Constellation Brands Stays Neutral - Analyst Blog

October 21 2011 - 7:15AM

Zacks

We have maintained our long-term

‘Neutral’ recommendation on Constellation Brands

Inc. (STZ) with a target price of $21.00 per share.

Moreover, the company has a Zacks #2 Rank, implying a short-term

‘Buy’ rating on the stock.

Constellation Brands is the largest

wine company in the world, commanding a dominant position in the

premium wine segment in the U.S. The company is also a leading

producer of wines in Canada and New Zealand. This provides a

competitive edge to the company and bolsters its well-established

position in the market.

Moreover, Constellation Brands

delivered a strong second-quarter 2012 result with earnings

increasing approximately 79.0% to 77 cents per share compared with

the prior-period earnings of 43 cents, primarily resulting from a

lower tax rate. Quarterly earnings also surpassed the Zacks

Consensus Estimate of 66 cents per share. Bolstered by

better-than-expected result, the company now expects earnings in

fiscal 2012 to be in the range of $2.00 to $2.10 per share, up from

its previous guidance range of $1.90 to $2.00, reflecting benefits

from share repurchase and change in tax rate guidance to 27% from

29% forecasted earlier.

Further, the recent stake sale in

Australian and U.K. businesses will help the company to focus on

organic growth of its brand portfolio, margin improvement, return

on invested capital and free cash flow. During the last two years,

the Australian and U.K. businesses were facing challenging market

conditions, which were no longer consistent with Constellation’s

business strategy. Moreover, both the companies have joined hands

to distribute and supply each other’s products globally.

Additionally, management has

reduced leverage by deploying operating cash to pay down debt.

Long-term debt at the end of the second quarter of fiscal 2012

decreased $402.0 million to $2,734.7 million from the debt level at

the end of fiscal 2011. Consequently, interest expense also

declined 15.5% year over year to $42.5 million in the second

quarter.

However, the company’s customers

remain sensitive to macroeconomic factors including interest rate

hikes, increase in fuel and energy costs, credit availability,

unemployment levels, and high household debt levels, which may

negatively affect their discretionary spending, and in turn, the

company’s growth and profitability.

Further,distilled spirits are

subject to excise tax in various countries. Rising fiscal pressure

in the U.S., European and many emerging markets may lead to

increasing risk of a potential excise tax on spirits by governments

of respective countries. The effect of any excise tax increase in

future may have an adverse effect on Constellation Brands’

financial performance.

Above all, the company faces

intense competition from other well-established players in the

industry, including Beam Inc. (BEAM),

Brown-Forman Corporation – B (BF.B) and

Diageo plc (DEO). Moreover, Constellation Brands

also encounters competition from local and regional players in the

respective countries. Consequently, this may dent the company’s

future operating performance.

BEAM INC (BEAM): Free Stock Analysis Report

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

Zacks Investment Research

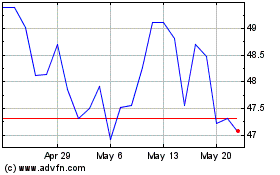

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jul 2023 to Jul 2024