Canadians don't mind paying for the perks of condo living

April 18 2012 - 7:30AM

PR Newswire (Canada)

- Three-quarters of condo buyers say monthly fees are a small price

to pay to enjoy the convenience and amenities of condos, according

to annual TD Canada Trust Condo Poll - TORONTO, April 18, 2012

/CNW/ - Attracted to the urban lifestyle, three-quarters of

Canadian condo buyers say condo fees are worth the extra monthly

expense to enjoy the benefits of living in a condominium. The TD

Canada Trust 2012 Condo Poll surveyed urban Canadians who recently

bought or intend to buy a condo and found they are drawn to condos

because they require less maintenance (60%), are more affordable

(45%), and offer more amenities (25%) than a house. "Managing your

housing expenses is about prioritizing your needs and budgeting

accordingly. It's clear that the convenience of condo living is

important to many Canadians, and they are willing to pay the

monthly fees that come with owning a condo," says Farhaneh Haque,

Director of Mortgage Advice, TD Canada Trust. The poll found that

one-third of condo buyers (35%) are willing to pay up to $200 per

month in condo fees, 44% would pay up to $400 and 17% would pay up

to $800. Across all cities, Torontonians are willing to pay the

highest fees; 38% are willing to pay more than $400 and 16% more

than $600. Conversely, the majority of Montreal residents (59%)

wouldn't pay more than $200 per month in condo fees. Even though

they've set these limits, many condo buyers understand that monthly

fees can increase at any time and have a plan: 29% have a buffer

built into their current budget and 34% say they could cut back in

other areas in the event of an increase. "The possibility of a fee

increase can be a little unnerving," says Haque. "While there's no

way to 'lock-in' to a monthly fee like you can with a mortgage, you

can prepare for a fee increase by building a buffer into your

monthly housing budget, as some Canadians have wisely done. That

way if fees go up, it won't be a major shock to your cash flow. If

they don't increase, you have extra money to put aside in savings

or towards your mortgage. You can also explore flexible mortgage

options that allow you to pay more towards your mortgage when you

can, then, upon an approved application, ease off on payments when

you need to. This can be a useful feature in the first few months

of transition to a fee increase." Top features Canadians look for

in condos According to the poll, condo buyers think the most

important features when deciding on a condo to buy are: 1. Good

building security (94%) and low condo fees (94%) 2.

Energy-efficient building features (92%) and attractive interior

design (92%) 3. A balcony (90%) 4. Parking for their car (87%) 5.

Close to public transit (84%) Women are more likely than men to

look for a building with a balcony (92% versus 87% of men) and

environmentally-friendly features (86% versus 79% of men), while

men are more likely to say finding a brand new condo - not a resale

(56% versus 46% of women) - is important to them. Condos as

stepping stone to home ownership Many condo buyers see condos as an

affordable alternative to renting: 29% say owning a condo is

cheaper than paying rent. But, one-quarter (24%) say paying condo

fees still feels like paying rent so they are saving up to buy

another place where they won't pay monthly fees. "Purchasing a

condo allows you to build equity rather than continuing to pay rent

as you save for a house," says Haque. "At the same time, it's

important you talk to a mortgage expert, because it's not just a

straight comparison of your monthly rent and some utilities to a

monthly mortgage payment and condo fees." Condos as investments

Almost one-third of condo buyers (32%) say the main reason for

their condo purchase is that it is a good investment. Recent

housing forecasts do not seem to have fazed most Canadians. Only

one-third (34%) of the general Canadian population say recent

forecasts have made them less likely to buy a condo. "Recent

housing forecasts have predicted that an over-supply of condos will

cause a drop in prices. How this affects your decision to purchase

a condo comes down to your goals at that time," says Haque. "If you

are buying a condo and see it as a source of rental income that

you'll move into when you are ready to downsize, this drop in value

will likely not have a big effect. On the other hand, if you see a

condo purchase as a way to build equity as you save up to buy a

home, you need to consider the potential effect of a decreased

price when you sell on the money you will have towards a down

payment on a house." Of those who are buying condos that will not

be their primary residence, 46% think they are a good investment to

buy and sell at a profit when prices have gone up. But - that is

not the only way Canadians see a condo purchase as an investment.

Almost an equal number (42%) see them as a long-term source of

rental income and 38% see them as a source of rental income for now

that they will move into later when they are ready to downsize. TD

hosts an online community for homebuyers at

www.tdcanadatrust.com/homeownership. The online community allows

home buyers to learn from each other's experiences, share stories

on a wide range of home financing topics and pose questions to TD

expert, Farhaneh Haque, Director of Mortgage Advice. About the TD

Canada Trust Condo Poll TD Bank Group commissioned Environics

Research Group to conduct a custom, online survey of 1,453

Canadians, 18 years of age or older, in Vancouver, Calgary, Toronto

and Montreal. Among those Canadians surveyed, 801 bought a condo in

the past 24 months or are considering buying one in the next 24

months. Responses were collected between January 23- February 2,

2012. About TD Canada Trust TD Canada Trust offers personal

and business banking to more than 11.5 million customers. We

provide a wide range of products and services from chequing and

savings accounts, to credit cards, mortgages and business banking,

to credit protection and travel medical insurance, as well as

advice on managing everyday finances. TD Canada Trust makes banking

comfortable with award-winning service and convenience through 24/7

mobile, internet, telephone and ATM banking, as well as in over

1,100 branches, with convenient hours to serve customers better.

For more information, please visit: www.tdcanadatrust.com. TD

Canada Trust is the Canadian retail bank of TD Bank Group, the

sixth largest bank in North America. TD Canada Trust CONTACT:

Sinead Brown / Caitie CrozaParadigm Public Relations416-413-5193 /

416-413-5206sbrown@paradigmpr.ca / ccroza@paradigmpr.caTamar

NersesianTD Bank Group416-944-7095Tamar.nersesian@td.com

Copyright

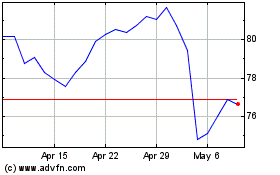

Toronto Dominion Bank (TSX:TD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Toronto Dominion Bank (TSX:TD)

Historical Stock Chart

From Dec 2023 to Dec 2024