TIDMVEL

RNS Number : 8329M

Velocity Composites PLC

26 January 2021

26 January 2021

VELOCITY COMPOSITES PLC

("Velocity", the "Company" or the "Group")

FINAL RESULTS FOR THE YEARED 31 OCTOBER 2020

Velocity Composites plc (AIM: VEL.L), the leading supplier of

advanced composite material kits, announces its audited results for

the year ended 31 October 2020 ("FY20").

Highlights

-- Revenue down at GBP13.6m (FY19: GBP24.3m) impacted by industry-wide effects of Covid-19

-- Gross margin decreased to 17.1% for FY20 (FY19: 21.7%) due to

provisions made for slow-moving stock reflecting significantly

reduced demand on existing contracts

-- Operating loss for FY20 of GBP3.1m (FY19: Loss GBP0.6m),

after charging GBP0.3m (FY19: GBP0.7m) of exceptional restructuring

costs

-- Adjusted EBITDA(*) loss for FY20 of GBP1.9m (FY19: Profit

GBP0.8m) due to significant reduction in sales demand of existing

contracts and time needed to right-size the business

accordingly

-- Cash at Bank at 31 October 2020 of GBP3.3m (FY19: GBP3.4m)

-- Confirmed extension of existing GBP2.0m Coronavirus Business

Interruption Loan (CBIL) term extended from 2 to 6 years (post

year-end)

-- Appointment of Margaret Amos as an Independent Non-Executive

Director and Chris Williams as Chief Financial Officer to the

Velocity Board

Andy Beaden, Chairman of Velocity, said:

"2020 was a uniquely challenging time for our industry, however,

we have used this period to right-size our own business, develop,

refocus our senior management team and consolidate our

relationships within the supply chain. This has been done

successfully and prepares Velocity well for recovery when the

sector begins to improve. The recovery will happen, but

realistically this will not be until 2022. Though top-line revenue

has been compressed, by the reduction in OEM build rates, we are

now securing new business and the long term value of our contracts

will grow significantly in the years ahead. The pipeline of new

opportunities also remains strong, with our existing customers

showing their commitment to Velocity's unique offering."

Summary & Outlook

It has been a challenging year for all in the aerospace sector,

including Velocity, but whilst 2020 has seen significant impact due

to Covid-19, it is with a cautious optimism we look to 2021, and

beyond, for signs of recovery. Since our last trading update, the

business has successfully completed the right-sizing of its cost

base in line with latest demand forecasts, whilst continuing its

new business focus and maintaining sufficient liquidity for the

foreseeable future.

Through a number of new initiatives the business has now reduced

the cost-base in line with a GBP13.5m turnover breakeven business

and is in a good position to take advantage of operational gearing

as recovery begins, though this is not expected until the second

half of 2021.

The new customer proposition is continuing to be rolled and is

being received very positively by both new and existing customers.

Our major customers have all expressed support through engaging in

new contract extensions and the opportunity for additional lines of

business, starting in 2021. We will be reporting on the progress of

these in the next few months. We remain on track to be achieving a

break-even position in adjusted-EBITDA(*) in the second half of

this new financial year, as announced in November 2020. As airline

travel returns, the industry then expects increases in production

rates going into 2022 and beyond, enabling the opportunity for

profitable growth at Velocity.

Velocity finishes the year with relatively strong liquidity.

With the final year end numbers reflecting a positive net cash

position, resulting from efforts to release cash from slow-moving

stock and, through extensive forecasting and scenario testing. Post

year-end we have also secured an extension to the term of the

existing GBP2.0m CBIL facility, from 2 to 6 years.

* Adjusted EBITDA defined as earnings before finance charges,

tax, amortisation, depreciation, impairment, share based payments

and exceptional restructuring costs. During the year the Group has

applied IFRS 16 using the modified retrospective approach and

therefore the comparative information has not been restated and

continues to be reported under IAS 17. In the adjusted EBITDA for

2019 the rent payments for those assets now accounted for as Right

of Use assets under IFRS 16 have been added back so that both years

can be compared. The rent payments are not significantly different

to the depreciation charge.

CHAIRMAN'S REPORT

We will all remember 2020 as a year of extraordinary events and

in the Aerospace industry it has been one of the most challenging

in living memory. For Velocity Composites plc, we entered the year

with the objectives of securing new business and developing our

strategy around being seen as the leading supplier of composite

kitting technology in our industry.

Despite the immense challenges, we have still advanced

significantly in developing a full package of solutions for the

composite aerospace sector around our core offering of Velocity

Resource Planning. This has led to us winning new business and

developing our relationships with the major composite aerospace

manufacturers.

The pandemic has resulted in significant reductions in the

manufacturing volumes of all civil aircraft frames by the primary

manufacturers Airbus and Boeing. The dramatic impact across the

airline industry has resulted in a series of lockdowns and

temporary plant closures forced upon our customers and resulted

directly to lower order levels for the Company. Revenues in the

second half of our financial year were GBP4.1m, compared to

GBP12.2m in H2 FY2019. As a result revenues for the full year were

GBP13.6m (FY2019: GBP24.3m).

In response to prevailing macro and industry conditions,

Velocity reacted swiftly to right size its business. In doing so,

we sadly had to reduce our staffing levels from 132 at the start of

the financial year to 70 by the end, and we utilised U.K.

government support packages. We have also focussed attention on

reducing inventory levels, working closely with both suppliers and

customers in this area. While this has resulted in an improvement

in working capital, the full benefit of the inventory reduction

process will be realised in 2021.

In anticipation of a sharp fall in sales, the Board has been

acutely focussed on ensuring that the Company maintained, and

continues to maintain, sufficient financial liquidity. In this

regard during the year we received support from our bank and the

U.K. Government through the Coronavirus Business Interruption Loan

scheme and secured GBP2.0m of new debt funding. This was repayable

over two years from July 2020, with repayments starting in August

2021, but with the continued uncertainty we have recently agreed to

extend this to a six year period. The interest cost is favourable

and covenants are minimal, with no cost to the Company in the first

year. The company also secured Government grants under the

Coronavirus Job Retention Scheme of GBP0.4m. This support, plus

cost reductions, utilisation of HMRC salary furlough credits and

inventory management, have meant we have controlled our cash

position. Even with the new debt, we have retained a net positive

cash position and expect to generate further cash through inventory

reduction in 2021.

As a result of the effects of the pandemic, customer and

Velocity shutdowns and some inventory obsolescence, the Company

recorded an adjusted EBITDA loss in the year of GBP1.9m. Further

details can be found in Note 4, with adjusted EBITDA being defined

as earnings before finance charges, taxation, depreciation,

amortisation, impairment, share-based payments and exceptional

restructuring costs. As we enter 2021, the level of these losses

has been narrowed, as a result of the cost reduction programme, and

the Board anticipates that going forward the Company will be EBITDA

break-even at FY2020 levels of revenues. Given the disruption in

early 2021, the realistic objective is for the Company to be EBITDA

breakeven by the second half of 2021. The Company is now highly

operationally geared, such that any significant recovery in

activity, even if only to below pre-pandemic levels, will have a

strong positive impact on future profitability.

The Board is making no rash assumptions as to the recovery of

build rates in the civil aircraft industry to pre-COVID levels, but

Velocity is fortunate to have been awarded a series of new

programmes with existing customers, who see our technology as a

contributor to greater cost efficiency and improved margins in

their own front end production processes. This new business, which

will take time to qualify and ramp up, is expected to result in a

significant improvement in sales for 2022 and beyond. It also means

when we eventually do see the upturn in primary aircraft production

rates, that upturn should push us above the pre-COVID sales levels.

We also continue to pursue a number of further new business

opportunities, including in the USA.

We have radically restructured our operations, with a focus on

Industry 4.0 technology and customer service, as well as changes to

our management team with the introduction of some new highly

skilled individuals, particularly strengthening our commercial and

financial functions. Colleagues have worked tirelessly in the

demanding period and our push towards being seen as a leading

engineering technology provider in our sector continues. This has

been funded via the EIS money raised at the IPO and everyone at

Velocity is energised by the exciting opportunities opening up for

the business.

During the period we were also pleased to welcome Margaret Amos

and Chris Williams to the Board. Margaret Amos brings with her

nearly 30 years aerospace and financial management expertise. She

has been appointed as our Audit Chair, along with supporting us in

governance and strategy Chris Williams, was appointed as the

Company's new permanent CFO in August 2020 and brings a diverse

range of systems and commercial finance skills.

In summary, the industry wide demand reductions are

disappointing, but with the prudent financial management and

strategic re-alignment, we remain very confident of the long-term

prospects. The business has gone through a major restructuring and

is leaner than before, but better skilled for the future demands in

our industry.

The Board is, and I am personally, extremely proud of Velocity's

employees and the dedication they have shown throughout 2020 and

the Company remains grateful for the ongoing support and backing

received by customers and suppliers during the year.

CEO REPORT

Market

The civil aerospace industry has gone through a large amount of

uncertainty over the past 10 months as the immediate and severe

effects on global flight schedules caused both Airbus and Boeing to

reduce aircraft production rates to minimal levels as the long-term

effects were understood. This in turn was replicated at the

customers of Velocity as they adjusted the production rates of

their sub-assemblies and the associated supply chains.

Both Airbus and Boeing publish detailed market outlook forecasts

annually, usually with clear correlations between the two

companies:

Airbus -

www.airbus.com/aircraft/market/global-market-forecast

Boeing -

www.boeing.com/commercial/market/commercial-market-outlook

At the time of writing only Boeing has updated its forecast

taking into account COVID-19 effects, with both companies expecting

to publish detailed updates by summer 2021. From this intermediate

report it is clear that despite the picture remaining dynamic and

the unprecedented disruption to the industry, the long-term growth

drivers and fundamentals for air travel remain. In support of this,

Boeing sets out a three-stage outlook for near term, medium term

and long term recovery and growth:

Near Term: Demand Focused on Fleet Renewal

Over the last decade, growth in passenger air travel averaged

6.5% per year, well above the long-term average of 5%. In this

business environment, many of the world's airlines grew their

fleets through deliveries of new airplanes and often delayed

airplane retirements to accommodate passenger demand.

The current downturn is likely to lead to the replacement of

many older passenger airplanes. This accelerated replacement cycle

will position airlines for the future by improving the efficiency

and sustainability of today's fleet.

Medium Term: Aviation Has Proven Resilient

While aviation has seen periodic demand shocks since the

beginning of the Jet Age, our industry has recovered from these

downturns every time. Boeing currently believe it will likely take

about three years for air travel to return to 2019 levels, and it

will be a few years beyond that for the industry to return to

long-term growth trends. Aviation remains an integral part of

transportation systems around the world. The maturation of many

emerging market economies will further increase consumer spending's

share of economic activity, bolstering demand for air travel. In

addition, coming out of every crisis, the industry has innovated by

improving service and value for the traveling public.

Long Term: Emphasis on Fleet Versatility

The current market disruption will shape airline fleet

strategies long into the future as airlines make decisions to renew

their fleets and resume growth. Airlines will focus on building

versatile fleets that provide future network flexibility,

maximizing capability while minimizing risk, and improving

efficiency and sustainability as the industry moves towards

de-carbonises by electrification and hydrogen power.

What this means for Velocity is that production rates are

expected to recover over the next 3 years, led by single aisle

platforms (A220, A320, B737) followed by the newer twin aisle

platforms (A350, B777X, B787). Capacity has been lost due to the

early retirement of predominantly metallic airframes and so

airlines will be looking to replace these with newer, more fuel

efficient/sustainable aircraft which all utilise higher volumes of

composite materials, both now and with future hydrocarbon free

power technologies.

Regarding military platforms these have been less effected by

rate reductions as they are not subject to the same commercial

pressures. The outlook for both production rates and composite

content on these platforms remains strong.

Strategy

Taking the market forecasts into account the long-term

fundamentals of Velocity remain compelling, albeit subject to

short-term disruption caused by production rate demand reductions,

customer response to the demand reductions, travel restrictions for

business development and general uncertainty in the aerospace

market.

What the disruption has demonstrated is that despite the effects

of a global pandemic (i.e. immediate one year of flight groundings

followed by three years of production rate recovery) not being part

of industry planning, the procedures, manufacturing processes and

technology of Velocity facilitated an orderly and data driven

transition for all customers and suppliers through the disruption

in 2020. Once stabilised, the technology, IP and flexible service

offering of Velocity has also allowed for newer, more relevant

solutions to be developed for customers to help them reduce costs,

right-size and manage the disruption through their manufacturing

areas until production rates recover. This reaffirms the need of

Velocity to remain at the forefront of raw material management,

material utilisation and lean manufacturing integration, whilst

having the flexibility to adapt to how the customer wants to use

Velocity's IP to reduce their own costs. To this end Velocity will

utilise the disruption period to focus on the following:

- Continued investment in digital technology, utilising the

fully open Advanced Technology Centre on the Burnley, UK site, to

further develop in-house Industry 4.0 solutions around material

nesting, real time vision system process augmentation, real time

material resource planning technology (including AI), real time

tracking of all life-managed raw materials using cloud computing

and RFID, rapid prototyping using 3D scanning technology.

- The integration of the above technology into the in-house

developed "VRP System" managing all aspects of the company's

services.

- Development of alternative service models utilising the

licensing of the above technology for customers who want a more

phased adoption of Velocity's model. This would be controlled by

Velocity centrally, but deployed in a more flexible way to permit

new customers to transition to Velocity by the sub-licence of

Velocity technology and serviced without immediate resource

intensive changes to their operational set-up.

- Investigations, with Velocity's industry partners (both supply

chain and material suppliers), of alternative markets where the

above technology can be deployed e.g. wind energy, surface

transport, light weighting for electrification of road transport,

medical, personal urban air vehicles and unmanned air vehicles.

The above developments have been planned and budgeted as part of

the company's Integrated Business Plan for FY21. Recent headcount

changes were structured to protect business development and

technology development personnel and bring forward longer term

development plans into a focussed and targeted plan for FY21 to

deliver the above benefits.

It is expected that accelerated development and completion of

the above plans will assist in the potential new-business pipeline

of GBP50m over the next three financial years, by bringing further

benefits and flexibility to existing customers, whilst creating a

unique system of software tools, manufacturing technology and

digital solutions to meet the global need in the advanced

composites industry.

So much has changed in the world during the last year that

Velocity's annual report unsurprisingly reflects two very distinct

periods, being the period before the effects of COVID-19 became

globally apparent and the time since. The year started with two key

executive recruitment goals, to appoint both a new Customer

Programmes Director and full time CFO, the latter of which had

previously been filled (by Andrew Hebb) on an interim basis.

Despite the onset of the COVID-19 pandemic during these processes,

I am pleased to announce that both roles were filled by the

preferred candidates, with James Eastbury taking up the position of

Head of Customer Programmes in May 2020 and Chris Williams joining

as Chief Financial Officer in August 2020. Both James and Chris

bring significant and valuable skills and experience to their roles

as the Company meets the challenges of the COVID-19 pandemic and

plans for the recovery that will follow.

The year also started well in progressing the key strategic

targets of working with a focused number of key customers for new

business growth and utilising Velocity's technology to drive

further efficiencies in the composites supply chain. These targets,

however, were impacted by the onset of the COVID-19 pandemic, which

led to an immediate and unprecedented reduction in air travel, and

in turn, leading to the immediate reduction in aircraft production

rates and the associated reduction in demand seen by Velocity's

customers.

The response from Velocity was swift, based around the safety of

our staff and the need to align the raw material supply chain with

the new customer demand, inside of the usual extended lead times.

From the onset of the pandemic, and through the summer months, the

demand from customers was changing on a daily basis. Our industry

sought to respond to the unprecedented circumstances, and the work

to align the raw material supply chain with customer demand

involved considerable real time planning and dynamic scenario

modelling utilising Velocity's bespoke technology. During this

period customer manufacturing plants were also closed for several

intervals and at different times, as each customer utilised

furlough schemes to help with the reduced demand build rates. The

immediate reductions also lead to higher raw material stock levels

for material that was already purchased by the Company, including

stock positions put in place to mitigate any effects of Brexit

disruption. As such, the Company continues to work collaboratively

with customers to consume these stocks, whilst managing the wider

supply chain effects of the COVID-19 pandemic.

During this period of maximum disruption, I am pleased to report

that Velocity's sites remained open and responsive to customers

along with home working and utilising the furlough scheme. As

reported, the Company agreed terms for a GBP2.0m CBIL during this

period to provide further headroom as the disruption was better

understood. The term of this loan has since been extended post

year-end, from 2 to 6 years. As this period concluded, and the

longer term effects of the pandemic were better understood, it

became clearer that production rates would not recover in the

short-term and government intervention around furlough support was

limited in duration, so plans were enacted to right size both the

direct and indirect headcount of the business based on the current

demand, whilst protecting the delivery of products to current

customers and the ability of the business to progress and respond

to new business activities. Regrettably, this involved the

reduction in headcount from 132 to 70 and I would like to

personally thank all staff members involved in these difficult

decisions for dealing with this restructuring in a professional and

understanding way.

Looking forward there is still not a definitive picture around

aircraft production rate recovery as both Boeing and Airbus are

awaiting the return of air travel numbers before committing rates

to the market, communicated publicly in their Market Forecast

documents. Whilst there has been some recent exciting developments

around vaccines and airport testing the industry needs demand to

recover in air travel before this translates into new aircraft

sales and aircraft part production. What is widely accepted is that

single aisle rate recovery will be faster than twin aisle rate

recovery and so along with military applications the company

continues to review its new customer portfolio to target the higher

demand for its services.

During the year the government supported the company with the

Coronavirus Job Retention Grants of GBP0.4m, the company also

applied for a GBP2m Coronavirus Business Interruption Loan which

was received in July 2020.

The Company has also worked closely with its existing customers

to ensure that the service offering remains compelling during and

after the disruption and rate reductions. Clearly this is a

challenging time for the whole industry and customers have had to

revisit their entire industrial strategy as capacity created during

previous growth years becomes available due to rate reductions.

Significant work has been undertaken to work with customers to

align future service with the new requirements, utilising

Velocity's technology to identify enhanced efficiencies to assist

customers. This has resulted in an extended long-term agreement

with one key customer and additional packages of work with another.

Work continues with our third key customer as part of a planned

contract renewal exercise.

As the industry stabilises around the new production rates the

company has a revised strategy to emerge more resilient from the

unprecedented effects of the COVID-19 pandemic. Clearly like for

like sales of existing business has been significantly reduced and

so our priority in FY21 is to continue the cost reductions and new

business growth to return the business to profit during the second

half of the year. The company is still working through a new

business sales opportunity pipeline of GBP50m over the next three

financial years, and utilising our technology, proven service

levels and geared operational capacity we expect the new

proposition process to form an important part of our customers

response to the new production rates.

The Company has also accelerated activities to utilise our

industry partners in both Europe and North America to investigate

new composite markets where our technology can be applied, for

example ground transportation, urban air vehicles, wind energy,

hydrogen power and military and transport electrification. As part

of this, the Velocity model will be developed to enable our

technology to be licensed or deployed internally at new customers

to accelerate the adoption in a cash light way.

Whilst their appears to be a roadmap to undo the physical

restrictions of the COVID-19 pandemic, the effects, particularly in

aerospace, will be felt for several years to come. At Velocity, the

team are focused on dealing with those immediate effects, ensuring

the long term sustainability of the business whilst adapting our

technology and offering to meet the continued needs of our

customers.

FINANCIAL REVIEW

Statement of Comprehensive Income

Revenue for FY20 has understandably been impacted significantly

by the impact of COVID-19, as has the wider Aerospace sectors. We

have remained operational throughout the period, but with

intermittent customer shutdowns and heavily reduced underlying

demand on existing programmes, we have finished the period with

sales 44% lower year-on-year at GBP13.6m (FY19: GBP24.3m) and had

to adjust the business accordingly.

This sales decline was nearly all attributable to the last 7

months of the year, as the pandemic hit hard across the industry.

As a result, sales for the first 5 months of the year were in-line

with management's expectations at GBP8.7m and continuing to display

healthy demand. From March 2020 however, underlying aircraft

production rates dropped significantly, flowing directly through

into our demand with sales of GBP4.9m in the final 7 months.

International sales and expansion has also paused over this period

as international borders were closed and business commuting

restricted, though the business is in a positive position to

continue this once travel is once again permitted.

Whilst this position has picked up to some extent in the final

months of the year, we expect underlying volumes with existing

programmes to remain suppressed into FY21 and starting to recover

in FY22 and beyond. In addition, the business continues to seek out

new contracts to deliver some of the identified pipeline

opportunities.

The gross margin has declined to 17.1% (FY19: 21.7%), but this

has been driven by one-off stock provisions reflecting a prudent

stance regarding slow-moving stock caused by the disruption in the

supply chain. Excluding these, the margin is in line with

management's expectations given the movement in sales mix during

the year. Year-on-year overheads have significantly reduced and the

full-year-effect of management's right-sizing efforts will be seen

as we go into FY21. This, combined with a strong pipeline of sales

will enable Velocity to positively leverage its high operational

gearing from H2 FY21 going into FY22 and beyond.

As explained above, increased stock provisions required for

slow-moving stock have reduced our overall gross margin to 17.1%

(FY19: 21.7%). Discussions are ongoing with customers to resolve

these, but with high uncertainty in the current climate, we have

taken a prudent position. Excluding the impact of slow-moving

stock, and despite the lower volumes, underlying gross margin was

in line with management's expectations, with a slight decline

reflecting our movement in sales mix. The gross margin can be

impacted by the mix between structural composite materials and

lower cost process materials, which is 2020 led to a slightly

negative margin impact.

The government supported the company with the Coronavirus Job

Retention Grants of GBP0.4m, the company received a GBP2m

Coronavirus Business Interruption Loan in July 2020.

Administrative expenses (excluding depreciation and share based

payments) for the year have decreased by GBP0.4m to GBP4.3m (FY19:

GBP4.7m) as the business has right-sized its cost base with the

latest demand forecast. Despite utilising the government furlough

scheme, the business has needed to undertake two rounds of

restructuring. As a result people costs have reduced by GBP0.8m in

the year with headcount being reduced 47% from 132 to 70. In

addition a Cost Improvement Plan has been successfully implemented,

bringing the overhead cost-base of the business down to a GBP13.5m

sales revenue breakeven sales level. Further cost reductions plans

are ongoing into FY21 to continue the work done in this area.

The Company has benefitted from being 70% naturally hedged from

both US Dollar and Euro foreign exchange movements, with both

revenues and direct material purchases now being aligned

contractually into the same currency where applicable.

On a consistent basis with last year, adjusted EBITDA amounted

to a GBP(1.9)m loss for the year (FY19: GBP0.8m profit). This

excludes share-based payments and exceptional administrative costs

relating to restructuring in response to the pandemic. The adjusted

EBITDA has been impacted adversely by the dramatic sales fall,

combined by some one-off costs in inventory valuation. The

restructuring benefits will start to show through in the first part

of 2021, with the full benefit seen by the second half of 2021.

Adjusted EBITDA(1)

31 October 31 October

2020 2019

Reconciliation from Operating Loss GBP'000 GBP'000

----------- -----------

Operating Loss (3,149) (594)

Add back:

Share-based payments 120 66

Depreciation & Amortisation 445 431

Impairment of Intangible assets 72 18

Depreciation on Right of Use assets under

IFRS 16 (equivalent

2019 rent payments) 246 221

Exceptional Administrative costs 341 692

Adjusted EBITDA(1) (1,925) 834

=========== ===========

(1) Adjusted EBITDA defined as earnings before finance charges,

tax, amortisation, depreciation, impairment, share based payments,

exceptional restructuring costs. During the year the Group has

applied IFRS 16 using the modified retrospective approach and

therefore the comparative information has not been restated and

continues to be reported under IAS 17. In the adjusted EBITDA for

2019 the rent payments for those assets now accounted for as Right

of Use assets under IFRS 16 have been added back so that both years

can be compared. The rent payments are not significantly different

to the depreciation charge.

Cashflow and Capital Investment

The year-end cash and cash equivalents reduced by GBP0.1m to

GBP3.3m (FY19: GBP3.4m). Cash utilised from operations of GBP(0.8)m

(FY19: GBP0.3m) in the year was driven by the GBP(1.9)m EBITDA

offset partly by GBP1.3m favourable working capital position as the

business right-sized. Cash used in Investing Activities of

GBP(2.4)m (FY19: GBP(0.2)m) primarily related to the capitalisation

of Right Of Use (leased) assets (GBP1.4m) as well as property,

plant and equipment as the new business premises and Technology

R&D centre were completed. Financing activities generated GBP3m

over the period (FY19: GBP(0.8)m) with the benefit of the GBP2.0m

CBIL facility agreed during the year, offset by GBP(0.5)m payments

towards Hire Purchase commitments and Invoice Discounting

arrangements. The Invoice Discounting facility was not being

utilised at 31 October 2020.

The cash balance at 31 October 2020 of GBP3.3m includes GBP2.0m

Coronavirus Business Interruption Loan (CBIL) proceeds and GBP0.7m

remaining EIS funds to be utilised in establishing a production

facility in the USA and to invest further in developing our

mainland European activities when international travel resumes. Our

focussed stock reduction programme is expected to yield additional

cash upside as we continue through FY21.

Despite the loss in the year, the business remains in a net cash

position at year end, with GBP0.9m net cash (FY19: GBP3.1m). This

includes Cash at bank, EIS, and CBIL proceeds offset by the

outstanding CBIL balance and hire purchase liabilities.

Year ended Year ended

31 October 31 October

2020 2019

GBP'000 GBP'000

------------ ------------

Cash 3,264 3,424

Cash Loans (excluding right to use assets):

CBIL Loan (2,000) -

Hire Purchase (358) (290)

Invoice discounting facility 2 (4)

Net Cash/(Debt) (Note 1) 908 3,130

============ ============

Note 1: The net cash/(debt) calculation is designed to explained

the level of financial debt, net of cash at bank. It does not

include the IFRS 16 presentation changes around property rental

agreements and similar short-term operating rental lease

agreements, where the rental liability and an equal asset right are

both now recognised for the contract life, on the balance

sheet.

Working capital

Inventory levels decreased at the year-end by GBP(1.3)m to

GBP1.9m (FY19: GBP3.2m) reflecting our increased stock provision

and additional stock reduction efforts in-year as underlying demand

has reduced.

Trade and other receivables reduced significantly during the

year by GBP1.7m to GBP2.5m as a result of the reduced sales and

continuing robust controls around debt collection improved monthly

routines to manage the collection of debts. Debtor days have

therefore decreased slightly to 44 days (FY19: 45 days).

Trade and other payables also reduced during the year by GBP1.7m

to GBP1.5m due to reduction in Trade Creditors of GBP1.7m as the

business utilises existing material stock.

Going concern

Under the current climate, Management have undergone a

significant level of cash flow forecasting and scenario modelling.

This work also supported the application for our CBIL and its

extension. Detailed financial projections for the following 24

month rolling period were prepared, and then extended annually for

a further 5 years. The Aerospace sector lends itself to this kind

of long-term planning due to the nature and length of customer

programmes, typically a minimum of 3 years, but often 5 years or

more. This has enabled the business to fully model the impact of

Covid-19 and the expected recovery period. Post year end the CBIL

facility term has been extended from 2 to 6 years to better reflect

the cash flow needs of the business and ongoing support from our

bank.

As the pandemic unfolded and continued to gather pace, our

initial forecasts illustrated the need for cost reductions to be

made, which unfortunately meant restructuring and several rounds of

redundancies, this has put the business once again on a stable

footing for FY21, with positive operational gearing to leverage

once growth resumes. Further scenario tests included losing major

customers, failure to utilise slow-moving stock under new demand

levels and not receiving additional CBIL support or extension of

terms. Even in the worst of these cases, with all three downside

scenarios happening, Management's mitigation plans, meant the

business could navigate the forecast period utilising its net cash

position and existing facilities, albeit with some shorter-term

decisions needed to be made. This recovery has been made possible

by a combination of existing contracts recovering to pre-COVID-19

run rates over the 5 to 7 year period, as well as new contracts

being won from the significant pipeline of opportunities being

targeted.

Continued monthly monitoring of this forecast model is ongoing

over a rolling 36 month period, with the business adopting a new

Integrated Business Planning approach in January 2021. As a result,

any departures from budget or future requirements for cash flow

will be identified early on. Key cash flow projects within this,

such as the stock reduction programme, have been flagged as

priorities in the Velocity strategy, with project leads, KPIs and

reporting mechanisms into the Board. Any gaps against forecast will

be caught in this process and a recovery plan put in place to

ensure delivery of results.

Having due regard to these projections and available cash at 31

October 2020 of GBP3.3m, an invoice discount facility where we can

borrow up to GBP5m dependent on debtor levels, and the continued

the support of our bank, customers and shareholders during these

difficult circumstances, it is the opinion of the Board that the

Group has adequate resources to continue to trade as a going

concern.

CONSOLIDATED STATEMENT OF TOTAL COMPREHENSIVE INCOME

Year ended Year ended

31 October 31 October

2020 2019

Note GBP'000 GBP'000

------------ ------------

Revenue 3 13,561 24,316

Cost of sales (11,237) (19,047)

------------ ------------

Gross profit 2,324 5,269

Administrative expenses excluding exceptional

costs (5,132) (5,177)

Exceptional administrative expenses (341) (692)

Other operating income - 6

Operating loss (3,149) (594)

------------------------------------------------ ----- ------------ ------------

Operating loss analysed as:

Adjusted EBITDA 4 (1,925) 834

Depreciation & Amortisation (445) (431)

Impairment of Intangible assets (72) (18)

Depreciation on Right of Use assets under (246) *(221)

IFRS 16 (equivalent

2019 rent payments)

Share based payments (120) (66)

Exceptional administrative expenses 5 (341) (692)

Finance income and expense (98) (58)

------------ ------------

Loss before tax from continuing operations (3,247) (652)

Income tax income 117 16

Loss for the period and total comprehensive

loss (3,130) (636)

============ ============

Loss per share - Basic (GBP) from continuing 6 (GBP0.08) (GBP0.02)

operations

============ ============

Loss per share - Diluted (GBP) from continuing 6 (GBP0.08) (GBP0.02)

operations

============ ============

There were no discontinued operations in the current or prior

period.

There is no other comprehensive income.

* The consolidated statement of total comprehensive income is

not restated but to aid comparability the alternative performance

measure adjusted EBITDA has been restated following implementation

of IFRS 16 for further details see Note 4.

CONSOLIDATED AND COMPANY STATEMENT OF FINANCIAL POSITION

Group Group Company Company

----------- ----------- ----------- -----------

31 October 31 October 31 October 31 October

2020 2019 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 167 318 167 318

Property, plant and equipment 1,723 1,061 1,723 1,061

Right-of-use assets 1,127 - 1,127 -

----------- ----------- ----------- -----------

Total non-current assets 3,017 1,379 3,017 1,379

----------- -----------

Current assets

Inventories 1,908 3,177 1,908 3,177

Trade and other receivables 2,464 4,149 2,490 4,178

Corporation tax - 75 - 75

Cash and cash equivalents 3,268 3,424 3,265 3,416

----------- ----------- ----------- -----------

Total current assets 7,640 10,825 7,663 10,846

-----------

Total assets 10,657 12,204 10,680 12,225

----------- ----------- -----------

Current liabilities

Loans 500 - 500 -

Trade and other payables 1,504 3,223 1,499 3,223

Grant income deferred - - - -

Net obligations under finance

leases 411 121 411 121

----------- ----------- ----------- -----------

Total current liabilities 2,415 3,344 2,410 3,344

----------- ----------- -----------

Non-current liabilities

Loans 1,500 - 1,500 -

Deferred tax liabilities - - - -

Net obligations under finance

leases 1,060 169 1,060 169

----------- ----------- ----------- -----------

Total non-current liabilities 2,560 169 2,560 169

-----------

Total liabilities 4,975 3,513 4,970 3,513

Net assets 5,682 8,691 5,710 8,712

Equity attributable to equity

holders of the company

Share capital 91 90 91 90

Share premium account 9,727 9,727 9,727 9,727

Share-based payments reserve 490 537 490 537

Retained earnings (4,626) (1,663) (4,598) (1,642)

----------- ----------- -----------

Total equity 5,682 8,691 5,710 8,712

=========== =========== =========== ===========

The Company has taken advantage of the exemption allowed under

section 408 of the Companies Act 2006 and not presented its own

statement of profit and loss in these financial statements. The

loss for the year was (GBP3,123,000).

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share-based

Share Share premium Retained payments Total

capital account earnings reserve equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- -------------- --------- ------------ --------

As at 31 October 2018 89 9,727 (1,091) 536 9,261

Loss for the year - - (636) - (636)

-------- -------------- --------- ------------ --------

89 9,727 (1,728) 536 8,624

-------- -------------- --------- ------------ --------

Transactions with shareholders:

Share-based payments - - - 66 66

Transfer of share option

reserve on vesting of

options and issue of equity 1 - 65 (65) 1

As at 31 October 2019 90 9,727 (1,663) 537 8,691

======== ============== ========= ============ ========

Share-based

Share Share premium Retained payments Total

capital account earnings reserve equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- -------------- --------- ------------ --------

As at 31 October 2019 90 9,727 (1,663) 537 8,691

Loss for the year - - (3,130) - (3,130)

-------- -------------- --------- ------------ --------

90 9,727 (4,793) 537 5,561

-------- -------------- --------- ------------ --------

Transactions with shareholders:

Share-based payments - - - 120 120

Transfer of share option

reserve on vesting of options

and issue of equity 1 - 167 (167) 1

As at 31 October 2020 91 9,727 (4,626) 490 5,682

======== ============== ========= ============ ========

COMPANY STATEMENT OF CHANGES IN EQUITY

Share-based

Share Share premium Retained payments Total

capital account earnings reserve equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- -------------- --------- ------------ --------

As at 31 October 2018 89 9,727 (1,062) 536 9,290

Loss for the year - - (645) - (645)

-------- -------------- --------- ------------ --------

89 9,727 (1,707) 536 8,645

-------- -------------- --------- ------------ --------

Transactions with shareholders:

Share-based payments - - - 66 66

Transfer of share option

reserve on vesting of options

and issue of equity 1 - 65 (65) 1

As at 31 October 2019 90 9,727 (1,642) 537 8,712

======== ============== ========= ============ ========

Share-based

Share Share premium Retained payments Total

capital account earnings reserve equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- -------------- --------- ------------ --------

As at 31 October 2019 90 9,727 (1,642) 537 8,712

Loss for the year - - (3,123) - (3,123)

-------- -------------- --------- ------------ --------

90 9,727 (4,765) 537 5,589

-------- -------------- --------- ------------ --------

Transactions with shareholders:

Share-based payments - - - 120 120

Transfer of share option

reserve on vesting of options

and issue of equity 1 - 167 (167) 1

As at 31 October 2020 91 9,727 (4,598) 490 5,710

======== ============== ========= ============ ========

CONSOLIDATED AND COMPANY STATEMENT OF CASH FLOWS

Group Group Company Company

------------ ------------ ------------ ------------

Year ended Year ended Year ended Year ended

31 October 31 October 31 October 31 October

2020 2019 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000

------------ ------------ ------------ ------------

Operating activities

Loss for the year (3,130) (636) (3,123) (645)

Taxation (117) (16) (117) (16)

Loss on disposal of assets - (11) - (11)

Finance costs 98 58 98 58

Amortisation of intangible assets 118 116 118 116

Impairment of Intangible assets 72 18 72 18

Depreciation of property, plant

and equipment 327 315 327 315

Depreciation of right to use assets 246 - 246 -

Share-based payments 120 65 120 65

Grant income amortisation - (6) - (6)

------------ ------------ ------------ ------------

Operating cash flows before movements

in working capital (2,266) (97) (2,259) (106)

Decrease in trade and other receivables 1,685 1,579 1,688 1,588

Decrease/(Increase) in inventories 1,269 (433) 1,269 (433)

Increase/(Decrease) in trade and

other payables (1,526) (1,363) (1,531) (1,363)

------------ ------------

Cash generated from operations (838) (314) (833) (314)

Income taxes received - 54 - 54

------------ ------------ ------------ ------------

Net cash (Outflow) from operating

activities (838) (260) (833) (260)

Investing activities

Purchase of property, plant and

equipment (991) (156) (991) (156)

Development expenditure capitalised (39) (89) (39) (89)

Proceeds from the sale of property,

plant and equipment 3 15 3 15

Net cash used in investing activities (1,027) (230) (1,027) (230)

Financing activities

Loan received 2,000 - 2,000 -

Finance lease proceeds 211 - 211 -

Finance costs paid (98) (58) (98) (58)

Increase/(Decrease) in invoice

discounting - (612) - (612)

Repayment of finance lease capital (404) (142) (404) (142)

Net cash generated from financing

activities 1,709 (812) 1,709 (812)

------------ ------------ ------------ ------------

Net (Decrease) in cash and cash

equivalents (156) (1,302) (151) (1,302)

Cash and cash equivalents at 01

November 3,424 4,726 3,416 4,718

------------ ------------ ------------ ------------

Cash and cash equivalents at 31

October 3,268 3,424 3,265 3,416

============ ============ ============ ============

Notes

1. General information

Velocity Composites Plc (the 'Company') is a public limited

company incorporated and domiciled in England and Wales. The

registered office of the Company is AMS Technology Park, Billington

Road, Burnley, Lancashire, BB11 5UB, United Kingdom. The registered

Company number is 06389233.

In order to prepare for future expansion in the Asia region, the

Company established a wholly owned subsidiary company, Velocity

Composites Sendirian Berhad, which is domiciled in Malaysia. The

subsidiary company commenced trading on 18 April 2018. The Company

also established a wholly owned subsidiary company, Velocity

Composites Aerospace Inc. to prepare for future expansion in the

United States of America. These subsidiaries together with Velocity

Composites plc, now forms the Velocity Composites Group ('the

Group').

The Group's principal activity is that of the sale of kits of

composite material and related products to the aerospace

industry.

2. Accounting policies

Basis of preparation

The financial statements have been prepared in compliance with

the measurement and recognition criteria of IFRS as adopted by the

European Union.

These financial statements have been prepared on a going concern

basis and using the historical cost convention, as modified by the

revaluation of certain items, as stated in the accounting policies.

These policies have been consistently applied to all periods

presented, unless otherwise stated. The financial statements are

presented in sterling and have been rounded to the nearest thousand

(GBP'000).

The Company has taken advantage of the exemption allowed under

section 408 of the Companies Act 2006 and not presented its own

statement of profit and loss in these financial statements.

Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and its subsidiary undertakings made up

to 31 October 2020. Subsidiaries are consolidated from the date of

acquisition, using the purchase method (see "Business combinations"

below).

Where necessary, adjustments are made to the financial

statements of subsidiaries to bring the accounting policies used

into line with those used by the Group. The Group's subsidiaries

have prepared their statutory financial statements in accordance

with Adopted IFRS, as from 1 May 2015.

Subsidiaries are entities controlled by the Group. The Group

controls an entity when it is exposed to, or has rights to,

variable returns from its involvement with the entity and has the

ability to affect those returns through its power over the entity.

In assessing control, the Group takes into consideration potential

voting rights. The acquisition date is the date on which control is

transferred to the acquirer. The financial statements of

subsidiaries are included in the consolidated financial statements

from the date that control commences until the date that control

ceases.

Intra-group balances and transactions, and any unrealised income

and expenses arising from intra-group transactions, are eliminated.

Unrealised gains arising from transactions with equity-accounted

investees are eliminated against the investment to the extent of

the Group's interest in the investee. Unrealised losses are

eliminated in the same way as unrealised gains, but only to the

extent that there is no evidence of impairment.

New Standards adopted at 1 November 2019

IFRS 16 Accounting for leases has become applicable for the

current reporting period, and the Group had to change its

accounting policy as a result. The impact of the adoption of the

leasing standard and the new policies are disclosed below.

The accounting policies set out below have, unless otherwise

stated, been applied consistently to all periods presented in the

consolidated financial statements.

Going concern

Under the current climate and the business need for CBIL and

furlough support, Management have invested a lot of time during the

year in cash flow forecasting and scenario modelling. Detailed

financial projections for the following 24 month rolling period

were prepared, and then extended annually for a further 5 years.

The Aerospace sector lends itself to this kind of long term

planning due to the nature and length of customer programmes,

typically a minimum of 3 years, but often 5 years or more. This has

enabled the business to fully model the impact of Covid-19 and the

expected recovery period.

Initial forecasts illustrated the need for further cost

reduction, which unfortunately meant additional restructuring, but

has put the business once again on a stable footing for FY21, with

positive operational gearing to leverage once growth resumes.

Further scenario tests included losing major customers, failure to

utilise slow-moving stock under new demand levels and not receiving

CBIL support or extension of terms. Even in the worst of these

cases, with all three downside scenarios happening, Management's

mitigation plans, meant the business could navigate the forecast

period utilising its net cash position and existing facilities,

albeit with some shorter-term decisions needed to be made. This

recovery has been made possible by a combination of existing

contracts recovering to pre-COVID-19 run rates over the 5-7 year

period, as well as new contracts being won from the significant

pipeline of opportunities being targeted.

Continued monthly monitoring of this forecast model is ongoing

over a rolling 36 month period, with the business adopting the

latest Integrated Business Planning approach in January 2021. As a

result, any departures from budget or future requirements for cash

flow will be identified early on. Key cash flow projects within

this, such as the stock reduction programme, have been flagged as

key priorities in the Velocity strategy, with project leads, KPIs

and reporting mechanisms into Board. Any gaps against forecast will

be caught in this process and a recovery plan put in place to

ensure delivery of results.

Having due regard to these projections and available cash at 31

October 2020 of GBP3.3m, an invoice discount facility where we can

borrow up to GBP5m dependent on debtor levels, and continued the

support of our bank, customers and shareholders during these

difficult circumstances, it is the opinion of the Board that Group

has adequate resources to continue to trade as a going concern.

Changes in accounting policies

The Group has applied the following accounting standards and

amendments for the first time for their annual reporting period

commencing on the 1 November 2019:

IFRS 16 'Leases'

The Group has applied IFRS 16 using the modified retrospective

approach and therefore the comparative information has not been

restated and continues to be reported under IAS 17. This note

explains the impact of the adoption of IFRS 16 on the Group's

financial statements and discloses the new accounting policies that

have been applied from 1 November 2019. The Group has adopted IFRS

16 retrospectively from 1 November 2019 but has not restated the

comparative for the 2019 reporting period, as permitted under the

specific transactional provisions in the standard. The

reclassifications and the adjustments arising from the new leasing

rules are therefore recognised in the opening balance sheet on 1

November 2019.

On adoption of IFRS, the Group recognised lease liabilities in

relation to leases which had previously been

Classified as 'operating leases' under the principles of IAS 17

Leases. These liabilities were measured at present value of the

remaining lease payments, discounted using the Group's incremental

borrowing rates as at 1 November 2019. The weighted average

incremental borrowing rate applied to the lease liabilities on 1

November 2019 was 5.2%. In applying IFRS 16 for the first time, the

Group has used the following practical expedients permitted by the

standard:

- the use of a single discount rate to a portfolio of leases

with reasonably similar characteristics

- reliance on the previous assessments on whether leases are onerous;

- the accounting of operating leases with a remaining lease term

of less than 12 months as at 1 November 2020 as short term

leases;

- the exclusion of initial direct costs for the measurement of

the right -of-use asset at the date of initial application; and

- the use of hindsight in determining the lease term where the

contract contains options to extend or terminate the lease.

Impact of transition to IFRS 16

On the transition date of 1 November 2019, the Group recognised

the following transactions:

GBP'000

Right of use assets:

Land and buildings 479

Motor Vehicles 13

--------

492

Lease liability (492)

Further recognition during the financial year of GBP885k related

to the addition of Unit 5 at the Burnley site.

The change in accounting policy affected the above items in the

balance sheet on 1 November 2020. The net impact on retained

earnings at 1 November 2020 was GBPNil. For the year ending 31

October 2020 operating lease rentals of GBP307k have been restated

as deprecation GBP246k and finance costs of GBP47k, EBITDA has

increased by GBP293k whereas profit before tax has reduced by

GBP47k.

Further analysis of the impact of IFRS 16 is provided in note

7.

Further recognition during the financial year of GBP885k related

to the addition of Unit 5 at the Burnley site.

There are no other IFRSs or IFRIC interpretations that are not

yet fully effective that could be expected to have a material

impact on the Group.

Revenue Recognition

From the 1 November 2019, the Group has applied IFRS 15 "Revenue

from Contracts with Customers". The new standard requires clear

identification of separate performance obligations and the revenue

associated with those obligations with each new contract entered

into is reviewed for consistency with the standard.

Revenue arises mainly from the sale of structural and consumable

materials for the use within the Aerospace industry.

To Determine whether to recognise revenue, the Group follows a

5-step process:

1 Identifying the contract with a customer

2 Identifying the performance obligations

3 Determining the transaction price

4 Allocating the transaction price to the performance obligations

5 Recognising revenue when/as performance obligations are satisfied

Performance obligations

Upon approval by the parties to a contract, the contract is

assessed to identify each promise to transfer a series of distinct

goods or services that are substantially the same and have the same

pattern of transfer to the customer. Goods and services are

distinct and accounted for as separate performance obligations in

the contract if the customer can benefit from them either on their

own or together with other resources that are readily available to

the customer and they are separately identifiable in the

contract.

The Group provides warranties to its customers to give them

assurance that its products and services will function in line with

agreed -- upon specifications. Warranties are not provided

separately and, therefore, do not represent separate performance

obligations

Recognition

Revenue is recognised as performance obligations are satisfied

as control of the goods and services is transferred to the

customer. Contracts are satisfied over a period of time, with the

dispatch of goods at a point in time. Revenue is therefore

recognised when control is transferred to the customer, which is

usually when legal title passes to the customer and the business

has the right to payment, for example, on delivery.

3. Segmental analysis

The Group supplies a single type of product into a single

industry and so has a single reportable segment. The Group's

subsidiary company, Velocity Composites Sendirian Berhad, is

located in Malaysia. Additional information is given regarding the

revenue receivable based on geographical location of the customer.

An analysis of revenue by geographical market is given below:

Year ended Year ended

31 October 31 October

2020 2019

GBP'000 GBP'000

------------ ------------

Revenue

United Kingdom 12,337 21,850

Europe 1,224 2,435

Rest of the World - 31

13,561 24,316

============ ============

During the year four customers accounted for 94.0% of the

Group's total revenue for the year ended 31 October 2020. This was

split as follows; Customer A - 43.6% (2019: 50.9%), Customer B -

27.2% (2019: 19.9%), Customer C - 12.9% (2019: 16.1%) and Customer

D - 10.3% (2019: 9.5%). The majority of revenue arises from the

sale of goods. Where engineering services form a part of revenue it

is only in support of the development or sale of the goods.

During the current and previous year, the Group operated in

Asia. No revenue was generated in Asia during the year ended 31

October 2020 and year ended 31 October 2019 as the site operates as

an Engineering Support Office for the Group.

4. Adjusted EBITDA

EBITDA is considered by the Board to be a useful alternative

performance measure reflecting the operational profitability of the

business. Adjusted EBITDA is defined as earnings before finance

charges, taxation, depreciation, amortisation, impairment,

share-based payments and exceptional restructuring costs.

Adjusted EBITDA 31 October 31 October

2020 2019

Reconciliation from Operating Profit GBP'000 GBP'000

----------- -----------

Operating Loss (3,149) (594)

Add back:

Share-based payments 120 66

Depreciation & Amortisation 445 431

Impairment of Intangible assets 72 18

Depreciation on Right of Use assets

under IFRS 16 (equivalent 2019 rent

payments) 246 *221

Exceptional Administrative costs 341 692

(1,925) 834

=========== ===========

* In the adjusted EBITDA for 2019 the rent payments for those

assets now accounted for as Right of Use assets under IFRS 16 have

been added back so that both years can be compared. The rent

payments are not significantly different to the depreciation

charge.

5. Exceptional administrative expenses

Year ended Year ended

31 October 31 October

2020 2019

GBP'000 GBP'000

------------------ ------------------

Restructuring costs 341 692

341 692

================== ==================

The exceptional items reported in 2020 GBP0.3m consist of cost

of restructuring and redundancy costs in the year due to COVID

-19.

Prior year costs GBP0.7m were in relation to the resignations

of the previous chairman and non-executive directors, settlement

of a dispute with the founding shareholders, and various other

associated costs relating to the restructuring of the board.

6. Loss per share

Year ended Year ended

31 October 31 October

2020 2019

GBP GBP

------------ ------------

Loss for the year (3,130,000) (636,000)

Shares Shares

------------ ------------

Weighted average number of shares in issue 35,995,289 35,860,652

Weighted average number of share options 2,143,440 587,101

------------ ------------

Weighted average number of shares (diluted) 38,138,729 36,447,753

Loss per share (GBP) (basic) (GBP0.08) (GBP0.02)

============ ============

Loss per share (GBP) (diluted) (GBP0.08) (GBP0.02)

============ ============

Share options have not been included in the diluted calculation

as they would be anti-dilutive with a loss being recognised.

7. Leases

In the current year, the Company adopted IFRS 16 and applied the

modified retrospective approach. The reclassifications and the

adjustments arising from the new leasing rules are therefore

recognised in the opening balance sheet on 1 November 2019.

Right-of-use-assets

Group and Company

Land and

property Motor Vehicles Total

GBP'000 GBP'000 GBP'000

---------- --------------- --------

Cost

Balance as at 1 November 2019 - - -

Adjustment on transition to IFRS

16 on 1 November 2019 479 9 488

Additions 885 - 885

Balance at 31 October 2020 1,364 9 1,373

Depreciation and amortisation

Balance as at 1 November 2019 - - -

Adjustment on transition to IFRS - - -

16 on 1 November 2019

Depreciation charge for the year 238 8 246

Balance at 31 October 2020 238 8 246

Net book value

At 31 October 2020 1,126 1 1,127

========== =============== ========

The associated right-of-use assets for property leases and other

assets were measured at the amount equal to the lease liability,

adjusted by the amount of any prepaid or accrued lease payments

relating to that lease recognised in the balance sheet as at 31

October 2020.

There is no impact on deferred tax. From the 1 November 2019,

the assets will be classified for capital allowances, with interest

based on a discount factor being allowable for corporation tax

purposes.

Right-of-use lease liabilities

GBP'000

At 1 November 2019 488

Repayment (307)

Additions to right-of-use assets in exchange for increased lease

liabilities

885

Other lease movements 47

At 31 October 2020 1,113

======

Land and Motor Vehicles Total

Analysis by length of liability property

GBP'000 GBP'000 GBP'000

---------- --------------- --------

Current 259 - 259

Non-current 854 - 854

Total 1,113 - 1,113

Number of right-to-use assets leased 5 2

Range of remaining term 1-10 years less than 1 year

Finance leases and right to use

The Group leases plant and equipment under finance leases which

are secured against the assets. Future lease payments are due as

follows these include the above split of right-of use lease

liabilities:

Minimum lease

payments Interest Present value

31 October 2019

Not later than one year 135 14 121

Later than one year and not later

than two years 123 13 110

Later than two years and not later

than five years 66 7 59

Later than five years - - -

-------------- --------- --------------

324 34 290

============== ========= ==============

31 October 2020

Not later than one year 480 69 411

Later than one year and not later

than two years 317 51 266

Later than two years and not later

than five years 899 105 794

Later than five years - - -

-------------- --------- --------------

1,696 225 1,471

============== ========= ==============

Operating leases

The Group leases motor vehicles and property, comprising both

offices and assembly space, under operating leases. The total value

of minimum lease payments due is payable as follows:

Group 31 October 31 October

2020 2019

GBP'000 GBP'000

----------- -----------

Motor vehicles

Not later than one year - 5

Later than one year and not later than two

years - 2

- 7

=========== =============

Land and buildings

Not later than one year 23 360

Later than one year and not later than two

years 4 360

Later than two years and not later than five

years - 443

Later than five years - 578

----------- -------------

27 1,741

=========== =============

Company 31 October 31 October

2020 2019

GBP'000 GBP'000

------------- -------------

Motor vehicles

Not later than one year - 5

Later than one year and not later than two

years - 2

- 7

============= =============

Land and buildings

Not later than one year 23 360

Later than one year and not later than two

years 4 360

Later than two years and not later than five

years - 443

Later than five years - 578

------------- -------------

27 1,741

============= =============

Operating leases not classed as right of use assets, relate to a

building security contract, all other prior year operating leases

have been classed as right-to-use asset on transition to IFRS

16.

8. Share capital

31 October 31 October

2020 2019

GBP GBP

----------- -----------

Share capital issued and fully paid

36,227,379 Ordinary shares of GBP0.0025 each 90,569 89,791

=========== ===========

Ordinary shares have a par value of 0.25p and an exercise price

of GBP0.39 as at 31 October 2020. They entitle the holder to

participate in dividends, and to share in the proceeds of winding

up the Company in proportion to the number of and amounts paid on

the shares held.

On a show of hands every holder of ordinary shares present at a

meeting in person or by proxy, is entitled to one vote, and upon a

poll each share is entitled to one vote. The Company does not have

a limited amount of authorised capital.

Options

Information relating to the Velocity Composites plc Employee

Option Plan, including details of options issued, exercised and

lapsed during the financial year and options outstanding at the end

of the reporting period, is set out in the Annual Report.

Nominal Number

Movements in share capital value of shares

GBP

Ordinary shares of GBP0.0025 each

At the beginning of the year 89,791 35,916,179

Exercising of share options 778 311,200

-------- -----------

Closing share capital at 31 October 2020 90,569 36,227,379

======== ===========

On 20 February 2020, the Company issued 70,000 new ordinary

shares of GBP0.0025 each to satisfy the exercise of options granted

under the Group's 2017 Share Option Scheme.

On the 15 September 2020, the company issued a further 241,200

new ordinary shares of GBP0.0025 each to satisfy the exercise of

options granted under the Group's 2017 Share Option Scheme.

9. Ultimate controlling party

The Directors do not consider there to be an ultimate

controlling party due to no individual party owning a majority

share in the Group.

10. Capital commitments

At 31 October 2020 the Group had GBPnil (2019: GBP445,369) of

capital commitments relating to the purchase of leasehold

improvements, plant and machinery and fixture and fittings.

11. Pension commitments

The Group makes contributions to defined contribution

stakeholder pension schemes. The contributions for the year of

GBP131,761 (2019: GBP115,654) were charged to the Consolidated

Income statement. Contributions outstanding at 31 October 2020 were

GBP22,142 (2019: GBP24,374).

12. Contingent liabilities

At 31 October 2020 the Group had in place bank guarantees of

GBPnil (2019: GBPnil) in respect of supplier trade accounts

13. Report & Accounts

This preliminary announcement, which has been agreed with the

auditors, was approved by the Board of Directors on 26 January

2021. It is not the Group's statutory accounts. Copies of the

Group's audited statutory accounts for the year ended 31 October

2020 will be available at the Company's website shortly and a

printed version will be despatched to shareholders on the 28

January 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DKPBBCBKDDDB

(END) Dow Jones Newswires

January 26, 2021 02:00 ET (07:00 GMT)

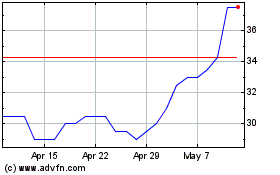

Velocity Composites (LSE:VEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Velocity Composites (LSE:VEL)

Historical Stock Chart

From Apr 2023 to Apr 2024