Brown-Forman Pinned to Neutral - Analyst Blog

March 27 2013 - 11:40AM

Zacks

We have maintained our long-term Neutral recommendation on

Brown-Forman Corporation (BF.B), one of the

leading producers and distributors of premium alcoholic beverages

in the world, with a target price of $72.00. Moreover, the company

holds a Zacks Rank #3 (Hold).

Why Reiterate?

We remain impressed with the company’s positive earnings

surprise trend, strong organic revenue growth and impressive

management guidance. However, on the other hand, intense

competition from private players and rising commodity costs make us

cautious on the stock.

The third quarter fiscal 2013 earnings of 73 cents per share at

Brown-Forman exhibited an improvement of 18% from the comparable

year-ago quarter as well as the Zacks Consensus Estimate of 70

cents. The year-over-year increase was primarily driven strong

top-line growth along with improved margins.

Looking at the earnings surprise history, the company has

surpassed the Zacks Consensus Estimates thrice in the trailing four

quarters. The average positive surprise in the trailing 4 quarters

comes to 3.6%.

Brown-Forman now projects fiscal 2013 earnings between $2.60 and

$2.68 per share. The current Zacks Consensus Estimate stands at

$2.68 per share, which is in line with the upper end of company’s

guidance range.

Moreover, Brown-Forman continues to expect operating income in

the low-double-digits range, while underlying sales are expected to

increase in the high-single-digit range.

Apart from the strong third-quarter results, Brown-Forman’s

growth story looks compelling. We believe that the company’s

sustained focus on pricing, product innovation and expanding

operations in the emerging markets will likely boost operational

performance.

On the flip side, stiff competition from other alcoholic

beverage companies, such as Diageo plc (DEO) along

with potential risk of operating in overseas market may have an

adverse effect on Brown-Forman’s operations. Moreover, we believe

that the shares of the company are richly valued at the current

juncture, which limits its upside potential. Brown-Forman currently

trades at a forward P/E of 25.83x, substantially premium from the

peer group average of 20.28x.

Further, distilled spirits are subject to excise tax in various

countries. Rising fiscal pressure in the U.S., Europe and

many emerging markets may increase the risk of a potential rise in

excise tax on spirits by governments of respective countries. A

hike in excise tax in the future may have an adverse effect on

Brown-Forman’s financial performance.

Other Stocks Worth Considering

Other stocks worth considering in the alcoholic beverage

industry are Companhia de Bebidas Das Americas aka

AMBEV (ABV) and Molson Coors Brewing

Company (TAP). Both the companies carry a Zacks Rank #2

(Buy).

AMBEV-PR ADR (ABV): Free Stock Analysis Report

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

MOLSON COORS-B (TAP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

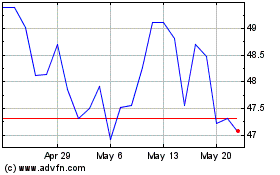

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jul 2023 to Jul 2024