Vodafone: Vantage Towers Portfolio Has Increased, Reaffirms Targets Ahead of Vantage IPO

February 15 2021 - 2:05AM

Dow Jones News

By Joe Hoppe

Vodafone Group PLC said its Vantage Towers portfolio rose over

the first nine months of fiscal 2021 and reaffirmed its full year

targets, ahead of the planned spin-off of the European telecom

tower company.

The U.K. telecommunications group said Vantage Towers' portfolio

in the nine months ended Dec. 31 rose by 450 new macro sites to

82,000 macro sites, with a presence in 10 European markets. Around

1,400 new tenancies were added over the period, and new agreements

were signed with Eir and Three in Ireland, and Spanish industry

body AOTEC.

Vodafone said that in the first nine months, Vantage Towers'

revenue was 725 million euros ($878.7 million), while adjusted

earnings before interest, taxes, depreciation and amortization was

EUR620 million.

The company reaffirmed its fiscal 2021 targets for Vantage

Towers, including a recurring cash flow of EUR375 million-EUR385

million, and an adjusted Ebitda of EUR520 million-EUR530 million,

after adjusting to reflect accounting reassessments under

accounting standard IFRS 16.

Vodafone said Vantage Towers is on track for a total dividend

payout of EUR280 million for fiscal 2021.

Vodafone said on Feb. 3 that an initial public offering of

Vantage Towers is firmly on track for early 2021.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

February 15, 2021 02:50 ET (07:50 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

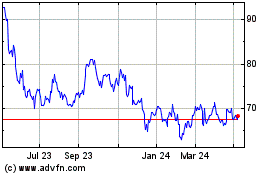

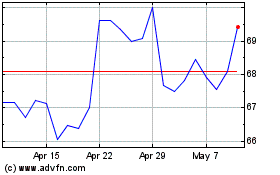

Vodafone (LSE:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vodafone (LSE:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024