TIDMTWD

RNS Number : 7849L

Trackwise Designs PLC

15 September 2021

TRACKWISE DESIGNS PLC

("Trackwise" or the "Company")

Interim Results for the six months ended 30 June 2021

Trackwise Designs (AIM: TWD), a leading provider of specialist

products using printed circuit technology, is pleased to announce

today its interim results for the six months ended 30 June

2021.

Financial highlights

-- Revenues of GBP4.1m (H1 2020: GBP2.4m)

-- IHT revenues of GBP0.58m (H1 2020: GBP0.25m)

-- Gross margin of 29% (H1 2020: 17.8%)

-- Adjusted(1) E BITDA of GBP0.45m (H1 2020: GBP0.10m)

-- Adjusted(2) o perating loss of GBP0.13m (H1 2020: GBP0.37m)

-- Reported loss after tax of GBP0.57m (H1 2020: profit

GBP0.92m) after additional deferred tax provisions to reflect the

change in Corporation Tax rate

-- Net cash(3) of GBP2.6m (GBP4.8m gross of borrowings) (31

December 2020: GBP11.4m), following investment at new Stonehouse

site; mortgage finance then in place August 2021

-- Basic EPS of (2.00) (loss) pence per share (H1 2020: 4.98 pence (profit))

(1) Before share based payments; and in addition in the prior

year before acquisition expenses, excluding a negative goodwill

(credit) arising on the acquisition of SCL and excluding a small FX

gain

(2) Prior year included the benefit of a GBP1.6 million negative

goodwill (credit) arising on the acquisition of SCL

(3) Cash less borrowings, excluding IFRS16 right of use lease

liabilities

Operational highlights

-- Acquisition of a 77,000 sq. ft. freehold property in

Stonehouse, Gloucestershire, for GBP2.8 million , to provide

additional IHT production capacity

-- Capital investment programme for the facility, aligned with

the Electric Vehicle customer's proposed OEM product delivery

schedule of early 2022

-- Further investment in people including the appointment of a

Chief Operating Officer to oversee the Group's day-to-day

operational functions, including the fit out of the Stonehouse

site

-- Growing number of enquiries, with the number of IHT total

customers and opportunities increasing to 97 at 30 June 2021 (30

June 2020: 82)

Outlook

-- While trading continues to be impacted by supply constraints

and inflation, the Group is well-positioned to manage these

pressures and is tracking in line with market expectations for the

full year

Philip Johnston, CEO of Trackwise, commented :

"The development of our third manufacturing site at Stonehouse

continues, and we expect to see this completed early in 2022 to

meet production demand from our EV OEM customer.

More widely, we are confident in the opportunities ahead in IHT

and we are seeing a fast-growing number of prospects for the

application of this technology across our chosen markets. Alongside

this, our Advanced PCBs division continues to deliver solid

revenues.

We are positive about the prospects for future growth for

Trackwise and we look forward to providing further updates on our

progress to the market."

Enquiries

Trackwise Designs plc +44 (0)1684 299 930

Philip Johnston, CEO www.trackwise.co.uk

Mark Hodgkins, CFO

finnCap Ltd +44 (0)20 7220 0500

NOMAD and Broker

Ed Frisby/Tim Harper - Corporate

Finance

Andrew Burdis/Barney Hayward - ECM

Alma PR +44 (0)20 3405 0205

Financial PR and IR

David Ison/Caroline Forde/Josh Royston/Kieran

Breheny

Notes to editors

Trackwise is a UK-based manufacturer of specialist products

using printed circuit technology.

The full suite includes: Improved Harness Technology(TM) ("IHT")

and Advanced PCBs - Microwave and Radio Frequency ("RF"), Short

Flex, Flex Rigid and Rigid Multilayer products.

IHT uses a proprietary, patented process that Trackwise has

developed to manufacture multilayer flexible printed circuits of

unlimited length. While the technology has many applications, the

directors expect that one of its primary uses will be to replace

traditional wire harness in a variety of industries.

The Company manufactures on two sites, located in Tewkesbury and

Stevenage (following the acquisition of Stevenage Circuits Ltd in

April 2020). It serves customers in Europe and North America. The

Company has acquired a third site in Stonehouse Gloucestershire

initially for its EV programme.

Trackwise Designs plc was admitted to trading on AIM in 2018

with the ticker TWD. For additional information please visit

www.trackwise.co.uk

Financial Review

Revenue for the period increased to GBP4.3m (H1 2020: GBP2.4m),

which reflects an improving level of revenue generation in 2021

compared to the Covid impacted revenue of 2020 as well as a full

contribution from Stevenage Circuits compared to last year.

Throughout H1 we have recorded a steady increase in IHT revenues

though APCB revenues have been impacted by material supply

difficulties.

Profitability was held back by supplier constraints and the

continuing impact of Covid which impacted across the Group during

the Covid lockdown in the early part of the period.

During the period we have invested heavily in capacity for the

EV OEM product manufacture and supply agreement won last September

deliveries for which begin in 2022. Capital expenditure in H1 was

GBP8.7m including GBP2.7m which relates to deposits on new

equipment, which is disclosed in the balance sheet as Other

Receivables. At 30 June 2021 the Company had net cash of GBP2.6m,

gross cash of GBP4.8m and unused facilities of up to GBP0.75m. In

August a new mortgage finance facility of GBP1.96m was completed on

the Stonehouse freehold site.

The outcome of the period is that losses per share were (2.00)p

(H1 2020 earnings per share: 4.98p)

Board Change

Mark Hodgkins has indicated his intention to step down from the

Board at the next AGM. Mark, 64, would like to reduce his full-time

work commitment and pursue a portfolio career. The Board has

commenced the search for his successor.

CEO's Statement

I am pleased to report on a period in which Trackwise has

ensured it is well positioned to meet further demand for its

proprietary technology. We performed well in the first half, seeing

an increase in demand across our target markets in our IHT and

Advanced PCBs divisions. We have progressed against our strategy

through the acquisition of a third manufacturing site. Through the

investments into production capabilities, we are significantly

better positioned to meet the anticipated uptick in demand expected

in our IHT division.

We also invested in a number of new appointments. Steve Hudson

as Chief Operating Officer brings over 20 years' experience in the

automotive and aerospace industry, having occupied operational and

programme leadership roles at Bentley Motors and Rolls Royce

Aerospace. As COO, Steve has been responsible for overseeing the

day-to-day operational functions of the Company across its three

sites and leads on the delivery of the Stonehouse site. In the

period we have made a number of senior new hires in advance of

production commencing at Stonehouse.

There remains a significant opportunity ahead for Trackwise and

the Group is seeing an increasing number of interested parties

across its target markets, particularly the automotive and medical

devices sectors. While the Group's main focus is on delivering

organic growth through the healthy pipeline we see ahead, we remain

open to the possibility of acquisition where appropriate.

Improved Harness Technology

Improved Harness Technology (IHT), the long-term growth driver

for Trackwise, is the patented technology which enables the

manufacture of length-unlimited multi-layer flexible printed

circuit boards.

IHT has delivered a strong performance in the first half, as a

result of the recovery of trading activity among our end customers

in combination with the increase in demand for this technology.

During the period, IHT revenues for the first half of 2021 were 95%

of those for the whole of 2020 and we expect these revenues to be

at record levels at the full year.

In April we completed the acquisition of a 77,000 sq. ft.

freehold property in Stonehouse, Gloucestershire, for GBP2.8

million. This site will house the high-volume, low mix, roll to

roll IHT production facility and significantly increases

Trackwise's production capacity to meet the expected demand for IHT

across its target markets.

The Company remains subject to global supply chain issues until

the full completion of machinery installation at Stonehouse, but

good progress is being made on the delivery of this site. We expect

to be in production in early 2022, in line with the revised ramp-up

in production by the Company's EV OEM customer, and we are working

increasingly closely with the customer as we progress towards this

date.

While IHT has a wide range of applications, we have set out the

three markets where we expect to see the greatest levels of growth

for this technology. These are:

1. Electric Vehicles

2. Medical

3. Aerospace

We remain confident in the applicability of our proprietary

technology to these markets and the significant revenues this has

the potential to generate.

Electric Vehicles

The Electric Vehicles market is the key area of activity for

Trackwise, and interest in IHT from this market continues to be

healthy. Following on from the EV OEM manufacturing agreement we

signed in September 2020, in July we announced an extension to the

agreement from three to four years, with a significant increase in

expected volumes and potential value. In line with the Stonehouse

site completion expected in January 2022, we expect a ramp up in

demand production and revenues from this deal in the same

month.

In line with the growing emphasis on the sustainability agenda

and an increasing legislative pressure to force the automotive

sector towards non-fossil fuel motive power, we expect to see

further interest from EV customers. During the year-to-date

progress has been made with passenger and commercial vehicle

OEMs/Tier1s, including the design, manufacture and supply of IHT

sample/development parts.

Medical

IHT's application for medical catheters represents a significant

opportunity through the provision of long, narrow flex PCBs to

replace multiple micro-wires, very small gauge wires that are

currently used to connect remote (distal) electronics through the

patient and out to the surgeon.

In May we announced a multi-year agreement with the

Stockholm-based medical device technology company CathPrint AB.

This agreement paves the way for a potential longer-term ramp up in

volume. Elsewhere, the Group has made good progress in this market

and is working with a number of other active customers in that

sector to supply parts for catheter products, and we expect to see

larger production orders placed in the not-too-distant future

Aerospace

Aerospace forms another of the target markets for Trackwise

through the application of IHT to battery management systems.

Despite the impact of COVID on the global aviation industry, the

Group is working with a number of customers in this space and, as

trading conditions and aviation activity normalises, we expect to

see further opportunities in this field.

Other IHT

The Group continues to attract interest from a number of

additional markets in which IHT is applicable. The Group continues

to explore these markets and engage with potential customers, and

this year it has successfully delivered a project to customer in

nuclear fusion, and the Group expects further demand from this

customer in due course.

Advanced PCBs

The Advanced PCBs division comprises Trackwise's legacy

radiofrequency (RF) division and the printed circuit board

manufacturer Stevenage Circuits Limited, acquired by Trackwise in

2020.

This division delivered a solid first half, despite the ongoing

impact from supply chain issues, with revenues up c. 6% from H2

2020. Our order book remains strong and there will be an additional

shift added to accommodate demand seen recently and anticipated in

future.

Current trading and outlook

The Company is making good progress with its investment into the

Stonehouse site, enabling the roll-to-roll production of IHT in the

new year in order to service our EV OEM customer and other

customers being developed.

Alongside this, IHT acceptance continues to grow, and the

Company is on track to deliver record IHT revenues in 2021. Our EV

OEM product delivery is due to begin in early 2022, aligned with

the opening of our third site at Stonehouse.

While the Company has successfully navigated the supply chain

issues around the supply of copper, we are not immune from the

ongoing uncertainty in the wider external environment. As a result,

while they will naturally ebb and flow, further supply chain issues

are likely to continue to affect the Group's end customers and

suppliers in the short term.

The Group is well-positioned to manage these pressures and, as a

result, management expects to report 2021 trading in line with

market expectations. Overall, the long-term prospects for the

Company remain as exciting as ever and we remain confident in the

Group's strategy and future growth prospects.

Interim Condensed Consolidated Statement of Comprehensive

Income

Notes Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

GBP'000 GBP'000 GBP'000

Revenue 3 4,090 2,389 2 6,068

Cost of sales (2,904) (1,964) (4,350)

Gross profit 1,186 425 1,718

Administrative expenses

excluding

exceptional costs and share

based payment

(1,315) (790) (1,903)

Exceptional and non-recurring

costs (195) - (128)

Share based payment charges 4 (149) (112) (228)

Total administrative expenses (1,623) (902) (2,259)

Operating loss (473) (477) (541)

Negative goodwill arising

on acquisition - 1,545 1,642

Acquisition expenses - (214) (226)

Exceptional integration

costs - - (278)

Finance income - - 4

Finance costs (138) (66) (195)

(Loss)/profit before taxation (611) 788 406

Taxation 5 42 133 828

(Loss)/profit and total

comprehensive (expense)/income

for the period (569) 921 1,234

------------ ------------- -------------

(Loss)/earnings per share

(pence)

Basic 7 (2.00) 4.98 5.96

------------ ------------- -------------

Diluted 7 (2.00) 4.82 5.70

------------ ------------- -------------

Interim Condensed Consolidated Statement of Financial

Position

Notes Unaudited Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Intangible assets 8 7,940 5,200 6,482

Property, plant and

equipment 11,425 8,363 8,175

19,365 13,563 14,657

---------- ---------- -------------

Current assets

Inventories 2,296 1,740 2,010

Trade and other receivables 5,498 1,585 1,752

Current tax receivable 1,146 448 804

Cash and cash equivalents 4,806 3,209 13,930

---------- ---------- -------------

13,746 6,982 18,496

---------- ---------- -------------

Total assets 33,111 20,545 33,153

---------- ---------- -------------

LIABILITIES

Current liabilities

Trade and other payables (2,501) (2,210) (1,956)

Borrowings (887) (575) (1,055)

(3,388) (2,785) (3,011)

---------- ---------- -------------

Non-current liabilities

Deferred income - grants (975) (914) (910)

Borrowings (3,714) (3,640) (4,078)

Deferred tax liabilities (506) (401) (206)

Provisions (79) (310) (79)

---------- ---------- -------------

(5,274) (5,265) (5,273)

---------- ---------- -------------

Total liabilities (8,662) (8,050) (8,284)

---------- ---------- -------------

Net assets 24,449 12,495 24,869

---------- ---------- -------------

EQUITY

Share capital 1,137 885 1,137

Share premium account 20,989 9,374 20,989

Retained earnings 2,214 2,088 2,615

Revaluation reserve 109 148 128

Total equity 24,449 12,495 24,869

---------- ---------- -------------

Interim Condensed Consolidated Statement of Changes in

Equity

Share Share premium Retained earnings Revaluation reserve Total equity

capital account

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2020 591 4,234 1,045 167 6,037

Profit and total

comprehensive

income for the

period - - 921 - 921

Issue of shares 294 5,140 - - 5,434

Share based payment - - 103 - 103

Revaluation

realised in period - - 19 (19) -

--------- -------------------- ------------------ -------------------- -------------

At 30 June 2020 885 9,374 2,088 148 12,495

--------- -------------------- ------------------ -------------------- -------------

Profit and total

comprehensive

income for the

period - - 313 - 313

Issue of shares 252 11,615 - - 11,867

Share based payment - - 160 160

Prior year tax

adjustment - - 34 - 34

Revaluation

realised in period - - 20 (20) -

At 31 December 2020

and 1 January 2021 1,137 20,989 2,615 128 24,869

--------- -------------------- ------------------ -------------------- -------------

Loss and total

comprehensive

expense for the

period - - (569) - (569)

Share based payment - - 149 - 149

Revaluation

realised in period - - 19 (19) -

-------------------- --------------------

At 30 June 2021 1,137 20,989 2,214 109 24,449

--------- -------------------- ------------------ -------------------- -------------

Interim Condensed Consolidated Statement of Cash Flows

Unaudited Six Unaudited Six Audited

months ended 30 months ended 30 Year ended 31

June 2021 June 2020 December 2020

GBP'000 GBP'000 GBP'000

Cash flow from operating activities

(Loss)/profit for the period before

taxation (611) 788 406

Adjustment for:

Employee share based payment charges 149 112 263

263

Depreciation of property, plant and

equipment 524 349 693

Amortisation of intangible assets 181 118 265

Negative goodwill credited - (1,545) (1,642)

Finance costs 138 66 191

Changes in working capital:

Increase in inventories (286) (314) (584)

(Increase)/decrease in trade and other

receivables (732) 459 374

(Decrease)/increase in trade and other

payables (221) 21 (362)

------------------- ------------------- --------------------

Cash (used in)/from operations (858) 54 (396)

Income tax received - 420 669

------------------- ------------------- --------------------

Net cash (used in)/from operating

activities (858) 474 273

------------------- ------------------- --------------------

Cash flow from investing activities

Purchase of property, plant and equipment (6,266) (359) (911)

Purchase of intangible assets (1,478) (1,036) (2,246)

Purchase of subsidiary (net of cash

acquired) - (1,629) (1,628)

Grant funding - purchase of intangible

assets 92 - 109

Interest received - - 4

(4,672)

Net cash used in investing activities (7,652) (3,024) (4,672)

------------------- ------------------- --------------------

Cash flow from financing activities

Share capital issued - 5,873 18,492

Expenses relating to share capital issue - (439) (1,191)

Interest paid (138) (66) (195)

Lease payments (106) (81) (87)

Advance of hire purchase finance against assets already purchased 135 - 1,139

Repayment of other finance (128) - -

Repayment of capital element of lease contracts (377) (95) (396)

---------- -------- ---------

Net cash (used in)/from financing activities (614) 5,192 17,762

---------- -------- ---------

(Decrease)/increase in cash and cash equivalents (9,124) 2,642 13,363

---------- -------- ---------

Net cash and cash equivalents at beginning of the period 13,930 567 567

Net cash and cash equivalents at end of period (all cash balances) 4,806 3,209 13,930

---------- -------- ---------

Notes to the Interim Financial Information

1. Corporate information

Trackwise Designs plc is a public company incorporated in the

United Kingdom. The registered address of the Company is 1 Ashvale,

Alexandra Way, Ashchurch, Tewkesbury, Gloucestershire, GL20

8NB.

The principal activity of the Company and the Group is the

development, manufacture and sale of printed circuit boards.

2. Accounting policies

Basis of preparation

This unaudited consolidated interim financial information has

been prepared in accordance with IFRS as adopted by the United

Kingdom including IAS 34 'Interim Financial Reporting'. The

principal accounting policies used in preparing the interim results

are those it expects to apply in its financial statements for the

year ending 31 December 2021. These are unchanged from those

applied in the 31 December 2020 Company financial statements

The financial information does not contain all of the

information that is required to be disclosed in a full set of IFRS

financial statements. The financial information for the six months

ended 30 June 2021 and 30 June 2020 is unreviewed and unaudited and

does not constitute the Group or Company's statutory financial

statements for those periods.

The comparative financial information for the full year ended 31

December 2020 has, however, been derived from the audited statutory

financial statements for that period. A copy of those statutory

financial statements has been delivered to the Registrar of

Companies. The auditor's report on those accounts was unqualified,

did not include references to any matters to which the auditor drew

attention by way of emphasis without qualifying its report and did

not contain a statement under section 498(2)-(3) of the Companies

Act 2006.

The financial information in the Interim Report is presented in

Sterling.

3. Segmental reporting

IFRS 8, Operating Segments, requires operating segments to be

identified on the basis of internal reports that are regularly

reviewed by the company's chief operating decision maker. The chief

operating decision maker is considered to be the Board of

Directors.

The operating segments are monitored by the chief operating

decision maker and strategic decisions are made on the basis of

adjusted segment operating results. From January 2018 the RF and

IHT activities began to be separately reviewed and monitored,

initially in respect of revenue. Since the acquisition of Stevenage

Circuits Limited in April 2020 the Company monitors separately the

IHT business and the Advanced PCB business, which comprises the

Stevenage Circuits Limited and the RF business of Trackwise Designs

plc.

All assets, liabilities and revenues are located in, or derived

in, the United Kingdom. The material assets and liabilities relate

to overall activity with the exception of the intangible

development costs and deferred grants which are solely in respect

of IHT.

In the six months ended 30 June 2021 the group had one major

customer who represented 11% of revenue (30 June 2020: two major

customers who each represented 12% of total revenue, and full year

ended 31 December 2020: 3 customers with similar revenue levels

together representing 29% of revenue).

Revenue by product and geographical destination was as

follows:

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

GBP'000 GBP'000 GBP'000

IHT 581 251 601

APCB 3,509 2,138 5,467

--------------- ------------ -------------

4,090 2,389 6,068

--------------- ------------ -------------

UK 3,053 1,495 3,693

Europe 732 751 1,688

Other 305 143 687

4,090 2,389 2 6,068

--------------- ------------ -------------

4. Exceptional and non-recurring items

Non recurring amounts disclosed in administrative expenses are

as follows:

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

GBP'000 GBP'000 GBP'000

New production site set 141 - -

up expenditure

Integration and other costs 54 - -

Set up costs for new customer - - 128

--------------- ------------ -------------

195 - 128

--------------- ------------ -------------

5. Income tax

Taxation is provided at the estimated rate of tax for the

period, applying the enacted rate of 25% (2020:19%) to deferred tax

balances as applicable to the expected reversal dates, and

including the benefit of enhanced allowances for research and

development costs in tax losses used to record a credit paid to the

group.

The credits have been impacted by both the change in deferred

tax rate following enactment of the Finance Act 2021 and by

movements in the period end share price directly affecting deferred

tax in respect of future deductions from the exercise of share

options. These non-recurring items have been analysed in the

elements of the tax credit shown below.

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

GBP'000 GBP'000 GBP'000

Development expenditure

tax credits 342 133 633

Deferred tax in respect

of share options (141) - 440

Deferred tax change in rate (121) - 53

Deferred tax from other

timing differences (38) - (298)

--------------- ------------ -------------

42 133 828

--------------- ------------ -------------

6. Dividends paid and proposed

No dividends have been paid or proposed in the period ended 30

June 2021 or year ended 31 December 2020.

7. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

GBP'000 GBP'000 GBP'000

(Loss)/earnings for the purpose

of basic and diluted earnings

per share being net (loss)/profit

attributable to the shareholders (569) 921 1,234

--------------- ------------ -------------

Number Number Number

Weighted average number of

ordinary shares for the purposes

of basic (loss)/earnings per

share 28,426,122 18,503,836 20,687,836

Weighted average number of

ordinary shares for the purposes

of diluted (loss)/earnings

per share 28,426,122 19,116,462 21,659,166

Options over 901,909 shares were granted to employees on 15 June

2018 and 984,000 on 24 June 2020 which are still exercisable and

potentially dilutive shares included in the weighted average for

the year ended 31 December 2020.

8. Intangible fixed assets

Development

costs

GBP'000

Cost

At 1 January 2020 4,368

Additions 1,024

As at 30 June 2020 5,392

Additions 1,423

As at 31 December 2020 6,815

Additions 1,548

As at 30 June 2021 8,363

------------

Amortisation or impairment

At 1 January 2020 268

Charge 113

As at 30 June 2020 381

Charge 142

As at 31 December 2020 523

Charge 175

As at 30 June 2021 698

------------

Carrying amount

As at 30 June 2020 5,011

------------

As at 31 December 2020 6,292

------------

As at 30 June 2021 7,665

------------

The capitalised development project costs relate to the

significant continuing investment in respect of the Company's

Improved Harness Technology ('IHT') process for unlimited length

printed circuit boards and know-how which is being developed by the

Company with amortisation on the initial development projects

commencing in 2018.

The remainder of intangible assets is represented by software

assets and an unchanged amount of goodwill in respect of the

initial technology.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKQBKDBKBNCD

(END) Dow Jones Newswires

September 15, 2021 02:00 ET (06:00 GMT)

Trackwise Designs (LSE:TWD)

Historical Stock Chart

From Mar 2024 to Apr 2024

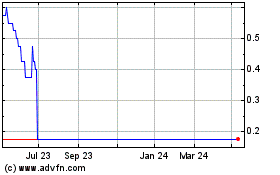

Trackwise Designs (LSE:TWD)

Historical Stock Chart

From Apr 2023 to Apr 2024