Orange issues a 6.5-year 0.75% EUR 750 million bond and a 10.5- year 1.50% EUR 500 million bond

March 02 2017 - 11:16AM

press release

Paris, March 2, 2017

Not for

distribution in the United States of America

Orange issues a 6.5-year 0.75% EUR 750 million

bond and a 10.5-year 1.50% EUR 500 million bond

Orange has agreed to sell EUR 750 million of notes

due September 2023 with a coupon of 0.75 % and EUR 500 million of

notes due September 2027 with a coupon of 1.50%.

|

Currency |

Format |

Term |

Notional |

Coupon |

Re-offer

spread |

| EUR |

Fixed

rate |

2023 |

750

million |

0.75% |

m/s + 50

bps |

| EUR |

Fixed

rate |

2027 |

500

million |

1.50% |

m/s + 78

bps |

Barclays, Royal Bank of Canada, Societe Generale

and Unicredit are acting as bookrunners for the 6.5 year

offering.

Barclays, Commerzbank, Credit Suisse and Societe

Generale are acting as bookrunners for the 10.5 year offering.

Barclays and Societe Generale are acting as global

coordinators.

With these offerings, Orange pursues its prudent

and active balance sheet management.

About Orange

Orange is one of the world's leading

telecommunications operators with sales of 40,9 billion euros in

2016 and 155,000 employees worldwide at 31 December 2016, including

96,000 employees in France. Present in 29 countries, the Group has

a total customer base of 263 million customers worldwide at 31

December 2016, including 202 million mobile customers and

18 million fixed broadband customers. Orange is also a leading

provider of global IT and telecommunication services to

multinational companies, under the brand Orange Business Services.

In March 2015, the Group presented its new strategic plan

"Essentials2020" which places customer experience at the heart of

its strategy with the aim of allowing them to benefit fully from

the digital universe and the power of its new generation

networks.

Orange is listed on Euronext Paris (symbol ORA)

and on the New York Stock Exchange (symbol ORAN).

For more information on the internet and on your mobile:

www.orange.com, www.orange-business.com or to follow us on Twitter:

@orangegrouppr.

Orange and any other Orange product or service

names included in this material are trademarks of Orange or Orange

Brand Services Limited.

Press contacts: +33 1 44 44 93

93

Olivier Emberger; olivier.emberger@orange.com

Tom Wright; tom.wright@orange.com

CAUTION: NOT FOR DISTRIBUTION IN THE UNITED

STATES

This press release, of a purely informative nature, is not and

cannot in any way be construed as an offering to sell any

securities, or as a solicitation of any offer to buy securities, in

any jurisdiction, including the United States, Japan, Australia,

Canada and the United Kingdom. The securities mentioned in this

press release have not been and will not be registered pursuant to

the US Securities Act of 1933, as modified. They cannot be offered

or sold in the United States absent registration or an exemption

from registration. No public offer of these securities has been or

will be made in the United States or elsewhere.

Orange issues bonds

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Orange via Globenewswire

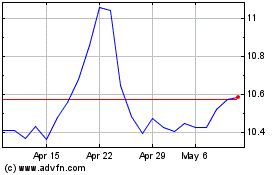

Orange (EU:ORA)

Historical Stock Chart

From Mar 2024 to Apr 2024

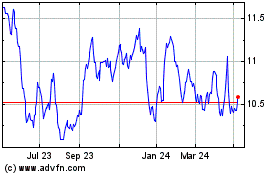

Orange (EU:ORA)

Historical Stock Chart

From Apr 2023 to Apr 2024