Apex Silver Mines Limited (AMEX: SIL) (the "Company") and its

wholly-owned subsidiary, Apex Silver Mines Corporation ("ASMC"),

filed voluntary petitions for reorganization under Chapter 11 of

the United States Bankruptcy Code (the "Bankruptcy Code") in the

United States Bankruptcy Court for the Southern District of New

York ("Bankruptcy Court") on January 12, 2009. The Company and ASMC

will continue to manage their properties and operate their

businesses as "debtors-in-possession" under the jurisdiction of the

Bankruptcy Court.

Plan Support Agreement

On January 12, 2009, the Company and ASMC entered into a Plan

Support Agreement (the "Plan Support Agreement") with Sumitomo

Corporation ("Sumitomo"), eleven of the twelve lenders under the

San Cristobal project finance facility (the "Senior Lenders"), and

the holders of approximately 65% of the outstanding principal

amount of the Company's 2.875% and 4.0% Convertible Senior

Subordinated Notes due 2024 (together, the "Subordinated

Noteholders"). Under the terms of the Plan Support Agreement, each

of the parties thereto has agreed, following receipt of a

Bankruptcy Court-approved disclosure statement, to vote in favor of

a joint plan of reorganization of the Company and ASMC on the terms

and conditions set forth in the Plan Term Sheet attached as part of

the Plan Support Agreement.

Under the proposed plan of reorganization contemplated by the

Plan Term Sheet, if the class of Subordinated Noteholders accepts

the plan, the Senior Lenders will waive and release their senior

claims and Subordinated Noteholders will receive a pro rata share

of approximately $45 million in cash plus common stock in the

reorganized Company. However, if the class of Subordinated

Noteholders rejects the proposed plan, the class would receive an

allocation of cash only after payment in full under the project

financing facility of Sumitomo and the Senior Lenders. In such

circumstances, the Subordinated Noteholders would receive common

stock of the reorganized company, but might not receive any cash

distributions under the proposed plan. The Company's existing

shareholders would receive no distributions under the proposed

plan.

San Cristobal Purchase and Sale Agreement

On January 12, 2009, the Company, ASMC and certain other

wholly-owned subsidiaries of the Company entered into a Purchase

and Sale Agreement with Sumitomo and one of its wholly-owned

subsidiaries (the "Purchase Agreement") pursuant to which Sumitomo

has agreed to purchase all of the Company's direct and indirect

interests in the San Cristobal mine for a cash purchase price of

$27.5 million. Under the terms of the Purchase Agreement, the

Company will be released from liabilities associated with the San

Cristobal mine, including its guarantee of San Cristobal

indebtedness, and will be reimbursed for $2.5 million in expenses

which were previously paid by the Company for the benefit of the

San Cristobal mine. The consummation of the transaction is subject

to certain conditions, including Bankruptcy Court approval of the

plan of reorganization. Proceeds from the transaction will be used,

in part, to provide cash distributions to creditors of the Company

and ASMC.

The Purchase Agreement includes a no-shop provision that

precludes the Company from affirmatively soliciting alternative

transactions for the sale of San Cristobal to a third party. If the

Company consummates an alternative transaction, it will be required

to pay a break-up fee of $16 million. In addition, if the Company

approves an alternative transaction or materially breaches the

Purchase Agreement, it would be obligated to pay up to $2.0 million

in Sumitomo expenses.

Sumitomo may terminate the Purchase Agreement under certain

circumstances, including (i) if the Bankruptcy Court does not

approve the break-up fee provision of the Purchase Agreement by

January 22, 2009, (ii) if the Bankruptcy Court does not approve the

plan or reorganization by March 16, 2009, and (iii) if the closing

of the Purchase Agreement does not occur prior to March 31,

2009.

Management Services Agreement

In connection with the Purchase Agreement, ASMC will enter into

a Management Services Agreement with Sumitomo (the "Management

Agreement") to provide certain management services to the San

Cristobal mine following consummation of the Purchase Agreement and

emergence from the Chapter 11 proceeding. The Company will receive

an annual fee of $6.0 million and a potential annual incentive fee

of $1.5 million. The services will include, for example, management

of technical and operating activities, administrative support,

information technology and local community relations. The

Management Agreement will have an initial term of twelve months and

thereafter may be terminated by either party with prior notice. If

terminated by Sumitomo, the Company will be entitled to a $1.0

million termination fee.

Senior Secured DIP Financing Facility

The Company and Sumitomo have agreed to the principal terms for

a Secured, Super-Priority Debtor-in-Possession Credit Agreement

with Sumitomo (the "DIP Financing Facility") under which Sumitomo

has agreed to finance the Company's pro rata portion of San

Cristobal's operating costs, up to $35.0 million. The DIP Financing

Facility will bear interest at 15% per annum and is secured by all

of the Company's assets. Sumitomo has agreed not to exercise its

remedies as lender under the San Cristobal project finance facility

or the MSC Loan Agreement dated August 11, 2008, as amended, until

maturity of the DIP Financing Facility. The DIP Financing Facility

will mature on the earliest to occur of: (i) March 31, 2009, (ii)

the acceleration of the DIP Financing Facility upon the occurrence

of an Event of Default under the DIP Financing Facility, which

includes, among other provisions, termination of the Purchase

Agreement, (iii) February 11, 2009, if the Bankruptcy Court has not

entered a final order approving the DIP Financing Facility, (iv)

the entry of a Bankruptcy Court order approving a plan of

reorganization that is consistent with the Plan Support Agreement

under which Sumitomo or its affiliates consummate the purchase of

the San Cristobal mine under the Purchase Agreement, or (v) the

entry by Apex or its affiliates into definitive documentation for

an alternative transaction. Upon consummation of the transactions

under the Purchase Agreement, Sumitomo has agreed to waive

repayment of the DIP Financing Facility. Upon consummation of an

alternative transaction, the Company has agreed to repay the

obligations under the DIP Financing Facility in full as well as

Sumitomo's $131.625 million claim as a lender to the San Cristobal

mine.

Notice of Delisting or Failure to Satisfy a Continued Listing

Rule or Standard

On January 12, 2009, the Company was informed orally by the NYSE

Alternext US LLC (the "Exchange") that the Exchange halted trading

of the Company's ordinary shares and planned to issue a notice of

delisting of the Company's shares. The Exchange noted that it

reached this decision in light of the Company's decision to file a

voluntary petition for reorganization relief under Chapter 11 of

the Bankruptcy Code in the Bankruptcy Court.

The last day that the Company's ordinary shares traded on the

Exchange was January 9, 2009. The Company does not intend to take

any further action to appeal the Exchange's decision, and therefore

it is expected that the ordinary shares will be delisted after the

completion of the Exchange's application to the U.S. Securities and

Exchange Commission.

Securities and Exchange Commission Wells Notice

As previously reported, in 2006, the U.S. Securities and

Exchange Commission (the "Commission") and the U.S. Department of

Justice informed the Company that they had commenced an

investigation with respect to potential payments to government

officials made by certain senior employees of one of the Company's

South American subsidiaries in 2003 and 2004 in connection with an

inactive, early stage exploration property. On January 7, 2009, the

Company received a "Wells notice" from the staff of the Commission.

The Wells notice states that the staff intends to recommend to the

Commission that it bring an enforcement action against the Company,

alleging that the Company violated Sections 13(b)(2)(A),

13(b)(2)(B), 13(b)(5) and 30A of the Securities Exchange Act of

1934. The notice further states that in connection with such

action, the staff may seek permanent injunctive relief,

disgorgement and civil monetary penalties against the Company.

Under the Commission's procedures, the recipient of a Wells notice

has the opportunity to respond to the staff before the staff makes

its formal recommendation on whether any civil action should be

brought by the Commission.

Additional Information

Additional information on Apex's Chapter 11 filing is available

at the following web site address:

http://www.apexsilver.com/restructure.html. Information is also

available at http://chapter11.epiqsystems.com/apex. Updated

information will be provided at this web address is it becomes

available.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act and Section 21E of

the Exchange Act, including statements regarding the Company's

planned reorganization under Chapter 11 of the Bankruptcy Code, its

anticipated financial resources and potential enforcement action

against the Company by the Commission. These statements are subject

to risks and uncertainties, including the ability of the Company to

continue business operations during the Chapter 11 proceeding;

whether the Company's anticipated financial resources during the

proceedings will be sufficient to fund its operations and its

ability to operate pursuant to the DIP Financing Facility; the

ability of the Company to obtain court approval of various motions

it expects to file as part of the Chapter 11 proceeding; the

ability of the Company to consummate its plan of reorganization as

currently planned; risks associated with third party motions in the

Chapter 11 proceeding, which may interfere with the Company's

ability to develop and consummate a plan of reorganization; the

potential adverse effects of the Chapter 11 proceeding on the

Company's liquidity or results of operations; the ability of the

Company to obtain and maintain reasonable terms with vendors and

service providers during the Chapter 11 proceeding; the Company's

ability to motivate and retain key executives and other necessary

personnel while seeking to implement its plan of reorganization;

and whether the Commission determines to proceed against the

Company and, if so, the nature of the penalties that may be sought

by the Commission and the impact of such an action on the ability

of the Company to implement its reorganization plan. The Company

assumes no obligation to update this information. Additional risks

relating to the Company may be found in the Company's periodic and

current reports filed with the Commission.

CONTACT: Apex Silver Mines Corporation Jerry W. Danni (303)

839-5060 Sr. Vice President Corporate Affairs

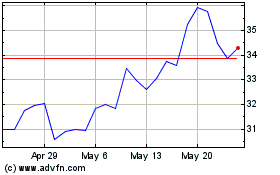

Global X Silver Miners (AMEX:SIL)

Historical Stock Chart

From Jan 2025 to Feb 2025

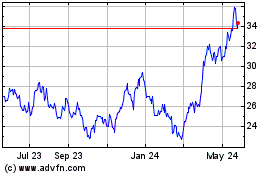

Global X Silver Miners (AMEX:SIL)

Historical Stock Chart

From Feb 2024 to Feb 2025