TIDMTXP

RNS Number : 2018F

Touchstone Exploration Inc.

13 November 2020

THIRD QUARTER 2020 RESULTS

CALGARY, ALBERTA (November 13, 2020) - Touchstone Exploration

Inc. ( " Touchstone ", "we", "our", "us" or the " Company " ) (TSX,

LSE: TXP) reports its unaudited financial and operating results for

the three months ended September 30, 2020. Selected information is

outlined below and should be read in conjunction with Touchstone's

September 30, 2020 unaudited consolidated interim financial

statements and related Management's Discussion and Analysis, both

of which will be available on the Company's website (

www.touchstoneexploration.com ) and under the Company's profile on

SEDAR ( www.sedar.com ). Unless otherwise stated, all financial

amounts herein are rounded to thousands of United States dollars

.

Third Quarter Highlights

-- Delivered average daily crude oil production of 1,310 barrels

per day ("bbls/d"), compared to 1,396 bbls/d in the second quarter

of 2020 and 1,729 bbls/d in the third quarter of 2019. As expected

and consistent with prior quarters, our crude oil production has

reduced due to the ongoing impact of natural declines, reflecting a

strategic focus on our Ortoire exploration program which has

limited capital investment and reduced discretionary field

maintenance expenditures.

-- Invested $5,758,000 in exploration activities, primarily

focused on Chinook-1 drilling operations and surface facility

equipment expenditures relating to Coho-1 tie-in operations.

-- Generated funds flow from operations of $192,000 and an

operating netback of $14.09 per barrel, representing increases from

the second quarter of 2020 based on higher realized crude oil sales

pricing.

-- Continued to focus on discretionary cost reductions, with

operating costs on a per barrel basis decreasing by 10 percent and

general and administrative expenses declining by 9 percent relative

to the third quarter of 2019.

-- Recognized a net loss of $703,000 ($0.00 per share) compared

to a net loss of $1,053,000 ($0.01 per share) in the third quarter

of 2019 despite a 47 percent reduction in petroleum revenues

between the corresponding periods.

-- Maintained financial flexibility, exiting the quarter with

cash of $7,673,000 and raising gross proceeds of approximately

$30.3 million via a private placement completed on November 12,

2020.

Paul R. Baay, President and Chief Executive Officer,

commented:

"The Board's focus remains on our Ortoire property where

exploration activities to date have significantly exceeded

expectations. Our base crude oil production continues to cover our

operating costs, allowing us to direct our capital exclusively to

our ongoing exploration program. The oversubscribed private

placement completed post period end places us in a strong position

to continue the execution of our Ortoire drilling, production

testing and tie-in operations. We are currently drilling our fourth

exploration well, Cascadura Deep-1, and we are in the process of

finalizing a nine-month extension to the exploration phase of the

Ortoire licence. Alongside this, we continue to negotiate a natural

gas sales agreement with the National Gas Company of Trinidad and

Tobago. I look forward to updating our shareholders as operations

progress."

Third Quarter Summary and Outlook

Despite the ongoing challenges as a result of COVID-19, we

continued to manage our business prudently during the quarter,

achieving positive cash flows despite limited developmental capital

activity since 2018 and progressing with our Ortoire exploration

program while maintaining safe and reliable operations. Our

investment focus remains on the Ortoire exploration block, as we

spudded our third drilling prospect (Chinook-1) in the quarter

which reached total depth in mid-October. We believe our operating

and general and administrative ("G&A") cost reductions

initiated in the second quarter of 2020 have enhanced our financial

resilience and financial capability to maintain our base production

and to deliver safe operations.

We remain focused on protecting the health of our employees and

communities while ensuring a decisive response for our investors.

We will continue to follow the advice of public health officials in

supporting our employees, their families and our business partners.

Our objective remains to bring our two natural gas exploration

discoveries onto production as soon as possible, which are expected

to not only increase cash flow but insulate us from further crude

oil price volatility from the continued effects of COVID-19.

Drilling operations are ongoing at our Cascadura Deep-1 prospect,

and we anticipate commencing production testing at our Chinook-1

discovery upon completion.

The rapid decline in oil prices had a negative impact on our

cash flows during the nine months ended September 30, 2020 and our

projections for the balance of the year. Ongoing weakness in

commodity prices resulting from COVID-19 impacts on demand and

market volatility may adversely affect our future financial and

operational results. We continue to monitor the situation and

economic environment, and we will continue to adapt our business

operations and exploration program to ensure that we preserve and

grow long-term shareholder value.

On the basis of the successful results from the first three

Ortoire exploration wells, we undertook a private placement that

closed on November 12, 2020 in order to support the completion of

the initial phase of exploration work on the Ortoire block. The

private placement raised gross proceeds of approximately $30.3

million by way of a placing of 24,291,866 common shares at a price

of 95 pence (C$1.64). We believe this enhanced liquidity will allow

us to continue with our exploration program at an optimal pace,

with a focus on bringing our initial exploration discoveries onto

production in 2021.

Financial and Operating Results Summary

Three months ended % change Nine months ended % change

September 30, September 30,

--------- ---------

2020 2019 2020 2019

--------------- ---------------------- ---------------------- --------- ---------------------- ---------------------- ---------

Operating

Highlights

Average daily

oil

production(1)

(bbls/d) 1,310 1,729 (24) 1,431 1,871 (24)

Net wells

drilled - 0.8 n/a - 0.8 n/a

Brent

benchmark

price

($/bbl) 42.91 61.95 (31) 41.15 64.65 (36)

Operating

netback(2)

($/bbl)

Realized

sales price 39.20 56.67 (31) 38.54 58.21 (34)

Royalties (11.17) (16.61) (33) (10.82) (16.32) (34)

Operating

expenses (13.94) (15.50) (10) (13.06) (14.82) (12)

--------------- ---------------------- ---------------------- --------- ---------------------- ---------------------- ---------

14.09 24.56 (43) 14.66 27.07 (46)

--------------- ---------------------- ---------------------- --------- ---------------------- ---------------------- ---------

Notes:

(1) The Company's reported crude oil production is a mix of

light and medium crude oil and heavy crude oil for which there is

not a precise breakdown since the Company's oil sales volumes

typically represent blends of more than one type of crude oil.

(2) Non-GAAP financial measure that does not have a standardized

meaning prescribed by International Financial Reporting Standards

("IFRS") and therefore may not be comparable with the calculation

of similar measures presented by other companies. See "Advisories:

Non-GAAP Measures" for further information.

Three months ended % change Nine months ended % change

September 30, September 30,

--------- ---------

2020 2019 2020 2019

---------------- ----------------------- ----------------------- --------- ----------------------- ----------------------- ---------

Financial

Highlights

($000's except

as

indicated)

Petroleum sales 4,725 9,011 (48) 15,178 29,734 (49)

Cash flow from

(used

in) operating

activities 4,126 (1,205) n/a 2,129 3,364 (37)

Funds flow

from

operations(2) 192 1,082 (82) 999 4,822 (79)

Per share -

basic

and

diluted(1)(2) 0.00 0.01 (100) 0.01 0.03 (67)

Net loss (703) (1,053) (33) (12,685) (2,071) 513

Per share -

basic

and diluted (0.00) (0.01) (100) (0.07) (0.01) 600

Exploration

capital

expenditures 5,758 3,234 78 8,830 4,275 107

Development

capital

expenditures 211 517 (59) 523 1,231 (58)

---------------- ----------------------- ----------------------- --------- ----------------------- ----------------------- ---------

Total capital

expenditures 5,969 3,751 59 9,353 5,506 70

---------------- ----------------------- ----------------------- --------- ----------------------- ----------------------- ---------

Working

capital

(surplus)

deficit(1) (869) 805 n/a

Principal

balance

of term loan 15,000 11,328 32

Net debt(1) -

end

of period 14,131 12,133 16

---------------- ----------------------- ----------------------- --------- ----------------------- ----------------------- ---------

Share

Information

(000's)

Weighted

average shares

outstanding -

basic

and diluted 184,277 160,688 15 179,112 154,192 16

Outstanding

shares

- end of

period 184,408 160,688 15

Notes:

(1) Non-GAAP financial measure that does not have a standardized

meaning prescribed by IFRS and therefore may not be comparable with

the calculation of similar measures presented by other companies.

See "Advisories: Non-GAAP Measures" for further information.

(2) Additional GAAP term included in the Company's consolidated

statements of cash flows. Funds flow from operations represents net

loss excluding non-cash items. See "Advisories: Non-GAAP Measures"

for further information.

Operating results

In the third quarter of 2020, we invested $5,758,000 in

exploration activities, which were predominantly Chinook-1 drilling

and Coho-1 tie-in expenditures. The Chinook-1 well reached its

target depth on October 13, 2020, and we are awaiting regulatory

approval to commence installation of the Coho-1 surface facility

equipment and pipeline operations.

We conducted minimal developmental activity in the quarter, with

average crude oil sales declining to 1,310 bbls/d, a 6 percent

decrease relative to the 1,396 bbls/d produced in the second

quarter of 2020 and a 24 percent reduction from 1,729 bbls/d

produced in the third quarter of 2019. Our crude oil sales volumes

have decreased due to the ongoing impact of natural declines

associated with limited capital investment since the final two

wells of the 2018 drilling program were brought onstream in January

2019. Further, since March 2020 we have deliberately reduced

discretionary operating expenditures in response to lower crude oil

pricing, focusing on performing well interventions on those deemed

high priority. Development capital activity for the fourth quarter

of 2020 is expected to be minimal as we continue to focus on our

exploration program.

Financial results

We reported nominal funds flow from operations of $192,000 in

the third quarter of 2020 versus $1,082,000 generated in the 2019

third quarter. The decrease reflected a 31 percent reduction in our

average realized crude oil prices as a result of the impact of the

COVID-19 pandemic and a 24 percent decline in crude oil production

from limited capital and operational investment.

We recorded a net loss of $703,000 ($0.00 per share) in the

third quarter of 2020 versus a net loss of $1,053,000 ($0.01 per

share) in the prior year equivalent quarter despite a 47 percent

reduction in petroleum revenues over the equivalent period. The

decrease in petroleum revenues was driven by a 24 percent decline

in crude oil production, a 31 percent reduction in realized average

crude oil pricing, and a corresponding 49 percent decrease in

royalty expenses. We continued with our cost-saving initiatives in

the third quarter, as quarterly operating costs decreased 32

percent and 10 percent on an absolute and per barrel basis from the

third quarter of 2019. In addition, we reduced third quarter 2020

G&A expenses by 9 percent in comparison to the third quarter of

2019. Relative to the third quarter of 2019, current income tax

expense decreased by $1,146,000 or 95 percent, reflective of

$1,087,000 of supplemental petroleum taxes incurred in the prior

year third quarter from higher realized crude oil pricing.

Touchstone exited the quarter with a working capital surplus of

$869,000, $15 million withdrawn on our term credit facility and net

debt of $14,131,000. Our liquidity is augmented by $5 million of

undrawn credit capacity, as well as the net proceeds from the

private placement that closed subsequent to quarter-end.

Touchstone Exploration Inc.

Touchstone Exploration Inc. is a Calgary, Alberta based company

engaged in the business of acquiring interests in petroleum and

natural gas rights and the exploration, development, production and

sale of petroleum and natural gas. Touchstone is currently active

in onshore properties located in the Republic of Trinidad and

Tobago. The Company's common shares are traded on the Toronto Stock

Exchange and the AIM market of the London Stock Exchange under the

symbol " TXP " .

For further information about Touchstone, please visit our

website at www.touchstoneexploration.com or contact:

Touchstone Exploration Inc.

Mr. Paul Baay, President and Chief Executive Officer Tel: +1

(403) 750-4487

Mr. Scott Budau, Chief Financial Officer

Shore Capital (Nominated Advisor and Joint Broker)

Nominated Advisor: Edward Mansfield / Daniel Bush / Michael McGloin Tel: +44 (0) 207 408 4090

Corporate Broking: Jerry Keen

Canaccord Genuity (Joint Broker)

Adam James / Henry Fitzgerald O'Connor / Thomas Diehl Tel: +44

(0) 207 523 8000

Camarco (Financial PR)

Nick Hennis / Billy Clegg Tel: +44 (0) 203 781 8330

Advisories

Non-GAAP Measures

This announcement contains terms commonly used in the oil and

natural gas industry, including funds flow from operations, funds

flow from operations per share, operating netback, working capital

and net debt. These terms do not have a standardized meaning

prescribed under Generally Accepted Accounting Principles ("GAAP")

or IFRS and may not be comparable to similar measures presented by

other companies. Shareholders and investors are cautioned that

these measures should not be construed as alternatives to cash flow

from operating activities, net earnings, net earnings per share,

total assets, total liabilities, or other measures of financial

performance as determined in accordance with GAAP. Management uses

these Non-GAAP measures for its own performance measurement and to

provide stakeholders with measures to compare the Company's

operations over time.

Funds flow from operations is an additional GAAP measure

included in the Company's consolidated statements of cash flows.

Funds flow from operations represents net earnings (loss) excluding

non-cash items. Touchstone considers funds flow from operations to

be an important measure of the Company's ability to generate the

funds necessary to finance capital expenditures and repay debt. The

Company calculates funds flow from operations per share by dividing

funds flow from operations by the weighted average number of common

shares outstanding during the applicable period.

The Company uses operating netback as a key performance

indicator of field results. Operating netback is presented on a

total and per barrel basis and is calculated by deducting royalties

and operating expenses from petroleum sales. If applicable, the

Company also discloses operating netback both prior to realized

gains or losses on derivatives and after the impacts of derivatives

are included. Realized gains or losses represent the portion of

risk management contracts that have settled in cash during the

period, and disclosing this impact provides Management and

investors with transparent measures that reflect how the Company's

risk management program can impact netback metrics. The Company

considers operating netback to be a key measure as it demonstrates

Touchstone's profitability relative to current commodity prices.

This measurement assists Management and investors with evaluating

operating results on a historical basis.

The Company closely monitors its capital structure with a goal

of maintaining a strong financial position in order to fund current

operations and the future growth of the Company. The Company

monitors working capital and net debt as part of its capital

structure to assess its true debt and liquidity position and to

manage capital and liquidity risk. Working capital is calculated as

current assets minus current liabilities as they appear on the

consolidated statements of financial position. Net debt is

calculated by summing the Company's working capital and the

principal (undiscounted) non-current amount of senior secured

debt.

Please refer to the Company's September 30, 2020 Management's

Discussion and Analysis for reconciliations of Non-GAAP Measures

contained herein to applicable GAAP measures.

Forward-Looking Statements

Certain information provided in this announcement may constitute

forward-looking statements and information (collectively,

"forward-looking statements") within the meaning of applicable

securities laws. Such forward-looking statements include, without

limitation, forecasts, estimates, expectations and objectives for

future operations that are subject to assumptions, risks and

uncertainties, many of which are beyond the control of the Company.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

"expects", "plans", "anticipates", "believes", "intends",

"estimates", "projects", "potential" and similar expressions, or

are events or conditions that "will", "would", "may", "could" or

"should" occur or be achieved.

Forward-looking statements in this announcement may include, but

is not limited to, statements relating to the Company's exploration

plans and strategies, including anticipated drilling, timing,

production testing, development, tie-in, facilities construction,

and ultimate production from exploration wells; the Company's

expectation regarding future demand for the Company's petroleum

products and economic activity in general; the impacts of COVID-19

on the Company's business and measures taken in response thereto;

uncertainty regarding COVID-19 and the impact it will have on

future petroleum pricing, global financial markets and the

Company's operations; and the sufficiency of resources and

available financing to fund future capital expenditures and

maintain financial liquidity. Although the Company believes that

the expectations and assumptions on which the forward-looking

statements are based are reasonable, undue reliance should not be

placed on the forward-looking statements because the Company can

give no assurance that they will prove to be correct. Since

forward-looking statements address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Actual results could differ materially from those currently

anticipated due to a number of factors and risks. Certain of these

risks are set out in more detail in the Company's 2019 Annual

Information Form dated March 25, 2020 which has been filed on SEDAR

and can be accessed at www.sedar.com. The forward-looking

statements contained in this announcement are made as of the date

hereof, and except as may be required by applicable securities

laws, the Company assumes no obligation to update publicly or

revise any forward-looking statements made herein or otherwise,

whether as a result of new information, future events or

otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTFXLBFBFLZFBK

(END) Dow Jones Newswires

November 13, 2020 02:00 ET (07:00 GMT)

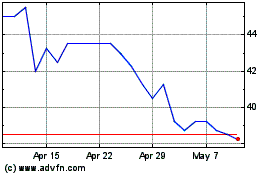

Touchstone Exploration (LSE:TXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Touchstone Exploration (LSE:TXP)

Historical Stock Chart

From Apr 2023 to Apr 2024