DaVita Inc. (NYSE: DVA) today announced results for the quarter

ended September 30, 2012. Net income attributable to DaVita Inc.

for the three and nine months ended September 30, 2012 was $144.7

million and $427.8 million, or $1.50 per share and $4.46 per share,

respectively, excluding for the nine months ended September 30,

2012 an after-tax legal proceeding contingency accrual and related

expense of $47.6 million, or $0.50 per share, that occurred in the

second quarter of 2012. Net income attributable to DaVita Inc. for

the nine months ended September 30, 2012 including this item was

$380.2 million, or $3.96 per share.

Our operating results for the three and nine months ended

September 30, 2012, include an additional $5.4 million of after-tax

debt expense, or $0.06 per share, resulting from the proposed

amendments under our senior secured credit facilities as well as

issuing the New Senior Notes in advance of the potential

acquisition of HCP.

Net income attributable to DaVita Inc. for the three and nine

months ended September 30, 2011 was $135.4 million and $344.3

million, or $1.42 per share and $3.54 per share, respectively,

excluding for the nine months ended September 30, 2011 an after-tax

non-cash goodwill impairment charge of approximately $14.4 million,

or $0.14 per share, that was recorded in the second quarter of 2011

related to our infusion therapy business. Net income attributable

to DaVita Inc. for the nine months ended September 30, 2011

including this item was $329.9 million or $3.40 per share.

Financial and operating highlights include:

- Cash Flow: For the rolling

twelve months ended September 30, 2012, operating cash flow was

$1,051 million and free cash flow was $665 million. For the three

months ended September 30, 2012, operating cash flow was $367

million and free cash flow was $271 million. For a definition of

free cash flow see Note 4 to the reconciliations of non-GAAP

measures.

- Operating Income: Operating

income for the three and nine months ended September 30, 2012 was

$341 million and $987 million, respectively, excluding for the nine

months ended September 30, 2012 the pre-tax legal proceeding

contingency accrual and related expenses of $78 million. Operating

income for the nine months ended September 30, 2012 including this

item was $909 million.

Operating income for the three and nine months ended September

30, 2011 was $319 million and $825 million, respectively, excluding

for the nine months ended September 30, 2011 the pre-tax non-cash

goodwill impairment charge of $24 million. Operating income for the

nine months ended September 30, 2011 including this item was $801

million.

- Volume: Total U.S. treatments

for the third quarter of 2012 were 5,550,645, or 71,162 treatments

per day, representing a per day increase of 12.3% over the third

quarter of 2011. Non-acquired treatment growth, as well as our

normalized non-acquired treatment growth in the quarter, were both

4.4% over the prior year’s third quarter.

- Effective Tax Rate: Our

effective tax rate was 36.4% for both the three and nine months

ended September 30, 2012, respectively. This effective tax rate is

impacted by the amount of third party owners’ income attributable

to non-tax paying entities. The effective tax rate attributable to

DaVita Inc. was 40.5% and 40.8% for the three and nine months ended

September 30, 2012, respectively. We still expect our 2012

effective tax rate attributable to DaVita Inc. to be in the range

of 40.0% to 41.0%.

- Acquisition: As previously

announced on May 21, 2012, we entered into a definitive merger

agreement to acquire HealthCare Partners (HCP), one of the

country’s largest operators of medical groups and physician

networks. The total purchase price to be paid by DaVita Inc. will

consist of $3.66 billion in cash and approximately 9.38 million

shares of DaVita common stock, subject to post-close adjustments.

In addition to the total merger consideration payable at close,

DaVita will pay to the owners of HCP a total of up to $275 million

of additional cash consideration in the form of two separate

earn-out payments if certain financial performance targets are

achieved by HCP in 2012 and 2013. We expect the transaction to

close in early November 2012 and anticipate HCP operating results

will be included in our consolidated operating results beginning in

November 2012.

- Debt Transactions: As previously

announced, in August 2012 we entered into amendments to our

existing senior secured credit facilities to permit additional

borrowings under the credit agreement in an aggregate principal

amount of $3.0 billion to be used to finance a portion of the HCP

transaction. For further details regarding these amendments, see

our SEC filing on Form 8-K dated August 28, 2012.

On August 28, 2012 we issued $1.25 billion

aggregate principal amount of 5 ¾% senior notes due 2022 (New

Senior Notes). All of the proceeds from the issuance of the New

Senior Notes along with related fees and interest through November

30, 2012 were deposited into escrow pending the consummation of the

HCP acquisition. For further details regarding this transaction,

see our SEC filings on Form 8-K dated August 28, 2012 and August

16, 2012.

- Center Activity: As of September

30, 2012, we operated or provided administrative services at 1,912

outpatient dialysis centers located in the United States serving

approximately 150,000 patients and 24 outpatient dialysis centers

serving approximately 1,200 patients that are located in five

countries outside of the United States. During the third quarter of

2012, we acquired 10 centers and opened a total of 21 centers

located in the United States. We also opened two centers and

provided administrative services to three additional centers

outside of the United States.

Outlook

We are updating our operating income guidance for 2012 for our

dialysis services and related ancillary businesses to now be in the

range of $1,315 million to $1,330 million. Our previous operating

income guidance for our dialysis services and related ancillary

businesses was in the range of $1,275 million to $1,325 million.

Following the expected close of the HCP acquisition in early

November 2012, we expect the incremental operating income

contribution from HCP to be in the range of $25 million to $30

million per month for the remainder of the year. Our operating

income guidance for our dialysis services and related ancillary

businesses for 2012 excludes the legal proceeding contingency

accrual and related expenses of $78 million and transaction

expenses related to the HCP acquisition.

Our consolidated operating income guidance for 2013 is expected

to be in the range of $1,750 million to $1,900 million including

the operating results of HCP. Our operating income guidance for

2013 for our dialysis services and related ancillary businesses is

expected to be in the range of $1,350 million to $1,450 million and

our operating income guidance for 2013 for HCP is expected to be in

the range of $400 million to $450 million. We also expect our

consolidated operating cash flows for 2013 to be in the range of

$1,350 million to $1,500 million. These projections and the

underlying assumptions involve significant risks and uncertainties,

including those described below, and actual results may vary

significantly from these current projections.

We will be holding a conference call to discuss our results for

the third quarter ended September 30, 2012 on October 30, 2012 at

5:00 p.m. Eastern Time. The dial in number is 800-399-4406. A

replay of the conference call will be available on DaVita’s

official web page, www.davita.com, for the following 30 days.

This release contains forward-looking statements, within the

meaning of the federal securities laws, including statements

related to our guidance and expectations for our 2012 and 2013

operating income, our 2013 operating cash flows and our 2012

effective tax rate attributable to DaVita Inc., and the anticipated

timing and closing of the HCP transaction. Factors that could

impact future results include the uncertainties associated with

governmental regulations, general economic and other market

conditions, competition, accounting estimates, the variability of

our cash flows and the risk factors set forth in our SEC filings,

including our quarterly report on Form 10-Q for the quarter ended

June 30, 2012 and subsequent quarterly reports to be filed on Form

10-Q or current reports on Form 8-K. The forward-looking statements

should be considered in light of these risks and uncertainties.

These risks and uncertainties include those relating to:

- the concentration of profits generated

from commercial payor plans,

- continued downward pressure on average

realized payment rates from commercial payors, which may result in

the loss of revenues or patients,

- a reduction in the number of patients

under higher-paying commercial plans,

- a reduction in government payment rates

under the Medicare End Stage Renal Disease program or other

government-based programs,

- the impact of health care reform

legislation that was enacted in the United States in March

2010,

- changes in pharmaceutical or anemia

management practice patterns, payment policies, or pharmaceutical

pricing,

- our ability to maintain contracts with

physician medical directors,

- legal compliance risks, including our

continued compliance with complex government regulations,

- current or potential investigations by

various government entities and related government or private-party

proceedings,

- continued increased competition from

large and medium-sized dialysis providers that compete directly

with us,

- the emergence of new models of care

introduced by the government or private sector, such as accountable

care organizations, independent practice association and integrated

delivery systems, and changing affiliation models for physicians

plans, such as employment by hospitals, that may erode our patient

base and reimbursement rates,

- our ability to complete any

acquisitions or mergers, including the consummation of the HCP

transaction, dispositions that we might be considering or announce,

or to integrate and successfully operate any business we may

acquire, including the HCP business, or to expand our operations

and services to markets outside the United States, or to businesses

outside of dialysis,

- variability of DaVita’s cash flows,

or

- risks arising from the use of

accounting estimates in our financial statements.

In addition, upon closing of the HCP transaction, certain other

risks and uncertainties related to HCP will also affect these

forward-looking statements, including those relating to:

- the loss of key HCP employees following

the HCP transaction,

- potential disruption from the HCP

transaction making it more difficult to maintain business and

operational relationships with customers, partners, affiliated

physicians and physician groups and others,

- the risk that the cost of providing

services under HCP’s agreements will exceed HCP’s

compensation,

- the risk that laws regulating the

corporate practice of medicine could restrict the manner in which

HCP conducts its business,

- the risk that reductions in

reimbursement rates and future regulations may negatively impact

HCP’s business, revenue and profitability,

- the risk that HCP may not be able to

successfully establish a presence in new geographic regions,

- the risk that reductions in the quality

ratings of health maintenance organization plan customers of HCP

could have an adverse effect on HCP’s business,

- the fact that HCP faces certain

competitive threats that could reduce its profitability, or

- the risk that a disruption in HCP’s

healthcare provider networks could have an adverse effect on HCP’s

operations and profitability.

We base our forward-looking statements on information currently

available to us at the time of this release, and we undertake no

obligation to update or revise any forward-looking statements,

whether as a result of changes in underlying factors, new

information, future events or otherwise.

This release contains non-GAAP financial measures. For

reconciliations of these non-GAAP financial measures to their most

comparable measure calculated and presented in accordance with

GAAP, see the attached reconciliation schedules. For the reasons

stated in the reconciliation schedules, we believe our presentation

of non-GAAP financial measures provides useful supplemental

information for investors.

DAVITA INC. CONSOLIDATED STATEMENTS OF INCOME

(unaudited) (dollars in thousands, except per share

data) Three months ended Nine

months ended September 30, September 30,

2012 2011 2012 2011

Dialysis patient service operating revenues $ 1,838,363 $ 1,669,086

$ 5,410,200 $ 4,749,469 Less: Provision for uncollectible accounts

related to patient service operating revenues (59,803 )

(50,039 ) (167,227 ) (138,520 ) Net patient

service operating revenues 1,778,560 1,619,047 5,242,973 4,610,949

Other revenues 184,406 138,783

516,368 370,427 Total net operating revenues

1,962,966 1,757,830 5,759,341

4,981,376 Operating expenses and charges:

Patient care costs 1,340,918 1,189,638 3,916,324 3,466,860 General

and administrative 201,198 182,638 623,208 498,033 Depreciation and

amortization 80,586 67,558 234,368 193,641 Provision for

uncollectible accounts 2,469 1,903 6,294 4,727 Equity investment

income (3,064 ) (2,619 ) (8,314 ) (6,555 ) Legal proceeding

contingency accrual and related expenses ─ ─ 78,000 ─ Goodwill

impairment charge ─ ─ ─ 24,000 Total operating

expenses and charges 1,622,107 1,439,118

4,849,880 4,180,706 Operating

income 340,859 318,712 909,461 800,670 Debt expense

(70,494

)

(60,848

)

(192,584

)

(179,340

)

Other income 819 798 2,698

2,195 Income from continuing operations before

income taxes 271,184 258,662 719,575 623,525 Income tax expense

98,634 94,204 262,138

224,034 Income from continuing operations 172,550

164,458 457,437 399,491 Discontinued operations: Income from

operations of discontinued operations, net of tax ─ 1,076 ─ 1,460

Loss on disposal of discontinued operations, net of tax ─

(3,688

)

─

(3,688

)

Net income 172,550 161,846 457,437 397,263

Less: Net income attributable to

noncontrolling interests

(27,829

)

(26,485

)

(77,259

)

(67,385

)

Net income attributable to DaVita Inc. $ 144,721 $ 135,361

$ 380,178 $ 329,878

Earnings per share:

Basic income from continuing operations per share attributable to

DaVita Inc. $ 1.52 $ 1.48 $ 4.03 $ 3.50

Basic net income per share attributable to DaVita Inc. $ 1.52

$ 1.45 $ 4.03 $ 3.47 Diluted income

from continuing operations per share attributable to DaVita Inc. $

1.50 $ 1.45 $ 3.96 $ 3.43 Diluted net

income per share attributable to DaVita Inc. $ 1.50 $ 1.42

$ 3.96 $ 3.40

Weighted average shares for

earnings per share: Basic 94,979,858

93,441,620 94,309,099 95,053,339

Diluted 96,634,620 95,171,225

96,124,226 97,057,773

Amounts attributable

to DaVita Inc.: Income from continuing operations $ 144,721 $

138,192 $ 380,178 $ 332,325 Discontinued operations ─

(2,831

)

─

(2,447

)

Net income $ 144,721 $ 135,361 $ 380,178 $

329,878

DAVITA INC. CONSOLIDATED

STATEMENTS OF COMPREHENSIVE INCOME (unaudited)

(dollars in thousands, except per share

data)

Three months ended Nine months

ended September 30, September 30, 2012

2011 2012 2011 Net income $

172,550 $ 161,846 $ 457,437 $ 397,263

Other comprehensive (loss) income, net of tax: Unrealized losses on

interest rate swap and cap agreements: Unrealized losses on

interest rate swap and cap agreements (1,741 ) (10,869 ) (6,104 )

(27,839 ) Less: Reclassifications of net swap and cap agreements

realized losses into net income 2,530 2,702 7,586 7,124

Unrealized gains (losses) on investments: Unrealized gains (losses)

on investments 445 (902 ) 1,387 (587 ) Less: Reclassification of

net investment realized gains into net income ─ ─ (75 ) (57 )

Foreign currency translation adjustments (135 ) ─

(1,593 ) ─ Other comprehensive income (loss) 1,099

(9,069 ) 1,201 (21,359 )

Total comprehensive income 173,649 152,777 458,638 375,904 Less:

Comprehensive income attributable to the noncontrolling interests

(27,829 ) (26,485 ) (77,259 ) (67,385 )

Comprehensive income attributable to DaVita Inc. $ 145,820 $

126,292 $ 381,379 $ 308,519

DAVITA INC. CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited) (dollars in thousands)

Nine months ended September 30, 2012

2011 Cash flows from operating activities: Net income

$ 457,437 $ 397,263 Adjustments to reconcile net income to cash

provided by operating activities: Depreciation and amortization

234,368 194,328 Stock-based compensation expense 34,857 36,392 Tax

benefits from stock award exercises 60,252 35,096 Excess tax

benefits from stock award exercises

(39,346

)

(19,640

)

Deferred income taxes

(1,374

)

38,377 Equity investment income, net 10 238 Other non-cash charges

and loss on disposal of assets 17,244 16,398 Goodwill impairment

charge ─ 24,000 Changes in operating assets and liabilities, other

than from acquisitions and divestitures: Accounts receivable

(51,349

)

(61,483

)

Inventories 1,958 11,767 Other receivables and other current assets

65,047 81,737 Other long-term assets 3,429 2,408 Accounts payable

(18,200 ) 56,652 Accrued compensation and benefits 113,101 121,631

Other current liabilities 87,223

(8,733

)

Income taxes

(69,108

)

88,454 Other long-term liabilities 5,064

14,502 Net cash provided by operating activities

900,613 1,029,387

Cash flows from investing

activities: Additions of property and equipment, net

(378,949

)

(251,879

)

Acquisitions

(419,114

)

(927,124 ) Proceeds from asset sales 2,118 51,623 Purchase of

investments available for sale (3,452 ) (2,118 ) Purchase of

investments held-to-maturity (5,257 ) (29,740 ) Proceeds from sale

of investments available for sale 6,796 1,149 Proceeds from

maturities of investments held-to-maturity 12,375 29,747 Purchase

of equity investments and other assets (1,276 ) (5,005 )

Distributions received on equity investments 2

340 Net cash used in investing activities (786,757 )

(1,133,007 )

Cash flows from financing activities:

Borrowings 26,992,105 27,506,051 Payments on long-term debt

(25,799,807 ) (27,350,513 ) Restricted cash (1,268,767 ) ─ Interest

rate cap premiums and other deferred financing costs (22,189 )

(17,863 ) Purchase of treasury stock ─ (323,348 ) Distributions to

noncontrolling interests (81,978 ) (67,408 ) Stock award exercises

and other share issuances, net 8,395 9,886 Excess tax benefits from

stock award exercises 39,346 19,640 Contributions from

noncontrolling interests 19,368 14,779 Proceeds from sales of

additional noncontrolling interests 1,844 2,675 Purchases from

noncontrolling interests (13,774 ) (9,190 ) Net cash

used in financing activities (125,457 ) (215,291 ) Effect of

exchange rate changes on cash and cash equivalents 43

─ Net decrease in cash and cash equivalents (11,558 )

(318,911 ) Cash and cash equivalents at beginning of period

393,752 860,117 Cash and cash equivalents at

end of period $ 382,194 $ 541,206

DAVITA INC. CONSOLIDATED BALANCE SHEETS

(unaudited) (dollars in thousands, except per share

data) September 30, December

31, 2012 2011 ASSETS Cash

and cash equivalents $ 382,194 $ 393,752 Short-term investments

5,836 17,399 Accounts receivable, less allowance of $232,127 and

$250,343 1,248,050 1,195,163 Inventories 78,322 75,731 Other

receivables 207,439 269,832 Other current assets 46,989 49,349

Income tax receivable 33,625 ─ Deferred income taxes 323,219

280,382 Total current assets 2,325,674

2,281,608 Property and equipment, net 1,654,657 1,432,651

Amortizable intangibles, net 177,542 159,491 Equity investments

28,705 27,325 Long-term investments 13,249 9,890 Other long-term

assets 30,558 34,231 Restricted cash 1,268,767 ─ Goodwill

5,324,960 4,946,976 $ 10,824,112 $

8,892,172

LIABILITIES AND EQUITY Accounts payable $

272,627 $ 289,653 Other liabilities 416,897 325,734 Accrued

compensation and benefits 529,492 412,972 Current portion of

long-term debt 117,821 87,345 Income tax payable ─

37,412 Total current liabilities 1,336,837 1,153,116

Long-term debt 5,620,716 4,417,624 Other long-term liabilities

145,246 132,006 Alliance and product supply agreement, net 15,990

19,987 Deferred income taxes 484,918 423,098

Total liabilities 7,603,707 6,145,831 Commitments and

contingencies Noncontrolling interests subject to put provisions

550,020 478,216 Equity: Preferred stock ($0.001 par value,

5,000,000 shares authorized; none issued) Common stock ($0.001 par

value, 450,000,000 shares authorized; 134,862,283 shares issued;

95,346,980 and 93,641,363 shares outstanding) 135 135 Additional

paid-in capital 543,751 596,300 Retained earnings 3,575,996

3,195,818 Treasury stock, at cost (39,515,303 and 41,220,920

shares) (1,564,178 ) (1,631,694 ) Accumulated other comprehensive

loss (18,283 ) (19,484 ) Total DaVita Inc.

shareholders’ equity 2,537,421 2,141,075 Noncontrolling interests

not subject to put provisions 132,964 127,050

Total equity 2,670,385 2,268,125

$ 10,824,112 $ 8,892,172

DAVITA

INC. SUPPLEMENTAL FINANCIAL DATA (unaudited)

(dollars in millions, except for per share and per treatment

data) Three months ended Nine

months ended September 30, 2012 September 30,

2012

June 30,

2012

September 30,

2011

1. Consolidated Financial Results: Consolidated operating

revenues $ 2,023 $ 1,984 $ 1,808 $ 5,927 Consolidated net operating

revenues $ 1,963 $ 1,930 $ 1,758 $ 5,759 Operating income $ 340.9 $

247.9 $ 318.7 $ 909.5 Operating income excluding the legal

proceeding contingency accrual and related expenses(1) $ 340.9 $

325.9 $ 318.7 $ 987.5 Operating income margin 16.9 % 12.5 % 17.6 %

15.3 % Operating income margin excluding the legal proceeding

contingency accrual and related expenses(1) 16.9 % 16.4 % 17.6 %

16.7 % Net income attributable to DaVita Inc. $ 144.7 $ 95.3 $

135.4 $ 380.2 Net income attributable to DaVita Inc. excluding the

legal proceeding contingency accrual and related expenses(1) $

144.7 $ 142.9 $ 135.4 $ 427.8 Diluted net income per share

attributable to DaVita Inc. $ 1.50 $ 0.99 $ 1.42 $ 3.96 Diluted net

income per share attributable to DaVita Inc.(1), excluding the

legal proceeding contingency accrual and related expenses $ 1.50 $

1.49 $ 1.42 $ 4.46

2. Consolidated Business Metrics:

Expenses Patient care costs as a percent of consolidated

operating revenues(2) 66.3 % 66.1 % 65.8 % 66.1 % General and

administrative expenses as a percent of consolidated operating

revenues(2) 9.9 % 10.8 % 10.1 % 10.5 % Total provision for

uncollectible accounts as a percent of consolidated operating

revenues 3.1 % 2.8 % 2.9 % 2.9 % Consolidated effective tax

rate 36.4 % 36.2 % 36.4 % 36.4 % Consolidated effective tax rate

attributable to DaVita Inc.(1) 40.5 % 41.5 % 40.5 % 40.8 %

3. Segment Financial Results: (dollar amounts rounded to nearest

million) Operating revenues Dialysis and related lab

services patient service operating revenues $ 1,842 $ 1,813 $ 1,672

$ 5,423 Less: Provision for uncollectible accounts related to

patient service operating revenues (60 ) (54 )

(50 ) (167 ) Dialysis and related lab services net patient

service operating revenues $ 1,782 $ 1,759 $ 1,622 $ 5,256 Other

revenues 3 3 3 8

Total net dialysis and related lab services operating

revenues 1,785 1,762 1,625 5,264 Other – Ancillary services and

strategic initiatives 180 170 135 503 Other – Ancillary services

and strategic initiatives net patient service operating revenues

(related to international dialysis operations and a vascular access

clinic) 5 5 2 12

Total net segment operating revenues 1,970 1,937 1,762 5,779

Elimination of intersegment revenues (7 ) (7 )

(4 ) (20 ) Total net consolidated operating revenues $ 1,963

$ 1,930 $ 1,758 $ 5,759

DAVITA INC. SUPPLEMENTAL FINANCIAL DATA—continued

(unaudited) (dollars in millions, except for per share

and per treatment data) Three months ended

Nine months ended September 30, 2012 September

30,

2012

June 30,

2012

September 30,

2011

3. Segment Financial Results: (dollar amounts rounded to

nearest million)(continued) Operating Income Dialysis

and related lab services operating income $ 361 $ 286 $ 333 $ 1,002

Other – Ancillary services and strategic initiatives, including

international dialysis operations operating losses (11 )

(19 ) (3 ) (48 ) Total segment operating

income $ 350 $ 267 $ 330 $ 954 Reconciling items: Other corporate

level general and administrative expenses including stock-based

compensation (12 ) (22 ) (13 ) (53 ) Equity investment income

3 3 2 8

Consolidated operating income $ 341 $ 248 $ 319

$ 909

4. Segment Business Metrics:

Dialysis and related lab services Volume Treatments

5,550,645 5,451,901 5,008,094 16,316,821 Number of treatment days

78.0 78.0 79.0 234.0 Treatments per day 71,162 69,896 63,394 69,730

Per day year over year increase 12.3 % 14.3 % 9.6 % 13.5 %

Non-acquired growth year over year 4.4 % 4.7 % 5.0 % 4.9 %

Operating revenues before provision for uncollectible

accounts Dialysis and related lab services revenue per

treatment $ 331.93 $ 332.67 $ 333.86 $ 332.34 Per treatment

(decrease) increase from previous quarter (0.2 %) 0.1 % 0.5 % ─ Per

treatment (decrease) increase from previous year (0.6 %) 0.1 % (1.5

%) 0.4 % Percent of consolidated revenues 91.0 % 91.3 % 92.5 % 91.4

%

Expenses Patient care costs Percent of total

segment operating revenues 64.3 % 64.1 % 64.5 % 64.1 % Per

treatment $ 213.90 $ 213.68 $ 215.66 $ 213.25 Per treatment

increase (decrease) from previous quarter 0.1 % 0.7 % (3.2 %) ─ Per

treatment decrease from previous year (0.8 %) (4.1 %) (7.4 %) (3.3

%) General and administrative expenses Percent of total

segment operating revenues 8.6 % 8.6 % 8.8 % 8.8 % Per treatment $

28.55 $ 28.80 $ 29.28 $ 29.23 Per treatment (decrease) increase

from previous quarter (0.9 %) (5.2 %) 9.3 % ─ Per treatment

(decrease) increase from previous year (2.5 %) 7.5 % 10.0 % 5.8 %

DAVITA INC. SUPPLEMENTAL FINANCIAL

DATA—continued (unaudited) (dollars in millions,

except for per share and per treatment data)

Three months ended Nine months ended September 30,

2012 September 30,

2012

June 30,

2012

September 30,

2011

5. Cash Flow: Operating cash flow $ 366.6 $ 202.1 $ 495.2 $

900.6 Operating cash flow, last twelve months $ 1,051.3 $ 1,179.8 $

1,149.9 Free cash flow(1) $ 271.4 $ 111.4 $ 423.1 $ 632.7 Free cash

flow, last twelve months(1) $ 664.8 $ 816.5 $ 860.2 Capital

expenditures: Routine maintenance/IT/other $ 63.7 $ 66.6 $ 51.1 $

185.9 Development and relocations $ 64.7 $ 71.4 $ 45.7 $ 193.0

Acquisition expenditures $ 72.3 $ 214.1 $ 775.9 $ 419.1

6. Accounts Receivable: Net receivables $ 1,248 $ 1,250 $

1,165 DSO 59 60 59

7. Debt and Capital Structure: Total

debt(3) $ 5,745 $ 4,505 $ 4,508 Net debt, net of cash and cash

equivalents including restricted cash at September 30, 3012(3) $

4,094 $ 4,232 $ 3,967 Leverage ratio (see calculation on page 11)

2.61x 2.70x 2.73x Overall weighted average effective interest rate

during the quarter 5.31 % 5.27 % 5.30 % Overall weighted average

effective interest rate at end of the quarter 5.38 % 5.28 % 5.27 %

Weighted average effective interest rate on the Senior Secured

Credit Facilities at end of the quarter 4.61 % 4.61 % 4.61 % Fixed

and economically fixed interest rates as a percentage of our total

debt(4) 66 % 57 % 57 % Share repurchases $ - $ - $ 7.3

8.

Clinical: (quarterly averages) Dialysis adequacy -% of patients

with Kt/V > 1.2 at the end of the quarter 98 % 98 % 97 %

Patients with arteriovenous fistulas placed 71 % 70 % 69 %

_________________

(1) These are non-GAAP financial measures. For a reconciliation

of these non-GAAP financial measures to their most comparable

measure calculated and presented in accordance with GAAP, see

attached reconciliation schedules.

(2) Consolidated percentages of revenues are comprised of the

dialysis and related lab services business, other ancillary

services and strategic initiatives, stock-based compensation

expenses, and in case of general and administrative expenses,

includes other certain corporate level general and administrative

expenses.

(3) The reported balance sheet amounts at September 30, 2012,

June 30, 2012 and September 30, 2011, are net of $6.6 million, $7.0

million and $8.3 million, respectively, of debt discounts

associated with our Term Loan B and our Term Loan A-2.

(4) The Term Loan A-2 and Term Loan B are subject to LIBOR

floors of 1.00% and 1.50%, respectively. Because LIBOR, for all

periods presented above, was lower than either of these floors, the

interest rates on the Term Loan A-2 and the Term Loan B are set at

their respective floors. At such time as the LIBOR-based component

of our interest rate exceeds 1.00% on the Term Loan A-2 and 1.50%

on the Term Loan B, we will then be subject to LIBOR-based interest

rate volatility on the LIBOR variable component of our interest

rate on all of the Term Loan A-2, as well as for the Term Loan B,

but limited to a maximum rate of 4.00% on $1.25 billion of

outstanding principal debt on the Term Loan B. The remaining $469

million outstanding principal balance of the Term Loan B is subject

to LIBOR-based interest rate volatility above a floor of 1.50%.

DAVITA INC.SUPPLEMENTAL FINANCIAL

DATA—continued(unaudited)(dollars in

thousands)

Note 1: Calculation of the Leverage Ratio

Under the Company’s Senior Secured Credit Facilities (Credit

Agreement), the leverage ratio is defined as all funded debt plus

the face amount of all letters of credit issued, minus cash and

cash equivalents, divided by “Consolidated EBITDA.” The leverage

ratio determines the interest rate margin payable by the Company

for its Term Loan A and revolving line of credit under the Credit

Agreement by establishing the margin over the base interest rate

(LIBOR) that is applicable. The following leverage ratio was

calculated using “Consolidated EBITDA” as defined in the Credit

Agreement. The calculation below is based on the last twelve months

of “Consolidated EBITDA,” pro forma for routine acquisitions that

occurred during the period. The Company’s management believes the

presentation of “Consolidated EBITDA” is useful to investors to

enhance their understanding of the Company’s leverage ratio under

its Credit Agreement.

Rolling twelve months ended September

30, 2012 Net income attributable to DaVita Inc. $

528,301 Income taxes 353,047 Interest expense 236,727 Depreciation

and amortization 307,355 Noncontrolling interests and equity

investment income, net 105,394 Stock-based compensation 47,183

Other items 23,624 “Consolidated EBITDA” $ 1,601,631

September 30, 2012 Total debt, excluding debt discount of

$6.6 million $ 5,745,136 Letters of credit issued 87,953 5,833,089

Less: Cash and cash equivalents and including restricted cash

(1,650,962) Consolidated net debt $ 4,182,127 Last twelve months

“Consolidated EBITDA” $ 1,601,631 Leverage ratio 2.61x

In accordance with the Credit Agreement, the Company’s

leverage ratio cannot exceed 4.25 to 1.0 as of September 30, 2012.

At that date the Company’s leverage ratio did not exceed 4.25 to

1.0.

DAVITA INC.RECONCILIATIONS FOR

NON-GAAP MEASURES(unaudited)(dollars in

thousands)

1. Net income attributable to DaVita Inc. excluding an

after-tax legal proceeding contingency accrual and related expenses

and an after-tax non-cash goodwill impairment charge and diluted

earnings per share attributable to DaVita Inc. excluding an

after-tax legal proceeding contingency accrual and related expenses

and an after-tax non-cash goodwill impairment charge.

We believe that net income attributable to DaVita Inc. excluding

an after-tax legal proceeding contingency accrual and related

expenses and an after-tax non-cash goodwill impairment charge

enhances a user’s understanding of our normal net income

attributable to DaVita Inc. and diluted earnings per share

attributable to DaVita Inc. for these periods by providing a

measure that is meaningful because it excludes an unusual charge

for a legal proceeding contingency accrual that resulted from an

agreement we reached in principle to settle federal program claims

relating to our historical Epogen practices during the second

quarter of 2012 and also excludes a non-cash goodwill impairment

charge that resulted from a decrease in the implied fair value of

goodwill below its carrying amount associated with our infusion

therapy business during the second quarter of 2011 and accordingly,

is more comparable to prior periods and indicative of consistent

net income attributable to DaVita Inc. and diluted earnings per

share to DaVita Inc. These measures are not measures of financial

performance under United States generally accepted accounting

principles (GAAP) and should not be considered as an alternative to

net income attributable to DaVita Inc., and diluted earnings per

share attributable to DaVita Inc.

Net income attributable to DaVita Inc. excluding an

after-tax legal proceeding contingency accrual and related expenses

and an after-tax non-cash goodwill impairment charge:

Three months ended Nine months ended

September 30, June 30, September

30, September 30, September 30,

2012 2012 2011 2012 2011 Net

income attributable to DaVita Inc. $ 144,721 $ 95,337 $ 135,361 $

380,178 $ 329,878 Add: Legal proceeding contingency accrual and

related expenses ─ 78,000 ─ 78,000 ─ Non-cash goodwill impairment

charge ─ ─ ─ ─ 24,000 Less: Related income tax ─ (30,420 ) ─

(30,420 ) (9,600 ) $ 144,721 $ 142,917 $

135,361 $ 427,758 $ 344,278

Diluted

earnings per share attributable to DaVita Inc. excluding an

after-tax legal proceeding contingency accrual and related expenses

and an after-tax non-cash goodwill impairment charge:

Three months ended Nine months ended

September 30, June 30, September

30, September 30, September 30,

2012 2012 2011 2012 2011 Diluted

earnings per share attributable to DaVita Inc. $ 1.50 $ 0.99 $ 1.42

3.96 $ 3.40 Add: Legal proceeding contingency accrual and related

expenses ─ 0.50 ─ 0.50 ─ Non-cash goodwill impairment charge ─ ─ ─

─ 0.14 $ 1.50 $ 1.49 $ 1.42 $ 4.46 $ 3.54

DAVITA INC.RECONCILIATIONS FOR

NON-GAAP MEASURES(unaudited)(dollars in

thousands)

2. Operating income excluding a pre-tax legal

proceeding contingency accrual and related expenses and a pre-tax

non-cash goodwill impairment charge.

We believe that operating income excluding a pre-tax legal

proceeding contingency accrual and related expenses and a pre-tax

non-cash goodwill impairment charge enhances a user’s understanding

of our normal operating income for these periods by providing a

measure that is meaningful because it excludes an unusual charge

for a legal proceeding contingency accrual that resulted from an

agreement we reached in principle to settle federal program claims

relating to our historical Epogen practices during the second

quarter of 2012 and also excludes a non-cash goodwill impairment

charge that resulted from a decrease in the implied fair value of

goodwill below its carrying amount associated with our infusion

therapy business during the second quarter of 2011 and accordingly,

is more comparable to prior periods and indicative of consistent

operating income. This measure is not a measure of financial

performance under GAAP and should not be considered as an

alternative to operating income.

Operating income excluding a pre-tax legal proceeding

contingency accrual and related expenses and a pre-tax non-cash

goodwill impairment charge: Three months ended

Nine months ended September 30, June

30, September 30, September 30,

September 30, 2012 2012 2011

2012 2011 Operating income $ 340,859 $ 247,882 $

318,712 $ 909,461 $ 800,670 Add: Legal proceeding contingency

accrual and related expenses ─ 78,000 ─ 78,000 ─ Non-cash goodwill

impairment charge ─ ─ ─ ─ 24,000 $ 340,859 $ 325,882 $

318,712 $ 987,461 $ 824,670

DAVITA INC.RECONCILIATIONS FOR

NON-GAAP MEASURES(unaudited)(dollars in

thousands)

3. Effective Income Tax Rates

We believe that reporting the effective income tax rate

attributable to DaVita Inc. enhances an investor’s understanding of

DaVita’s effective income tax rate for the periods presented

because it excludes noncontrolling owners’ income that primarily

relates to non-tax paying entities and accordingly is more

comparable to prior periods presentations regarding DaVita’s

effective income tax rate and is meaningful to an investor to fully

understand the related income tax effects on DaVita Inc.’s

operating results. This is not a measure under GAAP and should not

be considered as an alternative to the effective income tax rate

calculated in accordance with GAAP.

Effective income tax rate as compared to the effective income

tax rate attributable to DaVita Inc. is as follows:

Three months ended Nine months ended

September 30, 2012 September 30,

2012

June 30,

2012

September 30,

2011

Income from continuing operations before income taxes $ 271,184

$ 188,013 $ 258,662 $ 719,575 Income

tax expense $ 98,634 $ 68,009 $ 94,204 $

262,138 Effective income tax rate 36.4 % 36.2

% 36.4 % 36.4 %

Three months

ended Nine months ended September 30, 2012

September 30,

2012

June 30,

2012

September 30,

2011

Income from continuing operations before income taxes $ 271,184 $

188,013 $ 258,662 $ 719,575 Less: Noncontrolling owners’ income

primarily attributable to non-tax paying entities (27,954 )

(25,051 ) (26,604 ) (77,888 ) Income before

income taxes attributable to DaVita Inc. $ 243,230 $ 162,962

$ 232,058 $ 641,687 Income tax expense

98,634 68,009 $ 94,204 $ 262,138 Less: Income tax attributable to

noncontrolling interests (125 ) (384 ) (119 )

(629 ) Income tax attributable to DaVita Inc. $ 98,509

$ 67,625 $ 94,085 $ 261,509

Effective income tax rate attributable to DaVita Inc. 40.5 %

41.5 % 40.5 % 40.8 %

DAVITA INC.RECONCILIATIONS FOR

NON-GAAP MEASURES(unaudited)(dollars in

thousands)

4. Free cash flow

Free cash flow represents net cash provided by operating

activities less distributions to noncontrolling interests and

capital expenditures for routine maintenance and information

technology. We believe free cash flow is a useful adjunct to cash

flow from operating activities and other measurements under GAAP,

since free cash flow is a meaningful measure of our ability to fund

acquisition and development activities and meet our debt service

requirements. In addition, free cash flow excluding distributions

to noncontrolling interests provides an investor with an

understanding of free cash flows that are attributable to DaVita

Inc. Free cash flow is not a measure of financial performance under

GAAP and should not be considered as an alternative to cash flows

from operating, investing or financing activities, as an indicator

of cash flows or as a measure of liquidity.

Three months ended Nine months ended

September 30, 2012 September 30,

2012

June 30,

2012

September 30,

2011

Cash provided by operating activities $ 366,634 $ 202,105 $ 495,194

$ 900,613 Less: Distributions to noncontrolling interests

(31,500 ) (24,073 ) (20,985 ) (81,978 ) Cash

provided by operating activities attributable to DaVita Inc.

335,134 178,032 474,209 818,635 Less: Expenditures for routine

maintenance and information technology (63,718 )

(66,603 ) (51,107 ) (185,930 ) Free cash flow $

271,416 $ 111,429 $ 423,102 $ 632,705

Rolling 12-Month Period September

30, June 30, September 30,

2012 2012 2011 Cash provided by operating

activities $ 1,051,272 $ 1,179,832 $ 1,149,938 Less: Distributions

to noncontrolling interests (115,223 ) (104,708 )

(89,887 ) Cash provided by operating activities attributable

to DaVita Inc. 936,049 1,075,124 1,060,051 Less: Expenditures for

routine maintenance and information technology (271,234 )

(258,623 ) (199,860 ) Free cash flow $ 664,815

$ 816,501 $ 860,191

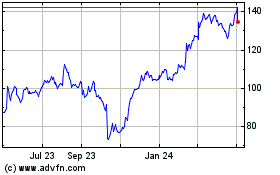

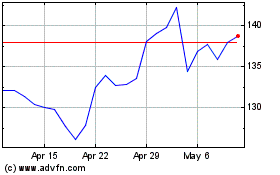

DaVita (NYSE:DVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

DaVita (NYSE:DVA)

Historical Stock Chart

From Jul 2023 to Jul 2024