TIDMTRT

RNS Number : 3140P

Transense Technologies PLC

17 February 2021

This announcement contains inside information for the purposes

of Regulation 11 of the Market Abuse (amendment) (EU Exit)

Regulations 2019/310

Transense Technologies plc

("Transense" or the "Company")

Interim results for the six months ended 31 December 2020

& Investor Presentation

Transense Technologies plc, the developer of specialist sensor

systems, reports its interim results for the six months ended 31

December 2020. The Company has delivered positive net earnings, and

taken significant steps to enhance future growth potential in each

of its main activities.

Highlights:

-- Revenues from continuing operations increased threefold to GBP0.90m (FY20 H1: GBP0.28m)

-- iTrack royalty run rate increased more than 15% since

inception of Bridgestone licensing deal

-- Strong growth in revenues from both SAW and Translogik

-- EBITDA* of GBP0.06m (FY20 H1: loss of GBP0.39m)

-- Net profit after taxation of GBP0.05m (FY20 H1: loss of GBP1.19m)

-- Earnings per share of 0.29 pence (FY20 H1: loss of 3.49 pence)

-- Net Cash at end of period of GBP1.05m (30 June 2020: GBP1.19m)

-- Post period-end, completion of capital reduction to facilitate future distributions

*Earnings before interest, tax, depreciation and

amortisation

Commenting on the results and prospects, Executive Chairman of

Transense, Nigel Rogers, said:

"These results reflect the transformational change in the

business since the transactions completed last June, moving iTrack

from an operational business into a licence model last June. We

have every confidence that iTrack will continue to achieve

increased market penetration, and deliver royalty income at or

above our current expectations.

"The commercial prospects for our SAW technology have been

revitalised after strengthening the management team, and enlisting

the support of key opinion leaders through the SAWCAP initiative.

Whilst it may take some time to determine the true value potential

of this technology, we are encouraged by the early progress that is

being made. In addition, the Translogik range of tyre probes

continues to gain traction and is showing further potential for

healthy revenue growth.

"Accordingly, we consider that the outlook for the Company is

positive, and prospects for the Company and its shareholders are

more favourable than at any time in the Company's history."

Investor Presentation: 4pm today, Wednesday 17 February 2021

Nigel Rogers (Executive Chairman) and Melvyn Segal (Chief

Financial Officer) will provide a presentation on the Company and

its Interim Results at 4pm today, Wednesday 17 February 2021. The

presentation will be hosted through the digital platform Investor

Meet Company.

To attend the presentation, investors can sign up to Investor

Meet Company for free and select to meet Transense Technologies plc

via the following link:

https://www.investormeetcompany.com/transense-technologies-plc/register-investor

. Investors who have already registered and selected to meet the

Company will automatically be invited to the presentation.

Questions can be submitted before the event to

transense@walbrookpr.com or in real time during the presentation

via the "Ask a Question" function.

This interim results report will not be posted to shareholders

but will be available on the Company's website later today along

with the investor presentation.

For further information please visit www.transense.com or

contact:

Transense Technologies plc Via Walbrook PR

Nigel Rogers (Executive Chairman)

Melvyn Segal (CFO)

Allenby Capital (Nominated Adviser and Tel: +44 (0)20 3328

Broker) 5656

Jeremy Porter/James Reeve (Corporate Finance)

Tony Quirke (Equity Sales)

Walbrook PR Tel: +44 (0)20 7933

Tom Cooper/Nick Rome/Nicholas Johnson 8780

Transense@walbrookpr.com

Notes to Editors:

Transense is a developer of specialist wireless sensor systems

used to enable real-time data gathering and monitoring. Products

include the patent protected Surface Acoustic Wave (SAW) sensor

technology, used to improve equipment power, performance,

reliability and efficiency; iTrack, Transense's Tyre Pressure

Monitoring System, recently licensed to Bridgestone Corporation,

the world's largest tyre producer, under a ten-year deal; and a

range of intelligent tyre monitoring equipment under the Translogik

brand. Target sectors include automotive, aerospace, industrial,

green energy, rail and marine.

The Company's strategy is to maximise shareholder value through

the delivery of sustained revenue growth from all three principal

technologies - SAW, iTrack and Translogik probes - through

leveraging excellence in innovation, know-how in commercialising

technologies, industry partnerships and exposure to global growth

markets.

The Company has a significant licensing agreement with General

Electric Company ("GE") for the use of patented, wireless, passive

SAW technology in GE Aviation's T901-GE-900 engine for the U.S.

Army Engineering and Manufacturing Development ("EMD") phase of the

Improved Turbine Engine Program ("ITEP"), which is the programme to

replace more than 6,000 engines in its current fleet of Boeing

AH-64 Apache and Sikorsky UH60 Black Hawk helicopters, expected to

commence in 2024 reaching full volume in 2026.

Transense is headquartered in Oxfordshire, UK, and was admitted

to trading on AIM, a market operated by the London Stock Exchange

(AIM: TRT), in 1999.

For further information please contact

transense@walbrookpr.com

Transense Technologies plc

Chairman's Statement

I am pleased to report that the Company has made good progress

following the major changes that took place as a result of the

licensing of iTrack and the transfer of the operating iTrack

business to Bridgestone Corporation in June 2020. This is reflected

in a trend of improving results, and a strong financial position

from which to develop the business further.

Business strategy

The business strategy of the Company remains to develop

innovative sensing solutions across a range of applications, which

are commercialised either through the launch of products and

services to customers or by forming strategic alliances with

partner organisations. Value is realised through a combination of

commercial income, royalties, licensing income and capital gains on

disposals.

Operational review

iTrack royalty income

In June 2020, the Company granted an exclusive worldwide licence

to ATMS Technology Limited ("ATMS"), a wholly-owned subsidiary of

Bridgestone Corporation Japan, covering all current and future

iTrack technology for a period of ten years. Under the licence,

ATMS offers Bridgestone customers worldwide tyre monitoring systems

for all off-the-road (OTR) vehicles using iTrack technology.

Transense receives a quarterly royalty payment based upon the

number and classification of vehicles upon which the iTrack

technology is deployed over a ten year period, at the conclusion of

which ATMS will have the option to acquire the technology for a

nominal cash sum.

During the six months ended 31 December 2020 the iTrack

installed base increased by more than 15% despite some adverse

effects from the global pandemic, generating royalty income of

GBP0.37m (FY20 H1: GBPNil). The roll out of Bridgestone's new

MasterCore tyres for OTR mining vehicles is now underway, and

progress is evident in marketing iTrack technology to key accounts.

There are clear indications that further momentum is building which

will be realised in the second half of this financial year and

subsequent years.

Surface Acoustic Wave

Transense is a leader in the development of Surface Acoustic

Wave ("SAW") sensor systems. SAW resonators can be used to measure

torque, strain, pressure and temperature, and are compact and

rugged. They can be interrogated wirelessly on a real-time basis

without the need for a local power source. These features

facilitate unique benefits in applications where real-time values

for torque or other measurands can be fed back to control systems

and used to optimise performance, reduce emissions and manage

preventative maintenance programmes.

During the period, revenues increased to GBP0.11m and further

grant income was generated amounting to GBP0.05m. Much of this

revenue was generated from motor sport, where we see opportunities

to generate increasing revenues. There are further business

development initiatives underway for off-road recreational

vehicles, which are expected to advance further in coming months.

We aim to further develop these relationships to seek adoption of

SAW in the high performance road vehicle sector in future.

Work in support of tier one partners on the GE Improved Turbine

Engine Program ("ITEP") has also progressed on plan. The ITEP

successfully completed a Critical Design Review milestone during

the period, and is on track towards First Engine To Test in the

final quarter of 2021. Production is planned to commence in 2024,

reaching full scale volumes in 2026. We believe our technology will

benefit from the credibility and visibility that this project

provides, and has the potential to be adopted in other aircraft

applications in future as a consequence.

There have been significant changes in management and commercial

activity in recent months, including the engagement of a Commercial

Advisory Panel of prominent industry experts ("SAWCAP"). The aim of

SAWCAP is to assist with the development and delivery of commercial

strategy, focusing on industry sectors and prospective business

partners, licencees and customers which are likely to be receptive

to SAW technology.

Evaluation is underway of initial opportunities identified,

which are focused on performance optimisation, condition monitoring

and predictive maintenance across a range of sectors, and there is

some early stage engagement with potential partners. We are

optimistic that SAW technology can generate significant value over

the medium term, whilst maintaining a cautious approach to

investment and expenditure until prospects of future success are

more visible.

Translogik - probes

Our range of tyre tread depth probes provide extremely accurate

and reliable tyre data instantly, and is aimed towards service

providers and fleet managers in truck and bus markets. Our product

range is compatible with the tyre management systems of the world's

leading tyre producers.

The Translogik probe range continues to make a valuable

contribution to the Company's results and revenues grew by 71% to

GBP0.41m during the period (FY20 H1: GBP0.24m). Geographical

coverage is broad, with half of revenues generated from customers

outside Europe, and sales to three of the world's leading tyre

producers.

The new modular TLGX Series range was launched during the

period. There are four models in this new range, which complement

the well established TL-G1 probe and offer progressively enhanced

features at a variety of price points. Sales of the new models have

commenced well, and the increasing level of enquiries supports the

optimism for continuing success.

Financial review

Key performance indicators

The Board considers the following to be key performance

indicators:

FY 2021 FY 2020*

Interim Interim Full Year

(unaudited) (unaudited) (audited)

------------- ------------- -----------

GBP'000 GBP'000 GBP'000

------------------------ ------------- ------------- -----------

Turnover 895 271 603

------------- ------------- -----------

Gross Profit 695 174 332

------------- ------------- -----------

EBITDA 56 (391) (678)

------------- ------------- -----------

(Loss) before Taxation (53) (570) (1,265)

------------- ------------- -----------

Profit/(Loss) after

Taxation 48 (570) (1,090)

------------- ------------- -----------

EPS (pence) 0.29 (3.49) (6.68)

------------- ------------- -----------

Cash 1,050 1,519 1,193

------------- ------------- -----------

Net decrease in cash (143) (1,146) (1,454)

------------- ------------- -----------

* FY20 figures relate to continuing operations only

Reported results

Revenues for the six months from continuing operations increased

threefold to GBP0.90m (FY20 H1: GBP0.28m).

Royalty income generated by iTrack technology amounted to

GBP0.37m, which compares to the subscription income generated in

the corresponding period last year of GBP0.66m, which in turn led

to a net loss on discontinued operations relating to iTrack of

GBP0.62m. The installed base increased by more than 15% during the

period, although some of the benefit of this growth was diluted by

adverse foreign exchange movements. Royalty income is denominated

in US Dollars, which depreciated against Sterling by approximately

9% during the period. The stream of future royalty income can be

forecast with reasonable certainty, and this will become

increasingly predictable over time as the rate of growth becomes

more firmly established. The Board will consider using forward

foreign currency contracts to lock in future income at attractive

rates as suitable opportunities arise.

SAW revenues increased to GBP0.11m and we also received the

final installment of grant income from the Lloyd's Register

Foundation project which amounted to GBP0.05m. The Board, supported

by SAWCAP, continue to explore other grant funded opportunities.

Whilst SAW activities produced a net loss of GBP0.25m, management

continues to support the current level of technical and commercial

overhead.

Translogik probe revenues increased by 71% to GBP0.41m

generating a net profit contribution of GBP0.17m to the Company's

results.

Operating expenses in the period reduced to GBP0.79m (FY20 H1:

GBP0.86m) and the Company delivered EBITDA* from continuing

operations of GBP0.06m (FY20 H1: loss of GBP0.39m).

The net loss before taxation from continuing operations was

GBP0.05m (FY20 H1: loss of GBP0.57m) and, after recognition of the

R&D tax credit in the period, the net profit after taxation

attributable to shareholders was GBP0.05m (FY20 H1: loss of

GBP1.19m). Earnings per share amounted to 0.29 pence (FY20 H1: loss

of 3.49 pence).

As set out in Note 5, half of the previous year's R & D tax

credit is recognised in these interim accounts and the amount

included of GBP0.10m is broadly split evenly between the SAW

business and historical development work on iTrack.

*Earnings Before Interest, Depreciation and Amortisation as set

out in Note 4.

Cash flow and financial position

Net cash inflow from operating activities before movements in

working capital amounted to GBP0.08m (FY20 H1: outflow of

GBP0.76m).

During the period the completion monies due from ATMS Technology

Limited in respect of the transfer of the iTrack operating business

in June 2020 were received amounting to GBP1.24m, and the final

part of the Bridgestone Corporation loan was repaid amounting to

GBP0.98m.

Net cash balances at the end of the period stood at GBP1.05m (30

June 2020: GBP1.19m) and net assets stood at GBP2.25m (30 Jun 2020:

GBP2.18m). The Board has assessed the financial and operational

needs of the business over the next twelve months taking into

account a range of contingencies, and the directors are satisfied

that the Company has access to adequate sources of finance.

Accordingly, the Board considers that the Company will have

sufficient resources to continue in operational existence for the

foreseeable future, and has adopted the going concern basis of

accounting.

At the Annual general Meeting of the Company held on 17 December

2020, the shareholders approved a Capital Reduction set out in the

Company's circular dated 23 November 2020. These proposals were

approved by the High Court on 26 January 2021 and became effective

on 28 January 2021 following registration of the court order and

statement of capital at Companies House. In order to be able to

utilise the Company's distributable reserves, the Company was

required to file unaudited accounts for the seven months ended 31

January 2021 with Companies House, which are summarised in note 7

below, and show that the Company has available distributable

reserves of GBP0.53m.

Covid - 19

The adverse effects of the pandemic are referenced above with

regards the growth in iTrack royalty income and, whilst the impact

on the Transense business as a whole has been minimal, the Board is

mindful that until the pandemic is fully under control there could

be further impacts on the Company's performance.

Brexit

The Brexit transition period ended on 31 December 2020 after

which the United Kingdom formally withdrew from the European Union.

The impact of Brexit will be relevant to the performance in the

second half of this financial year and subsequent trading periods.

As I write, the impact has been minimal and has focused on the

requirement to provide further information on documentation for

goods moving to Europe. There have been general concerns about the

flow of goods in and out of the UK, and again the Board is working

to ensure as little disruption as possible.

Outlook and prospects

These results reflect the transformational change in the

business since the transactions completed last June, moving iTrack

from an operational business into a licence model. We have every

confidence that iTrack will continue to achieve increased market

penetration, and deliver royalty income at or above our current

expectations.

The commercial prospects for our SAW technology have been

revitalised after strengthening the management team, and enlisting

the support of key opinion leaders through the SAWCAP initiative.

Whilst it may take some time to determine the true value potential

of this technology, we are encouraged by the early progress that is

being made. In addition, the Translogik probe range continues to

gain traction and is showing further potential for healthy revenue

growth.

Accordingly, we consider that the outlook for the Company is

positive, and prospects for the Company and its shareholders are

more favourable than at any time in the Company's history.

Nigel Rogers

Executive Chairman

17 February 2021

Transense Technologies plc

Condensed Consolidated Statement of Comprehensive Income

Half year to Half year to Full year to

31 Dec 20 31 Dec 19 30 Jun 20

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

------------------------------------------------------- ---- ------------- --- ------------- --- -------------

Continuing operations

Revenue 895 271 603

Cost of sales (200 ) (97) (271)

------------- ------------- -------------

Gross profit 695 174 332

Administrative expenses (790) (862) (1,703)

Operating loss (95) (688) (1,371)

Financial income - 4 5

Financial expense (6) (4) (17)

Other income 48 118 118

------------- ------------- -------------

Loss before taxation (53) (570) (1,265)

Taxation 101 - 175

Profit/(loss) for the period from continuing operations 48 (570) (1,090)

------------- ------------- -------------

Loss for the period from discontinued operations - (620) (1,452)

------------- ------------- -------------

Profit/(loss) for the period 48 (1,190) (2,542)

------------- ------------- -------------

Other comprehensive income:

Exchange difference on translating foreign operations - 18 -

------------- ------------- -------------

Other comprehensive income for the period - 18 -

Total comprehensive income/(expense) for the period

attributable to the equity holders of

the parent 48 (1,172) (2,542)

============= === ============= === =============

Transense Technologies plc

Condensed Consolidated Statement of Financial Position

31 Dec 20 31 Dec 19 30 Jun 20

(Unaudited) (Unaudited) (Audited)

---------------------------- ---- ------------- --- ------------- --- -----------

GBP'000 GBP'000 GBP'000

Non current assets

Property, plant and equipment 248 909 290

Intangible assets 815 1,033 844

------------- ------------- -----------

1,063 1,942 1,134

------------- ------------- -----------

Current assets

Inventory 61 730 63

Corporation tax receivable 100 - 175

Trade and other receivables 403 988 1,677

Cash and cash equivalents 1,050 1,519 1,193

------------- ------------- -----------

1,614 3,237 3,108

------------- ------------- -----------

Total assets 2,677 5,179 4,242

------------- ------------- -----------

Current liabilities

Trade and other payables (225) (1,290) (854)

Borrowings - - (976)

Lease liabilities (63) (59) (61)

Provisions - (50) -

------------- ------------- -----------

Total liabilities (288) (1,399) (1,891)

Non current liabilities

Lease liabilities (136) (204) (168)

------------- ------------- -----------

Total liabilities (424) (1,603) (2,059)

------------- ------------- -----------

Net assets 2,253 3,576 2,183

------------- ------------- -----------

Capital and reserves

Share capital 5,451 5,451 5,451

Share premium 2,591 2,591 2,591

Share based payments 63 41 41

Translation reserve - 41 -

Accumulated loss (5,852) (4,548) (5,900)

------------- ------------- -----------

Shareholders' funds 2,253 3,576 2,183

------------- ------------- -----------

Transense Technologies plc

Condensed Consolidated Statement of Changes in Equity (Unaudited)

Issued share Share premium Translation Share based Accumulated

capital account Reserve payments deficit Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

July 2019 5,451 2,591 23 41 (3,358) 4,748

Comprehensive income for the year:

Loss for the

year - - - - (2,542) (2,542)

Other comprehensive income for the year:

Currency

movement on

subsidiary

reserves - - - - - -

Total

comprehensive

expense for

the year: - - - - (2,542) (2,542)

Translation

reserve

recycled on

disposal (23) - - (23)

Balance at 30

June 2020 5,451 2,591 - 41 (5,900) 2,183

Comprehensive income for the period:

Loss for the

period - - - - 48 48

Other comprehensive income for the period:

Translation of

foreign entity - - - - - -

Total

comprehensive

income for the

period: - - - - 48 48

Share based

payments 22 - 22

Balance at 31

December 2020 5,451 2,591 - 63 (5,852) 2,253

-------------- -------------- -------------- -------------- -------------- -------------

Transense Technologies plc

Condensed Consolidated Statement of Cash Flows

Half year to 31 Dec 20 Half year to 31 Dec 19 Full year to 30 Jun 20

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Cash flow from operating

activities

Loss for the period 48 (1,190) (2,542)

Adjustments for:

Taxation (101) - (171)

Loss on disposal of trade

and assets - - 72

Net financial expense 6 - 9

Depreciation of property,

plant and equipment 43 211 538

Loss on disposal of fixed

assets - - 18

Amortisation and impairment

of intangible assets 60 216 504

Share based payments 22 - -

Operating cash flows before

movements in working

capital 78 (763) (1,572)

-------------------------- -------------------------- --------------------------

Change in receivables 37 (199) (177)

Change in payables (628) 583 477

Change in inventories 2 (164) (582)

Cash used in operations (511) (543) (1,854)

Taxation recovered/(paid) 176 - (4)

-------------------------- -------------------------- --------------------------

Net cash used in operations (335) (543) (1,858)

-------------------------- -------------------------- --------------------------

Cash flows from investing

activities

Interest received - 4 8

Acquisition of property,

plant & equipment (1) (300) (764)

Acquisition of intangible

assets (31) (303) (513)

Proceeds from disposal of

trade and assets (net of

cash) 1,236 - 772

-------------------------- -------------------------- --------------------------

Net cash used in investing

activities 1,204 (599) (497)

-------------------------- -------------------------- --------------------------

Cash flows from financing

activities

Loans advanced - - 1,585

Loans repaid (976) - (609)

Interest paid (6) (4) (17)

Payment of lease

liabilities (30) - (58)

-------------------------- -------------------------- --------------------------

Net cash used for financing

activities (1,012) (4) 901

-------------------------- -------------------------- --------------------------

Net decrease in cash and

cash equivalents (143) (1,146) (1,454)

Unrealised currency

translation gain - 18 -

Cash and cash equivalents

at beginning of period 1,193 2,647 2,647

-------------------------- -------------------------- --------------------------

Cash and cash equivalents

at end of period 1,050 1,519 1,193

-------------------------- -------------------------- --------------------------

Notes to the Interim results for the six months to 31 December

2020

1. Reporting Entity and Basis of Preparation

Transense Technologies plc ( "the Company") is a company

incorporated in the United Kingdom under the Companies Act 2006.

These unaudited condensed consolidated interim financial statements

of the Company as at and for the six months ended 30 December 2020

comprise the Company and its subsidiaries (together referred to as

"the Group" and individually as "Group entities" although the

current period only reflects the holding company's trading as all

the trading subsidiaries were transferred to ATMS as part of the

iTrack transaction). These condensed consolidated interim financial

statements are presented in pounds sterling, rounded to the nearest

thousand.

The consolidated financial statements of the Group are available

upon request from the Company's registered office or at

www.transense.com

2. Going Concern

The Board has considered the financial position and future plans

of the Company and is satisfied that the Company will have adequate

resources to continue in operational existence for the foreseeable

future. Accordingly, these interim financial statements have been

prepared on a going concern basis.

3. Accounting policies

The Condensed Consolidated Financial Statements for the half

yearly report for the six months ended 31 December 2020 have been

prepared using accounting policies and methods of computation

consistent with those set in Transense Technologies plc's Annual

Report and Financial Statements for the year ended 30 June 2020.

There has been no change to any accounting policy since the date of

that report.

4. Segmental analysis

Continuing Revenue by region

Half year Half year Full year

to 31 Dec to 31 Dec to 30 Jun

20 (Unaudited) 19 (Unaudited) 20 (Audited)

GBP'000 GBP'000 GBP'000

---------------- ---------------- --------------

North America 111 128 282

---------------- ---------------- --------------

South America 38 50 83

---------------- ---------------- --------------

Australia 17 5 5

---------------- ---------------- --------------

UK & Europe 261 64 148

---------------- ---------------- --------------

Rest of the World 94 24 85

---------------- ---------------- --------------

Royalty income 374 - -

---------------- ---------------- --------------

Total 895 271 603

---------------- ---------------- --------------

Following the sale of the iTrack business in June 2020, the

income model for this activity now comprises royalty income, with

an associated reduction in administrative and management expenses.

The Board now reviews segmental information on a new basis as set

out below. There are no direct comparatives for this information as

a consequence of this change in circumstances.

Half Year to 31 IT Royalties SAW Probes Admin Total

Dec 2020 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Turnover 374 114 408 - 896

------------------ ------------------- ------------------- ----------------- -------------------

Gross profit 374 109 212 - 695

------------------ ------------------- ------------------- ----------------- -------------------

Admistrative

expenses - (383) (60) (244) (687)

------------------ ------------------- ------------------- ----------------- -------------------

Other income - 48 - - 48

------------------ ------------------- ------------------- ----------------- -------------------

EBITDA* 374 (226) 152 (244) 56

------------------ ------------------- ------------------- ----------------- -------------------

Depreciation

and

amortisation (22) (78) (2) - (102)

------------------ ------------------- ------------------- ----------------- -------------------

Finance

expenses - (7) - - (7)

------------------ ------------------- ------------------- ----------------- -------------------

Profit/(loss)

before

taxation 352 (311) 150 (244) (53)

------------------ ------------------- ------------------- ----------------- -------------------

Taxation 50 51 - - 101

------------------ ------------------- ------------------- ----------------- -------------------

Profit/(loss)

after

taxation 402 (260) 150 (244) 48

------------------ ------------------- ------------------- ----------------- -------------------

*Earnings before interest, tax, depreciation and

amortisation

5. Corporation tax and deferred tax

The Company is entitled to a Corporation Tax credit in respect

of expenditure on Research and Development. In January 2021, the

Company received GBP0.20m R & D tax credit from HMRC in respect

of the Financial Year 2020. The benefit of this credit will be

recognised in the current year, with half having been recognised in

these interim financial statements. The benefit of R & D tax

credits has historically been recognised on a cash basis, however a

sustainable track record of successful claims has been established,

and it is now considered appropriate that the potential claim in

respect of the current year may be taken to income and accrued at

the year end.

The Company has approximately GBP23m of Corporation Tax losses

which, subject to agreement by HM Revenue and Customs, are

available for offset against future profits of the same trade.

There is no expiry date for tax losses, however there is an annual

restriction of GBP5m plus half of the surplus above GBP5m. An

appropriate asset will be recognised when the Group can demonstrate

a reasonable expectation of sufficient taxable profits to utilise

the temporary differences.

Accordingly, no deferred tax asset is recognised in these

interim financial statements in respect of trading losses to

date.

6. Earnings per share

31 December 31 December 30 June

2020 2019 2020

Shares Shares Shares

----------------------------------- ------------ ------------ -----------

Weighted average number of shares

in the period 16,307,282 16,307,282 16,307,282

------------ ------------ -----------

Basic and diluted Earnings per

share

------------ ------------ -----------

From continuing operations 0.29p (3.49)p (6.68)p

------------ ------------ -----------

From total profit/(loss) for

the period 0.29p (7.30)p (15.59)p

------------ ------------ -----------

7. Post Balance Sheet Event - Capital Reduction and unaudited accounts to 31 January 2021

At the Annual general Meeting of the Company held on 17 December

2020, the shareholders approved a Capital Reduction set out in the

Company's circular dated 23 November 2020. These proposals were

approved by the High Court on 26 January 2021 and became effective

on 28 January 2021 following registration of the court order and

statement of capital at Companies House.

On 17 February 2021, the Company filed unconsolidated and

unaudited accounts for the seven months ended 31 January 2021 with

Companies House, which are summarised below. This enables

recognition of the Company's distributable reserves for the Company

to be able to utilise them and accordingly, the Company now has

distributable reserves amounting to GBP525,000 based on the 31

January 2021 balance sheet.

Transense Technologies plc

Condensed Statement of Comprehensive Income

For the seven month period ended 31 January 2021

7 Months to 12 Months to

31 January 2021 30 June 2020

(Unaudited) (Audited)

GBP'000 GBP'000

Continuing operations

Revenue 1,005 603

Cost of sales ( 227 ) ( 271 )

------------------------ -------------

Gross profit 778 332

Administrative expenses ( 891 ) ( 1,703 )

------------------------ -------------

Operating loss ( 113 ) ( 1,371 )

Financial Expense (Net) ( 7 ) ( 12 )

Other income 48 118

------------------------ -------------

Loss before taxation ( 72 ) ( 1,265 )

Taxation 119 175

------------------------ -------------

Profit /(loss) for the period from continuing operations 47 ( 1,090 )

Loss for the period from discontinued operations - ( 1, 659)

------------------------ -------------

Total comprehensive income/(expense) for the period attributable to

the equity holders of

the parent 47 ( 2, 749)

======================== =============

Transense Technologies plc

Condensed Statement of Financial Position as at 31 January 2021

31 January 2021 30 June 2020

(Unaudited) (Audited)

GBP'000 GBP'000

Non current assets

Property, plant and equipment 243 290

Intangible assets 812 844

---------------- -------------

1,055 1,134

---------------- -------------

Current assets

Inventory 48 63

Corporation tax receivable 0 175

Trade and other receivables 296 1,677

Cash and cash equivalents 1,318 1,193

1,662 3,108

---------------- -------------

Total assets 2,717 4,242

---------------- -------------

Current liabilities

Trade and other payables ( 295 ) ( 854 )

Borrowings 0 ( 976 )

Lease liabilities ( 61 ) ( 61 )

Total liabilities ( 356 ) ( 1,891 )

Non current liabilities

Lease liabilities ( 140 ) ( 168 )

---------------- -------------

Total liabilities ( 496 ) ( 2,059 )

---------------- -------------

Net assets 2,221 2,183

---------------- -------------

Capital and reserves

Share capital 1,631 5,451

Share premium 0 2,591

Share based payments 65 41

Retained earnings/(Accumulated loss) 525 ( 5,900 )

Shareholders' funds 2,221 2,183

---------------- -------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FZGMZMVRGMZZ

(END) Dow Jones Newswires

February 17, 2021 02:00 ET (07:00 GMT)

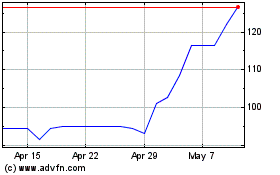

Transense Technologies (LSE:TRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Transense Technologies (LSE:TRT)

Historical Stock Chart

From Apr 2023 to Apr 2024