| have vested, such plan being described below under “Benefit Plans.” The amount for 2023 for P. Brown was $187,200. |

Also included in All Other Compensation are Seaboard’s contributions to its 401(k) Retirement Savings Plan on behalf of the Named Executive Officers, amounts paid for disability and life insurance and individual perquisites, including amounts paid as an automobile allowance (valuing this benefit on an average fair market value based on the IRS lease guidelines using the manufacturer’s suggested retail price less 8 percent), fuel card usage, personal usage of Seaboard’s airplane (valuing this benefit based on the number of miles flown and the Standard Industry Fare Level published by the Department of Transportation), and a gross-up for related taxes. With respect to the above-stated items, All Other Compensation includes the following amounts for 2023: (a) an automobile allowance of $30,000 for each of the Named Executive Officers; (b) an airplane benefit of $26,644 for R. Steer; and (c) an airplane benefit of $27,617 for E. Gonzalez. Reimbursement for taxes owed on the above-stated items total as follows for each of the Named Executive Officers for 2023: R. Steer, $37,580; D. Rankin, $21,341; E. Gonzalez, $33,734; P. Brown, $24,828; and J. Bresky, $14,508.

| (5) | J. Bresky was appointed to President of Seaboard Overseas and Trading Group on January 9, 2023. |

PAY RATIO

Pursuant to a mandate of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), set forth below for 2023 is a comparison of (i) the total compensation of R. Steer, Seaboard’s Chief Executive Officer (“CEO”); and (ii) the median of the annual total compensation of all employees of Seaboard and its consolidated subsidiaries (other than R. Steer). The median of the annual total compensation and the pay ratio described below are reasonable estimates calculated by Seaboard in a manner consistent with applicable SEC regulations.

In 2023, the annual total compensation of R. Steer was $5,678,799 and the median of the annual total compensation of all employees of Seaboard and its consolidated subsidiaries (other than R. Steer) was $45,793, and thus the ratio of the annual total compensation of R. Steer to the median of the annual total compensation of all of Seaboard’s employees was 124 to 1. Seaboard’s “median employee” worked in Seaboard’s live hog operations in Iowa.

To determine the median of the annual total compensation of all of Seaboard’s employees, as well as to determine the annual total compensation of Seaboard’s “median employee” and Seaboard’s Chief Executive Officer, Seaboard used the following methodology and made the following material assumptions, adjustments and estimates:

1.In 2023, Seaboard selected October 1, 2023, which is within the last three months of 2023, as the date upon which it would identify the “median employee” to allow sufficient time to identify the median employee given the global scope of its operations. To identify the “median employee,” Seaboard included all worldwide employees as of October 1, 2023, whether employed on a full-time, part-time or seasonal basis.

2.Seaboard determined that gross wages of such employees for the month of August 2023 was a reasonable compensation measure to determine the median employee, given (i) Seaboard’s large, international workforce; (ii) the diversity of countries and compensation structures in which Seaboard operates; and (iii) the high employee turnover in some of Seaboard’s operations. Seaboard believes that the use of this partial year period is appropriate as it confirmed that the period is reflective of the annual total compensation of all of its employees and would not significantly impact the identity of the median employee.

3.With respect to employees hired in the months of August and September 2023, and thus not having a full month of wages, Seaboard estimated their wages by (x) grossing up actual partial gross wages to reflect an entire month’s worth of wages based upon each employee’s status as full-time, part-time or seasonal employee; or (y) using the average wages received by employees performing a similar function (and in the same status, i.e., full-time, part-time or seasonal) at the same location during the month. All wages were converted into U.S. dollar equivalents using the respective exchange rates as of August 31, 2023. Seaboard did not make any cost-of-living adjustments in identifying the median employee.

4.Once Seaboard identified its median employee, Seaboard included the elements of such employee’s compensation for 2023 determined in accordance with the requirements of Item 402(c)(2)(x) of Regulation S-K. With respect to the annual total compensation of the CEO, Seaboard used the amount reported in the “Total” column of its 2023 Summary Compensation Table in this proxy statement, which likewise was calculated in accordance with those same requirements.

Bonuses. The Board of Directors established the 2023 bonuses for the Named Executive Officers based upon the recommendations of Seaboard’s Chairwoman of the Board and President and based upon a subjective determination, primarily considering:

| ● | Individual review of the executive’s compensation, both individually and relative to other officers; |

| ● | Individual performance of the executive; and |

| ● | Seaboard’s review of its general financial and operational performance. |

Retirement and Other Benefits. Each of the Named Executive Officers (other than P. Brown and J. Bresky) is, or previously was, a participant in the Executive Retirement Plan or the Cash Balance Retirement Plan. The benefit under these plans is generally equal to 2.5 percent of the final average remuneration (salary plus bonus) of the participant, multiplied by the participant’s years of service in the plan after January 1, 1997, subject to a limitation in the number of years of service and final average remuneration. The exact amount of the benefits, the offsets thereto and the benefit for years of service prior to January 1, 1997 are set forth in more detail on page 14 of this proxy statement.

Seaboard also maintains a tax-qualified retirement savings plan, to which all U.S.-based employees, including the Named Executive Officers, are able to contribute their annual compensation, up to the limit prescribed by the Internal Revenue Service. For 2023, Seaboard matched 100 percent of the first 3 percent of compensation contributed to the plan and 50 percent of the next 2 percent of compensation contributed to the plan. Beginning in 2022, all matching contributions vest after one year of service.

The Named Executive Officers (other than E. Gonzalez), in addition to certain other employees, are entitled to participate in the Post-2018 Deferred Compensation Plan, which gives participants the right to defer salary and bonus to be paid by Seaboard at a later time, all in accordance with applicable ERISA and income tax laws and regulations. In addition, Seaboard has the option to defer pursuant to this plan a portion of the bonus of a Named Executive Officer.

Seaboard’s LTI Plan provides retirement benefits for a select group of officers and managers, including certain Named Executive Officers (P. Brown and J. Bresky). Pursuant to the LTI Plan, participants may receive an award, at the discretion of Seaboard, which will vest on the schedule set out in such plan.

Seaboard also maintains for each of the Named Executive Officers (other than P. Brown) and certain other executives the Seaboard Corporation Retiree Medical Benefit Plan, which provides family medical insurance to each participant upon retirement: (i) in the event the participant has attained age 50, and has at least 15 years of service; or (ii) in the event the participant’s employment is involuntarily terminated (other than if the participant unlawfully converted a material amount of funds); or (iii) in the event of a change of control of Seaboard.

The Board believes that Seaboard’s retirement and other benefits are consistent with the philosophy of Seaboard to provide security and stability of employment to the Named Executive Officers as a mechanism to attract and retain these employees.

Perquisites and Other Personal Benefits. Seaboard provides the Named Executive Officers with perquisites and other benefits that the Board believes are reasonable and consistent with its overall compensation program to better enable Seaboard to attract and retain superior employees for key positions. These include an automobile allowance, fuel card usage, life insurance, disability insurance, personal use of Seaboard’s airplane up to a specified number of hours, and paid time off.

Tax Deductibility of Executive Compensation

Due to the enactment of the Tax Cuts and Jobs Act of 2017, any compensation Seaboard pays to the Named Executive Officers in excess of $1,000,000 will not be deductible for income tax purposes unless it qualifies for transitional relief applicable to certain binding, written compensation arrangements that were in place as of November 2, 2017. Seaboard may in certain instances elect to defer compensation of the Named Executive Officers pursuant to the Post-2018 Deferred Compensation Plan or LTI Plan. To the extent Seaboard does not elect the deferral and compensation to any Named Executive Officer is in excess of $1,000,000, Seaboard may lose the deduction.

Pay vs Performance Disclosure - USD ($)

|

7 Months Ended |

12 Months Ended |

41 Months Ended |

Jul. 19, 2020 |

Dec. 31, 2023 |

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

Dec. 31, 2023 |

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

|

| | | | | | | | | | | | | | | | | | | | | | | | | Summary | Summary | | | Average | | Value of Initial Fixed $100 | | | | | Compensation | Compensation | | | Summary | Average | Investment Based On: | | | | | Table | Table | Compensation | Compensation | Compensation | Compensation | | Peer | | | | | Total | Total | Actually | Actually | Table Total | Actually | | Group | | | | | for | for | Paid to | Paid to | for | Paid to | Total | Total | Net | Operating | | | First | Second | First | Second | Non-PEO | Non-PEO | Shareholder | Shareholder | Income | Income | | Year | PEO | PEO | PEO | PEO | NEOs | NEOs | Return | Return | (Millions) | (Millions) | | (a) | (b)(1) | (b)(2) | (c)(3) | (c)(4) | (d)(5) | (e)(6) | (f)(7) | (g)(8) | (h)(9) | (i)(10) | | | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | | | | | | | | | | | | | | 2023 | 5,678,799 | N/A | 4,082,621 | N/A | 1,810,735 | 1,849,106 | 84.84 | 122.32 | 227 | (87) | | 2022 | 5,375,311 | N/A | 4,366,995 | N/A | 1,854,999 | 1,938,756 | 89.49 | 132.83 | 582 | 657 | | 2021 | 5,653,886 | N/A | 4,243,843 | N/A | 2,284,297 | 1,785,252 | 93.07 | 119.61 | 571 | 458 | | 2020 | 4,104,135 | 3,234,300 | 2,939,282 | 1,548,910 | 2,984,015 | 1,995,859 | 71.51 | 103.50 | 283 | 245 | |

| (1) | R. Steer was appointed to President and Chief Executive Officer on July 20, 2020. The dollar amounts reported in column (b) with respect to the First PEO are the amounts of total compensation reported for R. Steer (our current President and Chief Executive Officer) for each corresponding year in the “Total” column of the Summary Compensation Table. Refer to “Executive Compensation and Other Information – Summary Compensation Table.” |

| (2) | The dollar amount reported in column (b) with respect to the Second PEO is the amount of total compensation reported for Steven J. Bresky (our former President and Chief Executive Officer) for the corresponding year in the “Total” column of the Summary Compensation Table. S. Bresky passed away in July 2020 and his annual salary and bonus for 2020 were prorated for his tenure as President and Chief Executive Officer in 2020. |

| (3) | The dollar amounts reported in column (c) with respect to the First PEO represent the amount of “compensation actually paid” to R. Steer, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to R. Steer during the applicable years. The pension benefit adjustments only include average service cost. There was no prior service cost. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to R. Steer’s total compensation for each year to determine the compensation actually paid: |

| | | | | | | | | | | | | | | Year | Reported Summary Compensation Table Total for First PEO | Reported Change in Pension Value and Non-Qualified Deferred Compensation Earnings | Pension Benefit Adjustments | Compensation Actually Paid to First PEO | | $ | $ | $ | $ | 2023 | 5,678,799 | (1,625,253) | 29,075 | 4,082,621 | 2022 | 5,375,311 | (1,045,695) | 37,379 | 4,366,995 | 2021 | 5,653,886 | (1,447,513) | 37,470 | 4,243,843 | 2020 | 4,104,135 | (1,199,183) | 34,330 | 2,939,282 |

| (4) | The dollar amount reported in column (c) with respect to the Second PEO represent the amount of “compensation actually paid” to S. Bresky, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to S. Bresky during the applicable year. The pension benefit adjustments only include average service cost. There was no prior service cost. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to S. Bresky’s total compensation for 2020 to determine the compensation actually paid: |

| | | | | | | | | | | Year | Reported Summary Compensation Table Total for Second PEO | Reported Change in Pension Value and Non-Qualified Deferred Compensation Earnings | Pension Benefit Adjustments | Compensation Actually Paid to Second PEO | | $ | $ | $ | $ | 2020 | 3,234,300 | (1,711,634) | 26,244 | 1,548,910 |

| (5) | The dollar amounts reported in column (d) represent the average of the amounts reported for the Company’s Named Executive Officers as a group (excluding R. Steer and S. Bresky, who each served as President and Chief Executive Officer during the periods stated above) in the “Total” column of the Summary Compensation Table in each applicable year. The names of the Named Executive Officers (excluding R. Steer and S. Bresky) included for purposes of calculating the average amounts in each applicable year are as follows: (i) for 2023, D. Rankin, E. Gonzalez, P. Brown, and J. Bresky; (ii) for 2022, D. Rankin, E. Gonzalez, David M. Dannov (former President and Chief Executive Officer of Seaboard Overseas and Trading Group) and P. Brown; (iii) for 2021, D. Rankin, E. Gonzalez, D. Dannov (former President and Chief Executive Officer of Seaboard Overseas and Trading Group) and P. Brown and (iv) for 2020, D. Rankin, E. Gonzalez, D. Dannov (former President and Chief Executive Officer of Seaboard Overseas and Trading Group) and Darwin E. Sand (former President and Chief Executive Officer of Seaboard Foods). |

| (6) | The dollar amounts reported in column (e) represent the average amount of “compensation actually paid” to the Company’s Named Executive Officers as a group (excluding R. Steer and S. Bresky), as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not represent the actual average amount of compensation earned or paid to the Named Executive Officers as a group (excluding R. Steer and S. Bresky) during the applicable years. The pension benefit adjustments only include average service cost. There was no prior service cost. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to average total compensation for the Named Executive Officers as a group (excluding R. Steer and S. Bresky) for each year to determine the compensation actually paid, using the same methodology described in Notes 3 and 4 above. |

| | | | | | | | | | | Year | Average Reported Summary Compensation Table Total for Non-PEO NEOs | Average Reported Change in Pension Value and Non-Qualified Deferred Compensation Earnings | Average Pension Benefit Adjustments | Average Compensation Actually Paid to Non-PEO NEOs | | $ | $ | $ | $ | 2023 | 1,810,735 | (35,184) | 73,555 | 1,849,106 | 2022 | 1,854,999 | (44,126) | 127,883 | 1,938,756 | 2021 | 2,284,297 | (608,999) | 109,954 | 1,785,252 | 2020 | 2,984,015 | (1,150,234) | 162,078 | 1,995,859 |

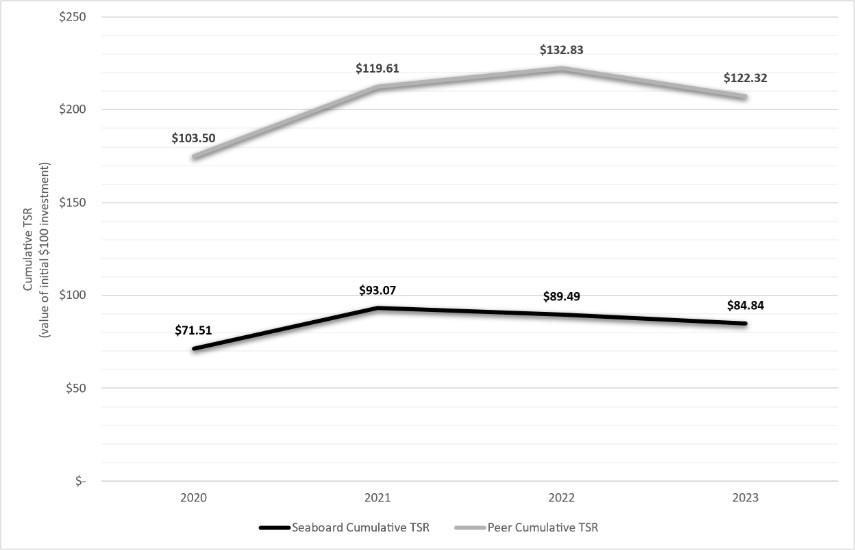

| (7) | The cumulative total shareholder return (“TSR”) values set forth in column (f) are calculated by dividing the sum of the cumulative amount of dividends for the measurement period and the difference between the Company’s share price at the end and the beginning of the measurement period by the Company’s share price at the beginning of the measurement period. |

| (8) | The values set forth in column (g) represent the weighted peer group TSR, weighted according to the respective companies’ stock market capitalization at the beginning of each period for which a return is indicated. The peer group used for this purpose is the following published industry indices: the Dow Jones U.S. Food Products and Dow Jones U.S. Marine Transportation Industry. |

| (9) | The dollar amounts reported in column (h) represent the amount of net income reflected in the Company’s audited financial statements for the applicable years. |

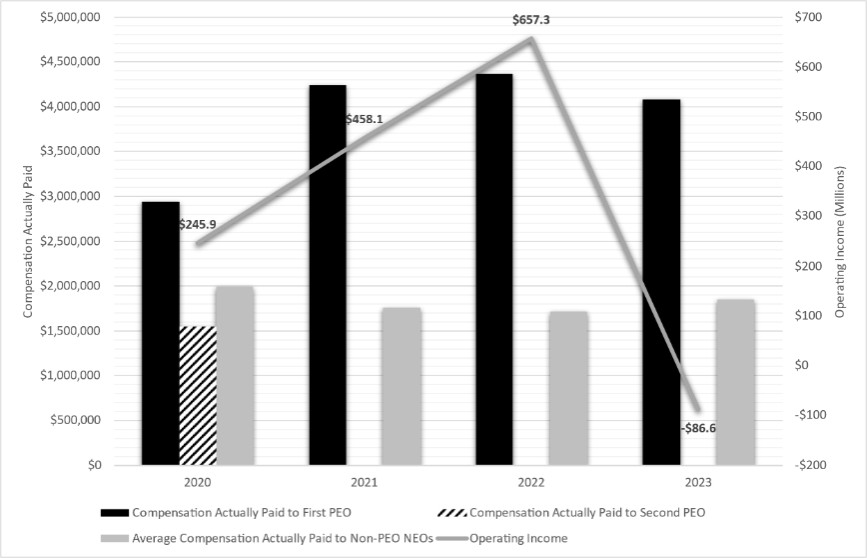

| (10) | The Company has determined that Operating Income is the financial performance measure that, in the Company’s assessment, represents the most important performance measure (that is not otherwise required to be disclosed in the table) used by the Company to link compensation actually paid to the Company’s Named Executive Officers, for the most recently completed fiscal year, to Company performance. The dollar amounts reported in column (i) represent the amount of operating income reflected in the Company’s audited financial statements for the applicable years. |

|

|

|

|

|

| Company Selected Measure Name |

|

Operating Income

|

|

|

|

|

| Named Executive Officers, Footnote |

| (2) | The dollar amount reported in column (b) with respect to the Second PEO is the amount of total compensation reported for Steven J. Bresky (our former President and Chief Executive Officer) for the corresponding year in the “Total” column of the Summary Compensation Table. S. Bresky passed away in July 2020 and his annual salary and bonus for 2020 were prorated for his tenure as President and Chief Executive Officer in 2020. |

|

| | | | | | | | | | | Year | Reported Summary Compensation Table Total for Second PEO | Reported Change in Pension Value and Non-Qualified Deferred Compensation Earnings | Pension Benefit Adjustments | Compensation Actually Paid to Second PEO | | $ | $ | $ | $ | 2020 | 3,234,300 | (1,711,634) | 26,244 | 1,548,910 |

|

|

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | Summary | Summary | | | Average | | Value of Initial Fixed $100 | | | | | Compensation | Compensation | | | Summary | Average | Investment Based On: | | | | | Table | Table | Compensation | Compensation | Compensation | Compensation | | Peer | | | | | Total | Total | Actually | Actually | Table Total | Actually | | Group | | | | | for | for | Paid to | Paid to | for | Paid to | Total | Total | Net | Operating | | | First | Second | First | Second | Non-PEO | Non-PEO | Shareholder | Shareholder | Income | Income | | Year | PEO | PEO | PEO | PEO | NEOs | NEOs | Return | Return | (Millions) | (Millions) | | (a) | (b)(1) | (b)(2) | (c)(3) | (c)(4) | (d)(5) | (e)(6) | (f)(7) | (g)(8) | (h)(9) | (i)(10) | | | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | | | | | | | | | | | | | | 2023 | 5,678,799 | N/A | 4,082,621 | N/A | 1,810,735 | 1,849,106 | 84.84 | 122.32 | 227 | (87) | | 2022 | 5,375,311 | N/A | 4,366,995 | N/A | 1,854,999 | 1,938,756 | 89.49 | 132.83 | 582 | 657 | | 2021 | 5,653,886 | N/A | 4,243,843 | N/A | 2,284,297 | 1,785,252 | 93.07 | 119.61 | 571 | 458 | | 2020 | 4,104,135 | 3,234,300 | 2,939,282 | 1,548,910 | 2,984,015 | 1,995,859 | 71.51 | 103.50 | 283 | 245 | |

| (1) | R. Steer was appointed to President and Chief Executive Officer on July 20, 2020. The dollar amounts reported in column (b) with respect to the First PEO are the amounts of total compensation reported for R. Steer (our current President and Chief Executive Officer) for each corresponding year in the “Total” column of the Summary Compensation Table. Refer to “Executive Compensation and Other Information – Summary Compensation Table.” |

|

| Peer Group Issuers, Footnote |

|

| (8) | The values set forth in column (g) represent the weighted peer group TSR, weighted according to the respective companies’ stock market capitalization at the beginning of each period for which a return is indicated. The peer group used for this purpose is the following published industry indices: the Dow Jones U.S. Food Products and Dow Jones U.S. Marine Transportation Industry. |

|

|

|

|

|

| Adjustment To PEO Compensation, Footnote |

| (4) | The dollar amount reported in column (c) with respect to the Second PEO represent the amount of “compensation actually paid” to S. Bresky, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to S. Bresky during the applicable year. The pension benefit adjustments only include average service cost. There was no prior service cost. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to S. Bresky’s total compensation for 2020 to determine the compensation actually paid: |

| | | | | | | | | | | Year | Reported Summary Compensation Table Total for Second PEO | Reported Change in Pension Value and Non-Qualified Deferred Compensation Earnings | Pension Benefit Adjustments | Compensation Actually Paid to Second PEO | | $ | $ | $ | $ | 2020 | 3,234,300 | (1,711,634) | 26,244 | 1,548,910 |

|

|

|

|

|

| (3) | The dollar amounts reported in column (c) with respect to the First PEO represent the amount of “compensation actually paid” to R. Steer, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to R. Steer during the applicable years. The pension benefit adjustments only include average service cost. There was no prior service cost. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to R. Steer’s total compensation for each year to determine the compensation actually paid: |

| | | | | | | | | | | | | | | Year | Reported Summary Compensation Table Total for First PEO | Reported Change in Pension Value and Non-Qualified Deferred Compensation Earnings | Pension Benefit Adjustments | Compensation Actually Paid to First PEO | | $ | $ | $ | $ | 2023 | 5,678,799 | (1,625,253) | 29,075 | 4,082,621 | 2022 | 5,375,311 | (1,045,695) | 37,379 | 4,366,995 | 2021 | 5,653,886 | (1,447,513) | 37,470 | 4,243,843 | 2020 | 4,104,135 | (1,199,183) | 34,330 | 2,939,282 |

|

| Non-PEO NEO Average Total Compensation Amount |

|

$ 1,810,735

|

$ 1,854,999

|

$ 2,284,297

|

$ 2,984,015

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

|

$ 1,849,106

|

1,938,756

|

1,785,252

|

1,995,859

|

|

| Adjustment to Non-PEO NEO Compensation Footnote |

|

| (6) | The dollar amounts reported in column (e) represent the average amount of “compensation actually paid” to the Company’s Named Executive Officers as a group (excluding R. Steer and S. Bresky), as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not represent the actual average amount of compensation earned or paid to the Named Executive Officers as a group (excluding R. Steer and S. Bresky) during the applicable years. The pension benefit adjustments only include average service cost. There was no prior service cost. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to average total compensation for the Named Executive Officers as a group (excluding R. Steer and S. Bresky) for each year to determine the compensation actually paid, using the same methodology described in Notes 3 and 4 above. |

| | | | | | | | | | | Year | Average Reported Summary Compensation Table Total for Non-PEO NEOs | Average Reported Change in Pension Value and Non-Qualified Deferred Compensation Earnings | Average Pension Benefit Adjustments | Average Compensation Actually Paid to Non-PEO NEOs | | $ | $ | $ | $ | 2023 | 1,810,735 | (35,184) | 73,555 | 1,849,106 | 2022 | 1,854,999 | (44,126) | 127,883 | 1,938,756 | 2021 | 2,284,297 | (608,999) | 109,954 | 1,785,252 | 2020 | 2,984,015 | (1,150,234) | 162,078 | 1,995,859 |

|

|

|

|

|

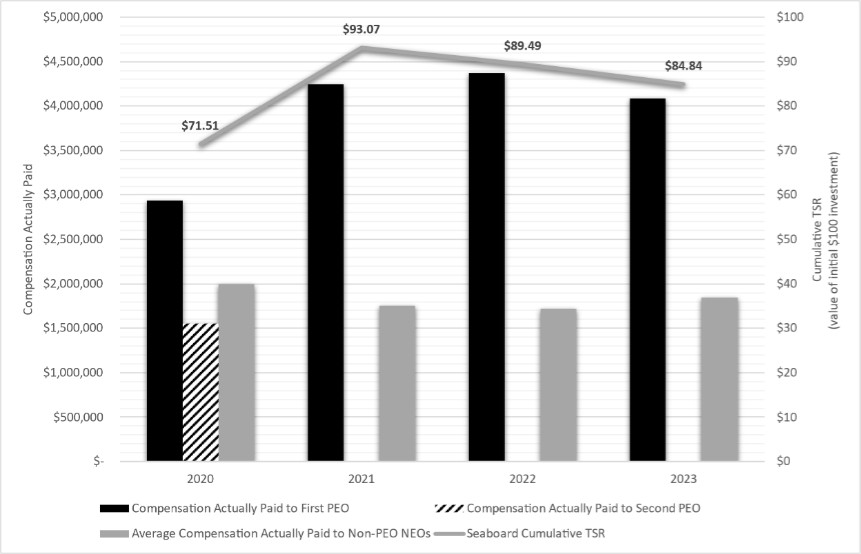

| Compensation Actually Paid vs. Total Shareholder Return |

|

Compensation Actually Paid and Cumulative TSR:

|

|

|

|

|

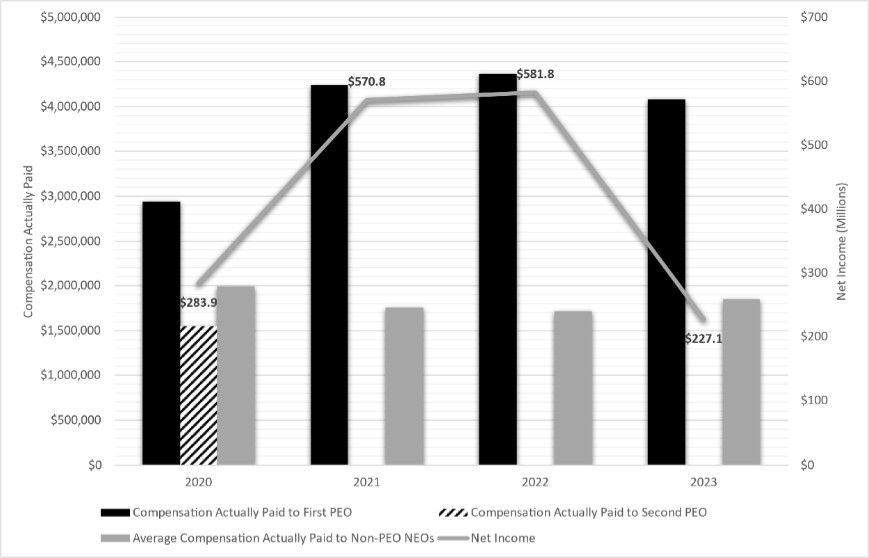

| Compensation Actually Paid vs. Net Income |

|

Compensation Actually Paid and Net Income:

|

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

|

Compensation Actually Paid and Operating Income:

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

|

Company TSR and Peer Group TSR:

|

|

|

|

|

| Total Shareholder Return Amount |

|

$ 84.84

|

89.49

|

93.07

|

71.51

|

|

| Peer Group Total Shareholder Return Amount |

|

122.32

|

132.83

|

119.61

|

103.50

|

|

| Net Income (Loss) |

|

$ 227,000,000

|

$ 582,000,000

|

$ 571,000,000

|

$ 283,000,000

|

|

| Company Selected Measure Amount |

|

(87,000,000)

|

657,000,000

|

458,000,000

|

245,000,000

|

|

| Measure:: 1 |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Name |

|

Operating Income

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Non-GAAP Measure Description |

|

| | | | | | | | | | | Year | Average Reported Summary Compensation Table Total for Non-PEO NEOs | Average Reported Change in Pension Value and Non-Qualified Deferred Compensation Earnings | Average Pension Benefit Adjustments | Average Compensation Actually Paid to Non-PEO NEOs | | $ | $ | $ | $ | 2023 | 1,810,735 | (35,184) | 73,555 | 1,849,106 | 2022 | 1,854,999 | (44,126) | 127,883 | 1,938,756 | 2021 | 2,284,297 | (608,999) | 109,954 | 1,785,252 | 2020 | 2,984,015 | (1,150,234) | 162,078 | 1,995,859 |

|

|

|

|

|

| First PEO |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| PEO Total Compensation Amount |

|

$ 5,678,799

|

$ 5,375,311

|

$ 5,653,886

|

$ 4,104,135

|

|

| PEO Actually Paid Compensation Amount |

|

$ 4,082,621

|

4,366,995

|

4,243,843

|

2,939,282

|

|

| PEO Name |

|

R. Steer

|

|

|

|

|

| First PEO | Reported Change in Pension Value and Non-Qualified Deferred Compensation Earnings |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

$ (1,625,253)

|

(1,045,695)

|

(1,447,513)

|

(1,199,183)

|

|

| First PEO | Pension Benefit Adjustments |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

29,075

|

37,379

|

37,470

|

34,330

|

|

| Second PEO |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| PEO Total Compensation Amount |

|

|

|

|

3,234,300

|

|

| PEO Actually Paid Compensation Amount |

|

|

|

|

1,548,910

|

|

| Second PEO | Reported Change in Pension Value and Non-Qualified Deferred Compensation Earnings |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

(1,711,634)

|

|

| Second PEO | Pension Benefit Adjustments |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

26,244

|

|

| Non-PEO NEO | Reported Change in Pension Value and Non-Qualified Deferred Compensation Earnings |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

(35,184)

|

(44,126)

|

(608,999)

|

(1,150,234)

|

|

| Non-PEO NEO | Pension Benefit Adjustments |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

$ 73,555

|

$ 127,883

|

$ 109,954

|

$ 162,078

|

|