TIDMZPHR

RNS Number : 7261T

Zephyr Energy PLC

29 March 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, RUSSIA, CANADA, AUSTRALIA, THE REPUBLIC OF SOUTH

AFRICA OR JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND SHALL NOT

CONSTITUTE AN OFFER TO SELL OR ISSUE OR THE SOLICITATION OF AN

OFFER TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE ANY ORDINARY

SHARES OF ZEPHYR ENERGY PLC.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION 11 OF THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS

2019/310. MARKET SOUNDINGS WERE TAKEN IN RESPECT OF THE MATTERS

CONTAINED IN THIS ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN

PERSONS PREVIOUSLY BECAME AWARE OF SUCH INSIDE INFORMATION. UPON

THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS

NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN AND ALL SUCH PERSONS

SHALL THEREFORE CEASE TO BE IN POSSESSION OF INSIDE

INFORMATION.

29 March 2021

Zephyr Energy plc

(the "Company" or "Zephyr")

Equity fundraising of GBP10m to fund the upcoming Paradox

lateral well and

to acquire and fund oil producing interests in the Bakken

Formation USA,

and notice of General Meeting

Zephyr Energy plc (AIM: ZPHR), the Rocky Mountain oil and gas

company focused on responsible resource development, is pleased to

announce a placing and subscription of 500,000,000 new ordinary

shares of 0.1 p each in the Company ("Placing Shares"), at a price

of 2.0 pence ("p") per Placing Share, to raise GBP10 million before

expenses (the "Placing"). The Placing has been supported by a range

of new and existing institutional investors, family offices, Zephyr

Board members and other investors, and was conducted by Turner Pope

Investments ("TPI") acting as sole broker for the Company.

The proceeds from the Placing will be invested with the

objective of transforming the Company into a self-sustaining

platform for organic growth with a diverse portfolio of production

assets in two established USA oil producing basins.

Of the funds raised in the Placing, GBP6 million is conditional,

inter alia, on the approval by the Company's Shareholders of

resolutions to provide authority to the Directors to issue and

allot further ordinary shares of 0.1p each ("Ordinary Shares") on a

non-pre-emptive basis, which will be sought at a General Meeting to

be held on 16 April 2021, further details of which are set out

below.

Summary

-- The Placing was carried out at a 2.5% discount to the

Company's closing price of 2.05p per share on Friday 26 March

2021.

-- The Placing will fully fund the $3.5 million State 16-2 CC LN

appraisal well (the "lateral well" or "Paradox lateral") drilling

programme targeting the Company's first production from its Paradox

project (the "Paradox" or the "Paradox project").

-- The Placing also allows the Company to proceed with the

proposed acquisition, and to fund associated capital expenditure

("CAPEX"), of highly economic working interests in currently

producing and near-term production wells in the Bakken Formation,

North Dakota, USA (the "Acquisition" or the "Bakken project").

-- Production from the Acquisition will provide the Company with

immediate oil production and the substantial cashflows expected to

be generated from the Bakken project have the potential to fund

multiple additional Paradox wells over the next 12 months. The

Company will also be able to utilise its historical tax losses of

more than $16 million to offset federal income taxes due on profits

from the Acquisition.

Colin Harrington, Chief Executive of Zephyr, said : "Today's

developments mark a truly ground-breaking moment for the Company.

Following the completion of this ambitious fundraise, Zephyr is

poised to transform itself into a well-capitalised, self-sustaining

platform with a financial flexibility that will enable the Company

to pursue - on an independent basis - the significant upside

potential which exists in our Paradox project.

The key benefit of our proposed Bakken project acquisition is

its potential to generate substantial cashflows which can be

reinvested into our Paradox project. This, combined with the

funding secured to drill the Company's first production target in

the Paradox later this year, means we have taken a massive step

towards unlocking the substantial potential value from the Paradox

project on a timeline and in a manner that is now within our

control.

The combination of a funded Paradox drilling programme and a

cash generating Bakken project will also give us the capacity to

fund any future potential exploration opportunities on the

additional 11 reservoirs in the Paradox we have identified above

and beyond our main target, the Cane Creek reservoir.

The Bakken project acquisition is a perfect addition to our

asset portfolio and is the ideal complement to our Paradox project.

Since I joined the Company in mid-2019, we have evaluated over 75

potential acquisitions, and I believe the Bakken project to be the

single best opportunity we've identified. We have been able to

negotiate the Acquisition on highly favourable economic terms,

particularly when taking into account the recent rise in the oil

price. The fact that the Bakken project wells have had all drilling

risk removed is a major bonus, and the resulting cash flow will

enable us to utilise the Company's historical tax losses of more

than $16 million.

"The next few months will see a flurry of corporate and

operational activity - including the completion of the Acquisition,

first Bakken oil production and revenues for the Company, the

Bakken well completions, the drilling of the State 16-2 lateral

well targeting our first production in the Paradox and the release

of additional analysis of the overlying reservoir zone in the

Paradox. The team has shown fantastic energy and resilience to get

the Company to this position, and we look forward to continuing

delivering on these key objectives for our Shareholders.

"I would like to thank TPI and the rest of our adviser team for

the successful execution of the Placing, a fantastic effort and

outcome, and I would very much like to take this opportunity to

welcome our new Shareholders and institutional investors on

board.

" In conclusion, I'd like to note that we are currently

operating in particularly exciting and unusual times - times which

simultaneously offer strengthening commodity prices as well as

reduced drilling and service costs, and times in which

opportunistic acquisitions, such as the Bakken project, can be made

at highly compelling valuations. Zephyr's Board has elected to be

opportunistic in these exceptional times in order to position the

Company for significant long-term growth - and that growth now has

the potential to be achieved without the need for future external

funding while giving the Company autonomy and flexibility to

deliver the value from its existing asset portfolio.

"We will be providing regular updates as we progress through

this transformational period and in the meantime, we will continue

to operate in line with our core values of being responsible

stewards of both our investors' capital and of the environment in

which we work."

Details of and reasons for the Acquisition

The proposed Acquisition will provide the Company with low-risk

oil production from already drilled wells and is expected to

generate substantial cashflows that can be utilised across the

Company, including funding for the additional development of the

Paradox project.

The key details of the Acquisition are as follows:

-- Acquisition of non-operated working interests in five wells

(one producing well and four drilled but uncompleted wells (a "DUC"

or "DUCs") in Mountrail County, North Dakota, USA (the " Bakken

Interests ")

-- The Bakken Interests on the five wells range from 16.8% to 37.2%

-- The wells are operated by Whiting Petroleum, an active and

highly experienced operator in the Bakken region (the " Operator

")

-- The Company is acquiring the Bakken Interests from a

privately owned exploration and production company based in the US

(the " Seller ") which has not funded any of its historic or future

CAPEX obligations on the Bakken Interests

-- Zephyr agreed headline terms with the Seller when the oil

price was at $45 per barrel of oil (" bo "), subject to further due

diligence, funding and final documentation

-- The producing well has been on production since March 2020

-- The four DUCs are scheduled to be completed in May 2021 and

production revenues are targeted to be received by August 2021

-- 2P Reserves being acquired are estimated at 449,434 barrels

of oil equivalent (" boe ") to Zephyr

-- The five wells are spread across three separate drilling

pads, creating production diversification

The key benefits of the Acquisition are as follows:

-- A low-risk acquisition with substantial near-term cash flow expected

-- No remaining drilling risk - all five wells have been drilled successfully to target depth

-- Excellent complement to (and funding source for) the higher

risk, higher upside Paradox Basin development

-- No federal tax payments will be payable in the short-term as

profits can be offset against Zephyr's historic tax losses

The economics on the Acquisition as calculated by Zephyr are

extremely attractive and establish Zephyr as an immediate oil

producer. Once the DUC wells are online, Zephyr forecasts that the

Bakken Interests will provide:

-- up to $8 million of undiscounted cash flow to Zephyr over the

following 12 months to deploy into the Paradox development or into

additional projects, and in total, $15 million of undiscounted cash

flow, at $60/bo

-- 2P Internal Rate of Return (" IRR "): 47% at $60/bo

-- 2P net present value at a 10% discount rate (NPV-10): $4.3 million

-- A cash flow breakeven oil price of $36.69/bo

-- H2 2021: approximately 720 boepd average production anticipated

-- a one-year payback

Terms of the Acquisition

Zephyr has a conditional agreement with the Seller providing

exclusivity for Zephyr to acquire the Bakken Interests by 31 March

2021 (the " Agreement "). Zephyr has already paid the Seller a

non-refundable deposit of $50,000. Pursuant to the Agreement, to

acquire the Bakken Interests Zephyr is required to make cash

payments by 31 March 2021 (for which proceeds from the Placing will

be used) totalling approximately $4 million, primarily representing

the outstanding historical CAPEX due to the Operator, with the

balance of less than 8 per cent. being payable to the Seller and

which equates to less than $1.00 per proved boe acquired.

Upon completion of the Acquisition, the Company will be

responsible for payment of future CAPEX obligations on the Bakken

Interests to complete the DUCs, which will be paid directly to the

Operator and is estimated to be approximately $4.2 million, and

which will become due after the wells are completed (currently

scheduled for May 2021). Therefore, total historical and future

CAPEX on the Bakken Interests payable by Zephyr is estimated to be

approximately $7.9 million and equates to $17.35/boe acquired, with

first revenue from the DUC wells expected by August 2021.

Status of the Acquisition process

-- Zephyr has exclusivity to acquire the Bakken Interests until 31 March 2021

-- Financial, technical and commercial due diligence completed

-- Land and lease checks completed

-- Financial modelling completed

-- Technical evaluation and asset review completed

-- Assignments and closing documentation drafted

The Acquisition is expected to complete on 31 March 2021 and

remains conditional on, inter alia, final contract, Zepyhr paying

approximately $4 million by 31 March 2021, release of Operator

liens and transfer of title.

Paradox project update and next steps

On 15 March 2021, the Company announced a comprehensive update

on the Paradox project, which included confirmation of evidence of

oil saturation across entirety of the continuous core acquired from

the Company's Cane Creek reservoir target. The Company also

announced it had elected to proceed with the near-term drilling of

the Paradox lateral. The lateral will target the Cane Creek

reservoir and will utilise the pre-existing roads, pad and wellbore

from the State 16-2 well as a low-cost, low environmental impact

sidetrack host.

It is estimated that the cost of the Paradox lateral well will

be approximately $3.5 million and funds from the second tranche of

the Placing (as detailed below) will be allocated towards drilling

this sidetrack well. It is currently expected that the Paradox

lateral will be drilled in July of this year.

The Company continues to refine the cost and economic benefits

of the lateral. The Paradox lateral is forecast by the Company's

Board to have strong economics based on its 2C estimate, which

includes:

-- A single-well net present value of approximately $8.2 million

at $60.00 per barrel of oil and at a ten per cent. discount rate

(NPV-10)

-- A cash flow breakeven oil price of $20.55 per barrel of oil

-- A single-well estimated ultimate recovery of 694,000 barrels of oil equivalent

The Board's decision to proceed with the Paradox lateral was

made following the initial analysis of the significant reservoir

data that was obtained from the drilling operations on the State

16-2 well that were completed in January 2021. This data included

113 feet of continuous core obtained from the Cane Creek

reservoir.

The highlights from that analysis were as follows:

-- Initial analysis of the Cane Creek continuous core data

provided further evidence of hydrocarbon saturation across the Cane

Creek reservoir.

-- The structure to be drilled has comparable geometry and form

to other productive structures found within the neighbouring Cane

Creek Field, and is characterised by multiple seismic indicators

along its length that may represent natural fracture networks

within the Cane Creek reservoir.

-- When integrated with the recently acquired log data, existing

3D seismic data, and geologic and regional analogue analysis, the

Board believes there is a strong justification to proceed to test

the Cane Creek reservoir zone with a target to deliver initial oil

production.

The use of the State 16-2 well's top hole enables a substantial

well cost reduction and drilling risk mitigation.

The Board's target is to deliver first oil production - and

benefit from the improved commodity price environment - in a rapid

and responsible manner . Permitting and detailed drill planning

efforts for the lateral are underway, and the Company has targeted

a spud date of July 2021, subject to final permit approval.

On a project-wide 2C basis, the Cane Creek reservoir on the

Company's acreage (which includes the State 16-2LN CC) is a

reservoir of substantial scale and is estimated by Zephyr to

hold:

-- Net recoverable resources of over 12mmboe; and

-- A net present value of approximately $156 million using a

flat oil price of $60 per barrel of oil and a ten per cent.

discount rate.

The above estimates only include forecast resources in the Cane

Creek reservoir and do not include the significant potential upside

from additional overlying reservoirs which are being evaluated

following the drilling of the State 16-2 well. The estimates for

the Cane Creek reservoir were calculated by Zephyr in accordance

with the Company's Competent Persons Report prepared by Gaffney

Cline & Associates in June 2018, and will be revised further

once all data from the State 16-2 well has been processed.

In addition, the analysis and interpretation work on the

multiple shallower reservoir targets continues to progress. Initial

results have provided encouraging evidence for the presence of

multiple stacked continuous oil and gas plays, and significant

additional data remains to be processed and analysed over the

coming months.

Use of Placing Proceeds

Proceeds from the Placing will fully fund the upcoming State

16-2 LN CC drilling programme on the Company's project in the

Paradox Basin, details of which were announced on 15 March 2021 and

summarised above.

The Placing will also fully fund the acquisition of, and CAPEX

related to, an attractive portfolio of non-operated production and

near-term production assets in the Bakken Formation, a prolific

Rocky Mountain oil and gas basin located in North Dakota to the

north-east of Zephyr's existing Paradox Basin holdings.

In particular, the Placing proceeds will be used as follows:

-- Approximately $3.5 million to drill the Paradox lateral,

which will target the Company's first oil production on its Paradox

project, details of which were announced on 15 March 2021.

-- Approximately $1.7 million to support and accelerate the

development build-out of the Paradox project.

-- Approximately $4 million to acquire and fund unpaid

historical drilling CAPEX related to a portfolio of attractive,

non-operated working interests in five drilled wells in the Bakken

Formation, North Dakota, USA, as detailed above.

-- Approximately $4.2 million of additional completion CAPEX

investment on the Bakken Interests when the four DUC wells are

completed and tied in for production (currently scheduled for May

2021). First cashflows from the DUC wells are expected to be

received by Zephyr by August 2021.

Of the funds raised in the Placing, GBP6 million is conditional,

inter alia, on the approval by the Company's shareholders of

resolutions at a General Meeting to be held on 16 April 2021,

further details of which are set out below.

Details of the Placing

In total, 500,000,000 Placing Shares are proposed to be issued

pursuant to the Placing, at a price of 2.0p per Placing Share (the

"Placing Price") to raise gross proceeds of GBP10 million. The

Placing Shares (save for director subscriptions as detailed below)

have been conditionally placed by Turner Pope Investments (TPI)

Limited ("TPI"), as agent and broker of the Company, with certain

new and existing institutional and other investors pursuant to a

Placing Agreement, as detailed below.

The Company currently has limited shareholder authority to issue

Ordinary Shares for cash on a non-pre-emptive basis. Accordingly,

the Placing is being conducted in two tranches as set out

below:

1. First tranche

A total of GBP4 million, representing the issue of 200,000,000

Placing Shares at the Placing Price (the "First Placing Shares"),

has been raised within the Company's existing share allotment

authorities which was granted at the Company's general meeting held

on 2 November 2020 (the "First Placing"). Application will be made

for the First Placing Shares to be admitted to trading on AIM and

it is expected that their admission to AIM will take place on or

around 30 March 2021 ("First Admission"). The issue of the First

Placing Shares is conditional, inter alia, on First Admission

becoming effective and the Placing Agreement becoming unconditional

in respect of the First Placing Shares and not being terminated in

accordance with its terms prior to First Admission.

The First Placing is not conditional on the Second Placing (as

defined below) completing (but the Second Placing is conditional on

the First Placing completing). Accordingly, should the First

Placing proceed but not the Second Placing, due to resolutions at

the GM (as defined below) not being passed or for another reason,

the Company will only receive gross proceeds of GBP4 million from

the Placing, which will enable the Acquisition to proceed but will

not provide sufficient funds for the Company's other objectives

such as to drill the Paradox lateral, and therefore the Company

will pursue alternative funding options to achieve this objective.

Further, whilst the Acquisition is expected to complete on 31 March

2021, it remains subject to final conditions such as release of

Operator liens on the Bakken Interests and transfer of title.

2. Second tranche

The balance of the Placing, being GBP6 million and representing

the issue of 300,000,000 Placing Shares at the Placing Price (the

"Second Placing"), is conditional upon, inter alia, the passing of

resolutions to be put to shareholders of the Company at a general

meeting of the Company to be held on 16 April 2021 (the "GM") to

provide authority to the Directors to issue and allot further

Ordinary Shares on a non-pre-emptive basis, whereby such authority

will be utilised by the Directors to enable completion of the

Second Placing. A circular containing a notice of the GM will be

posted to shareholders shortly.

Application will be made for the Second Placing Shares to be

admitted to trading on AIM and it is expected that their admission

to AIM will take place on or around 19 April 2021, conditional on

the passing of the resolutions at the GM ("Second Admission").

In addition to the passing of the resolutions at the GM, the

Second Placing is conditional, inter alia, on First Admission and

Second Admission becoming effective and the Placing Agreement

becoming unconditional in respect of the Second Placing Shares and

not being terminated in accordance with its terms prior to Second

Admission. The First Placing is not conditional on the Second

Placing completing.

The Placing as a whole would, if the necessary resolutions are

approved at the GM, result in the issue of 500,000,000 Placing

Shares, representing, in aggregate, approximately 41 per cent. of

the Company's issued ordinary share capital as enlarged by the

Placing.

The Placing Shares will, when issued, be credited as fully paid

and will rank pari passu in all respects with the existing Ordinary

Shares of the Company, including the right to receive all dividends

or other distributions made, paid or declared in respect of such

shares after the date of issue of the Placing Shares.

Director subscriptions and shareholdings

Origin Creek Energy LLC ("OCE") has subscribed for 2,500,000

Placing Shares in the Second Placing, equivalent to GBP50,000 at

the Placing Price. Rick Grant, the Chairman of Zephyr, and Colin

Harrington, the CEO of Zephyr, are both shareholders and directors

of OCE, and Colin Harrington is indirectly the controlling

shareholder of OCE. Upon First Admission, OCE's interest in

Ordinary Shares will remain unchanged at 134,636,364 Ordinary

Shares but will represent 14.64% of the then issued share capital.

Upon Second Admission, OCE will have an interest in 137,136,364

Ordinary Shares, equivalent to 11.22% of the Company's then issued

share capital.

In addition to OCE, Colin Harrington has also subscribed for

750,000 Ordinary Shares in the Second Placing. Mr Harrington's

total interest in Ordinary Shares will remain unchanged on First

Admission at 135,340,300 (which includes OCE's shareholding) but

will represent 14.72 per cent. of the then issued share capital.

His total interest in the Company on Second Admission will be

138,590,300 Ordinary Shares and will represent 11.34% of the then

issued share capital.

In addition, Rick Grant (Chairman of Zephyr), Chris Eadie (CFO

of Zephyr) and Gordon Stein (Non-Executive Director of Zephyr) have

also each subscribed for Placing Shares in the Second Placing as

follows:

No. of Placing Total shareholding Percentage held

Shares subscribed on Second Admission on Second Admission

Rick Grant* 1,500,000 1,500,000 0.12

------------------- --------------------- ---------------------

Chris Eadie 1,500,000 6,775,095 0.55

------------------- --------------------- ---------------------

Gordon Stein 500,000 2,350,000 0.19

------------------- --------------------- ---------------------

*In addition, Rick Grant has a minority shareholding in OCE

which holds Ordinary Shares, as noted above.

Placing Agreement

Under the terms of a Placing Agreement between the Company and

TPI, TPI will receive commission from the Company conditional on

First Admission and Second Admission and the Company will give

customary warranties and undertakings to TPI in relation, inter

alia, to its business and the performance of its duties. In

addition, the Company has agreed to indemnify TPI in relation to

certain liabilities that they may incur in undertaking the Placing.

TPI has the right to terminate the Placing Agreement in certain

circumstances prior to First Admission and Second Admission, in

particular, in the event that there has been, inter alia, a

material breach of any of the warranties. The Placing is not being

underwritten.

Warrants

The Company is proposing to issue TPI with 32,350,000 warrants

to subscribe for 32,350,000 new Ordinary Shares ("Broker Warrants")

as part of TPI's fees for undertaking the Placing. The Broker

Warrants will be exercisable at a price of 3 p per Ordinary share,

a 50 per cent. premium to the Placing price, for a period of three

years from issue.

The issue of the Broker Warrants is conditional on the passing

of the resolutions to be put to shareholders of the Company at the

GM to provide authority to the Directors to issue and allot further

Ordinary Shares on a non-pre-emptive basis. The Broker Warrants

will not be admitted to trading on AIM or any other stock

exchange.

Further issue of equity

The Company announces the proposed issue and allotment of

2,428,885 Ordinary Shares in lieu of professional fees incurred by

and due to a professional service-provider engaged by the Company

for services performed in 2020 ("Fee Shares"). The issue of the Fee

Shares is conditional on the passing of applicable resolutions at

the GM.

Application will be made for the Fee Shares to be admitted to

trading on AIM and it is expected that their admission to AIM will

take place on Second Admission.

The Fee Shares will rank pari passu in all respects with the

existing Ordinary Shares of the Company in issue and therefore will

rank equally for all dividends or other distributions declared,

made or paid after the issue of the Fee Shares.

Total voting rights

Following First Admission, the Company's total issued share

capital will consist of 919,339,287 Ordinary Shares, with one

voting right per share. The Company does not hold any shares in

treasury. Therefore, the total number of Ordinary Shares and voting

rights in the Company will be 919,339,287 from First Admission.

This figure may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in their

interest in, the share capital of the Company pursuant to the FCA's

Disclosure Guidance and Transparency Rules.

Following Second Admission, the Company's total issued share

capital will consist of 1,221,768,172 Ordinary Shares, with one

voting right per share. The Company does not hold any shares in

treasury. Therefore, the total number of Ordinary Shares and voting

rights in the Company will be 1,221,768,172 from Second Admission.

This figure may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in their

interest in, the share capital of the Company pursuant to the FCA's

Disclosure Guidance and Transparency Rules.

Notice of General Meeting

The Company will publish a Circular to convene the GM to propose

resolutions to enable completion of the Placing.

The GM will be held at 10.00 a.m. on 16 April 2021. The circular

containing the notice of general meeting will be published and sent

to Shareholders tomorrow and will then be available thereafter on

the Company's website, www.zephyrplc.com. Shareholders will not be

able to attend the meeting due to current COVID-19 restrictions and

are strongly urged to vote by proxy in accordance with the

instructions set out in the notice of general meeting.

Contacts:

Zephyr Energy plc Tel: +44 (0)20 7225

Colin Harrington (CEO) 4590

Chris Eadie (CFO)

Allenby Capital Limited - AIM Nominated Tel: +44 (0)20 3328

Adviser 5656

Jeremy Porter / Liz Kirchner

Turner Pope Investments - Broker Tel: +44 (0)20 3657

Andy Thacker / Zoe Alexander 0050

Flagstaff Strategic and Investor Communications

Tim Thompson / Mark Edwards / Fergus Tel: +44 (0) 20 7129

Mellon 1474

Dr Gregor Maxwell, BSc Hons. Geology and Petroleum Geology, PhD,

Technical Adviser to the Board of Zephyr Energy plc, who meets the

criteria of a qualified person under the AIM Note for Mining and

Oil & Gas Companies - June 2009, has reviewed and approved the

technical information contained within this announcement.

Glossary of Terms

1C: Low estimate of Contingent Resources

2C: Best estimate of Contingent Resources

3C: High estimate of Contingent Resources

1P: proven reserves (both proved developed reserves + proved

undeveloped reserves)

2P: 1P (proven reserves) + probable reserves, hence "proved and

probable"

3P: the sum of 2P (proven reserves + probable reserves) +

possible reserves, all 3Ps "proven and probable and possible"

Contingent Resources:

Those quantities of petroleum estimated, as of a given date, to

be potentially recoverable from known accumulations by application

of development projects, but which are not currently considered to

be commercially recoverable due to one or more contingencies.

Contingent Resources may include, for example, projects for

which there are currently no viable markets, or where commercial

recovery is dependent on technology under development, or where

evaluation of the accumulation is insufficient to clearly assess

commerciality. Contingent Resources are further categorized in

accordance with the level of certainty associated with the

estimates and may be sub-classified based on project maturity

and/or characterized by their economic status.

Reserves: Reserves are defined as those quantities of petroleum

which are anticipated to be commercially recovered from known

accumulations from a given date forward

mmboe: million barrels of oil equivalent

Notice to Distributors

Solely for the purposes of the temporary product intervention

rules made under sections S137D and 138M of the FSMA and the FCA

Product Intervention and Product Governance Sourcebook (together,

the "Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the Product Governance

Requirements) may otherwise have with respect thereto, the Placing

Shares have been subject to a product approval process, which has

determined that the Placing Shares are: (i) compatible with an end

target market of retail investors and investors who meet the

criteria of professional clients and eligible counterparties, as

defined under the FCA Conduct of Business Sourcebook COBS 3 Client

categorisation, and are eligible for distribution through all

distribution channels as are permitted by the FCA Product

Intervention and Product Governance Sourcebook (the "Target Market

Assessment").

Notwithstanding the Target Market Assessment, distributors

should note that: the price of the Placing Shares may decline and

investors could lose all or part of their investment; the Placing

offer no guaranteed income and no capital protection; and an

investment in the Placing is compatible only with investors who do

not need a guaranteed income or capital protection, who (either

alone or in conjunction with an appropriate financial or other

adviser) are capable of evaluating the merits and risks of such an

investment and who have sufficient resources to be able to bear any

losses that may result therefrom. The Target Market Assessment is

without prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Placing.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, Allenby Capital Limited will only procure investors who

meet the criteria of professional clients and eligible

counterparties. For the avoidance of doubt, the Target Market

Assessment does not constitute: (a) an assessment of suitability or

appropriateness for the purposes of the FCA Conduct of Business

Sourcebook COBS 9A and 10A respectively; or (b) a recommendation to

any investor or group of investors to invest in, or purchase, or

take any other action whatsoever with respect to the Placing

Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEFFFSLVVITFIL

(END) Dow Jones Newswires

March 29, 2021 02:00 ET (06:00 GMT)

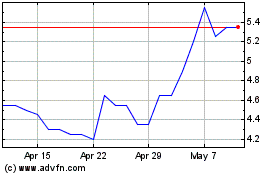

Zephyr Energy (LSE:ZPHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

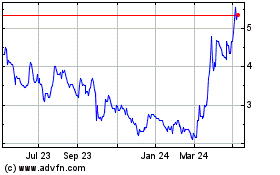

Zephyr Energy (LSE:ZPHR)

Historical Stock Chart

From Apr 2023 to Apr 2024