Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

May 06 2024 - 5:00AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

May 5, 2024

Commission File Number 001-36761

1 Temasek Avenue #37-02B

Millenia Tower

Singapore 039192

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT 99.1 TO THIS REPORT ON FORM 6-K IS INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-201716)

OF KENON HOLDINGS LTD. AND IN THE PROSPECTUSES RELATING TO SUCH REGISTRATION STATEMENT.

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

KENON HOLDINGS LTD.

|

|

|

|

|

|

|

|

Date: May 5, 2024

|

By:

|

/s/ Robert L. Rosen

|

|

|

|

|

Name: Robert L. Rosen

|

|

|

|

|

Title: Chief Executive Officer

|

|

Exhibit 99.1

Kenon’s Subsidiary OPC Energy Ltd. Announces Updates in respect of its Subsidiary Gnrgy Ltd.

Singapore, May 5, 2024. Kenon

Holdings Ltd.’s (NYSE: KEN, TASE: KEN) subsidiary OPC Energy Ltd. (“OPC”) announces updates regarding the separation agreement (the “Separation Agreement”) between OPC Holdings Israel

Ltd. (“OPC Israel”), which is 80% owned by OPC, and which

owns 51% of Gnrgy Ltd. (“Gnrgy”), a company which operates in

the field of charging electric vehicles and the installation of charging stations for electric vehicles in Israel and the founder (“Founder”) of Gnrgy, as described in Kenon’s report on Form 6-K furnished on January 16, 2024.

Pursuant to the Separation Agreement, each shareholder of Gnrgy gave each other an option to acquire their Gnrgy shares, and OPC Israel had a first right to purchase all of the Founder’s shares in Gnrgy. OPC also announced a non-binding memorandum

of understanding between OPC Israel and a third party (the “Memorandum of Understanding”) regarding a potential merger of operations between Gnrgy and the third party.

OPC has now announced that the Memorandum of Understanding did not result in an agreement, and OPC Israel did not exercise its

right to purchase the Founder’s Gnrgy shares within the prescribed period of time. Accordingly, the Founder will have the right to purchase OPC Israel’s Gnrgy shares within a certain period and under the conditions as set forth in the Separation

Agreement. OPC estimates that its financial statements as of March 31, 2024 will reflect an additional impairment in respect of its investment in Gnrgy of approximately NIS 21 million (approximately $6 million).

Caution Concerning Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements include statements with respect to the Founder’s right to purchase OPC Israel’s Gnrgy shares and the expected impact on OPC’s financial statements as of March 31, 2024 and other non-historical statements. These

forward-looking statements are based on current expectations or beliefs, and are subject to uncertainty and changes in circumstances. These forward-looking statements are subject to a number of risks and uncertainties which could cause the actual

results to differ materially from those indicated in these forward-looking statements. Such risks include the risks related to whether the Founder will exercise its right to acquire OPC Israel’s Gnrgy shares, risks relating to the terms and

conditions and timing with respect to the Separation Agreement, risks relating to the ultimate impact of the potential purchase of Gnrgy shares on OPC’s business or financial statements and other risks including those set forth under the heading

“Risk Factors” in Kenon’s most recent Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission. Except as required by law, Kenon undertakes no obligation to update these forward-looking statements, whether as a result of new

information, future events, or otherwise.

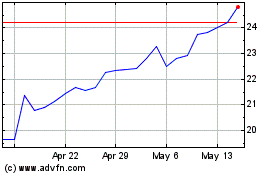

Kenon (NYSE:KEN)

Historical Stock Chart

From Apr 2024 to May 2024

Kenon (NYSE:KEN)

Historical Stock Chart

From May 2023 to May 2024