Filed Pursuant to Rule 424(b)(3)

Registration No. 333-276631

PROSPECTUS SUPPLEMENT NO. 3

(TO PROSPECTUS DATED FEBRUARY 12, 2024)

158,227 Units

(Each Unit Consisting of One Share of Common Stock and

One Warrant Initially Exercisable for One Share of Common Stock)

867,373 Pre-Funded Units

(Each Pre-Funded Unit Consisting of One Pre-Funded Warrant Exercisable for One Share of Common Stock and One Warrant Initially Exercisable

for One Share of Common Stock)

5,463,665 Shares of Common Stock Underlying

the Warrants

867,373 Shares of Common Stock Underlying the

Pre-Funded Warrants

WiSA Technologies, Inc.

This prospectus supplement updates and supplements

the prospectus dated February 12, 2024 (as supplemented or amended from time to time, the “Prospectus”), which forms a part

of our Registration Statement on Form S-1, as amended (Registration No. 333-276631). This prospectus supplement is being filed to update

and supplement the information in the Prospectus with the information contained in the attached Quarter Report on Form 10-Q, filed with

the U.S. Securities and Exchange Commission on May 20, 2024.

On April 4, 2024, our board of directors

approved a 1-for-150 reverse stock split (the “Reverse Stock Split”) of our outstanding shares of common stock and authorized

the filing of a certificate of amendment (the “Certificate of Amendment”) to our certificate of incorporation, as amended,

with the Secretary of State of the State of Delaware, to effect the Reverse Stock Split. On April 12, 2024, we filed the Certificate

of Amendment to effect the Reverse Stock Split as of 5:00 p.m. Eastern Time on April 12, 2024. Unless the context expressly

dictates otherwise, all references to share and per share amounts referred to in this prospectus supplement give effect to the Reverse

Stock Split.

The Prospectus and this prospectus supplement

relate to the offer and sale by us of 158,227 units (the “Units”) and 867,373 pre-funded units (the “Pre-Funded

Units”) for a purchase price of $9.75 per Unit and $9.735 per Pre-Funded Unit. Each Unit consists of (i) one share of common stock,

par value $0.0001 per share (“Common Stock”), and (ii) one warrant (the “Warrants”) initially exercisable for

one share of Common Stock (the “Warrant Shares”), at an initial exercise price of $9.75 per share. Each Pre-Funded Unit consists

of (i) one pre-funded warrant (the “Pre-Funded Warrants”) to purchase one share of Common Stock (the “Pre-Funded Warrant

Shares”), and (ii) one Warrant.

Pursuant to the share combination event adjustment

provisions of the Warrants, as a result of the Reverse Stock Split, the aggregate number of Warrant Shares upon exercise of all Warrants

was increased from 1,025,600 to 5,463,665, based on a new per share exercise price of $1.8302. Issuance of the Warrant Shares is subject

to Stockholder Approval, as defined and described in the Prospectus.

This prospectus supplement should be read in conjunction

with the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including

any amendments or supplements thereto, which is to be delivered with this prospectus supplement. This prospectus supplement updates and

supplements the information in the Prospectus. If there is any inconsistency between the information in the Prospectus and this prospectus

supplement, you should rely on the information in this prospectus supplement.

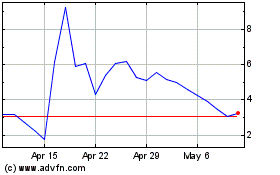

Our shares of Common Stock are listed on Nasdaq

under the symbol “WISA.” On May 20, 2024, the last reported sale price of our shares of Common Stock on Nasdaq was $3.56 per

share.

Investing in our securities involves a high

degree of risk. See “Risk Factors” beginning on page 9 of the Prospectus to read about factors you should consider before

investing in our securities.

You should rely only on the information contained

in the Prospectus, this prospectus supplement or any prospectus supplement or amendment hereto. We have not authorized anyone to provide

you with different information.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is May

20, 2024.

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

|

|

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| |

For the quarterly period ended March 31, 2024 |

| |

|

| |

or |

| |

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________to

_______________.

Commission File Number: 001-38608

WISA Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

| Delaware |

|

30-1135279 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

15268 NW Greenbrier Pkwy

Beaverton, OR 97006

(Address of principal executive offices) (Zip Code)

(408) 627-4716

(Registrant’s telephone number, including

area code)

N/A

(Former name, former address and former fiscal year,

if changed since last report)

Securities registered pursuant to Section 12(b)

of the Act:

| |

|

|

|

|

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

WISA |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check-mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number

of shares of the registrant’s common stock outstanding as of May

17, 2024 is 4,665,559.

Table of Contents

WISA TECHNOLOGIES, INC.

QUARTERLY REPORT ON FORM 10-Q

For the quarter ended March 31, 2024

| |

Page

Number |

| PART I: FINANCIAL INFORMATION |

|

| Item 1. Financial Statements (unaudited) |

|

| Condensed Consolidated Balance Sheets |

3 |

| Condensed Consolidated Statements of Operations |

4 |

| Condensed Consolidated Statements of Stockholders’ Equity (Deficit) |

5 |

| Condensed Consolidated Statements of Cash Flows |

6 |

| Notes to Condensed Consolidated Financial Statements |

7 |

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

35 |

| Item 3. Quantitative and Qualitative Disclosures About Market Risk |

37 |

| Item 4. Controls and Procedures |

37 |

| |

|

| PART II. OTHER INFORMATION |

|

| Item 1. Legal Proceedings |

39 |

| Item 1A. Risk Factors |

39 |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds |

39 |

| Item 3. Defaults Upon Senior Securities |

39 |

| Item 4. Mine Safety Disclosures |

39 |

| Item 5. Other Information |

39 |

| Item 6. Exhibits |

40 |

| SIGNATURES |

41 |

2

Table of Contents

PART I: FINANCIAL INFORMATION

Item 1. Financial

Statements

WISA TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share

data)

|

|

|

|

|

|

|

|

| |

|

March 31, 2024 |

|

December 31, 2023 |

| |

|

(unaudited) |

|

(1) |

| Assets |

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

2,763 |

|

$ |

411 |

| Accounts receivable |

|

|

290 |

|

|

294 |

| Inventories |

|

|

2,579 |

|

|

2,737 |

| Prepaid expenses and other current assets |

|

|

606 |

|

|

641 |

| Total current assets |

|

|

6,238 |

|

|

4,083 |

| Property and equipment, net |

|

|

79 |

|

|

93 |

| Other assets |

|

|

613 |

|

|

647 |

| Total assets |

|

$ |

6,930 |

|

$ |

4,823 |

| |

|

|

|

|

|

|

| Liabilities, Convertible Redeemable Preferred Stock and Stockholders’ Deficit |

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

| Accounts payable |

|

$ |

3,257 |

|

$ |

2,320 |

| Accrued liabilities |

|

|

1,088 |

|

|

1,317 |

| Total current liabilities |

|

|

4,345 |

|

|

3,637 |

| Warrant liabilities |

|

|

4,621 |

|

|

5,460 |

| Other liabilities |

|

|

633 |

|

|

636 |

| Total liabilities |

|

|

9,599 |

|

|

9,733 |

| |

|

|

|

|

|

|

| Commitments and contingencies (Note 8) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Series B Convertible Redeemable Preferred Stock, par value $0.0001; 375,000 shares authorized; 0 and 38,335 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively |

|

|

— |

|

|

247 |

| |

|

|

|

|

|

|

| Stockholders’ Deficit: |

|

|

|

|

|

|

| Common stock, par value $0.0001; 300,000,000 shares authorized; 1,757,195 and 222,380 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively |

|

|

1 |

|

|

1 |

| Additional paid-in capital |

|

|

241,665 |

|

|

241,884 |

| Accumulated deficit |

|

|

(244,335) |

|

|

(247,042) |

| Total stockholders’ deficit |

|

|

(2,669) |

|

|

(5,157) |

| Total liabilities, convertible preferred stock and stockholders’ deficit |

|

$ |

6,930 |

|

$ |

4,823 |

| (1) |

The condensed consolidated balance sheet as of December 31, 2023 was derived from the audited consolidated balance sheet as of that date. |

Note: Share and per share amounts have been retroactively

adjusted to reflect the impact of a 1-for-100 reverse stock split effected in January 2023 as well as a 1-for-150 reverse stock split

effected in April 2024, as discussed in Note 1.

The accompanying notes are an integral

part of these condensed consolidated financial statements

3

Table of Contents

WISA TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

For the three months ended March 31, 2024

and 2023

(in thousands, except share and per share

data)

(unaudited)

|

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

| |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

| Revenue, net |

|

$ |

255 |

|

$ |

469 |

| Cost of revenue |

|

|

338 |

|

|

1,722 |

| Gross deficit |

|

|

(83) |

|

|

(1,253) |

| Operating Expenses: |

|

|

|

|

|

|

| Research and development |

|

|

1,715 |

|

|

1,893 |

| Sales and marketing |

|

|

929 |

|

|

1,294 |

| General and administrative |

|

|

1,431 |

|

|

1,362 |

| Total operating expenses |

|

|

4,075 |

|

|

4,549 |

| Loss from operations |

|

|

(4,158) |

|

|

(5,802) |

| |

|

|

|

|

|

|

| Interest expense, net |

|

|

(1,265) |

|

|

(723) |

| Change in fair value of warrant liabilities |

|

|

8,129 |

|

|

5,604 |

| Other expense, net |

|

|

1 |

|

|

— |

| Income (loss) before provision for income taxes |

|

|

2,707 |

|

|

(921) |

| Provision for income taxes |

|

|

— |

|

|

— |

| Net income (loss) |

|

|

2,707 |

|

|

(921) |

| Deemed dividend on conversion of Series B preferred for common stock and repurchase of Series B preferred stock |

|

|

(5,842) |

|

|

— |

| Net loss attributable to common stockholders |

|

$ |

(3,135) |

|

$ |

(921) |

| Net loss per common share - basic and diluted |

|

$ |

(5.35) |

|

$ |

(79.84) |

| Weighted average number of common shares used in computing net loss per common share |

|

|

585,500 |

|

|

11,536 |

Note: Share and per share amounts have been retroactively

adjusted to reflect the impact of a 1-for-100 reverse stock split effected in January 2023 as well as a 1-for-150 reverse stock split

effected in April 2024, as discussed in Note 1.

The accompanying notes are an integral

part of these condensed consolidated financial statements.

4

Table of Contents

WISA TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’

EQUITY (DEFICIT)

For the three months ended March 31, 2024

and 2023

(in thousands, except share and per share

data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

| |

|

Convertible Preferred Stock |

|

|

Common Shares |

|

Additional |

|

Accumulated |

|

Stockholders’ |

| |

|

Shares |

|

Amount |

|

|

Shares |

|

Amount |

|

Paid-in Capital |

|

Deficit |

|

Equity (Deficit) |

| Balance as of December 31, 2023 |

|

38,335 |

|

$ |

247 |

|

|

222,380 |

|

$ |

1 |

|

$ |

241,884 |

|

$ |

(247,042) |

|

$ |

(5,157) |

| Stock-based compensation |

|

— |

|

|

— |

|

|

4 |

|

|

— |

|

|

380 |

|

|

— |

|

|

380 |

| Cumulative effect of ASC 2020-06 adoption |

|

— |

|

|

116 |

|

|

— |

|

|

— |

|

|

(116) |

|

|

— |

|

|

(116) |

| Issuance of Series B preferred stock in connection with warrant exercise, net of discounts |

|

29,322 |

|

|

386 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

| Issuance of common stock in connection with conversion of Series B preferred stock |

|

(5,000) |

|

|

(325) |

|

|

8,038 |

|

|

— |

|

|

325 |

|

|

— |

|

|

325 |

| Deemed dividend on conversion of Series B preferred for common stock and repurchase of Series B preferred stock |

|

— |

|

|

5,842 |

|

|

— |

|

|

— |

|

|

(5,842) |

|

|

— |

|

|

(5,842) |

| Repurchase of Series B preferred stock and Series B preferred stock warrants |

|

(62,657) |

|

|

(6,266) |

|

|

— |

|

|

— |

|

|

824 |

|

|

— |

|

|

824 |

| Issuance of common stock, pre-funded units and warrants, net of offering costs |

|

— |

|

|

— |

|

|

1,442,518 |

|

|

— |

|

|

4,210 |

|

|

— |

|

|

4,210 |

| Issuance of common stock in connection with reverse split rounding-up for fractional shares |

|

— |

|

|

— |

|

|

84,255 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

| Net income |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,707 |

|

|

2,707 |

| Balance as of March 31, 2024 |

|

— |

|

$ |

— |

|

|

1,757,195 |

|

$ |

1 |

|

$ |

241,665 |

|

$ |

(244,335) |

|

$ |

(2,669) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

| |

|

Convertible Preferred Stock |

|

|

Common Shares |

|

Additional |

|

Accumulated |

|

Stockholders’ |

| |

|

Shares |

|

Amount |

|

|

Shares |

|

Amount |

|

Paid-in Capital |

|

Deficit |

|

Equity/(Deficit) |

| Balance as of December 31, 2022 |

|

— |

|

— |

|

|

4,750 |

|

$ |

1 |

|

$ |

226,324 |

|

$ |

(228,321) |

|

$ |

(1,996) |

| Stock-based compensation |

|

— |

|

— |

|

|

— |

|

|

— |

|

|

499 |

|

|

— |

|

|

499 |

| Restricted stock awards cancelled |

|

— |

|

— |

|

|

(0) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

| Issuance of common stock in connection with convertible promissory note |

|

— |

|

— |

|

|

450 |

|

|

— |

|

|

708 |

|

|

— |

|

|

708 |

| Issuance of common stock in connection with warrant exercise |

|

— |

|

— |

|

|

5,723 |

|

|

— |

|

|

8,202 |

|

|

— |

|

|

8,202 |

| Issuance of common stock and warrants, net of offering costs |

|

— |

|

— |

|

|

9,470 |

|

|

— |

|

|

1,271 |

|

|

— |

|

|

1,271 |

| Net loss |

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(921) |

|

|

(921) |

| Balance as of March 31, 2023 |

|

— |

|

— |

|

|

20,393 |

|

$ |

1 |

|

$ |

237,004 |

|

$ |

(229,242) |

|

$ |

7,763 |

Note: Share and per share amounts have been retroactively

adjusted to reflect the impact of a 1-for-100 reverse stock split effected in January 2023 as well as a 1-for-150 reverse stock split

effected in April 2024, as discussed in Note 1.

The accompanying notes are an integral

part of these condensed consolidated financial statements.

5

Table of Contents

WISA TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS

For the three months ended March 31, 2024

and 2023

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

| |

|

2024 |

|

2023 |

| Cash flows from operating activities: |

|

|

|

|

|

|

| Net income (loss) |

|

$ |

2,707 |

|

$ |

(921) |

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

| Stock-based compensation |

|

|

380 |

|

|

499 |

| Depreciation and amortization |

|

|

20 |

|

|

33 |

| Amortization of debt discounts |

|

|

1,260 |

|

|

719 |

| Change in fair value of warrant liabilities |

|

|

(8,129) |

|

|

(5,604) |

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

| Accounts receivable |

|

|

4 |

|

|

47 |

| Inventories |

|

|

158 |

|

|

1,323 |

| Prepaid expenses and other current assets |

|

|

35 |

|

|

(271) |

| Other assets |

|

|

34 |

|

|

22 |

| Accounts payable |

|

|

223 |

|

|

137 |

| Accrued liabilities |

|

|

(229) |

|

|

(563) |

| Other liabilities |

|

|

(3) |

|

|

(39) |

| Net cash used in operating activities |

|

|

(3,540) |

|

|

(4,618) |

| |

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

| Purchases of property and equipment |

|

|

(6) |

|

|

(14) |

| Net cash used in investing activities |

|

|

(6) |

|

|

(14) |

| |

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

| Proceeds from issuance of short-term loan, net of issuance costs |

|

|

600 |

|

|

— |

| Proceeds from issuance of common stock and prefunded warrants, net of issuance costs |

|

|

11,517 |

|

|

6,968 |

| Proceeds from exercise of warrants |

|

|

714 |

|

|

32 |

| Repurchase of Series B preferred stock and warrants |

|

|

(6,266) |

|

|

— |

| Repayment of finance lease |

|

|

— |

|

|

(6) |

| Repayment of short-term loan |

|

|

(667) |

|

|

— |

| Net cash provided by financing activities |

|

|

5,898 |

|

|

6,994 |

| |

|

|

|

|

|

|

| Net increase in cash and cash equivalents |

|

|

2,352 |

|

|

2,362 |

| Cash and cash equivalents as of beginning of period |

|

|

411 |

|

|

2,897 |

| Cash and cash equivalents as of end of period |

|

$ |

2,763 |

|

$ |

5,259 |

| |

|

|

|

|

|

|

| Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

| Cash paid for interest |

|

$ |

272 |

|

$ |

2 |

| Cash paid for income taxes |

|

$ |

— |

|

$ |

— |

| |

|

|

|

|

|

|

| Noncash Investing and Financing Activities: |

|

|

|

|

|

|

| Issuance of warrant liabilities in connection with financing |

|

$ |

8,701 |

|

$ |

5,600 |

| Deemed dividend on conversion of Series B preferred stock and repurchase of Series B preferred stock |

|

$ |

5,842 |

|

$ |

— |

| Unpaid financings issuance costs |

|

$ |

714 |

|

$ |

— |

| Cashless exercise of warrants |

|

$ |

587 |

|

$ |

8,170 |

| Warrant exercise in connection with loan settlement |

|

$ |

333 |

|

$ |

— |

| Issuance of common stock in connection with Series B preferred stock |

|

$ |

325 |

|

$ |

— |

| Issuance of common stock in connection with convertible promissory note |

|

$ |

— |

|

$ |

708 |

| Deferred offering costs reclassed from prepaid expenses |

|

$ |

— |

|

$ |

(97) |

The accompanying notes are an integral

part of these condensed consolidated financial statements.

6

Table of Contents

WISA TECHNOLOGIES, INC.

NOTES TO CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

For

the Three Months Ended March 31, 2024 and 2023

(unaudited)

| 1. |

Business and Summary of Significant Accounting Policies |

WiSA Technologies, Inc. formerly known

as Summit Wireless Technologies, Inc. (together with its subsidiaries also referred to herein as “we”, “us”, “our”,

or the “Company”), was originally formed as a limited liability company in Delaware on July 23, 2010. Our business is to deliver

the best-in-class immersive wireless sound technology for intelligent devices and next generation home entertainment systems through the

sale of module components to audio companies as well as audio products to resellers and consumers.

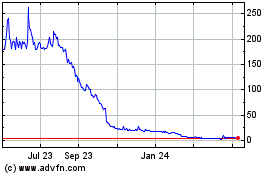

Nasdaq Compliance

On October 5, 2023, the Company received

notice from the Listing Qualifications Staff (the “Staff”) of Nasdaq that the bid price of its listed securities had closed

at less than $1 per share over the previous 30 consecutive business days, and, as a result, did not comply with Nasdaq Listing Rule 5550(a)(2)

(the “Minimum Bid Price Requirement”). Therefore, in accordance with Listing Rule 5810(c)(3)(A), the Company was provided

180 calendar days, or until April 2, 2024, to regain compliance with the Minimum Bid Price Requirement.

On November 17, 2023, the Staff notified

the Company that it was not in compliance with Nasdaq Listing Rule 5550(b)(1), which requires companies listed on Nasdaq to maintain a

minimum of $2,500,000 in stockholders’ equity for continued listing (the “Stockholders’ Equity Requirement”).

The Company reported stockholders’ equity (deficit) of ($885,000) in its Quarterly Report on Form 10-Q for the quarter ended September

30, 2023, and, as a result, did not satisfy the Stockholders’ Equity Requirement pursuant to Listing Rule 5550(b)(1).

On February 14, 2024, the Company received

notice (the “February 14 Letter”) from the Staff that the Staff had determined that as of February 14, 2024, the Company’s

securities had a closing bid price of $0.10 or less for ten consecutive trading days triggering application of Listing Rule 5810 (c)(3)(A)(iii)

which states in part: if during any compliance period specified in Rule 5810(c)(3)(A), a company’s security has a closing bid price

of $0.10 or less for ten consecutive trading days, the Listing Qualifications Department shall issue a Staff Delisting Determination under

Rule 5810 with respect to that security (the “Low Priced Stocks Rule”). As a result, the Staff determined to delist the Company’s

securities from Nasdaq, unless the Company timely requests an appeal of the Staff’s determination to a Hearings Panel (the “Panel”),

pursuant to the procedures set forth in the Nasdaq Listing Rule 5800 Series.

The Company requested a hearing before

the Panel to appeal the February 14 Letter and to address all outstanding matters, including compliance with the Minimum Bid Price Requirement,

the Low Priced Stocks Rule and the Stockholders’ Equity Requirement, which hearing was held on March 28, 2024. On April 5, 2024,

the Panel issued a decision (the “April 2024 Decision”) granting the Company’s request for continued listing on the

Nasdaq Capital Market, subject to the Company regaining compliance with (a) the Minimum Bid Price Requirement pursuant to Listing Rule

5550 (a)(2) by April 28, 2024, and (b) the Stockholders’ Equity Requirement pursuant to Listing Rule 5550 (b)(1) by June 28, 2024.

On April 29, 2024, the Company received

a letter (the “April 29 Letter”) from Nasdaq notifying the Company that it has regained compliance with the Minimum Bid Price

Requirement pursuant to Listing Rule 5550 (a)(2), as required by the April 2024 Decision. The Company will be subject to a mandatory panel

monitor for a period of one year from April 29, 2024 pursuant to Nasdaq Listing Rule 5815(d)(4)(B). If, within that one-year monitoring

period, the Staff finds the Company again out of compliance with the Minimum Bid Price Requirement, notwithstanding Nasdaq Listing Rule

5810(c)(2), the Company will not be permitted to provide the Staff with a plan of compliance with respect to that deficiency and the Staff

will not be permitted to grant additional time for the Company to regain compliance with respect to that deficiency, nor will the Company

be afforded an applicable cure or compliance period pursuant to Nasdaq Listing Rule 5810 (c)(3). Instead, the Staff will issue a delist

determination letter and the Company will have an opportunity to request a new hearing with the initial Panel or a newly convened hearings

panel if the initial Panel is unavailable.

7

Table of Contents

WISA TECHNOLOGIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

For the Three Months Ended March 31, 2024 and 2023

(unaudited)

| 1. |

Business and Summary of Significant Accounting Policies, continued |

Reverse Stock Splits

April 2024 Reverse Stock Split

On April 4, 2024, the Board approved

a 1-for-150 reverse stock split (the “April 2024 Reverse Stock Split”) of our outstanding shares of common stock and authorized

the filing of a certificate of amendment to our certificate of incorporation, as amended, with the Secretary of State of the State of

Delaware (the “Certificate of Amendment”) to effect the April 2024 Reverse Stock Split. On April 12, 2024, the April 2024

Reverse Stock Split was effected and the condensed consolidated financial statements have been retroactively adjusted. All common stock

share numbers, warrants to purchase common stock, prices and exercise prices have been retroactively adjusted to reflect the April 2024

Reverse Stock Split. The common stock began trading on a split-adjusted basis at the start of trading on April 15, 2024. Unless otherwise

indicated, the information presented in this Quarterly Report on Form 10-Q (this “Report”) gives effect to the April 2024

Reverse Stock Split.

January 2023 Reverse Stock Split

On January 24, 2023, the Board approved

a 1-for-100 reverse stock split (the “January 2023 Reverse Stock Split”) of our outstanding shares of common stock and authorized

the filing of a certificate of amendment to our certificate of incorporation, as amended, with the Secretary of State of the State of

Delaware to effect the January 2023 Reverse Stock Split. On January 26, 2023, the January 2023 Reverse Stock Split was effected and the

condensed consolidated financial statements have been retroactively adjusted. All common stock share numbers, warrants to purchase common

stock, prices and exercise prices have been retroactively adjusted to reflect the January 2023 Reverse Stock Split. The common stock began

trading on a split-adjusted basis at the start of trading on January 27, 2023. Unless otherwise indicated, the information presented in

this Report gives effect to the January 2023 Reverse Stock Split.

Basis of Presentation

The accompanying condensed consolidated

financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S.

GAAP”) and include all adjustments necessary for the fair presentation of the Company’s financial position, results of operations

and cash flows for the periods presented. The condensed consolidated financial statements reflect the accounts of WISA Technologies, Inc.

and its wholly-owned subsidiaries, WISA Technologies Korea, LTD, a Korean limited company, which was established in September 2022, and

WiSA, LLC, a Delaware limited liability company. All intercompany balances and transactions are eliminated.

Use of Estimates

The preparation of financial statements

in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements

and accompanying notes. Actual results could differ from those estimates.

Reclassification

Certain reclassifications have been made

to prior periods’ condensed consolidated financial statements to conform to the current period presentation. These reclassifications

did not result in any change in previously reported net income (loss), total assets or stockholders’ deficit.

8

Table of Contents

WISA TECHNOLOGIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

For the Three Months Ended March 31, 2024 and 2023

(unaudited)

| 1. |

Business and Summary of Significant Accounting Policies, continued |

Concentration of Credit Risk and

Other Risks and Uncertainties

Financial instruments that potentially

subject the Company to significant concentrations of credit risk consist primarily of cash and cash equivalents and accounts receivable.

Cash and cash equivalents are deposited in demand and money market accounts at one financial institution. At times, such deposits may

be in excess of insured limits. The Company has not experienced any losses on its deposits of cash and cash equivalents.

The Company’s accounts receivable

are derived from revenue earned from customers located throughout the world. The Company performs credit evaluations of its customers’

financial condition and may, in certain circumstances, require full or partial payment in advance of shipping. As of March 31, 2024 and

December 31, 2023, there was no allowance for credit losses. As of March 31, 2024, the Company had three customers accounting for 58%,

16%,and 10% of accounts receivable. As of December 31, 2023, the Company had two customers accounting for 71% and 20% of accounts receivable.

The Company had three customers accounting for 35%, 29% and 21% of its net revenue for the three months ended March 31, 2024. The Company

had four customers accounting for 25%, 19%, 14% and 13% of its net revenue for the three months ended December 31, 2023.

The Company’s future results of

operations involve a number of risks and uncertainties. Factors that could affect the Company’s future operating results and cause

actual results to vary materially from expectations include, but are not limited to, rapid technological change, continued acceptance

of the Company’s products, competition from substitute products and larger companies, protection of proprietary technology, strategic

relationships and dependence on key individuals.

The Company relies on sole-source suppliers

to manufacture some of the components used in its product. The Company’s manufacturers and suppliers may encounter problems during

manufacturing due to a variety of reasons, any of which could delay or impede their ability to meet demand. The Company is heavily dependent

on a single contractor in China for assembly and testing of its products, a single contractor in Japan for the production of its transmit

semiconductor chip and a single contractor in China for the production of its receive semiconductor chip.

Cash and Cash Equivalents

The Company considers all highly liquid

investments purchased with original maturities of three months or less to be cash equivalents.

Accounts Receivable and Allowance for Credit Losses

Accounts receivable are recorded at the

invoice amount and are generally not interest bearing. The Company reviews its trade receivables aging to identify specific customers

with known disputes or collection issues. The Company exercises judgment when determining the adequacy of these reserves as it evaluates

historical bad debt trends and changes to customers’ financial conditions.

Fair Value of Financial Instruments

Carrying amounts of certain of the Company’s

financial instruments, including cash and cash equivalents, accounts receivable, prepaid expenses and other current assets, accounts payable

and accrued liabilities approximate fair value due to their relatively short maturities. The carrying value of the Company’s borrowings

and capital lease liabilities approximates fair value based upon borrowing rates currently available to the Company for loans and capital

leases with similar terms. The Company’s Warrant liabilities are the only financial instrument that is adjusted to fair value on

a recurring basis.

9

Table of Contents

WISA TECHNOLOGIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

For the Three Months Ended March 31, 2024 and 2023

(unaudited)

| 1. |

Business and Summary of Significant Accounting Policies, continued |

Inventories

Inventories, principally purchased components,

are stated at the lower of cost or net realizable value. Cost is determined using an average cost, which approximates actual cost on a

first-in, first-out basis. Inventory in excess of salable amounts and inventory which is considered obsolete based upon changes in existing

technology is written off. At the point of loss recognition, a new lower cost basis for that inventory is established and subsequent changes

in facts and circumstances do not result in the restoration or increase in the new cost basis.

Property and Equipment, Net

Property and equipment are stated at

cost less accumulated depreciation and amortization. Depreciation of property and equipment is computed using the straight-line method

over their estimated useful lives of two to five years. Leasehold improvements and assets acquired under capital lease are amortized on

a straight-line basis over the shorter of the useful life or term of the lease. Upon retirement or sale, the cost and related accumulated

depreciation are removed from the balance sheet and the resulting gain or loss is reflected in operations. Maintenance and repairs are

charged to operations as incurred.

Convertible Financial Instruments

The Company bifurcates conversion options

and warrants from their host instruments and accounts for them as freestanding derivative financial instruments if certain criteria are

met. The criteria include circumstances in which (a) the economic characteristics and risks of the embedded derivative instrument

are not clearly and closely related to the economic characteristics and risks of the host contract, (b) the hybrid instrument that

embodies both the embedded derivative instrument and the host contract is not re-measured at fair value under otherwise applicable generally

accepted accounting principles with changes in fair value reported in earnings as they occur and (c) a separate instrument with the

same terms as the embedded derivative instrument would be considered a derivative instrument. An exception to this rule is when the

host instrument is deemed to be conventional, as that term is described under applicable U.S. GAAP.

When the Company has determined that

the embedded conversion options and warrants should be bifurcated from their host instruments, discounts are recorded for the intrinsic

value of conversion options embedded in the instruments based upon the differences between the fair value of the underlying common stock

at the commitment date of the transaction and the effective conversion price embedded in the instrument.

Debt discounts under these arrangements

are amortized to interest expense using the interest method over the earlier of the term of the related debt or their earliest date of

redemption.

Warrants for Common Shares, Convertible

Redeemable Preferred Shares, and Derivative Financial Instruments

Warrants for our common shares, convertible

redeemable preferred shares, and derivative financial instruments are classified as equity if the contracts (1) require physical settlement

or net-share settlement or (2) give the Company a choice of net-cash settlement or settlement in its own shares (physical settlement or

net-share settlement). Contracts which (1) require net-cash settlement (including a requirement to net cash settle the contract if an

event occurs and if that event is outside the control of the Company), (2) give the counterparty a choice of net-cash settlement or settlement

in shares (physical settlement or net-share settlement), or (3) that contain reset provisions that do not qualify for the scope exception

are classified as equity or liabilities. The Company assesses classification of its warrants for shares of common stock and other derivatives

at each reporting date to determine whether a change in classification between equity and liabilities is required.

10

Table of Contents

WISA TECHNOLOGIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

For the Three Months Ended March 31, 2024 and 2023

(unaudited)

| 1. |

Business and Summary of Significant Accounting Policies, continued |

Product Warranty

The Company’s products are generally

subject to a one-year warranty, which provides for the repair, rework, or replacement of products (at the Company’s option) that

fail to perform within the stated specification. The Company has assessed its historical claims and, to date, product warranty claims

have not been significant. The Company will continue to assess if there should be a warranty accrual going forward.

Revenue Recognition

The Company generates revenue primarily

from two product categories which include the sale of Consumer Audio Products as well as the sale of Components. The Company applies the

following five steps: (1) identify the contract with a customer, (2) identify the performance obligations in the contract, (3) determine

the transaction price, (4) allocate the transaction price to the performance obligations in the contract, and (5) recognize revenue when

a performance obligation is satisfied. The Company considers customer purchase orders to be the contracts with a customer. Revenues, net

of expected discounts, are recognized when the performance obligations of the contract with the customer are satisfied and when control

of the promised goods are transferred to the customer, typically when products, which have been determined to be the only distinct performance

obligations, are shipped to the customer. Expected costs of assurance warranties and claims are recognized as expense.

Taxes assessed by a governmental authority

that are both imposed on and concurrent with a specific revenue-producing transaction, that are collected by us from a customer and deposited

with the relevant government authority, are excluded from revenue. Our revenue arrangements do not contain significant financing components.

Sales to certain distributors are made

under arrangements which provide the distributors with price adjustments, price protection, stock rotation and other allowances under

certain circumstances. The Company does not provide its customers with a contractual right of return. However, the Company accepts limited

returns on a case-by-case basis. These returns, adjustments and other allowances are accounted for as variable consideration. We estimate

these amounts based on the expected amount to be provided to customers and reduce revenue recognized. We believe that there will not be

significant changes to our estimates of variable consideration.

If a customer pays consideration, or

the Company has a right to an amount of consideration that is unconditional before we transfer a good or service to the customer, those

amounts are classified as contract liabilities which are included in other current liabilities when the payment is made or it is due,

whichever is earlier.

Practical Expedients and Exemptions

In accordance with Accounting Standards

Codification Topic 606, Revenue from Contracts with Customers, we use the following practical expedients: (i) not to adjust the promised

amount of consideration for the effects of a significant financing component when we expect, at contract inception, that the period between

our transfer of a promised product or service to a customer and when the customer pays for that product or service will be one year or

less; (ii) to expense costs as incurred for costs to obtain a contract when the amortization period would have been one year or less;

(iii) not to assess whether promised goods or services are performance obligations if they are immaterial in the context of the contract

with the customer. In addition, we do not disclose the value of unsatisfied performance obligations for contracts with an original expected

length of one year or less.

11

Table of Contents

WISA TECHNOLOGIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

For the Three Months Ended March 31, 2024 and 2023

(unaudited)

| 1. |

Business and Summary of Significant Accounting Policies, continued |

During the three months ended March 31,

2024 and 2023, net revenue consisted of the following:

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended March 31, |

| (in thousands) |

|

2024 |

|

2023 |

| Components |

|

$ |

159 |

|

$ |

327 |

| Consumer Audio Products |

|

|

96 |

|

|

142 |

| Total |

|

$ |

255 |

|

$ |

469 |

Contract Balances

The Company receives payments from customers

based on a billing schedule as established in our contracts to partially offset prepayments required by our vendors on long lead time

materials. Amounts collected prior to the fulfillment of the performance obligation are considered contract liabilities and classified

as customer advances within accrued liabilities on the consolidated balance sheets. Contract assets are recorded when the Company has

a conditional right to consideration for our completed performance under the contracts. Accounts receivables are recorded when the right

to this consideration becomes unconditional. The Company does not have any material contract assets as of March 31, 2024 and December

31, 2023. During the three month ended March 31, 2024, the Company did not recognize any revenue that was included in the contract liabilities

balance as of December 31, 2023.

|

|

|

|

|

|

|

|

| |

|

March 31, |

|

December 31, |

| (in thousands) |

|

2024 |

|

2023 |

| Contract Liabilities |

|

$ |

13 |

|

$ |

19 |

Revenue by Geographic Area

In general, revenue disaggregated by

geography (See Note 10) is aligned according to the nature and economic characteristics of our business and provides meaningful disaggregation

of our results of operations. Since we operate in one segment, all financial segment and product line information can be found in the

condensed consolidated financial statements.

Stock-Based Compensation

The Company measures and recognizes the

compensation expense for restricted stock units and restricted stock awards granted to employees and directors based on the fair value

of the award on the grant date.

Restricted stock units give an employee

an interest in Company stock but they have no tangible value until vesting is complete. Restricted stock units and restricted stock awards

are equity classified and measured at the fair market value of the underlying stock at the grant date and recognized as expense over the

related service or performance period. The Company elected to account for forfeitures as they occur. The fair value of stock awards is

based on the quoted price of our common stock on the grant date. Compensation cost for restricted stock units and restricted stock awards

is recognized using the straight-line method over the requisite service period.

12

Table of Contents

WISA TECHNOLOGIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

For the Three Months Ended March 31, 2024 and 2023

(unaudited)

| 1. |

Business and Summary of Significant Accounting Policies, continued |

Research and Development

Research

and development costs are charged to operations as incurred and includes salaries, consulting expenses and an allocation of facility costs.

Advertising Costs

Advertising costs are charged to sales

and marketing expenses as incurred. Advertising costs for the three months ended March 31, 2024 and 2023 were $147,000 and $155,000, respectively.

Comprehensive Loss

Comprehensive loss represents the changes

in equity of an enterprise, other than those resulting from stockholder transactions. Accordingly, comprehensive loss may include certain

changes in equity that are excluded from net loss. For the three months ended March 31, 2024 and 2023, the Company’s comprehensive

loss is the same as its net loss.

Foreign Currency

The financial position and results of

operations of the Company’s foreign operations are measured using currencies other than the U.S. dollar as their functional currencies.

Accordingly, for these operations all assets and liabilities are translated into U.S. dollars at the current exchange rates as of the

respective balance sheet date. Expense items are translated using the weighted average exchange rates prevailing during the period. Cumulative

gains and losses from the translation of these operations’ financial statements are reported as a separate component of stockholders’

equity, while foreign currency transaction gains or losses, resulting from re-measuring local currency to the U.S. dollar are recorded

in the condensed consolidated statement of operations in other income (expense), net and were not material for the three months ended

March 31, 2024 and 2023.

Net Loss per Common Share

Basic and diluted net loss per common

share is presented in conformity with the two-class method required for participating securities. The Company considers all series of

convertible preferred stock to be participating securities. Under the two-class method, the net loss attributable to common stockholders

is not allocated to the convertible preferred stock as the holders of the convertible preferred stock do not have a contractual obligation

to share in the losses of the Company. Under the two-class method, net income would be attributed to common stockholders and participating

securities based on their participation rights.

Basic net loss per common share is calculated

by dividing the net loss attributable to common stockholders by the weighted average number of shares of common stock outstanding during

the period, without consideration for potentially dilutive securities. Diluted net loss per common share is computed by dividing the net

loss attributable to common stockholders by the weighted average number of common shares and potentially dilutive common share equivalents

outstanding for the period determined using the treasury-stock and if-converted methods. For purposes of the diluted net loss per common

share calculation, Series A 8% Senior Convertible Preferred Stock (“Series A Preferred Stock”), warrants exercisable for common

stock, restricted stock units and shares issuable upon the conversion of convertible notes payable are considered to be potentially dilutive

securities. Net loss is adjusted for any deemed dividends to preferred stockholders to compute income available to common stockholders.

For the three months ended March 31,

2024, warrants to purchase 1,985,138 shares of common stock, 5,362 shares of restricted stock, 17 shares of restricted stock issued under

an inducement grant and 14 shares underlying restricted stock units, have been excluded from the calculation of net loss per common share

because the inclusion would be antidilutive.

For the three months ended March 31,

2023, warrants to purchase 17,873 shares of common stock, 94 shares of restricted stock, 19 shares of restricted stock issued under an

inducement grant and 39 shares underlying restricted stock units have been excluded from the calculation of net loss per common share

because the inclusion would be antidilutive.

13

Table of Contents

WISA TECHNOLOGIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

For the Three Months Ended March 31, 2024 and 2023

(unaudited)

| 1. |

Business and Summary of Significant Accounting Policies, continued |

Income Taxes

Deferred taxes are provided on the liability

method whereby deferred tax assets are recognized for deductible temporary differences, and operating loss and tax credit carryforwards

and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported

amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of

management, it is “more-likely-than-not” that some portion or all of the deferred tax assets will not be realized. The Company

has recognized valuation allowances against its deferred tax assets as of March 31, 2024 and December 31, 2023. Deferred tax assets

and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

The Company uses a comprehensive model

for recognizing, measuring, presenting, and disclosing in the condensed consolidated financial statements tax positions taken or expected

to be taken on a tax return. A tax position is recognized as a benefit only if it is “more-likely-than-not” that the tax position

would be sustained in a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of

tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the “more-likely-than-not”

test, no tax benefit is recorded. The Company recognizes interest accrued and penalties related to unrecognized tax benefits in tax expense.

As of March 31, 2024 and December 31, 2023, the Company recognized no interest and penalties.

Recently Adopted

Accounting Pronouncements

In August 2020, the Financial Accounting

Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2020-06 “Debt - Debt with Conversion

and Other Options (Subtopic 470-20) and Derivatives and Hedging - Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting

for Convertible Instruments and Contracts in an Entity’s Own Equity”. This ASU simplifies accounting for convertible instruments

by removing major separation models required under current U.S. GAAP. The Company adopted this standard on January 1, 2024 using the modified

retrospective method by applying the ASU to financial instruments outstanding as of January 1, 2024, with the cumulative effect of adoption

recognized at that date through an adjustment to the opening balance of retained earnings. As such, the Company adopted the standard by

eliminating any unamortized discount to the Series B Preferred Stock for the beneficial conversion feature. The cumulative effect of ASU

2020-06 adoption adjusted against additional paid-in-capital due to the absence of retained earnings on January 1, 2024 amounted to $116,000.

Recently Issued and Not Yet Adopted

Accounting Pronouncements

In December 2023, the FASB issued ASU

2023-09 – Income Taxes (Topic 740): Improvements to Income Tax Disclosures, to help investors better understand an entity’s

exposure to potential changes in jurisdictional tax legislation and the ensuing risks and opportunities. Furthermore, the Update improves

disclosures used to assess income tax information that affects cash flow forecasts and capital allocation decisions. The Update is effective

for public business entities for annual periods beginning after December 15, 2024, on a prospective basis. The Company is currently evaluating

the impact of the adoption of this standard on our condensed consolidated financial statements.

In November 2023, the FASB issued ASU

2023-07 “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, aiming to enhance the transparency and relevance

of segment information provided in financial statements. The amendments in this Update require that a public entity disclose significant

segment expenses, profit or loss and assets, etc. for each reportable segment, on an annual and interim basis. The Update is effective

for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. The Company

is currently evaluating the impact of the adoption of this standard on our condensed consolidated financial statements.

14

Table of Contents

WISA TECHNOLOGIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

For the Three Months Ended March 31, 2024 and 2023

(unaudited)

We have reviewed other recent accounting

pronouncements and concluded they are either not applicable to the business, or no material effect is expected on the condensed consolidated

financial statements as a result of future adoption.

The condensed consolidated financial

statements of the Company have been prepared on a going concern basis, which contemplates the realization of assets and the discharge

of liabilities in the normal course of business. As of March 31, 2024, the Company had cash and cash equivalents of $2.8 million and reported

net cash used in operations of $3.5 million during the three months ended March 31, 2024. The Company expects operating losses to continue

in the foreseeable future because of additional costs and expenses related to research and development activities, plans to expand its

product portfolio, and increase its market share. The Company’s ability to attain profitable operations is dependent upon achieving

a level of revenues adequate to support its cost structure.

Based on current operating levels, the

Company will need to raise additional funds in the next 12 months by selling additional equity or incurring debt. To date, the Company

has funded its operations primarily through sales of its securities in public and private markets, proceeds from the exercise of warrants

to purchase common stock and the sale of convertible notes. Additionally, future capital requirements will depend on many factors, including

the rate of revenue growth, the selling price of the Company’s products, the expansion of sales and marketing activities, the timing

and extent of spending on research and development efforts and the continuing market acceptance of the Company’s products. These

factors raise substantial doubt about the Company’s ability to continue as a going concern for the twelve months from the date of

this Report.

Management of the Company intends to

raise additional funds through the issuance of equity securities or debt. There can be no assurance that, in the event the Company requires

additional financing, such financing will be available at terms acceptable to the Company, if at all. Failure to generate sufficient cash

flows from operations, raise additional capital and reduce discretionary spending could have a material adverse effect on the Company’s

ability to achieve its intended business objectives. As a result, the substantial doubt about the Company’s ability to continue

as a going concern has not been alleviated. The accompanying condensed consolidated financial statements do not include any adjustments

that might be necessary if the Company is unable to continue as a going concern.

| 3. |

Balance Sheet Components |

Inventories (in thousands):

|

|

|

|

|

|

|

|

| |

|

March 31, |

|

December 31, |

| |

|

2024 |

|

2023 |

| Raw materials |

|

$ |

608 |

|

$ |

621 |

| Finished goods |

|

|

1,971 |

|

|

2,116 |

| Total inventories |

|

$ |

2,579 |

|

$ |

2,737 |

Property and equipment, net (in thousands):

|

|

|

|

|

|

|

|

| |

|

March 31, |

|

December 31, |

| |

|

2024 |

|

2023 |

| Machinery and equipment |

|

$ |

744 |

|

$ |

741 |

| Tooling |

|

|

14 |

|

|

11 |

| |

|

|

758 |

|

|

752 |

| Less: Accumulated depreciation and amortization |

|

|

(679) |

|

|

(659) |

| Property and equipment, net |

|

$ |

79 |

|

$ |

93 |

15

Table of Contents

WISA TECHNOLOGIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

For the Three Months Ended March 31, 2024 and 2023

(unaudited)

| 3. |

Balance Sheet Components, continued |

Depreciation and amortization expense

for the three months ended March 31, 2024 and 2023 was $20,000 and $33,000, respectively.

Accrued liabilities (in thousands):

|

|

|

|

|

|

|

|

| |

|

March 31, |

|

December 31, |

| |

|

2024 |

|

2023 |

| Accrued vacation |

|

$ |

401 |

|

$ |

418 |

| Accrued rebate |

|

|

215 |

|

|

215 |

| Accrued audit fees |

|

|

194 |

|

|

211 |

| Accrued lease liability, current portion |

|

|

20 |

|

|

— |

| Accrued compensation |

|

|

— |

|

|

127 |

| Accrued other |

|

|

258 |

|

|

346 |

| Total accrued liabilities |

|

$ |

1,088 |

|

$ |

1,317 |

Convertible Promissory Note

On August 15, 2022, the Company entered

into a Securities Purchase Agreement (the “August Purchase Agreement”), by and between the Company and an institutional investor

(the “Convertible Note Investor”), pursuant to which the Company agreed to issue to the Investor a senior secured convertible

note in the principal amount of $3,600,000 (the “Convertible Note”) and a warrant (the “August Warrant”) to purchase

up to 140 shares of the Company’s common stock, at an initial exercise price of $14,955.00 per share (the “Exercise Price”),

in consideration for $3,000,000. Pursuant to the August Purchase Agreement, upon the closing of the private placement, pursuant to which

Maxim Group LLC (“Maxim”) acted as placement agent (the “Private Placement”), the Company received gross proceeds

of $3,000,000. After the deduction of banker fees, commitment fees and other expenses associated with the transaction, the Company received

net proceeds of $2,483,000. The Company used the net proceeds primarily for working capital and general corporate purposes.

The Convertible Note matured on August

15, 2024, does not bear interest and ranks senior to the Company’s existing and future indebtedness and is secured to the extent

and as provided in the Security Agreements. The Convertible Note is convertible in whole or in part at the option of the Convertible Note

Investor into shares of Common stock (the “Conversion Shares”) at the Conversion Price (as defined below) at any time following

the date of issuance of the Convertible Note. The Convertible Note defines “Conversion Price” as equal to the lesser of (a)

90% of the average of the five lowest daily VWAPs (as defined in the Convertible Note) during the previous twenty trading days prior to

delivery to the Company of the Convertible Note Investor’s applicable notice of conversion (the “Conversion Notice”)

and (b) $13,890.00 (the “Base Conversion Price”). The Base Conversion Price is subject to full ratchet antidilution protection,

subject to a floor conversion price of $75.00 per share (the “Floor Price”).

In connection with the Private Placement,

the Company issued warrants to the Convertible Note Investor and Maxim to purchase common shares of 140 and 13, respectively (see Note

5 – Fair Value Measurements). The sum of the fair value of the warrants, the original issue discount for interest, issuance costs

and the derivative liability for the embedded conversion feature for the August 2022 Notes were recorded as debt discounts totaling $2,509,000

to be amortized to interest expense over the respective term using the effective interest method. During the year ended December 31, 2023,

the Company recognized $737,000 of interest expense from the amortization of debt discounts and repayment of the convertible note payable

in April 2023.

In connection with the Private Placement,

the Company entered into a placement agency agreement with Maxim (the “Placement Agency Agreement”), and agreed to issue to

Maxim, a warrant to purchase up to an aggregate of 13 shares of Common Stock (the “Maxim Warrant”) at an initial exercise

price of $14,955.00 per share, which is exercisable at any time on or after the six-month anniversary of the closing date of the Private

Placement and will expire on the fifth (5th) anniversary of its date of issuance.

16

Table of Contents

WISA TECHNOLOGIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

For the Three Months Ended March 31, 2024 and 2023

(unaudited)

Effective August 24, 2022, the Company

and the Investor agreed to amend Section 3.1(b) of the Convertible Note to provide that the Conversion Price could not be lower than the

Floor Price until stockholder approval has been obtained, after which stockholder approval the Floor Price may be reduced to no lower

than $37.50, subject to adjustment pursuant to the terms of the August 2022 Note. The changes were effected by cancellation of the Convertible

Note and the issuance of a replacement senior secured convertible note (the “New Convertible Note”) to the Investor. The New

Convertible Note contains identical terms as the Convertible Note, except for the amendment to the Section 3.1(b).

On November 21, 2022, the Company and

Maxim entered into an agreement to amend the Maxim Warrant (the “Maxim Warrant Amendment”). Specifically, the Maxim Warrant

Amendment sets forth certain circumstances in which the lock up restrictions to which the Maxim Warrant is subject would not apply. The

Maxim Warrant Amendment also clarifies certain limitations with respect to demand registration rights and provides that Maxim’s

piggy-back registration rights expire on the fifth (5th) anniversary of the Maxim Warrant’s date of issuance.

The New Convertible Note contained several

embedded conversion features. The Company concluded that those conversion features require bifurcation from the New Convertible Note and

subsequent accounting in the same manner as a freestanding derivative. The Company recognized a derivative liability of $286,000 upon

execution of the note agreement and such amount was included in the $2,509,000 of debt discounts noted above. Subsequent changes in the

fair value of these conversion features are measured at each reporting period and recognized in the consolidated statement of operations.

On November 28, 2022, the Company entered

into a waiver of rights (the “Waiver”) with the New Convertible Note Investor, pursuant to which the New Convertible Note

Investor agreed to waive certain prohibitions under the August Purchase Agreement with respect to the offering of units in December 2022

in exchange for the issuance by the Company, on the closing date of such offering, of an additional number of Series A warrants to purchase

shares of Common Stock (“Series A Warrants”) and an additional number of Series B warrants to purchase shares of Common Stock

(“Series B Warrants”) equal to the quotient obtained by dividing $750,000 by the public offering price for the units sold

in the offering (such Warrants, the “Waiver Warrants”).

In connection with the public offering

the Company consummated on December 1, 2022 (the “December 2022 Offering”), the Company issued 357 Series A Warrants and 357

Series B Warrants to the New Convertible Note Investor (See Note 6). The Company’s obligation to issue shares of common stock underlying

the Waiver Warrants is expressly conditioned upon stockholder approval of all of the transactions contemplated by the August Purchase

Agreement. At a Special Meeting of Stockholders held on January 24, 2023, the Company received stockholder approval of the transactions

contemplated by the August Purchase Agreement. Additionally, as a result of the December 2022 Offering, the Base Conversion Price was

adjusted to the Floor Price.

On February 1, 2023, the holder of the

New Convertible Note converted approximately $708,000, a portion of the outstanding principal amount into 450 shares of the Company’s

common stock.

On April 11, 2023, the Company paid $1,656,744

to the holder of the New Convertible Note which repaid the entirety of the outstanding balance and included the unpaid principal, interest

through the payoff date, and a pre-payment premium of $276,000 which was recorded as a component of loss on debt extinguishment.

September 2023 Short-Term Loan Agreement

On September 8, 2023, the Company entered

into that certain Loan and Security Agreement with the Meriwether Group Capital Hero Fund LP (“Meriwether Hero Fund”). Pursuant

to the Loan and Security Agreement, the Meriwether Hero Fund agreed to provide the Company with bridge financing in the form of a term

loan in the original principal amount of $650,000, which term loan will be senior in priority to the Company’s present and future

indebtedness (“Meriwether Loan”). The Meriwether Loan matures on November 7, 2023, subject to further extension. In addition,

the Company has the right to request additional funding under the Loan and Security Agreement.

17

Table of Contents

WISA TECHNOLOGIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

For the Three Months Ended March 31, 2024 and 2023

(unaudited)

Borrowings under the Meriwether Loan

bore interest at a rate per annum equal to 18%. On the maturity date, subject to any extension, the Company was obligated to make a payment

equal to all unpaid principal and accrued interest. Pursuant to Meriwether Loan, the Company shall pay to the Meriwether Hero Fund a fully

earned, non-refundable, origination fee in the amount of$50,000. The Company shall also pay to the Meriwether Hero Fund a fully earned,

non-refundable, exit fee in the amount of $50,000 due and payable on the maturity date.

The Meriwether Loan also provided that

all present and future indebtedness and the obligations of the Company to the Meriwether Hero Fund shall be secured by a first priority

security interest in all real and personal property collateral of the Company.

The Meriwether Loan contains customary

representations, warranties and affirmative and negative covenants. In addition, the Meriwether Loan contains customary events of default

that entitle the Meriwether Hero Fund to cause the Company’s indebtedness under the Meriwether Loan to become immediately due and

payable, and to exercise remedies against the Company and the collateral securing the term loan.

On October 10, 2023, the Meriwether Hero

Fund, agreed to extend the Meriwether Loan maturity date from November 7, 2023 to December 7, 2023, for a fee of $20,000.

On December 7, 2023, the Company repaid

the full amount of the Meriwether Loan, including all fees and accrued interest.

January 2024 Short-Term Loan Agreement

On January 19, 2024, the Company entered

into promissory notes in the aggregate principal amount of $1,000,000 (the “January 2024 Promissory Notes”) and common stock

purchase warrants to purchase up to an aggregate of 66,665 shares (the “January 2024 Warrant Shares”) of the Company’s

common stock, at an initial exercise price of $22.23 per share with four accredited investors (each an “Investor” and together