ADA Slips Below $0.3389 Level, Deeper Downtrend Looming?

November 04 2024 - 7:30AM

NEWSBTC

Cardano (ADA) has once more dropped below the crucial $0.3389

support level, sparking fears of an extended bearish phase. This

level has previously held strong as a line of defense for ADA, but

its recent breach suggests that sellers may be gaining the upper

hand. With ADA navigating lower levels, investors are left

questioning whether this slip could open the door to a deeper

downtrend. As bears tighten their grip, this article aims to

analyze the recent decline of ADA below the critical $0.3389

support level and evaluate the likelihood of a deeper downtrend

unfolding. By exploring technical signals and market dynamics, this

piece will provide readers with a clear understanding of ADA’s

current position, potential risks, and paths forward in the face of

mounting bearish pressure. Technical Analysis: Is ADA Set For

Further Slide? On the 4-hour chart, ADA has recently broken below

the $0.3389 mark, with its price now exhibiting strong bearish

momentum as it trades beneath the 100-day Simple Moving Average

(SMA). This positioning under the SMA is a key indicator of a

possible prolonged downside move, suggesting that sellers are

currently in control. If selling pressure persists, the $0.2388

level will become an important area to monitor. Also, the 4-hour

Composite Trend Oscillator for ADA is displaying negative signals,

as both the SMA line and the signal line have dropped below the

zero level and are nearing the oversold zone. Typically, this

movement indicates that selling pressure is intensifying, showing

that sellers are becoming increasingly dominant in the market.

Related Reading: Cardano (ADA) Eyes a Potential Recovery: Can It

Bounce Back? On the daily chart, Cardano is exhibiting pronounced

downward strength, highlighted by a bearish candlestick pattern

that signifies increased selling pressure below the $0.3389 mark.

This pattern indicates that sellers are firmly in control of the

market, relentlessly driving the price lower, prompting a strong

likelihood of further losses in the near term. An in-depth

examination of the 1-day Composite Trend Oscillator reveals that

Cardano is likely poised for prolonged losses. Following its

failure to break above the SMA line, the signal line is descending

and moving into the oversold zone, indicating a significant

negative shift in momentum. If this downward trend continues,

Cardano may face considerable challenges in staging a recovery,

which could lead to an extended period of sluggish price movement.

Key Levels To Watch In The Coming Days As Cardano faces a

challenging market landscape, investors must monitor several key

levels in the coming days. Attention should be directed toward the

support level at $0.2388, which may provide crucial protection

against additional downturns. Should ADA sustain its position above

this threshold, it could pave the way for a potential recovery,

aiming for the $0.3389 level and even higher. Related Reading:

Bullish Analyst Sees Cardano (ADA) Rising 13% As Key Indicator

Signals Buy Conversely, if ADA falls below the $0.2388 support

level, it may indicate a deeper bearish trend, leading to possible

declines toward other support levels and triggering heightened

selling pressure. Featured image from Unsplash, chart from

Tradingview.com

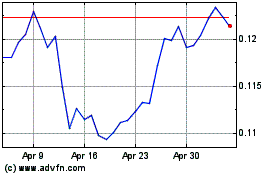

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024