Vodafone Seeks to Raise Up to $3.32 Billion in Vantage Towers IPO

March 09 2021 - 1:14AM

Dow Jones News

By Adria Calatayud

Vodafone Group PLC and its European towers unit, Vantage Towers

AG, on Tuesday set the price range for a planned initial public

offering of Vantage, in which shares worth up to EUR2.8 billion

($3.32 billion) will be offered.

Vantage said the price range for its planned IPO on the

Frankfurt Stock Exchange has been set at EUR22.50-EUR29 a share,

giving it a market capitalization of between EUR11.4 billion and

EUR14.7 billion.

Vodafone is targeting gross proceeds from a base offer of EUR2

billion from the sale of up to 88.9 million shares in Vantage,

which may be increased by up to EUR500 million by placing up to

22.2 million Vantage shares with investors, Vantage said.

Vodafone has also made available up to 13.3 million shares,

worth up to EUR300 million, to cover possible over-allotments,

taking the maximum size of the offer to EUR2.8 billion, Vantage

said.

Digital-infrastructure investor Digital Colony and

Singapore-based equity fund RRJ have committed to buying Vantage

shares worth EUR500 million and EUR450 million, respectively,

Vantage said.

Vantage said it won't receive any proceeds from the IPO. Trading

is expected to start on or around March 18, it said.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

March 09, 2021 01:59 ET (06:59 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

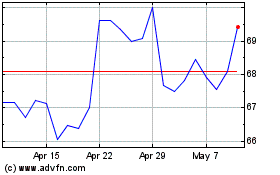

Vodafone (LSE:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

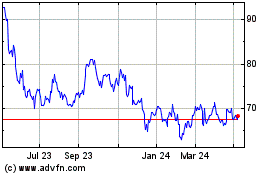

Vodafone (LSE:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024