- Current report filing (8-K)

October 31 2008 - 8:33AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): October 30, 2008 (October 31, 2008)

Brown-Forman Corporation

(Exact name of registrant as specified in its charter)

Delaware 002-26821 61-0143150

(State or other (Commission (I.R.S. Employer

jurisdiction of File Number) Identification No.)

incorporation)

|

850 Dixie Highway, Louisville, Kentucky 40210

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code (502) 585-1100

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

On October 30, 2008, Brown-Forman Corporation issued a press release, a copy of

which is furnished herewith as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

99.1 Press Release, dated October 30, 2008.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Brown-Forman Corporation

(Registrant)

Date: October 31, 2008 By: /s/ Nelea A. Absher

Nelea A. Absher

Vice President, Associate

General Counsel and Assistant

Corporate Secretary

|

Exhibit Index

Exhibit

Number Description

99.1 Press Release, dated October 30, 2008, issued by Brown-Forman

Corporation.

|

FOR IMMEDIATE RELEASE

BROWN-FORMAN COMPLETES STOCK DISTRIBUTION

Louisville, KY, October 30, 2008 (NYSE: BFA & BFB) - On October 27, 2008

Brown-Forman completed its stock distribution of one share of Class B common

stock for every four shares of either Class A or Class B common stock held, with

fractional shares paid in cash. The distribution was previously announced on

September 29, 2008. Upon completion of the distribution, outstanding shares of

Class A totaled 56,609,413 and outstanding Class B shares totaled 94,278,363.

Brown-Forman Class A and Class B shares began trading on the NYSE on a

price-adjusted basis on October 28, 2008. As of the close of the NYSE today, the

Company's total market capitalization was approximately $6.9 billion on an

aggregate of 150,887,776 shares outstanding.

According to Brown-Forman's corporate charter, each share of Class A common

stock and Class B common stock is entitled to the same rights as every other

share of common stock in distributions of earnings, including cash dividends.

Accordingly, any future cash dividends declared will reflect the greater number

of total shares outstanding after the stock distribution. In addition, all

per-share amounts in the company's subsequent financial statements will reflect

the stock distribution. For example, for the three months ended July 31, 2008,

with an additional 25% more common shares outstanding, earnings per share for

that quarter on each class of stock will be adjusted from $0.73 to approximately

$0.58 and cash dividends per share will be adjusted from $0.34 to approximately

$0.27.

Brown-Forman Corporation is a producer and marketer of fine quality beverage

alcohol brands, including Jack Daniel's, Southern Comfort, Finlandia Vodka,

Tequila Herradura, el Jimador Tequila, Canadian Mist, Fetzer and Bolla Wines,

and Korbel California Champagnes.

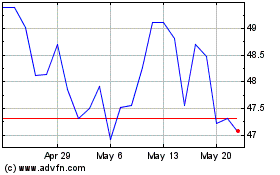

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jul 2023 to Jul 2024