TIDMUPL

RNS Number : 6845D

Upland Resources Limited

30 October 2020

30 October 2020

Upland Resources Limited

("Upland" or the "Company")

ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEARED 30 JUNE

2020

Upland Resources Limited (LSE: UPL), the oil and gas company

actively building a portfolio of attractive upstream assets, is

pleased to announce the publication of its audited annual report

and financial statements for the year ended 30 June 2020 ("2020

Report").

The Company's 2020 Report will be posted to shareholders shortly

and it will also be made available on the Company's website at:

http://uplandres.com/

In addition, a copy of the 2020 Report will be uploaded to the

National Storage Mechanism and will be available for viewing

shortly at http://www.morningstar.co.uk/uk/NSM

Highlights include:

-- Changed Company domicile from the British Virgin Islands to

Jersey to enhance corporate governance. This migration to Jersey

means that the Company has now become subject to the City code on

Takeovers and Mergers.

-- Appointment of two additional non-executive directors, Mr

Dixon Wong and Mr Christopher Pitman, to the Board.

-- Awarded the P2478 and P2470 'Innovate' licences by the UK Oil

and Gas Authority as a result of the competitive UK 31st Offshore

Licensing Round along with its partners. P2470 has been

relinquished, but a work sharing and confidentiality agreement has

been signed with a large international E&P company in respect

of P2478.

-- Successfully raised GBP250,000 in February via a

subscription. A further GBP470,000 was raised in July (after the

year-end) to progress the Company's projects in Tunisia and

opportunities in Sarawak and Brunei.

Post Period End:

-- On 10 September 2020, Bolhassan Di became interim CEO

replacing Christopher Pitman who remains a director but will now

concentrate on developing new business opportunities.

-- Commissioned highly experienced external consultant GAIA

Consulting to undertake a detailed geological and geophysical study

of the Saouaf Permit area in order to prepare a lead and prospect

inventory and to further evaluate existing Saouaf licence area data

ahead of initiating formal farm-out processes.

-- Recent political developments in Sarawak, Malaysia have given

cause for optimism in a highly attractive area for new hydrocarbon

plays.

Upland CEO Bolhassan Di commented:

"Against a backdrop of a particularly difficult period for the

oil and gas sector and global financial markets we were pleased to

be able to make progress in furthering our objectives to develop

the high potential Tunisian Saouaf License and to progress

initiatives to secure additional highly attractive hydrocarbon

plays in south-east Asia.

Following a period of data consolidation and preparation, we

have recently begun to see very promising results from our work in

Tunisia specifically identifying a highly promising sub-salt play,

new for the Saouaf area but well proven in Algeria and Morocco. The

first phase of this work is now complete, and we look forward to

updating investors on further phases in the near term.

In Brunei we have entered into a Memorandum of Understanding

with Bruneian oil and gas industry services provider Viddacom; this

was a strategy we have been working to progress for some time. The

MOU provides Upland with a strong local partner as we work hard to

pursue licence applications through the Petroleum Authority of

Brunei Darussalam.

In Sarawak, Malaysia there continues to be positive progress in

negotiations between the Sarawak state government and Petronas in

relation to the management of oil and gas assets in Sarawak. There

are now encouraging signals that industry players may soon be able

to work in the area with Petros to maximise the substantial

potential of Sarawak.

It has been tough and slow time for the industry, but we are

pleased to have progressed our work programme and strategy across

all our operating geographies and look forward to updating

shareholders further in due course."

-S-

This announcement contains inside information for the purposes

of Article 7 of the Regulation (EU) No 596/2014 on market abuse

For further information, please contact:

Upland Resources Limited www.uplandres.com

Bolhassan Di, CEO Tel: +60 198 861 919

bolhassan@gmail.com

bolhassan@uplandres.com

Optiva Securities www.optivasecurities.com

- Broker

Jeremy King Tel: _+44 (0)20 3137 1904

(Corporate Finance) jeremy.king@optivasecurities.com

Christian Dennis Tel: +44 (0)20 3411 1903

(Corporate Broker) christian.dennis@optivasecurities.com

FTI Consulting - Financial Tel: +44 (0)203 727 1065

PR ben.brewerton@fticonsulting.com

Ben Brewerton

Christopher Laing Tel: +44 (0)20 3727 1355

ch ristopher.laing @fticonsulting.com

Flowcomms - IR Contact

Sasha Sethi Tel: +44 (0)7891 677441

sasha@flowcomms.com

Upland Resources Limited

Chairman's Statement

On behalf of the Board of Directors, I hereby present the

consolidated financial statements of Upland Resources Limited (the

"Group", "Upland" or the "Company") for the year ended 30 June

2020.

On 15 August 2019, the Company changed its domicile from the

British Virgin Islands to Jersey to enhance corporate governance.

This migration to Jersey means that the Company has now become

subject to the City code on Takeovers and Mergers.

On 3 September 2019, two additional non-executive directors, Mr

Dixon Wong and Mr Christopher Pitman, were appointed to the

Board.

The Company announced on 20 September 2019 that its wholly owned

subsidiary, Upland Resources (UK Onshore) Limited, and its partners

had been awarded the P2478 and P2470 'Innovate' licences by the UK

Oil and Gas Authority as a result of the competitive UK 31(st)

Offshore Licensing Round. Both licences are located within the

northern (P2470) and southern (P2478) areas of the Inner Moray

Firth basin. The licences are held by Upland Resources (UK Onshore)

Limited (40%), Corallian Energy Limited (45%) and Baron Oil

(15%).

On 7 October 2019, Dr Steve Staley, resigned as CEO and a

director with immediate effect for personal reasons and was

succeeded by Mr Christopher Pitman as the Interim CEO.

Optiva Securities Limited issued an exercise notice on 8

November in respect of warrants related to a warrant agreement with

the Company dated 25 November 2016. This warrant exercise raised

GBP82,370 through the subscription for 6,336,154 new shares at 1.3p

per share.

On 24 December 2019, the Decree of the Minister of Industry and

Small and Middle Enterprises dated 14 November 2019 in respect of

the Prospecting Licence in the Saouaf permit area Tunisia was

published in the Official Gazette of the Tunisian Republic. This

publication marked the commencement of the initial two-year licence

term.

On 6 January 2020, the Board of Directors appointed Mr

Christopher Pitman as the CEO on a permanent basis together with Mr

Aimi Aizal Bin Nasharuddin as a Non-Executive Director.

It has been a particularly challenging year since February 2020

due to COVID 19 which has caused considerable difficulties in

travelling to our permit areas and maintaining our relationship

with in country managers and partners.

The Company also announced that it had successfully raised

GBP250,000 in February via a subscription managed by Optiva

Securities Limited and a further GBP470,000 was raised in July.

These funds have been employed to further progress the Company's

projects in Tunisia and opportunities in Sarawak and Brunei.

On 10 September 2020, I became interim CEO replacing Christopher

Pitman who will remain a director but will now concentrate on

developing new business opportunities.

The Company has recently commissioned highly experienced

external consultant GA.I.A. srl (GAIA Consulting) to undertake a

detailed geological and geophysical study of the Saouaf Permit in

order to prepare a lead and prospect inventory and to assess the

potential for de-risking through the application of seismic

re-processing techniques using the existing data acquired by

previous companies. It is believed that these studies will

demonstrate that significant potential also exists in a 'sub-salt'

play indicated by both the regional and permit data. It is the

Company's intention to solicit farm in interest from major oil

companies in order to progress exploration work in the Saoauf

Permit.

Upland Resources Limited

Chairman's Statement (continued)

Recent political developments have given cause for optimism in

our pursuit of an exploration permit in Sarawak and together with

positive findings from our initial geological studies have given

encouragement to our selection of a possible licence. We now hope

to be able to follow up with the relevant authorities.

Our knowledge gained through working on the Sarawak regional

geology has helped us identify contiguous permit areas in Brunei

Darussalam which are now the subject of more detailed geological

and geophysical studies.

.............................

B H Di

Chairman

29 October 2020

Upland Resources Limited

Strategic Report for the Year Ended 30 June 2020

The directors present their strategic report for the year ended

30 June 2020.

Principal activity

The Company and Group was formed for the purpose of acquiring

assets, businesses or target companies that have operations in the

oil and gas exploration and production sector that it will then

look to develop and expand.

Fair review of the business

Upland Resources ("Upland" or the "Company") continues to

progress game changing licence opportunities in the second half of

2020 within the Asia Pacific Region. Technical studies have also

commenced on the Saouaf Permit in Tunisia. The Company continues to

work closely with Corallian Energy (Licence Operator of P2478) on a

potential group farm-down together with the third partner, Baron

Oil. The present environment of lower oil prices together with

restrictive international travel due to the COVID 19 pandemic has

created a unique short-term opportunity to identify new assets and

the Company has found that it has a significant competitive

advantage over many of its peers due to its flexibility and

entrepreneurial philosophy.

On 15 August 2019, the Company changed its domicile from the

British Virgin Islands to Jersey to enhance corporate governance.

This migration to Jersey means that the Company has now become

subject to the City code on Takeovers and Mergers.

On 3 September 2019, two additional non-executive directors, Mr

Dixon Wong and Mr Christopher Pitman, were appointed to the

Board.

The Company announced on 20 September 2019 that its wholly owned

subsidiary, Upland Resources (UK Onshore) Limited, and its partners

had been awarded the P2478 and P2470 'Innovate' licences by the UK

Oil and Gas Authority as a result of the competitive UK 31(st)

Offshore Licensing Round. Both licences are located within the

northern (P2470) and southern (P2478) areas of the Inner Moray

Firth basin. The licences are held by Upland Resources (UK Onshore)

Limited (40%), Corallian Energy Limited (45%) and Baron Oil

(15%).

However, in April 2020, the P2470 licence was relinquished

following a post-drill review of the Wick structure. The original

licence was applied for prior to the drilling of the Wick prospect

and was downgraded by the results of the subsequent Wick

exploration well in 2018. Additionally, in April 2020, the Company

announced a work sharing and confidentiality agreement for the

remaining Inner Moray Firth P2478 Licence, valid to 30 September

2020, with a large international E&P company. On 1 October

2020, the Company announced that a 4-month extension to the

exclusivity period to 31 January 2021 had been agreed

On 7 October 2019, Dr Steve Staley, resigned as CEO and a

director with immediate effect for personal reasons and was

succeeded by Mr Christopher Pitman as the Interim CEO.

Optiva Securities Limited issued an exercise notice on 8

November 2019 in respect of warrants related to a warrant agreement

with the Company dated 25 November 2016. This warrant exercise

raised GBP82,370 through the subscription for 6,336,154 new shares

at 1.3p per share. The new ordinary shares were admitted to the

Official List of the FCA on 15 November 2019.

On 24 December 2019, the Decree of the Minister of Industry and

Small and Middle Enterprises dated 14 November 2019 in respect of

the Prospecting Licence in the Saouaf permit area Tunisia was

published in the Official Gazette of the Tunisian Republic. This

publication marked the commencement of the initial two-year licence

term.

Upland Resources Limited

Strategic Report for the Year Ended 30 June 2020 (continued)

Fair review of the business (continued)

On 6 January 2020, the Board of Directors appointed Mr

Christopher Pitman as the CEO on a permanent basis together with Mr

Aimi Aizal Bin Nasharuddin as a Non-Executive Director.

The Company also announced in March 2020 that it had

successfully raised GBP250,000 via a subscription managed by Optiva

Securities Limited. These funds were employed to continue progress

with the Company's projects in Tunisia and the additional targets

in the Asia Pacific Region. The Company recognises an opportunity

to secure attractive licences in mature onshore and offshore basins

with proven petroleum systems, such as those found in Sarawak,

Malaysia and Brunei. Progress continues with regard to acquiring a

new permit in Sarawak and this is emphasised by recent encouraging

political developments announced by the Company on 4 June 2020.

On 29 June 2020, an update on activities on the Tunisian Saouaf

Licence was announced which confirmed that a review of all the

technical data had commenced and that Mr Roberto Bencini of GAIA

Consulting, a highly experienced geologist, was undertaking the

geological and geophysical studies and data base compilation of the

Saouaf data. Mr Bencini also joined a newly formed technical panel

to strengthen the Company's expertise and experience. The impact of

the COVID 19 pandemic on international travel has had a direct

effect on the Company's ability to visit the permit area and to

engage with our joint venture partner, ETAP. It is hoped that

travel will be less restricted in the later part of this year and

that a field trip to the permit area with ETAP can be

completed.

Significant events since the balance sheet date

On 14 July 2020, the Company announced a successful fund raise

of GBP470,000 via a placing and subscription of ordinary shares.

Associated warrants were also issued on a one for two ordinary

share basis. These funds are being deployed to progress the

technical studies in Tunisia and to develop the new licence

opportunities to a negotiation stage.

In August 2020, the Company announced the execution of a

Memorandum of Understanding with Viddacom (B) Sdn Bhd, a local

Brunei oil services and logistics company. This agreement is

consistent with a strategy to identify and evaluate new attractive

opportunities offering significant potential for growth. Local

partners are seen to be instrumental in the evaluation and closure

of new licences and the Company continues to engage with other

prospective companies in target regions.

On 10 September 2020, the Company announced that Mr Christopher

Pitman relinquished his role as Chief Executive Officer to focus on

sourcing and developing new business opportunities. Mr Pitman

continues to serve as a director of the Company, with Mr Bolhassan

Di assuming the role of interim Chief Executive Officer from that

date.

Principal risks and uncertainties

The directors consider that the main business risks and

uncertainties of the Group are:

Sub-surface risks

Risk 1: The success of the business relies on accurate and

detailed analysis of the sub-surface. This can be impacted by poor

quality data, either historical or recently gathered, and limited

data coverage. Certain information provided by external sources may

not be accurate.

Mitigation: All externally provided historical data is

rigorously examined and discarded when appropriate. New data

acquisition will be considered and relevant programmes implemented,

but historical data can be reviewed and reprocessed to improve the

overall knowledge base.

Upland Resources Limited

Strategic Report for the Year Ended 30 June 2020 (continued)

Principal risks and uncertainties (continued)

Risk 2: Data can be misinterpreted leading to the construction

of inaccurate models and subsequent plans.

Mitigation: All analytical outcomes are challenged internally

and peer reviewed. Interpretations are carried out on modern

geoscience software.

Corporate risk

Risk: The Group's success depends on skilled management as well

as retention of technical and administrative staff and consultants.

The loss of critical members of the Group's team could have an

adverse effect on the business.

Mitigation: The Group periodically reviews the compensation and

contract terms of its staff and consultants to ensure that they are

competitive.

Going concern risk

Risk: There is no guarantee that the required funding will be

raised within the necessary timeframe, as a result there is an

uncertainty on the Group's ability to continue as a going

concern.

Mitigation: The Group regularly monitors funding requirements,

including the requirement to raise additional capital, to ensure

there is sufficient working capital to enable it to continue its

operations.

Approved by the Board on 29 October 2020 and signed on its

behalf by:

.........................................

B B H Di

Chairman

Upland Resources Limited

Directors' Report for the Year Ended 30 June 2020

The directors present their report and the audited consolidated

financial statements for the year ended 30 June 2020.

As a Jersey registered company, Upland Resources Limited is not

obliged to comply with the Companies Act 2006. However, the

Directors have elected to conform to the requirements of the

Companies Act 2006, as regards the Directors' Report, to the extent

they consider to be reasonably practical and appropriate for a

company of the Company's size and nature.

Details of key events during the year, significant events

affecting the Company and its subsidiaries since the end of the

financial year and an indication of likely future developments in

the business of the Company and its subsidiaries are included in

the Strategic Report.

Directors of the Group

The directors who held office during the year were as

follows:

B B H Di - Chairman and interim Chief Executive from 10

September 2020

C N Pitman (appointed 3 September 2019) - Chief Executive 7

October 2019 to 10 September 2020

J E S King

D K S Wong (appointed 3 September 2019)

A A B Nasharuddin (appointed 6 January 2020)

G H S Staley - Chief Executive (resigned 7 October 2019)

Results and dividends

The Group's loss on ordinary activities after taxation amounted

to GBP719,364 for the year (2019 - GBP4,394,505). The Directors are

unable to recommend payment of a dividend.

Financial instruments and risk management

An explanation of the Group's financial risk management

objectives, policies and strategies and information about the use

of financial instruments by the Company is given in note 10 to the

financial statements.

Capital structure

Details of the issued share capital, together with details of

the movements in the Company's issued share capital during the

period, are shown in note 17 to the financial statements. The

company has one class of ordinary shares which carry no right to

fixed income.

There are no specific restrictions on the size of a holding nor

on the transfer of shares, which are both governed by the general

provisions of the Articles of Association and prevailing

legislation. The Directors are not aware of any agreements between

holders of the Company's shares that may result in restrictions on

the transfer of securities or on voting rights.

No person has any special rights of control over the Company's

share capital.

Upland Resources Limited

Directors' Report for the Year Ended 30 June 2020

(continued)

With regard to the appointment and replacement of Directors, the

Company is governed by its Articles of Association, the Companies

(Jersey) Law 1991 and related legislation. The Articles themselves

may be amended by special resolution of the shareholders.

Directors' interests

As at 30 June 2020, the beneficial interests of the Directors

and their connected persons in the ordinary share capital of the

Company were as follows:

Director Number of Ordinary % of Ordinary

Shares Share Capital

B B H Di * 16,634,620 2.68%

A A B Nasharuddin 14,730,770 2.38%

J E S King ** 1,100,000 0.18%

* Included 7,788,460 shares held by the director's wife.

** Whilst J E S King is a director and minority shareholder in

Optiva Securities Limited which owns 49,430,576 shares, he is not

interested in such shares for the purposes of section 823 of the

Companies Act 2006.

Substantial shareholders

The following had interests of 3 per cent or more in the

Company's issued share capital as at 30 June 2020:

Party Name Number of Ordinary % of Ordinary

Shares Share Capital

M N B Zakaria 125,674,475 20.28%

Tune Assets Limited 74,579,604 12.04%

Optiva Securities Limited 49,430,576 7.98%

Warrants

On 25 November 2016, the Company granted to Optiva Securities

Limited 6,336,154 warrants to subscribe for new ordinary shares (on

the basis of 1 new ordinary share for each warrant) at a

subscription price of 1.3p per ordinary share and exercisable at

any time during the period of 3 years from 1 December 2016. The

warrants were exercised on 8 November 2019.

On 12 June 2018, the Company granted to Optiva Securities

Limited 5,498,442 warrants to subscribe for new ordinary shares (on

the basis of 1 new ordinary share for each warrant) at a

subscription price of 2.5p per ordinary share and exercisable at

any time during the period of 3 years from 12 June 2018. The

warrants will therefore expire on 12 June 2021.

Capital and returns management

The Directors believe that, following an acquisition, further

equity capital raisings may be required by the Company for working

capital purposes as the Company pursues its objectives. The amount

of any such additional equity to be raised, which could be

substantial, will depend on the nature of the acquisition

opportunities which arise and the form of consideration the Company

uses to make the acquisition and cannot be determined at this

time.

The Company expects that any returns for shareholders would

derive primarily from capital appreciation of the ordinary shares

and any dividends paid pursuant to the Company's dividend

policy.

Upland Resources Limited

Directors' Report for the Year Ended 30 June 2020

(continued)

Dividend policy

The Company intends to pay dividends on the ordinary shares

following an acquisition at such times (if any) and in such amounts

(if any) as the Board determines appropriate in its absolute

discretion. The Company's current intention is to retain any

earnings for use in its business operations, and the Company does

not anticipate declaring any dividends in the foreseeable future.

The Company will only pay dividends to the extent that to do so is

in accordance with all applicable laws.

Corporate governance

The Board is not subject to the provisions of a formal

governance code and given its present size does not intend to

formally adopt any specific code, but will apply governance the

Directors consider to be appropriate, having due regard to the

principles of governance set out in the UK Corporate Governance

Code.

In order to implement its business strategy, the Company has

adopted a corporate governance structure whereby the key features

of its structure are:

-- The Board of Directors is knowledgeable and experienced and

has extensive experience of making acquisitions;

-- Consistent with the rules applicable to companies with a

Standard Listing, unless required by law or other regulatory

process, shareholder approval is not required in order for the

Company to complete an acquisition. The Company will, however, be

required to obtain the approval of the Board of Directors, before

it may complete an acquisition;

-- The Company does not have separate audit and risk,

nominations or remuneration committees. The Board as a whole

reviews audit and risk matters, as well as the Board's size,

structure and composition and the scale and structure of the

Directors' fees, taking into account the interests of shareholders

and the performance of the Company, and takes responsibility for

the appointment of auditors and payment of their audit fee,

monitors and reviews the integrity of the Company's financial

statements and takes responsibility for any formal announcements on

the Company's financial performance;

-- At every Annual General Meeting of the Company, one-third of

the Directors for the time being (or if their number is not a

multiple of three, then the number nearest to and not exceeding

one-third) will retire from office and will be eligible for

re-election. In addition, any Director who has been appointed to

the Board other than pursuant to a Resolution of Members since the

last Annual General Meeting of the Company will retire and again

will be eligible for re-election; and

-- Following an acquisition, the Company may seek to transfer

from a Standard Listing to either a Premium Listing or other

appropriate listing venue, based on the track record of the Company

or business it acquires, subject to fulfilling the relevant

eligibility criteria at the time. If the Company is successful in

obtaining a Premium Listing, further rules will apply to the

Company under the Listing Rules and Disclosure Guidance and

Transparency Rules and the Company will be obliged to comply or

explain any derogation from the UK Corporate Governance Code.

Upland Resources Limited

Directors' Report for the Year Ended 30 June 2020

(continued)

Internal control and risk management

The Board has the ultimate responsibility for the Group's

internal control and risk management. The Board monitors internal

controls and risk management systems on an annual basis. The Group

has established a system of control and risk management involving

an appropriate degree of oversight by the Board.

The management, via the Board of Directors and board meetings,

provide the Board with updates of risk and uncertainties facing the

Group and accompanying actions to mitigate such risks. The Board is

satisfied with the appropriateness of the risk management framework

which provides for the identification and management of risk

factors by management and non-executive Directors.

As the Group expands, the Board will ensure that the Group's

control and risk management process is regularly reviewed and

updated as the Board deems necessary.

Going concern

The Directors have acknowledged the latest guidance on going

concern from the Financial Reporting Council (FRC). The Directors

regularly review the performance of the Group to ensure that they

are able to react on a timely basis to opportunities and issues as

they arise.

The Directors have completed a final assessment of the Group's

financial resources, including forecasts. Based on this review, the

Directors believe that the Group is in a position to manage its

business risks successfully within the expected economic

outlook.

After making suitable enquiries, and taking into consideration

the potential uncertainties of COVID 19, the Directors have formed

a judgement at the time of approving the financial statements that

there is a reasonable expectation that the Group will have adequate

resources to continue in operational existence for a period of at

least twelve months from the date of approval of the financial

statements. Accordingly, they continue to adopt the going concern

basis in preparing the financial statements.

Disclosure of information to the auditors

The directors of the Company who held office at the date of the

approval of this Annual Report as set out above confirm that:

-- so far as they are aware, there is no relevant audit

information (information needed by the Company's auditors in

connection with preparing their report) of which the Company's

auditors are unaware, and

-- they have taken all the steps that they ought to have taken

as directors in order to make themselves aware of any relevant

audit information and to establish that the Company's auditors are

aware of that information.

Approved by the Board on 29 October 2020 and signed on its

behalf by:

.........................................

B B H Di

Chairman

Upland Resources Limited

Statement of Directors' Responsibilities

The directors are required by the Companies (Jersey) Law 1991,

to prepare the financial statements for each financial year which

give a true and fair view of the state of affairs of the Company as

at the end of the financial year and of the loss of the company for

that period.

The directors are responsible for preparing the financial

statements in accordance with International Financial Reporting

Standards ('IFRS') as adopted by the European Union and Disclosure

and Transparency Rules of the United Kingdom's Financial Conduct

Authority ('DTR'). The directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and of the profit or loss

of the Group for that period. In preparing these financial

statements, the directors are required to:

-- select suitable accounting policies and apply them consistently;

-- make judgements and accounting estimates that are reasonable

and prudent;

-- state whether they have been prepared in accordance with IFRSs

as adopted by the European Union, subject to any material

departures disclosed and explained in the financial statements;

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Group will

continue in business.

The directors are responsible for keeping proper accounting

records that are sufficient to show and explain the Group's

transactions and disclose with reasonable accuracy at any time the

financial position of the Group and enable them to ensure that the

financial statements comply with all applicable legislation and, as

regards the Group financial statements. They are also responsible

for safeguarding the assets of the Group and hence for taking

reasonable steps for the prevention and detection of fraud and

other irregularities.

The directors are responsible for the maintenance and integrity

of the corporate and financial information included on the Group's

website. The work carried out by the auditors does not involve the

consideration of these matters and, accordingly, the auditors

accept no responsibility for any changes that may have occurred in

the accounts since they were initially presented on the website.

Legislation in the United Kingdom governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

The directors confirm that to the best of their knowledge the

financial statements, prepared in accordance with the relevant

financial reporting framework, give a true and fair view of the

assets, liabilities, financial position and profit or loss of the

Group and the undertakings included in the consolidation taken as a

whole; the strategic report includes a fair review of the

development and performance of the business and the position of the

Group and the undertakings included in the consolidation taken as a

whole, together with a description of the principal risks and

uncertainties they face; and the annual report and financial

statements, taken as a whole, are fair, balanced and understandable

and provide the information necessary for shareholders to assess

the Group's position, performance, business model and strategy.

This responsibility statement was approved by the Board on 29

October 2020 and signed on its behalf by:

...................................

B B H Di

Chairman

Upland Resources Limited

Independent Auditor's Report to the Members of Upland Resources

Limited

Opinion

We have audited the financial statements of Upland Resources

Limited (the 'parent company') and its subsidiaries (the 'Group')

for the year ended 30 June 2020 which comprise the consolidated

statement of comprehensive income, the consolidated statement of

financial position, the consolidated statement of changes in

equity, the consolidated statement of cash flows, and notes to the

financial statements, including a summary of significant accounting

policies. The financial reporting framework that has been applied

in their preparation is applicable law and International Financial

Reporting Standards (IFRSs) as adopted by the European Union.

In our opinion, the financial statements:

-- give a true and fair view of the state of the Group's affairs

as at 30 June 2020 and of its loss for the year then ended;

-- have been properly prepared in accordance with International

Financial Reporting Standards as adopted by the European Union;

-- have been properly prepared in accordance with the

requirements of the Companies (Jersey) Law 1991.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report. We are independent of the Group

in accordance with the ethical requirements that are relevant to

our audit of the financial statements in the UK, including the

FRC's Ethical Standard, and we have fulfilled our other ethical

responsibilities in accordance with these requirements. We believe

that the audit evidence we have obtained is sufficient and

appropriate to provide a basis for our opinion.

Material uncertainty relating to going concern

We draw attention to note 2 to the financial statements, which

details the factors the Group has considered when assessing the

going concern position. As detailed in note 2, the Group raises

funding from time to time to finance its exploration and ongoing

administrative activities. There is no guarantee that the required

funds will be raised within the necessary timeframe. The

uncertainty surrounding the availability of funds to finance its

activities indicates the existence of a material uncertainty that

may cast significant doubt on the Group's ability to continue as a

going concern. Our opinion is not modified in respect of this

matter.

Overview of our audit approach

Materiality

In planning and performing our audit we applied the concept of

materiality. An item is considered material if it could reasonably

be expected to change the economic decisions of a user of the

financial statements. We used the concept of materiality to both

focus our testing and to evaluate the impact of misstatements

identified.

Upland Resources Limited

Independent Auditor's Report to the Members of Upland Resources

Limited (continued)

Based on our professional judgement, we determined overall

materiality for the financial statements as a whole to be GBP36,000

(FY2019 GBP74,000). Given the assets were impaired last year, it

was considered appropriate to base this on an 5% measure of

operating result. The materiality is rounded to nearest

thousand.

We use a different level of materiality ('performance

materiality') to determine the extent of our testing for the audit

of the financial statements. Performance materiality is set based

on the audit materiality as adjusted for the judgements made as to

the entity risk and our evaluation of the specific risk of each

audit area having regard to the internal control environment.

Where considered appropriate performance materiality may be

reduced to a lower level, such as, for related party transactions

and directors' remuneration.

We agreed with the Audit Committee to report to it all

identified errors in excess of GBP3,000 (FY2019: GBP5,000). Errors

below that threshold would also be reported to it if, in our

opinion as auditor, disclosure was required on qualitative

grounds.

Overview of the scope of our audit

The Group's accounting function is outsourced to an accounting

organisation in the UK which directly reports to Directors. In

establishing the overall approach to the Group audit, we determined

the work that needed to be performed by us. All group companies

were within the scope of our audit testing.

Key Audit Matters

Key audit matters are those matters that, in our professional

judgement, were of most significance in our audit of the financial

statements of the current period and include the most significant

assessed risks of material misstatement (whether or not due to

fraud) that we identified. These matters included those which had

the greatest effect on: the overall audit strategy, the allocation

of resources in the audit; and directing the efforts of the

engagement team. These matters were addressed in the context of our

audit of the financial statements as a whole, and in forming our

opinion thereon, and we do not provide a separate opinion on these

matters.

A description of each key audit matter and how it was addressed

by our audit is as follows. This is not a complete list of all

risks identified by our audit.

Valuation of exploration and evaluation assets

The carrying value of these assets could be in excess of their

recoverable amount and hence an impairment charge may be required

and the amounts involved could be material.

We reviewed management's consideration of impairment triggers as

set out in IFRS 6 in relation to this assessment, as well as

validating the results of testing. We considered the adequacy of

the disclosures in respect of risks and significant judgements in

these areas.

Our audit procedures in relation to these matters were designed

in the context of our audit opinion as a whole. They were not

designed to enable us to express an opinion on these matters

individually and we express no such opinion.

Upland Resources Limited

Independent Auditor's Report to the Members of Upland Resources

Limited (continued)

Other information

The directors are responsible for the other information. The

other information comprises the information included in the annual

report, other than the financial statements and our auditor's

report thereon. Our opinion on the financial statements does not

cover the other information and we do not express any form of

assurance conclusion thereon.

In connection with our audit of the financial statements, our

responsibility is to read the other information and, in doing so,

consider whether the other information is materially inconsistent

with the financial statements or our knowledge obtained in the

audit or otherwise appears to be materially misstated. If we

identify such material inconsistencies or apparent material

misstatements, we are required to determine whether there is a

material misstatement in the financial statements or a material

misstatement of the other information. If, based on the work we

have performed, we conclude that there is a material misstatement

of this other information, we are required to report that fact.

We have nothing to report in this regard.

Matters on which we are required to report by exception

We have nothing to report to you in respect of the following

matters where the Companies (Jersey) Law 1991 requires us to report

to you if, in our opinion:

-- proper accounting records have not been kept by the Company,

or proper returns adequate for our audit have not been received

from branches not visited by us; or

-- the parent company financial statements are not in agreement

with the accounting records and returns; or

-- we have not received all the information and explanations we require for our audit.

Responsibilities of the directors for the financial

statements

As explained more fully in the directors' responsibilities

statement (set out on page 12), the directors are responsible for

the preparation of the financial statements and for being satisfied

that they give a true and fair view, and for such internal control

as the directors determine is necessary to enable the preparation

of financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the financial statements, the directors are

responsible for assessing the Group's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the Group or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditor's report that includes our opinion. Reasonable assurance is

a high level of assurance, but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a

material misstatement when it exists. Misstatements can arise from

fraud or error and are considered material if, individually or in

the aggregate, they could reasonably be expected to influence the

economic decisions of users taken on the basis of these financial

statements.

We did not identify any key audit matters relating to

irregularities, including fraud. As in all of our audits, we also

addressed the risk of management override of controls, including

testing journals and evaluating whether there was evidence of bias

by the directors that represented a risk of material misstatement

due to fraud.

Upland Resources Limited

Independent Auditor's Report to the Members of Upland Resources

Limited (continued)

A further description of our responsibilities for the audit of

the financial statements is located on the Financial Reporting

Council's website at: www.frc.org.uk/auditorsresponsibilities .

This description forms part of our auditor's report.

Other matters which we are required to address

We were appointed by the audit committee on 29 October 2020 to

audit the financial statements for the period ending 30 June 2021.

Our total uninterrupted period of engagement is 3 years, covering

the periods ended 30 June 2018 to 2020.

The non-audit services prohibited by the FRC's Ethical Standard

were not provided to the Group and we remain independent of the

Group in conducting our audit.

Our audit opinion is consistent with the additional report to

the audit committee.

Use of our report

This report is made solely to the Company's members, as a body,

in accordance with Article 113A of the Companies (Jersey) Law 1991.

Our audit work has been undertaken so that we might state to the

Company's members those matters we are required to state to them in

an auditor's report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone other than the Company and the Company's members as a body,

for our audit work, for this report, or for the opinions we have

formed.

......................................

John Glasby (Senior Statutory Auditor)

For and on behalf of

Crowe U.K. LLP

Statutory Auditor

55 Ludgate Hill

London

EC4M 7JW

29 October 2020

Upland Resources Limited

Consolidated Statement of Comprehensive Income for the Year

Ended 30 June 2020

2020 2019

Note GBP GBP

Revenues - -

Exploration and evaluation expenditure (2,130) (36,476)

Intangible asset impairment 11 - (3,397,291)

Administrative expenses (717,234) (889,108)

--------- -----------

Operating loss 3 (719,364) (4,322,875)

Finance costs 4 - (71,630)

--------- -----------

Loss before tax (719,364) (4,394,505)

Taxation 5 - -

--------- -----------

Loss for the financial year (719,364) (4,394,505)

========= ===========

Total comprehensive expense for the

financial year (719,364) (4,394,505)

========= ===========

Loss attributable to:

Owners of the Company (719,364) (4,394,505)

========= ===========

Total comprehensive expense attributable

to:

Owners of the Company (719,364) (4,394,505)

========= ===========

Loss per share

Basic and diluted (GBP per share) 6(0.001) (0.008)

======= =======

The above results were derived from continuing operations.

Upland Resources Limited

Consolidated Statement of Financial Position as at 30 June

2020

2020 2019

Note GBP GBP

Non-current assets

Intangible assets 11 79,417 -

----------- -----------

Current assets

Trade and other receivables 13 11,541 104,082

Cash and cash equivalents 14 823,127 1,064,601

----------- -----------

834,668 1,168,683

----------- -----------

Total assets 914,085 1,168,683

=========== ===========

Equity and liabilities

Stated capital 17 7,989,832 7,684,962

Retained earnings (7,450,830) (6,731,466)

----------- -----------

Total equity 539,002 953,496

Current liabilities

Trade and other payables 15 375,083 215,187

----------- -----------

Total equity and liabilities 914,085 1,168,683

=========== ===========

These financial statements were approved and authorised for

issue by the Board on 29 October 2020 and signed on its behalf

by:

.........................................

J E S King

Director

Upland Resources Limited

Consolidated Statement of Changes in Equity for the Year Ended

30 June 2020

Equity attributable to equity holders of the parent company

Stated capital Retained earnings Total equity

GBP GBP GBP

At 1 July 2019 7,684,962 (6,731,466) 953,496

Loss for the year and total

comprehensive income - (719,364) (719,364)

Transactions with shareholders

Issue of shares 332,370 - 332,370

Share issue costs (27,500) - (27,500)

At 30 June 2020 7,989,832 (7,450,830) 539,002

============== ================= ============

Stated capital Retained earnings Total equity

GBP GBP GBP

At 1 July 2018 7,619,962 (2,336,961) 5,283,001

Loss for the year and total

comprehensive income - (4,394,505) (4,394,505)

Transactions with shareholders

Issue of shares 65,000 - 65,000

At 30 June 2019 7,684,962 (6,731,466) 953,496

============== ================= ============

Upland Resources Limited

Consolidated Statement of Cash Flows for the Year Ended 30 June

2020

2020 2019

Note GBP GBP

Cash flows from operating activities

Loss from operations for the year (719,364) (4,322,875)

Adjustments to cash flows from non-cash

items:

Impairment of intangible assets 11 - 3,397,291

Operating cash flows before working

capital movements (719,364) (925,584)

Decrease/(increase) in trade and

other receivables 92,541 (36,442)

Increase in trade and other payables 151,399 52,275

--------- -----------

Net cash flow used in operating

activities (475,424) (909,751)

--------- -----------

Cash flows from investing activities

Expenditures incurred on exploration

and evaluation assets (70,920) (3,127,499)

--------- -----------

Net cash flow used in investing

activities (70,920) (3,127,499)

--------- -----------

Cash flows from financing activities

Proceeds from issue of ordinary

shares, net of issue costs 17 304,870 2,928,131

Net cash flow from financing activities 304,870 2,928,131

--------- -----------

Net decrease in cash and cash equivalents (241,474) (1,109,119)

Cash and cash equivalents at beginning

of period 14 1,064,601 2,173,720

--------- -----------

Cash and cash equivalents at end

of period 14 823,127 1,064,601

========= ===========

The movements in liabilities arising from financing activities

are included within the statement of cash flow .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLFEDIALAFII

(END) Dow Jones Newswires

October 30, 2020 03:00 ET (07:00 GMT)

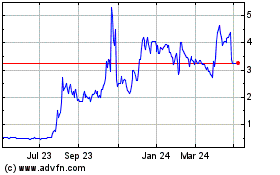

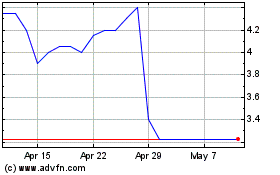

Upland Resources (LSE:UPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Upland Resources (LSE:UPL)

Historical Stock Chart

From Apr 2023 to Apr 2024