Eurotin Inc. Completes $835,000 Private Placement

March 10 2014 - 3:00PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES

Eurotin Inc. (TSX VENTURE:TIN) ("Eurotin" or the "Company"), is pleased to

announce that the Company has completed a private placement for gross proceeds

of $835,000 through the issuance of 16,700,000 common shares at a price of $0.05

per share.

In connection with the private placement, the Company has paid to PowerOne

Capital Markets Limited a cash commission of $27,600 and issued warrants to

purchase up to 1,002,000 common shares at a price of $0.05 per common share for

a period of two years.

Certain subscribers to the private placement were non-arm's length parties. The

securities issued under the private placement will be subject to a hold period

expiring on July 7, 2014.

The Company may complete additional placements for cash at $0.05 over the next

several weeks. In addition, the Company intends to complete debt conversion with

certain creditors of the Company whereby certain payables of the Company will be

converted into common shares at a deemed issue price of $0.05 per common share.

The Company anticipates that up to approximately $700,000 of debt will be

converted into common shares, the majority of which will be issued to the

drilling company which completed the Company's drill program on its Oropesa

property in 2013.

The Company intends to use the net proceeds from the Offering to continue

development of the Oropesa tin project and for general working capital purposes.

Forward looking statements

This press release includes certain forward-looking statements within the

meaning of Canadian securities laws that are based on the expectations of the

Company as of the date of this press release. There can be no assurance that

such statements will prove accurate, and actual developments are likely to

differ, in some case materially, from those expressed or implied by the

forward-looking statements contained in this press release.

Forward-looking statements contained in this press release are based on a number

of assumptions that may prove to be incorrect, including, but not limited to,

the terms of the Offering, the planned use of the proceeds, the receipt of all

regulatory approvals, general market conditions, general economic conditions,

the timing of the closing of the Offering and changes in the laws, rules and

regulations applicable to the Company. In addition to being subject to a number

of assumptions, forward-looking statements in this press release involve known

and unknown risks, uncertainties and other factors that may cause actual

developments to be materially different from those expressed or implied by such

forward-looking statements. The Company has no intention, nor obligation, to

update the forward-looking statements contained in this press release. Readers

of this press release are cautioned not to place undue reliance on any such

forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Eurotin Inc.

Trevor Richardson

CEO

416 918-2242

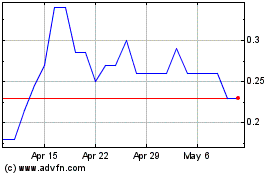

Tincorp Metals (TSXV:TIN)

Historical Stock Chart

From Apr 2024 to May 2024

Tincorp Metals (TSXV:TIN)

Historical Stock Chart

From May 2023 to May 2024

Real-Time news about Tincorp Metals Inc (TSX Venture Exchange): 0 recent articles

More Eurotin Inc. News Articles