Health-Data Watchdog Company Has a Powerful Adviser

March 24 2017 - 9:15AM

Dow Jones News

By Anna Wilde Mathews and Alexandra Berzon

A little-known health company says it has scored a high-profile

new board member: Michael D. Cohen, a close associate of President

Donald Trump who serves as the president's personal attorney.

4C Health Solutions focuses on detecting fraudulent or

questionable health-care billings sent to insurers. The closely

held company based in Midlothian, Va. -- whose corporate name is

HealthcarePays Network LLC -- brought in less than $2 million in

revenue last year and currently has around 20 employees, according

to Chief Executive David J. Adams.

The 4C board also includes well-connected former Republican

Cabinet officials Tommy G. Thompson, the company's chairman and a

former U.S. Secretary of Health and Human Services, and former

Treasury Secretary John W. Snow. Another board member is Bill

Fields, a former high-ranking executive at Wal-Mart Stores Inc.

Mr. Adams said he hopes they can help 4C achieve ambitious

growth, fueled by business from government programs such as

Medicare, Medicaid and the Veterans Health Administration, as well

as from corporate employers.

Mr. Adams said he doesn't expect Mr. Cohen to promote the firm

to the president or others in the Trump administration. "I don't

want Mr. Cohen to say, 'Mr. Trump, you ought to do this with' " 4C,

Mr. Adams said. "If Mr. Cohen wants to talk to Mr. Trump about the

problem of health-care fraud, that's fine."

He said Mr. Cohen is a valuable board member because of his

relationships with top corporate executives and expertise in

employment law.

Mr. Cohen declined to comment about 4C, referring questions to

the company. He said he had been "asked to join many boards."

Mr. Cohen is a longtime troubleshooter for Mr. Trump and has

called himself "the fix-it guy" for the president. He served in

that role as a Trump Organization employee and resigned from the

company when Mr. Trump became president. He has said he is paid

privately by Mr. Trump and isn't part of the government.

Some previous presidents, including Bill Clinton, have had

personal attorneys to address legal matters that fall outside their

government duties. Ethics experts said Mr. Cohen's role on a

corporate board of directors could present some

conflict-of-interest challenges, even though he doesn't face the

restrictions a government employee would face in personal business

matters.

Mr. Cohen "is free legally to pursue his own business interests,

but his role as Mr. Trump's personal employee gives him a unique

access point," said Kathleen Clark, a professor at Washington

University School of Law, in St. Louis.

As an attorney, Mr. Cohen has to serve his client's interests:

One question that could arise is whether that responsibility would

conflict with his obligations as a corporate board member, Prof.

Clark said. And Mr. Cohen's proximity to the president could lead

to a perception of favoritism if a company where he is on the board

attempts to win business with government agencies or influence

policy, ethics experts said.

A White House official didn't respond to a request for comment.

In an email, Mr. Cohen dismissed a question about ethics and

potential conflicts of interest as "fundamentally flawed and

biased" and said he did not see the benefit of engaging in a

conversation about it.

Mr. Thompson said he doesn't expect Mr. Cohen to discuss the

company with Mr. Trump or federal officials, though Mr. Thompson

said he himself has spoken about the costs of health-care fraud

with Trump administration officials. "I hope once he's on the

board, he helps us make our agenda apparent to people," Mr.

Thompson said. "I hope he will do his part with his connections,"

including in the business sector.

Mr. Adams said board members have invested their own money in

4C. Mr. Cohen hasn't done so, but will receive options to purchase

shares as part of his board service, the CEO said.

4C has been aggressively pitching its services to large

companies, saying it can save them money that they currently spend

on questionable health claims through employee health plans. 4C

says it can scan large volumes of claims and detect patterns that

may signal fraud. Other companies compete with 4C in offering such

services to employers.

4C wasn't profitable last year, Mr. Adams said. He said the

company aims to be in the black in 2017 when he projects revenue

will grow to around $17 million. The CEO said his company is

working with several large customers and potential customers but he

said he couldn't name them publicly due to confidentiality

requirements. 4C charges clients a set monthly fee for each person

covered by the health plan.

4C says it aims to prevent questionable payments before they are

made. Getting access midstream to large health insurers' systems to

intervene and stop allegedly problematic payments is likely to be

an uphill battle, industry experts said. Mr. Adams said 4C believes

employers have the legal right to block payments of their own money

for questionable claims.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and

Alexandra Berzon at alexandra.berzon@wsj.com

(END) Dow Jones Newswires

March 24, 2017 10:00 ET (14:00 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

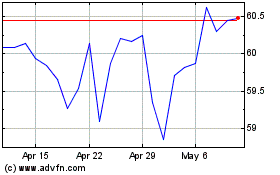

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

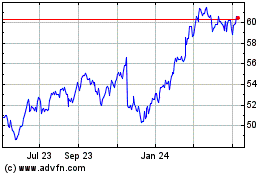

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024