TIDMYOU

RNS Number : 1051T

YouGov PLC

23 March 2021

23 March 2021

YouGov plc

("YouGov" or the "Group")

Half-year results for the six months to 31 January 2021

-Robust underlying revenue and profit growth in line with

expectations

-Reported results impacted by one-off items

-Continued i nvestment in the business for further growth

supported by a strong balance sheet

-Trading in the second half has started well on the back of a

strong sales pipeline

Summary of Results

Unaudited Unaudited Underlying

six months six months Change Change(2)

to to

31 January 31 January % %

2021 2020

GBPm GBPm

------------ ------------ -------- -----------

Revenue 79.0 76.9 3% 9%

------------ ------------ -------- -----------

Adjusted Operating Profit(1) 10.5 11.3 (7%) 15%

------------ ------------ -------- -----------

Adjusted Operating Profit

Margin (%)(1) 13.3% 14.8% (9.9%) 5%

------------ ------------ -------- -----------

Statutory Operating Profit 7.4 9.5 (22%) -

------------ ------------ -------- -----------

Adjusted Profit before Tax(1) 13.6 12.1 13% 37%

------------ ------------ -------- -----------

Statutory Profit before Tax 7.8 9.2 (15%) -

------------ ------------ -------- -----------

Adjusted Earnings per Share(1) 9.7p 8.7p 11% 44%

------------ ------------ -------- -----------

Statutory Basic Earnings per

Share 4.8p 6.2p (24%) -

------------ ------------ -------- -----------

1 Defined in the explanation of non-IFRS measures below.

2 Defined as growth in business excluding impact of current and

prior period acquisitions and Kurdistan business closure, and

movement in exchange rates.

Financial highlights

* Revenue growth of 3% with underlying(2) growth of 9%

to GBP79.0m and a solid sales pipeline weighted

towards the second half of the financial year

* Statutory operating profit down 22% to GBP7.4m (HY20:

GBP9.5m) impacted by an increase in deferred

consideration on the back of better than expected

performance of prior acquisitions

* Underlying(2) operating profit (excluding impact of

planned Kurdistan closure and foreign exchange

movements) was up by 15%, representing an

underlying(2) operating profit margin of 14.2% (HY20:

13.5%). This growth was achieved despite absorbing an

increased non-cash share-based payment charge of

GBP2.5m (HY20: GBP0.9m)

* Adjusted profit before tax(1) (excluding exceptional

costs and share-based payment charge) up by 13% to

GBP13.6m (HY20: GBP12.1m)

* Adjusted earnings per share(1) up by 11% to 9.7p

(HY20: 8.7p)

* Strong cash conversion of 92% (HY20: 93%)

* Robust balance sheet position maintained with net

cash at half year end of GBP27.5m (31 January 2020:

GBP27.2m) and no debt

Operational highlights

* Data Products revenue increased by 6% (8% from

underlying(2) business) to GBP26.5m

* Data Services revenue increased by 19% (18% from

underlying(2) business) to GBP21.8m, driven by strong

demand for more tactical, fast turnaround projects

* Custom Research revenue decreased by 11% (2% growth

from underlying(2) business) to GBP30.1m, due to the

planned closure of the Kurdistan operations

* Both Data Products and Custom Research have seen

positive sales momentum with larger, more strategic

projects coming th rough towards the end of the 2020

calendar year and in early 2021

* Mainland Europe delivered solid growth on the back of

large contract wins, while the US and UK saw more

moderate performance

* Further investment in panel recruitment of GBP6.1m

(HY20: GBP4.2m) due to the continued global expansion

into 15 new markets across Europe, South America, the

Middle East and North Africa as well as higher

recruitment in the US panel ahead of the presidential

election

* Expanded YouGov Direct, a unique platform that offers

rapid, self-serve research, to two new markets and

completed its integration with YouGov Chat, a curated

messaging platform

* Developed YouGov Safe, a new product enabling users

to securely generate value from their personal data

* Completed the acquisition of Wizsight, a Turkish

online-focussed research agency, allowing YouGov to

establish operations in this growth market

Post-period highlights

* Acquisition of Canadian sports research firm Charlton

Insights, expanding the Group's sports presence in

North America

* Significant new contract wins with a major

multinational media agency and a US-based game

developer

Current trading and outlook

* The second half has started well, with a strong sales

pipeline for the remainder of the financial year to

31 July 2021

* Current trading is in line with Board expectations

for the full year

* Given the strength of our business model, strong cash

balances and no debt, we will continue with

investment in our strategic initiatives, technology

and panels

Stephan Shakespeare, Chief Executive, said:

"We are extremely pleased with our performance in H1 as we

continued to deliver against our strategy and demonstrate our

resilience. During the period, our focus remained on providing

connected data solutions, valuable opinions and consumer insights

to our clients across the globe. We continue to innovate to better

serve our clients and their changing needs. We have expanded our

YouGov Direct offering, integrated it with YouGov Chat and YouGov

Safe, and further expanded our panels to 15 more countries.

"We have entered the second half with confidence buoyed by

growing new and existing client demand for our syndicated Data

Products augmented by long-term custom trackers. The second half

has started well and current trading is in line with Board

expectations for the full year".

Analyst presentation

A copy of the slides and a pre-recorded management presentation

will be available online at

https://corporate.yougov.com/investors/presentations/ shortly after

the half-year results announcement is live on the Regulatory News

Service (RNS).

Forward looking statements

Certain statements in this interim report are forward looking.

Although the Group believes that the expectations reflected in

these forward-looking statements are reasonable, we can give no

assurance that these expectations will prove to have been correct.

As these statements involve risks and uncertainties, actual results

may differ materially from those expressed or implied by these

forward-looking statements.

We undertake no obligation to update any forward-looking

statements whether as a result of new information, future events or

otherwise.

Enquiries:

YouGov plc

Stephan Shakespeare / Alex McIntosh / Hannah

Jethwani 020 7012 6000

FTI Consulting

Charles Palmer / Elena Kalinskaya / Debbie

Oluwaseyi Sonaike 020 3727 1000

Numis Securities Limited (NOMAD and Joint

broker)

Nick Westlake / Matt Lewis / Hugo Rubinstein 020 7260 1000

Berenberg (Joint Broker)

Mark Whitmore / Alix Mecklenburg-Solodkoff 020 3207 7800

Chief Executive Officer's Review

We are pleased to report another resilient set of results which

clearly demonstrate our continued ability to execute against our

stated strategy and relevance of our business proposition. In the

period, YouGov delivered strong underlying revenue growth

materially ahead of the market(1) . This performance was driven by

both a resurgence in demand for more tactical, fast-turnaround

projects during the period and a recovery in Mainland Europe

following unification of our European teams and large contracts

wins in the prior year. A shift in focus from a product-centric to

a client-centric account management structure in the US and UK led

to some temporary disruption at the start of the period. However,

with the transition now complete, the new account management

structure showed early signs of success, with our teams having

secured larger and more strategic project wins towards the end of

2020, underpinning our confidence for the future. While adjusted

and statutory profitability was impacted by the planned closure of

the Kurdistan business, underlying(2) operating profit margin

continued to improve.

1 According to the ESOMAR Global Market Research Report

published in September 2020, global research market turnover grew

by 3.9% in 2019 (adjusted for inflation).

2 Defined as growth in business excluding impact of current and

prior period acquisitions and Kurdistan business closure, and

movement in exchange rates.

Factors contributing to this resilient performance include:

* Connected data proposition: Progress made in Mainland

Europe to offer clients a connected data proposition

centred around combining our rich syndicated dataset

with custom trackers to enable more meaningful

insights.

* Data Services: Strong demand for more tactical,

fast-turnaround projects across most geographies.

* Sector diversification: The sports sector continued

its solid growth while the consumer sectors began to

recover after a tumultuous period. Our gaming and

e-sports business has made good progress during the

pandemic while our COVID-19 tracker has led to

greater penetration into the healthcare and

government segments.

* Panel expansion: Geographic expansion of our

proprietary panel into 15 new markets on the back of

client demand allowing sales teams to target more

global contracts.

* Innovative technology: Continued evolution to bring

our core data products and services onto a single

platform while further developing our self-service

and marketing activation offering to increase our

relevance to clients.

Long-term strategic growth plan FY19-23 (FYP2)

We are now in the second year of our long-term strategic growth

plan which is linked to YouGov's long-term incentive plan ("LTIP").

The previously announced LTIP performance targets for the 2019-23

performance period are:

* Double group revenue

* Double group adjusted operating profit margin(3)

* Achieve an adjusted earnings per share(3) compound

annual growth rate in excess of 30%

3 Defined in the explanation of non-IFRS measures below.

We are making good progress towards these three goals in what we

have designated as the investment phase of the long-term growth

plan. In this phase we are continuing to invest in our

technological platforms, panels, support functions and new markets

to enable us to scale further and make the most of the

opportunities we see in our markets. We continue to focus on three

strategic pillars: Data Integration, Ethical Activation and Public

Value.

Strong execution against our three strategic pillars

Data Integration

Strategic focus: Fully integrating custom research and client

service with our data products and tools to create new value from

existing data and open up new revenue streams through

customisation

* Progress made against this pillar during the period:

o Sales team reorganised in the core US and UK markets to

become more

client-centric leading to greater cross-selling and larger

contract wins.

o Commenced the back-end integration of our products and tools

to develop the next stage of the YouGov platform.

o Enhanced our Global Fan Profiles tool so properties, sponsors

and rights holders can now track fan sentiment and attitudes

in 32 key e-sports markets.

Ethical Activation

Strategic focus: Enabling marketing activation on our platform

with a focus on personal data protection and self-service

research

* Progress made against this pillar during the period:

o YouGov Direct launched in Singapore and Australia following

integration with YouGov Chat, our new member acquisition tool.

o Developed YouGov Safe, within the YouGov Direct platform,

to allow users to generate personal value from data portability

initiatives launched in response to GDPR/CCPA regulations.

o Substantial progress made in the integration of several

different platforms into a single platform to both enrich

connected data within the Cube for clients and unify our member

base for a simpler, more rewarding panellist experience.

Public Value

Strategic focus: Expanding YouGov Public Data as a public

service, for brand reputation, panel engagement and showcasing our

data

* Progress made against this pillar during the period:

o Expanded the US panel to provide extensive coverage and

polling data on the US presidential election resulting in

increased brand awareness and greater traffic to our websites.

o Launched our new B2B website structured along our key sectors

to ensure overlap between our public and syndicated data allowing

visitors to better engage with our data and increasing lead

acquisition.

o Added increased interactivity on our website using YouGov

Chat resulting in greater engagement with visitors and panellists.

Focus on operations

As we transform into a true platform, both in the technological

and the business-model sense, we continue to aim to be more

efficient, smarter, faster, and 24/7. During the period, we

continued to expand the role of our shared service centres (called

Centres of Excellence or CenX) to cover more areas of the business

resulting in increased recruitment at our CenXs in India. In

addition to this we have completed the rollout of our new global

key account management programme in the US, UK and Europe and

expect to extend this to the Asia Pacific region in the next

financial year.

We have commenced the biggest simultaneous expansion of YouGov's

panel presenting the Group with significant commercial

opportunities through the extended reach, now totalling 59 markets,

and allowing it to enhance its reputation as the first choice for

public opinion data globally. This expansion, along with our

increased penetration in key markets, has resulted in our global

panel exceeding 15 million registered members worldwide.

COVID-19 response

The COVID-19 pandemic and resulting lockdowns continue to cause

disruption and impact all our stakeholder groups globally. We took

widespread measures in 2020 to support these stakeholders while

minimising the impact on our business.

We moved our entire global workforce to working remotely at the

start of the global lockdown in March 2020 and did not furlough any

employees. As offices have reopened in some cities, we have taken

extensive measures to ensure the safety of our employees and phased

our return-to-office plans to ensure a smooth and safe transition.

The majority of our staff continue to operate seamlessly from home

and we are continuing to support individual circumstances as the

situation evolves in our various markets. In response to employee

surveys, the YouGov management team is currently looking to

launching a Group-wide workplace policy based on the principle of

flexibility in respect of working location.

The YouGov management team would like to thank all our employees

for supporting our clients and the business through these uncertain

times.

Current trading and outlook

Trading in the second half is off to a good start, with a

healthy pipeline of sales opportunities for the remainder of the

financial year and current trading is in line with Board

expectations for the full year. Considering the resilience our

business has demonstrated over the past year, especially in light

of unprecedented headwinds, we continue to believe in our stated

strategy. Our clients increasingly want to see their marketing

budgets deliver more value-for-money and we are in a strong

position to meet those demands. Our solid cash balances and

debt-free balance sheet enable us to continue investing in our

strategic initiatives, technology and panels.

On behalf of the Board and Shareholders, I would like to thank

all our panellists, partners and clients, and in particular our

employees, for their continued contribution and commitment to

YouGov's ongoing success.

Stephan Shakespeare

Chief Executive Officer

23 March 2021

Chief Financial Officer's Review

The Group has seen robust performance in the six months to 31

January 2021 in a trading period dominated by the pandemic.

Total Group revenue rose to GBP79.0m in the period, compared to

GBP76.9m in the six months to 31 January 2020.

Our core operating divisions continued to deliver growth with

reported results reflecting some specific one-off items including

the planned closure of our Kurdistan office, the depreciation of

the US Dollar and costs related to prior acquisitions.

Underlying revenue growth was 9% (but 3% in reported terms due

to foreign exchange and Kurdistan closure) since the prior period.

Underlying operating profit increased by 15% when excluding the

impact of these one-off items.

Six months to Six months to

31 Jan 2021 31 Jan 2020

GBPm GBPm

Underlying(1) operating

profit 11.4 9.9

------------- -------------

FX impact (0.3) 0.0

------------- -------------

Kurdistan closure (0.6) 1.5

------------- -------------

Adjusted operating profit(2) 10.5 11.3

------------- -------------

Separately reported items (3.1) (1.8)

------------- -------------

Statutory operating profit 7.4 9.5

------------- -------------

1 Defined as growth in business excluding impact of current and

prior period acquisitions and Kurdistan business closure, and

movement in exchange rates.

2 Defined in the explanation of non-IFRS measures below.

Our strategy of providing clients with a connected data

proposition has started to deliver initial results giving us

confidence as we continue to invest for future growth.

Adjusted operating margins and organic growth

Gross margins decreased by 113 basis points (bps) to 83% as a

higher proportion of sales was derived from the lower margin Data

Services division in this period.

Group operating costs (excluding separately reported items) of

GBP55.1m (HY20: GBP53.4m) increased by 3% in reported terms, and 5%

in constant currency terms. Group adjusted operating profit

(excluding separately reported items) decreased to GBP10.5m (a 7%

decline in the period) as a result of the full period impact from

the Kurdistan closure as well as an increased non-cash share-based

payments charge of GBP2.5m (HY20: GBP0.9m), resulting from a

modification in accounting treatment and a significant increase in

our share price. Recognition of the share-based payments charge

under the first five-year plan (FYP1) was backend weighted, however

we have modified the accounting treatment for FYP2 to be

straight-line over the plan period. Adjusted operating margins

decreased from 14.8% to 13.3%.

However, underlying adjusted operating profit margin (excluding

FX and Kurdistan impacts) has increased from 13.5% in HY20 to

14.2%. Underlying adjusted operating profit increased to GBP11.4m,

representing growth of 15% over the prior year period. The

statutory operating profit (which is after charging other

separately reported items of GBP3.1m) decreased to GBP7.4m (HY20:

GBP9.5m).

Performance by Division

Data Products

Our syndicated data products suite includes YouGov BrandIndex

and YouGov Profiles as well as newer sector specific offerings such

as YouGov SportsIndex and YouGov DestinationIndex.

The contribution of our Data Products division to Group revenue

and adjusted operating profit has been moderate due to the

previously announced move to a client-centric account management

structure which shifted sales into the latter half of the period.

Revenue from Data Products increased by 6% in reported terms (8%

growth in underlying terms) in the period. The adjusted operating

profit from Data Products increased by 4% to GBP8.8m and the

operating margin declined by 53 bps to 33%.

Geographically, the US remains the largest Data Products market

and grew by 9% in the period. Mainland Europe also contributed

strong revenue growth of 11% while the UK and Asia Pacific were

more subdued at 6% and 3%, respectively.

Data Services

Our Data Services division consists of our fast-turnaround

research services, including our market-leading YouGov Omnibus.

In the period, revenue from Data Services increased by 19% in

reported terms and by 18% in underlying terms to GBP21.8m. The

division saw stellar performance in the period due to the release

of pent-up demand for tactical, fast- turnaround projects as

businesses were adjusting to the COVID-19 situation in the prior

year period. Strong growth was seen across all regions, with the

exception of the Middle East. The focus on the US market (a 33%

increase in reported revenue) and relative stability in the Asia

Pacific markets in relation to COVID-19 has continued to help the

division expand the revenue base beyond the core UK market.

This strong revenue growth contributed to a 33% increase in the

Data Services operating profit to GBP3.7m and the operating margin

grew from 15% to 17%.

Custom Research

Our Custom Research division includes tailored research projects

and tracking studies.

During the period, the division's revenue declined by 11% in

reported terms due to the impact of the planned Kurdistan business

closure and grew by 2% in underlying terms to GBP30.1m. Strong

growth was recorded in Mainland Europe as a regional approach to

our connected data trackers was well received by clients while the

US benefitted from non-recurring election work. Adjusted operating

profit decreased by 41% to GBP4.7m and the operating margin

declined to 16% (HY20: 24%). This was largely due to lower revenue

growth in the UK and the closure of the Kurdistan business.

Revenue Six months Six months Revenue Underlying(1)

to to growth revenue

31 Jan 31 Jan % change

2021 2020 %

GBPm GBPm

------------------------- ----------- ----------- -------- --------------

Data Products 26.5 25.1 6% 8%

----------- ----------- -------- --------------

Data Services 21.8 18.4 19% 18%

----------- ----------- -------- --------------

Custom Research 30.1 33.9 (11%) 2%

----------- ----------- -------- --------------

Intra-group and Central

Revenue 0.6 (0.5) - -

----------- ----------- -------- --------------

Group 79.0 76.9 3% 9%

----------- ----------- -------- --------------

1 Defined as growth in business excluding impact of current and

prior period acquisitions and Kurdistan business closure, and

movement in exchange rates.

Adjusted Operating Profit(1) Six months Six months Operating Operating Margin

to to Profit

31 Jan 31 Jan growth

2021 2020 %

GBPm GBPm

------------------------------ ----------- ----------- ---------- ----------------------------

Six months Six months

to to

31 Jan 2021 31 Jan 2020

------------------------------ ----------- ----------- ---------- ------------- -------------

Data Products 8.8 8.5 4% 33% 34%

----------- ----------- ---------- ------------- -------------

Data Services 3.7 2.8 33% 17% 15%

----------- ----------- ---------- ------------- -------------

Custom Research 4.7 8.0 (41%) 16% 24%

----------- ----------- ---------- ------------- -------------

Central Costs (6.7) (8.0) - - -

----------- ----------- ---------- ------------- -------------

Group 10.5 11.3 (7%) 13% 15%

----------- ----------- ---------- ------------- -------------

1 Defined in the explanation of non-IFRS measures below.

Performance by Geography

Revenue Six months Six months Revenue Underlying(1)

to to growth / revenue

(reduction)

31 Jan 2021 31 Jan 2020 % change %

GBPm GBPm

UK 24.0 23.6 1% 1%

------------ ------------ ------------- -------------

USA 34.3 32.1 7% 11%

------------ ------------ ------------- -------------

Mainland Europe 14.0 11.7 20% 16%

------------ ------------ ------------- -------------

Middle East 2.4 5.8 (59%) 4%

------------ ------------ ------------- -------------

Asia Pacific 6.7 6.0 13% 15%

------------ ------------ ------------- -------------

Intra-group Revenues (2.4) (2.3) - -

------------ ------------ ------------- -------------

Group 79.0 76.9 3% 9%

------------ ------------ ------------- -------------

1 Defined as growth in business excluding impact of current and

prior period acquisitions and Kurdistan business closure, and

movement in exchange rates.

Adjusted Operating Six months Six months Operating Operating Margin

Profit(1) to to Profit growth

31 Jan 2021 31 Jan 2020 %

GBPm GBPm

-------------------- ------------- ------------- --------------- ----------------------------

Six months Six months

to to

31 Jan 2021 31 Jan 2020

-------------------- ------------- ------------- --------------- ------------- -------------

UK 7.2 7.8 (8%) 30% 33%

------------- ------------- --------------- ------------- -------------

USA 9.9 9.3 6% 29% 29%

------------- ------------- --------------- ------------- -------------

Mainland Europe 1.8 0.9 101% 13% 8%

------------- ------------- --------------- ------------- -------------

Middle East (0.1) 1.7 (107%) (5%) 29%

------------- ------------- --------------- ------------- -------------

Asia Pacific 0.0 0.0 17% 1% 1%

------------- ------------- --------------- ------------- -------------

Central Costs (8.3) (8.4) - - -

------------- ------------- --------------- ------------- -------------

Group 10.5 11.3 (7%) 13% 15%

------------- ------------- --------------- ------------- -------------

1 Defined in the explanation of non-IFRS measures below.

Panel Development

We continue to invest in our online panel to increase our

research capabilities, both in new geographies and specialist

panels. At 31 January 2021, the total number of registered

panellists had increased to 15.8 million, compared to 9.6 million

at 31 January 2020, as set out in the table below.

Region Panel size at Panel size at

31 January 2021 31 January 2020

millions millions

UK 2.47 1.80

---------------- ----------------

Americas 5.70 3.70

---------------- ----------------

Mainland Europe 3.27 1.37

---------------- ----------------

Middle East 1.94 1.15

---------------- ----------------

Asia Pacific 2.45 1.57

---------------- ----------------

Total 15.83 9.60

---------------- ----------------

Group financial performance

Amortisation of intangible assets and central costs

Amortisation charges for intangible assets totalled GBP6.8m in

the period (HY20: GBP5.0m) of which GBP3.1m (HY20: GBP2.1m) relates

to separately acquired assets and GBP3.9m (HY20: GBP2.2m) to

internally generated assets.

Central Revenue and Costs includes support functions and

incubator projects. Central Costs have declined to GBP6.7m (HY20:

GBP8.0m) due to income from incubator projects and reallocation of

divisional costs.

Separately reported items

Acquisition related costs in the period comprise of GBP3.0m of

contingent consideration treated as staff costs in respect of the

acquisitions of SMG Insight Limited, InConversation Media Limited

and Portent.io Limited and GBP0.1 of transactions costs in respect

of the acquisitions of Wizsight and Charlton Insights Inc.

Profit before tax and earnings per share

Adjusted profit before tax of GBP13.6m was an increase of 13% on

the comparable result of GBP12.1m for the six months to 31 January

2020. The adjusted tax rate decreased from 26% to 23%. Statutory

profit before tax decreased by 15% to GBP7.8m compared to GBP9.2m

in the six months ended 31 January 2020.

During the period adjusted earnings per share grew by 11% from

8.7p to 9.7p and statutory earnings per share fell by 24% from 6.2p

to 4.8p.

Technology investment and global expansion

The Group invested GBP5.2m (HY20: GBP3.5m) in the continuing

development of our technology platform and increased the investment

in panel recruitment to GBP6.1m (HY20: GBP4.2m) due to the

continued global expansion into 15 new markets as well as higher

recruitment in the US panel ahead of the presidential election.

These investments enabled us to broaden our international research

capability in key markets. Our investment in technology continued

across three main areas: websites and mobile applications, new

products and the development of the YouGov platform. GBP0.6m (HY20:

GBP0.6m) was spent on the purchase of property, plant and

equipment. Other cash outflows included GBP0.5m on acquisitions,

taxation payments of GBP4.1m (HY20: GBP1.7m) and the annual

shareholder dividend payment of GBP5.5m (HY20: GBP4.3m) in December

2020.

The Group is expecting GBP9.5m of deferred consideration payable

in respect of future earn-outs attached to acquisitions.

There was a net cash outflow of GBP7.3m in the period, compared

to GBP8.2m in the six months to 31 January 2020. Cash balances of

GBP27.5m were slightly higher than at 31 January 2020

(GBP27.2m).

Currency

The Group's results were affected by the net appreciation of GBP

Sterling as its average exchange rate was 4% higher against the USD

in this period than in the 6 months to 31 January 2020. Also, the

GBP Sterling was 3% lower against the EUR in this period than in

the 6 months to 31 January 2020. The net impact of foreign exchange

on the Group's adjusted operating profit(2) was a decrease of

GBP0.3m compared to calculation in constant currency terms.

Explanation of Non-IFRS measures

Financial Measure How we define it Why we use it

Separately reported Items that in the Directors' Provides a more comparable

items judgement are one-off basis to assess the

or need to be disclosed year-to-year operational

separately by virtue business performance

of their size or incidence and is how our performance

is reviewed internally

------------------------------ ----------------------------

Adjusted operating Operating profit excluding

profit separately reported items

------------------------------ ----------------------------

Adjusted operating Adjusted operating profit

profit margin expressed as a percentage

of revenue

------------------------------

Adjusted profit Profit before tax before

before tax share based payment charges,

imputed interest and

separately reported items

------------------------------ ----------------------------

Adjusted taxation Taxation due on the adjusted Provides a more comparable

profit before tax, excluding basis to assess the

the tax effect of separately underlying tax rate

reported items

------------------------------ ----------------------------

Adjusted tax rate Adjusted taxation expressed

as a percentage of adjusted

profit before tax

------------------------------ ----------------------------

Adjusted profit Adjusted profit before Facilitates performance

after tax tax less adjusted taxation evaluation, individually

and relative to other

companies

------------------------------ ----------------------------

Adjusted profit Adjusted profit after

after tax attributable tax less profit attributable

to owners of the to non-controlling interests

parent

------------------------------ ----------------------------

Adjusted earnings Adjusted profit after

per share tax attributable to owners

of the parent divided

by the weighted average

number of shares. Adjusted

diluted earnings per

share includes the impact

of share options

------------------------------ ----------------------------

Constant currency Current year revenue Shows the underlying

revenue change change compared to prior revenue change by

year revenue in local eliminating the impact

currency translated at of foreign exchange

the current year average rate movements

exchange rates

------------------------------ ----------------------------

Cash conversion The ratio of cash generated Indicates the extent

from operations to adjusted to which the business

EBITDA generates cash from

adjusted EBITDA

------------------------------ ----------------------------

Reconciliation of Non-IFRS measures

Adjusted Operating Profit(1) Six months Six months % Change

to to

31 Jan 2021 31 Jan 2020

GBPm GBPm

Statutory operating profit 7.4 9.5 (22%)

------------ ------------ --------

Separately reported items 3.1 1.8 68%

------------ ------------ --------

Adjusted operating profit(1) 10.5 11.3 (7%)

------------ ------------ --------

Adjusted Profit Before Six months Six months % Change

Tax(1) to to

31 Jan 2021 31 Jan 2020

GBPm GBPm

Statutory profit before

tax 7.8 9.2 (15%)

------------ ------------ --------

Separately reported items 3.1 1.8 63%

------------ ------------ --------

Share based payments 2.5 0.9 178%

------------ ------------ --------

Imputed interest - 0.1 100%

------------ ------------ --------

Adjusted profit before

tax(1) 13.6 12.1 13%

------------ ------------ --------

1 Defined in the explanation of non-IFRS measures above.

YOUGOV PLC

STATEMENT OF DIRECTORS' RESPONSIBILITIES

For the six months ended 31 January 2021

The Directors confirm that these condensed interim financial

statements have been prepared in accordance with International

Accounting Standard 34, 'Interim Financial Reporting', as adopted

by the European Union and that the interim management report

includes a fair review of the information required by DTR 4.2.7 and

DTR 4.2.8, namely:

* an indication of important events that have occurred

during the first six months and their impact on the

condensed set of financial statements, and a

description of the principal risks and uncertainties

for the remaining six months of the financial year;

and

* material related-party transactions in the first six

months and any material changes in the related-party

transactions described in the last annual report.

The Board of Directors of YouGov plc are:

* Roger Parry - Non-Executive Chair

* Rosemary Leith - Non-Executive Director and Senior

Independent Director

* Andrea Newman - Non-Executive Director

* Ashley Martin - Non-Executive Director

* Stephan Shakespeare - Chief Executive Officer

* Alex McIntosh - Chief Financial Officer

* Sundip Chahal - Chief Operating Officer

By order of the Board:

Alex McIntosh

Chief Financial Officer

23 March 2021

YOUGOV PLC

CONSOLIDATED INCOME STATEMENT

For the six months ended 31 January 2021

Unaudited Unaudited Audited

6 months 6 months Year ended

to to

31 January 31 January 31 July

2021 2020 2020

Note GBPm GBPm GBPm

Revenue 3 79.0 76.9 152.4

Cost of Sales (13.4) (12.2) (23.4)

----------- ----------- -----------

Gross profit 65.6 64.7 129.0

Administrative expenses (58.2) (55.2) (113.8)

----------- ----------- -----------

Operating profit 3 7.4 9.5 15.2

----------------------------------------- ----- ----------- ----------- -----------

Separately reported items 4 (3.1) (1.8) (6.6)

----------- ----------- -----------

Adjusted operating profit(1) 10.5 11.3 21.8

----------------------------------------- ----- ----------- ----------- -----------

Finance income 0.6 0.2 0.4

Finance costs (0.2) (0.5) (0.4)

Profit before taxation 7.8 9.2 15.2

Taxation 5 (2.6) (2.9) (5.8)

----------- ----------- -----------

Profit after taxation 5.2 6.3 9.4

----------- ----------- -----------

Attributable to:

Equity holders of the parent

company 5.2 6.6 9.6

Minority interests - (0.3) (0.2)

5.2 6.3 9.4

----------- ----------- -----------

Earnings per share

Basic earnings per share attributable

to equity holders of the company 6 4.8p 6.2p 9.0p

Diluted earnings per share attributable

to equity holders of the company 6 4.6p 5.9p 8.5p

1 Defined in the explanation of non-IFRS measures.

YOUGOV PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 31 January 2021

Unaudited Unaudited Audited

6 months 6 months

to to Year ended

31 January 31 January 31 July

2021 2020 2020

GBPm GBPm GBPm

Profit for the period 5.2 6.3 9.4

Other comprehensive income/(expense)

Item that may be subsequently reclassified

to profit or loss:

Currency translation differences (3.7) (5.3) (4.8)

Other comprehensive expense for

the year (3.7) (5.3) (4.8)

----------- ----------- -----------

Total comprehensive income for

the period 1.5 1.0 4.6

----------- ----------- -----------

Attributable to:

Equity holders of the parent company 1.5 1.3 4.8

Minority interests - (0.3) (0.2)

Total comprehensive income for

the period 1.5 1.0 4.6

----------- ----------- -----------

Items in the statement above are disclosed net of tax.

YOUGOV PLC

CONSOLIDATED sTATEMENT OF FINANCIAL POSITION

For the six months ended 31 January 2020

Unaudited Unaudited Audited

31 January 31 January 31 July

2021 2020 2020

Assets Note GBPm GBPm GBPm

Non-current assets

Goodwill 9 60.2 63.6 61.5

Other intangible assets 9 27.2 19.0 23.2

Property, plant and equipment 9 3.4 4.0 3.6

Right of use assets 9 12.9 9.3 8.9

Deferred tax assets 11.7 8.7 11.0

----------------------------- ----------- --------

Total non-current assets 115.4 104.6 108.2

----------------------------- ----------- --------

Current assets

Trade and other receivables 37.1 31.9 34.2

Current tax assets 0.7 2.4 0.7

Cash and cash equivalents 27.5 27.2 35.3

----------------------------- ----------- --------

Total current assets 65.3 61.5 70.2

----------------------------- ----------- --------

Total assets 180.7 166.1 178.4

----------------------------- ----------- --------

Liabilities

Current liabilities

Trade and other payables 36.0 36.4 38.5

Contingent consideration 9.5 1.6 3.4

Provisions 8.2 5.5 6.8

Current lease liabilities 2.9 2.5 2.5

Current tax liabilities 0.4 1.0 1.7

Total current liabilities 57.0 47.0 52.9

----------------------------- ----------- --------

Net current assets 8.3 14.5 17.3

----------------------------- ----------- --------

Non-current liabilities

Contingent consideration - 2.3 3.0

Provisions 4.8 4.5 4.6

Long term lease liabilities 10.9 7.3 6.9

Deferred tax liabilities 1.6 2.0 1.7

----------------------------- ----------- --------

Total non-current liabilities 17.3 16.1 16.2

----------------------------- ----------- --------

Total liabilities 74.3 63.1 69.1

----------------------------- ----------- --------

Net assets 106.4 103.0 109.3

----------------------------- ----------- --------

Equity

Issued share capital 10 0.2 0.2 0.2

Share premium 31.4 31.4 31.4

Merger reserve 9.2 9.2 9.2

Treasury share reserve (2.5) (1.7) (1.7)

Foreign exchange reserve 11.4 14.6 15.1

Retained earnings 57.3 50.1 55.8

------ ------ ------

Total shareholders' funds 107.1 103.8 110.0

Non-controlling interests

in equity (0.7) (0.8) (0.7)

------ ------ ------

Total equity 106.4 103.0 109.3

------ ------ ------

The accompanying accounting policies and notes form an integral

part of this financial information.

Alex McIntosh

Chief Financial Officer

23 March 2021

YOUGOV PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 31 January 2021

Attributable to equity holders of

the Company

---------------------------------------------------------

Treasury Foreign

Share Share Merger share exchange Retained Non-controlling

capital premium reserve reserve reserve earnings Total interest Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------- -------- -------- -------- --------- --------- ----- --------------- -------

Balance at 1 August

2019 0.2 31.4 9.2 (3.7) 19.9 51.0 108.0 (0.5) 107.5

Period to 31 January

2020

Exchange differences on

translating foreign

operations - - - - (5.3) - (5.3) - (5.3)

-------- -------- -------- -------- --------- --------- ----- --------------- -----

Net gain recognised

directly

in equity - - - - (5.3) - (5.3) - (5.3)

Profit/(loss) for the

period - - - - - 6.6 6.6 (0.3) 6.3

-------- -------- -------- -------- --------- --------- ----- --------------- -----

Total comprehensive

income

for the period - - - - (5.3) 6.6 1.3 (0.3) 1.0

-------- -------- -------- -------- --------- --------- ----- --------------- -----

Dividends paid - - - - - (4.3) (4.3) - (4.3)

Share-based payments - - - - - 0.9 0.9 - 0.9

Tax in relation to

share

based payments - - - - - 0.4 0.4 - 0.4

Award/(acquisition) of

treasury shares - - - 2.0 - (4.5) (2.5) - (2.4)

-------- -------- -------- -------- --------- --------- ----- --------------- -----

Total transactions with

owners recognised

directly

in equity - - - 2.0 - (7.5) (5.5) - (5.5)

-------- -------- -------- -------- --------- --------- ----- --------------- -----

Balance at 31 January

2020 0.2 31.4 9.2 (1.7) 14.6 50.1 103.8 (0.8) 103.0

Period to 31 July 2020

Exchange differences on

translating foreign

operations - - - - 0.5 - 0.5 - 0.5

-------- -------- -------- -------- --------- --------- ----- --------------- -----

Net income recognised

directly in equity - - - - 0.5 - 0.5 - 0.5

Profit/(loss) for the

period - - - - - 3.0 3.0 0.1 3.1

-------- -------- -------- -------- --------- --------- ----- --------------- -----

Total comprehensive

income

for the period - - - - 0.5 3.0 3.5 0.1 3.6

-------- -------- -------- -------- --------- --------- ----- --------------- -----

Share-based payments - - - - - 1.9 1.9 - 1.9

Tax in relation to

share

based payments - - - - - 0.8 0.8 - 0.8

Total transactions with

owners recognised

directly

in equity - - - - - 2.7 2.7 - 2.7

-------- -------- -------- -------- --------- --------- ----- --------------- -----

Balance at 31 July 2020 0.2 31.4 9.2 (1.7) 15.1 55.8 110.0 (0.7) 109.3

Period to 31 January

2021

Exchange differences on

translating foreign

operations - - - - (3.7) - (3.7) - (3.7)

-------- -------- -------- -------- --------- --------- ----- --------------- -----

Net income recognised

directly in equity - - - - (3.7) - (3.7) - (3.7)

Profit for the period - - - - - 5.2 5.2 - 5.2

-------- -------- -------- -------- --------- --------- ----- --------------- -----

Total comprehensive

income

for the period - - - - (3.7) 5.2 1.5 - 1.5

-------- -------- -------- -------- --------- --------- ----- --------------- -----

Dividends paid - - - - - (5.5) (5.5) - (5.5)

Share-based payments - - - - - 3.2 3.2 - 3.2

Treasury shares used to

settle share option

exercises - - - 1.4 - (1.4) - - -

(Acquisition)/award of

treasury shares - - - (2.2) - (2.2) - (2.2)

-------- -------- -------- -------- --------- --------- ----- --------------- -----

Total transactions with

owners recognised

directly

in equity - - - (0.8) - (3.7) (4.5) - (4.5)

-------- -------- -------- -------- --------- --------- ----- --------------- -----

Balance at 31 January

2021 0.2 31.4 9.2 (2.5) 11.4 57.3 107.1 (0.7) 106.4

-------- -------- -------- -------- --------- --------- ----- --------------- -----

YOUGOV PLC

CONSOLIDATED CASHFLOW STATEMENT

For the six months ended 31 January 2021

Unaudited Unaudited Audited

6 months 6 months Year ended

to to

31 January 31 January 31 July

2021 2020 2020

GBPm GBPm GBPm

Profit before taxation 7.8 9.2 15.2

Adjustments for:

Finance income (0.7) (0.2) (0.4)

Finance costs - 0.5 0.4

Amortisation 6.8 5.0 10.8

Depreciation 2.7 2.3 4.5

Share based payments 2.5 0.9 2.7

Other non-cash operating profit

(gains)/losses 3.0 0.8 5.3

(Increase)/decrease in trade and

other receivables (3.6) 0.2 (1.6)

(Decrease)/increase in trade and

other payables (1.9) (2.2) (0.2)

Increase in provisions 1.9 0.8 2.0

----------- ----------- -----------

Cash generated from operations 18.5 17.3 38.7

Interest paid (0.2) (0.1) (0.3)

Income taxes paid (4.1) (1.7) (3.2)

----------- ----------- -----------

Net cash generated from operating

activities 14.2 15.5 35.2

Cash flow from investing activities

Acquisition of subsidiaries (net (0.5) - -

of cash acquired)

Settlement of deferred consideration - (7.4) (7.4)

Purchase of property, plant and

equipment (0.6) (0.6) (1.0)

Purchase of intangible assets (11.3) (7.7) (17.6)

Interest received - 0.2 0.2

Net cash used in investing activities (12.4) (15.5) (25.8)

----------- ----------- -----------

Cash flows from financing activities

Principal elements of lease payments (1.4) (1.5) (3.0)

Dividends paid to company's shareholders (5.5) (4.3) (4.3)

Purchase of treasury shares (2.2) (2.4) (2.4)

Net cash used in financing activities (9.1) (8.2) (9.7)

----------- ----------- -----------

Net (decrease)/increase in cash

and cash equivalents (7.3) (8.2) (0.3)

Cash and cash equivalents at beginning

of period 35.3 37.9 37.9

Exchange (loss)/gain on cash and

cash equivalents (0.5) (2.5) (2.3)

----------- ----------- -----------

Cash and cash equivalents at end

of period 27.5 27.2 35.3

----------- ----------- -----------

YOUGOV PLC

notes to the CONDENSED consolidated interim financial

statements

For the six months ended 31 January 2021

1 GENERAL INFORMATION

YouGov plc and subsidiaries' (the 'Group') principal activity is

the provision of market research, opinion polling and data

analytics.

YouGov plc is the Group's ultimate parent company. It is

incorporated and domiciled in the United Kingdom. The address of

YouGov plc's registered office is 50 Featherstone Street, London,

EC1Y 8RT. YouGov plc's shares are listed on the Alternative

Investment Market.

YouGov plc's condensed consolidated interim financial statements

are presented in millions Pounds Sterling (GBPm). Sterling is also

the functional currency of the parent company.

These condensed consolidated interim financial statements have

been approved for issue by the Board of Directors of YouGov plc

(the 'Board') on 23 March 2021.

This condensed consolidated interim financial information for

the six months ended 31 January 2021 does not comprise statutory

accounts within the meaning of Section 434 of the Companies Act

2006. Statutory accounts for the year ended 31 July 2020 were

approved by the Board on 15 October 2020 and delivered to the

Registrar of Companies. The report of the auditors on those

accounts was unqualified, did not contain an emphasis of matter

paragraph and did not contain any statement under section 498 of

the Companies Act 2006. The condensed consolidated financial

statements of the Group for the year ended 31 July 2020 are

available from the Company's registered office or website

(https://corporate.yougov.com/).

This condensed consolidated interim financial information is

unaudited and not reviewed by the auditors.

2 BASIS OF PREPARATION

This condensed consolidated interim report for the six months

ended 31 January 2021 has been prepared in accordance with the

Disclosure and Transparency Rules of the Financial Services

Authority and IAS 34 'Interim financial reporting' as adopted by

the European Union. The condensed consolidated interim report

should be read in conjunction with the annual financial statements

for the year ended 31 July 2020, which has been prepared in

accordance with IFRS's as adopted by the European Union.

Accounting estimates and judgements

The preparation of interim financial information requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amount of income, expense, assets and liabilities.

The significant estimates and judgements made by management were

consistent with those applied to the consolidated financial

statements for the year ended 31 July 2020.

3 SEGMENTAL ANALYSIS

The Board of Directors (which is the 'chief operating decision

maker') primarily reviews information based on product lines,

Custom Research, Data Products and Data Services, with supplemental

geographical information.

Intra-group

revenues

Custom / Central

Research Data Products Data Services Costs Group

GBPm GBPm GBPm GBPm GBPm

For the six months to

31 January 2021 (Unaudited)

Revenue

Recognised over time 11.8 26.2 0.5 1.1 39.6

Recognised at a point

in time 18.3 0.3 21.3 (0.5) 39.4

------------ -------

Total revenue 30.1 26.5 21.8 0.6 79.0

Cost of sales (6.8) (1.9) (3.6) (1.1) (13.4)

---------- -------------- -------------- ------------ -------

Gross profit 23.3 24.6 18.2 (0.5) 65.6

Administrative expenses (18.6) (15.8) (14.5) (6.2) (55.1)

---------- -------------- -------------- ------------ -------

Adjusted operating profit/(loss) 4.7 8.8 3.7 (6.7) 10.5

Separately reported items (3.1)

-------

Operating profit 7.4

Net finance income 0.4

Profit before taxation 7.8

Taxation (2.6)

-------

Profit after taxation 5.2

-------

Other segment information

Depreciation and amortisation 0.5 0.2 - 8.8 9.5

---------- -------------- -------------- ------------ -------

Intra-group

revenues

Custom / Central

Research Data Products Data Services Costs Group

GBPm GBPm GBPm GBPm GBPm

For the six months to

31 January 2020 (Unaudited)

Revenue

Recognised over time 13.4 24.6 0.3 0.4 38.7

Recognised at a point

in time 20.5 0.5 18.1 (0.9) 38.2

------------ -------

Total revenue 33.9 25.1 18.4 (0.5) 76.9

Cost of sales (6.6) (2.1) (2.8) (0.7) (12.2)

---------- -------------- -------------- ------------ -------

Gross profit 27.3 23.0 15.6 (1.2) 64.7

Administrative expenses (19.3) (14.5) (12.8) (6.8) (53.4)

---------- -------------- -------------- ------------ -------

Adjusted operating profit/(loss) 8.0 8.5 2.8 (8.0) 11.3

Separately reported items (1.8)

-------

Operating profit 9.5

Net finance income/(cost) (0.3)

Profit before taxation 9.2

Taxation (2.9)

-------

Profit after taxation 6.3

-------

Other segment information

Depreciation and amortisation 0.4 0.2 - 6.7 7.3

---------- -------------- -------------- ------------ -------

3 SEGMENTAL ANALYSIS (cont)

Supplementary information by geography

Six months to 31 Six months to 31

January 2021 (Unaudited) January

2020 (Unaudited)

Adjusted Adjusted

operating operating

Revenue profit/(loss) Revenue profit/(loss)

GBPm GBPm GBPm GBPm

UK 24.0 7.2 23.6 7.8

USA 34.3 9.9 32.1 9.3

Mainland Europe 14.0 1.8 11.7 0.9

Middle East 2.4 (0.1) 5.8 1.7

Asia Pacific 6.7 - 6.0 -

Intra-group revenues

/ Central Costs (2.4) (8.3) (2.3) (8.4)

---------- ---------------- -------- ---------------

Group 79.0 10.5 76.9 11.3

---------- ---------------- -------- ---------------

4 SEPARATELY REPORTED ITEMS

Unaudited Unaudited Audited

6 months 6 months Year ended

to to

31 January 31 January 31 July

2021 2020 2020

GBPm GBPm GBPm

Impairment of goodwill - - 2.1

Acquisition related costs 3.1 1.8 4.5

Total separately reported items 3.1 1.8 6.6

----------- ----------- -----------

Acquisition related costs in the period comprise GBP3,024,000 of

contingent consideration treated as staff costs in respect of the

acquisitions of SMG Insight Limited, InConversation Media Limited

and Portent.io Limited and GBP81,000 of transactions costs in

respect of the acquisitions of Wizsight and Charlton Insights

Inc.

Acquisition related costs in the prior period comprise

GBP1,102,000 of contingent consideration treated as staff costs in

respect of the acquisitions of SMG Insight Limited, Galaxy Research

Pty Limited, InConversation Media Limited and Portent.io Limited

and GBP745,000 of changes in the previously estimated consideration

due and net assets acquired in respect of SMG Insight Limited.

5 TAXATION

Unaudited Unaudited Audited

6 months 6 months Year ended

to to

31 January 31 January 31 July

2021 2020 2020

GBPm GBPm GBPm

Current taxation charge 2.9 0.5 4.4

Deferred taxation (credit)/charge (0.3) 2.4 1.4

----------- ----------- -----------

Total income statement tax charge 2.6 2.9 5.8

----------- ----------- -----------

The tax charge for the period has been calculated based on the

expected tax rates for the full year in each country.

6 EARNINGS PER SHARE

Unaudited Unaudited Audited

6 months 6 months Year ended

to to

31 January 31 January 31 July

Number of shares 2021 2020 2020

Weighted average number of shares

during the period ('m shares):

- Basic 108.7 105.7 106.7

- Dilutive effect of options 3.9 6.9 5.8

----------- ----------- -----------

- Diluted 112.6 112.6 112.5

----------- ----------- -----------

Basic earnings per share (in

pence) 4.8p 6.2p 9.0p

Adjusted basic earnings per share

(in pence) 9.7p 8.7p 18.1p

Diluted earnings per share (in

pence) 4.6p 5.9p 8.5p

Adjusted diluted earnings per

share (in pence) 9.3p 8.2p 17.2p

----------- ----------- -----------

The adjustments have the following

effect:

Basic earnings per share 4.8p 6.2p 9.0p

Share based payments 2.3p 0.9p 2.6p

Social taxes on share-based payments 0.2p - 0.9p

Imputed interest - 0.1p 0.1p

Separately reported items 2.9p 1.7p 6.2p

Tax effect of the above adjustments

and adjusting tax items (0.5p) (0.2p) (0.7p)

----------- ----------- -----------

Adjusted basic earnings per share 9.7p 8.7p 18.1p

----------- ----------- -----------

Diluted earnings per share 4.6p 5.9p 8.5p

Share based payments 2.2p 0.8p 2.5p

Social taxes on share-based payments 0.2p - 0.8p

Imputed interest - 0.1p 0.1p

Separately reported items 2.8p 1.6p 5.9p

Tax effect of the above adjustments

and adjusting tax items (0.5p) (0.2p) (0.6p)

----------- ----------- -----------

Adjusted diluted earnings per

share 9.3p 8.2p 17.2p

----------- ----------- -----------

7 BUSINESS COMBINATIONS

Acquisition of Wizsight

On 12 November 2020, YouGov purchased a 100% shareholding in

Wizsight, a Turkish online-focussed research agency. This purchase

has been treated as a business combination. The amount payable was

EUR620,000 (GBP550,000), which was paid upon completion.

In addition, transaction costs of GBP78,000 were incurred in the

period in respect of this purchase and these have been recognised

in the income statement as separately reported items.

Ownership and control of Wizsight passed to YouGov on 12

November 2020 and the business has been consolidated within the

Group financial statements from that date. In the period the

acquiree has contributed GBP65,000 to Group revenue and increased

Group adjusted operating profit by GBP35,000.

8 DIVID

On 10 December 2020 a final dividend in respect of the year

ended 31 July 2020 of GBP5,510,000 (5.0p per share) (2019:

GBP4,298,000 (4.0p per share)) was paid to shareholders. No interim

dividend is proposed in respect of the period (2020: GBPnil).

9 GOODWILL, INTANGIBLE ASSETS, PROPERTY, PLANT AND EQUIPMENT AND RIGHT OF USE ASSETS

Other Property, Right

Intangible plant and of use

Goodwill assets equipment assets

GBPm GBPm GBPm GBPm

Carrying amount at 31

July 2019 65.6 16.7 4.4 10.5

Additions:

Separately acquired - 4.9 0.6 0.5

Internally developed - 2.8 - -

Amortisation and depreciation - (5.0) (0.8) (1.5)

Foreign exchange differences (2.0) (0.4) (0.2) (0.2)

--------- ------------ ----------- --------

Carrying amount at 31

January 2020 63.6 19.0 4.0 9.3

Additions:

Separately acquired - 4.8 0.5 1.2

Internally developed - 5.1 - -

Amortisation and depreciation (2.1) (5.7) (0.8) (1.4)

Disposals - - (0.1) (0.1)

Foreign exchange differences - - - (0.1)

--------- ------------ -----------

Carrying amount at 31

July 2020 61.5 23.2 3.6 8.9

Additions:

Business combinations 0.5 - - -

Separately acquired - 7.6 0.6 6.3

Internally developed - 3.7 - -

Amortisation and depreciation - (6.8) (0.7) (3.1)

Foreign exchange differences (1.8) (0.5) (0.1) 0.8

--------- ------------ ----------- --------

Carrying amount at 31

January 2021 60.2 27.2 3.4 12.9

--------- ------------ ----------- --------

In accordance with the Group's accounting policy, the carrying

values of goodwill and other intangible assets are reviewed for

impairment annually. A full impairment test is undertaken at each

financial year end and a review for indicators of impairment is

undertaken at the end of each interim period and an impairment test

undertaken if required. The last full annual impairment review was

undertaken as at 31 July 2020. There were no indications of

impairment as at 31 January 2021.

10 SHARE CAPITAL

Share

Number of capital

shares GBPm

At 31 January 2020 108,397,224 0.2

Issue of shares 78,929 -

At 31 July 2020 108,476,153 0.2

Issue of shares 2,771,871 -

------------ --------

At 31 January 2021 111,248,024 0.2

------------ --------

The company has only one class of share. The par value of each

share is 0.2p. All issued shares are fully paid. Shares issued in

the year were in respect of the exercise of 2,771,871 share options

at 0.2p per share. A total of 350,000 shares were repurchased for

the purposes of settling share option schemes as they vest.

11 FAIR VALUES OF FINANCIAL ASSETS AND FINANCIAL LIABILITIES

Where market values are not available, fair values of financial

assets and financial liabilities have been calculated by

discounting expected future cash flows at prevailing interest rates

and by applying year end foreign exchange rates.

The book value of the Group's primary financial instruments are

equal to their fair values. The primary categories are Trade &

Other receivables, Cash & Cash Equivalents and Trade &

Other payables as shown in the Consolidated Statement of Financial

Position.

12 TRANSACTIONS WITH DIRECTORS AND OTHER RELATED PARTIES

Other than emoluments, there were no other transactions with

Directors during the period. Trading between YouGov plc and group

companies is excluded from the related party note as this has been

eliminated on consolidation.

13 EVENTS AFTER THE REPORTING PERIOD

On 2 March 2021, YouGov wholly acquired Charlton Insights Inc,

for consideration of GBP396,000.

Other than the above no other material events have taken place

subsequent to the reporting date.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BCGDXLUDDGBD

(END) Dow Jones Newswires

March 23, 2021 03:00 ET (07:00 GMT)

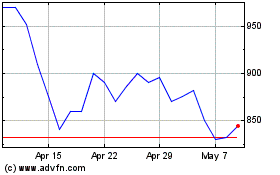

Yougov (LSE:YOU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Yougov (LSE:YOU)

Historical Stock Chart

From Apr 2023 to Apr 2024