UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): August 28, 2008 (August 28, 2008)

Brown-Forman Corporation

(Exact name of registrant as specified in its charter)

Delaware 002-26821 61-0143150

(State or other (Commission (I.R.S. Employer

jurisdiction of File Number) Identification No.)

incorporation)

|

850 Dixie Highway, Louisville, Kentucky 40210

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code (502) 585-1100

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

Brown-Forman Corporation issued a press release today, August 28, 2008,

reporting results of its operations for the fiscal quarter ended July 31, 2008.

A copy of this Brown-Forman Corporation press release is attached hereto as

Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits

(a) Not applicable.

(b) Not applicable.

(c) Exhibits

99.1 Press Release, dated August 28, 2008.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Brown-Forman Corporation

(Registrant)

Date: August 28, 2008 By: /s/ Nelea A. Absher

Nelea A. Absher

Vice President, Associate

General Counsel and Assistant

Corporate Secretary

|

Exhibit Index

Exhibit

Number Description

99.1 Press Release, dated August 28, 2008, issued by Brown-Forman

Corporation, reporting results of operations for the fiscal quarter

ended July 31, 2008.

|

FOR IMMEDIATE RELEASE

BROWN-FORMAN FIRST QUARTER EARNINGS PER SHARE DOWN 5%; EXCLUDING NON-CASH AGAVE

CHARGE, EARNINGS PER SHARE GROWS 12%

Louisville, KY, August 28, 2008 - Brown-Forman Corporation reported earnings per

share decreased 5% to $0.73 and operating income decreased 10% to $141 million

for the company's first quarter of fiscal 2009. This decline was due to a $22

million pre-tax ($16 million after-tax) non-cash charge related to an abnormal

number of agave(1) plants identified during the quarter as dead or dying.

Excluding this $0.13 per share non-cash charge, earnings per share rose 12% to

$0.86 and operating income grew 5% to $163 million as earnings per share

benefited from reduced net interest expense, a lower effective tax rate, and a

lower number of shares outstanding following the fiscal 2008 share repurchase.

Reported net sales for the first quarter ended July 31, 2008 were $790 million,

an increase of 7% from the prior-year period. Adjusting for the items listed on

Schedule A of this press release, underlying(2) net sales grew 4%, and

underlying operating income grew 3% versus the same period last fiscal year.

- Jack Daniel's Tennessee Whiskey first quarter reported net sales increased in

the mid-single digits, or in the low single digits on a constant currency(3)

basis, reflecting the benefit of price increases. Global depletions(4)

declined 1% for the period as gains in Eastern Europe and flat U.S. volumes

were offset by declines in markets with softening economies, particularly

Germany, the U.K., and South Africa.

(1) Agave is the primary raw material used in the company's tequila production.

(2) Underlying growth represents the percentage growth in reported financial

results in accordance with GAAP, adjusted for certain items. A

reconciliation from reported to underlying net sales, gross profit,

advertising expense, SG&A, and operating income (non-GAAP measures) growth

for the quarter, and the reasons why management believes these adjustments

to be useful to the reader, are included in Schedule A and the notes to

this press release.

(3) Constant currency represents reported net sales with the cost/benefit of

currency movements removed. Management uses the measure to understand the

growth of the business on a constant dollar basis, as fluctuations in

exchange rates can distort the underlying growth of the business both

positively and negatively.

(4) Depletions are shipments from wholesaler distributors to retail customers,

and are commonly regarded in the industry as an approximate measure of

consumer demand.

- Gentleman Jack net sales increased by double digits on both a reported and a

constant currency basis for the period. Jack Daniel's Single Barrel

delivered solid net sales growth. While the Jack Daniel's & Cola brand

experienced significant volume declines due to a substantial increase in

ready-to-drink excise taxes in Australia, global reported net sales grew in

the mid-single digits, but declined in the high single digits on a constant

currency basis.

- Finlandia net sales increased by double digits on both a reported and a

constant currency basis in the period, reflecting higher volumes and pricing

gains. Global depletions grew in the high single digits, led by continued

double-digit growth in Eastern Europe.

- Southern Comfort net sales, both reported and in constant currency, declined

in the mid-single digits during the quarter. Volume declines, due in part to

softness of the on-premise channel in the brand's major markets, were offset

partially by price increases.

- Reported and constant currency net sales for Sonoma-Cutrer, Bonterra,

Chambord, Tuaca, and Woodford Reserve grew at double-digit rates for the

quarter. The Casa Herradura portfolio's net sales grew by double digits on

a reported basis and in the mid-single digits on a constant currency basis.

Reported gross profit declined 3%, while underlying gross profit gained 1% after

adjusting for the non-cash charge related to agave inventory, the benefit of a

weaker U.S. dollar, discontinued agency relationships, and estimated changes in

global trade inventories. Underlying gross profit growth lagged underlying net

sales trends, as grain and energy cost pressures outpaced the rate of price

increases.

Reported advertising investments increased 3% over the prior year first quarter.

Adjusting for the weaker U.S. dollar and the absence of spending behind exited

agency brands, underlying advertising investments were flat for the quarter.

This reflects a reallocation of spending to those brands, markets, and channels

where we believe the consumer and trade are more responsive to the investments,

as well as some shifting of seasonal investments. Selling, general, and

administrative (SG&A) expenses increased 1% over the first quarter last year.

Adjusting for the weaker U.S. dollar and transition costs related to the fiscal

2007 Casa Herradura acquisition, SG&A decreased 1%, demonstrating the

continuation of tight management of expenses and the leveraging of investments

made in prior years.

Full-Year Outlook

Due to the non-cash agave charge in the quarter, the company is reducing its

fiscal 2009 full year earnings per share guidance to a range of $3.60 to $3.85,

representing growth of 1% to 7% over prior-year earnings. Excluding the charge,

fiscal 2009 guidance remains unchanged. The guidance incorporates expectations

of improving volumetric global trends for Jack Daniel's, benefits of price

increases, continued cost pressures, continued tight control of discretionary

operating expenses, lower net interest expense, and additional benefits from the

fiscal 2008 share repurchase.

Commenting on the quarter, Paul Varga, chief executive officer said, "The loss

of agave plants has reduced our inventory, but we do not believe this will

constrain our ability to build our tequila brands to their full potential. While

these are certainly challenging economic times, we remain confident about the

long-term growth opportunity for our excellent portfolio of premium and

super-premium brands."

Brown-Forman will host a conference call to discuss the results at 10:00 a.m.

(EDT) this morning. All interested parties in the U.S. are invited to join the

conference call by dialing 888-624-9285 and asking for the Brown-Forman call.

International callers should dial 706-679-3410 and ask for the Brown-Forman

call. No password is required. The company suggests that participants dial in

approximately ten minutes in advance of the 10:00 a.m. start of the conference

call.

A live audio broadcast of the conference call will also be available via

Brown-Forman's Internet Web site, www.brown-forman.com, through a link to

"Investors Relations." For those unable to participate in the live call, a

replay will be available by calling 800-642-1687 (U.S.) or 706-645-9291

(international). The identification code is 60515742. A digital audio recording

of the conference call will also be available on the Web site approximately one

hour after the conclusion of the conference call. The replay will be available

for at least 30 days following the conference call.

Brown-Forman Corporation is a producer and marketer of fine quality beverage

alcohol brands, including Jack Daniel's, Southern Comfort, Finlandia Vodka,

Tequila Herradura, el Jimador Tequila, Canadian Mist, Fetzer and Bolla Wines,

and Korbel California Champagnes.

IMPORTANT NOTE ON FORWARD-LOOKING STATEMENTS:

This release contains statements, estimates, or projections that constitute

"forward-looking statements" as defined under U.S. federal securities laws.

Generally, the words "expect," "believe," "intend," "estimate," "will,"

"anticipate," and "project," and similar expressions identify a forward-looking

statement, which speaks only as of the date the statement is made. Except as

required by law, we do not intend to update or revise any forward-looking

statements, whether as a result of new information, future events, or otherwise.

We believe that the expectations and assumptions with respect to our

forward-looking statements are reasonable. But by their nature, forward-looking

statements involve known and unknown risks, uncertainties and other factors that

in some cases are out of our control. These factors could cause our actual

results to differ materially from Brown-Forman's historical experience or our

present expectations or projections. Here is a non-exclusive list of such risks

and uncertainties:

- continuation of the deterioration in general economic conditions

(particularly in the United States where we earn about half of our profits,

and other markets where we do significant business), including higher energy

prices, declining home prices, deterioration of the sub-prime lending market,

interest rate fluctuations, inflation, decreased discretionary income or

other factors;

- pricing, marketing and other competitive activity focused against our major

brands;

- lower consumer confidence or purchasing related to economic conditions, major

natural disasters, terrorist attacks or widespread outbreak of infectious

diseases;

- tax increases and/or tariff barriers or other restrictions affecting beverage

alcohol, whether at the federal or state level in the U.S. or in other major

markets around the world, and the unpredictability or suddenness with which

they can occur;

- limitations and restrictions on distribution of products and alcohol

marketing, including advertising and promotion, as a result of stricter

governmental policies adopted either in the United States or in our other

major markets;

- fluctuations in the U.S. Dollar against foreign currencies, especially the

British Pound, Euro, Australian Dollar, Polish Zloty and the South African

Rand;

- reduced bar, restaurant, hotel and other on-premise business, including

consumer shifts to discount stores and other price sensitive purchases and

venues;

- longer-term, a change in consumer preferences, societal attitudes or cultural

trends that results in the reduced consumption of our premium spirits brands

or our ready-to-drink products;

- changes in distribution arrangements in major markets that limit our ability

to market or sell our products;

- adverse impacts relating to our acquisition strategies or our integration of

acquired businesses and conforming them to the company's trade practice

standards, financial controls environment and U.S. public company

requirements;

- price increases in energy or raw materials, including grapes, grain, agave,

wood, glass, and plastic;

- changes in climate conditions, agricultural uncertainties or other supply

limitations that adversely affect the price, availability, quality, or health

of grapes, agave, grain, glass, closures or wood;

- termination of our rights to distribute and market agency brands in our

portfolio;

- press articles or other public media related to our company, brands,

personnel, operations, business performance or prospects;

- counterfeit production, tampering, or contamination of our products and any

resulting negative effect on our sales, intellectual property rights, or

brand equity;

- adverse developments stemming from state or federal investigations of

beverage alcohol industry marketing or trade practices of suppliers,

distributors or retailers; and

- impairment in the recorded value of inventory, fixed assets, goodwill or

other acquired intangibles.

Brown-Forman Corporation

Unaudited Consolidated Statements of Operations

(Dollars in millions, except per share amounts)

Three Months Ended

July 31,

2007 2008 Change

------ ------ ------

CONTINUING OPERATIONS

Net sales $739.1 $790.0 7%

Excise taxes 152.0 176.2 16%

Cost of sales 196.1 233.0 19%

------ ------

Gross profit 391.0 380.8 (3%)

Advertising expenses 94.0 97.0 3%

Selling, general, and

administrative expenses 143.1 144.3 1%

Amortization expense 1.3 1.3

Other (income), net (2.8) (2.4)

------ ------

Operating income 155.4 140.6 (10%)

Interest expense, net 11.1 7.5

------ ------

Income before income taxes 144.3 133.1 (8%)

Income taxes 48.9 44.9

------ ------

Net income 95.4 88.2 (8%)

====== ======

Earnings per share:

Basic 0.77 0.73 (5%)

Diluted 0.77 0.73 (5%)

|

DISCONTINUED OPERATIONS

Net loss $(0.1) $ --

TOTAL COMPANY

Net income $ 95.3 $ 88.2 (7%)

Earnings per share:

Basic 0.77 0.73 (5%)

Diluted 0.77 0.73 (5%)

(more)

|

Brown-Forman Corporation

Unaudited Condensed Consolidated Balance Sheets

(Dollars in millions)

April 30, July 31,

2008 2008

------- -------

Assets:

Cash and cash equivalents $118.9 $160.2

Accounts receivable, net 453.2 428.8

Inventories 684.5 709.0

Other current assets 199.4 196.4

------- -------

Total current assets 1,456.0 1,494.4

Property, plant, and equipment, net 501.4 505.7

Goodwill 688.0 688.1

Other intangible assets 698.8 697.6

Prepaid pension cost 22.8 25.2

Other assets 38.0 37.9

------- -------

Total assets $3,405.0 $3,448.9

======= =======

Liabilities:

Accounts payable and accrued expenses $379.7 $343.0

Accrued income taxes 14.7 61.1

Dividends payable -- 41.0

Short-term borrowings 585.3 576.4

Current portion of long-term debt 4.3 4.3

------- -------

Total current liabilities 984.0 1,025.8

Long-term debt 417.0 416.7

Deferred income taxes 88.8 81.9

Accrued postretirement benefits 121.2 115.5

Other liabilities 68.8 58.0

------- -------

Total liabilities 1,679.8 1,697.9

Stockholders' equity 1,725.2 1,751.0

------- -------

Total liabilities and stockholders' equity $3,405.0 $3,448.9

======= =======

(more)

|

Brown-Forman Corporation

Unaudited Condensed Consolidated Statements of Cash Flows

(Dollars in millions)

Three Months Ended

July 31,

2007 2008

------ ------

Cash provided by operating activities $128.4 $104.7

Cash flows from investing activities:

Acquisition of brand names and trademarks (12.0) --

Sale of short-term investments 85.6 --

Additions to property, plant, and equipment (11.4) (13.2)

Other (1.8) (1.0)

------ ------

Cash provided by (used for)

investing activities 60.4 (14.2)

Cash flows from financing activities:

Net repayment of debt (58.9) (10.3)

Acquisition of treasury stock (7.0) (0.3)

Special distribution to stockholders (203.7) --

Dividends paid (37.3) (41.1)

Other 14.6 (0.7)

------ ------

Cash used for financing activities (292.3) (52.4)

Effect of exchange rate changes

on cash and cash equivalents 0.5 3.2

------ ------

Net (decrease) increase in

cash and cash equivalents (103.0) 41.3

Cash and cash equivalents, beginning of period 282.8 118.9

------ ------

Cash and cash equivalents, end of period $179.8 $160.2

====== ======

(more)

|

Brown-Forman Corporation

Supplemental Information (Unaudited)

(Dollars in millions, except per share amounts)

Three Months Ended

July 31,

2007 2008

------ ------

Net sales $739.1 $790.0

Excise taxes $152.0 $176.2

Net sales (stripped of excise taxes) $587.1 $613.8

Gross profit (as reported) $391.0 $380.8

Gross margin (as reported) 52.9% 48.2%

Gross margin (stripped net sales basis)* 66.6% 62.0%

Effective tax rate 33.9% 33.8%

Cash dividends paid per common share $0.3025 $0.3400

Shares (in thousands) used in the

calculation of earnings per share

- Basic 123,217 120,483

- Diluted 124,434 121,549

|

* Management believes that excluding excise taxes from the gross margin

calculation provides a more meaningful comparison because of periodic changes

in the company's distribution structures or excise tax rates that can result

in the company collecting and remitting varying levels of excise taxes (which

are reported as both a component of net sales and as a cost of sales) across

periods in which different distribution structures or excise tax rates were

in effect.

These figures have been prepared in accordance with the company's customary

accounting practices.

Schedule A

Brown-Forman Corporation

Continuing Operations Only

Supplemental Information (Unaudited)

Three Months

Ended

July 31, 2008

REPORTED NET SALES GROWTH 7%

Impact of foreign currencies (5%)

Net sales from agency brands 1%

Estimated net change in trade inventories 1%

-----

UNDERLYING NET SALES GROWTH 4%

=====

REPORTED GROSS PROFIT GROWTH (3%)

Impact of foreign currencies (4%)

Gross profit from agency brands 1%

Estimated net change in trade inventories 1%

Non-cash agave charge 6%

-----

UNDERLYING GROSS PROFIT GROWTH 1%

=====

REPORTED ADVERTISING GROWTH 3%

Impact of foreign currencies (5%)

Advertising from agency brands 2%

-----

UNDERLYING ADVERTISING GROWTH 0%

=====

REPORTED SG&A GROWTH 1%

Impact of foreign currencies (3%)

SG&A from acquisitions 1%

-----

UNDERLYING SG&A GROWTH (1%)

=====

REPORTED OPERATING INCOME GROWTH (10%)

Impact of foreign currencies (4%)

Transition expenses from acquisitions (2%)

Operating income from agency brands 1%

Estimated net change in trade inventories 3%

Non-cash agave charge 15%

-----

UNDERLYING OPERATING INCOME GROWTH 3%

=====

|

Notes:

Impact of foreign currencies - Refers to net gains and losses incurred by the

company relating to sales and purchases in currencies other than the U.S.

Dollar. We use the measure to understand the growth of the business on a

constant dollar basis as fluctuations in exchange rates can distort the

underlying growth of our business (both positively and negatively). To

neutralize the effect of foreign exchange fluctuations, we have historically

translated current year results at prior year rates. While we recognize that

foreign exchange volatility is a reality for a global company, we routinely

review our company performance on a constant dollar basis. We believe this

allows both management and our investors to understand better our company's

growth trends.

Agency brands - Refers to the impact of certain agency brands, primarily

Appleton, Amarula, Durbanville Hills, and Red Bull, which exited Brown-Forman's

portfolio during fiscal 2008.

Estimated net change in trade inventories - Refers to the estimated financial

impact of changes in wholesale trade inventories for the company's brands. We

compute this effect using our estimated depletion trends and separately identify

trade inventory changes in the variance analysis for our key measures. Based on

the estimated depletions and the fluctuations in trade inventory levels, we then

adjust the percentage variances from prior to current periods for our key

measures. We believe it is important to make this adjustment in order for

management and investors to understand the results of our business without

distortions that can arise from varying levels of wholesale inventories.

Non-cash agave charge - Refers to an abnormal number of agave plants identified

during the quarter as dead or dying. Although agricultural uncertainties are

inherent in our tequila or any other business including the growth and

harvesting of raw materials, we believe that the magnitude of this item in the

quarter distorts the underlying trends of our business. Therefore, we believe

that excluding this non-cash charge allows for a better understanding of

operating income growth trends.

Acquisitions - Refers to transition related expenses from the acquisition of the

Casa Herradura brands in January 2007, thus making comparisons difficult to

understand. We believe that excluding transition expenses related to the

acquisition provides helpful information in forecasting and planning the growth

expectations of the company.

The company cautions that non-GAAP measures may be considered in addition to,

but not as a substitute for, the company's reported GAAP results.

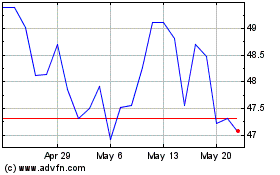

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jul 2023 to Jul 2024