Amplify ETFs Launches the Amplify BlackSwan ISWN ETF (NYSE Arca: ISWN)

January 26 2021 - 5:00AM

Amplify ETFs announces the launch of the Amplify BlackSwan ISWN ETF

(NYSE Arca: ISWN), an index-based ETF that seeks to hedge against

significant losses while still participating in the uncapped upside

of international equities. ISWN invests in a combination of two

low-correlated assets: U.S. Treasury securities and long-term

options (LEAPS) on the MSCI EAFE.

ISWN expands the firm’s suite of BlackSwan ETFs to include

international exposure, complementing the Amplify BlackSwan Growth

& Treasury Core ETF (NYSE Arca: SWAN). Launched in 2018, the

SWAN ETF has attracted more than $750 million in assets under

management, and has a proven track record of mitigating downside

and participating in upward markets.

“ISWN gives investors the opportunity to expand their portfolios

in markets outside of the U.S., allowing them to manage

international equity risk while staying invested,” said Christian

Magoon, CEO of Amplify ETFs. “Like never before, the past year has

demonstrated the need for risk-mitigation products that not only

seek to protect investor portfolios, but allow them to stay

invested. We’re excited to offer investors domestic and

international exposure using this proven and powerful investment

philosophy.”

ISWN seeks investment results that correspond to the S-Network

International BlackSwan Index (the Index). The Index’s strategy

seeks exposure to the MSCI EAFE (with no artificial cap), while

also protecting against significant losses. Approximately 90% of

ISWN is invested in U.S. Treasury securities with a targeted

duration of the 10-year Note, and 10% is invested in EFA ETF LEAP

options in the form of in-the-money calls.

Investors can learn more about ISWN at AmplifyETFs.com/ISWN.

About Amplify ETFs

Amplify ETFs, sponsored by Amplify Investments, has over $3.5

billion in assets across its suite of ETFs (as of 1/22/2021).

Amplify believes the ETF structure empowers investors through

efficiency, transparency and flexibility. Amplify ETFs deliver

expanded investment opportunities for growth, capital preservation,

and income-focused investors.

Sales Contact:Amplify

ETFs855-267-3837info@amplifyetfs.comorMedia

Contact: Gregory FCA for Amplify ETFsKerry

Davis610-228-2098amplifyetfs@gregoryfca.com

Carefully consider the Fund’s investment objectives,

risk factors, charges and expenses before investing. This and

additional information can be found in the Fund’s statutory and

summary prospectus, which may be obtained by calling 855-267-3837

or by visiting AmplifyETFs.com.

Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of

principal. Shares of any ETF are bought and sold at market price

(not NAV), may trade at a discount or premium to NAV and are not

individually redeemed from the Fund. The Fund's return may not

match or achieve a high degree of correlation with the return of

the underlying Index.

The use of derivative instruments, such as options contracts,

can lead to losses because of adverse movements in the price or

value of the underlying asset, index or rate, which may be

magnified by certain features of the derivatives. Investing in

options, including LEAP Options, and other instruments with

option-type elements may increase the volatility and/or transaction

expenses of the Fund. An option may expire without value, resulting

in a loss of the Fund’s initial investment and may be less liquid

and more volatile than an investment in the underlying securities.

Investments in debt securities typically decrease in value when

interest rates rise. This risk is usually greater for longer-term

debt securities. The Fund is non-diversified, meaning it may

concentrate its assets in fewer individual holdings than a

diversified fund.

Call options are financial contracts that give the option buyer

the right, but not the obligation, to buy a stock, bond, commodity

or other asset or instrument at a specified price within a specific

time period. An “in-the-money” call option contract is an option

contract with a strike price that is below the current price of the

underlying reference asset.

Amplify Investments LLC is the Investment Adviser to the Fund,

and ARGI Investment Services, LLC and Toroso Investments, LLC serve

as the Investment Sub-Advisers.

Amplify ETFs are distributed by Foreside Fund Services, LLC.

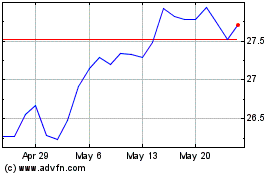

Amplify Blackswan Growth... (AMEX:SWAN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Amplify Blackswan Growth... (AMEX:SWAN)

Historical Stock Chart

From Jan 2024 to Jan 2025