Filed by Athena Consumer Acquisition Corp.

Pursuant to Rule 425 under the Securities Act of

1933

And deemed filed pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: Athena Consumer Acquisition Corp.

Commission File No. 001-40921

Date: March 10, 2023

Transcript of e.GO Presentation

UBS Energy Transition Conference Call

March 7, 2023

Ben:

Good

day, everyone, and welcome to the UBS Energy Transition Call with e.GO, hosted by Jon Windham. My name is Ben and I'm your event manager.

During the presentation, you are allowed to remain on listen only. If you require assistance at any time, please press *0 on your device

and the coordinator will be happy to assist you. I'd like to advise all parties that this conference is being recorded. Now, I would

like to hand it over to your host. Jon, the word is yours.

Jon

Windham:

Perfect.

Thanks, Ben, and welcome everybody to the latest installment of the UBS Energy Transition Call series. As usual, this is your host, Jon

Windham. I head up the Alternative Energy Environmental Services Equity Research here at UBS. In this call series, we attempt to connect

UBS institutional investor clients with energy experts and innovative companies that are in some way enabling or driving the energy transition.

Today, we'll be talking urban EDs with e.GO. Just as some background, e.GO is an in-production German ED producer focused on the urban

environment. Some background, on July 28th, 2022, e.GO announced a business combination with Athena Consumer Acquisition Corp, ACAQ,

upon closing of the transaction the company is expected to become publicly listed on the New York Stock Exchange under ticker symbol

EGOX. All right, on this call we're very happy to have with us today Ali Vezvaei, who's the chairman of the board.

Before

I turn it over to Ali for some opening comments, just a few logistical items. The format of today's call will be an opening presentation

by Ali about e.GO and the business model followed by Q&A. Ben, who's the operator, can provide instructions on how participants can

log any questions after the opening presentation. There are slides to accompany today's discussion. They were emailed to pre-registered

participants about 20 minutes ago. I know many of you prefer to ask your questions anonymously. Do feel free to email me if you would

like topics brought up on the call and I will bring them up anonymously for you as time permits.

I'm

sure you have my email address if you found your way to this call series, but it's Jon, J O N. Windham, W I N D H A M@ubs.com. And then

lastly, a disclosure. As a UBS research analyst, I am required to provide certain disclosures related to the nature of my relationship

or UBS's with any company discussed on today's call, a full list of disclosures is available on ubs.com/disclosures. Alternatively, do

feel free to email me and I can then send them to you. And then lastly, this call in and of itself is not a recommendation by UBS to

transact in any security. All right. With the logistics ahead of the way, Ali, thank you so much for being here. We're looking forward

to learning more about the e.GO story, so I will turn it over to you.

Ali

Vezvaei:

Thank

you, Jon. Good morning everyone. A good day, I guess, depending on wherever you're dialing from and thank you for taking the time to

listening to our story at e.GO. I guess when you put the words' energy transition, EV, pop market transaction, we sort of paint a rather

scary picture given regards to how the industry has performed so far, and the lack of performance in terms of delivering on the promise.

We decided to start the presentation with a slide because we think actions speak louder than words, so that you guys get to actually

see the production facility in Aachen, Germany with the team and with the cars that are coming off the production line. As Jon pointed

out, we are an in production, an EV young enterprise, which actually takes great pride in having combined innovation, disruption and

capital-lite business strategy.

Ultimately

trying to deliver on the promise by also adjusting the risk associated with that. On that note, I'll walk you through and as Jon said,

at the end, feel free to ask any question to the extent that it is allowed, I would be happy to answer the questions. So the company

has been founded a couple of years back in Germany, Aachen. Aachen, for those who know, is basically the likes of MIT of Germany where

a lot of innovation and particularly production technology has been born and delivered, and exported to the automotive industry.

As

part of that structure, there's a very, very strong scientific foundation in that city and also in the region, with great access to human

capital that actually provides resources to nurture and grow on that front. A few years ago, at e.GO, we sort of looked at the energy

transition and the disruption that was coming about with the electric cars. Our view was, are we doing the right thing? Is the design

of the product optimized? Is the design of the production technology optimized? And more importantly, how does the future mobility work

in conjunction with the grid capacity, charging, battery size and so on and so forth? Questions that a few years ago people looked at

us and said, "look, instead of worrying about that, can you please design a car which is large enough, goes fast enough and has

the longest range?" And we sort of looked back and said, "we don't think that that's the right approach for the production

of the battery electric cars," and that's the burst of e.GO.

Fast-forward,

we stand here from a regulatory point of view with unlimited EU homologation. So, as far as that process is concerned, we're basically

no different from other very known brands that you see in the market, more than 1,200 cars. In the meantime, of course the number has

increased but more than 1,200 cars already on the road in Europe driving by now more than seven million kilometers of driving experience,

more than nine terabyte of data collected and more importantly the factory in Germany, Aachen, is in production and we have a concept

that I'll walk you through a little bit later down in the presentation.

Decentralized

growth, which allows us to actually cyber-physically transport the factories to other countries and take advantage of the opportunities,

such as the Inflation Reduction Act for a very, very optimized combination of CapEx and time. That's well on track. And of course, given

regards to the segment in which we are focused, the price point, the technology behind the car and this decentralized production technology,

you have a positive path to growth, which sort of underlines the excitement about the leverage that we put before you, in terms of technology

and disruptive utilization of the product across its lifecycle.

Last,

but not least, the story of growth in 2022-23 cannot be possible without partnerships and there we have basically taken advantage of

the strategic and close partnership with some of the brands and names that most of you know well. Helping us continue to rethink and

optimize the journey, first of all, in terms of connectivity. Second of all, in terms of our direct-to-consumer approach and a couple

of other partnerships that have been announced in the meantime, which I'll now reflect in the presentation. The last of which was about

10 days ago with Trafigura, one of the largest metals and mining company in terms of supporting us with supply chain, battery, metal

and so on and so forth so that we basically build a stronger foundation as we now seriously grow our operations and expand on the sell

front.

So

long story short, when it comes to the technological kernel at e.GO, the disruption actually goes into three directions. One, the disruptive

view to the product itself, how we built products, which is fundamentally different from how the industry builds the products. The production

technology and also not only the view to the physical assets there but also to the digital interface. The ecosystem that allows for the

smart data layer to capture and utilize the production information across the user and product cycle. And last but not least is of course

the ecosystem as it relates to digital user experience, whether in charging or connectivity, or utilization of the asset across its lifecycle.

What do I mean with that is first of all, we built one of the cars that in our view is viewed as one of the most sustainable urban EVs.

Why? First of all, is the choice of material that we basically deploy. The industry uses typically steel and customer material that go

into the production of the car, we actually don't use any of that. We use aluminum and polymer, which are typically used in the aviation

industry.

The

obvious reason for that is the weight rigidity ratio. The other less obvious reason is the durability of aluminum as it relates to oxidization

fatigue and so on and so forth. And of course the use of polymer in conjunction with a very unique and disruptive aluminum space frame,

which is the next sort of disruption in how we build the car underneath allows for optimizing the weight and taking out parts of the

production cycle which are typically associated with significant CapEx, heavy pollution, quite a large energy consumption and ultimately

less optimized for the world in which we live.

When

it comes to the buildup of the product, we claim to build the cars in less than half the time and for a significantly lower amount of

CapEx in comparison to the standard industry. On the battery front, we actually have looked at it very differently to the industry again.

The battery at e.GO is not the typical cell-to-chassis, cell-to-pack or in simplified terms, an integral part of the structure of the

car, rather a proprietary aluminum housing that allows us to maintain absolute freedom as it relates to modularization of the battery

and also being relatively cell agnostic. I'm sure a few years ago being cell agnostic didn't mean much to the industry. A few years fast-forward

with a price of raw material through the availability of concern and largely political tensions, the ability to navigate between different

cell suppliers, different geometry of the cell, whether it was prismatic or cylindrical becomes a resilience in your supply chain, which

we have successfully incorporated and more importantly as you move forward there will be a disruption in technology as between a NMC

and LFP.

We

took cobalt out of the equation. There will come a point in time that we as human race will find the solution to replace lithium. At

that point in time, given regards to specifics of current cells and them being an integral part of chassis and of course part of the

overall design and safety of the car, replacement for a classical industry would be relatively expensive. In our case you basically change

like an old Nokia phones battery, roll it out, replace, roll it back in, flash, off you go. Of course, I simplify that. I'm sure the

R&D team would jump out of their chairs and listen to the story. But as far as the consumer is concerned, that's the process. We

also looked at the cycle of customer patience and appetite for products in the EV is reasonably shorter than what it used to be in the

ICE world simply because in the ICE world we have the complexity and the ability to play around a little bit with different features

and therefore extend the life cycle of a particular product for years.

In

the EV you basically look at a connected toy, it's powertrain, battery and connectivity. There is not much more to provide for an opportunity

in terms of change management and so on and so forth. And therefore connecting yourself to one platform and limiting or basically deploying

capital on one platform with derivative management becomes an expensive exercise. But of course as a young enterprise, we decided not

a great choice for us. So what we did is we resorted to innovation again with the smart skateboard platform that allows for a multi derivative,

multi product buildup on the same platform significantly reducing the development cost and time associated with various products.

A

great example is as we launched our urban car, as Jon referred to, we also decided, you know what? In the urban environment you see a

lot of last mile delivery that these current, call it, rush to electrify the vans of the world seems to be a sort of overkill both in

terms of the battery cost as well as the cost of the vehicle itself that the uptime/downtime when you wait for the charging. So why don't

we deliver a product for the urban environment to satisfy the last mile delivery? It took us less than six months to basically use the

same platform and reintroduce a new product in this case e.Xpress that provides around 940 liters of cargo space for the urban environment

configured to provide variety of applications from pharmaceuticals all the way to retail, all the way to groceries and with the same

price point.

Now,

you move on to the next level and you look at okay, a product that at least in our view seems to be disruptive, whether for good or otherwise

needed to also be built through a disruptive production process because otherwise the equation both economically and from a productivity

point of view doesn't add up. And if you load a product which is supposed to be very nimble, very lean and of course easy to deliver

to customers with a production facility which is capital heavy and quite call it resourceful when it comes to the depreciation of the

balance sheet, it basically tilted it out of the equation. So what we have done here is actually re-imagining how production processes

work and if you look at the current industry, whether ICE, EV, hybrid or otherwise, different brands it really doesn't matter. The production

process has four fundamental stages.

Stage

number one, press job, where you deploy a few hundred million euros or dollars of CapEx, consume a significant amount of energy and press

these metal sheets to form the 2D structure after which you move these 2D structures into the next relatively CapEx heavy part of the

process called body shop where these long line of robots do the spot welding, I'm sure you've seen in different videos and then create

this 3D structure by putting the 2D panels together.

The

third step would be the paint shop where not only is it capital heavy but also it comes with connectivity to the hydrocarbon industry

in terms of price volatility though most importantly is one of the most pollutive parts of the process when it comes to production of

cars, regardless of whether battery, electric or otherwise. And last, but not least, is the assembly, which is typically with the overhang

large hauls, heavy industrial foundations with the structures which are basically connected to the ceiling, lifting the cars and then

moving them along in 50, 60, 100 stations depending on the complexity and brand. What we have done is we've decided, you know what, you

do not need the press drop because you can actually create another extra dimension in your body shop. So instead of robots doing a two-dimensional

work of spot welding, what if we use AI to enhance the ability of those robots to work simultaneously on a 3D structure?

The

idea, is relatively simple when I spell it out that way, but getting those tolerances and the ability to deliver quality welding on aluminum

with a 0.0001% fault rate is something that has taken us around five years of training of that AI and mastering the art of thermal and

geometrical dimension adjustments, so on and so forth. More importantly, we wanted the technology to be sophisticated from the application,

but to be simplified in terms of supply chain. So, we do not use geometrically very complex profiles, of course, I'm simplifying here,

but to draw a parallel, you can imagine the profiles that from a geometry you see in doors and windows, but [inaudible] they go into

our very advanced autonomous robotic production facility and there are two personnels that manage these robotic body shops and they have

a job which is relatively simple, put the aluminum profiles into the machine, push the button, take a cup of coffee, get out of the way,

and then roughly seven minutes later, the 16 robot structure in three dimensions delivers out a construct which is grouped as aluminum

space frame.

The

idea is nothing extraordinary. The concept has been used in Formula 1 and in the racing industry because that construct provides one

of the highest safety for the passengers inside the car. However, it was barely used in the commercial and series production because

creating an autonomous robotic solution for that is something that hasn't been done for an industry for the last a hundred years. The

second part is we also decided so we don't have a press shop and of course with that, not only you save CapEx but also you significantly

take energy out of the equation. While we were at it, we decided why do you actually need a paint shop? Because with the current technology

which is out there and a little bit of an innovation thinking out of the box you can impregnate raw materials, for example polymers can

deliver really fascinating color variety and now add to that vacuum based thermo forming and not only can you provide the best contour

but also you get a final touch and feel of the sort of paint that you see.

I'm

trying to avoid some of the technical terms not to bore you and confuse you, but you basically have the same finish as if the car was

painted metallic or otherwise. And with that you also take the painting out of the process and when I say we take something out of the

process, it's not that we take it out of the process, park it on a supplier somewhere in a Third World country and then we say, you know

what? We have solved the equation. No, no, no, no, it doesn't exist. The eagle cars are not painted, not a single drop of paint exists.

And of course that provides a very interesting upside. When you don't have paint, you're not worried about scratch because the scratches

are moving paint from a surface. When you also have a thermo formed polymer, you have a higher ability to absorb displacement, impact

resistance.

So

that of course translate into different characteristic when it comes to accident and life cycle management. But more importantly we've

also innovated around our clipping technology where you connect these exterior polymer skin frames and parts to the underneath 3D structure.

You are basically doing the same work as iPhone, Apple does with iPhone, there is an underbody structure and then there are panels that

are being assembled onto it. This allows you to later on look at lifecycle management. If you have an accident, you don't need to repair

the car, you don't need to worry about it, you go through the app, find the right color for your panel, order, first service center next

to you for a hundred bucks and a couple of hours later that panel is changed. So the idea of residual value, life cycle cost and so on

and so forth have been completely reimagined.

Also,

you bought a car in red, three years later, you just don't like red, you want it blue. Shy of a thousand bucks and the car is renewed

to blue, all panels go for a hundred percent recycling, new panels are installed and you basically enjoy the ride. And all of this is

being done in a production facility which when we inaugurated it, was the first 5G connected factory on earth. We call it a MicroFactory,

you've heard the term from some of our other colleagues in the industry. However, this one works and this one is actually in production.

Number one and number two, this is one of the only first production facilities in automotive industry, which if we want it, we can run

it on a hundred percent renewable energy simply because by removing that those energy intensive parts of process we have significantly

reduced to energy consumption of the facility.

When

the energy crisis in Europe broke out about six months ago over, one of the first question we had from a number of analysts and investors

was, "oh, so what happens to your gas?" We told them, "we don't have a gas connection.", He said, "what do you

mean you don't have a gas connection?", "We don't need gas." "So where is your power plant?" "We don't

have a power plant, we don't use power plant". And if you look at, on your deck, slide number 13, you actually see the production

facility with solar panels on the roof, which of course allow us during the daylight to utilize as much as we want the renewable energy,

bring the cost down. But more importantly it's less about the cost, it's about the energy independence and the ability to solve for different

scenarios.

Our

MicroFactory in Southeast Europe is actually designed with a solar park next door so that we can run the facility, if you wanted to,

completely off grid. Now, depending on the tariff and availability of energy, you may not need to do that, but you have the freedom and

the ability to do so, if you dropped us in the middle of nowhere, all we needed was to basically put for ourselves a solar park next

door, connect and continue the production. Obviously, we are very fortunate that if your product is battery, electric cars in which there

are batteries, each car is part of your storage capacity.

Coming

back to the product itself, there are three very distinct features in our product as a car, which we take a great pride and everything,

it provides distinction as we move forward in the industry. Number one, the design of our battery naturally enables battery swap, so

the ability to exchange the battery instead of always worrying about infrastructure, fast charging, no fast charging, but in London,

the grid doesn't have the capacity, but in Germany we don't have the fast charging infrastructure. But in other parts of the world such

as the United Arab Emirates, Saudi Arabia and Thailand, the idea of fast charging is still not there. But what if you have high temperature?

Then how do you deal with that? We have decided to simplify and we think the simpler, the better in terms of the ability to scale.

When

you buy an e.GO, you get three options and all of them are standard with your car. You get a cable which is similar with a plug that

you have with your iPhone, find any normal wall plug where you plug in your iPhone, plug e.GO there and six, seven hours later you have

80% charge. That means regardless of where you live on the planet, we've got you covered. If you are committed to drive sustainable electric

mobility, we make sure you are enabled.

Number two, you get a fast charging cable, the usual one. If you

have a fast charging infrastructure next door, feel free use it. Number three, you also get the option for batteries swap and here we

offer two categories of batteries swap. The manual one takes around 25 minutes, different battery swap stations, we already be rolled

out a few in Germany and then we entered into strategic partnership with our partner in San Francisco, Ample, some of you may know them.

Really, really cool technology and robotics enterprise with two very good friends of mine having successfully rolled out for Uber first

and they just received another grant from [inaudible] to actually do something more.

With them, we have created, well credit goes to them, they have created

an autonomous solution for battery exchange. e.GO is compatible simply because our design of the battery is naturally swappable. We have

combined the synergies and with them we roll out the first autonomous battery swap sort of in the Western Hemisphere. In China, they used

to do that successfully in scale. However, what differentiates or what creates a difference between what we do and how it works in other

parts of the world is the CapEx, the battery swap stations that we roll out are significantly CapEx light as opposed to what you've seen

in the Asian part of the world where per station you're looking at between $250,000 to $400,000. We're having one digit less just to look

at that for now. So in terms of energy transition and the exposure to the grid, we have solved the equation by simplifying and diversifying

the opportunities for customers.

In terms of durability, the aluminum space frame that you see on

slide nine in the top right is designed to last a lot longer. There used to be a number of years there but of course as part of the public

market transactions we've been advised to be more conservative so we removed it, but let's say it's several many years longer than what

is supposed to be with the steel structure. And of course that corrosion free and durable structure underneath allows you to benefit from

multiple renewal cycles of the car, which is also part of the circular economy concept we're very proud of and the hundred percent recyclability

of the exterior top left on slide number nine gives rise to low cost sustainability across lifecycle but more importantly peace of mind

for customers. The tech advantages are very, very unique and advanced powertrain designed to last about a million miles and here credit

goes to our supplier, Bosch, I'm sure you know them all.

They deliver to most of the world. This particular powertrain with

a peak power around 85 kilowatt-hour per e.GO. On this car, which is a four-seater, provides a very, very unique sporty driving dynamic.

The car is designed with a slightly higher sum of gravity so when you sit inside, even though it's an urban car, you'll have a…

SUV would be an abuser word in a sales pitch. It's not an SUV but it's a crossover feeling that you have, and of course the G-force we

have created in this car, the lateral G-force equal to call it those car. So funky drive, very sporty yet provides absolute comfort and

space for your urban needs.

On page number 10, you also will see that while we try to do all

of this, we do not compromise or torture the customers in terms of connectivity and the touch and feel. So the car comes in its own class

with one of the largest displays that industry provide, 23 inches, the Apple car play, Google play connectivity and so on and so forth.

And not only that, we have also introduced e.GO connect app, which is our proprietary digital platform that allows also car sharing across

user share, lock and unlock, so on and so forth. But those are not something that I would say are extraordinary detail features that we

just packed into the car.

This was the right part of the product and you may rightfully ask,

great, we understand, so what? It all boils down to cost and CapEx because as we all have seen from the evolution somewhat painfully in

the automotive industry, particularly in the EV last five years, if your cost is not low, if your CapEx is not low, ultimately it doesn't

matter how beautiful the product is, it will be a painful enterprise journey. So our focus primarily has been on bring down the cost as

associated with the car, the parts and the design and the development as well and so forth. Use off-the-shelf components to the extent

possible which is what Tesla did at the beginning very successfully, try to standardize and simplify and use smart skateboard platforms

that at the beginning I alluded to enabling multiple or a number of products and derivatives out of one platform.

That also brings down big development costs because that's being

divided on number of platforms that are being large and of course taking advantage of great partnerships. As you see on the slide, we

work with a lot of tier one suppliers in the industry as our suppliers and not only does that give us the opportunity to take advantage

of the quality and the reliability they have, but also you take advantage of the economy scale because they have solved the equation around

some of their standardized parts by creating the scale and just good purchase, some of those parts. Anything that has technology and a

proprietary patent is being done by us at e.GO and anything which is a complimentary product. We very happily look at the industry, find

the best in class, best cost and our talent and ability is to integrate that like the open architecture that we've sort of structured

around the car and the interchangeability also gives us the flexibility to navigate when you have supply chain issues.

On slide number 12, you see what I described in terms of the differences

between the production concept and process in the automotive industry versus e.GO and I think the slide is speaking loud enough in terms

of comparison, the four step process versus two and the part that I left for this slide particularly was when you look at our assembly

hall, again, you will see that we have tried to reimagine the assembly so we did not go with the usual overhang structure with the lifting

process. We have gone with autonomous [inaudible] on the floor, magnetically guided, all of them controlled through our overall neural

network called internet of production with a cycle time around 10 minutes, 28 stations. So in 280 minutes you basically go through the

entire process. What also comes out of this disruptive way of looking at production is the scale. So our MicroFactories are standardized

with 30,000 cars per year production capacity and for that you basically require a space around give or take a hundred thousand square

meters.

This is particularly relevant as you try to take advantage of the

decentralized growth which is in our simplified terminology is copy pasting micro factors in different parts of the world. You can fit

yourself into available industrial zones, you can take advantage of the emerging or developing regions where the employment or unemployment

is a topic and therefore there are incentives being provided above and beyond and more importantly you can even repurpose brand field

facilities to get in there because our assembly hall is only 17,000 square meters in a U-shape format. And that of course gives you an

abundance of freedom in terms of the choices you have to make.

On slide number 13, you see what I referenced to. This is the MicroFactory

in Aachen, it looks more like a semiconductor facility and by the way, when you come and walk inside in terms of the cleanliness, the

noise level and also the operability, you may ask a few times the question, so is this really a production facility? Yes, it is and there's

something very important. The IT architecture that we've introduced to the industry, we call it the internal production in combination

with our smart data layer and connectivity allows us to even connect the tools in a way that you can sort of prevent them from human error.

Every tool is connected to the digital motherhood for the lack of term and the torque to be applied on a bolt, nut on the assembly line,

all of them are pre-configured and controlled. So a worker typically cannot apply too much or too less torque and if for whatever reason

that happened, the digital trace of that fault is on the digital twin of that car, which is on the digital twin of that shift and so on

and so forth.

So the traceability, quality control and also lifecycle management

has really become very different. In terms of replicability, of course, we are very, very excited about what opportunities are before

us. One part is, and I had the pleasure today to be in Berlin in a conference between two countries, Germany and another country in which

the minister of investment from that country mentioned something which is actually at the forefront of our strategy. When you look at

creating industrial development, employment opportunities and integration, automotive and automotive clusters are at the forefront of

GDP per dollars of investment given regards to the employment opportunity to create the exports and the integration that they do up and

downstream, the ability to do that for a fraction of CapEx and for a fraction of time using our disruptive MicroFactory is also something

that we consider to be one of our products.

So while you look at e.GO as a potential battery electric car manufacturer

out of Germany, and yes, we produce a car that you may or may not like it and we fully respect that. The company has another product which

is exporting its production technology. Have we done this? Yes, successfully and by now, twice. Outside of Germany, North Macedonia, contract

signed, government announced and groundbreaking was successfully held, construction is nearing start. Bulgaria is also a work in progress

and in the meantime we've received multiple requests from variety of countries emerging and otherwise that they're actually inviting us

to bring the production facility there and given the production capacity is not huge, the cannibalization risk you see with Giga or large

factories does not exist. 30,000 in some cases, not even enough to feed the potential demand in one region or one cluster.

And of course when we take these MicroFactories to different countries,

there are different models but usually we of course, take advantage of the good license fee, the royalty that comes with the car and the

partnership and a lot of incentives that I'm sure you've seen under the IRA and that potential program also exists in other parts of the

world in different shapes, forms and names and of course, we unlock that potential as we move forward.

A great example is when we look at our facility in Macedonia, ultimately

if I simplify that the incentives pay for the entire construction while we maintain a hundred percent ownership. So in terms of capital

deployment, we significantly optimize, reducing the amount of capital that actually e.GO needs to put forward simply leveraging our technology

as a contribution and maintain a hundred percent control. So that second product, the production technology is a very, very important

pillar and of course our ability to pivot around different products between urban commercial delivery, so on and so forth, larger, smaller,

gives us the chance to also optimize product roadmaps across different parts of the world. Last but not least is our focus on the customers.

We of course believe the world has changed and the consumers are a lot more connected, a lot more focused and a lot more aware. So we

take advantage of an omnichannel direct to consumer.

However, we do not fool ourselves by thinking the answer is only

digital so you do not or you should avoid all the physical touchpoints. However, there is one common theme in everything you see we do

as we go and of course the juries are still out, but we believe that's the right approach and that's significantly reduced the capital

required for the business. If and when we are a grown up enterprise, I think ROCE would be the only thing we look at a business in terms

of business metrics because that provides for the best value or best judgment in terms of value for money as we look at a company or an

organization in how we deploy capital to deliver return. Same applies to our go-to-market strategy. We either partner and we've seen the

name Amazon and will come in terms of leveraging that platform because ultimately battery electric cars in 2023 are nothing but connected

devices.

So as far as we are concerned, we are in the business of consumer

electronics and of course a platform for that and that's why you've seen us also in CES with Sibros, a company that Google invested in

terms of offering the future of connected mobility in the urban environment. So, number one, taking advantage of e-commerce platforms.

Number two, taking advantage of our own digital platform with proprietary e.GO connect app and the direct to consumer digital shop. We

also have partnered with a number of sales partners. These are not dealers in the traditional industry service for the brick and mortar,

very expensive lane on our balance sheet rather it's on their part and they collaborate with them around a sales agency model. And last,

but not least, is we basically incorporated the concept of Brand Store, one or two in prime locations in key cities in order for our customers

to get an opportunity to touch and feel, understand the technology and connect with the brand.

In terms of the vision, we see that as on the slide number 14 down

below and the two pictures down below also show you what I told you about the panel exchange. For example, you see the panels are sort

of hanging in the... This is a Brand Store in Berlin, this is actually next to Apple store in Berlin. When you walk in, you see different

panels are sort of hanging over from the ceiling. Customers can go through the app, pick, choose the color if the car had the damage,

if that was the same one or otherwise, and then basically move on.

And on top of that we also are very much aware of the fact that as

many of you haven't heard about us until today, we do need to work on our brand recognition and brand awareness. For that reason we have

signed Neymar Jr., the Brazilian football sensation as the brand ambassador and subsequent to the closing of the public market transaction,

once we get that homework and administrative work done, you will see him appearing and beginning to basically push for more brand recognition

and elevating the story of e.GO in terms of sustainability.

The common theme with Neymar Jr. is sustainable on and off the pitch,

which is something that we are going to take advantage of. Huge attention at the back of World Cup came to football and the commercialization

that you see comes at the back end of that process. So we're going to take advantage of that and build a little bit momentum as we go

forward. Let me pause here and I think Jon, probably that's a good time to open for questions.

Jon Windham:

Yeah, perfect. Ali, thank you. Ben, can you provide instructions

on assistance involving any questions on the call?

Ben:

Certainly, thank you. Allow me to inform our audience if you wish

to ask a question, please press *1 on your device. Thank you.

Jon Windham:

Perfect. Then feel free to interject as people ask questions. I'll

get the conversation started. Ali, thank you for the presentation. It's really interesting. I have a big picture question. When you sort

of think about where e.GO might be in five years, how do you think about the split in revenue or value of the company between actually

making and selling cars and then actually making and selling the process by which you make cars, right? The licensing and things like

that. Just more thought about how the relative size of those two opportunities.

Ali Vezvaei:

That's a great question and I would need to be careful around not

suggesting any projections but let's say on a denominated basis as we move forward and the company grows, obviously, and it's very simple

to calculate, each MicroFactory has around 30,000 car per annum capacity. Let's say give or take average price of the car, 25,000, 26,000

euros. That gives you around a billion dollars per MicroFactory. The speed of rolling out the MicroFactories with the number of MicroFactories

that we have in the backlog will give the company a faster grow in revenue as a share of product sales. However, what the sales of our

technology and licensing would do or the contribution thereof to our business is an over proportionate help on the bottom line because

those technology transfers, whether in form of license fees or royalties per car sold are immediately trickling down to the bottom line

even for the factories that we have sort of already in the backlog to be built in let's say Macedonia or in Bulgaria.

Therefore, to answer your question, I think the lion’s share

of our revenue as we grow will continue to come from the sales of the car. There will be a makeup on the positive side on the revenue

from sales of technology and an over proportionate of course boost on the bottom line simply because that top line trickle goes down directly

to the bottom line.

Jon Windham:

Got it. Thank you for that. And maybe, you actually answered my next

question and that answer on the average selling price of the car, I think you said 25,000 to 26,000 Euros?

Ali Vezvaei:

Average, yeah.

Jon Windham:

Yeah, average. I was wondering to just talk a little bit about the

direct competitors that are in that both sort of traditional ICE cars that you're competing against at that price point or against sort

of better EV offerings.

Ali Vezvaei:

That's a great question, thank you. Let me answer that question in

two dimensions. First of all, looking at the space, the urban segment, I must admit we are very fortunate that most of the other OEMs

have decided to focus on competing, where actually Tesla took the game. So if you look at the product roadmap that have been rolled out

by mostly OEMs over the last couple of years, they all have sort of abandoned the urban environment and decided to redirect their products

to compete exactly where Tesla is, which is, I will call it for the lack of any better term, mid to high end, larger cost, more luxury,

higher price. Of course, that left a very interesting wide spot for us because don't forget the first ban on ICE starts in the cities,

London, Frankfurt, Hamburg, you name it.

So first we need to solve that

equation of course while at $35,000 a car, that is a solution, that's not a solution for everybody and particularly not in Europe given

regards to the fabric of the society and also the architecture of the cities with relatively narrow roads, smaller parking spots and

a lot of issues around traffic. That's one point. The second part, so the space has enlarged or has been enlarged for us, thanks to call

it focused by the other OEMs being taken away somewhere else. So we have a wide spot here. A great testament to that is MINI closed down

the EV in the UK, public knowledge. Smart closed down the facility in Germany, also public knowledge and do not produce there. Volkswagen

discontinued the car in that segment twice. Volkswagen also abandoned the car that they wanted to introduce in 2024-25.

I'm sure you've seen Tesla's technology date. There is no Tesla Model

2 at least for now. So that gives us a very nice niche but quite sizable market and they have engaged Roland Berger, largest in the automotive

industry. They have done that work for us and there are millions of opportunities here, particularly at the back of conversion. Now, I

answer your question from a sales price point of view, in the absence of the economic advantages, it's very difficult to compare an EV

with a competitor ICE, whether the Tesla or for e.GO, it's the same equation. Now, when you look at the subsidies and the incentives that

are being introduced, for example in Germany or in across Europe as an average you have around 6,000 euros of government subsidies on

each electric cars and they continue for number of years. So if you take our car and the 25-26,000 was including the VAT, deduct from

that the 6,000, a customer basically cash out is around 18-19,000 euro.

At that price point, it's a very competitive product. And then this

is to answer your question in a mix between ICE and the EV, if I just tried to compare with the other BEVs, we are actually one of the,

call it more competitive ones because if you sort of list the existing ones, even the ones which are to be discontinued, the starting

price in that segment for a Smart Fortwo is around 21,000 euros. And that's a two seater, very different car on the 10 kilometers of range.

And then you work your way up and then you come to somewhere around Renault Zoe and then little Cooper Electric and so on and so forth.

But the price starts at a different digit.

So we sit constantly, I would say

in the lower quartile in terms of price, but offering a German made, German technology value for money with very distinct features, which

for example, if one day we decided we want to do the battery swap as a subscription service and we directed that to one of the partners

that has actually come forward and said, "look, I want to do this", meaning that's not an equals balance sheet, take out another

few thousand euros out of the car price and a customer subscribe to an energy delivery program. Ultimately you're looking at a very,

very different price point for the car. So are they comfortable? Yes, for that segment we think we have a fair chance to compete and

deliver value.

Jon Windham:

Got it. Thank you. I want to talk a little bit about customer acquisition

because I think it's a really interesting phenomenon that's happened particularly around EVs. Tesla started out and obviously dominates

the EV market in the United States, at least the early days of it today. And they don't advertise. I think a lot of people thought at

that point or at least traditional advertising, well, they can do that because of Elon Musk and then along came Rivian, which has had,

regardless what you think of a stock, a lot of the success getting customers orders with a straight social media, word of mouth advertising.

So just wondering to get a sense of where your customer leads come from, how many are sort of direct to consumer and how you see the evolution

of customer acquisition in the auto industry that seems to be going parallel track and coincidental at the same time as the evolution

of EVs?

Ali Vezvaei:

It's a very profound question and I think you already addressed two

very distinct players in that market. Tesla, they don't need to do marketing because the chief executive is a very, very successful marketer

as well, so that covers it. Rivian not only they took advantage of the direct to consumers and so on and so forth, but also the product

was one of the first pickup trucks that sort of got electrified. Look at the culture of mobility in US. People liked that kind of car.

It was an intriguing one and of course the partnership with Amazon and investment was a big bang because Amazon in itself is a marketing

platform. Now, if you take those two, I would say very distinct parts of the spectrum out of the process and look at all the normalized

one in between, what we have seen on the have data that we are analyzing because we already have by now, more than 11,000 customer reservations

so on and so forth in the mix.

We intentionally asked Neymar, our brand ambassador, not to post

anything like e.GO because we are still very, very Germanic when it comes to a promises it is a promise. When we signed with a customer

and we say you receive your car in 90 days, you receive your car in 90 days, not 91, not 109, 90 days. So we start that process of pumping

the news and pushing the brand out as soon as we are ready to actually cover all these orders and deliveries that we are already dealing

with. However, when we launched our 2022 model in Berlin, which was a few months back, he just did one Instagram post, not talking about

a car, just saying, "what an exciting night in Berlin". And we had between that night and I think about 48 hours later, roughly

3000 customers signed.

So what we see is the power of social media with digital platforms

even for the lack of any better term, what TikTok and generation TikTok has done to the awareness and the followership so on and so forth

in conjunction with a competitive and compelling price point for a product does a big chunk of the work that in the past the dealership

and the advertisement and so on and so forth used to do.

Does it mean it is a hundred percent replacement? I don't think we

have enough data to say you can immediately retire everything because we are neither a Tesla nor do I think that the US consumer culture

is comparable to what you see in other parts of the world. However, is a big fraction of your spending going to be focused on making your

product better and focused on the direct consumer digital channels? I think the answer to that would be, yeah, more likely.

Jon Windham:

Perfect, and we're getting close to the top of the hour here. Ben,

quick check on the line and then I have one email question I want to get to.

Ben:

We have received no questions on

the audio line.

Jon Windham:

Okay, perfect. We only a couple

minutes left. A couple different people asked this question. Thoughts about entering the US market?

Ali Vezvaei:

Number one, it's quite a sizable market that it's not ignored. Number

two, becoming a listed entity in very short period of time. We also think always to our own corporate strategy to have a US footprint.

And number three, and this is where you see why I was so excited in taking a lot of your time talking about the production technology

and MicroFactory, having a MicroFactory in which the core CapEx is two digit million dollars. We purposely did not put all the numbers

in presentation, but just to give the audience a flavor of why we are so excited as opposed to when you look at the industry with about

a billion CapEx and the ability to introduce the MicroFactory and bring it to commissioning in about 18 months, we have decided to actually

bring a MicroFactory to the US subsequent to closing our public market transaction.

We have started the conversation with a number of states. The Inflation

Reduction Act is very, very encouraging and more importantly, what we also do is now back to our Smart Skateboard platform. The car that

we introduced to US is a larger, slightly bigger version of the same car. However, we stay true to our vision. We believe urban mobility

and sustainable mobility is the name of the game also for the US, particularly when you see what's happening in California with the grid,

the energy, the queues and so on and so forth. So we want to be different. We want to address this great market, but coming from offering

a very different set of services to remove the pain and the concern that the consumers have.

Jon Windham:

Perfect. Ali, thank you so much for that. As we're at the top of

the hour, we're going to start to wrap up, but I will turn it back over to you, Ali, for any final closing comments. Before I do that,

thank you, Ben, the operator for helping us out today as well as all the participants for the email questions. Appreciate it. Quick advertisement.

We have a lot of calls in the UBS Global Energy transition call series in March. I'll just highlight the ones coming up this week. Tomorrow,

we'll be talking carbon negative fuels with Aon blue, intelligent energy storage with Electriq power on Thursday and on Friday, we'll

have Shoal's Technologies, SHLS, I will have their management team on for a fireside chat on Friday. If you need links to any of those

calls or for any of the other calls later in the month, please do email me. And with that, Ali, I really enjoyed the story. I look forward

to tracking your progress and tracking the closing of the transaction. I will leave the final words to you. Thank you so much for being

here today.

Ali Vezvaei:

Thank you, Jon. And also thanks to your audience for giving us the

time and the opportunity to share the e.GO story. Just wish us all the luck we can get. Thank you.

Ben:

Thank you for joining everyone. That concludes your conference. You

may now disconnect. Please enjoy the rest of your day. Goodbye.

Important

Information about the Business Combination and Where to Find It

In connection

with the proposed business combination (the “Business Combination”) between Athena Consumer Acquisition Corp. (“Athena”)

and Next.e.GO Mobile SE (“e.GO”), Next.e.GO B.V., a wholly-owned subsidiary of e.GO (“TopCo”) intends to file

with the U.S. Securities and Exchange Commission’s (“SEC”) a registration statement on Form F-4 (the “Registration

Statement”), which will include a preliminary prospectus and preliminary proxy statement. This communication is not a substitute

for the Registration Statement, the definitive proxy statement/prospectus or any other document that Athena will send to its stockholders

in connection with the Business Combination. Investors and security holders of Athena are advised to read, when available, the proxy

statement/prospectus in connection with Athena’s solicitation of proxies for its special meeting of stockholders to be held to

approve the Business Combination (and related matters) because the proxy statement/prospectus will contain important information about

the Business Combination and the parties to the Business Combination. Athena will mail the definitive proxy statement/final prospectus

and other relevant documents to its stockholders as of a record date to be established for voting on the Business Combination. Stockholders

will also be able to obtain copies of the proxy statement/prospectus, without charge, once available, at the SEC’s website at www.sec.gov

or by directing a request to: 442 5th Avenue, New York, NY, 10018.

Participants in the Solicitation

Athena, e.GO,

TopCo and their respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed

to be participants in the solicitation of proxies of Athena’s stockholders in connection with the Business Combination. Investors

and security holders may obtain more detailed information regarding the names and interests in the Business Combination of Athena’s

directors and officers in Athena’s filings with the SEC, and such information and names of e.GO’s directors and executive

officers will also be in the Registration Statement to be filed with the SEC by TopCo, which will include the proxy statement of Athena

for the Business Combination.

Forward Looking Statements

This

communication includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the

United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such

as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,”

“expect,” “anticipate,” “believe,” “seek,” “target”, “may”, “intend”,

“predict”, “should”, “would”, “predict”, “potential”, “seem”,

“future”, “outlook” or other similar expressions (or negative versions of such words or expressions) that predict

or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are

not limited to, statements regarding Athena, e.GO, and TopCo’s expectations with respect to future performance and anticipated

financial impacts of the Business Combination, the satisfaction of the closing conditions to the Business Combination, the level of redemptions

by Athena’s public stockholders, the timing of the completion of the Business Combination and the use of the cash proceeds therefrom.

These statements are based on various assumptions, whether or not identified herein, and on the current expectations of Athena, e.GO,

and TopCo’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative

purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction

or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ

from assumptions, and such differences may be material. Many actual events and circumstances are beyond the control of Athena, e.GO,

and TopCo.

These forward-looking

statements are subject to a number of risks and uncertainties, including: (i) changes in domestic and foreign business, market, financial,

political and legal conditions; (ii) the inability of the parties to successfully or timely consummate the proposed Business Combination,

including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that

could adversely affect the combined company or the expected benefits of the proposed Business Combination or that the approval of the

stockholders of Athena or e.GO is not obtained; (iii) failure to realize the anticipated benefits of the proposed Business Combination;

(iv) risks relating to the uncertainty of the projected financial information with respect to e.GO; (v) the outcome of any legal proceedings

that may be instituted against Athena and/or e.GO following the announcement of the Business Combination; (vi) future global, regional

or local economic and market conditions; (vii) the development, effects and enforcement of laws and regulations; (viii) e.GO’s

ability to grow and achieve its business objectives; (ix) the effects of competition on e.GO’s future business; (x) the amount

of redemption requests made by Athena’s public stockholders; (xi) the ability of Athena or the combined company to issue equity

or equity-linked securities in the future; (xii) the ability of e.GO and Athena to raise interim financing in connection with the Business

Combination, including to secure an e.GO IP-backed note; (xiii) the outcome of any potential litigation, government and regulatory proceedings,

investigations and inquiries; (xiv) the risk that the proposed Business Combination disrupts current plans and operations as a result

of the announcement and consummation, (xv) costs related to the Business Combination, (xvi) the impact of the global COVID-19 pandemic

and (xvii) those factors discussed below under the heading “Risk Factors” and in the documents filed, or to be filed, by

Athena and Topco with the SEC. Additional risks related to e.GO’s business include, but are not limited to: the market’s

willingness to adopt electric vehicles; volatility in demand for vehicles; e.GO’s dependence on the proceeds from the contemplated

Business Combination and other external financing to continue its operations; significant challenges as a relatively new entrant in the

automotive industry; e.GO’s ability to control capital expenditures and costs; cost increases or disruptions in supply of raw materials,

semiconductor chips or other components; breaches in data security; e.GO’s ability to establish, maintain and strengthen its brand;

e.GO’s minimal experience in servicing and repairing vehicles; product recalls; failure of joint-venture partners to meet their

contractual commitments; unfavorable changes to the regulatory environment; risks and uncertainties arising from the acquisition of e.GO’s

predecessor business and assets following the opening of insolvency proceedings over the predecessor’s assets in July 2020; and

e.GO’s ability to protect its intellectual property. If any of these risks materialize or our assumptions prove incorrect, actual

results could differ materially from the results implied by these forward-looking statements.

There

may be additional risks that neither e.GO nor Athena presently know or that e.GO and Athena currently believe are immaterial that could

also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect

e.GO’s and Athena’s expectations, plans or forecasts of future events and views as of the date of this communication. e.GO

and Athena anticipate that subsequent events and developments will cause e.GO’s and Athena’s assessments to change. However,

while e.GO and Athena may elect to update these forward-looking statements at some point in the future, e.GO and Athena specifically

disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing e.GO’s and Athena’s

assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking

statements.

No Offer or Solicitation

This communication

is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities, or

a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an applicable exemption

from the registration requirements thereof.

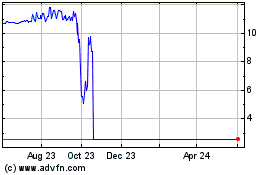

Athena Consumer Acquisit... (AMEX:ACAQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Athena Consumer Acquisit... (AMEX:ACAQ)

Historical Stock Chart

From Dec 2023 to Dec 2024