URU Metals Limited Disposal of the Company's Zebediela Nickel Project (6426G)

July 27 2021 - 7:42AM

UK Regulatory

TIDMURU

RNS Number : 6426G

URU Metals Limited

27 July 2021

27 July 2021

URU Metals Limited

("URU" or "the Company")

Disposal of the Company's Zebediela Nickel Project

URU Metals Limited (AIM: URU) is pleased to announce that Blue

Rhino Capital Corp ("Blue Rhino") has received conditional

acceptance from the TSX Venture Exchange (the "TSX-V") for its

proposed qualifying transaction, being the acquisition of the

Zebediela Nickel Company (Pty) Ltd. ("ZEB"), a wholly owned

subsidiary of URU (the "Transaction").

Pursuant to the Transaction, Blue Rhino will consolidate its

share capital on a 2.3-for-1 basis (the "Consolidation"), following

which it will issue 41,000,000 post-Consolidation common shares

(the "Common Shares") to URU, in consideration for all of the

outstanding share capital of ZEB. Blue Rhino will also assume all

ongoing liabilities and obligations of ZEB, which will include a

2.5% royalty on all revenue generated from the Zebediela Nickel

Project (the "Project"), a mining right application located in the

Limpopo Province in the Republic of South Africa, near the platinum

mining town of Mokopane (the "Royalty"). One percent of the Royalty

can be purchased for a one-time cash payment of US$2,000,000.

Following completion of the Transaction, it is anticipated that

Blue Rhino will change its name to "ZEB Nickel Corp." and it is the

intention of Blue Rhino will continue to carry on the business of

ZEB.

The completion of the Transaction is subject to a number of

conditions, including, but not limited to, receipt of all required

regulatory approvals, including final TSX-V acceptance and

satisfaction of other customary closing conditions. Assuming all

conditions are satisfied, closing of the Transaction is expected to

occur on or about 30 July 2021. The trading symbol of Blue Rhino /

ZEB Nickel Corp will be "ZBNI".

In connection with closing of the Transaction, and due to a high

level of interest, Blue Rhino has decided to increase the size of

its previously announced non-brokered private placement (the

"Concurrent Financing"). The Concurrent Financing will now be for

up to 11,200,000 subscription receipts (each, a "Receipt") at a

price of $0.25 per Receipt for aggregate gross proceeds of

C$2,800,000. All other terms will remain as previously announced by

the Company in its news release dated 3 March 2021.

Mr. Richard Montjoie, a senior employee of URU, will join the

board of Blue Rhino / ZEB Nickel Corp.

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014, incorporated into UK law by the

European Union (Withdrawal) Act 2018 until the release of this

announcement.

For further information, please contact:

URU Metals Limited

John Zorbas

(Chief Executive Officer)

+1 416 504 3978

SP Angel Corporate Finance LLP

(Nominated Adviser and Broker)

Ewan Leggat / Charlie Bouverat

+ 44 (0) 203 470 0470

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISPPUBWMUPGGPM

(END) Dow Jones Newswires

July 27, 2021 08:42 ET (12:42 GMT)

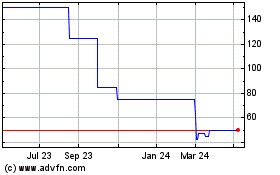

Uru Metals (LSE:URU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uru Metals (LSE:URU)

Historical Stock Chart

From Apr 2023 to Apr 2024