RioCan Real Estate Investment Announces Results of Voting at its Annual Meeting of Unitholders

June 04 2024 - 4:00PM

Business Wire

RioCan Real Estate Investment Trust (“RioCan” or the “Trust”)

(TSX: REI.UN) today announced the results of the votes held at its

June 4, 2024 annual meeting of unitholders (the “Meeting”).

The total number of units represented by unitholders present in

person or by proxy at the Meeting was 170,542,246, representing

56.85% of RioCan’s 299,961,688 outstanding units entitled to be

voted.

Each of the nominee Trustees listed in the Trust's Management

Information Circular dated April 19, 2024 was elected as a Trustee.

RioCan received proxies with regard to voting on the eleven

Trustees nominated for election, as set forth in the table

below:

Name of Nominee

Votes For

%

Votes Withheld

%

Bonnie Brooks, C.M.

167,112,377

98.45%

2,626,010

1.55%

Richard Dansereau

168,515,497

99.28%

1,223,474

0.72%

Janice Fukakusa, C.M.

163,691,024

96.44%

6,047,947

3.56%

Jonathan Gitlin

168,223,598

99.11%

1,515,373

0.89%

Marie-Josée Lamothe

167,743,977

98.83%

1,994,410

1.17%

Dale H. Lastman, C.M., O.Ont.

166,281,009

97.96%

3,457,962

2.04%

Jane Marshall

158,927,613

93.63%

10,810,774

6.37%

Guy Metcalfe

168,966,898

99.55%

772,073

0.45%

Edward Sonshine, O.Ont., K.C.

160,415,285

94.53%

9,282,276

5.47%

Siim A. Vanaselja

161,836,883

95.34%

7,901,504

4.66%

Charles M. Winograd

164,094,066

96.67%

5,644,904

3.33%

Appointment of Auditors

Ernst & Young LLP was reappointed as the auditor of the

Trust until the next annual meeting of unitholders by resolution

passed by a majority of the unitholders. Management received

proxies to vote for the appointment of the auditor (and to

authorize the Trustees to fix their remuneration) as follows:

Votes For

%

Votes Withheld

%

168,880,079

99.03%

1,662,167

0.97%

Say-On-Pay Non-Binding Advisory

Vote

The non-binding say-on-pay vote on the Trust’s approach to

executive compensation was passed as follows:

Votes For

%

Votes Against

%

153,246,145

90.28%

16,492,824

9.72%

About RioCan RioCan is one of Canada’s largest real

estate investment trusts. RioCan owns, manages and develops

retail-focused, increasingly mixed-use properties located in prime,

high-density transit-oriented areas where Canadians want to shop,

live and work. As at March 31, 2024, our portfolio is comprised of

188 properties with an aggregate net leasable area of approximately

32.6 million square feet (at RioCan's interest) including office,

residential rental and nine development properties. To learn more

about us, please visit www.riocan.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240604442950/en/

RioCan Kim Lee Vice President, Investor Relations (416)

646-8326

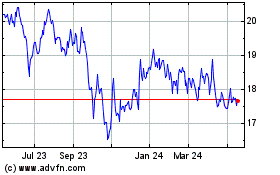

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

From May 2024 to Jun 2024

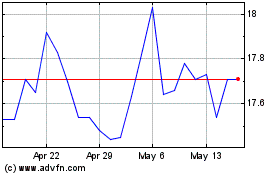

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

From Jun 2023 to Jun 2024