TIDMKIBO

RNS Number : 2987E

Kibo Energy PLC

29 June 2023

Kibo Energy PLC (Incorporated in Ireland)

(Registration Number: 451931

(External registration number: 2011/007371/10)

LEI code: 635400WTCRIZB6TVGZ23

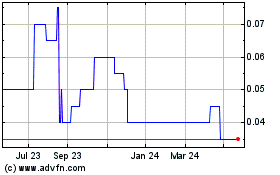

Share code on the JSE Limited: KBO

Share code on the AIM: KIBO

ISIN: IE00B97C0C31

("Kibo" or "the Company")

Dated: 29 June 2023

Kibo Energy PLC ('Kibo' or the 'Company')

Results for the Year Ended 31 December 2022

Kibo Energy PLC ("Kibo" or the "Company"), the renewable

energy-focused development company, is pleased to release its

consolidated annual financial results for the year ended 31

December 2022. The Company's Annual Report, which contains the full

financial statements is in the process of being prepared for

dispatch to shareholders. A copy of this Annual Report will also be

available on the Company's website at

https://kibo.energy/wp-content/uploads/Kibo-Annual-Report-2022-Final.pdf

.

Details of the date and venue for this year's AGM will be

announced in due course.

Overview

Financial results (includes the consolidated results of MAST

Energy Developments Plc)

-- Total revenues GBP1,036,743 (2021: GBP3,245);

-- Operating loss GBP10,570,952 (2021: GBP 24,071,363 loss);

-- Loss after tax for the year ended December 2022 GBP10,908,524

(2021: GBP23,148,155 loss) includes:

-- GBP181,684 (2021: GBP891,375) from the equity accounted

results of Katoro Gold Plc ("Katoro"), which is separately

funded;

-- GBP2,732,982 (2021: GBP1,079,083) from the consolidated

results of Mast Energy Developments Plc ("MED"), which is

separately funded.

-- GBP7,038,930 (2021: GBP20,705,209) impairment loss mainly on

Mast Energy Developments plc (Bordersley), Mbeya Coal to Power and

Mabesekwa Coal to Power projects as a result of the continuing

global shift to move toward renewable energy and disregard fossil

fuel assets, coupled with the Group's execution of its renewable

energy strategy during the 2022 financial period;

-- Administrative expenditure increased to GBP2,579,028 in the year ended December 2022 (2021: GBP2,325,750)

-- Listing and capital raising fees increased from GBP321,365 to GBP 363,368 ;

-- Additional renewable energy and exploration project

expenditure of GBP847,567 (2021: GBP687,963) incurred in 2022 by

Kibo's subsidiaries being mainly MAST Energy Developments plc on

Bordersley, Pyebridge and Rochdale and on Sustineri Energy (Pty)

Ltd on renewable energy in South Africa;

-- Cash outflows from company operating activities have

increased to GBP759,985 (2021: GBP491,229 cash outflow);

-- Group net debt position (cash less debt) is (GBP5,032,945) (2021: (GBP404,576) net debt);

-- Company net debt position (cash less debt) is (GBP2,659,817) (2021: GBP6,608 net cash);

-- Basic and diluted loss per share of GBP0.003 for December

2022 (2021: basic and diluted GBP0.009);

-- Headline loss per share of GBP0.0009 for December 2022 (2021:

headline loss per share of GBP0.0007).

Operational highlights in the 2022 year to date

-- Solidified our position in sectors like Waste to Energy,

Biofuel, Reserve Power, and Renewable Energy Generation Long

Duration Battery Storage, focusing on Southern Africa and the

UK.

-- Proceeded with the joint venture agreement to jointly develop

a portfolio of Waste to Energy projects in South Africa with

Industrial Green Energy Solutions (Pty) Ltd , which will initially

develop a phased c. 8MW project for an industrial client, to be

followed by six other projects at different sites, to a total

generation of up to 50MW. A 20-year conditional Power Purchase

Agreement secured for initial 2.7 MW phase.

-- Ongoing intention to divest from coal assets while retaining

energy projects through innovative biofuel technology. Recent

testing showed the superior potential of biomass (bio coal)

compared to conventional coal in industrial boilers.

-- Initiated a technical study to assess the feasibility of

replacing fossil fuels with renewable biofuel. In this regard, Kibo

has appointed an experienced international biomass and biofuel

consultant to evaluate the economic and operational feasibility of

implementing bio coal as a fuel replacement for utility-scale power

projects.

-- In discussions with the Tanzanian government for the Mbeya

Power Project, aligning with the Tanzanian Power System Master

Plan. A renewed MOU with TANESCO outlines the framework for

finalizing power purchase and implementation agreements.

-- Partnership with Enerox GmbH secures qualified exclusive

rights to deploy VRFB Energy Storage Systems, advancing our

commitment to sustainable energy.

-- Entered into a share purchase agreement to acquire Shankley

Biogas Limited, securing the rights to the Southport project-a 12

MW Waste to Energy initiative near Liverpool, UK. The project aims

to generate bio-methane, power a 10 MW CHP plant, and a 2 MW

battery storage facility.

Post period highlights and Outlook

-- Kibo appointed Beaumont Cornish to the Company as its

Nominated Advisor (Nomad) on 11 January 2023 following the

resignation of RFC Ambrian as Company Nomad on 9 December 2022.

-- Kibo appointed Ajay Saldanha to the Board as a director of the Company on 11 January 2023.

-- Kibo appointed Peter Oldacre as Kibo Group Business Development Executive on 10 March 2023.

-- Kibo announced a potential new revenue stream on 17 January

2023 for its initial project within the IGES waste to energy joint

venture, targeting the production of synthetic oil from

non-recyclable plastic waste (in addition to the previously

reported production of electricity from syngas), which promises

significant added benefits.

-- Kibo settled outstanding creditors by way of issuing

14,025,314 ordinary shares at 0.14 pence per share, of par value

EUR0.001 each (the "Settlement Shares") to a service provider in

payment of an outstanding invoice for value of GBP19,635.44.

-- The Kibo 7% Convertible Loan Note Instrument was redeemed

with the agreement of Noteholders for outstanding balances

amounting to GBP714,517 (principal and interest) as of 28 February

2023 on 11 April 2023 for Kibo shares to satisfy one of the

conditions precedents to the re-profiling of the Kibo Facility

Agreement signed on 10 April 2023 (refer below).

-- Kibo announced a reprofiling of the Bridge Loan Facility

Agreement signed with an Institutional Investor on 16 February 2022

and for which the maturity date was subsequently extended from its

original date of 16 June 2022 to 28 April 2023. The Reprofiling

Agreement saw GBP1,113,980 of the outstanding balance on the

existing bridge loan facility converted into a new 24-month term

loan (the Reprofiling Agreement) following the completion of the

conditions precedent under the Reprofiling Agreement which were

satisfied on 25 April 2023 and announced on 26 April 2023. Kibo has

also awarded 1,262,300,283 warrants to the Institutional under the

agreed reprofiling terms of the Facility.

-- Kibo repriced all unexercised and outstanding warrants in the

Company to the amount of 1,128,024,625 such that they are

exercisable at GBP0.001 (0.1p). Pursuant to the warrant repricing,

Kibo received warrant notices to exercise 284,524,625 Kibo warrants

for which 284,524,625 ordinary Kibo shares of EUR0.001 at a price

of GBP0.001 (0.1p) will be issued.

-- Kibo announced on 2 May 2023 that recent verification testing

on selected biomass types demonstrate that the selected biomass

types not only match but significantly outperforms conventional

coal in many specification categories used in industrial boilers.

These verification results have shown more favourable outcomes in

terms of specifications compared to previous tests.

-- Kibo announced on 18 May 2023 that the potential to fuel its

legacy coal power plant projects with biofuel is being advanced

alongside renewed negotiations on a power purchase agreement with

the Tanzanian Government in relation to the Mbeya Power Project.

Furthermore, Kibo announced the establishment of a Joint Technical

Committee with TANESCO to ensure the key milestones, as set out in

the MOU, are met.

-- Kibo's subsidiary, MAST Energy Developments plc (MED)

announced on 18 May 2023 that it has recently concluded a Heads of

Terms ('HoT') with regard to a new Joint Venture ('JV') agreement

between MED and a new institutional investor-led consortium (the

'Institutional Investor'). Under the HoT, it is envisaged that the

Institutional Investor will inject all required investment capital

into the JV with an expected total investment value of c. GBP33.6m,

with no funding contribution required from MED.

-- The Group continues to focus on its revised renewable energy

strategy in order to align with global requirements.

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR"). F or

further information please visit www.kibo.energy or contact:

Louis Coetzee info@kibo .energy Kibo Energy PLC Chief Executive Officer

Andreas Lianos +357 99 53 1107 River Group JSE Corporate and Designated

Adviser

----------------------------- ------------------- ----------------------------

Claire Noyce +44 (0) 20 3764 2341 Hybridan LLP Joint Broker

----------------------------- ------------------- ----------------------------

Damon Heath +44 207 186 9952 Shard Capital Joint Broker

Partners LLP

----------------------------- ------------------- ----------------------------

James Biddle +44 207 628 3396 Beaumont Cornish Nominated Adviser

Roland Cornish Limited

----------------------------- ------------------- ----------------------------

Zainab Slemang zainab@lifacommunications.com Lifa Communications Investor and Media

van Rijmenant Relations

Consultant

----------------------------- ------------------- ----------------------------

CHAIRMAN'S REPORT

I am pleased to provide a review of Kibo Energy PLC ("Kibo" or

the "Company") and its subsidiaries' (together with Kibo, the

"Group") activities for the 2022 FY reporting period and to present

our full-year audited accounts for 2022.

Kibo, still a relatively newcomer to the sustainable clean and

renewable energy sector, has made significant progress in

waste-to-energy, biofuel, reserve power, and battery storage

projects. Despite significant market challenges, Kibo remains

resilient, focused and committed to its goals. The Company has

successfully transitioned into a clean / renewable energy company

and has acquired a strong project portfolio in the UK and Southern

Africa.

To provide context, I will offer a concise summary of the year's

activities outlined in more detail elsewhere in this annual

report:

-- Joint venture with IGES converts un-recyclable plastic into

syngas, secures power purchase agreement for waste-to-energy

facility;

-- Kibo acquires Shankley Biogas Limited and invests in Mast

Energy Developments PLC for waste-to-energy and reserve energy

projects;

-- Initiates work program to establish the viability of

substituting coal with biofuel in thermal power plants and renews

MoU with Tanzanian Government for the Mbeya Power Project;

-- Entered Long Duration Energy Storage sector through strategic

agreement with Enerox GmbH and establishes joint venture with

National Broadband Solution (Pty) Ltd; and

-- New appointments made to the board, retirements of long-serving directors.

Kibo is pioneering the energy landscape in its approach to the

Company's strategic shift towards sustainable and renewable assets.

Through groundbreaking ventures and partnerships, we are driving

advancements in waste-to-energy, biofuel, reserve power, and

long-duration battery storage. With a forward - looking focus on

innovation to address the challenges in maintaining stable base

load generation while transitioning to sustainable renewable energy

generation solutions, Kibo is contributing to a productive, greener

and brighter future.

In terms of International Financial Reporting Standards (IFRS),

intangible assets with an indefinite life must be tested for

impairment on an annual basis. The change in the Group's strategy

during 2021 to move toward renewable energies coupled with global

divestments in fossil fuel assets, resulted therein that the Group

recognised impairment of GBP5,504,216 (2021: GBP20,088,240) related

to its coal assets. The result for the reporting period amounted to

a loss of GBP10,908,524 for the year ended 31 December 2022 (31

December 2021: GBP23,148,155) as detailed further in the Statement

of Profit or Loss and Other Comprehensive Income, and further

details on financial activities are detailed elsewhere in the

Annual Report. The loss is primarily due to the impairment of

non-current assets, referred to above.

In closing, I would like to acknowledge the support of our

shareholders and all stakeholders as we continue with advancing our

new project portfolio. I would like to thank our Board, as well as

management and staff, for their continued support and commitment in

advancing Kibo.

REVIEW OF ACTIVITIES

Introduction

During 2022, the Group demonstrated its firm commitment to

transition the Group into a sustainable renewable energy company,

despite challenging conditions. We solidified our position in

sectors like Waste to Energy, Biofuel, Reserve Power, and Renewable

Energy Generation Long Duration Battery Storage. Focusing on

Southern Africa and the UK, our achievements have been

significant.

Operations

Sustineri Energy Joint Venture - Waste-to-Energy Project (South

Africa)

Kibo and Industrial Green Energy Solutions (IGES) have formed

Sustineri Energy (Pty) Ltd, aiming to generate over 50 MW of

electricity in South Africa through waste-to-energy projects.

Pyrolysis technology will convert non-recyclable plastics into

syngas.

-- Kibo provides GBP560,000 financial support, including an equity loan.

-- First phase: phased construction of c. 8 MW Waste to Energy facility in Gauteng.

-- 20-year conditional Power Purchase Agreement secured for initial 2.7 MW phase.

-- JV explores synthetic oil production for additional revenue

and profitability from the original project design. Viability

assessments are being conducted; a feasibility optimisation study

is underway for oil integration into original design.

-- Kibo identifies additional waste-to-energy opportunities in pursuit of c. 50 MW capacity.

-- Lesedi Nuclear Services selected as strategic partner for EPC and O&M.

Southport - Waste-to-Energy Project (UK)

Kibo has entered into a share purchase agreement to acquire

Shankley Biogas Limited, securing the rights to the Southport

project-a 12 MW Waste to Energy initiative near Liverpool, UK. The

project aims to generate bio-methane, power a 10 MW CHP plant, and

a 2 MW battery storage facility. Shankley Biogas Limited has

secured a favourable conditional Power Purchase Agreement (PPA) and

Gas Purchase Agreement (GPA) with a reputable buyer. The project

has received full planning permission and has established grid and

gas connection points. Financial estimates demonstrate promising

returns and value for the project.

With reference to the qualified audit opinion on the Company's

investment in Shankley Biogas Limited, Kibo was unable to provide

the auditor with sufficient appropriate audit evidence about the

carrying values of the investment in Shankley and its associated

assets and liabilities, as included in the Group and Company

Balance Sheet as at 31 December 2022. This is because of a dispute

with the vendor due to the vendor's inability to provide sufficient

and reliable financial information for Shankley Biogas Limited,

despite numerous requests in this regard, and the Company being

unable to agree an option to lease agreement in respect of the site

with the vendor. The Company is currently engaged in constructive

negotiations to reach an amicable resolve for the ongoing dispute

and is confident that this will be settled soon.

Legacy Coal Projects - Tanzania, Botswana and Mozambique and

Biofuel Initiative

Kibo is actively pursuing sustainable fuel sources for its

energy projects in Tanzania, Botswana, and Mozambique.

-- Kibo aims to divest from coal assets while retaining energy

projects through innovative biofuel technology. Recent testing

showed the superior potential of biomass (bio coal) compared to

conventional coal in industrial boilers.

-- The company has initiated a technical study to assess the

feasibility of replacing fossil fuels with renewable biofuel. In

this regard, Kibo has appointed an experienced international

biomass and biofuel consultant to evaluate the economic and

operational feasibility of implementing bio coal as a fuel

replacement for utility-scale power projects.

-- Kibo is in discussions with the Tanzanian government for the

Mbeya Power Project, aligning with the Tanzanian Power System

Master Plan. A renewed MOU with TANESCO outlines the framework for

finalizing power purchase and implementation agreements.

Long Duration Energy Storage

Kibo's CellCube Vanadium Redox Flow Battery Energy Storage

Systems (VRFB BESS) strengthens the Company's Southern Africa

project development with durable, long-duration energy storage for

renewables, addressing key aspects such as load shedding and grid

stability.

-- The partnership with Enerox GmbH secures qualified exclusive

rights to deploy VRFB Energy Storage Systems, advancing our

commitment to sustainable energy.

-- Kibo's role as a project developer includes the prospective

manufacturing specific CellCube BESS, driving our clean energy

solutions.

Investments

Mast Energy Developments PLC ("MED")

Since its IPO in April 2021, MAST Energy Developers (MED), in

which Kibo holds a 57.86% investment has been steadily advancing

towards its goal of establishing a portfolio of flexible power

sites in the UK, aiming for a capacity of up to 300 MW. MED's

recent addition of the Hindlip Lane and Stather Road projects,

alongside existing gas peaker plants, brings them closer to this

target. The company's announcement of a heads of terms for a Joint

Venture Agreement, with a significant investor providing an

investment of c. GBP33.6 million, positions MED to accelerate

project acquisition and achieve their capacity goal within the next

two years.

Further information on these projects and the latest MED updates

can be found on its website at www.med.energy .

Katoro Gold PLC - Mineral Exploration

During 2022, Kibo's 20.88% investment in Katoro Gold PLC yielded

progressive results in their projects in Tanzania and South Africa.

While the planned listing and IPO for the Blyvoor gold tailings

joint venture was delayed, Katoro is actively seeking funding

options for its development. In Tanzania, Katoro made progress with

drilling phases in the Haneti Nickel-PGM Project and reestablished

a joint venture interest in the Imweru Gold Project, restructuring

the transaction with Lake Victoria Gold for the asset's

development.

Further information on the Katoro projects and the latest

updates can be found on its website at www.katorogold.com .

Corporate

In 2022, Kibo underwent financial and organizational changes,

issuing shares to settle invoices, fees, and debts.

-- Share Issuance: Kibo issued 108,540,021 new ordinary shares

at various prices to settle invoices, implementation fees, and

outstanding debts.

-- Director and Management Changes: In a series of key

transitions, Christian Schaffalitzky and Chris Schutte retired, and

Andreas Lianos resigned from their director positions. Ajay

Saldanha joined the Board in early 2023, while Pieter Krügel took

on the role of CEO at Mast Energy Developments PLC. Cobus van der

Merwe assumed the position of Kibo Group CFO, and Peter Oldacre was

appointed as the Group Business Development Executive. Shard

Capital Partners LLP became a joint broker alongside Hybridan LLP,

and Beaumont Cornish took over as the new Nomad. These changes

aimed to fortify internal management capacity and support strategic

growth.

Despite Kibo's proven ability to secure ongoing funding,

unexpected and uncontrollable obstacles during Q4 2022 disrupted

its annual funding plans, causing a loss of time and moreover,

business continuity.

-- The Company faced an initial setback with the unexpected

resignation of the previous NOMAD, resulting in a mandatory

suspension from AIM and a pause in closing planned funding

initiatives.

-- Additionally, major shareholders faced voting challenges

arising from a technical problem within the Euroclear system

preventing them from voting from outside the EU jurisdiction during

critically important extraordinary general meetings.

-- Despite the correction of, and recovery after the NOMAD and

Euroclear issues and the subsequent resumption of funding plans,

this created severe delays in securing funding, resulting in

extensive operational disruption and progressive execution.

Nevertheless, the situation was contained, and the company is back

on track.

Kibo remains confident in its ability to adequately address its

short and medium terms funding requirements through various

strategic partnerships and creative funding solutions. Recent

success in this regard is demonstrated by the various initiatives

set out below:

-- Convertible Loan Note Redeemable Instrument (CLN): In January

2022, a CLN was issued to settle debts. The maturity date was

extended multiple times, with a final date set for April 28, 2023.

Noteholders converted GBP714,517 worth of Notes into 510,369,286

Kibo shares.

-- Bridge Loan Facility: In February 2022, Kibo secured a bridge

loan facility of GBP1 million with an institutional investor. The

loan carried a fixed coupon interest rate of 3.5% and was

originally due for repayment in June 2022. To settle a facility

implementation fee of GBP70,000, shares were issued. The repayment

date was extended to April 2023, and the investor gained the right

to trade Mast Energy Developments PLC shares worth up to

GBP250,000, offsetting the outstanding amount.

-- Reprofiling Agreement: Kibo implemented a Reprofiling

Agreement on April 11, 2023, converting GBP1,113,980 of the bridge

loan facility into a 24-month term loan. Additionally, Convertible

Loan Notes were converted to shares, warrants were repriced and

exercised, and new warrants were awarded. The agreement took effect

on April 25, 2023, with the issuance of new warrants and

shares.

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

-------------------------------------------------------------------------------------

All figures are stated in Sterling 31 December 31 December

2022 2021

------------- -------------

Audited Audited

------

Notes GBP GBP

------

Revenue 2 1,036,743 3,245

Cost of sales (778,802) (34,321)

------------- -------------

Gross profit/(loss) 257,941 (31,076)

Administrative expenses (2,579,028) (2,325,750)

11, 12

Impairment of non-current assets & 14 (7,038,930) (20,705,209)

Listing and capital raising fees (363,368) (321,365)

Project and exploration expenditure (847,567) (687,963)

------------- -------------

Operating loss (10,570,952) (24,071,363)

Investment and other income 3 93,866 1,017,937

Share of loss from associate (181,684) (48,357)

Finance costs 4 (249,754) (46,372)

Loss before tax 5 (10,908,524) (23,148,155)

Taxation 8 - -

------------- -------------

Loss for the period (10,908,524) (23,148,155)

Other comprehensive loss:

Items that may be classified subsequently

to profit or loss:

Exchange differences on translation of foreign

operations 372,191 (212,919)

Exchange differences reclassified on disposal

of foreign operation - 345,217

Other Comprehensive loss for the period net

of tax 372,191 132,298

Total comprehensive loss for the period (10,536,333) (23,015,857)

------------- -------------

Loss for the period (10,908,524) (23,148,155)

------------- -------------

Attributable to the owners of the parent (9,776,917) (21,996,968)

Attributable to the non-controlling interest (1,131,607) (1,151,187)

Total comprehensive loss for the period (10,536,333) (23,015,857)

------------- -------------

Attributable to the owners of the parent (9,404,726) (21,864,515)

Attributable to the non-controlling interest (1,131,607) (1,151,342)

Loss Per Share

Basic loss per share 9 (0.003) (0.009)

Diluted loss per share 9 (0.003) (0.009)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

----------------------------------------------------------------------------------

All figures are stated in Sterling 31 December 31 December

2022 2021

------------- -------------

Audited Audited

----- ------------- -------------

Notes GBP GBP

----- ------------- -------------

Assets

Non--current assets

Property, plant and equipment 10 3,493,998 2,899,759

Intangible assets 11 2,691,893 4,964,550

Investments in associates 12 100,945 4,092,403

Total non-current assets 6,286,836 11,956,712

------------- -------------

Current assets

Other receivables 15 227,223 255,747

Cash and cash equivalents 16 163,884 2,082,906

Total current assets 391,107 2,338,653

------------- -------------

Total assets 6,677,943 14,295,365

============= =============

Equity and liabilities

Equity

Called up share capital 17 21,140,481 21,042,444

Share premium account 17 45,516,081 45,429,328

Share based payments reserve 19 73,469 466,868

Translation reserves 20 (93,993) (466,184)

Retained deficit (66,319,142) (56,627,389)

------------- -------------

Attributable to equity holders of the parent 316,896 9,845,067

------------- -------------

Non-controlling interest 21 1,164,218 1,962,816

------------- -------------

Total equity 1,481,114 11,807,883

------------- -------------

Liabilities

Non-current liabilities

Lease liability 10 346,674 289,045

Other financial liabilities 23 243,056 -

------------- -------------

Total non-current liabilities 589,730 289,045

------------- -------------

Current liabilities

Lease liability 10 3,980 2,473

Trade and other payables 22 2,395,090 1,116,273

Borrowings 23 1,195,239 1,079,691

Other financial liabilities 23 1,012,790 -

Total current liabilities 4,607,099 2,198,437

------------- -------------

Total liabilities 5,196,829 2,487,482

------------- -------------

Total equity and liabilities 6,677,943 14,295,365

============= =============

COMPANY STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

All figures are stated in Sterling 31 December 31 December

2022 2021

------------ ------------

Audited Audited

-----

Notes GBP GBP

-----

Revenue - -

Administrative expenses (804,820) (315,666)

Listing and capital raising fees (230,920) (39,583)

Impairment of subsidiary investments (12,333,224) (29,379,842)

Fair value adjustment (427,819) (1,635,881)

------------ ------------

Operating loss (13,796,783) (31,370,972)

Other income 3 16,266 135,709

Finance costs 4 (151,375) -

Loss before tax 5 (13,931,892) (31,235,263)

Taxation - -

------------ ------------

Loss for the period (13,931,892) (31,235,263)

------------ ------------

All activities derive from continuing operations.

The Company has no recognised gains or losses other than those

dealt with in the Statement of Profit or Loss and Other

Comprehensive Income.

COMPANY STATEMENT OF FINANCIAL POSITION

All figures are stated in Sterling 31 December 31 December

2022 2021

------------ ------------

Audited Audited

------------ ------------

Notes GBP GBP

------------ ------------

Non--current Assets

Investments 24 5,688,607 16,762,761

Property, plant and equipment 10 1,265

Total non-current assets 5,689,872 16,762,761

------------ ------------

Current assets

Other receivables 15 90,720 73,734

Cash and cash equivalents 16 19,442 239,674

Total current assets 110,162 313,408

------------ ------------

Total assets 5,800,034 17,076,169

============ ============

Equity and liabilities

Equity

Called up share capital 17 21,140,481 21,042,444

Share premium account 17 45,516,081 45,429,328

Share based payment reserve 19 73,469 466,868

Retained deficit (63,609,256) (50,095,537)

------------ ------------

Total equity 3,120,775 16,843,103

------------ ------------

Liabilities

Current liabilities

Trade and other payables 22 826,035 114,062

Borrowings 23 1,195,239 119,004

Other financial liabilities 23 657,985 -

Total current liabilities 2,679,259 233,066

============ ============

Total liabilities 2,679,259 233,066

============ ============

Total equity and liabilities 5,800,034 17,076,169

============ ============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

-----------------------------------------------------------------------------------------------------------------------

Share Share Warrants Control Foreign Retained Non-controlling Total

Capital premium and share reserve currency deficit interest equity

based translation

payment reserve

reserve

---------------- ---------- ---------- --------- -------- ----------- ------------ --------------- ------------

All figures are GBP GBP GBP GBP GBP GBP GBP GBP

stated in

Sterling

---------------- ---------- ---------- --------- -------- ----------- ------------ --------------- ------------

Balance as at 1

January 2021 20,411,493 44,312,371 1,728,487 (18,329) (598,637) (39,019,856) (256,841) 26,558,688

========== ========== ========= ======== =========== ============ =============== ============

Loss for the

year - - - - - (21,996,968) (1,151,187) (23,148,155)

Other

comprehensive

income -

exchange

differences - - - - (212,764) - (155) (212,919)

Shares issued 630,951 1,116,957 - - - - - 1,747,908

Disposal of

subsidiary - - - - - 3,259,232 3,201,014 6,460,246

Acquisition of

non-controlling

interest - - - - - (308,030) 308,030 -

Vesting of share

options -

Katoro Gold

PLC - - 146,249 - - - - 146,249

Warrants issued

by Kibo Energy

PLC - - 48,695 - - - - 48,695

Warrants issued

by Kibo Energy

plc which

expired during

the year - - (559,400) - - 559,400 - -

Change in

shareholding

without loss of

control - - (897,163) 18,329 345,217 878,833 (138,045) 207,171

Balance as at 31

December 2021 21,042,444 45,429,328 466,868 - (466,184) (56,627,389) 1,962,816 11,807,883

---------- ---------- --------- -------- ----------- ------------ --------------- ------------

Loss for the

year - - - - - (9,776,917) (1,131,607) (10,908,524)

Other

comprehensive

income -

exchange

differences - - - - 372,191 - - 372,191

Change in

shareholding

without loss of

control (333,009) 333,009 -

Shares issued 98,037 86,753 - - - - 184,790

Warrants issued

by Kibo Energy

PLC during

the year - - 24,774 - - - - 24,774

Warrants issued

by Kibo Energy

PLC which

expired during

the year - - (418,173) - - 418,173 - -

Balance as at 31

December 2022 21,140,481 45,516,081 73,469 - (93,993) (66,319,142) 1,164,218 1,481,114

========== ========== ========= ======== =========== ============ =============== ============

Notes 17 17 19 18 20 21

COMPANY STATEMENT OF FINANCIAL POSITION

----------------------------------------------------------------------------------------------------------------------

Share capital Share premium Share based payment reserve Retained deficit Total equity

--------------------------- ------------- ------------- --------------------------- ---------------- ------------

All figures are stated in GBP GBP GBP GBP GBP

Sterling

--------------------------- ------------- ------------- --------------------------- ---------------- ------------

Balance as at 1 January

2021 20,411,493 44,312,371 977,575 (19,419,674) 46,281,765

Profit the year - - - (31,235,263) (31,235,263)

Shares issued 630,951 1,116,957 - - 1,747,908

Shares issued to pay

deferred vendor liability - - 48,693 - 48,693

- - (559,400) 559,400 -

Balance as at 31 December

2021 21,042,444 45,429,328 466,868 (50,095,537) 16,843,103

============= ============= =========================== ================ ============

Loss for the year - - - (13,931,892) (13,931,892)

Shares issued 98,037 86,753 - - 184,790

Warrants issued by Kibo

Energy PLC during the year - - 24,774 - 24,774

Warrants issued by Kibo

Energy PLC which expired

during the year - - (418,173) 418,173 -

Balance as at 31 December

2022 21,140,481 45,516,081 73,469 (63,609,256) 3,120,775

============= ============= =========================== ================ ============

Notes 17 17 19

CONSOLIDATED STATEMENT OF CASH FLOWS

---------------------------------------------------------------------------------------

All figures are stated in Sterling 31 December 31 December

2022 2021

------------ ------------

Audited Audited

-----

Notes GBP GBP

-----

Cash flows from operating activities

Loss for the period before taxation (10,908,524) (23,148,155)

Adjustments for:

(Profit)/Loss from the disposal of subsidiary - (529,415)

Interest accrued 248,202 46,357

Debt forgiven 3 - (355,659)

Warrants and options issued 24,774 194,945

Impairment of goodwill 14 - 300,000

Impairment of intangible assets 11 3,229,155 13,955,528

Impairment of associates 12 3,809,775 6,449,681

Loss from equity accounted associate 181,684 48,357

Exploration and development expenditure on

a Joint Operation - 91,179

Impairment of financial asset receivable - 43,722

Depreciation on property, plant and equipment 10 66,582 10,635

Profit on sale of property, plant and equipment (7,264) -

Gains on revaluations of derivatives (86,558) -

Costs settled through the issue of shares 95,001 -

Directors' fees settled with credit loan notes 44,591 -

Other non-cashflow items 133 -

(3,302,449) (2,892,825)

------------ ------------

Movement in working capital

Decrease / (Increase) in debtors 15 28,524 (145,525)

Increase / (Decrease) in creditors 22 678,817 (240,958)

------------ ------------

707,341 (386,483)

------------ ------------

Net cash outflows from operating activities (2,595,108) (3,279,308)

------------ ------------

Cash flows from financing activities

Proceeds of issue of share capital - 1,527,576

Proceeds from disposal of shares to non-controlling

interest - 6,099,500

Repayment of lease liabilities (27,000) (27,000)

Repayment of borrowings (44,917) (195,282)

Proceeds from borrowings 2,322,824 38,975

Net cash proceeds from financing activities 2,250,907 7,443,769

------------ ------------

Cash flows from investing activities

Cash received from /(advanced) to Joint Venture 20,955 (91,179)

Property, plant and equipment acquired (excluding

right of use assets) (1,020,747) (1,654,239)

Intangible assets acquired (342,038) (150,273)

Cash forfeited on disposal of subsidiary - (272,075)

Deferred payment settlement (555,535) -

Net cash flows from investing activities (1,897,365) (2,167,766)

------------ ------------

Net (decrease) / increase in cash (2,241,566) 1,996,695

Cash at beginning of period 2,082,906 256,760

Exchange movement 322,544 (170,549)

------------ ------------

Cash at end of the period 16 163,884 2,082,906

------------ ------------

COMPANY STATEMENT OF CASH FLOWS

----------------------------------------------------------------------------------

All figures are stated in Sterling 31 December 31 December

2022 2021

------------ ------------

Audited Audited

----- ------------ ------------

Notes GBP GBP

----- ------------ ------------

Cash flows from operating activities

(Loss) for the period before taxation

Adjusted for: (13,931,892) (31,235,263)

Inter-company sales capitalised - (61,000)

Fair value adjustment 406,863 1,635,881

Warrants and options issued 24,774 48,693

Interest accrued 151,377 -

Non-cash recoveries of expenses - (114,253)

Impairment of investment in subsidiaries 12,354,180 29,379,842

Expenses settled in shares 95,001 -

Directors' fees settled with credit loan notes 44,591 -

Other non-cash items 134 -

(854,972) (346,100)

------------ ------------

Movement in working capital

(Increase) / Decrease in debtors 15 (16,986) (40,314)

Increase / (Decrease) in creditors 22 111,973 (104,815)

94,987 (145,129)

------------ ------------

Net cash outflows from operating activities (759,985) (491,229)

------------ ------------

Cash flows from financing activities

Proceeds of issue of share capital 17 - 1,497,176

Proceeds from borrowings 23 1,672,824 -

Repayment of borrowings (44,917) (50,007)

------------ ------------

Net cash proceeds from financing activities 1,627,907 1,447,169

------------ ------------

Cash flows from investing activities

Cash advances to Group Companies (1,086,889) (858,054)

Purchase of Property, Plant and Equipment 10 (1,265) -

------------ ------------

Net cash used in investing activities (1,088,154) (858,054)

------------ ------------

Net (decrease)/increase in cash (220,232) 97,886

Cash at beginning of period 239,674 141,788

Cash at end of the period 16 19,442 239,674

============ ============

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

1. Segment analysis

IFRS 8 requires an entity to report financial and descriptive

information about its reportable segments, which are operating

segments or aggregations of operating segments that meet specific

criteria. Operating segments are components of an entity about

which separate financial information is available that is evaluated

regularly by the chief operating decision maker. The Chief

Executive Officer is the chief operating decision maker of the

Group.

Management currently identifies individual projects as operating

segments. These operating segments are monitored, and strategic

decisions are made based upon their individual nature, together

with other non-financial data collated from exploration activities.

Principal activities for these operating segments are as

follows:

2022 Group Mabasekwa 31 December

Bordersley Coal to Mbeya Pyebridge Rochdale Sustineri 2022 (GBP)

Power Power Coal Power Power Energy Corporate Group

------------ ------------ ------------- ---------- ---------- ---------- ------------ -------------

Revenue - - - 1,036,743 - - - 1,036,743

Cost of sales - - - (778,802) - - - (778,802)

Administrative

and other cost (46,064) (7,065) (7,186) (52,809) (10,763) (1,766) (2,453,375) (2,579,028)

Impairments and

fair value

adjustments (1,288,578) (3,563,639) (1,940,577) - - - (246,136) (7,038,930)

Listing and

Capital

raising fees - - - - - - (363,368) (363,368)

Project and

exploration

expenditure (222,296) - - (255,601) (104,090) (108,912) (156,668) (847,567)

Share in loss

of associate - - - - - - (181,684) (181,684)

Investment and

other income - - - - - 10 93,856 93,866

Finance costs (24,537) - - - - - (225,217) (249,754)

------------

Loss before

tax (1,581,475) (3,570,704) (1,947,763) (50,469) (114,853) (110,668) (3,532,592) (10,908,524)

------------ ------------ ------------- ---------- ---------- ---------- ------------ -------------

2021 Group Benga Blyvoor Lake Mabesekwa Mbeya 31 December

Power Joint Bordersley Victoria Coal to Coal to Pyebridge Rochdale Sustineri 2021 (GBP)

J. V Venture Power Haneti Gold Power Power Power Power Energy Corporate Group

---------- ---------- ----------- ---------- ------------ ------------ ------------- ---------- ---------- ---------- ------------ ---------------

Revenue - - - - - - - 3,245 - - - 3,245

Cost of sales - - - - - - - (34,321) - - - (34,321)

Administrative

and other cost (26,682) (16,799) (332,550) (82,504) (141,098) (13,944) (43,967) (13,448) (4,641) (1,097) (1,649,020) (2,325,750)

Impairments and

fair value

adjustments - - (300,000) - - (6,132,711) (13,955,528) - - - (316,970) (20,705,209)

Listing and

Capital

raising fees - - - - - - - - - - (321,365) (321,365)

Project and

exploration

expenditure (74,337) (126,173) (24,878) (119,101) - - (100,165) (44,004) (11,265) (94,207) (93,833) (687,963)

Investment and

other income 787 5,134 355,659 - 16,505 - 48,298 - - - 591,554 1,017,937

Loss before

tax (100,232) (137,838) (301,769) (201,605) (124,593) (6,146,655) (14,051,362) (88,528) (15,906) (95,304) (1,884,363) (23,148,155)

---------- ---------- ----------- ---------- ------------ ------------ ------------- ---------- ---------- ---------- ------------ ---------------

2022 Group 31

Mabasekwa December

Bordersley Coal to MbeyaCoal Pyebridge Rochdale Sustineri 2022 (GBP)

Power Power to Power Power Power Energy Corporate Group

----------- ---------- ---------- ---------- --------- ---------- ----------

Assets

Segment assets 1,733,554 235 - 2,082,352 262,043 293,160 2,306,599 6,677,943

Liabilities

Segment

liabilities 296,984 7,270 2,320 133,650 6,897 48,491 4,701,217 5,196,829

2021 Group 31

Benga Mabesekwa Mbeya December

Power Bordersley Coal to Coal to Pyebridge Rochdale Sustineri 2021 (GBP)

J. V Power Power Power Power Power Energy Corporate Group

-------

Assets

Segment assets 14,219 3,085,261 3,405,354 1,944,925 2,491,666 261,454 278,985 2,813,501 14,295,365

Liabilities

Segment

liabilities 10,065 394,588 5,577 52,379 70,847 5,570 18,976 1,929,480 2,487,482

Geographical segments

The Group operates in six principal geographical areas being

Tanzania (Exploration), Botswana (Exploration), Cyprus (Corporate),

South Africa (Renewable Energy), United Kingdom (Renewable Energy)

and Ireland (Corporate).

South United 31 December

Tanzania Botswana Cyprus Africa Kingdom Ireland 2022 (GBP)

Carrying value of

segmented

assets - - 218,735 293,160 5,564,783 601,265 6,677,943

Revenue - - - - 1,036,743 - 1,036,743

Loss before tax (1,947,763) (3,563,639) (1,517,557) (110,843) (2,732,982) (1,035,740) (10,908,524)

------------ ------------ ------------ ---------- ------------ ------------ -------------

South United 31 December

Tanzania Botswana Cyprus Africa Kingdom Ireland 2021 (GBP)

Carrying value of

segmented

assets 1,944,925 3,405,354 188,879 283,831 7,630,489 841,887 14,295,365

Revenue - - - - 3,245 - 3,245

Profit/ Loss after tax (14,211,842) (6,143,283) (1,008,539) (218,316) (1,827,534) 261,359 (23,148,155)

------------- ------------ ------------ ---------- ------------ -------- -------------

All revenue generated was from the United Kingdom geographical

area with the only customer being Statkraft Markets GMBH.

2. Revenue

31 December 31 December

2022 (GBP) 2021 (GBP)

Group Group

Electricity sales 1,036,743 3,245

------------------------ -----------------------

1,036,743 3,245

------------------------ -----------------------

Revenue comprised ancillary electricity sales from operational

testing of the renewable energy operations of MAST Energy

Developments PLC in the United Kingdom.

3. Investment and other Income

31 December 31 December 31 December 31 December

2022 2021 2022 2021

(GBP) (GBP) (GBP) (GBP)

Group Group Company Company

Debt forgiven - 355,659 - -

Interest received 44 - 34 -

Gain on revaluation of

derivative liabilities 86,558 - - -

Profit on the loss of

control over subsidiary - 529,415 - -

Profit on sale of plant

and equipment 7,264 - - -

Recoveries - - 16,232 61,000

Other income - 132,863 - 74,709

93,866 1,017,937 16,266 135,709

------------- ------------- ------------- -------------

During the financial year the Group recorded other income

resulting from the revaluation of derivative liabilities. These

liabilities were recognised as part of convertible loan notes

entered into during the financial year. The derivative liability

was fair valued at year end and resulted in a gain for the

financial year.

4. Finance costs

31 December 31 December 31 December 31 December

2022 2021 2022 2021

(GBP) (GBP) (GBP) (GBP)

Group Group Company Company

Interest paid to finance

houses 223,623 21,647 151,375 -

Interest from leases

(refer note 10) 26,131 24,725 - -

249,754 46,372 151,375 -

------------- ------------- ------------- -------------

5. Loss on ordinary activities before taxation

Operating loss is 31 December 31 December 31 December 31 December

stated after the 2022 (GBP) 2021 (GBP) 2022 (GBP) 2021 (GBP)

following key transactions: Group Group Company Company

Depreciation of property,

plant and equipment 66,582 10,635 - -

Impairment of other

financial assets

- receivable from

Lake Victoria Gold - 16,240 - -

Group auditors' remuneration

for audit of financial

statements 58,425 45,000 58,425 -

Subsidiaries auditors'

remuneration for

audit of the financial

statements 172,767 155,094 - -

Impairment of goodwill - 300,000 - -

Impairment of intangible

assets 3,229,155 13,955,528 - -

Impairment of associates 3,809,774 6,449,682 - -

Impairment of subsidiary

investments - - 12,354,180 29,379,842

Fair value adjustments - - 406,863 1,635,881

Gains on revaluations

of derivatives (86,558) - - -

Profit on sale of

assets (7,264) - - -

6. Staff costs (including Directors)

Group Group Company Company

31 December 31 December 31 December 31 December

2022 (GBP) 2021 (GBP) 2022 (GBP) 2021 (GBP)

Wages and salaries 949,355 898,145 28,297 27,415

Share based remuneration - 146,250 -

949,355 1,044,395 28,297 27,415

------------- ------------- ------------- -------------

The average monthly number of employees (including executive

Directors) during the period was as follows:

Group Group Company Company

31 December 31 December 31 December 31 December

2022 2021 2022 2021

Exploration and development

activities 10 10 1 1

Administration 7 7 1 1

------------- ------------- ------------- -------------

17 17 2 2

------------- ------------- ------------- -------------

7. Directors' emoluments

Group Group Company Company

31 December 31 December 31 December 31 December

2022 (GBP) 2021 (GBP) 2022 (GBP) 2021 (GBP)

Basic salary and fees accrued 374,308 397,262 24,366 27,415

Share based payments - - - -

------------- ------------- ------------- -------------

374,308 397,262 24,366 27,415

------------- ------------- ------------- -------------

The emoluments of the Chairman were GBP 55,950 (2021: GBP 47,578

). The emoluments of the highest paid director were GBP164,726

(2021: GBP 129,347) .

Directors received shares in the value of GBPNil during the year

(2021: GBPNil) and warrants to the value of GBPNil (2021: GBPNil)

during the year.

Key management personnel consist only of the Directors. Details

of share options and interests in the Company's shares of each

director are shown in the Directors' report.

T he following table summarises the remuneration applicable to

each of the individuals who held office as a director during the

reporting period:

31 December 2022 Salary

Salary and fees

and fees settled Warrants

accrued in shares issued Total

GBP GBP GBP GBP

Christian Schaffalitzky 16,990 - - 16,990

Louis Coetzee 164,726 - - 164,726

Noel O'Keeffe 38,135 - - 38,135

Andreas Lianos 31,274 - - 31,274

Christiaan Schutte 123,183 - - 123,183

Total 374,308 - - 374,308

---------- ----------- -------------- ----------

31 December 2021 Salary

Salary and fees

and fees settled Warrants

accrued in shares issued Total

GBP GBP GBP GBP

Christian Schaffalitzky 20,578 - - 20,578

Louis Coetzee 165,347 - - 165,347

Noel O'Keeffe 38,319 - - 38,319

Lukas Maree 7,349 - - 7,349

Wenzel Kerremans 7,349 - - 7,349

Andreas Lianos 36,050 - - 36,050

Christiaan Schutte 122,270 - - 122,270

Total 397,262 - - 397,262

---------- ----------- --------- --------

As at 31 December 2022, an amount of GBP174,482 (2021:

GBP443,336) was due and payable to Directors for services rendered

not yet settled.

8. Taxation

Current tax

31 December 31 December

2022 (GBP) 2021 (GBP)

Charge for the period in respect of corporate - -

taxation

------------ ------------

Total tax charge - -

------------ ------------

The difference between the total current tax shown above and the

amount calculated by applying the standard rate

of corporation tax for various jurisdictions to the loss before

tax is as follows:

2022 (GBP) 2021 (GBP)

------------- -------------

Loss on ordinary activities before tax (10,908,524) (23,148,155)

------------- -------------

Income tax expense calculated at blended rate

of 13.18% (2021: 18.86%) (1,437,917) (4,365,742)

------------- -------------

Income which is not taxable (4,615) (100,589)

Expenses which are not deductible 913,814 3,959,520

Losses available for carry forward 528,718 506,811

Income tax expense recognised in the Statement - -

of Profit or Loss

------------- -------------

The effective tax rate used for the December 2022 and December

2021 reconciliations above is the corporate rate of 14.15% and

18.86% payable by corporate entities on taxable profits under tax

law in that jurisdiction respectively. The tax jurisdictions in

which the Group operates are Cyprus, Ireland, South Africa,

Tanzania and the United Kingdom.

No provision has been made for the 2022 deferred taxation as no

taxable income has been received to date, and the probability of

future taxable income is indicative of current market conditions

which remain uncertain . At the Statement of Financial Position

date, the Directors estimate that the Group has unused tax losses

of GBP41,896,825 (2021: GBP38,201,734) available for potential

offset against future profits which equates to an estimated

potential deferred tax asset of GBP5,779,065 (2021: GBP5,076,208).

No deferred tax asset has been recognised due to the

unpredictability of the future profit streams. Losses may be

carried forward indefinitely in accordance with the applicable

taxation regulations ruling within each of the above

jurisdictions.

9. Loss per share

Basic loss per share

The basic loss and weighted average number of ordinary shares

used for calculation purposes comprise the following:

Basic Loss per share 31 December 31 December

2022(GBP) 2021 (GBP)

Loss for the period attributable to equity

holders of the parent (9,776,917) (21,996,968)

Weighted average number of ordinary shares

for the purposes of basic loss per share 3,010,992,501 2,480,279,189

Basic loss per ordinary share (GBP) (0.003) (0.009)

As there are no instruments in issue which have a dilutive

impact, the dilutive loss per share is equal to the basic loss per

share, and thus not disclosed separately.

10. Property, plant and equipment

GROUP Land Furniture Motor Office I.T Plant & Right of Total

and Vehicles Equipment Equipment Machinery use

Fittings assets

Cost (GBP) (GBP) (GBP) (GBP) (GBP) (GBP) (GBP) (GBP)

------- --------- -------- --------- --------- --------- -------- ---------

Opening Cost

as at 1

January 2021 - 2,436 16,131 4,970 4,989 8,601 - 37,127

------- --------- -------- --------- --------- --------- -------- ---------

Disposals - - - - - - - -

Additions 602,500 - - - 509 2,011,409 293,793 2,908,211

Exchange

movements - 29 192 (28) (108) 102 - 187

Closing Cost

as at 31

December 2021 602,500 2,465 16,323 4,942 5,390 2,020,112 293,793 2,945,525

------- --------- -------- --------- --------- --------- -------- ---------

Disposals - (2,465) - (3,383) (3,193) (5,642) - (14,683)

Additions - - - - 6,031 75,061 62,090 143,182

Assets under

development - - - - - 939,664 - 939,664

Derecognition

as a result

of waiver - - - - - (421,041) - (421,041)

Exchange

movement - - - - - 2,695 - 2,695

Closing Cost

as at 31

December 2022 602,500 - 16,323 1,559 8,228 2,610,849 355,883 3,595,342

------- --------- -------- --------- --------- --------- -------- ---------

Land Furniture Motor Office I.T Plant & Right of Total

and Vehicles Equipment Equipment Machinery use

Fittings assets

Accumulated (GBP) (GBP) (GBP) (GBP) (GBP) (GBP) (GBP) (GBP)

Depreciation

("Acc Depr")

------- --------- -------- --------- --------- --------- -------- ---------

Acc Depr as at

1 January

2021 - (2,436) (15,285) (4,398) (4,289) (8,601) - (35,009)

------- --------- -------- --------- --------- --------- -------- ---------

Disposals - - - - - - - -

Depreciation - - (842) - - - (9,793) (10,635)

Exchange

movements - (29) (196) (9) 215 (103) - (122)

Acc Depr as at

31 December

2021 - (2,465) (16,323) (4,407) (4,074) (8,704) (9,793) (45,766)

------- --------- -------- --------- --------- --------- -------- ---------

Disposals - 2,465 - 3,383 3,193 1,974 - 11,015

Depreciation - (1,385) (52,632) (12,565) (66,582)

Exchange

movements - - - - - (11) - (11)

Acc Depr as at

31 December

2022 - - (16,323) (1,024) (2,266) (59,373) (22,358) (101,344)

------- --------- -------- --------- --------- --------- -------- ---------

Furniture Motor Office I.T Plant & Right of Total

Land and Vehicles Equipment Equipment Machinery use

Fittings assets

Carrying Value (GBP) (GBP) (GBP) (GBP) (GBP) (GBP) (GBP) (GBP)

------- --------- -------- --------- --------- --------- ---------

Carrying value

as at 31

December 2021 602,500 - - 535 1,316 2,011,408 284,000 2,899,759

------- --------- -------- --------- --------- --------- -------- ---------

Carrying value

as at 31

December 2022 602,500 - - 535 5,962 2,551,476 333,525 3,493,998

------- --------- -------- --------- --------- --------- -------- ---------

COMPANY Land Furniture Motor Office I.T Plant & Right Total

and Vehicles Equipment Equipment Machinery of use

Fittings assets

Cost (GBP) (GBP) (GBP) (GBP) (GBP) (GBP) (GBP) (GBP)

----- --------- -------- --------- --------- --------- ------ -----

Opening Cost - - - - - - - -

as at 1

January 2021

----- --------- -------- --------- --------- --------- ------ -----

Closing Cost - - - - - - - -

as at 31

December 2021

----- --------- -------- --------- --------- --------- ------ -----

Additions - - - - 1,265 - - 1,265

Closing Cost

as at 31

December

2022 - - - - 1,265 - - 1,265

----- --------- -------- --------- --------- --------- ------ -----

Land Furniture Motor Office I.T Plant & Right Total

and Vehicles Equipment Equipment Machinery of use

Fittings assets

Accumulated (GBP) (GBP) (GBP) (GBP) (GBP) (GBP) (GBP) (GBP)

Depreciation

("Acc Depr")

----- --------- -------- --------- --------- --------- ------ -----

Acc Depr as - - - - - - - -

at 1 January

2021

----- --------- -------- --------- --------- --------- ------ -----

Acc Depr as - - - - - - - -

at 31

December 2021

----- --------- -------- --------- --------- --------- ------ -----

Acc Depr as - - - - - - - -

at 31

December 2022

----- --------- -------- --------- --------- --------- ------ -----

Furniture Motor Office I.T Plant & Right Total

Land and Vehicles Equipment Equipment Machinery of use

Fittings assets

Carrying (GBP) (GBP) (GBP) (GBP) (GBP) (GBP) (GBP) (GBP)

Value

----- --------- -------- --------- --------- --------- -----

Carrying - - - - - - - -

value as at

31 December

2021

----- --------- -------- --------- --------- --------- ------ -----

Carrying

value as at

31 December

2022 - - - - 1,265 - - 1,265

----- --------- -------- --------- --------- --------- ------ -----

Right of use asset

The Group has one lease contract for land it shall utilise to

construct a 5MW gas-fuelled power generation plant. The land is

located at Bordesley, Liverpool St. Birmingham.

The land has a lease term of 20 years, with an option to extend

for 10 years which the Group has opted to include due to the highly

likely nature of extension as at the time of the original

assessment.

The Group's obligations under its leases are secured by the

lessor's title to the leased assets. The Group's incremental

borrowing rate ranges between 8.44% and 10.38%.

The Group has valued its property, plant and equipment in line

with its directors' estimation of the Value in Use for those

assets. Kindly refer to note 11 for the key variables used in the

estimation of the value thereof.

Right of use asset 31 December 31 December

2022 2021

(GBP) (GBP)

Group Group

Set out below are the carrying amounts of

right-of-use assets recognised and the movements

during the period:

Opening balance 284,000 -

Additions 62,090 293,793

Depreciation (12,565) ( 9,793 )

Closing balance 333,525 284,000

------------- -------------

Lease liability

Set out below are the carrying amounts of

lease liabilities and the movements during

the period:

Opening balance 291,518 -

Additions 60,005 293,793

Interest 26,131 24,725

Repayment (27,000) (27,000)

------------- -------------

Closing balance 350,654 291,518

------------- -------------

Spilt of lease liability between current

and non-current portions:

Non-current 346,674 289,045

Current 3,980 2,473

Total 350,654 291,518

------------- -------------

Future minimum lease payments fall due as

follows

- within 1 year 33,960 27,000

- later than 1 year but within 5 years 135,840 108,000

- later than 5 years 756,720 648,000

------------- -------------

Subtotal 926,520 783,000

------------- -------------

- Unearned future finance charges (575,866) (491,482)

Closing balance 350,654 291,518

------------- -------------

A 100bp change in the Incremental Borrowing Rate ("IBR"), would

result in a GBP29,603 change in the Right of Use Asset, and

corresponding Lease Liability on inception date.

11. Intangible assets

Intangible assets consist of separately identifiable

prospecting, exploration and renewable energy assets in the form of

licences, intellectual property or rights acquired either through

business combinations or through separate asset acquisitions.

The following reconciliation serves to summarise the composition

of intangible assets as at period end:

ADV001 ARL018 Bordersley Mbeya Rochdale Shankley Sustineri Total

Hindlip Stather Power (GBP) Coal to Power Biogas Energy ( GBP)

Lane (GBP) Road (GBP) Power ( GBP) (GBP) ( GBP)

Project

( GBP)

----------- ------------ ------------ ------------- --------- --------- ---------- -------------

Carrying

value at 1

January

2021 - - 2,595,000 15,896,105 - - - 18,491,105

Impairments - - - (13,955,528) - - - (13,955,528)

Acquisition

of Rochdale

Power - - - - 150,273 - - 150,273

Acquisition

of

Sustineri

Energy - - - - - - 278,700 278,700

----------- ------------ ------------ ------------- --------- --------- ---------- -------------

Carrying

value at 1

January

2022 - - 2,595,000 1,940,577 150,273 - 278,700 4,964,550

Impairments - - (1,288,578) (1,940,577) - - - (3,229,155)

Acquisition

of ARL018

Stather

Road - 91,482 - - - - - 91,482

Acquisition

of ADV001

Hindlip

Lane 247,506 - - - - - - 247,506

Acquisition

of Shankley

Biogas Ltd - - - - - 603,050 - 603,050

Exchange

movements - - - - - - 14,460 14,460

----------- ------------ ------------ ------------- --------- --------- ---------- -------------

Carrying

value at 31

December

2022 247,506 91,482 1,306,422 - 150,273 603,050 293,160 2,691,893

----------- ------------ ------------ ------------- --------- --------- ---------- -------------

Intangible assets attributable to prospecting or exploration

activities with an indefinite useful life are not amortised until

such time that active mining operations commence, which will result

in the intangible asset being amortised over the useful life of the

relevant project.

Intangible assets attributable to renewable energy activities

are amortised once commercial production commences, over the

remaining useful life of the project, which is estimated to be

between 20 to 30 years, depending on the unique characteristics of

each project.

Until such time as the underlying operations commence

production, intangible assets with an indefinite useful life are

assessed for impairment on an annual basis, against the recoverable

value of the intangible asset, or earlier if an indication of

impairment exists.

One or more of the following facts or circumstances indicate

that the Group should test an intangible asset for impairment:

-- the period for which the Group has the right to develop the

asset has expired during the period or will expire in the

foreseeable future;

-- substantial expenditure on the asset in future is neither planned nor budgeted;

-- sufficient data exists to indicate that, although a

development in the specific area is likely to proceed, the carrying

amount of the development asset is unlikely to be recovered in full

from successful development or by sale.

In assessing whether a write-down is required in the carrying

value of a potentially impaired intangible asset, the asset's

carrying value is compared with its recoverable amount.

The recoverable amount is the higher of the asset's fair value

less costs to sell and value in use.

The valuation techniques applicable to the valuation of the

above mentioned intangible assets comprise a combination of fair

market values, discounted cash flow projections and historic

transaction prices.

The following key assumptions influence the measurement of the

intangible assets' recoverable amounts, through utilising the value

in use calculation performed:

-- measurement of the available resources and reserves;

-- currency fluctuations and exchange movements applicable to the valuation model;

-- commodity prices related to resources and reserve and forward-looking statements;

-- expected growth rates in respect of production capacity;

-- cost of capital related to funding requirements;

-- determination of the commercial viability period;

-- applicable discounts rates, inflation and taxation implications;

-- future operating expenditure related to the realisation of the respective project assets; and

-- co-operation of key project partners going forward.

The following key assumptions influence the measurement of the

intangible assets' recoverable amounts, through utilising the fair

value calculation performed:

-- Determination of consideration receivable based on recently

completed transactions, considering the nature, location, size and

desirability of recently completed transactions, for similar

assets.

A summary of each project and the impairment assessment

performed for each of the intangible assets are detailed below.

Mbeya Coal to Power Project

The Mbeya Coal to Power Project situated in the Mbeya region of

Tanzania, which comprises the Mbeya Coal Mine, a potential 1.5Mt

p/a mining operation, and the Mbeya Power Plant, a planned 300MW

mine-mouth thermal power station. The Mbeya Coal Mine has a defined

120.8 Mt NI 43-101 thermal coal resource. The 300MW mouth-of-mine

thermal power station has long term scalability with the potential

to become a 1000MW plant. The completed full Power Feasibility

Study highlighted an annual power output target of 1.8GW based on

annual average coal consumption of 1.5Mt.

Subsequent to the completion of a compulsory tender process

through TANESCO on the development of the Mbeya Coal to Power

Project, the Group was informed that its bid to secure a

Power-Purchase Agreement was unsuccessful in February 2019. Further

engagement with TANESCO has subsequently culminated in the receipt

of a formal notice from TANESCO during 2020 and inviting the Group

to develop the Mbeya Coal to Power Project for the export market

and thereby enabling the Company to engage with the African Power

Pools regarding potential off-take agreements.

Result of impairment review undertaken during the period

Status of the Term Sheet

The initial Term Sheet signed with interested parties for the

Mbeya Coal Ltd Mining Licenses is no longer valid. After conducting

due diligence, the interested parties discovered several factors

that contribute to the reduced commercial attractiveness and

feasibility of the project. These factors include the low quality

of the coal and the significant challenges posed by its grade and

associated market related price, as well as the remote location of

the mining site (1000 km from Dar es Salaam or 600 km from Mtwara).

The absence of bulk coal handling facilities at nearby ports and

the high indicative transportation costs further undermines the

project's viability. Without a nearby off-taker, it is no longer

feasible to design, construct, and operate a mid-sized coal mine on

the indicative Mbeya mining site.

The project's original intention was to exclusively supply coal

to the mine-mouth power station. However, Mbeya Power Ltd, the

sister company of MCPP (Mbeya Coal Power Project), has made the

decision to align with its parent company, Kibo Energy PLC, and not

pursue coal-fired steam power. As a result, there is no longer a

need to supply coal exclusively to the power station.

In conclusion, the abandonment of coal-fired steam power by

Mbeya Power Ltd, along with the low-quality coal, remote location,

lack of infrastructure, high transportation costs, and unattractive

coal price, has rendered the Mbeya Coal Ltd Mining Licenses

commercially unviable and infeasible.

Status of the Mining Licenses (Mining Licences Numbers ML 655-ML

661)

Mbeya Coal Ltd is a Tanzanian registered mining and exploration

company that was actively involved in the development of a 300MW

integrated coal-to-power project, aligned with the Tanzania Power

System Master Plan. As part of the Mbeya Coal to Power Project

(MCPP), Mbeya Coal Ltd holds a portfolio of Coal Prospecting

Licences that led to the application and granting of the seven

above mentioned Mining Licenses. The coal mine intended for this

project serves as the sole fuel source for the 300MW power plant.

Kibo Energy PLC, in collaboration with TANESCO, has made a USD 20

million investment in the development of the MCPP project.

Throughout the exploration and mining license application

process, the Mining Commission was duly informed that this project

was an integrated coal-to-power initiative, and that the

commencement of mine development was contingent upon signing

relevant power agreements with TANESCO and the Government of

Tanzania. This understanding was officially acknowledged on

multiple occasions.

The Mining Commission granted the aforementioned mining licenses

on March 2, 2022, subject to the payment of annual rent fees.

However, the investor expressed reluctance to pay the annual rent

until a new Memorandum of Understanding (MoU) with TANESCO was

signed to avoid incurring unnecessary expenses amounting to

approximately USD 210,000 annually. The Mining Commission was

notified of this situation, and they agreed to extend the payment

deadlines pending discussions and the eventual signing of a

definitive MoU with TANESCO.

On September 20, Mbeya Coal reported positive progress in

discussions with TANESCO and indicated that the signing of the MoU

was imminent. They requested another extension for the payment

deadline until the MoU was either signed or denied. On December 12,

Mbeya Coal Ltd informed the Mining Commission that the MoU with

TANESCO had been signed on November 15, 2022. However, no responses

were received in relation to these official requests.

Subsequently, Mbeya Coal discovered that the status of the

Mining License in question had been changed online and replaced

with a foreign Prospecting License. Concerned about this

development, Mbeya Coal made an urgent inquiry, leading to the

receipt of a letter from the Mining Commission dated December 28,

2022, stating that the Mining Licenses had been cancelled due to

Mbeya Coal's alleged failure to respond to a Default Notice issued

on August 3, 2022.

Mbeya Coal promptly disputed the unilateral and unfair

cancellation, asserting that the Mining Commission had disregarded

their various requests for extensions and highlighting

irregularities and potential illegality in the commission's

procedures. The matter was pursued vigorously with the Minerals

Department and Mining Commission and eventually escalated to the

office of the Prime Minister of Tanzania. (The latter was

acknowledged by the PM's office)

As of now, the unjust cancellation of the mining licenses by

Mbeya Coal Ltd remains in dispute and unresolved, and Mbeya Coal

Ltd is still awaiting a response from the Principal Secretary for

Energy's office.

An independent consultant was appointed who is actively engaging

the Mining Commission in following up this matter.

Resultingly, we estimated the recoverable amount of Kibo's Coal

Assets to be GBPNil, due to there being no viable offer at present

for the acquisition of the mining licences coupled with the fact

that the licences have been revoked and currently under

dispute.

During the year, the intangible asset was by impaired by

GBP1,940,577 to GBPNil.

Bordersley - 2019

MAST Energy PLC initially acquired an indirect 100% equity

interest in shovel-ready reserve power generation project,

Bordersley, which will comprise a 5MW gas-fuelled power generation

plant for the consideration of GBP175,000 settled through the issue

of shares.

Thereafter, MAST acquired all of St Anderton's direct and

indirect interests (Royalty Agreements) in the Bordersley power

project described above giving it a 100% economic and 100% equity

interest in Bordersley (the 'Acquisition'). Consideration for the

Acquisition consists of the allotment and issue of 46,067,206

ordinary shares in the capital of MAST to St Anderton at an issue

price of GBP0.0525 per share and payable in five tranches

('Consideration Shares') such that the full consideration is only

payable in the event that Bordersley is progressively

de-risked.

As there were no separately identifiable assets and/or

liabilities acquired, the purchase price was allocated toward the

Intellectual Property acquired, in the amount of GBP2,595,000.

During the year, the intangible asset was measured at its value

in use value and found to be impaired in the amount of

GBP1,288,578. The discount rate applicable to the value in use

assessment was 13.54%.

Pyebridge Power Ltd - 2021

Sloane Developments (Sloane) acquired a 100% equity interest in

Pyebridge Power Limited ("Pyebridge") for GBP2,500,000 in cash

which is settled as follows:

-- An initial GBP1,485,500 to be paid in cash at completion date on the 10th of August 2021;

-- Repayment of the loan outstanding of GBP14,500 by Sloane to Pyebridge;

-- Deferred consideration of GBP1,000,000 to be paid in two

tranches 8 months and 12 months respectively from the date of

completion. During the 2022 financial year GBP421,041 of the

deferred consideration was waived and the cost price of the assets

reduced by the same amount.

The acquisition of Pyebridge comprised of the following:

-- An installed and commissioned synchronous gas-powered standby generation facility; and

-- The land on which the gas-powered facility stands.

The acquisition of land and gas-powered generation facility has

been accounted for as assets purchased at consolidated level, and

not as a business combination in accordance with IFRS 3. Therefore,

the purchase price has been allocated between land and the PPE

based on their respective fair values as at the date of acquisition

, as disclosed in Note 10.

Rochdale Power Ltd - 2021

Sloane Developments (Sloane) acquired a 100% interest in

Rochdale Power Limited ("Rochdale"), from Balance Power Projects

Limited, for the installation of a 4.4 MW flexible gas power

project in Dig Gate Lane, Rochdale, OL 16 4NR.

The acquisition purchase price totals GBP239,523 of which the

freehold site amounts to GBP90,750 excluding VAT and the property

rights amount to GBP150,273. The acquisition purchase price is to

be paid in cash. The freehold site purchased is the property at Dig

Gate Lane, Kingsway Business Park, Rochdale, OL16 4NR.

The acquisition of land and gas-powered generation facility will

be accounted for as assets purchased at consolidated level, and not

as a business combination in accordance with IFRS 3. Therefore, the