false

0000033533

0000033533

2024-06-10

2024-06-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D. C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report

June 10, 2024

ESPEY MFG & ELECTRONICS CORP.

(Exact name of registrant as specified

in its charter)

| New York |

|

001-04383 |

|

14-1387171

|

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

233 Ballston Avenue, Saratoga Springs, New York 12866

(Address of principal executive offices)

(518) 584-4100

(Registrant’s telephone number, including area code)

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock $.33-1/3 par value |

ESP |

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 6, 2024 the Company entered a new Employment

Agreement with David O’Neil, its President and Chief Executive Officer, for a term through December 31, 2026. The term will automatically

renew for an additional one year unless either party gives notice at least 120 days prior to that date of an intention not to renew.

Mr. O’Neil’s Employment Agreement dated

January 1, 2022 had expired on December 31, 2023.

The new Employment Agreement continues Mr. O’Neil’s

current base salary of $300,296, which is subject to annual review (but with no decrease) by the Board.

In addition, Mr. O’Neil is entitled to an

annual performance-based cash bonus comprised of three components, with the maximum amount payable not to exceed his annual base

salary. This is unchanged from the prior agreement. The first component is purely discretionary based upon an annual performance

assessment and may not exceed 50% of the base salary. The second component is based on the increase in combined sales plus backlog

over the average of the prior three fiscal years, times 0.5% (one half of one percent), and may not exceed 50% of base salary. The

third component is based on the increase in operating earnings over the average of the prior three fiscal years, times 5% (five

percent), and may not exceed 50% of base salary.

If Mr. O’Neil is terminated without cause, or

if he voluntarily terminates his employment for “good reason”, he is entitled to severance pay equal to 9 months of his base

salary. If he voluntarily terminates his employment incidental to a “change of control”, he is entitled to severance pay equal

to 18 months of his base salary.

Item 8.01. Other Events.

On June 6, 2024 the Company issued a press

release announcing Mr. O’Neil’s new employment agreement, the appointment of a new Assistant Corporate Secretary and the

declaration of a dividend. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: June 10, 2024 |

|

ESPEY MFG. & ELECTRONICS CORP.

|

| |

By: |

/s/ Katrina Sparano |

| |

|

Katrina Sparano

Principal Financial Officer |

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT,

dated as of June 6, 2024 (the “Agreement”), is entered into by and between ESPEY MFG. & ELECTRONICS CORP., a New York

corporation (the “Company”), and DAVID O’NEIL (the “Executive”).

WHEREAS, the Executive

has been serving the Company as its President and Chief Executive Officer since January 1, 2022, and the Board of Directors of the Company

desires to continue the services and employment of the Executive on behalf of the Company in such capacity, and the Executive is willing

to accept the continuation of his employment on the terms and conditions set forth herein (the “Employment”).

NOW, THEREFORE, in consideration

of the mutual covenants contained herein, the parties hereto agree as follows:

1. Employment

Term. Except for earlier termination as provided for in Section 5 hereof, the Company hereby agrees to employ the Executive, and the

Executive hereby agrees to be employed by the Company, subject to the terms and provisions of this Agreement, for the period through December

31, 2026 (the “Employment Term”); provided that the Employment Term shall be extended for an additional period of one

year, unless either party gives prior written notice to the other at least one hundred twenty (120) days before the end of the then current

term not electing to renew this Agreement.

2. Extent

of Employment.

(a) Duties.

During the Employment Term, the Executive shall serve as President and Chief Executive Officer of the Company. In his capacity as

President and Chief Executive Officer, the Executive shall report solely to the Company’s Board of Directors (the “Board”)

and shall perform such senior executive duties, services, and responsibilities on behalf of the Company consistent with such position

as determined by the Board and as may be assigned to the Executive from time to time by the Board. During the Employment Term Executive

shall continue to serve on the Board without additional compensation and subject to paragraph 5(d) herein.

(b) Exclusivity.

During the Employment Term, the Executive shall devote his full business time, attention, and skill to the performance of such duties,

services, and responsibilities, and shall use his best efforts to promote the interests of the Company, and the Executive shall not engage

in any other business activity without the approval of the Board. The Board may grant or withhold its approval in its exclusive discretion.

The Executive shall be permitted to serve on industry, trade, civic or charitable boards or committees, and engage in charitable activities

and community affairs to the extent such service and activities do not interfere with his Employment.

(c) Place

of Employment. During the Employment Term, the Executive shall perform his services hereunder in, and shall be headquartered at,

the principal offices of the Company in Saratoga Springs, New York, except for business travel related to business and activities of

the Company.

3. Compensation

and Benefits.

(a) Base

Salary. During the Employment Term, in full consideration of the performance by the Executive of the Executive’s obligations

hereunder (including any services as an officer, employee, or member of any committee of any affiliate of the Company, or otherwise on

behalf of the Company), the Executive shall receive from the Company a base salary (the “Base Salary”) at an annual

rate of $300,296 per year, payable in accordance with the normal payroll practices of the Company then in effect. The Base Salary shall

be subject to annual review by the Board or the Compensation Committee of the Board. Pursuant to such annual review the Base Salary, as

then currently in effect, may be adjusted (but not decreased), at the discretion of the Board.

(b) Annual

Bonus. During the Employment Term, the Executive shall also receive, in respect of each fiscal year during which the Employment Term

is in effect, a performance-based cash bonus (the “CEO Annual Bonus”) as determined and payable in accordance with

Exhibit A hereto. The CEO Annual Bonus is in lieu of any other bonus program that may be available to other management employees of the

Company.

(c) Equity

Compensation. The Executive shall be a participant in the Company’s Employee Retirement Plan and Trust (“ESOP”)

in accordance with the terms and conditions of the ESOP. The Executive shall be entitled to the award of stock options or other stock-based

rights by the Board from time to time in its discretion.

(d) Benefits.

During the Employment Term, the Executive and his eligible dependents shall be entitled to participate in the employee health and

benefit plans, policies, programs, and arrangements as may be amended from time to time, on the same terms as senior executives of the

Company to the extent the Executive meets the eligibility requirements for any such plan, policy, program, or arrangement.

(e) 401(k)

Retirement. During the Employment Term, the Executive shall be entitled to participate in the Company 401(k) retirement plan on the

same terms as all other Company employees.

(f) Vacation.

During the Employment Term, four (4) weeks of paid vacation during each fiscal year to be used in accordance with the Company’s

policies in effect from time to time. Executive’s right to carry forward vacation time from year to year and/or be paid for unused

vacation shall be in accordance with the Company’s policies in effect from time to time.

(g) Expense

Reimbursement. In addition to and not in lieu of any other payments to be made to the Executive hereunder, the Company shall reimburse

the Executive for reasonable and documented business expenses incurred by the Executive during the Employment Term in accordance with

the Company’s expense reimbursement policies then in effect, including but not limited to all travel, lodging and meal expenses

in connection with Executive’s travel in connection with providing his services hereunder.

(h) Incorporation

of Incentive Compensation Recovery Policy. The terms and conditions of the Company’s Incentive Compensation Recovery Policy

adopted effective December 1, 2023 are incorporated in this Agreement as if set forth at length.

4. Withholding.

The Executive shall be solely responsible for taxes imposed on the Executive by reason of any compensation and benefits provided under

this Agreement, during the Employment Term and thereafter. All such compensation and benefits shall be subject to applicable withholding

as determined by the Company and the Executive shall cooperate with the Company, as necessary, to enable the Company to discharge its

withholding obligations.

5. Termination.

(a) Events

of Termination. The Executive’s employment with the Company and the Employment Term shall terminate upon the expiration of the

Employment Term or upon the earlier occurrence of any of the following events (the date of termination, the “Termination Date”):

(i) The

termination of employment by reason of the Executive’s death.

(ii) The

termination of employment by the Company for Cause.

(iii) The

termination of employment by the Company for Disability.

(iv) The

termination of employment by the Company other than for Cause.

(v) The

voluntary termination of employment by the Executive.

(b) Certain

Definitions. For purposes of this Agreement:

(i) “Cause”

means: as determined by the Board, (A) the failure of the Executive to perform his duties or his negligent performance of such

duties (other than any such failure due to the Executive’s physical or mental illness) that has caused or is reasonably expected

to result in injury to the Company or any of its affiliates; (B) the Executive having engaged in misconduct that has caused or

is reasonably expected to result in injury to the Company or any of its affiliates; (C) a violation by the Executive of a Company

policy that has caused or is reasonably expected to cause an injury to the Company; (D) the breach by the Executive of any of his

obligations under this Agreement; (E) failure by the Executive to timely comply with a lawful and reasonable direction or instruction

given to him by the Board; or (F) Executive having been convicted of, or entering a plea of guilty or nolo contendere to

a crime; provided however, notwithstanding the foregoing, that in the case of clauses (A)-(E), before the Company shall

have the right to terminate the Executive for Cause, (i) the Company shall first be required to give the Executive 10 days’

prior written notice (the “Notice Period”) of such action, which written notice shall set forth in the nature of Executive’s

alleged breach, and, if such action is capable of being cured, the Executive shall not have cured such action to the satisfaction of the

Company within the Notice Period; thereafter, the termination shall take effect with no further action required of the Company.

(ii) “Disability”

means: (A) the Executive’s disability as determined under the long-term disability plan of the Company as in effect from

time to time; or (B) if no such plan is in effect, the inability of the Executive to perform his duties, services, and responsibilities

hereunder by reason of a physical or mental infirmity, as reasonably determined by the Board, for a total of 120 days in any twelve-month

period during the Employment Term.

(iii) “Good

Reason” means (i) the assignment to the Executive of duties that are different from, and that result in a material diminution

of, the duties set forth in this Agreement; (ii) a reduction in the rate of the Executive’s Base Salary; (iii) a material

breach by the Company of this Agreement; (iv) failure to pay the CEO Annual Bonus when due; or (v) requirement by the Board

of Directors that the Executive relocate his personal residence more than forty (40) miles from Saratoga Springs, New York; provided

that the Executive shall have given the Company written notice specifying in reasonable detail the circumstances claimed to constitute

Good Reason within 30 days following the occurrence, without the Executive’s consent, of any of the events in clauses (i)–(v),

and the Company shall not have cured the circumstances set forth in the Executive’s notice of termination within 20 days of receipt

of such notice.

(iv) A

“Change of Control” shall be deemed to have occurred if (i) any “person” (as such term is used in Sections

13(d) and 14(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), other than a trustee or other fiduciary

holding securities under an employee benefit plan of the Company or a corporation owned directly or indirectly by the stockholders of

the Company in substantially the same proportions as their ownership of stock of the Company, is or becomes the “beneficial owner”

(as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company representing more than 50% of

the total voting power represented by the Company’s then outstanding voting securities, (ii) the stockholders of the Company approve

a merger or consolidation of the Company with any other business entity, other than a merger or consolidation which would result in the

Company’s voting securities outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by

being converted into voting securities of the surviving entity) at least 80% of the total voting power represented by the voting securities

of the Company or such surviving entity outstanding immediately after such merger or consolidation, (iii) the stockholders of the Company

approve a plan of complete liquidation of the Company or an agreement for the sale or disposition by the Company of (in one transaction

or a series of transactions) all or substantially all of the Company’s assets, or (iv) the Board of Directors, in its sole discretion,

determines that a change of control of the Company has occurred, whether or not any event described above has occurred or is contemplated.

(c) Cooperation.

In the event of termination of the Executive’s employment for any reason (other than death), the Executive shall cooperate with

the Company and be available to the Company for a reasonable period of time thereafter with respect to matters arising out of the Executive’s

employment hereunder or related to the Company’s business, whether such matters are business-related, legal, or otherwise.

(d) Resignation

from All Positions. Upon termination of the Executive’s employment for any reason, the Executive shall be deemed to have resigned

from all other positions with the Company including, without limitation, as an officer and director, as applicable.

6. Termination

Payments. The Executive shall be entitled to certain payments upon termination of his employment as follows:

(a) Termination

for Cause. In the event that the Executive’s employment is terminated for Cause, the Executive shall be entitled to receive

only: (i) any accrued and unpaid Base Salary as of the Termination Date; and (ii) all accrued and unpaid benefits

under any benefit plans, policies, programs, or arrangements in which the Executive participated as of the Termination Date in accordance

with the applicable terms and conditions of such plans, policies, programs, or arrangements (all of the foregoing, collectively, the “Accrued

Compensation”).

(b) Termination

for Death or Disability. In the event that the Executive’s employment is terminated pursuant to Section 5(a)(i) or 5(a)(iii)

hereof, the Executive shall be entitled to receive the Accrued Compensation.

(c) Termination

without Cause. In the event that the Executive’s employment is terminated pursuant to Section 5(a)(iv) hereof, the Executive

shall be entitled to receive: (i) the Accrued Compensation; (ii) the CEO Annual Bonus, as applicable, in accordance with

its terms; and (iii) severance pay (“Severance Pay”) equal to nine months of Base Salary at the rate in effect on the

Termination Date. Any Severance Pay under this Agreement shall be paid in equal installments in accordance with the Company’s regular

payroll practices, commencing on the first payroll date following the thirtieth day after the Termination Date.

(d) Voluntary

Termination by Executive. In the event the Executive voluntarily terminates his employment, the Executive shall be entitled to receive

only the Accrued Compensation. If the voluntary termination of employment is for Good Reason, the Executive shall be entitled to

receive (i) the Accrued Compensation, (ii) the CEO Annual Bonus, as applicable, in accordance with its terms; and (iii) Severance Pay

equal to nine months of Base Salary at the rate in effect on the Termination Date. If the voluntary termination of employment is contemporaneous

with a Change of Control (whether or not the Executive has Good Reason), the Executive shall be entitled to receive (i) the Accrued Compensation,

(ii) the CEO Annual Bonus, as applicable, in accordance with its terms; and (iii) Severance Pay equal to eighteen (18) months’ of

Base Salary at the rate in effect on the Termination Date.

(e) Release.

Notwithstanding any other provision of this Agreement, no Severance Pay or other benefits shall become payable under Section 6(c)

or the second or third sentences of Section 6(d) of this Agreement unless and until (i) the Executive executes a general release of claims

substantially similar to the form of release annexed hereto as Exhibit B, and such release has become irrevocable within 30 days following

the Termination Date, provided that the Executive shall not be required to release any indemnification rights that he may have

under the Company’s Certificate of Incorporation or By-Laws and (ii) the Executive fully complies with the Executive Covenants described

in Section 7.

(f) Full

Satisfaction. The payments to be provided to the Executive pursuant to this Section 6 upon termination of the Executive’s employment

shall constitute the exclusive payments in the nature of severance or termination pay or salary continuation that shall be due to the

Executive upon a termination of employment, and shall be in lieu of any other such payments under any plan, program, policy, or other

arrangement that has heretofore been or shall hereafter be established by the Company.

7. Executive

Covenants.

(a) Confidentiality.

The Executive agrees and understands that in the Executive’s position with the Company, the Executive will be exposed to and

will receive information relating to the confidential affairs of the Company, including but not limited to, information regarding the

Company’s ownership, technical information, intellectual property, business and marketing plans, strategies, customer information,

other information concerning the products, promotions, development, financing, expansion plans, business policies and practices of the

Company, and other forms of information considered by the Company reasonably and in good faith to be confidential and in the nature of

trade secrets (“Confidential Information”). Confidential Information does not include information that is or becomes

widely available in any industry in which the Company does business other than as a result of any act or omission by the Executive in

violation of this Agreement or law. The Executive agrees that during the Employment Term and thereafter, the Executive shall not, other

than on behalf of the Company, disclose such Confidential Information, either directly or indirectly, to any third person or entity without

the prior written consent of the Company; provided that disclosure may be made to the extent required by law, regulation, or order

of a regulatory body, in each case so long as the Executive gives the Company as much advance notice of the disclosure as possible to

enable the Company to seek a protective order, confidential treatment, or other appropriate relief. This confidentiality covenant has

no temporal, geographical, or territorial restriction. Upon termination of the Employment Term, the Executive shall promptly supply to

the Company: (i) all property of the Company; and (ii) all notes, memoranda, writings, lists, files, reports, customer lists,

correspondence, tapes, disks, cards, surveys, maps, logs, machines, technical data, or any other tangible product or document containing

Confidential Information produced by, received by, or otherwise submitted to the Executive during or prior to the Employment Term.

Executive acknowledges

that pursuant to the Defend Trade Secrets Act, an individual may not be held criminally or civilly liable under any federal or state trade

secret law for the disclosure of a trade secret that is made: (i) in confidence to a federal, state, or local government official, either

directly or indirectly, or to an attorney; and (ii) solely for the purpose of reporting or investigating a suspected violation of law;

or is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. Also, an individual

who files a lawsuit for retaliation by an employer for reporting a suspected violation of law may disclose the trade secret to the attorney

of the individual and use the trade secret information in the court proceeding if the individual files any document containing the trade

secret under seal and does not disclose the trade secret, except pursuant to Court order.

(b) Noncompetition.

By and in consideration of the Company entering into this Agreement and the payments to be made and benefits to be provided by the

Company hereunder, and further in consideration of the Executive’s exposure to Confidential Information, the Executive shall not,

during the Noncompetition Term (as defined below), directly or indirectly, own, manage, operate, join, control, be employed by, or participate

in the ownership, management, operation or control of, or be connected in any manner with, including but not limited to holding any position

as a shareholder, director, officer, consultant, independent contractor, employee, partner, or investor in, any Restricted Enterprise

(as defined below); provided that in no event shall ownership of less than 1% of the outstanding equity securities of any issuer

whose securities are registered under the Exchange Act, standing alone, be prohibited by this Section 7(b). Following termination of the

Employment Term, upon request of the Company during the Noncompetition Term, the Executive shall notify the Company of the Executive’s

then-current employment status.

(c) Nonsolicitation.

During the Noncompetition Term, the Executive shall not, and shall not cause any other person to: (i) interfere with or harm,

or attempt to interfere with or harm, the relationship of the Company with any Restricted Person (as defined below); or (ii) endeavor

to entice any Restricted Person away from the Company.

(d) Nondisparagement.

During the Employment Term and thereafter, and accept as may be required by law, the Executive shall not make or publish any disparaging

statements (whether written or oral) regarding the Company, its officers, directors, employees or business, except as shall be necessary

for the Executive to enforce any agreements between the parties or to comply with any requirements or obligations under law. In addition,

during the Employment Term and thereafter, the Company will request that its directors and officers not make or publish any disparaging

statements (whether written or oral) regarding the Executive, except as may be necessary to comply with any requirements or obligations

under law.

(e) Proprietary

Rights. The Executive assigns all of the Executive’s interest in any and all inventions, discoveries, improvements, and patentable

or copyrightable works initiated, conceived, or made by the Executive, either alone or in conjunction with others, during the Employment

Term and related to the business or activities of the Company to the Company or its nominee. Whenever requested to do so by the Company,

the Executive shall execute any and all applications, assignments, or other instruments that the Company in good faith deems necessary

to apply for and obtain trademarks, patents, or copyrights of the United States or any foreign country or otherwise protect the interests

of the Company therein. These obligations shall continue beyond the conclusion of the Employment Term and the Noncompetition Term with

respect to inventions, discoveries, improvements, or copyrightable works initiated, conceived, or made by the Executive during the Employment

Term.

(f) Remedies.

The Executive agrees that any breach of the terms of this Section 7 would result in irreparable harm to the Company for which the

Company would have no adequate remedy at law; the Executive therefore also agrees that in the event of such breach or any threat of breach,

the Company shall be entitled to seek equitable relief to prevent such breach, threatened breach, or continued breach by the Executive

and any and all persons or entities acting for or with the Executive, in addition to any other remedies to which the Company may be entitled

at law or in equity including the recovery of reasonable attorneys’ fees. The terms of this Section 7 shall not prevent the Company

from pursuing any other available remedies for any breach or threatened breach hereof, including but not limited to, the recovery of damages

from the Executive including reasonable attorneys’ fees. The Executive and the Company further agree that the provisions of the

covenants contained in this Section 7 are reasonable and necessary to protect the business of the Company because of the Executive’s

access to Confidential Information and his material participation in the operation of such business. Should a court, arbitrator, or other

similar authority determine, however, that any provisions of the covenants contained in this Section 7 are not reasonable or valid, either

in period of time, geographical area, or otherwise, the parties hereto agree that such covenants are to be interpreted and enforced to

the maximum extent to which such court or arbitrator deems reasonable or valid. The existence of any claim or cause of action by the Executive

against the Company, whether predicated on this Agreement or otherwise, shall not constitute a defense to the enforcement by the Company

of the covenants contained in this Section 7.

(g) Certain

Definitions. For purposes of this Agreement:

(i) The

“Noncompetition Term” means the period beginning on the date of this Agreement and ending twelve (12) months

following the Termination Date. If the Executive’s employment is terminated under Section 5(a)(iv) and he delivers the release in

the form of Exhibit B, the Noncompetition Term for purposes of Section 7(b) only shall be nine (9) months following the Termination Date.

If the Executive’s employment is terminated voluntarily under Section 5(a)(v) incidental to a Change of Control, the Noncompetition

Term for purposes of Section 7(b) only shall eighteen (18) months following the Termination Date.

(ii) “Restricted

Enterprise” means any person, corporation, partnership, or other entity that is engaged in the Territory with a business

or product lines of the same or similar nature as those offered by the Company; For purposes of this definition, “product lines

of the same or similar nature as those offered by the Company” shall also include, at any date, potential new product lines the

development of which the Company has, during the 12 months preceding such date, devoted more than de minimis resources.

(iii) “Restricted

Person” means any person who at any time during the two-year period prior to the Termination Date, was an employee, consultant,

independent contractor or customer of the Company, or otherwise had a material business relationship with the Company.

(iv) The

“Territory” means, the United States of America and other areas of the world where the Company conducts business.

8. Representations

by the Executive. The Executive represents to the Company that (i) his execution and performance of this Agreement does not violate

any agreement or obligation (whether or not written) that the Executive has with or to any person or entity including, but not limited

to, any prior employer, (ii) he is not subject to the terms of any noncompetition, non-solicitation or confidentiality agreement with

any prior employer, and (iii) he has not been convicted of, or entered a plea of guilty or nolo contendere to a crime that constitutes

a felony in any jurisdiction (or comparable crime in any jurisdiction which uses a different nomenclature). In the event of a determination

by the Board that the Executive is in material breach of either of these representations, the Company may terminate the Executive’s

employment, and any such termination shall be considered a termination for Cause under Section 5(a)(ii).

9. No

Waiver of Rights. The failure to enforce at any time the provisions of this Agreement or to require at any time performance by any

other party of any of the provisions hereof shall in no way be construed to be a waiver of such provisions or to affect either the validity

of this Agreement or any part hereof, or the right of any party to enforce each and every provision in accordance with its terms.

10. Notices.

Every notice relating to this Agreement shall be in writing and shall be given by personal delivery, by a reputable same-day or overnight

courier service (charges prepaid), by registered or certified mail, postage prepaid, return receipt requested, or by facsimile to the

recipient with a confirmation copy to follow the next day to be delivered by personal delivery or by a reputable same-day or overnight

courier service to the appropriate party’s address or fax number below (or such other address and fax number as a party may designate

by notice to the other party):

| |

If to the Executive: |

To the Executive at the address most recently contained in the Company’s records. |

| |

If to the Company: |

Chairman of the Board 1 |

| |

|

Espey Mfg. & Electronics Corp. |

| |

|

233 Ballston Avenue |

| |

|

Saratoga Springs, New York 12866 |

11. Binding

Effect/Assignment. This Agreement shall inure to the benefit of and be binding upon the parties hereto and their respective heirs,

executors, personal representatives, estates, successors (including, without limitation, by way of merger), and permitted assigns. Notwithstanding

the provisions of the immediately preceding sentence, the Executive shall not assign all or any portion of this Agreement without the

prior written consent of the Company.

12. Entire

Agreement. This Agreement sets forth the entire understanding of the parties hereto with respect to the subject matter hereof and

supersedes all prior agreements, written or oral, between them as to such subject matter, including, without limitation, that certain

Employment Agreement dated as of January 1, 2022.

13. Severability.

If any provision of this Agreement, or any application thereof to any circumstances, is invalid, in whole or in part, such provision

or application shall to that extent be severable and shall not affect other provisions or applications of this Agreement.

14. Governing

Law; and Consent to Jurisdiction. This Agreement shall be governed by and construed in accordance with the internal laws of the State

of New York, without reference to the principles of conflict of laws.

15. Modifications

and Waivers. No provision of this Agreement may be modified, altered, or amended except by an instrument in writing executed by the

parties hereto. No waiver by any party hereto of any breach by any other party hereto of any provision of this Agreement to be performed

by such other party shall be deemed a waiver of similar or dissimilar provisions at the time or at any prior or subsequent time.

16. Headings.

The headings contained herein are solely for the purposes of reference, are not part of this Agreement, and shall not in any way affect

the meaning or interpretation of this Agreement.

17. Applicability

of Section 409A of the Code.

(a) Generally.

This Agreement is intended to comply with Sections 409A of the Internal Revenue Code of 1986, as amended and the Treasury Regulations

and IRS guidance thereunder (“Section 409A”). Notwithstanding anything to the contrary, this Agreement shall, to the

maximum extent possible, be administered, interpreted, and construed in a manner consistent with Section 409A. If any provision of this

Agreement provides for payment within a time period, the determination of when such payment shall be made within such time period shall

be solely in the discretion of the Company.

1 If there is no Chairman

of the Board, then Chairman of the Board Compensation Committee.

(b) Reimbursements.

To the extent that any reimbursement, fringe or other in-kind benefit, or other, similar plan or arrangement in which the Executive

participates during the Employment Term or thereafter provides for a “deferral of compensation” within the meaning of Section

409A: (i) the amount of expenses eligible for reimbursement provided to the Executive during any calendar year will not affect

the amount of expenses eligible for reimbursement or in-kind benefits provided to the Executive in any other calendar year; (ii) the

reimbursements for expenses for which the Executive is entitled to be reimbursed shall be made as soon as practicable following the date

on which such expenses were incurred and documented to the Company, but in no event later than the last day of the calendar year following

the calendar year in which the applicable expense is incurred; (iii) the right to payment or reimbursement or in-kind benefits

hereunder may not be liquidated or exchanged for any other benefit; and (iv) the reimbursements shall be made pursuant to objectively

determinable and nondiscretionary Company policies and procedures regarding such reimbursement of expenses.

(c) Termination

Payments. If and to the extent required to comply with Section 409A, no payment or benefit required to be paid under this Agreement

on account of termination of the Executive’s employment shall be made unless and until the Executive incurs a “separation

from service” within the meaning of Section 409A. In addition, with respect to any payments or benefits subject to Section 409A,

reference to Executive’s “termination of employment” (and corollary terms) from the Company shall be construed to refer

to the Executive’s “separation from service” (as determined under Treas. Reg. Section 1.409A-1(h), as uniformly applied

by the Company) from the Company and all entities aggregated with the Company under Section 409A. Notwithstanding anything to the contrary

contained herein, if the Executive is a “specified employee” within the meaning of Section 409A, and if any or all of the

payments or the continued provision of any benefits under Section 6 or any other provision of this Agreement are subject to Section 409A

and payable upon a separation from service, then such payments or benefits that the Executive would otherwise be entitled to receive during

the first six months after termination of employment shall be accumulated and paid or provided on the first business day after the six-month

anniversary of termination of employment (or within 30 days following the Executive’s death, if earlier) in a single lump sum and

any remaining payments and benefits due under this Agreement shall be paid or provided in accordance with the normal payment dates specified

for them herein.

18. Counterparts.

This Agreement may be executed in two or more counterparts, each of which shall be deemed to be an original but all of which together

shall constitute one and the same instrument.

IN WITNESS WHEREOF, the

Company and the Executive have caused this Agreement to be duly executed effective as of the day and year first above written.

| |

ESPEY MFG.& ELECTRONICS CORP. |

| |

|

| |

By: |

/s/ Carl Helmetag |

| |

|

Carl Helmetag |

| |

|

Chairman of the Board |

| |

|

|

| |

|

|

| |

EXECUTIVE |

| |

|

| |

/s/ David O’Neil |

| |

David O’Neil |

| |

President and Chief Executive Officer |

EXHIBIT A

CEO Annual Bonus

| Component |

|

|

| A |

Discretionary Bonus

Up to 50% of Base Salary as determined by the board at its sole discretion. |

|

| B |

Increase in sales/ backlog

Dollar increase in combined sales and backlog vs. average of prior three

years combined sales and backlog times 0.5% (one half of one percent), not to exceed 50% of Base Salary |

|

| C |

Increase in operating earnings

Dollar Increase in operating earnings vs average of prior three years’

operating earnings times 5% (five percent), not to exceed 50% of Base Salary |

|

| D |

Notes |

Total Earned bonus (A+B+C) shall not exceed Base Salary.

Calculation of any bonus, or bonus component, shall be as determined by

the Board in its sole discretion. The Board, in its discretion, may modify any bonus component but shall not decrease the potential benefit

to Executive. The Board shall determine the amount of any bonus at the meeting of the Board following the availability of the audited

financial statements for the applicable fiscal year.

Components B and C shall be determined based upon the Operating Income/

Sales Backlog as reported in the Company’s audited financial statements and Form 10-K filed or to be filed for the applicable fiscal

year. |

EXHIBIT B

SEPARATION AGREEMENT AND GENERAL RELEASE

This “Separation

Agreement and General Release” (hereinafter “Release”), signed by DAVID O’NEIL (hereinafter “you”

or “your”) and in favor of Espey Mfg. & Electronics Corp. (hereinafter “the Company”) is for the purpose of

amicably and fully resolving any and all claims, disputes and issues arising out of your employment at the Company and the termination

of that employment.

As your employment with

the Company terminated on ____________ (“your Termination Date”), and

As you have agreed to provide

this Release to the Company in return for the consideration set forth herein;

Therefore, in consideration

of the mutual covenants and promises hereinafter provided and of the actions to be taken pursuant thereto, you agree as follows:

1. (a) You hereby

accept the sums set forth in Section 1(b) below. Except as provided in said Section 1(b) and in Section 5 below, you will not be entitled

to any other compensation or benefits from the Company.

(b) (i) The

Company will make severance payments to you in the gross aggregate amount of $____________, (representing nine months of your base salary)

less all withholdings and deductions required by law, to be paid according to your regular payroll cycle until fully paid.

(ii) The

Company will commence making severance payments to you beginning on the first regular payroll after the thirtieth day following your Termination

Date.

(iii) To

the extent any taxes may be due on the payments provided in this Agreement, beyond any withheld by the Company, you shall pay them yourself

and shall indemnify and hold the Company harmless from any tax claims or penalties resulting from such payments. You further agree to

provide the Company any and all information pertaining to you upon request as reasonably necessary for the Company and other entities

released herein to comply with applicable tax laws. You hereby acknowledge that the Company has not made any representations regarding

the tax consequences of the payments provided in this Release and that the Company has not provided you with any tax advice regarding

the payments provided in this Release, including without limitation advice on the treatment of the payments under Section 409A of the

Internal Revenue Code.

2. In

exchange for the sums and benefits set forth above, you agree to release the Company, its subsidiaries, its affiliated and related entities

and their current and former shareholders, officers, directors, agents, employees, successors and assigns (hereinafter collectively the

“Released Parties”) from all claims, demands, actions, and liabilities, whether known or unknown (except as expressly

set forth in Section 4 below), you may have against them or any one of them in any way related to your employment at the Company and/or

the termination of that employment. By way of example, the types of claims that are covered under this Release include, but are not limited

to:

(a) all

“wrongful discharge” claims, “constructive discharge” claims, claims relating to any contracts of employment,

expressed or implied, any covenants of good faith and fair dealing, expressed or implied, any personal wrongs or injuries and any claim

for attorney’s fees;

(b) any

claims that could be brought pursuant to Title VII of the Civil Rights Act of 1964, 42 U.S.C. § 2000-1 et seq., the Age Discrimination

in Employment Act, 29 U.S.C. § 621 et seq., the Americans with Disabilities Act, 42 U.S.C. § 12101 et seq., the

Employee Retirement Income Security Act, 29 U.S.C. § 1131 et seq., the Family and Medical Leave Act, 29 U.S.C. § 2601

et seq. the Lilly Ledbetter Fair Pay Act of 2009, Pub. L. No. 111L-2; the New York Human Rights Law, McKinney’s Executive

Law §290, et seq., (all as may have been amended);

(c) any

claims that could be brought under any other federal, state, county or municipal statute or ordinance dealing with (i) discrimination

in employment on the basis of sex, race, national origin, religion, disability, age, marital status, affectional or sexual orientation

or other reason; (ii) employee whistleblower protection; and (iii) employee family leave rights; and

(d) all

other claims including those of which you are not aware and those not specifically mentioned in this Release.

3. (a) You agree that

you will never sue or otherwise institute a claim of any kind against the Released Parties or any one of them for anything that has happened

up to now, whether such claim is presently known or unknown by you, in any way related to your employment at the Company and/or

the termination of that employment.

(b) If

you breach the terms of this Release by suing the Company or the Company’s personnel, you agree that you will pay all costs and

expenses incurred by the Company and the Company’s personnel in defending against the suit, including reasonable attorneys’

fees.

(c) Additionally,

if you breach the terms of this Release, you agree that the Company shall have the right to immediately stop paying the Severance Pay

and/or if already paid, to obtain, by way of counterclaim or other lawful means, repayment of the full amount paid to you as consideration

for this Release.

4. Notwithstanding

anything in this Release to the contrary, (a) this Release does not include any claims you may have with respect to any medical, prescription,

dental, flexible spending account, life insurance, retirement and savings or other benefits provided by plans maintained by the Company

to which you may be entitled, any rights that you may have under this Release, Company’s Employee Stock Ownership Plan or outstanding

stock options granted to you by the Company, any rights to indemnification you may have under the Company’s Certificate of Incorporation

or By-Laws, or to any payments due you under this Release, and (b) nothing in this Release is intended to prohibit or restrict you from:

making any disclosure of information required by law or (i) filing a charge with, (ii) providing information to, or (iii) testifying or

otherwise assisting or participating in any investigation or proceeding brought by, any regulatory or law enforcement agency or legislative

body, including, but not limited to, the Equal Employment Opportunity Commission and the National Labor Relations Board; nevertheless,

you acknowledge and agree that by virtue of this Release you have waived any relief available to you (including without limitation, monetary

damages, equitable relief and reinstatement) under any of the claims and/or causes of action waived in this Release, and you therefore

agree you will not accept any award or settlement from any source or proceeding (including but not limited to any proceeding brought by

any other person or by any government agency) with respect to any claim or right waived in this Release.

5. You

agree that you have executed this Release on your own behalf and also on behalf of any heirs, agents, representatives, successors and

assigns that you may have now or in the future.

6. You

acknowledge and agree that the benefits provided herein exceed any amount to which you would otherwise be presently entitled under the

Company’s policies, procedures and benefit programs and/or under any applicable law without providing this Release, and constitute

valuable consideration for this Release.

7. You

acknowledge that, by requesting this Release, the Company does not admit, expressly or implicitly, that it has engaged in any wrongdoing

whatsoever.

8. (a) You hereby acknowledge and

agree that Section 7 of your Employment Agreement dated June 6, 2024, which contains various covenants as to Confidential

Information, non-competition and non-solicitation shall remain in full force and effect according to its terms.

(b) You

further acknowledge and represent that you have returned to the Company all Confidential Information (including copies), all other documents,

and all tangible property of the Company, including, but not limited to, keys, credit cards, cell phones, computers and other electronic

equipment.

9. You

and the Company agree that neither you nor the Company will make any statements, orally or in writing (including electronic communications),

that disparage the business reputation or good will of the Released Parties or any one of them or of you.

10. You

agree to keep both the existence and the terms of this Release completely confidential, except that you may discuss this Release with

your attorney, accountant or other tax professional, and your spouse, and (b) to the extent necessary to enforce your rights hereunder.

11. You

acknowledge that you have been advised of the following:

(a) you

have the right to and should consult with an attorney prior to signing this Release;

(b) you

have 21 days to decide whether to sign this Release and deliver it to, ________________ at the Company’s offices, 233 Ballston

Avenue, Saratoga Springs, New York 12866.

(c) if

you sign this Release, you have up to 7 days to revoke it and the Release will not become effective until this 7-day period has

expired;

12. This

Release is not effective or enforceable for 7 days after you sign it and you may revoke it during that time. To revoke, a written notice

of revocation must be delivered to, ________________ at the Company’s offices at the above address, within 7 days after you sign

this Release. The revocation must be:

(a) sent

by certified mail within the 7-day period; and

(b) properly

addressed to ________________________ at the above address.

If ____________ does not

receive a written verification in accordance with the foregoing terms, you will not be able to rescind this Release.

13. You

agree that this Release contains the entire agreement of the parties and that this Release cannot be amended, modified, or supplemented

in any respect except by the written agreement of both parties.

14. You

agree that if any term or provision of this Release or the application thereof to any alleged claim or party or circumstances, shall to

any extent be determined to be invalid, void, or unenforceable, the remaining provisions and any application thereof shall nevertheless

continue in full force and effect without being impaired or invalidated in any way. The parties further agree to replace any such void

or unenforceable provision of this Release with a valid and enforceable provision that will achieve, to the extent possible, the economic,

business or other purposes of the void or unenforceable provision.

15. You

agree that this Release shall be governed by the laws of the State of New York without giving effect to any conflicts of law principles.

16. This

Agreement will not become effective until the expiration of the 7-day revocation period set forth in paragraph 12 above.

17. You

hereby acknowledge that you have read this Release in its entirety, understand fully the meaning and significance of all its terms, and

hereby voluntarily and knowingly agree to accept all of its terms. You further acknowledge that you have not relied on any representations,

promises, or agreements of any kind made to you in connection with your decision to sign this Release except for the agreements set forth

in the Release.

___________________________

Date:

Espey Increases and Declares Regular Quarterly

Dividend of $0.20 Per Share; Announces New Employment Agreement with Chief Executive Officer and Appoints New Assistant Corporate Secretary

Saratoga Springs, NY; June 6, 2024 - The

Board of Directors of Espey Mfg. & Electronics Corp. (NYSE AMERICAN: ESP) has declared a regular quarterly dividend of $0.20 per share,

a 14% increase over the prior dividend. The dividend will be payable on June 24, 2024 to all shareholders of record on June 17,

2024.

The Board of Directors is pleased to announce the

signing of a new employment agreement between Espey Mfg. & Electronics Corp. and David O’Neil, President and Chief Executive

Officer.

Furthermore, the Board of Directors appointed Ms.

Jennifer Pickering to the position of Assistant Corporate Secretary. Jennifer joined the company as Chief HR Officer in April 2024 after

previously holding human resource executive roles in the semiconductor and building materials manufacturing industries.

Espey's primary business is the development,

design, and production of specialized military and industrial power supplies/transformers. The Company can be found on the Internet

at www.espey.com.

For further information, contact Ms. Katrina Sparano at invest@espey.com.

Certain statements in this press release are "forward-looking

statements" and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking

statements represent the Company's current expectations or beliefs concerning future events. The matters covered by these statements are

subject to certain risks and uncertainties that could cause actual results to differ materially from those set forth in the forward-looking

statements. The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only

as of the date made.

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

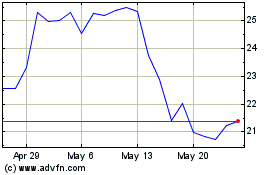

Espey Manufacturing and ... (AMEX:ESP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Espey Manufacturing and ... (AMEX:ESP)

Historical Stock Chart

From Dec 2023 to Dec 2024