TIDMSVS

RNS Number : 4025Y

Savills PLC

12 May 2021

12 May 2021

SAVILLS PLC

("Savills" or "the Company")

Trading update

Ahead of its "virtual" Annual General Meeting (AGM) to be held

at 12 noon today at Savills, Finsbury Circus House, 15 Finsbury

Circus, London EC2M 7EE Savills plc, the international real estate

advisor issues the following trading update:

-- Our Less Transactional businesses have continued to perform

well with progressive recovery in a number of transactional markets

becoming evident. The strategy of retaining staffing levels through

2020 has positioned the Group well for recovery

-- For the year to date, the Group has traded better than

anticipated and comfortably ahead of the prior equivalent period.

Residential markets, particularly in the UK and China have

continued strongly; the Commercial Transaction business has

benefited both from improving sentiment in many markets and from

the completion of transactions which were postponed or delayed

during the lockdowns of Q4 2020

-- Subject to the impact of further waves of COVID infections,

the Board is confident in its expectations for the full year

Mark Ridley, Chief Executive, commented:

"I am delighted that our strategy of maintaining full client

service through the pandemic continues to prove successful and

improving sentiment has enabled much of the business development

activity undertaken before and during 2020 to begin to bear fruit.

We have a strong balance sheet and are focused on continuing to

develop our global businesses through the recovery period, keeping

our staff and visitors safe and maintaining a first class service

to our clients.

"Our Less Transactional businesses of Consultancy and Property

Management have continued to perform well to date as clients have

begun to review longer term strategies once more and management

contracts won in 2020 have begun to translate into revenue.

"Our Transactional businesses have benefited from improving

sentiment in most markets, although travel restrictions still

represent an obstacle to cross-border capital deployment. In

summary, the combination of solid trading in the less transactional

service lines, improving transactional markets (including the

completion of previously delayed transactions) and continued cost

containment, has resulted in a markedly improved performance

compared with the same period last year."

Trading Update

In the Asia Pacific region, recovery has been most evident

throughout the period in Greater China. More recently we have seen

significant improvements in Australia, Singapore and Korea,

accelerated in part by business development activity undertaken

pre-pandemic, and have a healthy near-term pipeline in Japan.

Throughout the period, our substantial Property and Facilities

Management business in the region performed well.

In the UK, our performance has been very strong, driven

primarily by the continued high levels of activity in the

residential markets (both private and institutional), our strength

in less transactional service lines and signs of recovery in

development markets. We have also benefited from a number of

transactions which were delayed during lock down.

In Continental Europe and the Middle East, where Savills is more

dependent upon transactional activity, performance has improved

compared with the prior period with recovery now evident in the

Middle East, Ireland, Germany and France in particular. The current

outbreaks of COVID-19 in parts of the region mean that the

trajectory of recovery remains less clear.

In North America, where the Group is substantially dependent

upon leasing activity by corporate occupiers, our business

performance was in line with our expectations but has not yet

reached the levels of the same period last year. Given the strong

national vaccination programme, pre-transaction activity levels

indicate that corporates are beginning to give serious

consideration to their longer term real estate needs, which is a

precursor to improved transaction levels. We continue to anticipate

progressive recovery through H2 2021.

Savills Investment Management has performed ahead of our

expectations, albeit in an environment which remains challenging

for the deployment of equity capital. Debt markets are more

positive for alternative lenders, such as DRC Capital, as the

traditional bank lenders have widened margins and tightened LTV

covenants and investors seek increasing exposure to this asset

class.

Outlook

Our Less Transactional businesses continue to provide a solid

platform for the Group and our residential businesses have shown

strong recovery, albeit that we expect activity to return to more

normal levels, particularly in the UK, during the second half of

the year compared with an unusually strong comparative period in

2020. Internationally, commercial investment markets are showing

varying speeds of recovery and, subject to further pandemic

outbreaks, we expect this trend to continue through the year,

although cross-border activity will depend upon how soon travel and

quarantine restrictions can be eased.

We are confident in the Group's position both to benefit from

progressive recovery in transactional markets and to continue to

execute our growth strategies. The Board remains confident in its

expectations for 2021 as a whole.

We anticipate announcing the Group's Half Year Results for the

six months to 30 June on 5 August 2021.

For further information, contact:

Savills 020 7409 8934

Mark Ridley, Group Chief Executive

Simon Shaw, Group Chief Financial Officer

Tulchan Communications 020 7353 4200

David Allchurch

Elizabeth Snow

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGMFLFSIEAIFLIL

(END) Dow Jones Newswires

May 12, 2021 06:51 ET (10:51 GMT)

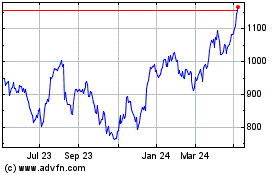

Savills (LSE:SVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

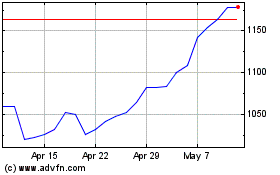

Savills (LSE:SVS)

Historical Stock Chart

From Apr 2023 to Apr 2024