TIDMTRCS

RNS Number : 7474U

Tracsis PLC

08 April 2021

8 April 2021

Tracsis plc

('Tracsis', 'the Company' or 'the Group')

Unaudited Interim results for the six months ended 31 January

2021

Tracsis, a leading provider of software, hardware, data

analytics/GIS and services for the rail, traffic data and wider

transport industries, is pleased to announce its unaudited interim

results for the six months ended 31 January 2021.

Financial Highlights:

-- Revenue decreased to GBP22.2m (H1 2020: GBP26.4m), with

growth in the Rail Technology & Services Division offset by

lower sales in our Events and Traffic Data businesses as expected

due to ongoing Covid-19 restrictions on their end markets

-- GBP6.1m decrease in revenue in those businesses directly

impacted by Covid-19. Revenue growth of 5% across the rest of the

Group before the contribution from prior period acquisitions(+)

-- Adjusted EBITDA* of GBP5.4m (H1 2020: GBP5.6m) only slightly

lower than the same period last year, including the positive impact

of cost reduction actions taken in response to the pandemic

-- Cash balances of GBP20.8m with no Covid deferrals due to be

paid (31 July 2020: GBP17.9m, 31 January 2020: GBP26.0m)

-- No interim dividend declared. The Board continues to review

the situation and is committed to restoring the dividend policy at

the earliest appropriate date

Operational Highlights:

-- Further growth in higher margin Rail Technology &

Services Division, as well as in Data Analytics / GIS

-- Continuing to implement a number of large multi-year rail contracts won in previous years

-- Two large multi-year rail opportunities in the final stages of contract award

-- Traffic Data and Events business units continue to win new

projects but at significantly reduced levels

-- Cost reduction actions tracking in line with expectations

-- Group integration activities progressing well

Post period end Highlights:

-- Appointment of Andy Kelly as Chief Financial Officer

-- Remote condition monitoring hardware and software contract

win with major transit agency in North America

-- Launch of new Group-wide branding to improve collaboration and enhance market awareness

-- Strengthened the Group's transport consultancy offering

through the acquisition of Flash Forward Consulting Ltd

-- Encouraging start to Q3 trading with high activity levels across large parts of the Group

(+) Group revenue growth excluding the Events, Traffic Data and

Delay Repay businesses where activity levels were impacted by

Covid-19; and excluding iBlocks that was acquired in March

2020.

* Earnings before finance income & expense, tax,

depreciation, amortisation, exceptional items, other operating

income, share-based payment charges and share of result of equity

accounted investees. See note 10 for reconciliation.

Chris Barnes, Chief Executive Officer, commented:

"I am pleased with the first half performance which was in line

with our expectations and I'm encouraged by the trading momentum in

the business as we move through the third quarter. The entire

Tracsis team has done an outstanding job over the past 12 months in

protecting jobs and employee wellbeing, in identifying and winning

new business and in robustly responding to the challenges linked to

Covid-19.

We have a significant pipeline of large multi-year opportunities

across our Rail Technology and Services Division in both UK and

international markets, and in our Data Analytics/GIS business unit.

In addition, we are now starting to see an increase in new business

enquiries across those businesses that have been hardest hit by the

Covid pandemic and this is driving increased confidence around

future growth prospects.

We continue to focus on integration and consolidation activities

which alongside the launch of a new Group-wide Tracsis brand will

increase the opportunities for R&D collaboration and cross

selling. We remain committed to pursuing organic and acquisitive

growth supported by a strong balance sheet."

Presentation and Overview video

Tracsis is hosting an online presentation open to all investors

on Tuesday 13 April 2021 at 1.30pm UK time. Anyone wishing to

connect should register here:

http://bit.ly/TRCS_FY21_interim_results_retail

A video overview of the results featuring CEO Chris Barnes and

CFO Andy Kelly is available to view here:

http://bit.ly/TRCS_H1_overview

Enquiries:

Tracsis plc Tel: 0845 125 9162

Chris Barnes, CEO / Andy Kelly, CFO

finnCap Ltd Tel: 020 7220 0500

Christopher Raggett / Charlie Beeson, Corporate Finance

Andrew Burdis, Corporate Broking

Alma PR Tel: 020 3405 0205

David Ison / Helena Bogle / Kieran Breheny / Joe Pederzolli

tracsis@almapr.co.uk

The information communicated in this announcement is inside

information for the purposes of Article 7 of the Market Abuse

Regulation (EU) No. 596/2014.

Chairman & Chief Executive Officer's Report

The Group has reported first half performance in line with

management's expectations. There was further growth in the Rail

Technology & Services Division, where activity levels remain

high. As anticipated, there were Covid-19 related headwinds in the

Events and Traffic Data business units. Cost reduction actions

taken last summer in response to these headwinds are tracking in

line with expectations.

Results Summary

H1 revenue of GBP22.2m was GBP4.2m lower than the prior year (H1

2020: GBP26.4m). Revenues in the Rail Technology & Services

Division grew, with the impact of Covid-19 limited only to the

effect of lower passenger numbers on delay repay transaction

revenues. This growth was offset, however, by lower revenue in our

Events and Traffic Data businesses as a result of Covid-19

restrictions on their end markets. The estimated total adverse

impact to revenue from Covid-19 for the Group was GBP6.1m across

the Events, Traffic Data and Delay Repay businesses. There was

revenue growth of 5% versus H1 20 across the rest of the Group,

before the GBP1.3m revenue contribution from iBlocks that was

acquired in March 2020.

Despite the reduction in revenue, adjusted EBITDA* of GBP5.4m

was only GBP0.2m lower than the prior year (H1 20: GBP5.6m). This

reflects the positive impact of cost reduction actions taken in

response to the pandemic, which delivered a benefit to EBITDA

versus the comparative period last year of GBP1.3m. In addition the

Group has claimed through the Coronavirus Job Retention Scheme in

respect of furloughed staff in the period, with support to the

Income Statement of GBP0.5m.

Statutory profit before tax of GBP1.1m is GBP1.3m lower than the

prior year (H1 20: GBP2.4m). In addition to the GBP0.2m decrease in

adjusted EBITDA*, this includes GBP0.5m higher amortisation of

acquired intangible assets following the acquisition of iBlocks in

March 2020; GBP0.4m relating to the unwinding of previously

discounted contingent consideration balances in accordance with

IFRS accounting standards; and GBP0.3m exceptional charge relating

to deal costs and the fair value of contingent consideration.

A summary of the Group's results is set out below:

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

31 January 31 January 31 July

2021 2020 2020

GBP'000 GBP'000 GBP'000

--------------------------- ----------- ----------- --------

Revenue 22,239 26,365 47,998

Adjusted EBITDA (note 10) 5,431 5,586 10,463

Adjusted Pre-Tax Profit

(note 10) 4,655 4,805 8,581

Profit before tax 1,102 2,419 4,111

--------------------------- ----------- ----------- --------

*Earnings before finance income & expense, tax,

depreciation, amortisation, exceptional items, other operating

income, share-based payment charges and share of result of equity

accounted investees. See note 10 for reconciliation.

Revised Segmental Structure

As reported in the Group's final results for the year ended 31

July 2020, the Group has been reorganised into a new segmental

structure in order to better align with key areas of future

transport industry growth. Segmental performance in both the

current and prior periods reflects the new segmental structure, as

summarised below:

Rail Technology & Services

-- Rail Operations & Planning (includes Bellvedi)

-- Digital Railway / Infrastructure

o Remote condition monitoring hardware and data acquisition

(MPEC)

o Safety and risk management software and asset visualisation

(OnTrac)

-- Customer Experience

o Transit and ticketing solutions (iBlocks)

o Automated delay repay

Data, Analytics, Consultancy & Events

-- Traffic Data Capture & Analysis

-- Event Transport Planning and Management (includes SEP and CTM)

-- Data Analytics / GIS (Compass Informatics)

-- Transport Consultancy (includes Tracsis Passenger Analysis)

Data Analytics / GIS and Transport Consultancy operate across

the whole of the Group, but are reported within the Data,

Analytics, Consultancy & Events segment. The Group's previous

segmental structure included Rail Consultancy within the Rail

Technology & Services segment.

Trading Progress and Prospects

Rail Technology & Services

Activity levels in this segment remain high. The Covid-19

pandemic has resulted in a significant decrease in rail passenger

numbers, however this has had only a modest impact on Tracsis'

performance as the majority of our products and services are

derived from the operational requirements of running and

maintaining the railway. They are integral to the rail industry

delivering its future vision for a digital railway. Our first half

performance demonstrates the robustness of our business model in

this regard and we have a significant pipeline of future

opportunities.

Summary segment results:

Revenue GBP12.1m (H1 2020: GBP10.9m)

Adjusted EBITDA* GBP3.8m (H1 2020: GBP3.9m)

Profit before Tax GBP3.4m (H1 2020: GBP3.8m)

The Division has delivered further revenue growth in the period.

It continues to benefit from high levels of recurring software

revenue, and revenue from multi-year contract wins in previous

years. The impact of Covid-19 was limited to delay repay revenues,

with fewer people travelling due to Government restrictions. This

was more than offset by the contribution from iBlocks, the smart

ticketing business acquired in March 2020. Adjusted EBITDA* margin

of 31% was lower than the comparative period last year, reflecting

the phasing of contract milestones for development work undertaken

in the period. These milestones will be delivered in the second

half of this financial year.

We have two large rail opportunities in the final stages of

contract awards, and all parts of the Division have been involved

in major multi-year tenders, some in international markets. Many of

these opportunities involve recurring software licence

revenues.

Rail Operations & Planning

Total revenues from the Group's rail operations & planning

software and hosting offerings were GBP4.9m (H1 2020: GBP4.8m).

This takes account of the various revenue streams from our TRACS,

ATTUne, COMPASS, and Retail & Operations product suites.

Software sales continue to benefit from high renewal rates from

existing customers, and also from multi-year contract wins from

previous years which we are currently implementing for our clients.

Work continues on implementing our TRACS Enterprise product at

three major Train Operating Companies which were secured in

previous years, and which are expected to go-live during the

summer. Bellvedi continues to perform well, and the ATTUne product

forms an integral part of the overall TRACS Enterprise solution. We

continue to see large multi-year TRACS Enterprise opportunities in

both the passenger and freight sectors of the industry.

Digital Railway & Infrastructure

Total revenues across the Digital Railway and Infrastructure

offerings increased by 9% to GBP5.8m (H1 2020: GBP5.3m). This

includes the revenue from remote condition monitoring (MPEC) which

continued to see strong demand from our core UK client base, and

from our safety and risk management product suites within OnTrac

where activity was dominated by design and development work on our

RailHub product suite as part of a funded enterprise licence

opportunity. Both businesses have a strong pipeline of large

contract opportunities.

Post period end we announced the award of new contracts for the

supply of remote condition monitoring hardware and software to a

major North American transit agency, which will expand our

installed base into a new growth market.

Rail Customer Experience

Revenue of GBP1.4m increased by GBP0.6m (H1 2020: GBP0.8m). As

anticipated, the reduction in rail passenger numbers as a result of

Covid-19 restrictions resulted in a reduction in delay repay

transaction revenues. This business continues to operate from a

modest cost base. The decrease in revenue from delay repay was more

than offset by the revenue contribution from iBlocks which was

acquired in March 2020. We are seeing good levels of interest in

iBlocks' smart ticketing product offering, which is well aligned

with future passenger requirements as Covid-19 restrictions are

lifted. We have a number of contract opportunities under

discussion.

Data, Analytics, Consultancy & Events

As anticipated, the Covid-19 restrictions continue to have a

significant impact on the end markets of our Events and Traffic

Data businesses. In both cases, we believe the underlying demand

remains strong and that activity levels will progressively return

to normal as restrictions are lifted. The timing of this remains

uncertain, and we therefore retain a cautious outlook for the

second half of this financial year.

The Data Analytics / GIS market continues to offer attractive

opportunities for growth and has been largely unaffected by

Covid-19. We have a strong pipeline of opportunities and are

actively looking to expand our capability and client base to

accelerate growth in this area.

Our consultancy business continues to perform well and has been

strengthened by the post period end acquisition of Flash Forward

Consulting and the subsequent launch of a broader Transport

Consultancy offering.

Summary segment results:

Revenue GBP10.2m (H1 2020: GBP15.5m)

Adjusted EBITDA* GBP1.6m (H1 2020: GBP1.6m)

Profit before Tax GBP1.2m (H1 2020: GBP1.1m)

The Data, Analytics, Consultancy & Events Division has

performed in line with management's expectations, despite ongoing

Covid-19 related challenges. As anticipated, there was lower

activity in the Events and Traffic Data businesses as a result of

the impact of restrictions on their end markets. Cost reduction

measures have been implemented in this part of the Group to ensure

that we proactively manage the cost base through this period. There

was good growth in our data analytics / GIS revenue where activity

levels have been unaffected by the pandemic. Despite lower revenue,

adjusted EBITDA* was maintained in line with H1 20 as a result of

the cost reduction actions.

Traffic Data

H1 21 revenue of GBP3.2m was GBP2.1m lower than the prior year

(H1 20: GBP5.3m). This was due to the impact of Covid-19 related

restrictions, which resulted in work being postponed or cancelled

as the prevailing traffic conditions were not representative of

client needs. The main exception was the National Road Traffic

Census which has continued and was a valuable source of revenue in

the period. Work on the Spring and Summer 2021 elements of this has

now started.

Event Transport Planning & Management

Revenues were significantly impacted by Covid-19, with a number

of events cancelled or postponed due to the pandemic. As a result,

revenue of GBP2.2m in the first half was GBP3.3m lower than the

same period last year (H1 20: GBP5.5m). Despite these headwinds,

there remains a level of underlying activity that has supported the

business through this challenging period. Additionally the business

has won new work with new and existing customers, which will help

to support H2 and future revenues. However, overall activity levels

remain significantly lower than normal while Covid restrictions are

in place.

Data Analytics / GIS

Compass Informatics has continued to perform well in the period,

delivering GBP3.0m revenue in the first half (H1 2020: GBP2.6m)

with high activity levels across Irish and UK customers. In the

period Compass Informatics went 'live' with an innovative new

product that is now used by three water utilities to manage the

regulated use of biosolids in agriculture, and continued to develop

a range of innovative mobile apps and data analytics tools for

other clients across the rail, bus, environmental and utilities

sectors. The business has a strong pipeline of new

opportunities.

Transport Consultancy

Consultancy revenues of GBP1.8m compare with GBP2.1m in the same

period last year. Rail Consultancy revenue increased by 12%,

however this was offset by lower activity in Passenger Analytics.

Post period-end, the Group's consulting offering across the

transport industries was expanded through the acquisition of Flash

Forward Consulting. The combined business was launched as Tracsis

Transport Consultancy on 1(st) March 2021, and will offer

consultancy services that cover all areas of the Group.

Strategy Update

The Group's growth strategy is unchanged, and is focused on

organic growth supplemented by M&A.

Organic Growth

There are opportunities for continued growth in all areas of the

Rail Technology & Services Division, supported by strong market

fundamentals. All of our rail businesses are involved in major

multi-year tenders, which give us confidence in our ability to

continue to drive organic growth. Our strategy is to pursue growth

opportunities in each of the four areas outlined below, supported

by collaborative product development and increased levels of

cross-selling:

-- Operational Performance Software

-- Remote Condition Monitoring

-- Safety and Risk Management Software and Asset Visualisation

-- Smart Ticketing

In the Data, Analytics, Consultancy & Events Division we are

focused on growing our Data Analytics / GIS and Consultancy

businesses through targeted investment, and on maximising the

'bounce back' in our Events and Traffic Data business units as the

Covid recovery continues.

Acquisitions

Our strategy is to continue to supplement organic growth with

M&A, with a focus on software, technology and Data

Analytics/GIS businesses that have a good level of high quality,

recurring revenue. Our M&A strategy is supported by a strong

balance sheet and good levels of cash generation, and we continue

to actively pursue acquisition opportunities.

On 26 February 2021 we completed the acquisition of Flash

Forward Consulting Ltd, a UK based transport consultancy business

operating predominantly across the rail and bus sectors. It has a

well-established senior level network across the transport owning

groups, local and central transport governing authorities and

Network Rail, and offers a range of strategic and practical

technical consulting services. The acquisition expands the Group's

consulting offering to customers across the transport

industries.

Operations

Alongside executing this growth strategy, the Group continues to

make progress in implementing a more closely integrated operating

model. A shared services model has been adopted in core support

functions including health & safety, HR, risk management and

quality. This will be extended to the finance function in the

second half of this financial year. The Innovation Hub launched

last year is facilitating enhanced R&D collaboration across the

Group and post period end a new Group-wide brand was launched that

ensures all parts of the Group will share a consistent brand

identity which will broaden the awareness of the Group's breadth of

products and services across the transport industry.

Covid-19

The impact of the Covid pandemic has been felt most in our Data,

Analytics, Consultancy and Events Division, where activity levels

in the Events and Traffic Data end markets have decreased as a

result of the ongoing restrictions. We expect these activity levels

to progressively return to normal as restrictions are lifted. The

impact of the pandemic on the Rail Technology & Services

Division has been modest as the majority of our products and

services are derived from the operational requirements of running

the railway, rather than being directly linked to revenue from

passenger numbers. The estimated total adverse impact to revenue

from Covid-19 for the Group as a whole in H1 21 was GBP6.1m. We

have implemented cost reduction actions in response to the

pandemic, and have utilised the UK furlough scheme to minimise

permanent headcount reductions.

Our priority throughout the pandemic has been to safeguard the

health, welfare and safety of our people and to protect as many

jobs as possible. The response of our teams has been outstanding.

We have largely moved to remote homeworking across the Group,

whilst ensuring that our product and service offerings have been

able to continue. Health and wellbeing support was implemented and

is ongoing and we conduct regular employee surveys to ensure that

we can quickly respond to any areas of concern. We have followed

Government guidelines to implement health & safety and social

distancing measures, to ensure that all of our sites are

Covid-secure.

Dividend

The Board does not consider it appropriate to pay an interim

dividend for the six months ended January 2021. The Board is

committed to restoring the progressive dividend policy at the

earliest appropriate date.

Board

Further to the announcement on 28 September 2020, Andy Kelly was

appointed Chief Financial Officer post-period end on 1 February

2021, replacing Max Cawthra. The Board would like to thank Max for

his significant contribution to Tracsis over the past decade.

Financial position

The Group continues to have significant levels of cash and

remains debt free. Cash balances at 31 January 2021 were GBP20.8m

(31 July 2020: GBP17.9m, 31 January 2020: GBP26.0m). Cash

generation remains strong; net cash flow from operating activities

of GBP3.6m was GBP0.9m higher than H1 20 reflecting favourable

movements in working capital that reflect normal trading patterns.

The Group has paid all VAT, PAYE and Corporation Tax due in the

period and has not taken advantage of any Government support in

respect of taxes. It has claimed grant money in respect of

furloughed staff in the period, with support to the Income

Statement of GBP0.5m.

A summary of cash flows is set out below:

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

31 January 31 January 31 July

2021 2020 2020

GBP'000 GBP'000 GBP'000

--------------------------------- ------------ ------------ ---------

Net cash flow from operating

activities 3,587 2,670 10,553

Net cash flow used in investing

activities (63) (279) (15,401)

Net cash flow used in financing

activities (660) (450) (1,336)

Movement during the period 2,864 1,941 (6,184)

--------------------------------- ------------ ------------ ---------

Summary and Outlook

The Board was pleased with the first half performance, with

continued growth in Rail Technology & Services, and Group

adjusted EBITDA* maintained close to H1 last year despite revenue

headwinds in the Data, Analytics, Consultancy & Events

Division.

We begin the second half of the year with confidence in the

strength of our financial position and with high activity levels

across large parts of the Group. There has been an encouraging

start to Q3 trading. The Board's expectations for the year to 31

July 2021 remain unchanged.

Activity levels are high in our Rail Technology and Data

Analytics / GIS businesses with high levels of recurring revenues.

We are making good progress in delivering multi-year contracts that

were won in prior years, and are in the latter stages of contract

award for two large multi-year rail opportunities. We are involved

in large multi-year tenders in our rail businesses, and post period

end we have won new contracts for the supply of remote condition

monitoring hardware and software to a major North American transit

agency.

We believe activity levels in the Events and Traffic Data

businesses will progressively return to normal as Covid-19

restrictions are lifted. The timing of this remains uncertain, and

we therefore retain a cautious outlook for the second half of this

financial year for these businesses. We will continue to

proactively manage costs whilst the Covid-19 pandemic impacts the

Group.

Our strategy has not changed and we remain committed to our

growth and investment plans. The positive growth drivers in our

core markets are unchanged, and we believe that there are good

opportunities for Tracsis to deliver sustainable revenue growth

while continuing to drive strong cash performance and continuing to

pursue M&A opportunities.

Chris Cole Chris Barnes

Non-Executive Chairman Chief Executive Officer

8 April 2021

Tracsis plc

Condensed consolidated interim income statement for the six

months ended 31 January 2021

Unaudited Unaudited

6 months 6 months Audited

ended 31 ended Year

January 31 January ended

2021 2020 31 July

2020

Note

GBP'000 GBP'000 GBP'000

Revenue 3 22,239 26,365 47,998

Cost of sales (6,007) (10,463) (16,796)

-------------------------------- ----- ----------------------------------------------- ------------ ----------

Gross profit 16,232 15,902 31,202

Administrative costs (14,624) (13,291) (26,779)

3,

Adjusted EBITDA * 10 5,431 5,586 10,463

Depreciation (776) (781) (1,882)

-------------------------------- ----- ----------------------------------------------- ------------ ----------

Adjusted profit ** 10 4,655 4,805 8,581

Amortisation of intangible

assets (2,126) (1,628) (3,599)

Other operating income - - 376

Share-based payment charges (665) (566) (1,050)

-------------------------------- ----- ----------------------------------------------- ------------ ----------

Operating profit before

exceptional

items 1,864 2,611 4,308

Exceptional items:

Impairment losses 4 - - (1,155)

Other 4 (256) - 1,270

-------------------------------- ----- ----------------------------------------------- ------------ ----------

Operating profit 1,608 2,611 4,423

Finance income 6 42 76

Finance expense 5 (408) (30) (79)

Share of result of equity

accounted investees (104) (204) (309)

Profit before tax 1,102 2,419 4,111

Taxation (325) (472) (1,234)

-------------------------------- ----- ----------------------------------------------- ------------ ----------

Profit for the period 777 1,947 2,877

-------------------------------- ----- ----------------------------------------------- ------------ ----------

Other comprehensive income

Foreign currency translation

differences (49) (71) 21

Total recognised income for

the period 728 1,876 2,898

-------------------------------- ----- ----------------------------------------------- ------------ ----------

Earnings per ordinary share

Basic 6 2.66p 6.76p 9.95p

Diluted 6 2.58p 6.56p 9.67p

* Earnings before finance income and expense, tax, depreciation,

amortisation, exceptional items, other operating income,

share-based payment charges and share of result of equity accounted

investees - see note 10

** Earnings before finance income and expense, tax,

amortisation, exceptional items, other operating income,

share-based payment charges, and share of result of equity

accounted investees. - see note 10

Tracsis plc

Condensed consolidated interim balance sheet as at 31 January

2021

Unaudited Unaudited Audited

At 31 January At 31

At 31 January July

2021 2020 2020

Note GBP'000 GBP'000 GBP'000

------------------------------------------- ----- -------------- -------------- --------

Non-current assets

Property, plant and equipment 3,312 3,564 3,581

Intangible assets 52,251 37,184 54,376

Investments - equity 50 350 50

Loans due from associated undertakings - 250 -

Investments in equity accounted

investees 935 894 1,039

Deferred tax assets 1,035 744 877

------------------------------------------- ----- -------------- --------------

57,583 42,986 59,923

------------------------------------------- ----- -------------- -------------- ----------

Current assets

Inventories 386 384 430

Trade and other receivables 7,335 8,452 6,382

Cash and cash equivalents 20,784 26,045 17,920

------------------------------------------- ----- -------------- -------------- ----------

28,505 34,881 24,732

------------------------------------------- ----- -------------- -------------- ----------

Total assets 86,088 77,867 84,655

------------------------------------------- ----- -------------- -------------- ----------

Non-current liabilities

Lease liabilities 883 689 986

Contingent consideration payable 11 6,216 4,975 5,587

Deferred tax liabilities 7,828 5,701 8,234

14,927 11,365 14,807

------------------------------------------- ----- -------------- -------------- ----------

Current liabilities

Lease liabilities 1,025 931 1,128

Trade and other payables 13,160 13,329 13,509

Contingent consideration payable 11 1,653 1,151 1,747

Current tax liabilities 891 793 439

------------------------------------------- ----- -------------- -------------- ----------

16,729 16,204 16,823

------------------------------------------- ----- -------------- -------------- ----------

Total liabilities 31,656 27,569 31,630

------------------------------------------- ----- -------------- -------------- ----------

Net assets 54,432 50,298 53,025

------------------------------------------- ----- -------------- -------------- ----------

Equity attributable to equity holders of the Company

Called up share capital 117 115 116

Share premium reserve 6,386 6,364 6,373

Merger reserve 5,420 3,921 5,420

Retained earnings 42,520 39,952 41,078

Translation reserve (11) (54) 38

------------------------------------------- ----- -------------- -------------- ----------

Total equity 54,432 50,298 53,025

------------------------------------------- ----- -------------- -------------- ----------

Tracsis plc - Consolidated statement of changes in equity

For the six months ended 31 January 2021

Unaudited Share

Share Premium Merger Retained Translation

Capital Reserve Reserve Earnings Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 August

2019 115 6,343 3,921 37,545 17 47,941

Impact on

initial

application

of IFRS

16 (net of

tax) - - - (106) - (106)

Total

comprehensive

income for the

period

Profit for the

six

month period

ended

31 January

2020 - - - 1,947 - 1,947

Other

comprehensive

income for

the period

ended 31

January

2020 - - - - (71) (71)

--------------- --------- ---------------------- ------- ------------------------- ----- -------

Total

Comprehensive

income for

the period - - - 1,947 (71) 1,876

--------------- --------- ---------------------- ------- ------------------------- ----- -------

Transactions

with

owners of the

Company

Share based

payment

charges - - - 566 - 566

Exercise of

share

options - 21 - - - 21

--------------- --------- ---------------------- ------- ------------------------- ----- -------

At 31 January

2020 115 6,364 3,921 39,952 (54) 50,298

--------------- --------- ---------------------- ------- ------------------------- ----- -------

Audited

--------------- --------- ------------------ ------- ------------------------- -----

At 1 August

2019 115 6,343 3,921 37,545 17 47,941

Impact on

initial

application

of IRS 16

(net of tax) - - - (106) - (106)

Total

comprehensive

income for the

period

Profit for the

year

ended 31 July

2020 - - - 2,877 - 2,877

Other

comprehensive

income for

the year

ended 31 July

2020 - - - - 21 21

--------------- --------- -------------- ------ ------- ------------------------- --------------

Total

Comprehensive

income for

the period - - - 2,877 21 2,898

--------------- --------- -------------- ------ ------- ------------------------- --------------

Transactions

with owners

of the

Company

Dividends - - - (288) - (288)

Share based

payment

charges - - - 1,050 - 1,050

Exercise of

share options - 30 - - - 30

Shares issued

as

consideration

for business

combinations 1 - 1,499 - - 1,500

--------------- --------- -------------- ------ ------- ------------------------- --------------

At 31 July

2020 116 6,373 5,420 41,078 38 53,025

--------------- --------- -------------- ------ ------- ------------------------- --------------

Tracsis plc - Consolidated statement of changes in equity

(continued)

For the six months ended 31 January 2021

Unaudited Share

Share Premium Merger Retained Translation

Capital Reserve Reserve Earnings Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 August

2020 116 6,373 5,420 41,078 38 53,025

Total

comprehensive

income for the

period

Profit for the

six

month period

ended

31 January

2021 - - - 777 - 777

Other

comprehensive

income for

the period

ended 31

January

2021 - - - - (49) (49)

--------------- ---------- --------- ---------- ----------- ------------- --------

Total

Comprehensive

income for

the period - - - 777 (49) 728

--------------- ---------- --------- ---------- ----------- ------------- --------

Transactions

with

owners of the

Company

Share based

payment

charges - - - 665 - 665

Exercise of

share

options 1 13 - - - 14

--------------- ---------- --------- ---------- ----------- ------------- --------

At 31 January

2021 117 6,386 5,420 42,520 (11) 54,432

--------------- ---------- --------- ---------- ----------- ------------- --------

Tracsis plc

Condensed consolidated interim statement of cash flows for the

six months to 31 January 2021

Unaudited Unaudited

Six months Six months Audited

to to Year ended

31 July

31 Jan 2021 31 Jan 2020 2020

Note GBP'000 GBP'000 GBP'000

----------------------------------------- ----- ------------ ------------ ------------

Operating activities

Profit for the period 777 1,947 2,877

Finance income (6) (42) (76)

Finance expense 408 30 79

Depreciation 776 781 1,882

Profit on disposal of plant & equipment - - (12)

Non-cash exceptional items 172 - (320)

Other operating income - - (376)

Amortisation of intangible assets 2,126 1,628 3,599

Effect of foreign exchange adjustments (49) (71) 21

Share of result of equity accounted

investees 104 204 309

Income tax charge 325 472 1,234

Share based payment charges 665 566 1,050

----------------------------------------- ----- ------------ ------------ ------------

Operating cash inflow before changes

in working capital 5,298 5,515 10,267

Movement in inventories 44 (3) (49)

Movement in trade and other receivables (967) 1,219 5,121

Movement in trade and other payables (356) (3,571) (3,875)

----------------------------------------- ----- ------------ ------------ ------------

Cash generated from operations 4,019 3,160 11,464

Interest received 4 42 76

Interest paid - (30) (79)

Income tax paid (436) (502) (908)

----------------------------------------- ----- ------------ ------------ ------------

Net cash flow from operating activities 3,587 2,670 10,553

----------------------------------------- ----- ------------ ------------ ------------

Investing activities

Purchase of plant and equipment (63) (222) (387)

Proceeds from disposal of plant

and equipment - - 66

Acquisition of subsidiaries (net

of cash acquired) - - (13,852)

Payment of contingent consideration 11 - (57) (1,228)

Net cash flow used in investing

activities (63) (279) (15,401)

----------------------------------------- ----- ------------ ------------ ------------

Financing activities

Dividends paid - - (288)

Proceeds from the exercise of share

options 14 21 30

Lease liability payments (688) (471) (1,089)

Lease liability receipts 14 - 11

Net cash flow used in financing

activities (660) (450) (1,336)

----------------------------------------- ----- ------------ ------------ ------------

Net increase/(decrease) in cash

and cash equivalents 2,864 1,941 (6,184)

Cash and cash equivalents at beginning

of period 17,920 24,104 24,104

Cash and cash equivalents at end

of period 20,784 26,045 17,920

----------------------------------------- ----- ------------ ------------ ------------

Notes to the consolidated interim report

For the six months ended 31 January 2021

1 Basis of preparation

Tracsis plc (the 'Company') is a company domiciled in England.

The condensed consolidated interim financial report of the Company

as at and for the six months ended 31 January 2021 comprises the

Company and its subsidiaries (together referred to as the 'Group').

The principal activities of the Group are the provision of

software, services and technology for the rail industry ('Rail

Technology & Services'), along with traffic surveys,

consultancy, event planning and traffic management, and data

analytics including software development ('Data, Analytics,

Consultancy & Events) (see note 3).

The condensed consolidated interim financial information should

be read in conjunction with the annual financial statements for the

year ended 31 July 2020, which have been prepared in accordance

with International Financial Reporting Standards ("IFRS") as

adopted by the European Union.

These interim condensed consolidated financial statements and

accompanying notes are neither audited nor reviewed, do not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006 and do not include all the information and

disclosures required in annual statutory financial statements. They

should be read in conjunction with the Group's Annual Report and

Accounts for the year ended 31 July 2020 which are available on the

Group's website. Those statutory accounts were approved by the

Board of Directors on 4 December 2020 and have been filed with

Companies House. The report of the auditors on those accounts was

unqualified.

The principal risks and uncertainties are largely unchanged from

the previous year. These risks and uncertainties are expected to be

unchanged for the remainder of the financial year. Further details

are provided on pages 9 to 13 of the Annual Report & Accounts

for the year ended 31 July 2020. The Board considers risks on a

periodic basis and has maintained the key risks as follows, on a

Group wide basis:

-- Rail industry structure changes

-- Project Delivery

-- Cyber Security Incident

-- Attraction and retention of key employees

-- Technological changes

-- Brand reputation

-- Regulatory breach

-- Coronavirus (Covid-19) - disruption to the Data, Analytics, Consultancy and Events Division

-- Reduced government spending

-- Reliance on certain key customers

-- Competition

-- Health & Safety

-- Customer pricing pressure

-- Integration risk

The Directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future. Accordingly, the Directors continue to adopt

the going concern basis in preparing this interim financial

information. The Group is debt free and has substantial cash

resources. At 31 January 2021 the Group had net cash and cash

equivalents totalling GBP20.8m. The Board has considered future

cash flow requirements taking into account reasonably possible

changes in trading financial performance amid the timing

uncertainty related to the recovery from Covid-19.

The condensed consolidated interim financial information was

approved for issue on 8 April 2021.

2 Accounting Policies

The accounting policies applied by the Group in these interim

financial statements are the same as those applied by the Group in

its audited consolidated financial statements for the year ended 31

July 2020 and which will form the basis of the 2021 Annual Report.

The basis of consolidation is set out in the Group's accounting

policies in those financial statements.

The preparation of the interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expenses. Estimates

and judgements are continually evaluated and are based on

historical experience and other factors, such as expectations of

future events and are believed to be reasonable under the

circumstances. Actual results may differ from these estimates. In

preparing these interim financial statements, the significant

judgements made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty were the

same as those applied to the audited consolidated financial

statements for the year ended 31 July 2020.

There have been no new accounting standards or changes to

existing accounting standards applied for the first time from 1

August 2020 which have a material effect on these interim results.

The Group has chosen not to early adopt any new standards or

amendments to existing standards or interpretations.

3 Revenue and Segmental analysis

a) Revenue

Sales revenue is summarised below:

Six months Six months Year

ended ended Ended

31 January 31 January 31 July

2021 2020 2020

GBP'000 GBP'000 GBP'000

--------------------------------------- ----------- ----------- --------

Rail Technology & Services 12,057 10,903 23,441

Data, Analytics, Consultancy & Events 10,182 15,462 24,557

Total revenue 22,239 26,365 47,998

--------------------------------------- ----------- ----------- --------

Sales revenue has been split between the Rail Technology &

Services segment and the Data, Analytics, Consultancy & Events

segment for these interim results. See note 3b for further detail

of this change. Comparative periods have been re-stated to reflect

these segments.

A geographical analysis of revenue is provided below:

Six months Six months Year

ended 31 ended 31 ended

January January 31 July

2021 2020 2020

GBP'000 GBP'000 GBP'000

------------------- ----------- ----------- ---------

United Kingdom 18,723 23,621 41,529

Europe 3,338 2,611 6,127

North America 21 75 57

Rest of the World 157 58 285

Total 22,239 26,365 47,998

------------------- ----------- ----------- ---------

b) Segmental Analysis

As reported in the Group's final results for the year ended 31

July 2020, the Group has been reorganised into a new segmental

structure in order to align with key areas of future transport

industry growth. The Group has divided its results into two

segments being 'Rail Technology & Services' and 'Data,

Analytics, Consultancy & Events'. The comparatives included in

these interim results have been re-stated to reflect the new

segmental structure.

In accordance with IFRS 8 'Operating Segments', the Group has

made the following considerations to arrive at the disclosure made

in these financial statements. IFRS 8 requires consideration of the

Chief Operating Decision Maker ("CODM") within the Group. In line

with the Group's internal reporting framework and management

structure, the key strategic and operating decisions are made by

the Board of Directors, who review internal monthly management

reports, budgets and forecast information as part of this.

Accordingly, the Board of Directors are deemed to be the CODM.

Operating segments have then been identified based on the

internal reporting information and management structures within the

Group. From such information it has been noted that the CODM

reviews the business as two operating segments, receiving internal

information on that basis. The management structure and allocation

of key resources, such as operational and administrative resources,

are arranged on a centralised basis.

Reconciliations of reportable segment revenues, profit or loss,

assets and liabilities and other material items

Information regarding the results of the reportable segments is

included below. Performance is measured based on segment profit

before income tax, as included in the internal management reports

that are reviewed by the Board of Directors. Segment profit is used

to measure performance. There are no material inter-segment

transactions, however, when they do occur, pricing between segments

is determined on an arm's length basis. Revenues disclosed below

materially represent revenues to external customers.

Six months ended 31 January 2021

Rail Technology Data, Analytics,

& Services Consultancy Unallocated

& Events Total

GBP000 GBP000 GBP000 GBP000

------------------------------------ ---------------- ----------------- -------------- --------

Revenues

Total revenue for reportable

segments 12,057 10,182 - 22,239

Consolidated revenue 12,057 10,182 - 22,239

------------------------------------ ---------------- ----------------- -------------- --------

Profit or loss

EBITDA for reportable segments 3,790 1,641 - 5,431

Amortisation of intangible

assets - - (2,126) (2,126)

Depreciation (355) (421) - (776)

Exceptional Items (net) - - (256) (256)

Share-based payment charges - - (665) (665)

Share of result of equity

accounted investees - - (104) (104)

Interest receivable/payable(net) (21) (18) (363) (402)

------------------------------------ ---------------- ----------------- -------------- --------

Consolidated profit before

tax 3,414 1,202 (3,514) 1,102

------------------------------------ ---------------- ----------------- -------------- --------

Six months ended 31 January 2020

Rail Technology Data, Analytics,

& Services Consultancy Unallocated

& Events Total

GBP000 GBP000 GBP000 GBP000

--------------------------------------- ---------------- ----------------- -------------- --------

Revenues

Total revenue for reportable

segments 10,903 15,462 - 26,365

Consolidated revenue 10,903 15,462 - 26,365

--------------------------------------- ---------------- ----------------- -------------- --------

Profit or loss

EBITDA for reportable segments 3,944 1,642 - 5,586

Amortisation of intangible

assets - - (1,628) (1,628)

Depreciation (222) (559) - (781)

Share-based payment charges - - (566) (566)

Share of result of equity accounted

investees - - (204) (204)

Interest receivable/payable(net) 30 (18) - 12

--------------------------------------- ---------------- ----------------- -------------- --------

Consolidated profit before tax 3,752 1,065 (2,398) 2,419

--------------------------------------- ---------------- ----------------- -------------- --------

Year ended 31 July 2020

Rail Technology Data, Analytics,

& Services Consultancy

& Events Unallocated Total

GBP000 GBP000 GBP000 GBP000

------------------------------------ -------------------------- ----------------- -------------- ---------

Revenues

Total revenue for reportable

segments 23,441 24,557 - 47,998

Consolidated revenue 23,441 24,557 - 47,998

------------------------------------ -------------------------- ----------------- -------------- ---------

Profit or loss

EBITDA for reportable segments 8,633 1,830 - 10,463

Amortisation of intangible

assets - - (3,599) (3,599)

Depreciation (589) (1,293) - (1,882)

Exceptional items (net) - - 115 115

Other operating income - - 376 376

Share-based payment charges - - (1,050) (1,050)

Interest receivable/payable(net) 33 (36) - (3)

Share of results of equity

accounted investees - - (309) (309)

Consolidated profit before

tax 8,077 501 (4,467) 4,111

------------------------------------ -------------------------- ----------------- -------------- ---------

31 January 2021

Rail Technology Data, Analytics,

& Services Consultancy

& Events Unallocated Total

GBP'000 GBP000 GBP000 GBP000

------------------------------------ -------------------------- ----------------- -------------- -----------

Assets

Total assets for reportable

segments (exc. cash) 5,676 5,357 - 11,033

Intangible assets and investments - - 53,236 53,236

Deferred tax assets - - 1,035 1,035

Cash and cash equivalents 12,563 6,093 2,128 20,784

Consolidated total assets 18,239 11,450 56,399 86,088

------------------------------------ -------------------------- ----------------- -------------- -----------

Liabilities

Total liabilities for reportable

segments (11,836) (4,123) - (15,959)

Deferred tax - - (7,828) (7,828)

Contingent consideration - - (7,869) (7,869)

Consolidated total liabilities (11,836) (4,123) (15,697) (31,656)

------------------------------------ -------------------------- ----------------- -------------- -----------

31 January 2020

Rail Data,

Technology Analytics,

& Services Consultancy Unallocated Total

& Events

GBP'000 GBP000 GBP000 GBP000

----------------------------------- ---------------------- ------------- -------------- ---------

Assets

Total assets for reportable

segments (exc. cash) 4,854 7,546 - 12,400

Intangible assets and investments - - 38,678 38,678

Deferred tax assets - - 744 744

Cash and cash equivalents 10,426 4,803 10,816 26,045

Consolidated total assets 15,280 12,349 50,238 77,867

----------------------------------- ---------------------- ------------- -------------- ---------

Liabilities

Total liabilities for reportable

segments (10,603) (5,139) - (15,742)

Deferred tax - - (5,701) (5,701)

Contingent consideration - - (6,126) (6,126)

Consolidated total liabilities (10,603) (5,139) (11,827) (27,569)

----------------------------------- ---------------------- ------------- -------------- ---------

31 July 2020

Rail Data,

Technology Analytics,

& Services Consultancy Unallocated Total

& Events

GBP'000 GBP000 GBP000 GBP000

----------------------------------- ---------------------- ------------- -------------- ---------

Assets

Total assets for reportable

segments (exc. cash) 5,070 5,323 - 10,393

Intangible assets and investments - - 55,465 55,465

Deferred tax assets - - 877 877

Cash and cash equivalents 11,103 4,827 1,990 17,920

Consolidated total assets 16,173 10,150 58,332 84,655

----------------------------------- ---------------------- ------------- -------------- ---------

Liabilities

Total liabilities for reportable

segments (11,562) (4,500) - (16,062)

Deferred tax - - (8,234) (8,234)

Contingent consideration - - (7,334) (7,334)

Consolidated total liabilities (11,562) (4,500) (15,568) (31,630)

----------------------------------- ---------------------- ------------- -------------- ---------

4 Exceptional items

Six months Six months Year

ended 31 ended 31 ended

January January 31 July

2021 2020 2020

GBP'000 GBP'000 GBP'000

---------------------------------------- ----------- ----------- ---------

Impairment losses - - 1,155

Contingent consideration fair value

adjustment 172 - (1,475)

Legal and professional fees in respect

of acquisitions(1) 84 - 205

Total 256 - (115)

---------------------------------------- ----------- ----------- ---------

(1) Legal and professional fees incurred in relation to the

acquisition of Flash Forward Consulting Limited, which completed on

26 February 2021

5 Finance Costs

Six months Six months Year

ended 31 ended 31 ended

January January 31 July

2021 2020 2020

GBP'000 GBP'000 GBP'000

-------------------------------------- ----------- ----------- ---------

Interest on lease liabilities 38 30 73

Net foreign exchange loss 7 - 6

Unwind of discount on liabilities(1) 363 - -

Total 408 30 79

-------------------------------------- ----------- ----------- ---------

(1) See note 11 Contingent Consideration

6 Earnings per share

Basic earnings per share

The calculation of basic earnings per share for the Half Year to

31 January 2021 was based on the profit attributable to ordinary

shareholders of GBP777,000 (Half Year to 31 January 2020:

GBP1,947,000, Year ended 31 July 2020: GBP2,877,000) and a weighted

average number of ordinary shares in issue of 29,163,000 (Half Year

to 31 January 2020: 28,795,000, Year ended 31 July 2020:

28,919,000), calculated as follows:

Weighted average number of ordinary shares

In thousands of shares

Six months Six months Year

ended 31 ended 31 ended

January January 31 July

2021 2020 2020

Issued ordinary shares at start of period 29,123 28,749 28,749

Effect of shares issued related to business

combinations - - 76

Effect of shares issued for cash 40 46 94

Weighted average number of shares at

end of period 29,163 28,795 28,919

--------------------------------------------- ----------- ----------- ---------

Diluted earnings per share

The calculation of diluted earnings per share for the Half Year

to 31 January 2021 was based on the profit attributable to ordinary

shareholders of GBP777,000 (Half Year to 31 January 2020:

GBP1,947,000, Year ended 31 July 2020: GBP2,877,000) and a weighted

average number of ordinary shares in issue after adjustment for the

effects of all dilutive potential ordinary shares of 30,149,000

(Half Year to 31 January 2020: 29,665,000, Year ended 31 July 2020:

29,740,000).

Adjusted EPS

In addition, Adjusted Profit EPS is shown below on the grounds

that it is a common metric used by the market in monitoring similar

businesses. A reconciliation of this figure is provided below:

Six months Six months Year

ended 31 ended 31 ended

January January 31 July

2021 2020 2020

GBP'000 GBP'000 GBP'000

Profit attributable to ordinary shareholders 777 1,947 2,877

Amortisation of intangible assets 2,126 1,628 3,599

Share-based payment charges 665 566 1,050

Exceptional items (net) 256 - (115)

Other operating income - - (376)

---------------------------------------------- ----------- ----------- ---------

Adjusted profit for EPS purposes 3,824 4,141 7,035

---------------------------------------------- ----------- ----------- ---------

Weighted average number of ordinary

shares

In thousands of shares

-------------------------------------------- ------- ------- -------

For the purposes of calculating Basic

earnings per share 29,163 28,795 28,919

Adjustment for the effects of all dilutive

potential ordinary shares 986 870 821

-------------------------------------------- ------- ------- -------

For the purposes of calculating Diluted

earnings per share 30,149 29,665 29,740

-------------------------------------------- ------- ------- -------

Basic adjusted earnings per share 13.11p 14.38p 24.33p

Diluted adjusted earnings per share 12.68p 13.96p 23.66p

-------------------------------------------- ------- ------- -------

7 Seasonality

The Group offers a wide range of products and services within

its overall suite, meaning that revenues can fluctuate depending on

the status and timing of certain sales. Some of these are exposed

to high levels of seasonality for example:

-- The Group's Data, Analytics, Consultancy & Events

division derives significant amounts of revenue from work taking

place at certain times of the year and is highly exposed to

seasonality, in particular for SEP and CTM which has a very high

level of seasonality based on the timing of events, but also

Traffic Data where work typically takes place when the weather

conditions are more predictable;

-- Ontrac and Compass Informatics both perform some significant

software development projects and the specific timing of these can

vary depending on the commercial terms;

-- Revenues from remote condition monitoring are also driven by

the size and timing of significant orders received from major

customers;

-- Finally, the timing of certain software licence renewals, new sales, and also major project implementations along with consultancy offerings can also impact on when work is performed, revenues are delivered and therefore recognised.

As such, the overall Group continues to be exposed to a high

degree of seasonality throughout the year and reporting period. It

is anticipated that the impact of Covid-19 will continue to affect

the Group in the second half of this financial year, predominantly

impacting our Events and Traffic Data business units due to ongoing

Covid-19 related restrictions on their end markets. It is expected

that activity levels in the Events and Traffic Data businesses will

progressively return to normal as lockdown restrictions are

lifted.

8 Dividends

The Board does not consider it appropriate to pay an interim

dividend for the six months ended January 2021. The Board is

committed to restoring the progressive dividend policy at the

earliest appropriate date.

9 Related party transactions

The following transactions took place during the year with other

related parties:

Purchase of Amounts owed to

goods and services related parties

H1 2021 H1 2020 FY 2020 H1 2021 H1 2020 FY 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- -------- -------- -------- -------- -------- --------

Citi Logik Limited (1) - - - - - -

Nutshell Software Limited

(1) 26 63 13 63 - -

Vivacity Labs Limited (1) 174 176 404 37 51 4

WSP UK Limited (2) - 5 - - - -

Sale of Amounts owed by

goods and services related parties

H1 2021 H1 2020 FY 2020 H1 2021 H1 2020 FY 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- -------- -------- -------- -------- -------- --------

WSP UK Limited (2) 1,368 1,190 2,706 - 33 495

Citi Logik Limited (1) - - - - - -

Vivacity Labs Limited (1) 1 20 - - - -

Nutshell Software Limited

(1) 15 - 14 10 - -

(1) Citi Logik Limited, Nutshell Software Limited and Vivacity

Labs Limited are related parties by virtue of the Group's

shareholding in these entities.

(2) WSP UK Limited (WSP) is a company which is connected to

Chris Cole who serves as non-executive Chairman of Tracsis plc and

also of WSP Global Inc, WSP's parent company. Sales to WSP took

place at arm's length commercial rates and were not connected to Mr

Cole's position at WSP.

In the financial statements for the year ended 31 July 2020 and

the interim results to 31 January 2020 Nexus Leeds Limited was

identified as a related party through its connection to the

University of Leeds. Having assessed this entity at 31 January 2021

against the criteria set out in IAS 24 Related Party Disclosures

the entity no longer meets the definition of being a related party,

and consequently disclosure of transactions is no longer

required.

10 Reconciliation of adjusted profit metrics

In addition to the statutory profit measures of operating profit

and profit before tax, the Group quotes Adjusted EBITDA and

Adjusted profit. These figures are relevant to the Group and are

provided to provide a comparison to similar businesses and are

metrics used by Equities Analysts who cover the Group as they

better reflect the underlying performance of the Group, and its

ability to generate cash. The largest components of the adjusting

items, being depreciation, amortisation, share based payments, and

share of associates, are 'non cash' items and so are separately

analysed in order to assist with the understanding of underlying

trading. Adjusted EBITDA is defined as earnings before finance

income and expense, tax, depreciation, amortisation, exceptional

items, other operating income, share-based payment charges and

share of result of equity accounted investees. Adjusted EBITDA can

be reconciled to statutory profit before tax as set out below:

Six months Six months

ended 31 ended 31 Year ended

January January 31 July

2021 2020 2020

GBP'000 GBP000 GBP000

------------------------------------- ----------- ----------- -------------

Profit before tax 1,102 2,419 4,111

Finance expense / (income) -

net 402 (12) 3

Share-based payment charges 665 566 1,050

Exceptional items - net 256 - (115)

Other operating income - - (376)

Amortisation of intangible assets 2,126 1,628 3,599

Depreciation 776 781 1,882

Share of result of equity accounted

investees 104 204 309

Adjusted EBITDA 5,431 5,586 10,463

-------------------------------------- ----------- ----------- -------------

Adjusted profit is defined as earnings before finance income and

expense, tax, amortisation, exceptional items, other operating

income, share-based payment charges, and share of result of equity

accounted investees. Adjusted profit can be reconciled to statutory

profit before tax as set out below:

Six months Six months

ended 31 ended 31 Year ended

January January 31 July

2021 2020 2020

GBP'000 GBP000 GBP000

----------------------------- ----------- ----------- -------------

Profit before tax 1,102 2,419 4,111

Finance expense/(income) -

net 402 (12) 3

Share-based payment charges 665 566 1,050

Exceptional items - net 256 - (115)

Other operating income - - (376)

Amortisation of intangible

assets 2,126 1,628 3,599

Share of result of equity

accounted investees 104 204 309

Adjusted profit 4,655 4,805 8,581

------------------------------ ----------- ----------- -------------

Adjusted EBITDA reconciles to adjusted profit as set out

below:

Six months Six months

ended 31 ended 31 Year ended

January January 31 July

2021 2020 2020

GBP'000 GBP000 GBP000

----------------- ----------- ----------- -------------

Adjusted EBITDA 5,431 5,586 10,463

Depreciation (776) (781) (1,882)

Adjusted profit 4,655 4,805 8,581

------------------ ----------- ----------- -------------

11 Contingent Consideration

During the financial year ended 31 July 2019, the Group acquired

Cash & Traffic Management Limited, Compass Informatics Limited

and Bellvedi Limited. Under the share purchase agreements in place

for each of these acquisitions, contingent consideration is payable

which is linked to the profitability of the acquired businesses for

a two to four year period post acquisition. The maximum amount

payable is GBP750,000 for Cash & Traffic Management Limited,

EUR2,000,000 for Compass Informatics Limited and GBP7,900,000 for

Bellvedi Limited. The fair value at 31 January 2021 is assessed at

GBP119,000 for Cash & Traffic Management Limited, GBP1,029,000

for Compass Informatics Limited and GBP3,381,000 for Bellvedi

Limited. In the financial year ended 31 July 2020 the Group

acquired iBlocks Limited. Under the share purchase agreement in

place for this acquisition contingent consideration is payable

which is linked to the profitability of the acquired business for a

three year period post acquisition. The maximum amount payable is

GBP8,500,000, and the fair value of the amount payable was assessed

at GBP3,340,000 at 31 January 2021.

The movement on contingent consideration can be summarised as

follows:

31 January 31 January 31 July

2021 2020 2020

GBP000 GBP000 GBP000

----------------------------------------- ----------- ----------- --------

At the start of the year 7,334 6,183 6,183

Arising on acquisition - - 3,854

Cash payment - (57) (1,228)

Fair value adjustment to Statement

of Comprehensive Income 172 - (1,475)

Unwind of discounting (finance expense) 363 - -

At the end of the period 7,869 6,126 7,334

----------------------------------------- ----------- ----------- --------

The ageing profile of the remaining liabilities can be

summarised as follows:

31 January 31 January 31 July

2021 2020 2020

GBP000 GBP000 GBP000

------------------------------- ----------- ----------- --------

Payable in less than one year 1,653 1,151 1,747

Payable in more than one year 6,216 4,975 5,587

Total 7,869 6,126 7,334

------------------------------- ----------- ----------- --------

12 Events after the Balance Sheet date

On 1 February 2021 Andrew Kelly was appointed to the role of

Chief Financial Officer replacing Max Cawthra who stepped down on

31 January 2021.

On 26 February 2021 the Group acquired Flash Forward Consulting

Limited a transport consultancy busines operating predominantly

across the rail and bus sectors. The overall consideration for this

acquisition was GBP1.5m, plus a further cash payment of circa GBP1m

reflecting the net current asset position of the business. The

Group is currently evaluating the fair value of the assets and

liabilities acquired.

Further information for Shareholders

Company number: 05019106

Registered office: Nexus

Discovery Way

Leeds

LS2 3AA

Directors: Chris Cole (Non-Executive Chairman)

Chris Barnes (Chief Executive Officer)

Andrew Kelly (Chief Financial Officer)

Lisa Charles-Jones (Non-Executive Director)

Liz Richards (Non-Executive Director)

Mac Andrade (Non-Executive Director)

Company Secretary: Andrew Kelly

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRGDSIXGDGBR

(END) Dow Jones Newswires

April 08, 2021 02:00 ET (06:00 GMT)

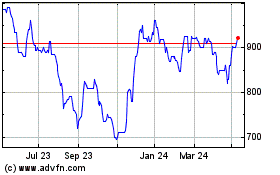

Tracsis (LSE:TRCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

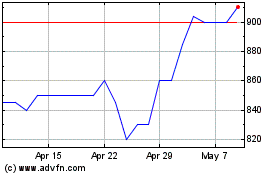

Tracsis (LSE:TRCS)

Historical Stock Chart

From Apr 2023 to Apr 2024