false

0001289340

0001289340

2024-05-13

2024-05-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(D) of the Securities Exchange Act Of 1934

Date

of report (Date of earliest event reported): May 13, 2024

STEREOTAXIS,

INC.

(Exact

Name of Registrant as Specified in Its Charter)

Delaware

(State

or Other Jurisdiction of Incorporation)

| 001-36159 |

|

94-3120386 |

| (Commission

File Number) |

|

(IRS

Employer Identification No.) |

| 710

North Tucker Boulevard, Suite 110, St. Louis, Missouri |

|

63101 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(314)

678-6100

(Registrant’s

Telephone Number, Including Area Code)

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act: ☐

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

STXS |

|

NYSE

American LLC |

| Item

2.02 |

Results

of Operations and Financial Condition |

On

May 13, 2024, Stereotaxis, Inc. (the “Company”) issued a press release (the “Earnings Press Release”) setting

forth its financial results for the 2024 first quarter. A copy of the Earnings Press Release is being filed as Exhibit 99.1 hereto, and

the statements contained therein are incorporated by reference herein.

In

accordance with General Instruction B.2. of Form 8-K, the information contained in this Item 2.02 and Exhibit 99.1 attached hereto shall

not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing

under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such

a filing.

On

May 13, 2024, the Company issued a further press release (the “APT Press Release” and together with the Earnings Press Release,

the “Press Releases”) announcing that the Company had entered into a definitive share purchase agreement under which the

Company will acquire Access Point Technologies EP, Inc., a privately held Minnesota-based developer of innovative electrophysiology catheters.

A copy of the APT Press Release is being filed as Exhibit 99.2 hereto, and the statements contained therein are incorporated by reference

herein.

Forward-Looking

Statements and Additional Information

Statements

are made herein or incorporated herein that are “forward-looking statements” as defined by the Securities and Exchange Commission

(the “SEC”). All statements, other than statements of historical fact, included or incorporated herein that address activities,

events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements.

These statements are not guarantees of future events or the Company’s future performance and are subject to risks, uncertainties

and other important factors that could cause events or the Company’s actual performance or achievements to be materially different

than those projected by the Company. For a full discussion of these risks, uncertainties and factors, the Company encourages you to read

its documents on file with the SEC. Except as required by law, the Company does not intend to update or revise its forward-looking statements,

whether as a result of new information, future events or otherwise.

| Item

9.01 |

Financial

Statements and Exhibits |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

STEREOTAXIS,

INC. |

| |

|

|

| Date:

May 13, 2024 |

By: |

/s/

Kimberly R. Peery |

| |

Name: |

Kimberly

R. Peery |

| |

Title: |

Chief

Financial Officer |

Exhibit

99.1

Stereotaxis

Reports 2024 First Quarter Financial Results

ST.

LOUIS, May 13, 2024 (GLOBE NEWSWIRE) – Stereotaxis (NYSE: STXS), a pioneer and global leader in surgical robotics for

minimally invasive endovascular intervention, today reported financial results for the first quarter ended March 31, 2024.

“Stereotaxis

is driving continued commercial, technological, and strategic progress,” said David Fischel, Chairman and CEO. “We are pleased

to report revenue growth in the first quarter and an increase in system backlog with two Genesis systems orders since our last call.

Our innovation strategy remains key to driving substantial commercial success, and we are making robust progress on multiple fronts in

line with previous timelines. The acquisition of APT, as detailed in a separate press release, provides us valuable commercial synergies

and strengthens us strategically.”

“Regulatory

submissions for the MAGiC catheter were made in both Europe and the United States during the first quarter. We appreciate the responsiveness

and collaborative nature of both regulatory bodies, having had substantive interaction with both since the submissions. Formal testing

of our smaller highly-accessible robot is advancing well, with the majority of tests successfully completed. Regulatory submissions for

the robot are expected during the second quarter, and European regulatory clearance is anticipated mid-year followed by FDA clearance

in the second half of the year. We also expect commercial launches later this year of a guidewire that expands our technology into new

indications, a comprehensive product ecosystem in China, and a digital surgery solution enabling broad operating room connectivity.”

“We

are continuing to advance our technology and strategy in a financially prudent fashion. We retain a strong balance sheet which allows

us to bring our transformative product ecosystem to market, fund its commercialization, and reach profitability. We have multiple shots

on goal for breakout growth in 2025 and beyond.”

2024

First Quarter Financial Results

Revenue

for the first quarter of 2024 totaled $6.9 million, growth of 5% from $6.5 million in the prior year first quarter. System revenue for

the first quarter was $2.6 million and recurring revenue was $4.3 million, compared to $1.8 million and $4.7 million in the prior year

first quarter, respectively.

Gross

margin for the first quarter of 2024 was 58% of revenue. Recurring revenue gross margin was 76% and system gross margin was 27%. Operating

expenses in the first quarter of $8.7 million include $2.6 million in non-cash stock compensation expense. Excluding non-cash stock compensation

expense, adjusted operating expenses in the quarter were $6.1 million, compared to $6.9 million for adjusted operating expenses in the

prior year first quarter.

Operating

loss and net loss for the first quarter of 2024 were ($4.7) million and ($4.5) million, respectively, compared to ($5.6) million and

($5.3) million in the previous year. Adjusted operating loss and adjusted net loss for the quarter, excluding non-cash stock compensation

expense, were ($2.2) million and ($1.9) million, respectively, compared with ($3.0) million and ($2.7) million in the previous year.

Negative free cash flow for the first quarter was ($2.3) million.

Cash

Balance and Liquidity

At

March 31, 2024, Stereotaxis had cash and cash equivalents, including restricted cash, of $18.2 million and no debt.

Forward

Looking Expectations

Stereotaxis

maintains its expectation of double-digit revenue growth for the full year 2024 driven by revenue recognition of system backlog and new

system orders, and not incorporating contribution of revenue from APT.

First

quarter cash utilization is typically higher than subsequent quarters. Stereotaxis anticipates a lower rate of cash utilization, even

incorporating the expenses associated with acquiring, integrating and operating APT. Stereotaxis’ balance sheet allows it to advance

its transformative product ecosystem to market, fund its commercialization, and reach profitability without the need for additional financing.

Conference

Call and Webcast

Stereotaxis

will host a conference call and webcast today, May 13, 2024, at 4:30 p.m. Eastern Time. To access the conference call, dial 1-800-715-9871

(US and Canada) or 1-646-307-1963 (International) and give the participant pass code 7212885. To access the live and replay webcast,

please visit the investor relations section of the Stereotaxis website at www.Stereotaxis.com.

About

Stereotaxis

Stereotaxis

(NYSE: STXS) is a pioneer and global leader in innovative surgical robotics for minimally invasive endovascular intervention. Its mission

is the discovery, development and delivery of robotic systems, instruments, and information solutions for the interventional laboratory.

These innovations help physicians provide unsurpassed patient care with robotic precision and safety, expand access to minimally invasive

therapy, and enhance the productivity, connectivity, and intelligence in the operating room. Stereotaxis technology has been used to

treat over 100,000 patients across the United States, Europe, Asia, and elsewhere. For more information, please visit www.Stereotaxis.com.

This

press release includes statements that may constitute “forward-looking” statements, usually containing the words “believe”,

“estimate”, “project”, “expect” or similar expressions. Forward-looking statements inherently involve

risks and uncertainties that could cause actual results to differ materially. Factors that would cause or contribute to such differences

include, but are not limited to, the Company’s ability to manage expenses at sustainable levels, acceptance of the Company’s

products in the marketplace, the effect of global economic conditions on the ability and willingness of customers to purchase its technology,

competitive factors, changes resulting from healthcare policy, dependence upon third-party vendors, timing of regulatory approvals, the

impact of pandemics or other disasters, risks related to the completion, integration and ongoing operations relating to the proposed acquisition

of APT set forth in our concurrent press release announcing the APT transaction, and other risks discussed in the Company’s periodic and other filings with the

Securities and Exchange Commission. By making these forward-looking statements, the Company undertakes no obligation to update these

statements for revisions or changes after the date of this release. There can be no assurance that the Company will recognize revenue

related to its purchase orders and other commitments because some of these purchase orders and other commitments are subject to contingencies

that are outside of the Company’s control and may be revised, modified, delayed, or canceled.

Company

Contacts:

David

L. Fischel

Chairman

and Chief Executive Officer

Kimberly

R. Peery

Chief

Financial Officer

314-678-6100

Investors@Stereotaxis.com

STEREOTAXIS, INC.

STATEMENTS OF OPERATIONS

(Unaudited)

| (in thousands, except share and per share amounts) | |

Three Months Ended

March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenue: | |

| | | |

| | |

| Systems | |

$ | 2,612 | | |

$ | 1,821 | |

| Disposables, service and accessories | |

| 4,268 | | |

| 4,727 | |

| Total revenue | |

| 6,880 | | |

| 6,548 | |

| | |

| | | |

| | |

| Cost of revenue: | |

| | | |

| | |

| Systems | |

| 1,900 | | |

| 1,697 | |

| Disposables, service and accessories | |

| 1,014 | | |

| 975 | |

| Total cost of revenue | |

| 2,914 | | |

| 2,672 | |

| | |

| | | |

| | |

| Gross margin | |

| 3,966 | | |

| 3,876 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

| 2,243 | | |

| 2,746 | |

| Sales and marketing | |

| 3,003 | | |

| 3,148 | |

| General and administrative | |

| 3,466 | | |

| 3,601 | |

| Total operating expenses | |

| 8,712 | | |

| 9,495 | |

| Operating loss | |

| (4,746 | ) | |

| (5,619 | ) |

| | |

| | | |

| | |

| Interest income, net | |

| 239 | | |

| 272 | |

| Net loss | |

$ | (4,507 | ) | |

$ | (5,347 | ) |

| Cumulative dividend on convertible preferred stock | |

| (331 | ) | |

| (331 | ) |

| Net loss attributable to common stockholders | |

$ | (4,838 | ) | |

$ | (5,678 | ) |

| | |

| | | |

| | |

| Net loss per share attributed to common stockholders: | |

| | | |

| | |

| Basic | |

$ | (0.06 | ) | |

$ | (0.07 | ) |

| Diluted | |

$ | (0.06 | ) | |

$ | (0.07 | ) |

| | |

| | | |

| | |

| Weighted average number of common shares and equivalents: | |

| | | |

| | |

| Basic | |

| 83,476,498 | | |

| 76,500,965 | |

| | |

| | | |

| | |

| Diluted | |

| 83,476,498 | | |

| 76,500,965 | |

STEREOTAXIS, INC.

BALANCE SHEETS

| (in thousands, except share amounts) | |

March 31,

2024 | | |

December 31,

2023 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 17,633 | | |

$ | 19,818 | |

| Restricted cash - current | |

| 525 | | |

| 525 | |

| Accounts receivable, net of allowance of $609 and $672 at 2024 and 2023, respectively | |

| 3,953 | | |

| 3,822 | |

| Inventories, net | |

| 8,252 | | |

| 8,426 | |

| Prepaid expenses and other current assets | |

| 845 | | |

| 676 | |

| Total current assets | |

| 31,208 | | |

| 33,267 | |

| Property and equipment, net | |

| 3,164 | | |

| 3,304 | |

| Restricted cash | |

| 88 | | |

| 219 | |

| Operating lease right-of-use assets | |

| 4,876 | | |

| 4,982 | |

| Prepaid and other non-current assets | |

| 116 | | |

| 137 | |

| Total assets | |

$ | 39,452 | | |

$ | 41,909 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 3,307 | | |

$ | 3,190 | |

| Accrued liabilities | |

| 3,164 | | |

| 2,972 | |

| Deferred revenue | |

| 5,938 | | |

| 6,657 | |

| Current portion of operating lease liabilities | |

| 443 | | |

| 428 | |

| Total current liabilities | |

| 12,852 | | |

| 13,247 | |

| Long-term deferred revenue | |

| 1,581 | | |

| 1,637 | |

| Operating lease liabilities | |

| 4,945 | | |

| 5,062 | |

| Other liabilities | |

| 43 | | |

| 43 | |

| Total liabilities | |

| 19,421 | | |

| 19,989 | |

| | |

| | | |

| | |

| Series A - Convertible preferred stock: | |

| | | |

| | |

| Convertible preferred stock, Series A, par value $0.001; 21,908 and 22,358 shares outstanding at 2024 and 2023, respectively | |

| 5,464 | | |

| 5,577 | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, par value $0.001; 300,000,000 shares authorized, 82,132,777 and 80,949,697 shares issued at 2024 and 2023, respectively | |

| 82 | | |

| 81 | |

| Additional paid-in capital | |

| 556,878 | | |

| 554,148 | |

| Treasury stock, 4,015 shares at 2024 and 2023 | |

| (206 | ) | |

| (206 | ) |

| Accumulated deficit | |

| (542,187 | ) | |

| (537,680 | ) |

| Total stockholders’ equity | |

| 14,567 | | |

| 16,343 | |

| Total liabilities and stockholders’ equity | |

$ | 39,452 | | |

$ | 41,909 | |

Exhibit 99.2

Stereotaxis

Announces Definitive Agreement to Acquire Access Point Technologies

ST.

LOUIS, May 13, 2024 (GLOBE NEWSWIRE) – Stereotaxis (NYSE: STXS), a pioneer and global leader in surgical robotics for

minimally invasive endovascular intervention, today announced that it has entered into a definitive share purchase agreement under which

Stereotaxis will acquire Access Point Technologies EP (APT), a privately-held Minnesota-based developer of innovative electrophysiology

catheters.

“Acquiring

APT provides Stereotaxis with high-quality catheter development and manufacturing capabilities, and will amplify and accelerate Stereotaxis’

efforts to advance the treatment of complex arrhythmias and the adoption of robotics broadly within endovascular surgery,” said

David Fischel, Stereotaxis Chairman and CEO. “The acquisition offers valuable commercial synergies, strengthens us strategically,

and was pursued in a financially-prudent and shareholder-friendly fashion.”

APT

designs, manufactures, and commercializes a portfolio of differentiated high-quality diagnostic catheters used during cardiac ablation

procedures. The catheters offer clinical value to patients and physicians, are particularly beneficial in challenging and complex arrhythmias,

and are commercially available across key global geographies. The transaction consideration includes an upfront payment and additional

contingent payments based upon the achievement of key regulatory and commercial milestones. All consideration is payable in Stereotaxis

common stock. Stereotaxis currently estimates that APT will contribute approximately $5 million in annual revenue during the first year

post-acquisition. The acquisition is subject to customary closing conditions and is expected to close in the third quarter.

“We

are very excited to join Stereotaxis,” said Steve Berhow, President of Access Point Technologies. “This acquisition provides

the APT team with a great partner and expanded home in the growing field of Electrophysiology. It allows us to continue contributing

our unique expertise in high-quality EP catheters while also playing a central role in an exciting new mission of pioneering endovascular

robotics.”

“We

are delighted to welcome the APT team to Stereotaxis,” added David Fischel. “This acquisition is a reflection of Stereotaxis’

commitment to significant innovations that improve the treatment of patients with arrhythmias and broadly enable robotics to positively

transform endovascular surgery.”

Conference

Call and Webcast

Stereotaxis

will discuss the acquisition during its scheduled first quarter financial results conference call and webcast today, May 13, 2024, at

4:30 p.m. Eastern Time. To access the conference call, dial 1-800-715-9871 (US and Canada) or 1-646-307-1963 (International) and give

the participant pass code 7212885. To access the live and replay webcast, please visit the investor relations section of the Stereotaxis

website at www.Stereotaxis.com.

About

Stereotaxis

Stereotaxis

(NYSE: STXS) is a pioneer and global leader in innovative surgical robotics for minimally invasive endovascular intervention. Its mission

is the discovery, development and delivery of robotic systems, instruments, and information solutions for the interventional laboratory.

These innovations help physicians provide unsurpassed patient care with robotic precision and safety, expand access to minimally invasive

therapy, and enhance the productivity, connectivity, and intelligence in the operating room. Stereotaxis technology has been used to

treat over 100,000 patients across the United States, Europe, Asia, and elsewhere. For more information, please visit www.Stereotaxis.com.

This

press release includes statements that may constitute “forward-looking” statements, usually containing the words “believe”,

“estimate”, “project”, “expect” or similar expressions. These forward-looking statements include

without limitation statements regarding the proposed acquisition, its timing and its consummation, the anticipated financial performance

of Stereotaxis and APT related thereto, including the anticipated closing of, and benefits expected from, the proposed acquisition, potential

strategic implications as a result of the proposed acquisition, and the potential for achievement of the regulatory and commercial milestones

that would trigger contingent payments in the transaction. Forward-looking statements inherently involve risks and uncertainties that

could cause actual results to differ materially. Factors that would cause or contribute to such differences include, but are not limited

to, uncertainties involving the following: the potential timing of the consummation of the proposed acquisition and the ability of the

parties to consummate the proposed transaction; the satisfaction of the conditions precedent to consummation of the proposed transaction,

any litigation related to the proposed transaction; disruption of APT’s or Stereotaxis’s current plans and operations as

a result of the proposed transaction; the ability of APT or Stereotaxis to retain and hire key personnel; competitive responses to the

proposed transaction; unexpected costs, charges or expenses resulting from the proposed transaction; the ability of Stereotaxis to successfully

integrate APT’s operations, and continue the commercialization, development and sales of APT’s catheters and related products

and services; the ability of Stereotaxis to implement its plans, forecasts and other expectations with respect to APT’s business

after the completion of the proposed transaction and realize additional opportunities for growth and innovation; the ability of Stereotaxis

to realize the anticipated benefits from the proposed transaction in the anticipated amounts or within the anticipated timeframes or

at all; the ability to maintain relationships with Stereotaxis’s and APT’s respective employees, customers, other business

partners and governmental authorities; and the other risks discussed in the Company’s periodic and other filings with the Securities

and Exchange Commission. Additional risks and uncertainties that could affect our financial results are included under the captions “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual

Report on Form 10-K filed with the SEC on March 8, 2024, which is available on our website at https://ir.stereotaxis.com and

on the SEC’s website at www.sec.gov. Additional information will also be set forth in other filings that we make

with the SEC from time to time. All forward-looking statements in this press release are based on information available to us as of the

date hereof, and we do not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances

that exist after the date on which they were made. There can be no assurance that the Company will recognize revenue related to its purchase

orders and other commitments because some of these purchase orders and other commitments are subject to contingencies that are outside

of the Company’s control and may be revised, modified, delayed, or canceled.

Company

Contacts:

David

L. Fischel

Chairman

and Chief Executive Officer

Kimberly

R. Peery

Chief

Financial Officer

314-678-6100

Investors@Stereotaxis.com

v3.24.1.1.u2

Cover

|

May 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 13, 2024

|

| Entity File Number |

001-36159

|

| Entity Registrant Name |

STEREOTAXIS,

INC.

|

| Entity Central Index Key |

0001289340

|

| Entity Tax Identification Number |

94-3120386

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

710

North Tucker Boulevard

|

| Entity Address, Address Line Two |

Suite 110

|

| Entity Address, City or Town |

St. Louis

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

63101

|

| City Area Code |

(314)

|

| Local Phone Number |

678-6100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

STXS

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

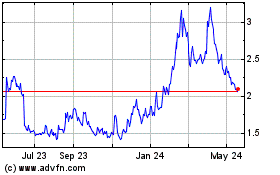

Stereotaxis (AMEX:STXS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Stereotaxis (AMEX:STXS)

Historical Stock Chart

From Nov 2023 to Nov 2024