ETF Trading Report: China, Brazil ETFs In Focus - ETF News And Commentary

August 02 2012 - 12:03PM

Zacks

American stocks faced another rough session during Thursday

trading as a lack of action from the ECB kept a gloomy outlook over

the market. European Central Bank President Mario Draghi failed to

crush brewing worries over issues in the European debt market and

did not announce any new measures, leaving many investors

disappointed in Thursday trading.

Thanks to this lack of ECB action, broad European markets

slumped heavily on the day, with Italian and Spanish markets

leading the way on the downside. Meanwhile, in the U.S., all the

major benchmarks were lower, although only modestly so with the Dow

and S&P 500 falling by about 0.7% and the Nasdaq slumping by

0.4%

In terms of sector performances, basic materials and financials

were the biggest losers, with key companies in both of these

segments falling heavily on the day. Services, health care, and

utilities held up better than most, while tech delivered another

mixed performance.

Currency markets did favor the greenback on the day, with the

biggest moves coming against the euro and the yen. However, this

paled in comparison to the bond market, as American and German

10-year securities both saw yields fall, while Italy and Spain both

experienced a 38 basis point increase in their respective benchmark

securities (see Three Currency ETFs Outperforming the Dollar).

Given this broad risk off trade, many commodities were under

pressure during Thursday trading. Natural gas was the biggest

loser, slumping by over 8% thanks to a weak storage report while

metals, and most of the softs followed natural gas lower for the

day.

In ETF trading, volume was relatively in line with historic

averages, as modest trading was seen I a number of broad index ETFs

as well as in the commodity and foreign market spaces. Light

trading, however, did impact some products in the leveraged space,

broad commodity funds, and a few of the U.S. sector products as

well (read Escape Low Yields with These Three ETFs).

For one fund that saw outsized volume, investors can look to the

WisdomTree Drefyus Brazilian Real ETF (BZF). This

product usually sees about 42,000 shares in a normal session but

saw over 315,000 change hands during Thursday trading.

Interestingly, the vast majority of the volume was concentrated

in the final 90 minutes of the session, as BZF didn’t even trade

during at least an hour of the morning period. Still, BZF finished

the day down roughly 0.3% although the currency ETF did lose

another 1.8% after-hours (read The Comprehensive Guide to Brazil

ETFs).

This is somewhat surprising as some of the more popular Brazil

stock ETFs saw extremely light volume days suggesting that many are

looking to the real to play the increasingly troubled Brazilian

economy instead.

(Currently, BZF has a Zacks ETF Rank of 5 or ‘Strong Sell’)

Another segment which saw a great deal of volume during today’s

session was in the Chinese market, specifically in the case of the

Guggenheim China Technology Fund (CQQQ). This

product usually does less than 6,000 shares of volume in a normal

day but experienced just over 83,000 shares in activity during

today’s trading (see Forget FXI: Try These Three China ETFs

Instead).

This huge spike in volume wasn’t exactly positive in the product

as CQQQ lost just under 1.8% on the day, although it should be

noted that other Chinese ETFs also finished the Thursday lower as

well. However, CQQQ was definitely one of the biggest losers on the

day and could see more trouble if the Chinese economy continues to

appear weak in the coming months.

(see more in the Zacks ETF Center)

WISDMTR-BRZ RL (BZF): ETF Research Reports

GUGG-CHINA TEC (CQQQ): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

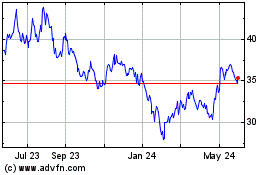

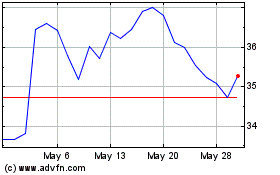

Invesco China Technology... (AMEX:CQQQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

Invesco China Technology... (AMEX:CQQQ)

Historical Stock Chart

From Feb 2024 to Feb 2025