TIDMTRR

RNS Number : 7337U

Trident Royalties PLC.

08 April 2021

8 April 2021

Trident Royalties Plc

("Trident" or the "Company")

Completion of Pukaqaqa Royalty Package Acquisition,

Issue of Consideration Shares

and

Total Voting Rights

Trident Royalties Plc (AIM: TRR, FSX: 5KV), is pleased to

announce that the pre-completion meeting for the Pukaqaqa Royalty

Package acquisition (as defined below) from Orion Resource Partners

has now been held and that completion will occur automatically on

Admission of the Consideration Shares (as defined below).

On 18 December 2020, the Company announced that it had entered

into a binding agreement to acquire a package of existing copper

royalties (the "Royalty Package") over the Pukaqaqa Copper Project

in Peru. The Royalty Package was acquired for total consideration

of US$3,000,000 to be satisfied by the issue of 6,878,027 new

ordinary shares of 1p each in Trident ("Consideration Shares") at

32.0314p per Ordinary Share.

Following Admission, Orion will be interested in 11,091,747

Ordinary Shares representing approximately 6.2 per cent. of the

Company's issued share capital.

Settlement and Dealings

Application has been made to the London Stock Exchange Plc for

admission to trading on the AIM Market of the 6,878,027

Consideration Shares, which rank pari passu with the Company's

existing issued Ordinary Shares ("Admission"). Dealings on AIM are

expected to commence at 8:00am on 9 April 2021.

Total Voting Rights

For the purposes of the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules ("DTRs"), following Admission,

Trident will have 178,102,362 ordinary Shares of 1p each in the

capital of the Company in issue with voting rights attached.

Trident does not hold any shares in treasury. This figure of

178,102,362 may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in the Company, under the DTRs.

Adam Davidson, Chief Executive Office of Trident commented:

"The completion of the acquisition of the Pukaqaqa Royalty

Package increases our copper exposure with royalties over a large,

long-life asset operated by an established mid-tier miner with deep

roots in South America. We are delighted to have completed this

transaction with Orion, which continues to demonstrate itself a

professional and friendly counterparty, and we look forward to

exploring further opportunities to transact with them in the

future."

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014 which is part of UK law by virtue of

the European Union (withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

** Ends **

Contact details:

Trident Royalties Plc www.tridentroyalties.com

Adam Davidson +1 (757) 208-5171

Grant Thornton (Nominated Adviser) www.grantthornton.co.uk

Colin Aaronson / Samantha Harrison +44 020 7383 5100

/ Seamus Fricker

---------------------------------------------------------

Tamesis Partners LLP (Financial www.tamesispartners.com

Adviser and Joint Broker) +44 203 882 2868

Richard Greenfield

---------------------------------------------------------

Shard Capital Partners LLP (Joint www.shardcapital.com

Broker) +44 207 186 9927

Erik Woolgar / Isabella Pierre

---------------------------------------------------------

St Brides Partners Ltd (Financial www.stbridespartners.co.uk

PR & IR) +44 20 7236 1177

Susie Geliher / Catherine Leftley

/ Charlotte Hollinshead

---------------------------------------------------------

About Trident

Trident is a growth-focused, diversified mining royalty and

streaming company, providing investors with exposure to a mix of

base and precious metals, bulk materials (excluding thermal coal)

and battery metals.

Key highlights of Trident's strategy include:

-- Building a royalty and streaming portfolio to broadly mirror

the commodity exposure of the global mining sector (excluding

thermal coal) with a bias towards production or near-production

assets, differentiating Trident from the majority of peers which

are exclusively, or heavily weighted, to precious metals;

-- Acquiring royalties and streams in resource-friendly

jurisdictions worldwide, while most competitors have portfolios

focused on North and South America;

-- Targeting attractive small-to-mid size transactions which are

often ignored in a sector dominated by large players;

-- Active deal-sourcing which, in addition to writing new

royalties and streams, will focus on the acquisition of assets held

by natural sellers, such as: closed-end funds, prospect generators,

junior and mid-tier miners holding royalties as non-core assets,

and counterparties seeking to monetise packages of royalties and

streams which are otherwise undervalued by the market;

-- Maintaining a low-overhead model which is capable of

supporting a larger scale business without a commensurate increase

in operating costs; and

-- Leveraging the experience of management, the board of

directors, and Trident's adviser team, all of whom have deep

industry connections and strong transactional experience across

multiple commodities and jurisdictions.

The acquisition and aggregation of individual royalties and

streams is expected to deliver strong returns for shareholders as

assets are acquired on terms reflective of single asset risk

compared with the lower risk profile of a diversified, larger scale

portfolio. Further value is expected to be delivered by the

introduction of conservative levels of leverage through debt. Once

scale has been achieved, strong cash generation is expected to

support an attractive dividend policy, providing investors with a

desirable mix of inflation protection, growth and income.

Forward-looking Statements

This news release contains forward -- looking information. The

statements are based on reasonable assumptions and expectations of

management and Trident provides no assurance that actual events

will meet management's expectations. In certain cases, forward --

looking information may be identified by such terms as

"anticipates", "believes", "could", "estimates", "expects", "may",

"shall", "will", or "would". Although Trident believes the

expectations expressed in such forward -- looking statements are

based on reasonable assumptions, such statements are not guarantees

of future performance and actual results or developments may differ

materially from those projected. Mining exploration and development

is an inherently risky business. In addition, factors that could

cause actual events to differ materially from the forward-looking

information stated herein include any factors which affect

decisions to pursue mineral exploration on the relevant property

and the ultimate exercise of option rights, which may include

changes in market conditions, changes in metal prices, general

economic and political conditions, environmental risks, and

community and non-governmental actions. Such factors will also

affect whether Trident will ultimately receive the benefits

anticipated pursuant to relevant agreements. This list is not

exhaustive of the factors that may affect any of the forward --

looking statements. These and other factors should be considered

carefully and readers should not place undue reliance on

forward-looking information.

Third Party Information

As a royalty and streaming company, Trident often has limited,

if any, access to non-public scientific and technical information

in respect of the properties underlying its portfolio of royalties

and investments, or such information is subject to confidentiality

provisions. As such, in preparing this announcement, the Company

has relied upon information provided by or the public disclosures

of the owners and operators of the properties underlying its

portfolio of royalties, as available at the date of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEASLXELAFEFA

(END) Dow Jones Newswires

April 08, 2021 04:00 ET (08:00 GMT)

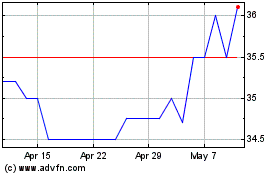

Trident Royalties (LSE:TRR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trident Royalties (LSE:TRR)

Historical Stock Chart

From Apr 2023 to Apr 2024