Glencore Raises Offer for Rio Tinto's Australian Coal Assets -- Update

June 23 2017 - 10:17AM

Dow Jones News

By Tapan Panchal

LONDON-- Glencore PLC said Friday it has submitted a sweetened

all-cash offer of $2.68 billion for Rio Tinto PLC's Australian coal

assets, days after its previous attempt to scotch an acquisition

from a Chinese suitor was rejected.

The Anglo-Swiss mining-and-commodities trading giant said its

bid for Coal & Allied Industries Ltd., which includes a coal

price-linked royalty, is fully funded and is at least $225 million

greater than an offer made by Yancoal Australia Ltd., a subsidiary

of China's Yanzhou Coal Mining Co.

Anglo-Australian mining company Rio Tinto on Tuesday rebuffed a

$2.5 billion offer Glencore made earlier this month, and

recommended that shareholders approve Yancoal's $2.45 billion bid,

in part because it expects to complete the deal faster than one

with Glencore.

Glencore also offered Rio Tinto a $225 million deposit to be

forfeited if the transaction were unable to obtain regulatory

approval.

Friday's raised offer from Glencore further demonstrates the

renewed appetite for deal-making by Chief Executive Ivan Glasenberg

almost two years after the Switzerland-based commodity giant

experienced a downward spiral in share price.

Since the company's stock recovered, Mr. Glasenberg has

engineered the purchase of a stake in Russian state oil company PAO

Rosneft, taken full control of a Congolese mine and made an offer

to take over agricultural trader Bunge Ltd.

Mr. Glasenberg has long coveted Rio Tinto's coal assets because

they sit near some of Glencore's Australian coal operations,

offering opportunities for cost savings were they to merge.

"The probability of Glencore gaining these assets has increased

in our view," RBC Capital Markets said in a note on Friday.

Rio Tinto is trying to shed much of its coal operations,

especially thermal coal, the type burned to make electricity.

The price of thermal coal shot up in 2016 as demand from China

heated up. The market has cooled this year, and analysts expect

prices to remain subdued as countries switch to cleaner-burning

fuels.

Glencore, the world's biggest trader of thermal coal, expects

demand for the fossil fuel to remain solid, since it is one of the

cheapest fuels for electricity generation.

Shares of Glencore were down 0.4% in Friday afternoon trading,

while Rio shares were up 1.2%.

Write to Tapan Panchal at Tapan.Panchal@wsj.com

(END) Dow Jones Newswires

June 23, 2017 11:02 ET (15:02 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

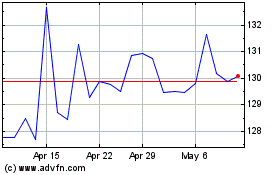

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024