Deutsche Bank Launches All China ETF - ETF News And Commentary

May 02 2014 - 2:00PM

Zacks

The ETF world has seen a good number of product launches targeting

China by different issuers over the past one year. These include

KraneShares Bosera MSCI China A Share ETF (KBA), db X-trackers

Harvest CSI 300 China A-Shares Fund (ASHR), CSI Five Year Plan ETF

(KFYP) and CSI China Internet ETF (KWEB).

In a move to expand the country’s offerings, Deutsche Bank

introduced

db X-trackers Harvest MSCI All China Equity Fund

(CN) on the last trading day of April. This has boosted

the issuer line-up to a total of 20 ETFs (read: China A-Shares ETF

from KraneShares Hits the Market).

New China ETF in Focus

This ETF looks to track the performance of the MSCI All China

Index, which includes A-shares, H-shares, B-shares, Red chips, and

P chips along with China securities (including ADRs) that are

listed on NYSE Euronext (New York), NASDAQ, New York AMEX and the

Singapore stock exchanges.

The fund would provide a wide exposure to both large and mid cap

firms that are listed in China, Hong Kong, the U.S. and Singapore.

It also attempts to gain exposure to the China A share components

by investing in its own ASHR. The ETF holds 145 securities in its

basket with ASHR making up for half of the portfolio (read: Inside

the Recent China A Shares ETF Slump).

Other securities such as Tencent Holdings, China Mobile and China

Construction Bank and Ind & Comm Bk of China round off the top

five with a combined 14.19% share. This suggests lower

concentration risk among a number of securities and prevents heavy

concentration.

From a sector look, the product is weighted heavily toward

financials with 38.5% of total assets while telecom services and

energy make up for double-digit exposure in the basket. In terms of

geographical allocation, North American firms account for 50.2%

share, followed by China (48.2%) and Hong Kong (1.6%).

How does it fit in a portfolio?

This ETF could be an intriguing choice for investors seeking a

diversified play on the Chinese equity market with all types of

shares trading in one basket. Though the recent indicators point to

a sluggish growth in the world’s second largest economy, the

weakness could be viewed as a buying opportunity (read: China ETFs

Slump on Terrible Export Numbers).

This is especially true as IMF raised the Chinese economic growth

outlook by 0.3% to 7.5% for this year, suggesting that new reforms

would certainly drive the economy higher in the long term despite

the growing debt concerns. Further, China is expected to overtake

the U.S. as the No. 1 economy by the year end, as per the latest

data from the world's leading statistical agencies.

Given this, the new product could see a nice boost in the coming

months as it provides huge diversification benefits across a single

security and some cushion across sectors.

ETF Competition

Competition for the new China ETF looks to be quite fierce as there

are currently close to three dozens of China ETFs in the market. In

particular, the product would face stiff competition from the three

most popular ETFs – iShares FTSE China 25 Index Fund

(

FXI), iShares MSCI China Index Fund

(

MCHI) and SPDR S&P China ETF

(

GXC).

FXI is a large cap centric fund with over $4.7 billion in AUM and

provides exposure to a small basket of 26 Chinese stocks with heavy

concentration on its top 10 holdings. MCHI holds 142 securities in

its basket with moderate concentration in its top 10 firms. The ETF

has amassed nearly $965.5 million in its asset base and is focused

on large and mid-sized companies in China.

The third fund, GXC, offers exposure to the large basket of 267

stocks with a slight tilt toward large caps. The fund has moderate

concentration in the top 10 firms and has managed $773.5 million in

its asset base so far (see: all the Emerging Asia Pacific ETFs

here).

The new All China Equity Fund is a bit pricey, charging 71 basis

points a year compared to 62 bps for MCHI and 59 bps for GXC.

However, it is inexpensive given the expense ratio of 0.73% for the

ultra-popular FXI.

Given this, the new Deutsche Bank fund may find it difficult to

garner investor’s interest and with the slowdown in the Chinese

economy and the current slump in the stocks, investors might stay

away from this market for the time being.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-CHINA LC (FXI): ETF Research Reports

SPDR-SP CHINA (GXC): ETF Research Reports

ISHARS-MS CH IF (MCHI): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

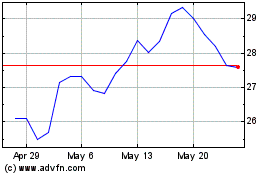

iShares China Large Cap (AMEX:FXI)

Historical Stock Chart

From Nov 2024 to Dec 2024

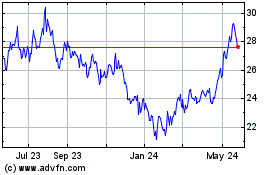

iShares China Large Cap (AMEX:FXI)

Historical Stock Chart

From Dec 2023 to Dec 2024