ALPS, a DST Company announced that the Sprott Gold Miners

Exchange-Traded Fund (ETF) (NYSE: SGDM) is available on Schwab ETF

OneSource™ – the program that provides investors and advisors with

access to the most commission-free ETFs1 in the industry.

The industry’s first factor-based gold mining ETF, the Sprott

Gold Miners ETF, was created with Sprott Asset Management LP, a

globally renowned investor in precious metals. With its addition to

the Schwab ETF OneSource lineup, Schwab clients will be able to buy

and sell six ALPS-distributed ETFs with zero online trade

commissions.

ALPS is a comprehensive financial services company with a strong

track record of innovation in the asset management, asset

servicing, and asset gathering business. The fourth largest

distributor of ETFs in the U.S., ALPS specializes in satellite and

non-traditional asset classes, including Alternative Income,

Private Equity, Commodities, and Master Limited Partnerships

(MLPs).

“By expanding our Schwab ETF OneSource lineup to include the

Sprott Gold Miners ETF, we can offer the strategy to a wider range

of investors without commissions,” says Jeremy Held, Director of

Product Distribution at ALPS. “All ALPS ETFs are designed to

provide investors with exposure to attractive investment themes,

and we expect to bring more innovative solutions to the market this

year.”

Schwab ETF OneSource offers investors more than 200 ETFs

spanning 66 Morningstar Categories without any trade commissions,

early redemption fees or enrollment requirements.1

“We are very pleased with the growing interest in Sprott Gold

Miners ETF,” said John Ciampaglia, Head of ETFs at Sprott. “The

fund’s addition to the Schwab ETF OneSource platform will only

enhance that interest.”

A complete list of Schwab ETF OneSource ETFs is available at

Schwab.com.

For more information on the Sprott Gold Miners ETF, visit

www.alpsfunds.com.

About ALPS

Through its subsidiary companies, ALPS Holdings, Inc. is a

leading provider of innovative investment products and customized

servicing solutions to the financial services industry. Founded in

1985, Denver-based ALPS delivers its Asset Gathering and Asset

Servicing Solutions through offices in Boston, New York, Seattle,

and Toronto. ALPS is a wholly owned subsidiary of Kansas City-based

DST Systems, Inc. For more information about ALPS and its services,

visit www.alpsinc.com. Information about ALPS products is available

at www.alpsfunds.com.

About DST

DST Systems, Inc. is a leading provider of sophisticated

information processing and servicing solutions to companies around

the world. Through its global enterprise, DST delivers

strategically unified transactions and business processing, data

management, and customer communications solutions to the asset

management, brokerage, retirement, and healthcare markets.

Headquartered in Kansas City, MO., DST is a publicly traded company

on the New York Stock Exchange. For more information, visit

www.dstsystems.com.

About Schwab ETF OneSource

Schwab ETF OneSource offers investors and advisors access to the

most commission-free ETFs anywhere in the industry. As of April 30,

2015, Schwab ETF OneSource has $44 billion in assets under

management. Commission-free online trading is available to

individual investors at Schwab, to approximately 7,000 independent

investment advisors who use Schwab’s custodial services and through

Schwab retirement accounts that permit trading of ETFs. Schwab

offers a range of resources to help clients choose ETFs that fit

their investment needs, including the Schwab ETF Select List™,

tutorials, education, research and tools available via Schwab’s

online ETF center and live events at local Schwab branches.

1Conditions Apply: Trades in ETFs available through Schwab ETF

OneSource (including Schwab ETFs™) are available without

commissions when placed online in a Schwab account. Service charges

apply for trade orders placed through a broker ($25) or by

automated phone ($5). An exchange processing fee applies to sell

transactions. Certain types of Schwab ETF OneSource transactions

are not eligible for the commission waiver, such as short sells and

buys to cover (not including Schwab ETFs). Schwab reserves the

right to change the ETFs it makes available without commissions.

ETFs are subject to management fees and expenses. Please see the

Charles Schwab Pricing Guide for additional information.

Important Disclosures and Definitions

An investor should consider the investment objectives, risks,

charges, and expenses carefully before investing. To obtain a

prospectus, which contains this and other information, please

contact your financial professional or call 1.855.215.1425. Read

the prospectus carefully before investing.

Sprott Gold Miners ETF shares are not individually

redeemable. Investors buy and sell shares of the Sprott Gold Miners

ETF on a secondary market. Only market makers or “authorized

participants” may trade directly with the Fund, typically in blocks

of 50,000 shares.

The Fund is not suitable for all investors. There are risks

involved with investing in ETFs including the loss of money. The

Fund is considered non-diversified and can invest a greater portion

of assets in securities of individual issuers than a diversified

fund. As a result, changes in the market value of a single

investment could cause greater fluctuations in share price than

would occur in a diversified fund.

The Fund is concentrated in the gold and silver mining industry.

As a result, the Fund will be sensitive to changes in, and its

performance will depend to a greater extent on, the overall

condition of the gold and silver mining industry. Also, gold and

silver mining companies are highly dependent on the price of gold

and silver bullion. These prices may fluctuate substantially over

short periods of time so the Fund’s Share price may be more

volatile than other types of investments.

Funds that emphasize investments in small/mid cap companies will

generally experience greater price volatility.

Funds investing in foreign and emerging markets will also

generally experience greater price volatility.

The Sprott Gold Miners ETF is a new product with a limited

operating history.

ALPS Portfolio Solutions Distributor, Inc. is not affiliated

with Sprott Asset Management LP or Schwab ETF OneSource.

ALPS Portfolio Solutions Distributor, Inc. is the Distributor

for the Sprott Gold Miners ETF.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150707005262/en/

DST Global Public RelationsLaura M. Parsons,

816-843-9087mediarelations@dstsystems.com

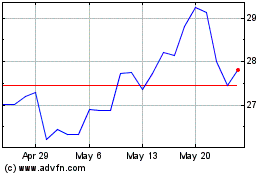

Sprott Gold Miners (AMEX:SGDM)

Historical Stock Chart

From Feb 2025 to Mar 2025

Sprott Gold Miners (AMEX:SGDM)

Historical Stock Chart

From Mar 2024 to Mar 2025