India ETFs: Behind The Crash - Leveraged ETFs

December 05 2011 - 3:01AM

Zacks

Although many emerging markets have had a tough year, it is hard

to find more than a couple of nations that were as hard hit as

India. The world’s most populous democracy has seen extreme

pressure thanks to a variety of factors impacting its economy

including rampant inflation, slowing growth, and a weak currency.

While the inflation issue seems to be slowing down due in part to

the broader economic weakness, the currency issue is beginning to

become an even bigger problem.

The rupee has been facing extreme weakness in recent weeks

thanks in part to the broad risk-off trade in the marketplace as

well as concerns over monetary policy. Many are questioning the

country’s central bank and its ability to act to support the

currency while still keeping inflation in check and growth from

collapsing. This is already a problem as GDP growth was below 7% in

the most recent quarter while the rupee has fallen by about 14.2%

so far this year, making the currency the worst performer in all of

Asia in the time period (see HDGE: The Active Bear ETF Under The

Microscope).

While this currency weakness might be welcomed news in a number

of Asian nations, it is not so in India as the country is a huge

importer of energy products and an owner of a large current account

deficit. As a result, prices are remaining elevated and the

country’s borrowing costs are going up as well; yields on 10 year

Indian bonds have risen nearly 100 basis points on the year to just

under 8.85%. This is in stark contrast to other nations in the area

as both China and South Korea saw drops for their comparable bonds,

putting further pressure on the rupee in comparison.

All of these factors have combined to have a devastating effect

on the country’s stock markets, pushing Indian securities to sharp

losses on the year. This tumble was also far worse than other

emerging countries in Asia, and especially so when compared to

Southeast Asian nations. These nations have managed to hold steady

so far in 2011 and could continue to serve as an alternate

investment destination for investors looking for emerging Asian

assets (see Inside The SuperDividend ETF).

Yet for investors still bullish on India or for those looking to

dollar-cost average into the space, now could make for an

interesting time to buy securities in the country. Indian firms

have been beaten down but many still have strong fundamentals and

ultra-low P/E ratios. For these investors, or for those seeking to

make a short play on the beaten down Indian market, we take a

closer look at three popular India ETPs and how they have held up

in this difficult time:

WisdomTree India Earnings Fund (EPI)

This fund is the single most popular ETF tracking the India

market with close to $800 million in AUM. EPI also does solid

volume of close to three million shares a day giving investors a

very liquid way to play the Indian market. Investors should also

note that the product doesn’t track a market cap-based index,

instead focusing in on the WisdomTree Earnings Index. This

benchmark only includes firms that are profitable and can be bought

by foreign investors, weighting firms by earnings rather than

market capitalization (read the November ETF Asset Inflow

Report).

This method produces a relatively-value laden portfolio of

securities with large and giant caps dominating the list of top

holdings. Firms such as Reliance Industries and Infosys (INFY)

receive the two top allocations, while from a sector perspective,

financials, energy, and technology take the top three spots making

up nearly 54% of the portfolio. Despite this large cap focus,

however, losses have still been pretty severe for EPI as the fund

has lost close to one third of its value since the start of the

year including close to 10% in the past month. The fund has been

trending higher in recent sessions, although it clearly has a long

way to go to get back to break-even.

Market Vectors India Small-Cap ETF (SCIF)

While large caps are an intriguing way to play the Indian

market, small caps, with their greater growth potential, could be

an interesting choice as well. One of the most popular funds in the

space tracking the Indian market is SCIF from Van Eck. The fund,

which has volume of about 70,000 shares a day and AUM of just under

$38 million, tracks an index of small cap securities that are based

in India, holding about 125 securities in total.

In terms of sectors, the fund offers a different experience than

its large cap counterparts, focusing on industries such as consumer

discretionary (22.8%) and industrials (22.4%). Yet with that being

said, the fund does also afford a double digit weighting to

financials and materials while providing the tech sector with a

close to 10% weighting as well. Since the product consists of small

caps, it is often time more volatile than its large cap

counterparts outgaining them on the upside but also suffering

greater losses when markets are tumbling. This was true once again

in 2011 as SCIF has fallen by close to 47% on the year including a

nearly 15.8% loss in the past month alone. Unfortunately, the

product hasn’t come back as strong as its large cap-focused

counterparts in recent days either, suggesting that concerns may

still exist for consumer companies and other sectors that are more

predisposed to pint-sized securities (read Forget FXI: Try These

China ETFs Instead).

EGShares India Infrastructure Fund (INXX)

For investors seeking a truly unique way to play the Indian

economy, it is tough to beat EGShares’ INXX. The fund tracks the

Indxx India Infrastructure Index which is a free-float market

capitalization weighted stock market index comprised of 30 leading

companies that Indxx, LLC determines to be representative of

India's infrastructure industries. Given the great need for more

roads, airports, and general infrastructure in the country, this

could be a lower risk way to play the economy while also giving

investors higher growth potential if the Indian government spends

as much on the sector as some are forecasting (Africa ETFs: Three

Ways To Play).

Investors should note that INXX holds just 30 securities in its

basket, charging investors a somewhat steep 0.85% expense fee for

its services. Top industry weightings go to construction and

electricity which both make up about 20% of assets while mobile

telecoms and industrial metals & mining combine for another

quarter of assets as well. Unfortunately, given the weakness in the

Indian economy and concerns over inflation, it hasn’t been a very

good time to be invested in the space as the fund has lost close to

36.4% year-to-date. Losses have been significant over the short

term as well, as INXX has lost close to 12% in the past month,

although it has started to bounce back in the beginning of December

and could push higher if the Indian economy finally stabilizes.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

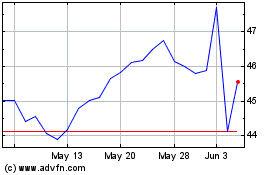

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Dec 2024 to Jan 2025

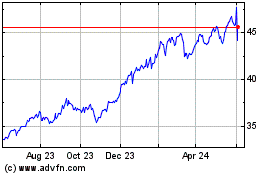

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Jan 2024 to Jan 2025