TIDMTW.

RNS Number : 2311W

Taylor Wimpey PLC

22 April 2021

22 April 2021

Taylor Wimpey plc

Trading statement for the period covering 1 January 2021 to

today

Taylor Wimpey plc is holding its Annual General Meeting (AGM) at

10:00am today at its registered office in High Wycombe, where the

following comments will be made regarding current trading,

financial performance, and outlook for the financial year. In light

of current restrictions, shareholders will unfortunately not be

permitted to attend the AGM in person and are encouraged to follow

the AGM remotely via an audiocast facility.

Pete Redfern, Chief Executive, commented:

"The UK housing market continues to be resilient and we are

trading in line with our full year expectations. With strong market

fundamentals, customer demand for our high-quality homes remains

robust and we are achieving a strong sales rate and building a

healthy forward order book.

The last year has been very challenging for everyone and I must

again thank our teams for their outstanding efforts and commitment

which have enabled us to continue to deliver for customers. It was

pleasing to be recognised by the Home Builders Federation as a

five-star homebuilder in March this year and we remain focused on

delivering the highest quality service to our customers.

We are a cash generative business with a strong balance sheet

and remain focused on our strategic priorities to drive operating

profit margin while creating long term value for our customers and

shareholders."

UK current trading and operations

The UK housing market has remained healthy in 2021, underpinned

by continued strong customer demand, low interest rates, good

mortgage availability and ongoing Government support, particularly

for first time buyers. The transition into the next phase of Help

to Buy has progressed smoothly and we have experienced strong

customer demand for our homes under the new scheme.

Our net private sales rate for the year to 18 April was strong

at 1.00 (2020 equivalent period: 0.90) with a cancellation rate of

14% (2020 equivalent period: 16%). We have achieved growth on sales

prices realised at the end of last year.

As at 18 April 2021, our total order book value stood at

approximately GBP2,808 million (2020 equivalent period: GBP2,668

million). This represents 10,995 homes (2020 equivalent period:

10,853 homes), excluding legal completions to date.

We have made good early progress on our 2021 priorities,

including driving operating profit* margin and an enhanced cost

control mindset across the business. Our focus remains on

delivering our operating profit margin target of c.21-22% in the

medium term.

Growing quality landbank

Our high-quality landbank continues to be a strategic

differentiator for the business. At the end of March 2021, our

short term landbank stood at c.82k plots (2020 equivalent period:

c.78k plots). Our strategic land pipeline stood at c.143k potential

plots as at the end of March 2021 (2020 equivalent period: c.137k

plots).

Dividends

As previously announced, we intend to pay a 2020 final ordinary

dividend of 4.14 pence per share on 14 May 2021 (2019 final

dividend: nil), subject to shareholder approval at today's AGM, and

a 2021 interim dividend of c.4.14 pence per share in November, in

line with our Ordinary Dividend Policy to return c.7.5% of net

assets annually, in two equal instalments.

As we look forward, it remains our intention to return excess

capital to shareholders in line with our policy. We are not

planning to make a capital return in 2021 and will review the

potential level of excess capital at the time of our 2021 full year

results in March 2022, for payment in 2022.

Board updates

Since last year's AGM, Kate Barker stepped down at the end of

her tenure after serving commendably on the Board since 2010. Two

new Non Executive Directors, Scilla Grimble and Jitesh Gadhia

joined our Board on 1 March 2021. Both are highly experienced

executives who will add valuable skills and perspectives to the

Board.

Outlook

Despite the continuation of national restrictions in the first

few months of the year, customer demand for new housing has

remained resilient. The extension of the Stamp Duty Land Tax

holiday and the announcement of the 95% Mortgage Guarantee Scheme

demonstrate that housing remains a priority for the UK

Government.

Trading is in line with expectations and we remain on track to

deliver against our guidance set out at our 2020 full year results

in March.

-Ends-

* Operating profit is defined as profit on ordinary activities

before net finance costs, exceptional items and tax, after share of

results of joint ventures.

For further information please contact:

Taylor Wimpey plc Tel: +44 (0) 7826 874461

Chris Carney, Group Finance Director

Debbie Archibald, Investor Relations

Andrew McGeary, Investor Relations

Finsbury TaylorWimpey@Finsbury.com

Faeth Birch

Anjali Unnikrishnan

Notes to editors:

Taylor Wimpey plc is a customer-focused residential developer,

operating at a local level from 23 regional businesses across the

UK. We also have operations in Spain.

For further information, please visit the Group's website:

www.taylorwimpey.co.uk

Follow us on Twitter via @TaylorWimpeyplc

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFLTSAILFIL

(END) Dow Jones Newswires

April 22, 2021 02:00 ET (06:00 GMT)

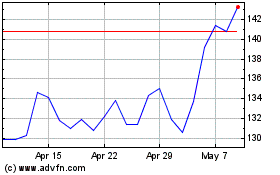

Taylor Wimpey (LSE:TW.)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taylor Wimpey (LSE:TW.)

Historical Stock Chart

From Apr 2023 to Apr 2024