GBP63,110 (a

2x return on the original investment) and an increase of GBP72,033 on

their carrying value as at 30 June 2020. The Company's Ordinary Share

pool retains 12,000,000 Scancell shares.

New Ordinary Share Net Asset Value

The Board have reviewed the carrying value of all Ordinary Share pool

investments, including Scancell at a bid price of 15p per share as at 14

September 2020, and report that as at 14 September 2020 the unaudited

NAV per Ordinary share was 35.8p, an increase of 13.6p per Ordinary

share from the unaudited NAV of 22.2p per Ordinary share (the unaudited

NAV as at 30 June 2020 net of the dividend of 8p per Ordinary Share that

was paid on 28 August 2020). This increase is a result of the profit

generated on the sale of Omega and Scancell shares, and the increase in

value of the remaining Scancell shares, net of the associated movement

in the performance fee accrual.

The information above is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU No.

596/2014). Upon the publication of this announcement via a Regulatory

Information Service this inside information is now considered to be in

the public domain.

For further information, please contact:

John Hustler, Seneca Growth Capital VCT Plc at

https://www.globenewswire.com/Tracker?data=SFI1o_Z6m6HvfkCgstkxYVwc80FvM9twdxXs1EIdj32l7Q-iurfZl9vRwt3QtlNJoc5Wa3UqlpeFTVl7odZMdYnsxDim3uGHE-5IlmaYT4zod9a9Sqwlk-28D7hxLrJA

john.hustler@btconnect.com

Richard Manley, Seneca Growth Capital VCT Plc at

https://www.globenewswire.com/Tracker?data=lT6P9xAswoyxMo4HVcG8LD-0DN5D3O703YVdkJp8KGcqAtHVQCJSwEBJyj_qukXBKKgEQmvumXJgGI5zyPT9mDcKWad8MMVi6Ixa8ZcI_ctOPhF7XPhngy_BAtZeep4jy1S1d1N_yK-vyXfZ2sv2TQ==

Richard.Manley@senecapartners.co.uk

(END) Dow Jones Newswires

September 16, 2020 02:00 ET (06:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

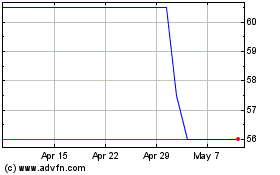

Seneca Growth Capital Vct (LSE:SVCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

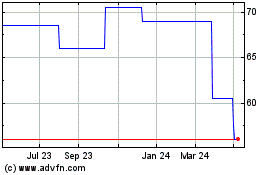

Seneca Growth Capital Vct (LSE:SVCT)

Historical Stock Chart

From Apr 2023 to Apr 2024