TIDMTXP

RNS Number : 5684T

Touchstone Exploration Inc.

26 March 2021

TOUCHSTONE ANNOUNCES YEAR- 2020 RESULTS

CALGARY, ALBERTA (March 26, 2021) - Touchstone Exploration Inc.

( " Touchstone ", "we", "our", "us" or the " Company " ) (TSX, LSE:

TXP) reports its operating and financial results for the three

months and year ended December 31, 2020. Selected information is

outlined below and should be read in conjunction with Touchstone's

December 31, 2020 audited consolidated financial statements, the

related Management's discussion and analysis and Annual Information

Form, all of which will be available under the Company's profile on

SEDAR (www.sedar.com) and the Company's website

(www.touchstoneexploration.com). Unless otherwise stated, all

financial amounts herein are rounded to thousands of United States

dollars .

2020 Highlights

-- Achieved annual crude oil sales of 1,392 barrels per day

("bbls/d"), a 24 percent decrease relative to the 1,825 bbls/d

produced in 2019. As expected and consistent with 2019, our crude

oil production has reduced due to the ongoing impact of natural

declines, reflecting a strategic focus on our Ortoire exploration

program which has limited development capital investment.

-- Executed a high impact, incident free $17,861,000 exploration

program, primarily focused on drilling two gross (1.6 net)

wells.

-- Despite limited capital and operational development asset

investment and considerably lower crude oil pricing, generated

funds flow from operations of $263,000 (2019 - $6,840,000) and an

operating netback of $14.49 per barrel (2019 - $26.61).

-- Continued to focus on discretionary cost reductions, with

operating costs on a per barrel basis decreasing by 12 percent and

general and administration expenses declining by 6 percent relative

to 2019.

-- Recognized a net loss of $11,030,000 ($0.06 per share)

compared to a net loss of $5,620,000 ($0.04 per share) in 2019,

driven by $11,418,000 in net impairment losses recorded in the year

predominantly based on lower forecasted crude oil pricing.

-- Established a $20 million term loan with a Trinidad based

financial institution and successfully accessed capital markets to

continue our Ortoire exploration program, raising total net

proceeds of $39.2 million from two oversubscribed equity

financings.

-- Maintained financial flexibility, exiting the year with cash

of $24,281,000, a working capital balance of $12,933,000 and

$7,500,000 drawn on our $20 million term credit facility, resulting

in a net surplus of $5,433,000.

-- Business continuity plans remain effective across our

locations in response to COVID-19 with minimal health and safety

impacts or disruptions to production.

Paul Baay, President and Chief Executive Officer, commented:

"2020 presented significant challenges to the wider oil and gas

industry due to the impact of COVID-19 on working operations and

the volatile nature of global oil prices. It is against that

backdrop that I am delighted to report another year of significant

progress at Touchstone in which we have enhanced our financial

position significantly, encountered major natural gas discoveries

as well as signed a historic long-term natural gas sales agreement

with the National Gas Company of Trinidad and Tobago.

I would like to thank the entire team at Touchstone for their

dedication, perseverance and flexibility during this difficult

period which has enabled us to achieve such success. As a result of

their hard work, the Company is very well positioned for another

year of growth as we move forward with our exploration, development

and production program at Ortoire and across the wider portfolio.

"

2020 Annual Summary and Outlook

The resilience and quality of our employees and asset base were

demonstrated throughout an extremely challenging operational and

financial period in 2020. The impacts on our business due to

COVID-19 and the associated volatility in crude oil prices forced

prompt decisions to preserve financial flexibility and protect the

health of our employees and stakeholders. We remain focused on

protecting the health of our employees and communities while

ensuring a decisive response for our investors. We will continue to

follow the advice of public health officials in supporting our

employees, their families, and our business partners.

Despite these challenges, Touchstone continued with its focus on

improving financial liquidity, capturing cost savings, and

increasing the long-term value of our core assets. We managed our

business prudently during the year, progressing with our Ortoire

exploration program and maintaining our base production while

continuing safe and reliable operations.

The enhanced liquidity provided from our debt refinancing and

our 2020 equity financings are expected to allow us to fund our

exploration program in 2021, with a core focus on drilling our

final work commitment exploration well (Royston-1), completing our

2D seismic program, testing our two exploration wells drilled in

2020, and bringing our Coho-1 and Cascadura-1ST1 discoveries onto

production in 2021.

Our primary objective remains to bring our two natural gas

exploration discoveries at Ortoire onto production in 2021.

Additionally, production testing operations are ongoing at our

Chinook-1 and Cascadura Deep-1 prospects, and we anticipate

drilling our Royston-1 location in the second quarter of 2021. As

the current economic and health related challenges persist, we will

continue to adapt our business operations and capital programs to

ensure health and safety and enhance long-term shareholder

value.

Financial and Operating Results Summary

Three months ended % change Year ended % change

December 31, December 31,

--------- ---------

2020 2019 2020 2019

--------------- ---------------------- ---------------------- --------- ---------------------- ---------------------- ---------

Operating

Highlights

Average daily

oil

production(1)

(bbls/d) 1,274 1,690 (25) 1,392 1,825 (24)

Net wells

drilled 1.6 0.8 100 1.6 1.6 -

Brent

benchmark

price

($/bbl) 44.32 63.17 (30) 41.96 64.28 (35)

Operating

netback(2)

($/bbl)

Realized sales

price 37.66 57.38 (34) 38.34 58.01 (34)

Royalties (10.48) (17.05) (39) (10.74) (16.49) (35)

Operating

expenses (13.28) (15.21) (13) (13.11) (14.91) (12)

--------------- ---------------------- ---------------------- --------- ---------------------- ---------------------- ---------

13.90 25.12 (45) 14.49 26.61 (46)

--------------- ---------------------- ---------------------- --------- ---------------------- ---------------------- ---------

Notes:

(1) The Company's reported crude oil production is a mix of

light and medium crude oil and heavy crude oil for which there is

not a precise breakdown since the Company's oil sales volumes

typically represent blends of more than one type of crude oil.

(2) Non-GAAP financial measure that does not have a standardized

meaning prescribed by IFRS and therefore may not be comparable with

the calculation of similar measures presented by other companies.

See "Non-GAAP Measures" for further information.

Three months ended % change Year ended % change

December 31, December 31,

--------- ---------

2020 2019 2020 2019

---------------- ----------------------- ----------------------- --------- ----------------------- ----------------------- ---------

Financial

Highlights

($000's except

as

indicated)

Petroleum sales 4,414 8,920 (51) 19,592 38,654 (49)

Cash from

operating

activities 167 2,090 (92) 2,296 5,454 (58)

Funds flow

(used in)

from

operations(2) (736) 2,018 n/a 263 6,840 (96)

Per share -

basic

and

diluted(1)(2) (0.00) 0.01 n/a 0.00 0.04 (100)

Net earnings

(loss) 1,655 (3,549) n/a (11,030) (5,620) 96

Per share -

basic

and diluted 0.01 (0.02) n/a (0.06) (0.04) 50

Exploration

capital

expenditures 9,031 5,838 55 17,861 10,113 77

Development

capital

expenditures 186 157 18 709 1,388 (49)

---------------- ----------------------- ----------------------- --------- ----------------------- ----------------------- ---------

Total capital

expenditures 9,217 5,995 54 18,570 11,501 61

---------------- ----------------------- ----------------------- --------- ----------------------- ----------------------- ---------

Working capital

(surplus)

deficit(1) (12,933) 1,139 n/a

Principal

non-current

balance of

term loan 7,500 15,364 (51)

Net (surplus)

debt(1)

- end of

period (5,433) 16,503 n/a

---------------- ----------------------- ----------------------- --------- ----------------------- ----------------------- ---------

Share

Information

(000's)

Weighted avg.

shares

outstanding

Basic 197,686 160,691 23 183,781 155,830 18

Diluted 206,072 160,691 28 183,781 155,830 18

Outstanding

shares

- end of

period 209,400 160,703 30

Notes:

(1) Non-GAAP financial measure that does not have a standardized

meaning prescribed by IFRS and therefore may not be comparable with

the calculation of similar measures presented by other companies.

See "Non-GAAP Measures" for further information.

(2) Additional GAAP term included in the Company's consolidated

statements of cash flows. Funds flow from operations represents net

loss excluding non-cash items. See "Non-GAAP Measures" for further

information.

Annual operating results

Throughout 2020, we conducted minimal capital development

activity and continued to allocate capital to exploration

activities on our Ortoire property. As a result, crude oil

production during the fourth quarter averaged 1,274 bbls/d, a 25

percent decrease relative to the 1,690 bbls/d produced in the

fourth quarter of 2019 based on the ongoing impact of natural

declines. Further, commencing in March 2020, we deliberately

reduced discretionary operating expenditures in response to lower

crude oil pricing, focusing on performing well interventions on

those deemed high priority. Accordingly, annual 2020 crude oil

production averaged 1,392 bbls/d, representing a decrease of 24

percent from crude oil production delivered in 2019. We invested

$709,000 in development activities in 2020, which mainly consisted

of recompletion activities on legacy wellbores and upgrades to our

oilfield service equipment to maintain base production levels.

We remained heavily focused on our Ortoire exploration

activities in 2020, investing $17,861,000 in exploration assets

during the year. In 2020, we drilled two gross exploration wells

(1.6 net) and incurred production testing costs on the

Cascadura-1ST1 well drilled in December 2019. The Chinook-1

exploration well reached its total depth on October 13, 2020, and

we concluded drilling operations on Cascadura Deep-1 on December

19, 2020.

Annual financial results

We reported funds flow from operations of $263,000 in 2020

versus $6,840,000 generated in the prior year. Petroleum sales

recognized in 2020 decreased by 49 percent or $19,062,000 from

2019, reflecting a 34 percent reduction in our realized sales

pricing as a result of the COVID-19 pandemic and a 24 percent

decline in crude oil production volumes from limited capital and

operational investment. The reduction in 2020 petroleum sales

resulted in a 50 percent decline in royalty expenses compared to

2019. In response to the drastic decrease in realized crude oil

pricing, we instituted cost-saving initiatives, decreasing annual

operating expenses by 33 percent and 12 percent on an absolute and

per barrel basis from 2019, respectively. As a result, our annual

2020 operating netback was $14.49 per barrel versus $26.61 per

barrel reported in 2019. In addition, we reduced annual 2020

general and administration expenses by 6 percent in comparison to

2019. Finance expenses increased by $3,419,000 from 2019, as

non-cash finance expenses increased by $1,734,000 predominately as

a result of the Company's term loan refinancing. Further,

Touchstone recognized a one-time $1,286,000 income tax interest

reversal recorded in net finance expenses in the prior year.

Relative to 2019, current income tax expense decreased by

$5,094,000 or 95 percent, reflective of $4,914,000 in supplemental

petroleum taxes incurred in the prior year from higher realized

crude oil pricing.

We recorded a net loss of $11,030,000 ($0.06 per share) in 2020

compared to a net loss of $5,620,000 ($0.04 per share) in 2019.

Touchstone recognized net impairment losses of $11,418,000 in 2020

compared to impairment losses of $7,960,000 recorded in 2019. 2020

impairments were a result of $795,000 of licence costs on non-core

exploration assets and $10,623,000 in net property and equipment

impairments. $19,215,000 in impairment losses were recognized in

the first quarter of 2020 based on the precipitous decline in

forward crude oil pricing, while net property and equipment

impairment recoveries of $8,592,000 were recorded in the fourth

quarter of 2020 based on our updated reserve report and a recovery

of forward oil prices as at December 31, 2020. The net impairment

losses were minimized by their corresponding effect on deferred

taxes, as a recovery of $6,273,000 was recognized during the year

ended December 31, 2020 (2019 - $1,813,000).

On the basis of the successful results from the first three

Ortoire exploration wells, we undertook a private placement that

closed on November 12, 2020 in order to support the completion of

the initial phase of exploration work on the Ortoire block, raising

net proceeds of $28,386,000. Touchstone exited the year with a cash

balance of $24,281,000, a working capital surplus of $12,933,000

and $7,500,000 drawn on our term credit facility resulting in a net

surplus position of $5,433,000. Our near-term liquidity is

augmented by $12.5 million of undrawn credit capacity.

Touchstone Exploration Inc.

Touchstone Exploration Inc. is a Calgary, Alberta based company

engaged in the business of acquiring interests in petroleum and

natural gas rights and the exploration, development, production and

sale of petroleum and natural gas. Touchstone is currently active

in onshore properties located in the Republic of Trinidad and

Tobago. The Company's common shares are traded on the Toronto Stock

Exchange and the AIM market of the London Stock Exchange under the

symbol " TXP " .

For further information about Touchstone, please visit our

website at www.touchstoneexploration.com or contact:

Touchstone Exploration Inc.

Mr. Paul Baay, President and Chief Executive Officer Tel: +1

(403) 750-4487

Mr. Scott Budau, Chief Financial Officer

Shore Capital (Nominated Advisor and Joint Broker)

Nominated Advisor: Edward Mansfield / Daniel Bush / Michael McGloin Tel: +44 (0) 207 408 4090

Corporate Broking: Jerry Keen

Canaccord Genuity (Joint Broker)

Adam James / Henry Fitzgerald O'Connor / Thomas Diehl Tel: +44

(0) 207 523 8000

Camarco (Financial PR)

Nick Hennis / Billy Clegg Tel: +44 (0) 203 781 8330

Advisories

Non-GAAP Measures

This announcement contains terms commonly used in the oil and

natural gas industry, including funds flow from operations, funds

flow from operations per share, operating netback, working capital

and net debt. These terms do not have a standardized meaning

prescribed under Generally Accepted Accounting Principles ("GAAP")

or IFRS and may not be comparable to similar measures presented by

other companies. Shareholders and investors are cautioned that

these measures should not be construed as alternatives to cash flow

from operating activities, net earnings, net earnings per share,

total assets, total liabilities, or other measures of financial

performance as determined in accordance with GAAP. Management uses

these Non-GAAP measures for its own performance measurement and to

provide stakeholders with measures to compare the Company's

operations over time.

Funds flow from operations is an additional GAAP measure

included in the Company's consolidated statements of cash flows.

Funds flow from operations represents net earnings (loss) excluding

non-cash items. Touchstone considers funds flow from operations to

be an important measure of the Company's ability to generate the

funds necessary to finance capital expenditures and repay debt. The

Company calculates funds flow from operations per share by dividing

funds flow from operations by the weighted average number of common

shares outstanding during the applicable period.

The Company uses operating netback as a key performance

indicator of field results. Operating netback is presented on a

total and per barrel basis and is calculated by deducting royalties

and operating expenses from petroleum sales. If applicable, the

Company also discloses operating netback both prior to realized

gains or losses on derivatives and after the impacts of derivatives

are included. Realized gains or losses represent the portion of

risk management contracts that have settled in cash during the

period, and disclosing this impact provides Management and

investors with transparent measures that reflect how the Company's

risk management program can impact netback metrics. The Company

considers operating netback to be a key measure as it demonstrates

Touchstone's profitability relative to current commodity prices.

This measurement assists Management and investors with evaluating

operating results on a historical basis.

The Company closely monitors its capital structure with a goal

of maintaining a strong financial position in order to fund current

operations and the future growth of the Company. The Company

monitors working capital and net (surplus) debt as part of its

capital structure to assess its true debt and liquidity position

and to manage capital and liquidity risk. Working capital is

calculated as current assets minus current liabilities as they

appear on the consolidated statements of financial position. Net

(surplus) debt is calculated by summing the Company's working

capital and the principal (undiscounted) non-current amount of

senior secured debt.

Please refer to the Company's December 31, 2020 Management's

Discussion and Analysis for reconciliations of Non-GAAP Measures

contained herein to applicable GAAP measures.

Forward-Looking Statements

Certain information provided in this announcement may constitute

forward-looking statements and information (collectively,

"forward-looking statements") within the meaning of applicable

securities laws. Such forward-looking statements include, without

limitation, forecasts, estimates, expectations and objectives for

future operations that are subject to assumptions, risks and

uncertainties, many of which are beyond the control of the Company.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

"expects", "plans", "anticipates", "believes", "intends",

"estimates", "projects", "potential" and similar expressions, or

are events or conditions that "will", "would", "may", "could" or

"should" occur or be achieved.

Forward-looking statements in this announcement may include, but

is not limited to, statements relating to the Company's exploration

plans and strategies, including anticipated drilling, timing,

production testing, development, tie-in, facilities construction,

and ultimate production from exploration wells; the Company's

expectation regarding future demand for the Company's petroleum

products and economic activity in general; the impacts of COVID-19

on the Company's business and measures taken in response thereto;

uncertainty regarding COVID-19 and the impact it will have on

future petroleum pricing, global financial markets and the

Company's operations; and the sufficiency of resources and

available financing to fund future capital expenditures and

maintain financial liquidity. Although the Company believes that

the expectations and assumptions on which the forward-looking

statements are based are reasonable, undue reliance should not be

placed on the forward-looking statements because the Company can

give no assurance that they will prove to be correct. Since

forward-looking statements address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Actual results could differ materially from those currently

anticipated due to a number of factors and risks. Certain of these

risks are set out in more detail in the Company's 2020 Annual

Information Form dated March 25, 2021 which will be filed on SEDAR

and can be accessed at www.sedar.com. The forward-looking

statements contained in this announcement are made as of the date

hereof, and except as may be required by applicable securities

laws, the Company assumes no obligation to update publicly or

revise any forward-looking statements made herein or otherwise,

whether as a result of new information, future events or

otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR JAMTTMTBTTTB

(END) Dow Jones Newswires

March 26, 2021 03:00 ET (07:00 GMT)

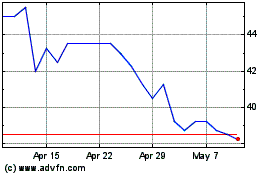

Touchstone Exploration (LSE:TXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Touchstone Exploration (LSE:TXP)

Historical Stock Chart

From Apr 2023 to Apr 2024