false

0001047335

0001047335

2024-07-31

2024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2024

NATIONAL HEALTHCARE CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation)

|

001-13489

(Commission File Number)

|

52-2057472

(I.R.S. Employer Identification No.)

|

| |

|

|

|

100 Vine Street

Murfreesboro, Tennessee

(Address of Principal Executive Offices)

|

|

37130

(Zip Code)

|

Registrant’s telephone number, including area code: (615) 890-2020

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.1 par value

|

NHC

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On August 1, 2024, National HealthCare Corporation (“NHC”), as Borrower, and certain of its subsidiaries, as Guarantors, entered into a Credit Agreement (the “Credit Agreement”) with Bank of America, N.A., as lender (the “Lender”).

The Credit Agreement provides for a $200,000,000 senior credit facility with a five-year term consisting of a $50,000,000 revolving facility and a $150,000,000 term facility (the “Credit Facility”).

The Credit Facility is for general corporate purposes, including working capital and acquisitions. NHC is permitted, upon required notice to Lender and subject to certain minimum prepayment amounts, to prepay the amounts outstanding under the Credit Facility at any time without penalty. The unutilized portion of the commitments under the Credit Facility may be irrevocably reduced or terminated by NHC at any time. Loans bear interest at either (i) Term SOFR for interest periods of one (1), three (3) or six (6) months, plus the applicable margin or, at NHC’s option, (ii) the Base Rate plus the applicable margin. The applicable margin is a rate per annum between 1.30% and 1.65% for Term SOFR loans and between .30% and .65% for Base Rate loans, depending upon NHC meeting certain conditions.

NHC’s obligations under the Credit Agreement are unsecured. The Credit Agreement contains customary representations and warranties, financial covenants, and other customary affirmative and negative covenants. The Credit Agreement also contains customary events of default.

The description of the terms of the Credit Agreement contained in this Item 1.01 is qualified in its entirety by reference to the full text of the Credit Agreement, a copy of which NHC will file as an exhibit to the Company's Quarterly Report on Form 10-Q for the period ended September 30, 2024.

ITEM 2.01. COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

NHC announced that on July 31, 2024 it completed the previously announced acquisition of fourteen skilled nursing facilities, which includes five facilities in North Carolina (three of which are continuing care retirement communities), and nine facilities in South Carolina, the assignment of a lease agreement for one skilled nursing facility under lease with White Oak of Waxhaw, LLC in North Carolina (the “White Oak Senior Care Business”), and the purchase of the White Oak long term care pharmacy domiciled in South Carolina and licensed in both North Carolina and South Carolina (the “Transaction”), effective August 1, 2024. The acquisition was effectuated pursuant to a Purchase and Sale Agreement entered on May 31, 2024 (the “Agreement”) by and between NHC/OP, L.P., a subsidiary of NHC, and White Oak Manor, Inc., a South Carolina corporation, its corporate subsidiaries, and White Oak Pharmacy, Inc., a South Carolina corporation, along with Douglas M. Cecil, Oliver K. Cecil, Jr., Dorothy Dean Cecil, Jeni Cecil Feeser, Beth Creech Cecil, John P. Barber and Teresa J. Cecil, as Trustee of the Teresa J. Cecil Revocable Trust U/A (collectively, the “Seller Parties” or “White Oak”), the entry of which was previously reported on a Form 8-K filed on May 31, 2024. NHC also entered a lease for the White Oak home office building in Spartanburg, South Carolina.

The purchase price for the Transaction was Two Hundred Twenty-One Million Four Hundred Thousand and 00/100 Dollars ($221,400,000.00), subject to prorations and adjustments as set forth in the Agreement. NHC purchased the name “White Oak,” and derivations thereof, including any logos and trademarks and will initially operate the facilities under the White Oak name.

The description of the terms of the Agreement and acquisition contained in this Item 2.01 is qualified in its entirety by reference to the full text of the Agreement, a copy of which NHC will file as an exhibit to the Company's Quarterly Report on Form 10-Q for the period ended June 30, 2024. The representations, warranties and covenants set forth in the Agreement have been made only for the purposes of the Agreement and were solely for the benefit of the parties to the Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures, may have been made for the purposes of allocating contractual risk between the parties to the Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Accordingly, the Agreement, when filed, is only to provide investors with information regarding the terms of the Transaction, and not to provide investors with any other factual information regarding the parties or their respective businesses and should be read in conjunction with the disclosures in the Company's periodic reports and other filings with the Securities and Exchange Commission.

Item 7.01 REGULATION FD DISCLOSURE

On August 6, 2024, NHC issued a press release announcing its completion of the asset acquisition of the White Oak Senior Care Business and White Oak long term care pharmacy. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| |

Number

|

Exhibit

|

| |

99.1

|

|

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

NATIONAL HEALTHCARE CORPORATION

|

By:

|

/s/Stephen F. Flatt

|

|

Name:

|

Stephen F. Flatt

|

|

Title:

|

CEO

|

Exhibit 99.1

For Release August 6, 2024

Contact: Casey Reese

615-571-2992 | media@nhccare.com

NHC COMPLETES ACQUISITION OF WHITE OAK SENIOR LIVING PORTFOLIO

MURFREESBORO, TN. (August 6, 2024) – National Healthcare Corporation (NYSE American: NHC), a national leader in senior care, announced today that it has completed the acquisition of the White Oak Senior Living (“White Oak”) portfolio, operating in North Carolina and South Carolina, including its long-term care pharmacy. White Oak’s portfolio consists of six skilled nursing facilities in North Carolina, three of which are continuing care retirement centers, including one leased facility. In South Carolina, the portfolio consists of nine skilled nursing facilities, one of which also includes assisted and independent living units.

“White Oak has been a premier skilled nursing and senior living provider in North and South Carolina for many years. We are honored to acquire and operate the White Oak brand and continue to provide critical services to their patients and families,” said Steve Flatt, Chief Executive Officer of NHC.

The acquisition represents both an expansion of NHC’s operations into a new state and a strategic advancement of its growth in its existing operational footprint. Prior to this acquisition, NHC operated thirteen skilled nursing facilities and five assisted living communities in South Carolina, as well as a long-term care pharmacy. The White Oak acquisition will add 1,928 skilled nursing beds, 48 assisted living units, and 302 independent living units to NHC’s current operations.

“We are excited to make a strategic move into North Carolina and expand our offerings in South Carolina. We expect this acquisition to be accretive to NHC’s earnings and create several long-term operational efficiencies and synergies inside our operating networks. Above all, the cultures at White Oak and NHC both value excellent care as the highest priority. That’s what made this opportunity so attractive,” Mr. Flatt continued.

About National HealthCare Corporation

NHC affiliates operate for themselves and third parties 80 skilled nursing facilities with 10,349 beds. NHC affiliates also operate 26 assisted living communities with 1,413 units, nine independent living communities with 778 units, three behavioral health hospitals, 34 homecare agencies, and 30 hospice agencies. NHC’s other services include Alzheimer’s and memory care units, pharmacy services, a rehabilitation services company, and providing management and accounting services to third party post-acute operators. Other information about the company can be found on our web site at www.nhccare.com.

Forward-Looking Statements

Statements in this press release that are not historical facts are forward-looking statements. NHC cautions investors that any forward-looking statements made involve risks and uncertainties and are not guarantees of future performance. The risks and uncertainties are detailed from time to time in reports filed by NHC with the Securities Exchange Commission (“SEC”), including Forms 8-K, 10-Q and 10-K, and include, among others, the following: the ability to integrate the White Oak operations into its operating networks in a timely manner, if at all; liabilities and other claims asserted against us and patient care liabilities, as well as the resolution of current litigation; availability of insurance and assets for indemnification; national and local economic conditions; including their effect on the availability and cost of labor, utilities and materials; the effect of government regulations and changes in regulations governing the healthcare industry, including our compliance with such regulations; changes in Medicare and Medicaid payment levels and methodologies and the application of such methodologies by the government and its fiscal intermediaries, the ability of third parties for whom we have guaranteed debt to refinance certain short term debt obligations; and other factors referenced or incorporated by reference in NHC’s SEC filings. The risks included here are not exhaustive. All forward-looking statements represent NHC’s best judgment as of the date of this release.

v3.24.2.u1

Document And Entity Information

|

Jul. 31, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NATIONAL HEALTHCARE CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 31, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-13489

|

| Entity, Tax Identification Number |

52-2057472

|

| Entity, Address, Address Line One |

100 Vine Street

|

| Entity, Address, City or Town |

Murfreesboro

|

| Entity, Address, State or Province |

TN

|

| Entity, Address, Postal Zip Code |

37130

|

| City Area Code |

615

|

| Local Phone Number |

890-2020

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NHC

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001047335

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

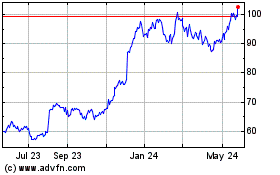

National HealthCare (AMEX:NHC)

Historical Stock Chart

From Dec 2024 to Jan 2025

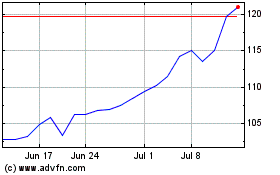

National HealthCare (AMEX:NHC)

Historical Stock Chart

From Jan 2024 to Jan 2025