TIDMWHI

RNS Number : 7512N

W.H. Ireland Group PLC

27 September 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR) as in force in

the United Kingdom pursuant to the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service (RIS), this inside information is now

considered to be in the public domain.

WH Ireland Group Plc

("WH Ireland" or the "Company" and with its subsidiaries the

"Group")

Financial Results for the Twelve Months ended 31 March 2023

Notice of AGM

WH Ireland announces its final results for the year ended 31

March 2023.

Financial & Operating Highlights

-- Revenue of GBP26.7m (FY 2022: GBP32.0m)

-- Underlying* loss before tax GBP2.0m (FY 2022: underlying profit before tax of GBP1.4m)

-- Statutory loss before tax GBP1.8m (FY 2022: profit before tax

GBP0.1m) reflecting impact of:

o Substantial fall in revenue as above

o Significant reduction in administration expenses to GBP27.6m

(FY 2022: GBP33.1m)

o Loss on investments of GBP2.7m (FY 2022: profit of

GBP1.6m)

o Significant VAT rebate in Wealth Management of GBP2.2m (FY

2022: nil)

-- Loss per share (basic) of 3.29p (FY 2022: profit of 0.13p)

-- Cash and cash equivalents as at 31 March 2023 of GBP4.2m (FY 2022: GBP6.4m)

o Cash and cash equivalents of GBP7.8m as at 22 September 2023,

ahead of the receipt of quarterly recurring cash from the Company's

platform providers (anticipated to be c. GBP2.5m), due

imminently

-- Group Assets under Management ("AUM") of GBP2.1bn (FY 2022: GBP2.4bn)

*A reconciliation from underlying profits to statutory profits

is shown within the financial review on page 8.

Divisional Highlights

Wealth Management:

-- Revenue of GBP14.4m (FY 2022: GBP15.8m), principally reflecting a fall in commission income

-- Returned to profitability during the year on an underlying and statutory basis

-- Continued improvement in the quality of the business with fee

income now representing 89% of total wealth management income (FY

2022: 85%)

-- Discretionary managed assets ("DFM") at GBP1.00bn (FY2022: GBP1.02bn)

-- Wealth Management total AUM at GBP1.4bn (FY2022: GBP1.6bn)

Capital Markets:

-- Revenue of GBP12.2m (FY 2022: GBP16.2m) reflecting

significant reduction in transaction fees, and despite increase in

retainer fees and commissions & trading income

-- GBP111m funds raised for public and private corporate clients (FY 2022: GBP236m)

-- Total equity transactions 25 (FY 2022: 38) reflecting very

challenging AIM market conditions

-- Won 18 new quoted corporate clients to end the year with 90

quoted corporate clients (FY 2022: 88)

-- Retained strong position as a top AIM broker: top three

ranking as corporate broker and top five as NOMAD

-- Ultra High Net Worth and Family Office AUM of GBP0.7bn (FY 2022: GBP0.7bn)

Current Trading and Outlook

-- Challenging first half due to the continuing very difficult market backdrop

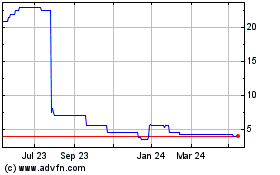

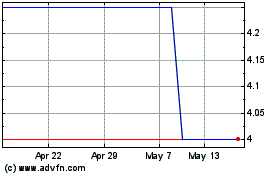

-- Successful GBP5m placing completed in August 2023 to restore regulatory capital position

-- Successful cost reduction exercise completed in September

2023 to reduce annualised costs by c.GBP3.8m

-- Stable platform to navigate challenging markets and to take

advantage of better market conditions in future

Commenting, Phillip Wale, Chief Executive Officer said:

"The market backdrop has been extremely challenging. While the

FTSE 100 was relatively resilient compared with overseas exchanges,

the AIM market fell 22% over the period and this severely impacted

transactional business (and particularly fundraisings) in our

Capital Markets business.

"Following the fundraise in July, we have a s table platform to

navigate challenging markets and to take advantage of better market

conditions in future. After significant first half losses, the

completion of our cost reduction programme gives us the opportunity

of returning to a break-even position in the remainder of the

financial year."

Annual General Meeting

The Company confirms that it will today post to shareholders the

annual report and accounts for the period ended 31 March 2023, and

a notice convening the annual general meeting of the Company. A

copy of the annual report and accounts along with the notice of AGM

is available on the Company's website www.whirelandplc.com . The

Annual General Meeting of the Company will be held at the Company's

offices at 24 Martin Lane, London EC4R 0DR on 24

October 2023 at 10.00 a.m .

For further information please contact:

WH Ireland Group plc www.whirelandplc.com

Phillip Wale, Chief Executive

Officer +44(0) 20 7220 1666

Canaccord Genuity Limited www.canaccordgenuity.com

Emma Gabriel / Harry Rees +44(0) 20 3523 8000

MHP Communications whireland@mhpgroup.com

Reg Hoare / Charles Hirst +44 (0) 20 3128 8193

Notes to Editors:

About WH Ireland Group plc

Wealth Management Division

WH Ireland provides independent financial planning advice and

discretionary investment management. Our goal is to build long

term, mutually beneficial, working relationships with our clients

so that they can make informed & effective choices about their

money and how it can support their lifestyle ambitions. We help

clients to build a long term financial plan and investment strategy

for them and their families.

Capital Markets Division

Our Capital Markets Division is specifically focused on the

public and private growth company marketplace. The team's

significant experience in this exciting segment means that we are

able to provide a specialist service to each of its respective

participants. For companies, we raise public and private growth

capital, as well as providing both day-to-day and strategic

corporate advice. Our tailored approach means that our teams engage

with all of the key investor groups active in our market - High Net

Worth Individuals, Family Offices, Wealth Managers and Funds. Our

broking, trading and research teams provide the link between growth

companies and this broad investor base.

Chief Executive's statement

Phillip Wale, Chief Executive's statement

Market backdrop

The market backdrop has been extremely challenging. While the

FTSE 100 has been relatively resilient compared with overseas

exchange, the AIM All Share Index fell 22% over the period. These

market conditions severely impacted transactional business (and

particularly fundraisings) in our Capital Markets Divisions.

The Financial Year 2023

Overall revenue fell 17% from the previous year from GBP32.0m to

GBP26.7m, but we also reduced administrative expenses by 17% from

GBP33.1m to GBP27.6m. However in the previous financial year we had

benefited from gains on investments (GBP1.6m), principally warrants

or equity received in partial payment of fees. Many of these

investments are in smaller companies, and the reversal in markets

during the year saw a loss on investments of GBP2.7m. While we

benefitted from significant VAT rebates during the year of GBP2.2m,

this led to a loss overall for the business of GBP1.8m.

In October 2022, in response to continuingly poor market

conditions the Board engaged external corporate advisors to assist

in a review of the strategy for the group. As a result of this

review the Board actively explored asset sales of parts of the

business.

Following the end of the period under review, the Group

announced in July 2023, it had conditionally raised GBP5m through a

placing of shares in the Company. The placing with both new and

existing shareholders was approved by shareholders on 15 August

2023 (see note 33 for further details).

At the same time, the Group also commenced a cost reduction

exercise, the benefit of which is expected to take effect from Q3

of Financial Year ending 31 March 2024. The Directors believe the

recent placing and the cost reduction exercise gives the Group an

improved chance of returning to a break-even position and securing

the future of the Group.

Clients

Our clients remain our priority and our central mission is to

continue to provide excellent and improved service to our

corporate, institutional and private clients. I would like to take

the opportunity to thank all of our clients for their loyalty and

flexibility as we have continued to introduce change and

improvements during another year of challenges.

Employees

We have kept tight controls on costs throughout the year and

finished the year with 159 employees against 158 at the start of

the period. A further fall in headcount is expected after the year

end following the cost reduction exercise.

On behalf of the Board, I would like to express our appreciation

for the continuing hard work and loyalty of employees throughout a

difficult period.

Shareholders

I would like to thank our shareholders for their continuing

support and welcome the new investors who joined in our most recent

placing in July 2023.

Wealth Management (WM)

WM income was more resilient, but market falls still led to a

reduction of assets under management from GBP1.6bn to GBP1.4bn.

This was the principal reason for a fall in revenue of 9% (from

GBP15.8m to GBP14.4m). However we also acted to reduce costs,

including the closure of our Cardiff office, and WM recorded a

small profit for the year, after receipt of the VAT rebate .

Capital Markets (CM)

CM revenue is derived from retainer income, earned from our role

as NOMAD or broker to clients, and transactional income. While

retainer income held up well, and we finished the year with 90

clients, against 88 at the beginning of the period, transactional

income was severely hit, with a particularly sharp fall in

corporate fundraisings. This led to an overall drop in CM revenue

of 25%, from GBP16.2m to GBP12.2m.

Looking forward

Following the July fundraise after the year-end and together

with the implementation of our cost reduction programme, we believe

the Group has an improved chance of returning to a break-even

position.

Financial review

Overview

The WH Ireland Group consists of a principal operating

subsidiary, WH Ireland Limited.

WH Ireland Limited consists of two business divisions: Wealth

Management (WM), which provides investment management solutions and

financial advisory services to retail clients and Capital Markets

(CM) which provides a range of services to both public and private

companies, including day to day regulatory and strategic corporate

advice, institutional sales and broking services; and the

production of equity research. It also provides trading services to

Funds, High Net worth individuals and Family Offices.

Total assets managed by the Group are GBP2.1bn (FY22: GBP2.4bn).

Of this total, GBP1.4bn (FY22: GBP1.6bn) is held in WM with a

further GBP0.7bn (FY22: GBP0.7bn) within CM's Ultra High Net Worth

business.

The Group's income is derived from activities conducted in the

UK with a number of retail, high net worth, ultra-high net worth,

institutional and corporate clients.

The average Group headcount for the year was 163 (FY22: 158) in

the UK.

Strategy summary

Following the fundraise that took place after the year ended 31

March 2023 (see note 33 for further details), the Group's aim is to

increase the value of discretionary assets under management in WM.

We also aim to continue to service our new and existing corporate

client list in CM, whilst sourcing new transactional activity

utilising our strong distribution capability in public and private

markets.

Group financial results summary

Year to Year to

31 Mar 2023 31 Mar 2022

GBP'000 GBP'000

----------------------------------------------- --------------- -------------

Revenue 26,688 32,035

Administrative expenses (27,550) (33,062)

Expected credit loss (239) (81)

Operating loss (1,101) (1,108)

Net (loss) / gains on investments (2,683) 1,626

Finance income 10 1

Finance expense (224) (511)

Other income 2,175 -

(Loss) / profit before tax (1,823) 8

Taxation (121) 67

----------------------------------------------- --------------- -------------

(Loss) /profit and total comprehensive income

for the year (1,944) 75

----------------------------------------------- --------------- -------------

Reconciliation between underlying and statutory profits

Underlying profit before tax is considered by the Board to be an

accurate reflection of the Group's performance when compared to the

statutory results, as this excludes income and expense categories

which are deemed of a non-recurring nature or non-cash operating

item. Reporting at an underlying level is also considered

appropriate for external analyst coverage and peer group

benchmarking. A reconciliation between underlying and statutory

profit before tax for the year ended 31 March 2023 with comparative

is shown below:

Year to Year to

31 Mar 2023 31 Mar 2022

GBP'000 GBP'000

--------------------------------------------------------- ------------- ---------------

Underlying (loss) / profit before tax (1,987) 1,397

Acquisition related items

- Deal structuring and integration costs - (446)

Amortisation of acquired brand and client relationships (496) (505)

Changes in fair value and finance cost of deferred

consideration (173) (416)

Restructuring costs - (835)

Other income 1,957 -

Net changes in the value of non-current investments (1,124) 813

Total underlying adjustments 164 (1,389)

Statutory (loss) / profit before tax (1,823) 8

--------------------------------------------------------- ------------- ---------------

Underlying earnings per share

--------------------------------------------------------- ------------- -------------

Weighted average number of shares in issue during

the period (note 12) 59,206 59,692

--------------------------------------------------------- ------------- -------------

Basic underlying earnings per share (3.36p) 2.34p

--------------------------------------------------------- ------------- -------------

Deal restructuring and integration costs

These represent costs incurred in relation to the acquisition of

Harpsden and include the integration and retention costs of staff

and the costs of the transfer of assets on to the SEI operating

platform.

Amortisation of acquired brand and client relationships

These intangible assets are created in the course of acquiring

funds under management and are amortised over their useful life

which have been assessed between two to 12 years. This charge has

been excluded from underlying profit as it is a significant

non-cash item.

Changes in fair value and finance cost of deferred

consideration

This comprises the fair value measurement arising on the

deferred consideration payments from acquisitions together with the

associated finance costs from the unwinding of the present value

discount relating to the Harpsden acquisition.

Restructuring costs

These costs relate to the restructuring costs within both WM and

CM and the resultant costs of redundancies of staff in the London

office arising from the closure of the Cardiff office.

Other income

During the year the Group received a refund of GBP2.2m from

HMRC. This was following confirmation from HMRC that the supply of

certain Group services were exempt from VAT during the period from

2017 to 2022. This is presented net of commission payable to third

parties of GBP218k.

Net changes in value of investments

As part of the fee arrangement with corporate clients in CM,

there is often a grant of warrants over shares or the issue of

actual shares in addition to the cash element of the fee. The value

of such warrants and shares are credited to revenue on the date of

the fee note and then any changes in the valuation are recorded as

net gains or losses. In view of the nature of these gains or

losses, including non-cash, these gains or losses have been

excluded from underlying profit. Corresponding commission payable

of GBP1,559k on the gain or loss of these warrants are included in

the net changes above.

Revenue

Wealth Management

The Wealth Management Division incorporates both investment

management services and financial planning advice from offices in

London, Manchester, Poole and Henley.

The strategy in this division is to focus our efforts on growing

the number of discretionary portfolios. This will be achieved by a

mixture of organic growth through new business initiatives,

continued personal referrals and the movement of existing advisory

and execution clients to our discretionary service.

Total WM AUM at 31 March 2023 was GBP1.4bn (FY22: GBP1.6bn) as

detailed in the table below. The majority of client assets are

managed on the SEI platform with a small balance of ex-Harpsden

clients remaining on another third-party platform.

Discretionary funds on SEI fell by 5.8% over the year (FY22:

increased by 6.2%), due to net business outflows of GBP26.7m (FY22:

net inflows GBP64.9m) representing a loss of 2.6% of opening funds

(FY22: a gain of 6.7%) and a market performance reduction of

GBP30.6m (FY22: GBP22.1m) due to negative market conditions.

WM funds flow table for the year:

Execution

Discretionary Advisory Only Custody* Total

GBPm GBPm GBPm GBPm GBPm

---------------------- -------------- --------- ---------- -------- --------

As at 1 April 2022 1,019.5 84.8 362.9 101.2 1,568.4

Inflows 115.2 3.5 44.7 18.7 182.1

Outflows (141.9) (6.8) (102.3) (22.0) (273.0)

Service switches (2.2) (24.5) 26.7 - -

Market Performance (30.6) (13.7) (22.3) (13.0) (79.6)

---------------------- -------------- --------- ---------- -------- --------

SEI at 31 March 2023 960.0 43.3 309.7 84.9 1,397.9

External platforms 36.2 - - - 36.2

---------------------- -------------- --------- ---------- -------- --------

Total WM AUM at 31

March 2023 996.2 43.3 309.7 84.9 1,434.1

---------------------- -------------- --------- ---------- -------- --------

*Custody represents discretionary managed assets held on our SEI

platform by New Horizons LLP a company with whom revenues are

shared. Note that growth in discretionary assets under management

is represented by the sum of net inflows, net service switches and

market performance.

Total WM revenue fell by 8.8% to GBP14.4m (FY22: increased

19.2%). Market conditions impacted on trading activity resulting in

a reduction of commission revenue in the year of 48.0% to GBP1.2m

(FY22: GBP2.2m).

2023 2022

GBP'000 GBP'000

------------------------------------- --------- ---------

Management fees and wealth planning 13,223 13,549

Commissions 1,156 2,221

Other 64 67

Total 14,443 15,837

------------------------------------- --------- ---------

Capital Markets

Our Capital Markets Division is specifically focused on the

public and private growth company marketplace. The team's

significant experience in this dynamic segment means that we are

able to provide a specialist service to each of its respective

participants. For companies, we raise public and private growth

capital, as well as providing both day-to-day and strategic

corporate advice. Our tailored approach means that our teams engage

with all of the key investor groups active in our market - High Net

Worth Individuals, Family Offices, Wealth Managers and Funds. Our

broking, trading and research teams provide the link between growth

companies and this broad investor base. Total CM AUM at 31 March

2023 was GBP0.7bn (FY22: GBP0.8bn). The client assets are managed

on the Pershing platform and the majority are held as execution

only.

Total revenue for the year decreased by 24.4% to GBP12.2m (FY22:

GBP16.2m) due to challenging market conditions impacting on

activity levels and the number of transactio ns. The number of

retained clients increased to 90 at the year-end and an increase in

retainer fees provided an uplift in retainer revenue of 12.4% to

GBP4.2m (FY22: GBP3.8m). The completion of three successful IPOs

(compared to five in the previous period) and fall in total num ber

of transactions to 25 (FY22: 38) were the drivers for the 48.6%

decrease to GBP5.1m (FY22: GBP9.9m) in transaction fees. CM also

executed a wide range of advisory work for its clients. Despite the

market backdrop, trading and commission revenue increased by 17.7%

in the year.

2023 2022

GBP'000 GBP'000

-------------------------------- --------- ---------

Transaction fees 5,128 9,979

Retainer fees 4,234 3,769

Equity Commissions and Trading 2,883 2,450

Total 12,245 16,198

-------------------------------- --------- ---------

Transaction fees are further analysed as follows:

2023 2022

GBP'000 GBP'000

-------------------------------------- --------- ---------

IPOs 934 1,878

Secondary equity issues 4,060 4,311

Other revenue incl. advisory and M&A 134 3,790

Total 5,128 9,979

-------------------------------------- --------- ---------

Expenses

Total o perational costs decreased by 16.7%. As part of cost of

sales, third party commission reduced by 87.6%, due to agreements

that are revenue contingent. Variable people costs, mainly related

to bonus payments have reduced by 40%.

2023 2022

GBP'000 GBP'000

------------------------------------------------ --------- ---------

Cost of sales - non-salaried staff costs (note

7) 605 4,895

Fixed non-people costs 10,826 10,464

Fixed people costs 14,243 14,577

Variable people costs 1,876 3,126

Total 27,550 33,062

------------------------------------------------ --------- ---------

Financial position and regulatory capital: Net assets decreased

to GBP13.6m at 31 March 2023 (FY22: GBP15.4m) and tangible net

assets (net assets excluding intangible assets and goodwill)

decreased by 14.1% to GBP6.5m (FY22 : GBP7.6m).

The Investment Firms Prudential Regime (IFPR) applies to all

solo-regulated MiFID investment firms and WH Ireland is a non-SNI

(small and non-interconnected) MIFIDPRU investment firm.

Accordingly, the Group's regulatory capital requirement is its

fixed overhead requirement as defined by the Financial Conduct

Authority (FCA). Due to market conditions remaining challenging and

losses incurred during the period, the Group notified the FCA that

it had fallen within its regulatory capital planning buffer. The

Group had further discussions with the FCA in order to ensure that,

in the absence of the injection of further capital pursuant to the

Placing, the Company could deliver a solvent wind down for the

Group, if required, in line with the Company's solvent wind down

plan (SWDP). A solvent wind down plan is a plan drawn up in

accordance with regulatory requirements in order to facilitate an

orderly wind down of a regulated firm. After the year-end the Group

carried out a placing to raise GBP5m by way of the issue of

ordinary shares (further details can be found in note 33), to

ensure that the Group's own funds are in excess of its regulatory

capital requirement.

Cost reduction exercises were also implemented after the

year-end, including certain members of senior management agreeing

to sacrifice a proportion of their salary in return for share

options, alongside a collective consultation regarding headcount

reduction.

As a result, the Directors have reviewed the forward-looking

position as part of the going concern modelling and stress testing

and in light of post year-end events believe that the regulatory

requirements will be met.

Future developments

The Group was subject to challenging market conditions resulting

from a number of well documented public events. The Directors

believe that the combination of the placing, approved by

shareholders in August 2023, and the cost reduction exercise gives

the Group an improved chance of returning to a break-even position.

The funds from the placing have been used to provide working

capital, secure the current regulatory capital position and achieve

a more stable financial position for the Group against the current

market backdrop. Prior to the placing, the Board had actively

explored asset sales. The Directors will continue to assess the

benefit of asset sales to shareholders should any future market

opportunities arise.

Key Performance Indicators

The following financial and strategic measures have been

identified as the key performance indicators (KPIs) of the Group's

overall performance for the financial year.

1. GROUP ASSETS UNDER MANAGEMENT *FY 2021 includes acquisition of

The total value of funds under management Harpsden Wealth Management Limited.

has a direct impact on the Group's

revenue.

-11%

------------------------------------------- ---------------------------------------

2. NUMBER OF RETAINED CAPITAL MARKETS

CORPORATE CLIENTS

The number of retained clients has

a direct relationship to the value

of fees earned from success fees

and retainer income in Capital Markets.

+2

------------------------------------------- ---------------------------------------

3. TOTAL REVENUE

The amount of revenue generated *FY 2021 revenue has been restated

by Wealth Management and Capital to reflect the reclassification from

Markets together is one of the key revenue to net gains on investments.

growth indicators.

-16%

------------------------------------------- ---------------------------------------

4. DISCRETIONARY AND ADVISORY ASSETS

UNDER MANAGEMENT (WM)

Discretionary and advisory funds

are the main income driver for our

Wealth Management business.

-10%

*FY 2021 includes acquisition of Harpsden Wealth Management

Limited.

Dividends

The Board does not propose to pay a dividend in respect of the

financial year (FY22: GBPnil).

Statement of Financial Position and Capital Structure

Maintaining a strong and liquid statement of financial position

remains a key objective for the Board, alongside its regulatory

capital requirement. Due to losses during the period, the group

notified the FCA on 21 December 2022 that it was within its Capital

Planning Buffer of GBP2.8m, which forms part of its regulatory

capital requirement, and further losses in the final quarter of the

financial year meant that at the year-end the Group was GBP0.9m

below the regulatory capital requirement of GBP9.6m. The Group has

been in discussion with the FCA with regard to its capital position

and having actively explored the option of an asset sale, undertook

a successful placing of shares subsequent to the year-end as

detailed in note 33 below in order to provide working capital,

secure the current regulatory capital position and achieve a more

stable financial position for the Group against the current market

backdrop. As at 31 March 2023, total net assets were GBP13.6m

(FY22: GBP15.4m) and net current assets GBP4.6m (FY22: GBP3.9m).

Cash balances at year-end were GBP4.2m (FY22: GBP6.4m).

Risks and Uncertainties

Risk appetite is established, reviewed and monitored by the

Board. The Group, through the operation of its Committee structure,

considers all relevant risks and advises the Board as necessary.

The Group maintains a comprehensive risk register as part of its

risk management framework encouraging a risk-based approach to the

internal controls and management of the Group. The risk register

covers all categories including human capital risk, regulatory

risk, conduct (client) risk, competition, financial risk, IT and

operational resilience risk and legal risk. Each risk is ranked on

impact and likelihood and mitigating strategies are identified. In

addition, the Executive Committee which is formed of the Executive

Directors, the Heads of the business divisions, a representative

from HR and Chief Risk and Compliance Officer meet to assess and

monitor these. An Executive Risk Committee has recently been

established to manage and monitor risks and report into the

Board.

The Group has outsourced its internal audit function to Deloitte

since April 2021. Deloitte formally report to Tom Wood, Chair of

the Audit Committee with Stephen Balonwu, Chief Risk and Compliance

Officer, being the principal day to day contact.

Liquidity and capital risk

The Group continues to focus on managing the costs of its

business and returning to growth and sustainable profitability

whilst increasing the proportion of recurring revenue with CM and

the building of its discretionary fee paying client base in WM to

better fit the regulatory environment in which it operates.

To mitigate risk, the Board continues to focus on ensuring that

the financial position remains robust and suitably liquid with

sufficient regulatory capital being maintained over the minimum

common equity tier 1 capital requirements. Regulatory capital and

liquid assets are monitored on a daily basis.

Operational risk

Operational risk is the risk of loss to the Group resulting from

inadequate or failed internal processes, people and systems, or

from external events.

Business continuity risk is the risk that serious damage or

disruption may be caused as a result of a breakdown or

interruption, from either internal or external sources, of the

business of the Group. This risk is mitigated in part by the number

of branches across the UK and the Group having business continuity

and disaster recovery arrangements including business interruption

insurance.

The Group seeks to ensure that its risk management framework and

control environment is continuously evolving which Compliance and

Risk monitor on an ongoing basis.

Credit risk

The Board takes active steps to minimise credit losses including

formal new business approval, and the close supervision of credit

limits and exposures, and the proactive management of any overdue

accounts. Additionally, risk assessments are performed on an

ongoing basis on all deposit taking banks and custodians and our

outsourced relationships.

Regulatory risk

The Company operates in a highly regulated environment in the

UK. The Directors monitor changes and developments in the

regulatory environment and ensure that sufficient resources are

available for the Group to implement any required changes. The

impact of the regulatory environment on the Group's management of

its capital is discussed in note 27 of the financial

statements.

Section 172 Statement

Broader Stakeholder Interests

Directors of the Group must consider Section 172 of the

Companies Act 2006 which requires them to act in the way that would

most likely promote the success of the Group for the benefit of all

its stakeholders. The Board and its committees consider who its key

stakeholders are, the potential impact of decisions made on them

taking into account a wider range of factors, including the impact

on the Company's operations and the likely consequences of

decisions made in the long-term. The Group's key stakeholders and

how the Board and the Group have engaged with them during the year

is set out below.

Employees

The CEO and his management team on behalf of the Board engage

with employees through a variety of methods including periodic 'all

staff' updates, information and points of interest, staff forums,

group meetings and Town Hall meetings. Further details can be found

in the corporate social responsibility section on page 29.

Shareholders

Our shareholders have been pivotal in supporting the Group and

its management team and Board. The Board recognise and frequently

discuss the importance of good, open and constructive relationships

with both potential new shareholders as well as existing

shareholders and is committed to this communication. The way in

which this has been achieved during the year has been by our Chief

Executive Officer, supported by the management team, maintaining

regular contact and meetings with individual and institutional

shareholders, both existing and potential, and communicating and

discussing shareholders' views with the Board. A number of Board

members and employees also hold the Group's shares and regular

communications are provided. The Group's strategy and results are

presented to shareholders through meetings following announcements

of the final and interim results. Shareholders are also invited to

meet the Board and management team, who attend the Annual General

Meeting. The annual report and accounts for the year ended 31 March

2023 along with all past accounts, regulatory communications and

other material is set out on the Group's website at

https://www.whirelandplc.com/investor-relations .

Regulators

The Board maintains continuous and open communication with our

regulators at the FCA as well as with the London Stock Exchange.

Regular ongoing dialogue has continued through the CEO and CFO with

the FCA who receive regular Management information. The FCA have

approved the appointments of each member of the Management team and

the Board members as required.

Clients

Our clients are fundamental to the business of the Group and the

Board recognise that their interests are of paramount importance.

Management of WM and CM closely engage with clients to understand

their objectives so that the service provided by the business is

appropriate. In WM the client's profile and the suitability of the

investment strategy provided is frequently assessed by our

professional investment managers and this is supplemented by a

second line of review from management and our compliance team. It

is recognised that the status of our clients can and does change in

line with the environment and vulnerable clients in particular are

identified and discussed at management and at Committee level to

ensure that they are provided with the best possible advice.

In CM the Group's objective is also to achieve the best outcome

and this applies equally to institutional corporate clients.

Regular contact is maintained with them across all departments

including corporate broking, corporate finance, trading and

research. Our investor relations team arranges meetings with

investors, undertakes site visits and organises events for a wide

range of our clients' teams.

Community and Suppliers

The Board through its Executive Directors is keenly focused on

its key supplier relationships and regularly challenges and reviews

its arrangements. The Group openly encourages its offices and

employees to engage in local charitable, community groups and other

causes. Further detail can be found on page 31.

Each of the Board members consider that they have acted

together, in good faith in a way most likely to promote the success

of the Group for the benefit of its broader range of stakeholders

as a whole taking into account section 172 (1) (a-f) of the

Companies Act 2006.

The Strategic Report on pages 7 - 14 has been approved by the

Board and signed on its behalf by:

S Jackson

Chief Finance Officer

September 2023

Consolidated statement of comprehensive income

Year ended Year ended

31 March 2023 31 March 2022

Note GBP'000 GBP'000

Revenue 5 26,688 32,035

Administrative expenses (27,550) (33,062)

Expected credit loss (239) (81)

----------------------------------------- ----- ----------------

Operating loss 6 (1,101) (1,108)

17,

Net (loss) / gains on investments 21 (2,683) 1,626

Finance income 8 10 1

Finance expense 8 (224) (511)

Other income 9 2,175 -

----------------------------------------- ----- ----------------

(Loss) / profit before tax (1,823) 8

Taxation 10 (121) 67

----------------------------------------- ----- --------------- ----------------

(Loss) / profit and total comprehensive

income for the year (1,944) 75

----------------------------------------- ----- --------------- ----------------

Earnings per share 12

----------------------------------------- ----- --------------- --------------

From continuing operations

Basic (3.29p) 0.13p

Diluted - 0.12p

----------------------------------------- ----- --------------- --------------

There were no items of other comprehensive income for the

current year or prior years.

Consolidated and Company statement of financial position

Group Company

31 March 31 March 31 March 31 March

2023 2022 2023 2022

Note GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ----- --------- --------- --------- ---------

ASSETS

Non-current assets

Intangible assets 15 3,763 4,259 - -

Goodwill 14 3,539 3,539 - -

Investment in subsidiaries 16 - - 26,448 26,448

Property, plant and

equipment 13 569 325 - 4

Investments 17 820 3,013 - -

Right of use asset 18 635 1,168 - -

Deferred tax asset 19 - 190 - -

Treasury note 28 - - 1,093 900

9,326 12,494 27,541 27,352

----------------------------- ----- --------- --------- --------- ---------

Current assets

Trade and other receivables 20 5,444 5,758 29 113

Other investments 21 2,049 1,912 - -

Cash and cash equivalents 22 4,234 6,446 - 1,246

11,727 14,116 29 1,359

----------------------------- ----- --------- --------- --------- ---------

Total assets 21,053 26,610 27,570 28,711

----------------------------- ----- --------- --------- --------- ---------

LIABILITIES

Current liabilities

Trade and other payables 23 (4,013) (6,681) (1,136) (2,357)

Lease liability 18 (319) (376) - -

Deferred consideration 24 (2,121) (2,412) (2,121) (2,412)

Deferred tax liability 19 (663) (732) - -

(7,116) (10,201) (3,257) (4,769)

----------------------------- ----- --------- --------- --------- ---------

Non-current liabilities

Lease liability 18 (293) (999) - -

(293) (999) - -

----------------------------- ----- --------- --------- --------- ---------

Total liabilities (7,409) (11,200) (3,257) (4,769)

----------------------------- ----- --------- --------- --------- ---------

Total net assets 13,644 15,410 24,313 23,942

----------------------------- ----- --------- --------- --------- ---------

Capital and reserves

Share capital 27 3,116 3,104 3,116 3,104

Share premium 27 19,014 19,014 19,014 19,014

Other reserves 981 981 228 228

Retained earnings (8,374) (6,789) 1,955 1,596

Treasury shares 28 (1,093) (900) - -

----------------------------- ----- --------- --------- --------- ---------

Shareholders' funds 13,644 15,410 24,313 23,942

----------------------------- ----- --------- --------- --------- ---------

The Company has elected to take the exemption under Section 408

of the Companies Act 2006 not to present the Company statement of

comprehensive income. The loss after tax of the Company for the

year was GBPnil (FY22: GBPnil).

These financial statements were approved by the Board of

Directors on 26 September 2023 and were signed on its behalf

by:

S Jackson

Director

Consolidated and Company statement of cash flows

Group Company

-------------------------- --------------------------

Year ended Year ended Year ended Year ended

31 Mar 2023 31 Mar 2022 31 Mar 2023 31 Mar 2022

Notes GBP'000 GBP'000 GBP'000 GBP'000

Operating activities:

(Loss) / profit for the year: (1,944) 75 - -

(1,944) 75 - -

Adjustments for non-cash items:

Depreciation and amortisation 13, 15, 18 1,093 1,229 - -

Finance income 8 (10) (1) - -

Finance expense 8 224 511 173 416

Tax 10 121 (67) - -

Non-cash adjustment for share option charge 7 359 470 359 470

Non-cash adjustment for investment gains 17, 21 2,683 (1,626) - -

Non-cash consideration for revenue (1,096) (1,651) - -

Non-cash adjustment for right of use assets 18 (125) - - -

Working capital changes:

Decrease / (increase) in trade and other

receivables 314 (601) 88 (57)

(Decrease) / increase in trade and other

payables (2,668) (942) (1,221) (603)

Net cash (used in) / generated from operations (1,049) (2,603) (601) 226

Income taxes received/(paid) 10 - - -

Net cash inflows / (outflows) from operating

activities (1,049) (2,603) (601) 226

------------------------------------------------- ----------- ------------ ------------ ------------ ------------

Investing activities:

Acquisition of property, plant and equipment 13 (475) (103) - (4)

Decrease / (increase) in loan receivables - - (193) (256)

Interest received 8 10 - - -

Movement in current asset investments 17, 21 430 1,933 - -

Net cash (used in) / generated from investing

activities (35) 1,830 (193) (260)

------------------------------------------------- ----------- ------------ ------------ ------------ ------------

Finance activities:

Proceeds from issue of share capital 27 12 34 12 34

Purchase of own shares by Employee Benefit Trust (193) (256) - -

Interest paid 8 - (2) - -

Deferred consideration paid 24 (464) - (464) -

Lease liability payments (483) (768) - -

Net cash (used in) / generated from financing

activities (1,128) (992) (452) 34

------------------------------------------------- ----------- ------------ ------------ ------------ ------------

Net (decrease) / increase in cash and cash

equivalents (2,212) (1,765) (1,246) -

Cash and cash equivalents at beginning of year 6,446 8,211 1,246 1,246

Cash and cash equivalents at end of year 4,234 6,446 - 1,246

------------------------------------------------- ----------- ------------ ------------ ------------ ------------

Reconciliation of Group and Company liabilities arising from

financing activities in the year:

As at Cash flows Non-cash As at

31 March

1 April 2022 changes 2023

Group GBP'000 GBP'000 GBP'000 GBP'000

----------------- ------------- ----------- --------- ---------

Lease liability 1,375 (483) (280) 612

1,375 (483) (280) 612

----------------- ------------- ----------- --------- ---------

Reconciliation of Group and Company liabilities arising from

financing activities in the prior year:

As at Cash flows Non-cash As at

31 March

1 April 2021 changes 2022

Group GBP'000 GBP'000 GBP'000 GBP'000

----------------- ------------- ----------- --------- ---------

Lease liability 2,058 (768) 85 1,375

2,058 (768) 85 1,375

----------------- ------------- ----------- --------- ---------

There are no Company liabilities arising from financing

activities.

Consolidated and Company statement of changes in equity

Share Share Other Retained Treasury Total

capital premium reserves earnings shares equity

Group GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- -------- -------- --------- --------- --------- --------

Balance at 1 April 2021 3,101 18,983 981 (7,334) (644) 15,087

Profit and total comprehensive

income for the year - - - 75 - 75

-------------------------------- -------- -------- --------- --------- --------- --------

Transactions with owners in their

capacity as owners:

Employee share option scheme - - - 470 - 470

New share capital issued 3 31 - - - 34

Purchase of own shares by

Employee Benefit Trust - - - - (256) (256)

Balance at 31 March 2022 3,104 19,014 981 (6,789) (900) 15,410

-------------------------------- -------- -------- --------- --------- --------- --------

Loss and total comprehensive

income for the year - - - (1,944) - (1,944)

-------------------------------- -------- -------- --------- --------- --------- --------

Transactions with owners in their

capacity as owners:

Employee share option scheme - - - 359 - 359

New share capital issued 12 - - - - 12

Purchase of own shares by

Employee Benefit Trust - - - - (193) (193)

-------------------------------- -------- -------- --------- --------- --------- --------

Balance at 31 March 2023 3,116 19,014 981 (8,374) (1,093) 13,644

-------------------------------- -------- -------- --------- --------- --------- --------

Retained earnings include GBP10k (2022: GBP10k) ESOT

reserve.

Share Share Other Retained Treasury Total

capital premium reserves earnings shares equity

Company GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- -------- -------- --------- --------- --------- --------

Balance at 1 April 2021 3,101 18,983 228 1,126 - 23,438

Profit / (loss) and total - - - - -

comprehensive income for the

year

------------------------------- -------- -------- --------- --------- --------- --------

Transactions with owners in their

capacity as owners:

Employee share option scheme - - - 470 - 470

New share capital issued 3 31 - - - 34

Balance at 31 March 2022 3,104 19,014 228 1,596 - 23,942

------------------------------- -------- -------- --------- --------- --------- --------

Profit / (loss) and total - - - - - -

comprehensive income for the

year

------------------------------- -------- -------- --------- --------- --------- --------

Transactions with owners in their

capacity as owners:

Employee share option scheme - - - 359 - 359

New share capital issued 12 - - - - 12

------------------------------- -------- -------- --------- --------- --------- --------

Balance at 31 March 2023 3,116 19,014 228 1,955 - 24,313

------------------------------- -------- -------- --------- --------- --------- --------

The nature and purpose of each reserve, whether consolidated or

Company only, is summarised below:

Share premium

The share premium is the amount raised on the issue of shares

that is in excess of the nominal value of those shares and is

recorded less any direct costs of issue.

Other reserves

Other reserves comprise a (consolidated) merger reserve of

GBP753k (FY22: GBP753k) and a (consolidated and company) capital

redemption reserve of GBP228k (FY22: GBP228k).

Retained earnings

Retained earnings reflect accumulated income, expenses, gains

and losses, recognised in the statement of comprehensive income and

the statement of recognised income and expense and is net of

dividends paid to shareholders. It includes GBP10k (FY22: GBP10k)

of ESOT reserve.

Treasury shares

Purchases of the Company's own shares in the market are

presented as a deduction from equity, at the amount paid, including

transaction costs. That is, shares are shown as a separate class of

shareholders' equity with a debit balance. This includes shares in

the Company held by the EBT or ESOT, both of which are consolidated

within the consolidated figures.

Notes to the financial statements

1. General information

WH Ireland Group plc is a public company incorporated in the

United Kingdom. The shares of the Company are traded on the AIM, a

market of the London Stock Exchange Group plc. The address of its

registered office is 24 Martin Lane, London, EC4R 0DR.

Basis of preparation

The consolidated and Parent Company financial statements have

been prepared in accordance with International Accounting Standards

as adopted by the UK and in accordance with the Companies Act 2006.

The principal accounting policies adopted in the preparation of the

consolidated financial statements are set out in note 3. The

policies have been consistently applied to all the years presented,

unless otherwise stated.

The consolidated financial statements are presented in British

Pounds (GBP), which is also the Group's functional currency.

Amounts are rounded to the nearest thousand, unless otherwise

stated.

Going concern

The financial statements of the Group have been prepared on a

going concern basis. In making this assessment, the Directors have

prepared detailed financial forecasts for the period to September

2024 which consider the funding and capital position of the Group

and Company. Those forecasts make assumptions in respect of future

trading conditions, notably the economic environment and its impact

on the Group's revenues and costs. In addition to this, the nature

of the Group's business is such that there can be considerable

variation in the timing of cash inflows. The forecasts take into

account foreseeable downside risks, based on the information that

is available to the Directors at the time of the approval of these

financial statements.

Certain activities of the Group are regulated by the FCA, the

statutory regulator for financial services business in the UK which

has responsibility for policy, monitoring and discipline for the

financial services industry. The FCA requires the Group's capital

resources to be adequate; that is sufficient in terms of quantity,

quality and availability, in relation to its regulated activities.

The Directors monitor the Group's regulatory capital resources on a

regular basis.

The Group had been in discussion with the FCA (including in

respect of the Group's relevant net asset and regulatory capital

positions) in order to ensure that, in the absence of the injection

of further capital pursuant to the Placing, the Company could

deliver a solvent wind down for the Group, if required, in line

with the Company's solvent wind down plan (SWDP). A solvent wind

down plan is a plan drawn up in accordance with regulatory

requirements in order to facilitate an orderly wind down of a

regulated firm, as further described below. On the basis of the

adverse current and forecast trading and resultant losses, without

further funding pursuant to the placing, the SWDP would have been

required to be implemented post year-end.

The Directors have conducted full and thorough assessments of

the Group's business and the past financial year has provided a

thorough test of those assessments. The significant market

turbulence presented a range of challenges to the business and as a

result after the year-end the Group proceeded to raise additional

capital by way of placing of ordinary shares to existing

shareholders and new investors (further details can be found in

note 33) raising GBP5m. Additionally, cost reduction exercises were

implemented and the benefits expected to take effect from quarter 3

of the financial year. The cost savings have been factored into the

forecasts.

Whilst there always remains uncertainty over the economic

environment, after the year-end the business has improved its

capital position and likelihood of a return to a break-even

position. Further actions open to the Directors include incremental

cost reductions, regulatory capital optimisation programmes or

further capital raising.

An analysis of the potential downside impacts was conducted as

part of the going concern assessment to assess the potential impact

on revenue and asset values with a particular focus on the variable

component parts of our overall revenue, such as corporate finance

fees and commission. Furthermore, reverse stress tests were

modelled to assess what level the Group's business would need to

reduce to before resulting in a liquidity crisis or a breach of

regulatory capital. That modelling concluded that transactional,

non-contractual revenue would need to decline by more than 60% from

management's forecasts to create such a crisis situation within 18

months' time.

Based on all the aforementioned, the Directors believe that

regulatory capital requirements will continue to be met and that

the Group and Company has sufficient liquidity to meet its

liabilities for the next twelve months and that the preparation of

the financial statements on a going concern basis remains

appropriate.

2. Adoption of new and revised standards

New and amended standards that are effective for the current

year

A number of new or amended standards became applicable for the

current reporting period and as a result the Group and Company has

applied the following standards:

- Amendments to IFRS 16: Property, Plant and Equipment -

Proceeds before Intended Use

- Amendments to IFRS 3: Reference to Conceptual Framework

- Amendments to IAS 37: Onerous Contracts - Cost

The above requirements did not have a material impact on the

financial statements of the group or company.

New standards, interpretations and amendments not yet

effective

Name Description Effective date

------------------- ------------------------------------------- ---------------

IAS 1 (amendments) Presentation of Financial Statements: 1 January 2023

Classification of Liabilities as

Current or Non-Current and Classification

of Liabilities as Current or Non-Current

- Deferral of Effect Date.

IAS 1 (amendments) Non-current Liabilities with covenants 1 January 2024

The Directors do not expect the adoption of these standards and

amendments to have a material impact on the Financial

Statements.

3. Significant accounting policies

Basis of consolidation

Where the company has control over an investee, it is classified

as a subsidiary. The company controls an investee if all three of

the following elements are present: power over the investee,

exposure to variable returns from the investee and the ability of

the investor to use its power to affect those variable returns.

Control is reassessed whenever facts and circumstances indicate

that there may be a change in any of these elements of control.

The consolidated financial statements present the results of the

Company and its subsidiaries ("the Group") as if they formed a

single entity. Intercompany transactions and balances between group

companies are therefore eliminated in full. The consolidated

financial statements incorporate the results of business

combinations using the acquisition method. In the statement of

financial position, the acquiree's identifiable assets, liabilities

and contingent liabilities are initially recognised at their fair

values at the acquisition date. The results of acquired operations

are included in the consolidated statement of comprehensive income

from the date on which control is obtained until the date on which

control ceased.

In the Company's accounts, investments in subsidiary

undertakings are stated at cost less any provision for

impairment.

Business combinations

All business combinations are accounted for by applying the

purchase method. The purchase method involves recognition, at fair

value, of all identifiable assets and liabilities, including

contingent liabilities, of the subsidiary at the acquisition date,

regardless of whether or not they were recorded in the financial

statements of the subsidiary prior to acquisition. The cost of

business combinations is measured based on the fair value of the

equity or debt instruments issued and cash or other consideration

paid, plus any directly attributable costs. Any directly

attributable costs relating to business combinations before or

after the acquisition date are charged to the statement of

comprehensive income in the period in which they are incurred.

Goodwill arising on a business combination represents the excess

of cost over the fair value of the Group's share of the

identifiable net assets acquired and is stated at cost less any

accumulated impairment losses. The cash generating units to which

goodwill is allocated are tested annually for impairment. Any

impairment is recognised immediately in administrative expenses in

the statement of comprehensive income and is not subsequently

reversed. On disposal of a subsidiary the attributable amount of

goodwill that has not been subject to impairment is included in the

determination of the profit or loss on disposal.

Revenue

WEalth management (WM)

Management and custody fees

Investment management fees are recognised in the period in which

the related service is provided. It is a variable fee based on the

average daily market value of assets under management and is

invoiced on a calendar quarter basis in arrears. The performance

obligation is satisfied over time as the contractual obligations

are on ongoing throughout the period under contract. The revenue

accrued but not yet invoiced is recognised as a contract asset.

Initial and ongoing advisory fees

Initial advisory fees are charged to clients on a fixed one-off

fee agreement. The performance obligation is satisfied as the

initial advice is provided. Ongoing advisory fees are variable fees

based on the average daily market value of assets under management

and invoiced on a calendar quarter basis in arrears. Both initial

and ongoing advisory fees are recognised in the period in which the

related service is provided. The performance obligation of ongoing

advice is satisfied over time as the contractual obligations are

ongoing throughout the period under contract. The revenue accrued

but not yet invoiced is recognised as a contract asset.

Commission and transaction charges

Commission is recognised when receivable in accordance with the

date of settlement. It is a variable fee based on a percentage of

the transaction and therefore the performance obligation is

satisfied at the date of the underlying transaction. The

transaction price is calculated based on the agreed percentage of

the underlying consideration of the trade. The underlying

consideration being the number of shares multiplied by the share

price at the time of the underlying transaction.

CApital markets (cM)

Commission

Brokerage commission is recognised when receivable in accordance

with the date of settlement. It is a variable fee based on a

percentage of the transaction and therefore performance obligation

is satisfied at the date of the underlying transaction. The

transaction price is calculated based on the agreed percentage of

the underlying consideration of the trade. The underlying

consideration being the number of shares multiplied by the share

price at the time of the underlying transaction.

Corporate finance advisory fees

Corporate finance advisory fees are fixed fees agreed on a deal

by deal basis and might include non-cash consideration received in

the form of shares, loan notes, warrants or other financial

instruments recognised at the fair value on the date of receipt and

therefore the performance obligation is satisfied at a point in

time when the Group has fully completed the performance obligations

per the contract.

Retainer fees

Retainer fees are recognised over the length of time of the

agreement. Fees are fixed and invoiced quarterly in advance based

on the agreed engagement letter. The performance obligation is

satisfied over time as the contractual obligations are on ongoing

throughout the period under contract. The deferred revenue is

recognised as a contract liability.

Corporate placing commissions

Corporate placing commissions are variable fees agreed on a

deal-by-deal basis based on a percentage of the funds raised as

part of a transaction. This includes non-cash consideration

received in the form of shares, loan notes, warrants or other

financial instruments recognised at the fair value on the date of

receipt. Given that fees related to this work are success based,

there is a significant risk of reversal of the variable revenue and

therefore the performance obligation is satisfied at a point in

time when the transaction is completed. The combination of

corporate placing commissions and corporate finance advisory fees

are referred to as corporate success fees.

Employee benefits

The Group contributes to employees' individual money purchase

personal pension schemes. The assets of the schemes are held

separately from those of the Group in independently administered

funds. The amount charged to the statement of comprehensive income

represents the contributions payable to the schemes in respect of

the period to which they relate.

Short-term employee benefits are those that fall due for payment

within 12 months of the end of the period in which employees render

the related service. The cost of short-term benefits is not

discounted and is recognised in the period in which the related

service is rendered. Short-term employee benefits include

cash-based incentive schemes and annual bonuses.

Share-based payments

The share option programmes allow Group employees to receive

remuneration in the form of equity-settled share-based payments

granted by the Company.

The cost of equity-settled transactions with employees is

measured by reference to the fair value at the date at which they

are granted. The fair value of the options granted is measured

using an option valuation model. The cost of equity-settled

transactions is recognised, together with a corresponding increase

in equity, over the period in which the performance or service

conditions are fulfilled (the vesting period), ending on the date

on which the relevant employees become fully entitled to the award

(the vesting date). The cumulative expense recognised for equity

settled transactions, at each reporting date until the vesting

date, reflects the extent to which the vesting period has expired

and the Group's best estimate of the number of equity instruments

that will ultimately vest. The statement of comprehensive income

charge or credit for a period represents the movement in cumulative

expense recognised at the beginning and end of that period.

Where the terms of an equity-settled award are modified, an

incremental value is calculated as the difference between the fair

value of the repriced option and the fair value of the original

option at the date of re-pricing. This incremental value is then

recognised as an expense over the remaining vesting period in

addition to the amount recognised in respect of the original option

grant.

Where an equity-settled award is cancelled or settled (that is,

cancelled with some form of compensation) it is treated as if it

had vested on the date of cancellation and any expense not yet

recognised for the award is recognised immediately.

However, if a new award is substituted for the cancelled award

and is designated as a replacement award on the date that it is

granted, the cancelled and new awards are treated as if they were a

modification of the original award, as described in the previous

paragraph. Any compensation paid up to the fair value of the award

is accounted for as a deduction from equity. Where an award is

cancelled by forfeiture, when the vesting conditions are not

satisfied, any costs already recognised are reversed (subject to

exceptions for market conditions).

In all instances, the charge/credit is taken to the statement of

comprehensive income of the Group or Company by which the

individual concerned is employed.

Employee Benefit Trust (EBT)

The cost of purchasing own shares held by the EBT are shown as a

deduction against equity. The proceeds from the sale of own shares

held increase equity. Neither the purchase nor sale of own shares

leads to a gain or loss being recognised in the consolidated

statement of comprehensive income.

Employee Share Ownership Trust (ESOT)

The Company has established an ESOT. The assets and liabilities

of this trust comprise shares in the Company and loan balances due

to the Company. The Group includes the ESOT within these

consolidated Financial Statements and therefore recognises a

Treasury shares reserve in respect of the amounts loaned to the

ESOT and used to purchase shares in the Company. Any cash received

by the ESOT on disposal of the shares it holds, will be used to

repay the loan to the Company.

Treasury shares

The costs of purchasing Treasury shares are shown as a deduction

against equity. The proceeds from the sale of own shares held

increase equity. Neither the purchase nor sale of treasury shares

leads to a gain or loss being recognised in the consolidated

statement of comprehensive income.

Income taxes

Income tax on the profit or loss for the years presented,

comprising current tax and deferred tax, is recognised in the

statement of comprehensive income except to the extent that it

relates to items recognised directly in equity, in which case it is

recognised in equity.

Current tax is the expected tax payable on the taxable income

for the year, using rates enacted or substantively enacted at the

reporting year-end date and any adjustment to tax payable in

respect of previous years.

Deferred tax is provided for temporary differences, at the

reporting year-end date, between the tax bases of assets and

liabilities and their carrying amounts for financial reporting

purposes. The following temporary differences are not provided

for;

-- goodwill which is not deductible for tax purposes;

-- the initial recognition of assets or liabilities that affect

neither accounting nor taxable profit; and

-- temporary differences relating to investments in subsidiaries

to the extent that they will probably not reverse in the

foreseeable future.

The amount of deferred tax provided is based on the expected

manner of realisation or settlement of the carrying amount of

assets and liabilities, using tax rates enacted or substantively

enacted at the reporting period end date (note 19).

A deferred tax asset is recognised for all deductible temporary

differences and unused tax losses only to the extent that it is

probable that future taxable profits will be available against

which the assets can be utilised. The deferred tax asset of GBP190k

was released during the period in light of recent forecasts (FY22:

GBP190k).

Plant and equipment

Plant and equipment is stated at cost less accumulated

depreciation and impairment. Depreciation is calculated, using the

straight-line method, to write down the cost or revalued amount of

plant and equipment over the assets' expected useful lives, to

their residual values, as follows:

Computers, fixtures and fittings - 4 to 7 years

Intangible assets

Measurement

Intangible assets with finite useful lives that are acquired

separately are measured, on initial recognition at cost. Following

initial recognition, they are carried at cost less accumulated

amortisation and any accumulated impairment. The cost of intangible

assets acquired in a business combination is their fair value at

the date of acquisition.

Intangible assets other than goodwill are amortised over the

expected pattern of their consumption of future economic benefits,

to write down the cost of the intangible assets to their residual

values as follows:

Client relationships - 10 to 12 years

Brand - 2 years

The amortisation period and method for an intangible asset are

reviewed at least at each financial year end. Changes in the

expected useful life or the expected pattern of consumption of

future economic benefits embodied in the asset or its residual

value are accounted for by changing the amortisation period or

method.

Impairment

The carrying amounts of the Group's intangible assets, excluding

goodwill, are reviewed when there is an indicator of impairment and

the asset's recoverable amount is estimated.

The recoverable amount is the higher of the asset's fair value

less costs to sell (or net selling price) and its value-in-use.

Value-in-use is the discounted present value of estimated future

cash inflows expected to arise from the continuing use of the asset

and from its disposal at the end of its useful life. Where the

recoverable amount of an individual asset cannot be identified, it

is calculated for the smallest cash-generating unit (CGU) to which

the asset belongs. A CGU is the smallest identifiable group of

assets that generates cash inflows independently.

When the carrying amount of an asset (or CGU) exceeds its

recoverable amount, the asset (or CGU) is considered to be impaired

and is written down to its recoverable amount. An impairment loss

is immediately recognised as an expense. Any subsequent reversal of

impairment credited to the statement of comprehensive income shall

not cause the carrying amount of the intangible asset to exceed the

carrying amount that would have been determined had no impairment

been recognised.

Impairment of assets

Goodwill and other intangible assets that have an indefinite

life are not subject to amortisation, they are tested annually for

impairment. Other assets are tested for impairment when any changes

in circumstance indicate the carrying amount is possibly not

recoverable. An impairment loss is recognised when the asset's

carrying amount exceeds its recoverable amount. The recoverable

amount is the higher of an asset's fair value less costs to sell

and the value in use. Goodwill is allocated to cash generating

units for the purpose of assessing impairment, assets (excluding

goodwill) are grouped together based on the assets that

independently generates cash flow whose cash flow is largely

independent of the cash flows generated by other assets (cash

generating units).

Leased assets

Measurement and recognition of leases as a lessee

For any new lease contracts entered into on or after 1 April

2019, as permitted under IFRS 16, the Group recognises a right of

use asset and a lease liability except for:

-- Leases with a term of 12 months or less from the lease commencement date

-- Leases of low value assets

Lease liabilities are measured at the present value of the

unpaid lease payments discounted using an incremental borrowing

rate.

Right of use assets are initially measured at the amount of the

lease liabilities plus initial direct costs, costs associated with

removal and restoration and payments previously made. Right of use

assets are amortised on a straight-line basis over the term of the

lease.

Lease liabilities are subsequently increased by the interest

charge using the incremental borrowing rate and reduced by the

principal lease.

Financial instruments

Financial assets and financial liabilities are recognised in the

Group's balance sheet when the Group becomes a party to the

contractual provisions of the instrument.

Financial assets and liabilities

Investments are recognised and derecognised on the trade date

where the purchase or sale of an investment is under a contract

whose terms require delivery of the investment within the timeframe

established by the market concerned, and are initially measured at

fair value, plus transaction costs, except for those financial

assets classified as at fair value through profit or loss, which

are initially measured at fair value.

Assets and liabilities are presented net where there is a legal

right to offset and an intention to settle in that way.

The three principal classification categories for financial

assets are: measured at amortised cost, fair value through other

comprehensive income (FVOCI) and fair value through profit or loss

(FVTPL). The classification of financial assets under IFRS 9 is

generally based on the business model in which a financial asset is

managed and its contractual cash flow characteristics.

Financial assets are not reclassified after their initial

recognition unless the Group changes its business model for

managing financial assets, in which case all affected financial

assets are reclassified on the first day of the first reporting

period following the change in the business model.

A financial asset is measured at amortised cost if it meets both

of the following conditions and is not designated as at FVTPL:

-- it is held within a business model whose objective is to hold

assets to collect contractual cash flows; and

-- its contractual terms give rise on specified dates to cash

flows that are solely payments of principal and interest on the

principal amount outstanding.

On initial recognition of an equity investment that is not held

for trading, the Group may irrevocably elect to present subsequent

changes in the investment's fair value in OCI. This election is

made on an investment-by-investment basis.

All financial assets not classified as measured at amortised

cost or FVOCI as described above are measured at FVTPL. This

includes all derivative financial assets. On initial recognition,

the Group may irrevocably designate a financial asset that

otherwise meets the requirements to be measured at amortised cost

or at FVOCI as at FVTPL if doing so eliminates or significantly

reduces an accounting mismatch that would otherwise arise.

Assets held at FVTPL are subsequently measured at fair value.

Net gains and losses, including any interest or dividend income,

are recognised in profit or loss.

Financial assets at amortised cost are subsequently measured at

amortised cost using the effective interest method. The amortised

cost is reduced by impairment losses. Trade receivables and other

receivables are measured and carried at amortised cost using the

effective interest method, less any impairment. If impaired, the

carrying amount of other receivables is reduced by the impairment

loss directly and a charge is recorded in the Income Statement. For

trade receivables, the carrying amount is reduced by the expected

credit lifetime losses under the simplified approach permitted

under IFRS9. Subsequent recoveries of amounts previously written

off are credited against the allowance account and changes in the

carrying amount of the allowance account are recognised in the

Income Statement.